Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsDirect Vs Indirect Labor

Direct Vs Indirect Labor

Uploaded by

RenzCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Dos and Donts in MarkstratDocument5 pagesDos and Donts in MarkstratEliana RusuNo ratings yet

- Exercise 4-24: Job Costing, Journal Entries Given:: Direct TracingDocument22 pagesExercise 4-24: Job Costing, Journal Entries Given:: Direct TracingAlmirNo ratings yet

- Account Management PlaybookDocument116 pagesAccount Management PlaybookJorge Luis SerranoNo ratings yet

- Hampton Machine Tool CompanyDocument6 pagesHampton Machine Tool CompanyClaudia Torres50% (2)

- Discussion 3 FinanceDocument7 pagesDiscussion 3 Financepeter njovuNo ratings yet

- Acfm CH - Four 2022Document182 pagesAcfm CH - Four 2022mihiretche0No ratings yet

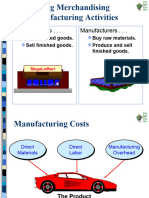

- Merchandisers - . - Manufacturers - .Document14 pagesMerchandisers - . - Manufacturers - .Mahbubur MasnunNo ratings yet

- OCBA 2022 Impact StudyDocument18 pagesOCBA 2022 Impact StudySarah McRitchieNo ratings yet

- 3.3.4 Guia 27Document2 pages3.3.4 Guia 27valeriaNo ratings yet

- Managerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinDocument55 pagesManagerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinWaqas HussainNo ratings yet

- Elements of Cost in Overheads and Labor Rates and Their SignificanceDocument15 pagesElements of Cost in Overheads and Labor Rates and Their SignificanceBrandy SangurahNo ratings yet

- Forum 12 - 43219010035 - Leonita Mega PratiwiDocument5 pagesForum 12 - 43219010035 - Leonita Mega PratiwiLeonita Mega PratiwiNo ratings yet

- Management Accounting: Product CostingDocument22 pagesManagement Accounting: Product CostingDaksh AnejaNo ratings yet

- Cost-Concepts and DefinitonsDocument4 pagesCost-Concepts and DefinitonsSHIENA TECSONNo ratings yet

- Direct Labour & Indirect LabourDocument6 pagesDirect Labour & Indirect LabourRishab Jain 2027203No ratings yet

- Introduction To Cost and Management AccountingDocument31 pagesIntroduction To Cost and Management AccountingTestNo ratings yet

- Ilovepdf MergedDocument34 pagesIlovepdf Mergeddivyanshi singhNo ratings yet

- BDAP2203Document4 pagesBDAP2203Clarissa ChenNo ratings yet

- Chapter 2 Sol 40-43Document6 pagesChapter 2 Sol 40-43Something ChicNo ratings yet

- Cost Terminologies and ClassficationsDocument51 pagesCost Terminologies and ClassficationsLim Jie XiNo ratings yet

- Chapter3 LabourCostingDocument23 pagesChapter3 LabourCostingMilton Reyes Ba�uelosNo ratings yet

- Cost Accounting and Control 1Document205 pagesCost Accounting and Control 1celynah.rheudeNo ratings yet

- 530-Article Text-1108-1-10-20230619Document5 pages530-Article Text-1108-1-10-20230619bertha yuvitaNo ratings yet

- Cost Acc. Service Audit TDocument7 pagesCost Acc. Service Audit TAli DemsisNo ratings yet

- Unit 2: Final Accounts of Manufacturing Entities: Learning OutcomesDocument11 pagesUnit 2: Final Accounts of Manufacturing Entities: Learning OutcomesUmesh KotianNo ratings yet

- Introduction To Managerial Accounting and Cost ConceptsDocument85 pagesIntroduction To Managerial Accounting and Cost Conceptsحسين عبدالرحمن100% (1)

- Financial Planning S.I.E Presentation SKMDocument36 pagesFinancial Planning S.I.E Presentation SKMVincent ChilesheNo ratings yet

- Job Costing: Example 4.18Document4 pagesJob Costing: Example 4.18Dhruvina MerNo ratings yet

- Job Order Costing - Sia and MedrianoDocument23 pagesJob Order Costing - Sia and MedrianoRichelle So SiaNo ratings yet

- Costs: Different Ways To Categorize CostsDocument7 pagesCosts: Different Ways To Categorize Costsraul_mahadikNo ratings yet

- Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions ManualDocument36 pagesCost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manualatwovarusbbn8d100% (27)

- Dwnload Full Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual PDFDocument36 pagesDwnload Full Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual PDFleroyweavervpgnrf100% (19)

- Chapter 2 - Managerial Acc. & Cost ConceptsDocument23 pagesChapter 2 - Managerial Acc. & Cost ConceptsMuhammad Ali KazmiNo ratings yet

- Unit 2: Final Accounts of Manufacturing Entities: Learning OutcomesDocument17 pagesUnit 2: Final Accounts of Manufacturing Entities: Learning OutcomessajedulNo ratings yet

- Chapter19 Principles of Accounts For Caribbean StudentsDocument7 pagesChapter19 Principles of Accounts For Caribbean StudentsPetaGay BrownNo ratings yet

- Comparing Merchandising and ManufacturingDocument14 pagesComparing Merchandising and ManufacturingOna MaeNo ratings yet

- Overhead Cost and Labour CostDocument8 pagesOverhead Cost and Labour CostMAAN SINGHANIANo ratings yet

- Product CostDocument2 pagesProduct Costmba departmentNo ratings yet

- Assignment Activity - Scope and Environment of Managerial FinanceDocument5 pagesAssignment Activity - Scope and Environment of Managerial FinanceKate Francine ChuaNo ratings yet

- Basic Cost ConceptDocument15 pagesBasic Cost ConceptExa AkbarNo ratings yet

- Odoocms Class Material-5254-Material - FileDocument23 pagesOdoocms Class Material-5254-Material - FileHoly HamsterNo ratings yet

- Module 2Document3 pagesModule 2Joe DomarsNo ratings yet

- Hand Out-6 - CostingDocument19 pagesHand Out-6 - CostingmuhammadNo ratings yet

- 2 Final Acc. Manu.Document24 pages2 Final Acc. Manu.caprerna2022No ratings yet

- An Introduction To Managerial Accounting and Cost Concepts: Mcgraw-Hill /irwinDocument93 pagesAn Introduction To Managerial Accounting and Cost Concepts: Mcgraw-Hill /irwinsaraNo ratings yet

- Introduction to Managerial Accounting Canadian 5th Edition Brewer Solutions Manual download pdf full chapterDocument54 pagesIntroduction to Managerial Accounting Canadian 5th Edition Brewer Solutions Manual download pdf full chapterjikybloch100% (8)

- Presentation On OverheadDocument10 pagesPresentation On Overheadshriti_prabhaNo ratings yet

- Individual Assignment: Management Accounting Question 1: Mariam Cakes A. Difference Between Product Cost and Period CostDocument6 pagesIndividual Assignment: Management Accounting Question 1: Mariam Cakes A. Difference Between Product Cost and Period Cost赵璐No ratings yet

- Cost Accounting Foundations and Evolutions 8th Edition Kinney Solutions ManualDocument23 pagesCost Accounting Foundations and Evolutions 8th Edition Kinney Solutions Manualatwovarusbbn8d100% (29)

- Week 2 Day 1 and 2Document29 pagesWeek 2 Day 1 and 2tantangernaldo73No ratings yet

- Lesson 2-Manufacturing AccountDocument20 pagesLesson 2-Manufacturing Accountandrewsamuelhernandez1No ratings yet

- Cost Accounting Direct CostDocument3 pagesCost Accounting Direct CostMaria G. BernardinoNo ratings yet

- Estimation and CostingDocument23 pagesEstimation and CostingYuva Rudra KolluNo ratings yet

- Cost - Accounting 04122022-1Document30 pagesCost - Accounting 04122022-1Mohamed SamerNo ratings yet

- Cost Accounting: Introduction To Cost Accounting Lecture-1 Jameel A Khan HakroDocument35 pagesCost Accounting: Introduction To Cost Accounting Lecture-1 Jameel A Khan Hakrokashif aliNo ratings yet

- Manufacturing and Non Manufacturing CostsDocument26 pagesManufacturing and Non Manufacturing Costsrajaguru_s0% (2)

- Ctivity Ased Osting Is As Simple As: A B C ABCDocument32 pagesCtivity Ased Osting Is As Simple As: A B C ABCsaptarshi_majumdar_5No ratings yet

