Professional Documents

Culture Documents

Noswiping

Noswiping

Uploaded by

danny belenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Noswiping

Noswiping

Uploaded by

danny belenCopyright:

Available Formats

Protect Your Identity

CHAPTER 5, LESSON 5

NAME DATE

Daniela 3-14-24

DIRECTIONS

In this activity, you will compare and contrast forms of identity theft using Venn diagrams. In each circle, write

down three to four defining characteristics of that form of identity theft. Where the circles overlap, write down

two to three similarities between the two forms of identity theft. Then answer the questions.

ERS ONLINE PUR

S KIMM CH

RD AS

CA ES

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 1 O F 3

Protect Your Identity

CHAPTER 5, LESSON 5

EP TING MAIL RESTAURANTS &

E RC STO

I NT RE

S

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 2 O F 3

Protect Your Identity

CHAPTER 5, LESSON 5

1. As a smart budgeter, what should you check regularly to make sure there are no

unusual purchases or other suspicious activity?

You should check your bank statements as well as your card statements

2. If you notice a purchase on your debit card that you didn’t make, who should you

contact and what should you do?

You should contact the bank and make sure they cancel or turn off your card.

3. What should you do if your card is lost or stolen?

You should call the bank and make sure to close all activity on the card.

4. What should you do if you notice that your mail looks like it’s been tampered with or

opened and you believe you may be a victim of mail fraud?

Contact the mail services and explain the situation. Also if necessary you can contact the police

because it is illeagal to open other peoples mail but only if necessary.

5. When shopping on the internet, you should never store your

online. What should you do instead?

You could either shop in person or re-enter your details each time you shop there.

6. How can you protect yourself from card skimmers when you’re at a gas pump, ATM

machine, or anywhere that uses a card reader?

Look for skimming devices placed on top of gas station card readers. If possible, use a credit card

instead of a debit card to avoid entering your PIN. Look for signs of tampering or anything that

looks unrealistic or suspicious. However, to completely avoid it you could pay with cash inside.

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 3 O F 3

You might also like

- Alpha Carding GuideDocument56 pagesAlpha Carding Guidestanislav mollov50% (2)

- The Complete Guide to Escorting: Advanced TechniquesFrom EverandThe Complete Guide to Escorting: Advanced TechniquesRating: 5 out of 5 stars5/5 (4)

- JulioDocument4 pagesJuliodakpi479No ratings yet

- BibfraudDocument5 pagesBibfraudStoyan Malinin0% (1)

- Introduction to Internet Scams and Fraud: Credit Card Theft, Work-At-Home Scams and Lottery ScamsFrom EverandIntroduction to Internet Scams and Fraud: Credit Card Theft, Work-At-Home Scams and Lottery ScamsRating: 4 out of 5 stars4/5 (6)

- New Privacy Catalog-Eden PressDocument24 pagesNew Privacy Catalog-Eden Pressrifishman1100% (1)

- Types of Credit/debit Card Fraud Educate YourselfDocument13 pagesTypes of Credit/debit Card Fraud Educate YourselfAmita RahiNo ratings yet

- Scams Unit 2024Document33 pagesScams Unit 2024Kevin TianNo ratings yet

- Fraud Know It Before It Knows You PDFDocument2 pagesFraud Know It Before It Knows You PDFKarthikNo ratings yet

- National Law Institute University, Bhopal: Project of Economics - 3 On Nigerian Letter ScamDocument13 pagesNational Law Institute University, Bhopal: Project of Economics - 3 On Nigerian Letter ScamChaitanya ChauhanNo ratings yet

- Dating Scam (Option 1)Document7 pagesDating Scam (Option 1)Ling Gamb100% (3)

- Dating Scam PDFDocument7 pagesDating Scam PDFLing GambNo ratings yet

- WHAT's in Your Wallet: Study Strategy Cheat SheetDocument2 pagesWHAT's in Your Wallet: Study Strategy Cheat SheetBrayanPalaciosNo ratings yet

