Professional Documents

Culture Documents

Unit 4.1 Hedging

Unit 4.1 Hedging

Uploaded by

hannah0781Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 4.1 Hedging

Unit 4.1 Hedging

Uploaded by

hannah0781Copyright:

Available Formats

BBA F&A Year) (3 rd

International Financial Management

COC642B – SEMESTER 6

International Financial Management COC642B – BBA F&A Jan to May 2023

Market Participants

Hedgers:

➢ Primary participants in the market.

➢ Main objective to safeguard their investment

➢ Is any individual, firm that buy and sell physical commodity.

➢ They can be producers, wholesalers, retailers etc.

➢ Motive is not to make profit but to minimize the risk.

➢ Hedging strategy is to minimize the price risk that is impacted by the

market force on the underlying asset.

International Financial Management COC642B – BBA F&A Jan to May 2023

Market Participants

Speculators:

➢ Main objective is to make profit.

➢ They take on risk.

➢ With respect to anticipation of future price.

➢ In hope of making gain that are large enough to offset the risk

➢ They do not have any business interest

International Financial Management COC642B – BBA F&A Jan to May 2023

Market Participants

Arbitrageurs:

➢ A person which simultaneously buy and sell the asset or group of

asset from different market in order to make profit (At the moment)

➢ They are risk free because they seeks to make profit due to variation

in the prices in market.

➢ These persons gain from the mis-pricing of the instrument / market

mistakes.

➢ They turn the markets level.

International Financial Management COC642B – BBA F&A Jan to May 2023

Hedging

➢ It is a financial strategy used by the investors to mitigate the risk

➢ Recognizing the dangers that come with every investment and

choosing to be protected from any untoward event that can impact

one’s finances.

➢ It does not mean that the loss can be evaded but the loss can be

mitigated with a gain from alternative or can be minimized.

International Financial Management COC642B – BBA F&A Jan to May 2023

Hedging Currency Risk

Internal Techniques:

➢ Invoicing in domestic currency

➢ Leading and lagging – adjustment to time of payment (e.g. early

payment)

➢ Netting – within group companies (e.g. receivable / payable)

➢ Matching – payment and receipt. (match two sides of cashflow)

➢ Price variation – increase in price (last option)

➢ Asset Liability management

International Financial Management COC642B – BBA F&A Jan to May 2023

Hedging Currency Risk

External Techniques:

➢ Money market hedging

Is an agreement to exchange a certain amount of one currency for a fixed amount of another

currency.

Advantages

(a) Fixes the future rate, thus eliminating downside risk exposure.

(b) Flexibility with regard to the amount to be covered.

(c ) Money market hedges may be feasible as a way of hedging for currencies where

forward contracts are not available.

Disadvantages include:

(a) More complicated to organise than a forward contract.

(b) Fixes the future rate - no opportunity to benefit from favourable movements in exchange rates

International Financial Management COC642B – BBA F&A Jan to May 2023

Hedging Currency Risk

External Techniques:

➢ Derivative instrument

Forwards / Futures / Options and Swaps

International Financial Management COC642B – BBA F&A Jan to May 2023

Forwards

➢ An agreement to buy something on a future date at a specified price

➢ It is an OTC derivatives

➢ The party with an obligation to buy is known as “long party” and

holds “long position”

➢ The party with an obligation to Sell is known as “Short party” and

holds “Short position”

➢ The guaranteed price is the “Delivery price” or “Contract price”

➢ The date on which the sale will transpire is the “settlement date”

➢ Examples – interest rate / forex…

International Financial Management COC642B – BBA F&A Jan to May 2023

Futures

➢ An agreement to buy something on a future date at a specified price

➢ It is traded in an exchange

➢ The party with an obligation to buy is known as “long party” and

holds “long position”

➢ The party with an obligation to Sell is known as “Short party” and

holds “Short position”

➢ The guaranteed price is the “Delivery price” or “Contract price”