- Cost Manage Account Searchabel PDFDocument123 pagesCost Manage Account Searchabel PDFSuhas BRNo ratings yet

- Cost Accounting Foundations and Evolutions 8th Edition Kinney Solutions ManualDocument26 pagesCost Accounting Foundations and Evolutions 8th Edition Kinney Solutions ManualToniSmithmozr100% (55)

- BudgetDocument94 pagesBudgetbolaemil20No ratings yet

- Chapter 1 - Manufacturing Account (I)Document16 pagesChapter 1 - Manufacturing Account (I)NG JIA LUNGNo ratings yet

- FABM 1 Lesson 5 June 18Document29 pagesFABM 1 Lesson 5 June 18RenzNo ratings yet

- Banking and Financial InstitutionDocument8 pagesBanking and Financial InstitutionRenzNo ratings yet

- FM - Lesson 2Document18 pagesFM - Lesson 2RenzNo ratings yet

- FABM 1 Lesson 1 June 4Document38 pagesFABM 1 Lesson 1 June 4RenzNo ratings yet

- Journal Entries FormsDocument2 pagesJournal Entries FormsRenzNo ratings yet

- Perez RealtyDocument3 pagesPerez RealtyRenzNo ratings yet

- 1) What Are The Different Types of Retailers?: Retail Categories: Service LevelDocument6 pages1) What Are The Different Types of Retailers?: Retail Categories: Service LevelMohudoom HilmiNo ratings yet

- Equipment Ledger CardDocument5 pagesEquipment Ledger CardDana A Daspit ConteNo ratings yet

- Ahn 和 Choi - 2009 - The role of bank monitoring in corporate governancDocument10 pagesAhn 和 Choi - 2009 - The role of bank monitoring in corporate governanczilin LiNo ratings yet

- Cadbury Final Report BY Jatish Cadbury Final Report BY JatishDocument22 pagesCadbury Final Report BY Jatish Cadbury Final Report BY JatishRibhu MehraNo ratings yet

- ArielDocument13 pagesArielGanifzaNo ratings yet

- Sample CVFormat 2Document2 pagesSample CVFormat 2ranajit dwibediNo ratings yet

- How Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutDocument5 pagesHow Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutalphathesisNo ratings yet

- O Levels Accounting NotesDocument10 pagesO Levels Accounting Notesoalevels90% (20)

- POM - 9. Organisational Structure and DesignDocument24 pagesPOM - 9. Organisational Structure and Designsuj.barlaasNo ratings yet

- CFA RC Equity Research Report EssentialsDocument3 pagesCFA RC Equity Research Report EssentialsSahil GoyalNo ratings yet

- Part 3Document158 pagesPart 3Lala BubNo ratings yet

- SAP SD IMG Configuration Notes 1Document135 pagesSAP SD IMG Configuration Notes 1dhiren1529No ratings yet

- Flores - Week 1 - BUSI-612 - D01 - Spring2023Document11 pagesFlores - Week 1 - BUSI-612 - D01 - Spring2023Charlene de GuzmanNo ratings yet

- Blue and White Illustrated Finance Pitch Deck PresentationDocument20 pagesBlue and White Illustrated Finance Pitch Deck PresentationAnnisa SophiaNo ratings yet

- QM-QFD (Banna Sir) - 1Document15 pagesQM-QFD (Banna Sir) - 1shahadat hossainNo ratings yet

- Transaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoDocument3 pagesTransaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoIntan BinalandNo ratings yet

- 9706 Y10 SM 2 PDFDocument6 pages9706 Y10 SM 2 PDFTinyiko BandaNo ratings yet

- Econ241 Mock ExamDocument8 pagesEcon241 Mock ExamJonathan RollingsNo ratings yet

- Substantive Audit Testing - ExpenditureDocument28 pagesSubstantive Audit Testing - ExpenditureAid BolanioNo ratings yet

- Audit Strategy For May 23Document3 pagesAudit Strategy For May 23CA Mohit SharmaNo ratings yet

- CIE A Level Accounting Work Sheet Topic: Budgeting: Loss 5 945Document15 pagesCIE A Level Accounting Work Sheet Topic: Budgeting: Loss 5 945rizwan ul hassanNo ratings yet

- Sample Audit ReportsDocument3 pagesSample Audit Reportsvivek1119100% (1)

