Professional Documents

Culture Documents

PocketFM Submission - Manpreet

PocketFM Submission - Manpreet

Uploaded by

manpreet.imt16180 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

PocketFM Submission_Manpreet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesPocketFM Submission - Manpreet

PocketFM Submission - Manpreet

Uploaded by

manpreet.imt1618Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

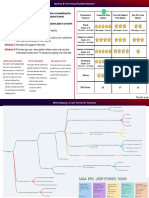

Acquisition (New Users) Retention and Engagement (Existing Users) Growth Equation

User Metrics to be tracked: User Metrics to be tracked:

Unique New User Count Acquisitions of the New Users from existing # of ads clicked

(City-wise) platform (PFM) customer base (Cross sell) WoW User Avg. Time

# 1-3 star ratings for a non-paying Revenue

Retention spent/user

Ad Spends (Across Unique New User Count user

CAC (PFM)

channels) (Paid vs Free) Unique Customer # audio Adverts

# of 5 star ratings

Acquisitions of the genre Unique New User Count Count downloaded/user impression rate

CAC (Channel wise)

(Fantasy) (Channel-wise) # of Users Revenue/User Frequency

# of episodes

Sponsorships: DAU of the genre

DAU # of shares/user paid/Total # of

• College fests (Top universities across India) (Fantasy)

episodes New Customers Innovative pricing • Content

• Scholarships across best Tier-2 schools for the top performing students + Retained User strategies already Related

Rewarding the binge: Factors

• MM Champions: Ambassadors across colleges showing exemplary Base + in place:

• Milestone based reward system that would be given to the user post • Pay-as-you-go • Non-

performance Reactivated

he completes certain episodes (50th, 100th etc.). These can be • Smaller content

• Comicon: A unique event in Comicon featuring MM Users = Active

coupons, cashbacks in the form of coins etc. subscription related

Partnerships and collaborations with other companies: Users factors

Community building (Online + Offline) packages

• Partner with Boat, Noise on MM (free 50 episodes). Can leverage their

• Build a MM community (online and offline)

customer base

Offline:

• Mobile companies with pre-installed MM app) - help with acquisition, Acquisition Retention

• Offline community events and meetups to drive user engagement.

retention and engagement)

Themes can be on the future story lines, contests and their rewards

Advertisements: Online:

• Radio adverts in Tier-1 & 2 cities (Shehar ke Mahabali: People doing • New Markets • Early Retention

• Online community pages on Whatsapp, Instagram, Snapchat on • Awareness • Stable Retention

something good for the society) quizzes, contests • New Languages

• Advertise on forums where similar demographics spend more time • MM App can include links to the episodes which would link to PFM, an

(Career websites, Sports networks and OTT platforms) Non-content Related Factors

interactive game with rewards (coin back, coupons), Offline events

• Offline banners around areas with high student population (PGs, finder Pricing UI/UX App Functionality

Coaching institutes, colleges) Product Strategy

Cross Selling: • Ensure glitch free functioning of the app. Most negative reviews on Content Related Factors

• Cross selling on users who have subscribed to shows having the same

Play store are due to glitches in app

genre tags (Fantasy) and have not listened to MM Quality Relevance

• Customer nudges to users completed N episodes or Have streamed

GTM Strategy: more than X hours of MM content. Nudges can be across all

• Launching in more languages (Gujarati, Punjabi) platforms - In-App, Mail, SMS

• Launching in newer cities to drive breadth

Alternate Revenue Sources

Content Strategy

Content Strategy: • Voiceovers by celebrities to create buzz and spike engagement. Ads Sales

• Episodes with crossovers between characters of other shows (Super Ranveer Singh for Mayank • Allow ad sales through Sponsored content, brand

Yoddha, Phunkaar) to get acquisition from those • Release of episodes on a weekly basis to ensure proper stickability integrations and Targeted audio ads on the episodes

Referral: • Monitor very closely the feedback metrics of the episodes (on content) Partnerships and Collaborations

• Since trust plays a major role in content recommendation (42% as per • Analyse where the drop outs are happening within for MM episodes (1 • Partnership with other companies who want to increase

Digital Entertainment Insight-2023), we can leverage the power of minute, 5 minutes etc.) their reach

referrals

Primary and Secondary Research Why should PFM focus on Fantasy?