➢ The date on which the sale will transpire is the “settlement date”

➢ Examples – interest rate / forex…

International Financial Management COC642B – BBA F&A Jan to May 2023

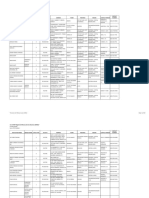

Forwards Vs Futures

Forwards Futures

OTC derivatives Traded in exchanges

Counterparties are known to each other Anonymous counterparty

Customised contract Standard contract

Settlement on delivery Daily settlement

High credit risk Low credit risk

No collateral Margin money required

Low liquidity High liquidity

International Financial Management COC642B – BBA F&A Jan to May 2023

Example on Currency futures and Forwards.

International Financial Management COC642B – BBA F&A Jan to May 2023

Swaps

➢ An agreement to exchange future cash flows

➢ The cash flow can be interest or currency.

➢ Combination of buying and selling of currencies

International Financial Management COC642B – BBA F&A Jan to May 2023

Options

➢ Grants its holder, a right but NOT an obligation to buy or sell

something

➢ “long party” or “holder” is the buyer of the instrument

➢ “Short party” or “writer” is the seller of the instrument

➢ Holder pays “Premium” to writer

➢ In return for the premium holder has right but not the obligation to

execute the contract.

➢ When “holder” buys the underlier then it is called “Call option”

➢ When “holder” sells the underlier then it is called “Put Option”

International Financial Management COC642B – BBA F&A Jan to May 2023

American Vs European option

➢ European option can be exercised only at the expiry of the contract

➢ American option can be exercised anytime during the contract.

➢ These are nothing to do with geography. These options are used in

various markets across the world.

➢ “In the money” concepts are not relevant in European option until

expiry, however for American option “In the money” concept is

relevant at any point of time during the contract period.

International Financial Management COC642B – BBA F&A Jan to May 2023

Options

Options

Call Put

Long call Short call Long put Short put

Right to buy the Obligation to sell

underlying asset the underlying asset

Call – Buy

Long position have Right

Put - Sell

Short position have obligation

International Financial Management COC642B – BBA F&A Jan to May 2023

Payoff diagram

Long forward payoff: Pcall,long = S - K

40

Strike (K) Spot (S) P / (L)

30

40 0 -40

20 40 10 -30

40 20 -20

P/ 10

(L) 40 30 -10

0

0 10 20 30 40 50 60 70 80

S 40 40 0

-10

40 50 10

-20 40 60 20

-30

40 70 30

40 80 40

-40

International Financial Management COC642B – BBA F&A Jan to May 2023

Payoff diagram

Long Call option payoff: Pcall,long = Max(0,S–K)

40

30

Strike (K) Spot (S) P / (L)

40 0 0

20

40 10 0

P/ 10

40 20 0

(L) 0

0 10 20 30 40 50 60 70 80

S 40 30 0

-10 40 40 0

-20 40 50 10

-30

40 60 20

40 70 30

-40

40 80 40

International Financial Management COC642B – BBA F&A Jan to May 2023

Payoff diagram

Short Call option payoff: Pcall,short = Min(0,K–S)

40

Strike (K) Spot (S) P / (L)

30

40 0 0

20 40 10 0

P/ 10 40 20 0

(L) 40 30 0

0

S

0 10 20 30 40 50 60 70 80

40 40 0

-10

40 50 -10

-20 40 60 -20

-30 40 70 -30

40 80 -40

-40

International Financial Management COC642B – BBA F&A Jan to May 2023

Payoff diagram

long put option payoff: Pput,long = Max(0,K–S)

40

Strike (K) Spot (S) P / (L)

30

40 0 40

20

40 10 30

P/ 10

40 20 20

(L) 40 30 10

0

0 10 20 30 40 50 60 70 80

S

-10

40 40 0

-20

40 50 0

40 60 0

-30

40 70 0

-40

40 80 0

International Financial Management COC642B – BBA F&A Jan to May 2023

Payoff diagram

Short put option payoff: Pput,Short = Min(0,S–K)