- Options Trading CourseDocument12 pagesOptions Trading CourseYogesh NitNo ratings yet

- Value Propositions Customer Relationships Customer Segments Key Activities Key PartnershipsDocument1 pageValue Propositions Customer Relationships Customer Segments Key Activities Key PartnershipsBenedictus Anindita SatmokoNo ratings yet

- Cisco IPF at A GlanceDocument1 pageCisco IPF at A GlanceShantanu PalNo ratings yet

- Direct Marketing and Marketing StrategyDocument29 pagesDirect Marketing and Marketing StrategyShubham SinghNo ratings yet

- Group - 4 - La Moderna - WorksheetDocument1 pageGroup - 4 - La Moderna - WorksheetJasminNo ratings yet

Direct Vs Indirect Labor

Direct Vs Indirect Labor

Uploaded by

Renz0 ratings0% found this document useful (0 votes)

7 views8 pagesOriginal Title

Direct vs Indirect Labor

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views8 pagesDirect Vs Indirect Labor

Direct Vs Indirect Labor

Uploaded by

RenzCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 8

Direct vs. Indirect Labor: What are the Difference?

In order to have an accurate picture of your labor cost, it’s

important to understand the difference between direct labor

and indirect labor. Learn how to calculate these two labor

costs.

Labor is the cost of paying your employees. This cost includes

all employee-related expenses, such as payroll taxes, sick time

and vacation time, and any other benefits they may receive.

Regardless of the type of business you own, if you have

employees, you have labor costs.

However, calculating labor costs isn’t enough. In order to get a

clearer picture of your business health, you should be

calculating both direct and indirect labor. There are numerous

reasons these two labor costs need to be calculated accurately:

Ability to measure worker productivity: Tracking direct

labor costs will help you to determine how efficiently your

employees are working and how quickly they are able to

produce a product.

More accurate product pricing: Both direct and indirect

labor costs should play a starring role in determining

accurate product pricing. That’s why it’s vital that both

direct and indirect costs are factored into any final pricing

decisions.

Product profitability levels: If you only manufacture a single

product, you can easily tell whether that product is

profitable. However, for businesses that manufacture

more than one product, both direct and indirect labor

costs can play a significant role in determining individual

product profitability.

Financial statement accuracy: Financial statements are

essential in order to understand your current fiscal status.

But running a balance sheet or income statement doesn’t

yield any new insights if the information contained in the

statements is inaccurate.

Tracking both direct and indirect labor costs is important for all

business owners, particularly those that manufacture products.

The good news for you or your bookkeeper is that if you’re

using accounting software, much of the heavy lifting is done for

you.

What is direct labor?

Direct labor refers to any employee that is directly involved in

the manufacturing of a product. If your business manufactures

bicycles, the employees producing the bicycles are considered

direct labor.

Assemblers, welders, painters, and machinists would all be

considered direct labor. Direct labor costs are always variable

costs, as they will rise and fall with production costs.

Direct labor costs are the expenses incurred by paying the

wages of your direct labor employees. For example, if you work

for an automobile manufacturer and your job is to paint the

cars as they are completed, your salary would be considered a

direct labor cost.

It’s important to keep direct labor costs separate from other

labor costs, since you’ll need to have access to these costs in

order to accurately calculate total production costs.

Service businesses aren’t off the hook for calculating direct and

indirect labor, though.

If you have a service business, your direct labor costs are the

wages of staff members that provide services directly to your

customers, which would include retail salespeople, wait staff,

beauty salon stylists, and even accountants and attorneys.

Direct labor includes the employees involved in producing a

product or providing a service. Source: CFI.

What is indirect labor?

Indirect labor is labor that is not directly related to the

production of a product. For example, once a product has been

completed, the salespeople you employ would be responsible

for selling the product, but because they were not involved in

making the product, they would be considered indirect labor.

Indirect labor costs can be fixed costs or variable costs,

depending on the situation. In a manufacturing setting,

administrative staff, maintenance staff, accounting staff, and

supervisors would all be considered indirect labor.

Just like direct labor costs, it’s important to track indirect labor

costs. With indirect labor, though, the expense is tracked as

overhead, not as cost of goods sold.

For example, let’s say you’re a practicing attorney that employs

a receptionist and a research assistant. Although both of your

employees play a vital supporting role in keeping your practice

running, both are considered indirect labor, as neither provides

services directly to the customer.