- Chapter 5 TPC 2Document28 pagesChapter 5 TPC 2Janella LlamasNo ratings yet

- Phishing: The Fraudulent Attempt To O Btain Sensitive InformationDocument7 pagesPhishing: The Fraudulent Attempt To O Btain Sensitive InformationPrincess Jonna BoiserNo ratings yet

- Green Orange Organic Shapes and Blobs Grocery Company BrochureDocument2 pagesGreen Orange Organic Shapes and Blobs Grocery Company Brochureallanaturner0118No ratings yet

- Chargeback 3Document3 pagesChargeback 3Jay DiadoraNo ratings yet

- Love Is Blind - So You Better Wear Glasses: Romance ScamsDocument4 pagesLove Is Blind - So You Better Wear Glasses: Romance ScamsRenier CaneoNo ratings yet

- New Privacy CatalogDocument16 pagesNew Privacy Catalogemmanuelhood642No ratings yet

- Banking Ombudsman - Quick Guides 2Document5 pagesBanking Ombudsman - Quick Guides 2atty_denise_uy0% (1)

- Scambusters!: More than 60 Ways Seniors Get Swindled and How They Can Prevent ItFrom EverandScambusters!: More than 60 Ways Seniors Get Swindled and How They Can Prevent ItNo ratings yet

- Making Money In Thailand: Live and Work In ThailandFrom EverandMaking Money In Thailand: Live and Work In ThailandRating: 3.5 out of 5 stars3.5/5 (2)

- Cover Letter For Visa Application KoreaDocument4 pagesCover Letter For Visa Application Koreafskt032h100% (1)

- April 3, 2020Document24 pagesApril 3, 2020amoses88No ratings yet

- Dating and Romance ScamDocument3 pagesDating and Romance ScamOmar AqoubNo ratings yet

- It Pays To Stop and Think: Protect Yourself From Financial FraudDocument5 pagesIt Pays To Stop and Think: Protect Yourself From Financial FraudHamza AbbasNo ratings yet

- Life Partner Online?: CautiousDocument7 pagesLife Partner Online?: CautiousYuva SpandanNo ratings yet

- Matrimonial Fraud Brochure FinalDocument7 pagesMatrimonial Fraud Brochure FinalYashu YashNo ratings yet

- Lottery 8.20.15Document2 pagesLottery 8.20.15kamerNo ratings yet

- 86627745680Document4 pages86627745680scottjames419sugardaddyNo ratings yet

- The Dummies Guide To FreedomDocument37 pagesThe Dummies Guide To FreedomJose Barcelona100% (1)

- Identity Theft WebquestDocument2 pagesIdentity Theft Webquestapi-256416574No ratings yet

- Banking and Online Account ScamsDocument3 pagesBanking and Online Account ScamsRadhi ShatobNo ratings yet

- Frauds in Banks..1Document39 pagesFrauds in Banks..1Tilak SalianNo ratings yet

- Amerant - Begin Using New Online Credentials November 6 - Learn HowDocument5 pagesAmerant - Begin Using New Online Credentials November 6 - Learn Howscribd01No ratings yet

- #280 BBB 03-26-09 12Document1 page#280 BBB 03-26-09 12bmoakNo ratings yet

- Our Scams LeafletDocument12 pagesOur Scams LeafletMarius HultoanaNo ratings yet

- FormedSkillful RW3 Unit 1 Test - EditableDocument5 pagesFormedSkillful RW3 Unit 1 Test - EditableAndrea AguilarNo ratings yet

- ANZ Scams and Fraud GuideDocument6 pagesANZ Scams and Fraud GuideDhruv GomberNo ratings yet

- How to Protect Yourself from 'Pretend' Friend Requests & Email ScamsFrom EverandHow to Protect Yourself from 'Pretend' Friend Requests & Email ScamsNo ratings yet