40

Strike (K) Spot (S) P / (L)

30

40 0 -40

20

40 10 -30

P/ 10 40 20 -20

(L) 40 30 -10

0

0 10 20 30 40 50 60 70 80

S

-10

40 40 0

40 50 0

-20

40 60 0

-30

40 70 0

-40 40 80 0

International Financial Management COC642B – BBA F&A Jan to May 2023

Profit/ loss diagram (with margin) 40

40

30

30

20

Long put

20 Long Call

10

10

0 0

0 10 20 30 40 50 60 70 80 0 10 20 30 40 50 60 70 80

-10 -10

-20 -20

-30

-30

-40

-40

40 40

30

Short Call 30

Short put

20

20

10

10

0

0 10 20 30 40 50 60 70 80 0

-10 0 10 20 30 40 50 60 70 80

-10

-20

-20

-30

-30

-40

-40

International Financial Management COC642B – BBA F&A Jan to May 2023

Example on Options.

International Financial Management COC642B – BBA F&A Jan to May 2023

Example 2:

India Imports from US – Payable USD 1,00,000 in 3 Months

Forward Rate Currency Option

SR $1 = INR 60 – 61 Contract Size - $ 9,000

3M FR $1 = INR 62 – 63 Call 3 Mth EP – INR 61.50

Call Premium – INR 0.70 / $

Put Premium – INR 0.15 / $

International Financial Management COC642B – BBA F&A Jan to May 2023

Example 3:

India Export to US – Receivable USD 1,00,000 in 3 Months

Forward Rate Currency Option

SR INR 1 = $ 0.0165 – 0.0167 Contract Size – INR 5,20,000

3M FR INR 1 = $ 0.0172 – 0.0175 Call 3 Mth EP – INR 1 = $ 0.0170

Call Premium – $ 0.0005 / INR

Put Premium – $ 0.0002 / INR

International Financial Management COC642B – BBA F&A Jan to May 2023

Initial margin and maintenance margin

Initial Margin:

➢ Initial margin is taken when the position is created. This is generally a %

of the contract value. The initial margins vary from one product to

another.

➢ Initial margins are calculated by most exchanges across the world using

the methodology called SPAN (Standard Portfolio Analysis of Risk).

➢ Initial margins are generally taken in cash. However certain exchanges

accept collaterals like bank guarantees, Govt bonds, T Bills, Certificate

of deposits etc also in lieu of cash margins.

➢ Exchanges however apply a haircut in accepting these securities to

provide for a change in their prices

International Financial Management COC642B – BBA F&A Jan to May 2023

Initial margin and maintenance margin

Maintenance Margin:

Futures contract follow a practice called as daily Mark to Market. It means that at

the end of each trading day, the exchange credits or debits your account by

comparing your positions to the daily settlement price. This is a key difference

between the forwards and futures contracts as well.

Once Margin falls below Maintenance Margin then margin call is initiated to top up

the margin to initial margin.

International Financial Management COC642B – BBA F&A Jan to May 2023

Numerics – Margin Money

Mr A imports goods from Mr. B and agreed to pay US$ 1,000 after 2 Months.

Mr. A enters into currency futures on US$

Initial Margin Money is 20% : Maintenance Margin Money is 10%

Calculate Margin requirements for the following days assuming the spot rate are as below:

Day Rate (INR) Assuming contract size is US$1,000

0 50

1 52

2 49

3 47

4 44

5 51

International Financial Management COC642B – BBA F&A Jan to May 2023

Moneyness

If S (Market Price) is the stock price and K is the strike price then

International Financial Management COC642B – BBA F&A Jan to May 2023

Currency forward

➢ Financial assets: loans, shares, bonds, foreign currency etc.