Direct vs. indirect labor: What's the difference?

Direct labor always involves production. Anyone directly

involved in the manufacturing of products or delivery of

services is considered direct labor.

Indirect labor can be a bit trickier to identify, though, because

while many employees are essential to production, they are not

necessarily involved in the actual manufacturing process. The

chart below lists some common jobs and whether the role

should be considered direct or indirect labor.

DIRECT OR

TYPE OF

JOB INDIRECT REASON

BUSINESS

LABOR

Not directly involved in p

Accountant Manufacturing Indirect

production

Directly provides services

Accountant Service Direct

customers

Directly involved in produ

Welder Manufacturing Direct

production

Directly involved in produ

Assembly worker Manufacturing Direct

production

Directly involved in produ

Machinist Manufacturing Direct

production

Quality control oversees

Quality control Manufacturing Indirect products so it cannot be ti

to one individual product

Administrative Not directly involved in p

Service Indirect

assistant services

Not directly involved in p

Security Service Indirect

services

Not directly involved in p

Security Manufacturing Indirect

services

Directly involved in produ

Painter Manufacturing Direct

production

The chart lists various jobs and whether they should be

considered direct or indirect labor.

Looking at the chart above, you’ll see that an accountant at a

manufacturing company would be considered indirect labor, as

they have no direct role in producing a product.

However, an accountant that provides services to clients would

be considered direct labor because they are directly involved in

providing the services that the business offers.

When in doubt, an easy way to determine whether an

employee’s labor costs should be considered direct or indirect

labor is whether you can directly tie them back to a specific

product or service.

How to calculate labor costs

In order to have an accurate estimate of labor costs, you’ll need

to track both direct and indirect labor costs.

Direct labor

To calculate direct cost, you’ll need to first calculate the hourly

rate for your employee. The hourly rate needs to include any

fringe benefits as well as employee payroll taxes. For example,

your welder earns $20/hour and typically works a 40-hour

week. Fringe benefits and payroll taxes for the week total $90.

Your first step is to calculate the total hourly wage for your

employee:

$90 ÷ 40 = $2.25

You’ll then add the $2.25 to the hourly wage of $20:

$2.25 + $20.00 = $22.50

That is your actual labor cost per hour. If your employee

worked 180 hours in June, his total direct labor cost would be

$4,050.

Indirect labor

While they’re not directly involved in production, indirect labor

plays a supporting role in the manufacturing process. To

calculate indirect labor, you’ll need to add up the hours that

any indirect employees worked and calculate their salary

accordingly.

For example, you had two indirect employees work in the

month of June. Sam worked 80 hours with a salary of $10/hour

and fringe benefits of $100, while Debra worked 120 hours with

a salary of $15/hour and fringe benefits totaling $125.

Sam’s indirect labor for the month would be calculated as

follows:

80 x $10 + $100 = $900

Deborah’s indirect labor for the month will be calculated as:

120 x $15 + $125 = $1,925

Added together, the total indirect labor cost for the month

would be $2,825. To calculate your total labor costs, you’ll just

add the two totals:

$4,050 + $2,825 = $6,875

Indirect labor can be a fixed or variable cost, depending on the

employee, while direct labor costs will always fluctuate with

production totals.

Tracking direct and indirect labor costs is important for any business

While it’s standard practice for larger businesses, even smaller

businesses can gain from tracking both direct and indirect labor

costs. Some of the benefits include:

Accurate financial reporting

Better budgeting

More accurate pricing

Remember, even service businesses can benefit from keeping

track of direct and indirect labor costs. While it may seem like a

lot of extra work, particularly for a small business, you’ll have a

much clearer picture of the financial health of your business by

managing these costs properly.