- Guarding Against Online Identity Theft: A Simple Guide to Online SecurityFrom EverandGuarding Against Online Identity Theft: A Simple Guide to Online SecurityNo ratings yet

- Identity Theft WebquestDocument2 pagesIdentity Theft Webquestapi-256421103No ratings yet

- Common Internet ScamsDocument4 pagesCommon Internet ScamsAvani JainNo ratings yet

- Advance Fee Fraud SchemesDocument6 pagesAdvance Fee Fraud Schemeshouessiononfiace468No ratings yet

- 5 Common Scams in MalaysiaDocument1 page5 Common Scams in MalaysianoorhanaNo ratings yet

- How To Identify Counterfeit BillsDocument5 pagesHow To Identify Counterfeit BillsABIGAIL LEA CANTO QUISPEALAYANo ratings yet

- Looch - A.S.A.D. Night in HamburgDocument48 pagesLooch - A.S.A.D. Night in HamburgMario Langlois100% (1)

- Assignment of Management of Financial Services: Submitted To: Submitted byDocument9 pagesAssignment of Management of Financial Services: Submitted To: Submitted bygautam_gt2No ratings yet

- WHAT's in Your Wallet: Study Strategy Cheat SheetDocument2 pagesWHAT's in Your Wallet: Study Strategy Cheat SheetPlus BNo ratings yet

- COPS SCAMS CommonDocument7 pagesCOPS SCAMS Commonlucif9968No ratings yet

- Draja Mickaharic - A Miscellany of Information - Magical and OtherwiseDocument148 pagesDraja Mickaharic - A Miscellany of Information - Magical and OtherwiseSnocrash75% (4)

- Advanced Carding. CvvRamirezDocument24 pagesAdvanced Carding. CvvRamirezScribdTranslationsNo ratings yet

- Edited - Pineapple Pro Tip - Using Remembering NamesDocument1 pageEdited - Pineapple Pro Tip - Using Remembering NamesCaron DhojuNo ratings yet

- 11 Things You Should Never Share On Social MediaDocument2 pages11 Things You Should Never Share On Social MediaDoha KoteichNo ratings yet

- Financial Peace University:lesson2 Action Steps:fpu - Lesson 02 - PlasectomyDocument2 pagesFinancial Peace University:lesson2 Action Steps:fpu - Lesson 02 - PlasectomymathmatrixNo ratings yet

- 2023 EPS FraudPrevention Brochure WEBDocument2 pages2023 EPS FraudPrevention Brochure WEBRe ZaNo ratings yet

- Terms PDFDocument15 pagesTerms PDFdanny belenNo ratings yet

- Chem ReviewDocument21 pagesChem Reviewdanny belenNo ratings yet

- Am Lit Review Sheet Scarlet LetterDocument3 pagesAm Lit Review Sheet Scarlet Letterdanny belenNo ratings yet

- Us History Test 4-6Document4 pagesUs History Test 4-6danny belenNo ratings yet

- US History Unit 1 ReviewDocument6 pagesUS History Unit 1 Reviewdanny belenNo ratings yet

- Biology Mammal Review SheetDocument4 pagesBiology Mammal Review Sheetdanny belenNo ratings yet

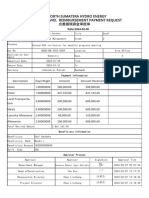

- ReinbursementDocument1 pageReinbursementtherey jawaNo ratings yet

- Account Statement From 1 Aug 2023 To 5 Sep 2023: TXN Date Value Date Description Ref No./Cheque No. DebitDocument8 pagesAccount Statement From 1 Aug 2023 To 5 Sep 2023: TXN Date Value Date Description Ref No./Cheque No. DebitPraveen SainiNo ratings yet