➢ Fluctuating prices of financial assets and risk

➢ Risk faced by importers of goods

➢ Risk faced by exporters of goods

➢ Forward contracts are commitments entered into by two parties to exchange a

specified amount of money for a particular good or service at a specified future

time

➢ Price, delivery date and quantity are decided at the time of initiating the

contract, but the actual payments and delivery of the assets take place later.

International Financial Management COC642B – BBA F&A Jan to May 2023

Currency futures

➢ Also known as FX, a contract to exchange one currency to other at a

specified date in future at an agreed price

➢ On NSE the price of future is quoted INR to 1 unit of other currency.

➢ Allows investors to hedge against exchange risk

➢ Currency derivatives are available in four currencies, USD / GBP /

EUR / JPY

➢ Currency options are available in USD

International Financial Management COC642B – BBA F&A Jan to May 2023

Currency Swap

Consider an example that a US parent Co want to invest in

infrastructure in its subsidiary in France.

Three options:

1. Borrow USD convert to EUR – Exposes Company to exchange Risk

2. Borrow in France – Rate may be high

3. Finds a counterparty and setup a swap

International Financial Management COC642B – BBA F&A Jan to May 2023

Currency Swap

US MNC need EUR 40 M to fund its plants expansion at France. If US

MNC can find a counterparty in french who needs USD equivalent to

the above amount assuming the SR is 1 EUR = US 1.5.

Assuming the French company need USD 60 M

The borrowing rates are as follows:

$ EUR

US MNC 8% 7%

French MNC 9% 6%

International Financial Management COC642B – BBA F&A Jan to May 2023

Currency Swap

Swap Bank

US MNC French MNC

Borrow USD @ 8% Borrow EUR @ 6%

International Financial Management COC642B – BBA F&A Jan to May 2023

Swap Illustration

Drilldip Inc. a US based company has a won a contract in India for drilling oil field.

The project will require an initial investment of INR 500 crore. The oil field along

with equipments will be sold to Indian Government for INR 740 crore in one year

time. Since the Indian Government will pay for the amount in Indian Rupee the

company is worried about exposure due exchange rate volatility.

You are required to:

(a) Construct a swap that will help the Drilldip to reduce the exchange rate risk.

(b) Assuming that Indian Government offers a swap at spot rate which is 1US$ =

INR50 in one year, then should the company should opt for this option or should it

just do nothing. The spot rate after one year is expected to be 1US$ = INR 54.

Further you may also assume that the Drilldip can also take a US$ loan at 8% p.a.

International Financial Management COC642B – BBA F&A Jan to May 2023

Practical questions

Illustration 1:

ABN-Amro Bank, Amsterdam, wants to purchase INR 15 million against US$ for

funding their Vostro account with Canara Bank, New Delhi. Assuming the inter-

bank, rates of US$ is INR 51.3625/3700, what would be the rate Canara Bank would

quote to ABN-Amro Bank? Further, if the deal is struck, what would be the

equivalent US$ amount.

International Financial Management COC642B – BBA F&A Jan to May 2023

Practical questions

Illustration 2:

ABC Ltd. of UK has exported goods worth Can $ 5,00,000 receivable in 6 months.

The exporter wants to hedge the receipt in the forward market. The following

information is available:

Spot Exchange Rate Can $ 2.5/£

Interest Rate in UK 12%

Interest Rate In Canada 15%

The forward rates truly reflect the interest rates differential. Find out the gain/loss

to UK exporter if Can $ spot rates (i) declines 2%, (ii) gains 4% or (iii) remains

unchanged over next 6 months.

International Financial Management COC642B – BBA F&A Jan to May 2023

Practical questions

Illustration 3:

XYZ Bank, Amsterdam, wants to purchase INR 25 million against £ for funding their

Nostro account and they have credited LORO account with Bank of London,

London.

Calculate the amount of £’s credited. Ongoing inter-bank rates are per $, INR

61.3625/3700 & per £, $ 1.5260/70.