You might also like

- Dos and Donts in MarkstratDocument5 pagesDos and Donts in MarkstratEliana RusuNo ratings yet

- Exercise 4-24: Job Costing, Journal Entries Given:: Direct TracingDocument22 pagesExercise 4-24: Job Costing, Journal Entries Given:: Direct TracingAlmirNo ratings yet

- Account Management PlaybookDocument116 pagesAccount Management PlaybookJorge Luis SerranoNo ratings yet

- Hampton Machine Tool CompanyDocument6 pagesHampton Machine Tool CompanyClaudia Torres50% (2)

- Discussion 3 FinanceDocument7 pagesDiscussion 3 Financepeter njovuNo ratings yet

- Acfm CH - Four 2022Document182 pagesAcfm CH - Four 2022mihiretche0No ratings yet

- Merchandisers - . - Manufacturers - .Document14 pagesMerchandisers - . - Manufacturers - .Mahbubur MasnunNo ratings yet

- OCBA 2022 Impact StudyDocument18 pagesOCBA 2022 Impact StudySarah McRitchieNo ratings yet

- 3.3.4 Guia 27Document2 pages3.3.4 Guia 27valeriaNo ratings yet

- Managerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinDocument55 pagesManagerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinWaqas HussainNo ratings yet

- Elements of Cost in Overheads and Labor Rates and Their SignificanceDocument15 pagesElements of Cost in Overheads and Labor Rates and Their SignificanceBrandy SangurahNo ratings yet

- Forum 12 - 43219010035 - Leonita Mega PratiwiDocument5 pagesForum 12 - 43219010035 - Leonita Mega PratiwiLeonita Mega PratiwiNo ratings yet

- Management Accounting: Product CostingDocument22 pagesManagement Accounting: Product CostingDaksh AnejaNo ratings yet

- Cost-Concepts and DefinitonsDocument4 pagesCost-Concepts and DefinitonsSHIENA TECSONNo ratings yet

- Direct Labour & Indirect LabourDocument6 pagesDirect Labour & Indirect LabourRishab Jain 2027203No ratings yet

- Introduction To Cost and Management AccountingDocument31 pagesIntroduction To Cost and Management AccountingTestNo ratings yet

- Ilovepdf MergedDocument34 pagesIlovepdf Mergeddivyanshi singhNo ratings yet

- BDAP2203Document4 pagesBDAP2203Clarissa ChenNo ratings yet

- Chapter 2 Sol 40-43Document6 pagesChapter 2 Sol 40-43Something ChicNo ratings yet

- Cost Terminologies and ClassficationsDocument51 pagesCost Terminologies and ClassficationsLim Jie XiNo ratings yet

- Chapter3 LabourCostingDocument23 pagesChapter3 LabourCostingMilton Reyes Ba�uelosNo ratings yet

- Cost Accounting and Control 1Document205 pagesCost Accounting and Control 1celynah.rheudeNo ratings yet

- 530-Article Text-1108-1-10-20230619Document5 pages530-Article Text-1108-1-10-20230619bertha yuvitaNo ratings yet

- Cost Acc. Service Audit TDocument7 pagesCost Acc. Service Audit TAli DemsisNo ratings yet

- Unit 2: Final Accounts of Manufacturing Entities: Learning OutcomesDocument11 pagesUnit 2: Final Accounts of Manufacturing Entities: Learning OutcomesUmesh KotianNo ratings yet

- Introduction To Managerial Accounting and Cost ConceptsDocument85 pagesIntroduction To Managerial Accounting and Cost Conceptsحسين عبدالرحمن100% (1)

- Financial Planning S.I.E Presentation SKMDocument36 pagesFinancial Planning S.I.E Presentation SKMVincent ChilesheNo ratings yet

- Job Costing: Example 4.18Document4 pagesJob Costing: Example 4.18Dhruvina MerNo ratings yet

- Job Order Costing - Sia and MedrianoDocument23 pagesJob Order Costing - Sia and MedrianoRichelle So SiaNo ratings yet

- Costs: Different Ways To Categorize CostsDocument7 pagesCosts: Different Ways To Categorize Costsraul_mahadikNo ratings yet

- Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions ManualDocument36 pagesCost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manualatwovarusbbn8d100% (27)

- Dwnload Full Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual PDFDocument36 pagesDwnload Full Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual PDFleroyweavervpgnrf100% (19)

- Chapter 2 - Managerial Acc. & Cost ConceptsDocument23 pagesChapter 2 - Managerial Acc. & Cost ConceptsMuhammad Ali KazmiNo ratings yet

- Unit 2: Final Accounts of Manufacturing Entities: Learning OutcomesDocument17 pagesUnit 2: Final Accounts of Manufacturing Entities: Learning OutcomessajedulNo ratings yet

- Chapter19 Principles of Accounts For Caribbean StudentsDocument7 pagesChapter19 Principles of Accounts For Caribbean StudentsPetaGay BrownNo ratings yet