Objective: Age split:

To understand the following points: A big retention and engagement lever:

• Types of consumers • As seen from the primary research, most

• What type of content do they consume? of the respondents will watch the next

• Why do they like that content? season/movie if it comes. They still

Methodology Used: periodically binge-watch these shows

Data Collection and Collation was done via google form. Attempt was made • Fantasy genre comes out among the top-3

to find significant data to prevent skewness movies and TV series (English and Non-

Respondent Details: English) for Netflix Link:

# of respondents: 59 https://www.netflix.com/tudum/top10/m

ost-popular/tv

City wise breakup: Fantasy consumption (Type of content): • Indian Fantasy TV shows have also

Key Insights: garnered high TRPs in the past. Shows like

• Most of the respondents consumed video content, followed by print. Audio Nagin, Divya Drishti are a testament to

content didn’t come up much this Link:

• Harry Potter, GOT, Stranger Things and House of Dragon were listed as the best https://timesofindia.indiatimes.com/tv/ne

shows ws/hindi/supernatural-fantasy-shows-

• Irrespective of the platform, the respondents preferred the content to be ruled-the-trp-charts-on-hindi-

engaging tv/articleshow/80049440.cms

• The above mentioned shows were commonly recurring across ages 16-45 • Sci-fi and fantasy overtook comedy as the

years. Fantasy penetration starts to decrease in the Gen X most popular genre, with 12% favouring

• Tier-2 cities also had very large viewership of the above shows this . Netflix commissioned 29% of all

Occupation split: • Most of the respondents used Mobile Apps (57%) followed by TV (23%) and upcoming shows in this genre. Link:

Tablets (20%) to consume data https://tbivision.com/2018/04/25/netflix-

• Most of the respondents have paid annual membership to consume this ordered-more-sci-fi-after-genre-hits-says-

content (92%) ampere/#close-modal

• Preferred language of consumption started to turn towards the native language Acts as a reliable acquisition lever too:

in Tier-2 cities (Hindi the preferred choice) • Although no substantial data can be given

• Choice of choosing the next recommendation is majorly driven through word- on the number of subscribers acquired

of-mouth (40%) and social media (38%). Personal networks play a key role here due to Fantasy genre, a correlation can be

• A high majority of the respondents (92%) will watch the next season/sequel if made. Link:

it comes. Loyal fanbase and stickiness comes into play here (Retention) https://economictimes.indiatimes.com/m

• Thrilling plot, drama and good special effects play a major role in selecting the arkets/stocks/news/netflix-reverses-

content subscriber-slump-shares-surge-

Gender split: Motivators to like Fantasy Content

14/articleshow/94953692.cms?from=mdr

Key Insights:

• Sense of escapism, Classical story line (good vs evil) and Imagination being Relatable content in India as a culture

kindled came out to be the major reasons. Corroborated through secondary • As a culture we thrive on mythology and

research as well. Link: stories. Hence, it would be relatively

https://www.researchgate.net/publication/348064566_Escape_to_Fantasy_Rel easier to make relatable content

ocation_of_Fantastic_Genre_on_Netflix_Platform

You might also like

- Aerostar - Maintenance - Manual - Chapters - 21 To 25Document319 pagesAerostar - Maintenance - Manual - Chapters - 21 To 25Oleksiyk Rakovych100% (2)

- Growth-Marketing-Canvas A1 V19 PDFDocument1 pageGrowth-Marketing-Canvas A1 V19 PDFCOSMOS1983No ratings yet