International Financial Management COC642B – BBA F&A Jan to May 2023

Practical questions

Illustration 4:

JKL Ltd., an Indian company has an export exposure of JPY 10,000,000 payable August 31, 2014. Japanese Yen

(JPY) is not directly quoted against Indian Rupee.

The current spot rates are:

INR/US $ = INR 62.22 JPY/US$ = JPY 102.34

It is estimated that Japanese Yen will depreciate to 124 level and Indian Rupee to depreciate against US $ to

INR 65.

Forward rates for August 2014 are

INR/US $ = INR 66.50 JPY/US$ = JPY 110.35

Required:

(i) Calculate the expected loss, if the hedging is not done. How the position will change, if the firm takes

forward cover?

(ii) If the spot rates on August 31, 2014 are:

INR/US $= INR 66.25

JPY/US$ = JPY 110.85

Is the decision to take forward cover justified?

International Financial Management COC642B – BBA F&A Jan to May 2023

Practical questions

Illustration 5:

You, a foreign exchange dealer of your bank, are informed that your bank has sold a

T.T. on Copenhagen for Danish Kroner 10,00,000 at the rate of Danish Kroner 1 =

INR 6.5150. You are required to cover the transaction either in London or New York

market. The rates on that date are as under:

Mumbai-London INR 74.3000 INR 74.3200

Mumbai-New York INR 49.2500 INR 49.2625

London-Copenhagen DKK 11.4200 DKK 11.4350

New York-Copenhagen DKK 07.5670 DKK 07.5840

In which market will you cover the transaction, London or New York, and what will

be the exchange profit or loss on the transaction? Ignore brokerages.

International Financial Management COC642B – BBA F&A Jan to May 2023

Practical questions

Illustration 6:

Following information relates to AKC Ltd. which manufactures some parts of an electronics device

which are exported to USA, Japan and Europe on 90 days credit terms.

Cost and Sales information:

Japan USA Europe

Variable cost per unit INR 225 INR 395 INR 510

Export sales per unit Yen 650 US$ 10.23 Eur 11.99

Receipt from sale due in 90 days Yen 78,00,000 US$ 1,02,300 Eur 95,920

Foreign Exchange rate information:

Yen / INR US$ / INR Eur / INR

Spot market 2.417-2.437 0.0214-0.0217 0.0177-0.0180

3 months forward 2.397-2.427 0.0213-0.0216 0.0176-0.0178

3 months spot 2.423-2.459 0.02144-0.02156 0.0177-0.0179

Advice AKC Ltd. by calculating average contribution to sales ratio whether it should hedge it’s foreign currency risk or not

International Financial Management COC642B – BBA F&A Jan to May 2023

You might also like

- FX GOAT SessionsDocument6 pagesFX GOAT Sessionsjames johnNo ratings yet

- A Project On Equity AnalysisDocument93 pagesA Project On Equity Analysissam483979% (70)

- EMA Chronicles - The MagnetsDocument22 pagesEMA Chronicles - The MagnetsStellamaris MutukuNo ratings yet

- FM Mid Term RevisionDocument20 pagesFM Mid Term RevisionSheril ThomasNo ratings yet

- Goldman Sachs - Weekly Fund Flows The Selling AcceleratesDocument9 pagesGoldman Sachs - Weekly Fund Flows The Selling AcceleratesRoadtosuccessNo ratings yet

- Option MarketsDocument27 pagesOption MarketsRitika YachnaNo ratings yet

- 02 Lecture 01Document60 pages02 Lecture 01Yoann DacruzNo ratings yet

- Adobe Scan 21 Dec 2021Document20 pagesAdobe Scan 21 Dec 2021RAJAT SRIVASTAVANo ratings yet

- GBP Rates Strategy 28 January 2020Document4 pagesGBP Rates Strategy 28 January 2020Nikolaus HildebrandNo ratings yet

- Derivatives Overview PDFDocument30 pagesDerivatives Overview PDFRobinson MojicaNo ratings yet