- Comparing Merchandising and ManufacturingDocument14 pagesComparing Merchandising and ManufacturingOna MaeNo ratings yet

- Overhead Cost and Labour CostDocument8 pagesOverhead Cost and Labour CostMAAN SINGHANIANo ratings yet

- Product CostDocument2 pagesProduct Costmba departmentNo ratings yet

- Assignment Activity - Scope and Environment of Managerial FinanceDocument5 pagesAssignment Activity - Scope and Environment of Managerial FinanceKate Francine ChuaNo ratings yet

- Basic Cost ConceptDocument15 pagesBasic Cost ConceptExa AkbarNo ratings yet

- Odoocms Class Material-5254-Material - FileDocument23 pagesOdoocms Class Material-5254-Material - FileHoly HamsterNo ratings yet

- Module 2Document3 pagesModule 2Joe DomarsNo ratings yet

- Hand Out-6 - CostingDocument19 pagesHand Out-6 - CostingmuhammadNo ratings yet

- 2 Final Acc. Manu.Document24 pages2 Final Acc. Manu.caprerna2022No ratings yet

- An Introduction To Managerial Accounting and Cost Concepts: Mcgraw-Hill /irwinDocument93 pagesAn Introduction To Managerial Accounting and Cost Concepts: Mcgraw-Hill /irwinsaraNo ratings yet

- Introduction to Managerial Accounting Canadian 5th Edition Brewer Solutions Manual download pdf full chapterDocument54 pagesIntroduction to Managerial Accounting Canadian 5th Edition Brewer Solutions Manual download pdf full chapterjikybloch100% (8)

- Presentation On OverheadDocument10 pagesPresentation On Overheadshriti_prabhaNo ratings yet

- Individual Assignment: Management Accounting Question 1: Mariam Cakes A. Difference Between Product Cost and Period CostDocument6 pagesIndividual Assignment: Management Accounting Question 1: Mariam Cakes A. Difference Between Product Cost and Period Cost赵璐No ratings yet

- Cost Accounting Foundations and Evolutions 8th Edition Kinney Solutions ManualDocument23 pagesCost Accounting Foundations and Evolutions 8th Edition Kinney Solutions Manualatwovarusbbn8d100% (29)

- Week 2 Day 1 and 2Document29 pagesWeek 2 Day 1 and 2tantangernaldo73No ratings yet

- Lesson 2-Manufacturing AccountDocument20 pagesLesson 2-Manufacturing Accountandrewsamuelhernandez1No ratings yet

- Cost Accounting Direct CostDocument3 pagesCost Accounting Direct CostMaria G. BernardinoNo ratings yet

- Estimation and CostingDocument23 pagesEstimation and CostingYuva Rudra KolluNo ratings yet

- Cost - Accounting 04122022-1Document30 pagesCost - Accounting 04122022-1Mohamed SamerNo ratings yet

- Cost Accounting: Introduction To Cost Accounting Lecture-1 Jameel A Khan HakroDocument35 pagesCost Accounting: Introduction To Cost Accounting Lecture-1 Jameel A Khan Hakrokashif aliNo ratings yet

- Manufacturing and Non Manufacturing CostsDocument26 pagesManufacturing and Non Manufacturing Costsrajaguru_s0% (2)

- Ctivity Ased Osting Is As Simple As: A B C ABCDocument32 pagesCtivity Ased Osting Is As Simple As: A B C ABCsaptarshi_majumdar_5No ratings yet

- Cost Manage Account Searchabel PDFDocument123 pagesCost Manage Account Searchabel PDFSuhas BRNo ratings yet

- Cost Accounting Foundations and Evolutions 8th Edition Kinney Solutions ManualDocument26 pagesCost Accounting Foundations and Evolutions 8th Edition Kinney Solutions ManualToniSmithmozr100% (55)

- BudgetDocument94 pagesBudgetbolaemil20No ratings yet

- Chapter 1 - Manufacturing Account (I)Document16 pagesChapter 1 - Manufacturing Account (I)NG JIA LUNGNo ratings yet

- FABM 1 Lesson 5 June 18Document29 pagesFABM 1 Lesson 5 June 18RenzNo ratings yet

- Banking and Financial InstitutionDocument8 pagesBanking and Financial InstitutionRenzNo ratings yet