- Alibaba Group Canvas Business ModelDocument12 pagesAlibaba Group Canvas Business ModelMustika ZakiahNo ratings yet

- PocketFM Submission - ManpreetDocument2 pagesPocketFM Submission - Manpreetmanpreet.imt1618No ratings yet

- Lean CanvasDocument1 pageLean CanvasujjwaltNo ratings yet

- The Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsDocument2 pagesThe Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsWilson Carranza ChNo ratings yet

- Lean Canvas Example: Facebook - Advertisers + College StudentsDocument1 pageLean Canvas Example: Facebook - Advertisers + College StudentsFreddie MendezNo ratings yet

- The Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsDocument1 pageThe Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer Segmentsarif fatkhurNo ratings yet

- The Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsDocument1 pageThe Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer Segmentshahahuhu hahahuhuNo ratings yet

- The Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsDocument1 pageThe Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsLuisNo ratings yet

- Lean Canvas: Problem Solution Unique Value Proposition Unfair Advantage Customer SegmentsDocument1 pageLean Canvas: Problem Solution Unique Value Proposition Unfair Advantage Customer SegmentsRoopesh ReddyNo ratings yet

- Lean CanvasDocument1 pageLean CanvasMisha AliNo ratings yet

- Lean-Canvas Explained and Template-DikonversiDocument2 pagesLean-Canvas Explained and Template-DikonversiMUHAMAD REZANo ratings yet

- 014 Abhinav Anurag Disney StarDocument8 pages014 Abhinav Anurag Disney Starpgp39228No ratings yet

- Plantilla Lean CanvasDocument2 pagesPlantilla Lean CanvasYessenia Angela Benique EscobedoNo ratings yet

- Lean CanvasDocument2 pagesLean CanvasAngga RamaNo ratings yet

- Lean Canvas TemplateDocument2 pagesLean Canvas TemplateAnimaLahNo ratings yet

- Lean Canvas PhaniDocument3 pagesLean Canvas PhaniphaniNo ratings yet

- Startup Self Assessment - IndigoBetalist 2022Document6 pagesStartup Self Assessment - IndigoBetalist 2022Chaca NZNo ratings yet

- Muhtia Luchfi - Pitchdeck Marketing StrategyDocument6 pagesMuhtia Luchfi - Pitchdeck Marketing Strategymuhtia luchfiNo ratings yet

- A Case Study On Multi-Gaming PlatformsDocument22 pagesA Case Study On Multi-Gaming PlatformsRehan Shah100% (1)

- Lean Business Model Canvas TemplateDocument1 pageLean Business Model Canvas TemplateJames BarfordNo ratings yet

- Bisnis MumtaazDocument3 pagesBisnis MumtaazlailaNo ratings yet

- The Lean CanvasDocument2 pagesThe Lean Canvasapi-639964626No ratings yet

- The Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsDocument2 pagesThe Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer Segmentsbudisatri4No ratings yet

- A Case Study On Gaming AppsDocument12 pagesA Case Study On Gaming AppsRehan ShahNo ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument1 pageBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsQuangdat NguyenNo ratings yet

- Lean Busssiness Canvass - Action Plan VersionDocument2 pagesLean Busssiness Canvass - Action Plan VersionRamkumarNo ratings yet

- Business Model CanvasDocument4 pagesBusiness Model CanvasOperations Club NCRNo ratings yet

- IIT Guwahati Case Study Challenge 2021Document12 pagesIIT Guwahati Case Study Challenge 2021rick jonasNo ratings yet

- Customer Journey Map TemplateDocument1 pageCustomer Journey Map TemplatewellaapyarNo ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument2 pagesBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsJohn Kenneth Santiago PaulinoNo ratings yet

- Campaign Note June2019Document10 pagesCampaign Note June2019Raghav RajNo ratings yet

- Business Idea ModelDocument2 pagesBusiness Idea ModelSercan SivrikayaNo ratings yet