- RT Half Year Results 2020 SlidesDocument52 pagesRT Half Year Results 2020 SlidesВасилий ВеликийNo ratings yet

- 4.1 Introduction To Forward ContractDocument9 pages4.1 Introduction To Forward ContractTimy WongNo ratings yet

- OTC Foreign Exchange Futures Market Framework: FMDQ Securities Exchange Limited Version 8.0 - February 13, 2020Document10 pagesOTC Foreign Exchange Futures Market Framework: FMDQ Securities Exchange Limited Version 8.0 - February 13, 2020mayorladNo ratings yet

- FM DVD NotesDocument103 pagesFM DVD NotesEhab GamilNo ratings yet

- LB Emtn Prospectus 18aug2022Document191 pagesLB Emtn Prospectus 18aug2022mariejoe.market1No ratings yet

- Accounting and Finance 2 (2200110169)Document15 pagesAccounting and Finance 2 (2200110169)lizashah5225No ratings yet

- Financial Management 25.11.2013 Sem5 PDFDocument4 pagesFinancial Management 25.11.2013 Sem5 PDFAlena TonyNo ratings yet

- Presentation On Summer Training: at Phoenix AdvisorsDocument36 pagesPresentation On Summer Training: at Phoenix AdvisorsYatin BhardwajNo ratings yet

- FM06 Derivatives MKT 0316Document56 pagesFM06 Derivatives MKT 0316Derek LowNo ratings yet

- Md. Ahsan Ullah - International Trade Finance and Role of BanksDocument34 pagesMd. Ahsan Ullah - International Trade Finance and Role of Banks12-057 MOHAMMAD MUSHFIQUR RAHMANNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Adv MTP A20Document14 pagesAdv MTP A20Pawan AgrawalNo ratings yet

- Barclays Primer On Spread OptionsDocument11 pagesBarclays Primer On Spread OptionsNeil SchofieldNo ratings yet

- FM DVD NotesDocument103 pagesFM DVD NotesMuhammad Shazwan NazrinNo ratings yet

- Goedgekeurde-Prospectussen 27918Document306 pagesGoedgekeurde-Prospectussen 27918davidNo ratings yet

- ARRC Best PracticesDocument9 pagesARRC Best Practicesalpha.square.betaNo ratings yet

- Accounts Dec21 Suggested Answer InterDocument27 pagesAccounts Dec21 Suggested Answer InterKotadiya RonakNo ratings yet

- Aa CH 02Document27 pagesAa CH 02zmm45x7sjtNo ratings yet

- Australian Rates Strategy: Back To The Belly - Looking To Receive 2-5-10s, 2y/2y AU vs. UKDocument5 pagesAustralian Rates Strategy: Back To The Belly - Looking To Receive 2-5-10s, 2y/2y AU vs. UKDylan AdrianNo ratings yet

- Economic Highlights: Foreign Exchange Reserves Inched Up To US$96.1bn As at 14 May - 21/05/2010Document2 pagesEconomic Highlights: Foreign Exchange Reserves Inched Up To US$96.1bn As at 14 May - 21/05/2010Rhb InvestNo ratings yet

- Time Value of MoneyDocument4 pagesTime Value of MoneynevillemukoroNo ratings yet

- CCP402Document14 pagesCCP402api-3849444No ratings yet

- FIA Regarding Proposed Rules Relating To Definitions Contained in Title VII of Dodd-Frank Wall Street Reform and Consumer Protection ActDocument7 pagesFIA Regarding Proposed Rules Relating To Definitions Contained in Title VII of Dodd-Frank Wall Street Reform and Consumer Protection ActMarketsWikiNo ratings yet

- CH 02 Hull Fundamentals 9 The DDocument27 pagesCH 02 Hull Fundamentals 9 The DTrang LeNo ratings yet

- Commodities On The Radar - Weekly Commodity UpdateDocument9 pagesCommodities On The Radar - Weekly Commodity UpdateTrading FloorNo ratings yet