- FM - Lesson 2Document18 pagesFM - Lesson 2RenzNo ratings yet

- FABM 1 Lesson 1 June 4Document38 pagesFABM 1 Lesson 1 June 4RenzNo ratings yet

- Journal Entries FormsDocument2 pagesJournal Entries FormsRenzNo ratings yet

- Perez RealtyDocument3 pagesPerez RealtyRenzNo ratings yet

- 1) What Are The Different Types of Retailers?: Retail Categories: Service LevelDocument6 pages1) What Are The Different Types of Retailers?: Retail Categories: Service LevelMohudoom HilmiNo ratings yet

- Equipment Ledger CardDocument5 pagesEquipment Ledger CardDana A Daspit ConteNo ratings yet

- Ahn 和 Choi - 2009 - The role of bank monitoring in corporate governancDocument10 pagesAhn 和 Choi - 2009 - The role of bank monitoring in corporate governanczilin LiNo ratings yet

- Cadbury Final Report BY Jatish Cadbury Final Report BY JatishDocument22 pagesCadbury Final Report BY Jatish Cadbury Final Report BY JatishRibhu MehraNo ratings yet

- ArielDocument13 pagesArielGanifzaNo ratings yet

- Sample CVFormat 2Document2 pagesSample CVFormat 2ranajit dwibediNo ratings yet

- How Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutDocument5 pagesHow Would Einstein Value Financial Assets? The Asset Pricing Implications of The Great BailoutalphathesisNo ratings yet

- O Levels Accounting NotesDocument10 pagesO Levels Accounting Notesoalevels90% (20)

- POM - 9. Organisational Structure and DesignDocument24 pagesPOM - 9. Organisational Structure and Designsuj.barlaasNo ratings yet

- CFA RC Equity Research Report EssentialsDocument3 pagesCFA RC Equity Research Report EssentialsSahil GoyalNo ratings yet

- Part 3Document158 pagesPart 3Lala BubNo ratings yet

- SAP SD IMG Configuration Notes 1Document135 pagesSAP SD IMG Configuration Notes 1dhiren1529No ratings yet

- Flores - Week 1 - BUSI-612 - D01 - Spring2023Document11 pagesFlores - Week 1 - BUSI-612 - D01 - Spring2023Charlene de GuzmanNo ratings yet

- Blue and White Illustrated Finance Pitch Deck PresentationDocument20 pagesBlue and White Illustrated Finance Pitch Deck PresentationAnnisa SophiaNo ratings yet

- QM-QFD (Banna Sir) - 1Document15 pagesQM-QFD (Banna Sir) - 1shahadat hossainNo ratings yet

- Transaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoDocument3 pagesTransaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoIntan BinalandNo ratings yet

- 9706 Y10 SM 2 PDFDocument6 pages9706 Y10 SM 2 PDFTinyiko BandaNo ratings yet

- Econ241 Mock ExamDocument8 pagesEcon241 Mock ExamJonathan RollingsNo ratings yet

- Substantive Audit Testing - ExpenditureDocument28 pagesSubstantive Audit Testing - ExpenditureAid BolanioNo ratings yet

- Audit Strategy For May 23Document3 pagesAudit Strategy For May 23CA Mohit SharmaNo ratings yet

- CIE A Level Accounting Work Sheet Topic: Budgeting: Loss 5 945Document15 pagesCIE A Level Accounting Work Sheet Topic: Budgeting: Loss 5 945rizwan ul hassanNo ratings yet

- Sample Audit ReportsDocument3 pagesSample Audit Reportsvivek1119100% (1)

- Options Trading CourseDocument12 pagesOptions Trading CourseYogesh NitNo ratings yet

- Value Propositions Customer Relationships Customer Segments Key Activities Key PartnershipsDocument1 pageValue Propositions Customer Relationships Customer Segments Key Activities Key PartnershipsBenedictus Anindita SatmokoNo ratings yet

- Cisco IPF at A GlanceDocument1 pageCisco IPF at A GlanceShantanu PalNo ratings yet

- Direct Marketing and Marketing StrategyDocument29 pagesDirect Marketing and Marketing StrategyShubham SinghNo ratings yet

- Group - 4 - La Moderna - WorksheetDocument1 pageGroup - 4 - La Moderna - WorksheetJasminNo ratings yet