- ISO 27001 VS. PCI DSS. What Is ISO 27001 - by Lakshika Sammani Chandradeva - MediumDocument5 pagesISO 27001 VS. PCI DSS. What Is ISO 27001 - by Lakshika Sammani Chandradeva - MediumJoel Colquepisco EspinozaNo ratings yet

- Tanggapan Kunjungan Mine-1Document13 pagesTanggapan Kunjungan Mine-1Energi Alam BorneoNo ratings yet

- Sbiepay Sbiepay: Sbi Branch Payment Challan Sbi Branch Payment ChallanDocument1 pageSbiepay Sbiepay: Sbi Branch Payment Challan Sbi Branch Payment Challanmehraishita42No ratings yet

- XXXXXXX 4172Document8 pagesXXXXXXX 4172Appam GopiNo ratings yet

- Pengawasan e Commerce Dalam Undang-Undang Perdagangan Dan Undang-Undang Perlindungan KonsumenDocument20 pagesPengawasan e Commerce Dalam Undang-Undang Perdagangan Dan Undang-Undang Perlindungan KonsumenkarilaNo ratings yet

- Customer AttendanceDocument3 pagesCustomer Attendancejsl2001No ratings yet

- Account STMTDocument7 pagesAccount STMTanujabairagi1877No ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFBiswajeet Kumar RouthNo ratings yet

- WWW - Carddelivery. Com - Google SearchDocument1 pageWWW - Carddelivery. Com - Google SearchOluwaseyi OwolabiNo ratings yet

- Search by IFSC CodeDocument1 pageSearch by IFSC CodeMeera ChoudharyNo ratings yet

- OmniCard The Best Spend Management Platform For Indian BusinessesDocument10 pagesOmniCard The Best Spend Management Platform For Indian BusinessesmeisheilNo ratings yet

- ATM InterfaceDocument10 pagesATM InterfaceDEVNo ratings yet

- GST ChallanDocument2 pagesGST ChallanrajorajisunnyNo ratings yet

- GBP Statement: Beatriz Manchado FloresDocument2 pagesGBP Statement: Beatriz Manchado Floresmr.laravelNo ratings yet

- FIS TheGlobalPaymentsReport 2023Document182 pagesFIS TheGlobalPaymentsReport 2023Erlend ClaessenNo ratings yet

- PrintDocument2 pagesPrintShrim MasterNo ratings yet

- Routing Instructions Pakistan Conventional 07102019Document1 pageRouting Instructions Pakistan Conventional 07102019marvatNo ratings yet

- 1 PDFDocument4 pages1 PDFVishal BawaneNo ratings yet

- Statement of Axis Account No:918010022379745 For The Period (From: 01-01-2022 To: 31-12-2022)Document75 pagesStatement of Axis Account No:918010022379745 For The Period (From: 01-01-2022 To: 31-12-2022)Murugesh SalemNo ratings yet

- Barclay BillDocument3 pagesBarclay Billafish110No ratings yet

- CHASE 04-14-24 (xxxx85)Document4 pagesCHASE 04-14-24 (xxxx85)Riad HossainNo ratings yet

- Rezaul System Zone LLC (Ask My Accountant Query List)Document3 pagesRezaul System Zone LLC (Ask My Accountant Query List)Md. Munir HossainNo ratings yet

- April 12, 2023 April 30, 2023: Credit Card StatementDocument4 pagesApril 12, 2023 April 30, 2023: Credit Card StatementRaja KumarNo ratings yet

- Excel TaskDocument27 pagesExcel TaskMark JonesNo ratings yet

- Fee Schedule - CEX - IODocument1 pageFee Schedule - CEX - IOBhavsar DharnendraNo ratings yet

- Manoj Kumar StatementDocument19 pagesManoj Kumar StatementramamodupuNo ratings yet

- Account Statement From 21 Jul 2022 To 31 Aug 2022Document3 pagesAccount Statement From 21 Jul 2022 To 31 Aug 2022chinmoy patraNo ratings yet