- Economic Highlights - Foreign Exchange Reserves Fell To US$95.5bn As at 31 May - 8/6/2010Document2 pagesEconomic Highlights - Foreign Exchange Reserves Fell To US$95.5bn As at 31 May - 8/6/2010Rhb InvestNo ratings yet

- Bankex 240624Document4 pagesBankex 240624Karuna SriNo ratings yet

- FMR Flash Economy 2011-932 21-12-2011 GBDocument7 pagesFMR Flash Economy 2011-932 21-12-2011 GBsidharthNo ratings yet

- Arbitrage & BasisDocument25 pagesArbitrage & Basisashmitgupta411No ratings yet

- BOP NEW May 4009Document26 pagesBOP NEW May 4009hitz_88100% (2)

- Chapter 1Document32 pagesChapter 1k60.2112340088No ratings yet

- Solution Assignment - Fall 2020 - FIN622Document2 pagesSolution Assignment - Fall 2020 - FIN622KASHIFNo ratings yet

- Paper14-Solution Set2Document13 pagesPaper14-Solution Set2varshavivek.shanbhagNo ratings yet

- Scope & Limitations of Currency Derivatives in IndiaDocument39 pagesScope & Limitations of Currency Derivatives in IndiaChitrang PatelNo ratings yet

- Assignment No 1 - POF: Topics: Financial Statement Analysis & Time Value of MoneyDocument2 pagesAssignment No 1 - POF: Topics: Financial Statement Analysis & Time Value of MoneyIQRAsummers 2021No ratings yet

- How big is cash-futures basis trading in Canada’s government bond market_ - Bank of CanadaDocument15 pagesHow big is cash-futures basis trading in Canada’s government bond market_ - Bank of CanadafelixniefeiusNo ratings yet

- s6 Bcom Tax 2020 Regular - SupplyDocument33 pagess6 Bcom Tax 2020 Regular - SupplylekshmissavpmNo ratings yet

- Financial AnalysisDocument47 pagesFinancial Analysis20B81A1235cvr.ac.in G RUSHI BHARGAVNo ratings yet

- Revision Ntragroup Transactions Sundry Aspects TaxationDocument52 pagesRevision Ntragroup Transactions Sundry Aspects TaxationValerie Verity MarondedzeNo ratings yet

- Assignment NO 1 POFDocument15 pagesAssignment NO 1 POFMuhammad AsimNo ratings yet

- BIR Ruling (DA - (FIT-002) 054-10) - FWT, GRT and DST On Treasury Bonds and On Secondary TradingDocument14 pagesBIR Ruling (DA - (FIT-002) 054-10) - FWT, GRT and DST On Treasury Bonds and On Secondary TradingJerwin DaveNo ratings yet

- SocGen Hedge Fund ResearchDocument12 pagesSocGen Hedge Fund ResearchdadamNo ratings yet

- Bkar3033 Financial Accounting and Reporting Iii: Dr. Halimah at Nasibah Binti AhmadDocument23 pagesBkar3033 Financial Accounting and Reporting Iii: Dr. Halimah at Nasibah Binti AhmadezwanNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementDiya MukherjeeNo ratings yet

- Financial Derivatives PresentationDocument27 pagesFinancial Derivatives PresentationCompliance CRGNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Bact 310topic Four Accounting For Long Term Investments-2Document22 pagesBact 310topic Four Accounting For Long Term Investments-2Pa HabbakukNo ratings yet

- Inflation AccountingDocument34 pagesInflation AccountingUnbeatable 9503No ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- DERIVATIVES IncompleteDocument9 pagesDERIVATIVES IncompleteyjgjbhhbNo ratings yet

- Brazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsFrom EverandBrazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsNo ratings yet

- Bastion. StatementDocument5 pagesBastion. StatementАндрей КрупникNo ratings yet

- 22 Dollar in Riyal - SearchDocument1 page22 Dollar in Riyal - SearchMohamed IbrahimNo ratings yet