- Consumer Lifetime Value AnalysisDocument12 pagesConsumer Lifetime Value AnalysisBhargava AnshulNo ratings yet

- Business Model CanvasDocument3 pagesBusiness Model Canvasfinancecom.vccNo ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument3 pagesBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsChristina ApriliaNo ratings yet

- Value Proposition and Business Model CanvasesDocument3 pagesValue Proposition and Business Model Canvasesrccgkd1youthsNo ratings yet

- ED9&10 EntrepDevDocument35 pagesED9&10 EntrepDevdivyaa230204No ratings yet

- Customer Relationship Management A Databased Approach: V. Kumar Werner J. ReinartzDocument15 pagesCustomer Relationship Management A Databased Approach: V. Kumar Werner J. ReinartzfurnishingNo ratings yet

- Business Model CanvasDocument3 pagesBusiness Model CanvasKaren ValentiaNo ratings yet

- Business Model CanvasDocument3 pagesBusiness Model CanvasSriGaneshNo ratings yet

- One Way Messenger For BJBDocument12 pagesOne Way Messenger For BJBwibi wibisonoNo ratings yet

- Digital Colombia: January 2 ., 2016Document16 pagesDigital Colombia: January 2 ., 2016David ValenciaNo ratings yet

- Digital Engagement Cheatsheet PDFDocument2 pagesDigital Engagement Cheatsheet PDFGeorge Cristian Aquiño HuamanNo ratings yet

- Presentacion Curso Profesional de Diseno de Videojuegos Bdb8707b 0d3c 4615 9747 055e0163fa60Document31 pagesPresentacion Curso Profesional de Diseno de Videojuegos Bdb8707b 0d3c 4615 9747 055e0163fa60masturbin PINEDANo ratings yet

- 5 Business Model IntroDocument10 pages5 Business Model IntroSHASHANK BHARATHI V ms22w040No ratings yet

- PocketFM ManpreetDocument5 pagesPocketFM Manpreetmanpreet.imt1618No ratings yet

- The Delta Model: Discovering New Sources of Profitability in A Networked EconomyDocument33 pagesThe Delta Model: Discovering New Sources of Profitability in A Networked Economypushpa i aNo ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument3 pagesBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsismiNo ratings yet

- SportsUnity - CX - Audit + PlanDocument21 pagesSportsUnity - CX - Audit + PlanAmit KumarNo ratings yet

- (Some) Major Players: Team Delta 4Document5 pages(Some) Major Players: Team Delta 4AthulNo ratings yet

- Business Modal CanvasDocument3 pagesBusiness Modal CanvasMera AnaNo ratings yet

- NextLeap Graduation Project GPayDocument10 pagesNextLeap Graduation Project GPayzxcvbnmNo ratings yet

- Case Study UFLIXDocument4 pagesCase Study UFLIXIlan GoldensteinNo ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument2 pagesBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsAndy HernandezNo ratings yet

- CombinepdfDocument2 pagesCombinepdfhimaniNo ratings yet

- Addict-O-Genic HarshBohra DN1Document2 pagesAddict-O-Genic HarshBohra DN1harshbohra23No ratings yet

- Conversational Banking: Edition ViiiDocument10 pagesConversational Banking: Edition ViiiAHMED MOHAMMED SADAQAT PGP 2018-20 BatchNo ratings yet

- (Bookflare - Net) - Javascript Basics and AdvancedDocument330 pages(Bookflare - Net) - Javascript Basics and AdvancedTabasamu FiberNo ratings yet

- Zombicide Survivors & Gear 2Document20 pagesZombicide Survivors & Gear 2Jorge T ParadaNo ratings yet

- ITSY005 - ERP Implementation at BPCLDocument12 pagesITSY005 - ERP Implementation at BPCLAkash KoreNo ratings yet

- Students' Requirements For Online ExaminationDocument22 pagesStudents' Requirements For Online ExaminationShaan ChadhaNo ratings yet

- JNTUA Database Management Systems Notes - R20Document143 pagesJNTUA Database Management Systems Notes - R202021cse.rl1No ratings yet

- CodeKul PVT LTD Final ReportDocument9 pagesCodeKul PVT LTD Final ReportYASH TAMBATKAR100% (1)

- Alcatel-Lucent Omnipcx Enterprise Communication Server: Abc-Ip Logical LinkDocument46 pagesAlcatel-Lucent Omnipcx Enterprise Communication Server: Abc-Ip Logical Linkjuan50% (2)

- Application of Ultra-High-Speed Protection and Traveling-Wave Fault Locating On A Hybrid LineDocument13 pagesApplication of Ultra-High-Speed Protection and Traveling-Wave Fault Locating On A Hybrid Linesriramv93No ratings yet

- Library Management SystemDocument31 pagesLibrary Management SystemFahim MuntasirNo ratings yet

- FILE - 20211020 - 154446 - Comparison of Chison Products-JimDocument13 pagesFILE - 20211020 - 154446 - Comparison of Chison Products-JimqdatNo ratings yet

- Aspire AX1430 Desktop Computer Service Guide: Printed in TaiwanDocument126 pagesAspire AX1430 Desktop Computer Service Guide: Printed in TaiwanCarlos SerranoNo ratings yet

- Ds Pac n3000 683260 677054Document31 pagesDs Pac n3000 683260 677054waldoalvarez00No ratings yet

- Ae HAX 2500 SDocument3 pagesAe HAX 2500 SAmerico AndresNo ratings yet

- ZipGrade50QuestionV2 PDFDocument1 pageZipGrade50QuestionV2 PDFcherries sanchezNo ratings yet

- Transmission T-7336 PsDocument186 pagesTransmission T-7336 PsSabadsag Darius100% (1)

- Ccac 4Document23 pagesCcac 4DAKSHIN BIHAR GRAMEEN BANKNo ratings yet

- Multicriteria Group Decision Making Technique For A Low-Class Road Maintenance Program AHPDocument11 pagesMulticriteria Group Decision Making Technique For A Low-Class Road Maintenance Program AHPana majstNo ratings yet

- Digital Evidence Courtroom InstructionsDocument2 pagesDigital Evidence Courtroom Instructionsgodardsfan100% (1)

- 3COM 3C16703A US Datasheet PDFDocument4 pages3COM 3C16703A US Datasheet PDFthys2000No ratings yet

- REAR FOG LAMP l200Document3 pagesREAR FOG LAMP l200Miguel RomoNo ratings yet

- Westin Premier Electric MotorDocument4 pagesWestin Premier Electric MotorSandi AslanNo ratings yet

- ProCurve VoIP LLDP QosDocument5 pagesProCurve VoIP LLDP QosfocconNo ratings yet

- LECTURE 24 Curriculum Development Reforms and EnhancementDocument6 pagesLECTURE 24 Curriculum Development Reforms and EnhancementAeleu JoverzNo ratings yet

- California Air Tools 10020C PDFDocument17 pagesCalifornia Air Tools 10020C PDFnowaypadreNo ratings yet

- Part List GA55+90 MKVDocument68 pagesPart List GA55+90 MKVRamraj EnterprisesNo ratings yet

- Related LiteratureDocument2 pagesRelated LiteraturePANAO, BABYLYN T.No ratings yet

- Resume Quang Diem PhamDocument3 pagesResume Quang Diem PhamQuang-Điềm PhạmNo ratings yet

- Venkata Sravani Business Analyst ResumeDocument5 pagesVenkata Sravani Business Analyst ResumeArunNo ratings yet

- Statement of Purpose - ExampleDocument1 pageStatement of Purpose - ExampleGhazi ZulhazmiNo ratings yet