- FOREX 2 - 0 Launch EbookDocument68 pagesFOREX 2 - 0 Launch EbookAbi Ayesha100% (1)

- Foreign Exchange Management in IndiaDocument19 pagesForeign Exchange Management in IndiaOwais ShaikhNo ratings yet

- Mga Bansa Sa HILAGANG AMERIKA at Ang Pera NilaDocument6 pagesMga Bansa Sa HILAGANG AMERIKA at Ang Pera NilaAnneNosaNo ratings yet

- QPFGR Inwards 07-Mar-24 070307 1004204Document2 pagesQPFGR Inwards 07-Mar-24 070307 1004204bengunindwandweNo ratings yet

- Foreign Exchange and Risk ManagementDocument26 pagesForeign Exchange and Risk ManagementAbhimanyu SoniNo ratings yet

- PipCollector v.02 User ManualDocument6 pagesPipCollector v.02 User ManualBudi MulyonoNo ratings yet

- Worksheet 1 Financial MathDocument8 pagesWorksheet 1 Financial Mathcaroline_amideast8101No ratings yet

- 8 PDFDocument52 pages8 PDFKevin CheNo ratings yet

- Export Demo History 23654024 1632225497Document4 pagesExport Demo History 23654024 1632225497ponyot aNo ratings yet

- Munro5@chass - Utoronto.ca John - Munro@utoronto - CaDocument45 pagesMunro5@chass - Utoronto.ca John - Munro@utoronto - CakimjimNo ratings yet

- Dokumen - Pub Security Analysis and Portfolio Management 2eDocument1,054 pagesDokumen - Pub Security Analysis and Portfolio Management 2eTop Five ProductsNo ratings yet

- AN 2628 High Risk Purchase Identifier Enhancement Updated 20190618Document9 pagesAN 2628 High Risk Purchase Identifier Enhancement Updated 20190618Mariam MatiashviliNo ratings yet

- WFP Aip Canteen 2024 1Document3 pagesWFP Aip Canteen 2024 1Maureen VillacobaNo ratings yet

- Annexure - I: List of Government Land Parcels Proposed For E-Auction-Cum-E-Tender of Ranga Reddy District in Phase-IIIDocument7 pagesAnnexure - I: List of Government Land Parcels Proposed For E-Auction-Cum-E-Tender of Ranga Reddy District in Phase-IIImohommed shahedNo ratings yet

- Financial Literacy and Banking Ppt-1Document15 pagesFinancial Literacy and Banking Ppt-1278Mariyam RahmanNo ratings yet

- Ma. Eleanor T. FernandezDocument14 pagesMa. Eleanor T. FernandezJessica AcostaNo ratings yet

- Week 7 Learning EbookDocument169 pagesWeek 7 Learning EbookAnniNo ratings yet

- Cbtllll2O2O: Goreng: Customer'S Po No: Date 23-April-?02S Supermi Mie 4.50Document3 pagesCbtllll2O2O: Goreng: Customer'S Po No: Date 23-April-?02S Supermi Mie 4.50Procopio DoysabasNo ratings yet

- 1.0-Fresh Levels Versus Original LevelsDocument6 pages1.0-Fresh Levels Versus Original LevelsYvette ZitouNo ratings yet

- Ch02 Foreign Exchange MarketsDocument8 pagesCh02 Foreign Exchange MarketsPaw VerdilloNo ratings yet

- MSBsDocument538 pagesMSBsEvangeline VillegasNo ratings yet

- MAINDocument80 pagesMAINNagireddy KalluriNo ratings yet

- Application-Level Requirements AssignmentDocument4 pagesApplication-Level Requirements AssignmentJJWW1990No ratings yet

- Axitrader Ebook1 7 Lessons Forex Market Types v2 PDFDocument18 pagesAxitrader Ebook1 7 Lessons Forex Market Types v2 PDFem00105No ratings yet