Professional Documents

Culture Documents

CAN PayslipGuide en

CAN PayslipGuide en

Uploaded by

reachtobloggerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAN PayslipGuide en

CAN PayslipGuide en

Uploaded by

reachtobloggerCopyright:

Available Formats

Canada Payslip Guide

Read this guide to learn more about your payslip

The period of work you are

paid for and the date you

Your personal data: name, are paid (pay date)

company ID, how often

you are paid, the amount

you are paid per hour, and

your department.

Your address

Employer’s address Employer’s legal name and

your job title.

Amazon Confidential Version date 29 September 2022 Page 1

Canada Payslip Guide

Read this guide to learn more about your payslip

List of the earnings, Calculation of the

benefits, taxes, and earnings, benefits, taxes,

deductions that make up and deductions that make

your wages up your wages this pay

period

Your take-home pay and

the last four digits of your Your earnings, benefits,

bank account number. If taxes, and deductions

no bank account is listed, from the beginning of the

this means that you are year or your start date

paid by check. (total at the bottom)

Remaining balances for

the various types of time

off

Amazon Confidential Version date 29 September 2022 Page 2

Please note that not every employee is entitled to each type of payment listed below.

This is not a full list of all items that could appear on your payslip.

Field Description

EARNINGS

Holiday Holiday hours.

Holiday-OT Any hours actually worked on holidays.

Overtime Overtime based on hours worked.

Personal Used personal time off.

Regular Hours Regular worked hours.

Restricted Stock Value of your Restricted Stock Units (RSU) vested in CAD, paid as per Amazon policy.

Role Premium This is an earning you receive depending on your job role.

Shift Prem This is additional pay that you receive depending on the shift time you worked.

This is a bonus you are paid after you join Amazon. If applicable, this is included in the terms and

Signing Bonus

conditions of your employment contract.

SUPP BONUS This is a bonus you receive depending on the business you are working on.

You can use the transportation allowance to pay for bus passes, parking, or bike credits. This is a

Trans Allowance taxable earning. This benefit is granted to eligible employees based on Amazon policy and work

location.

Amazon Confidential Version date 29 September 2022 Page 3

Please note that not every employee is entitled to each type of payment listed below.

This is not a full list of all items that could appear on your payslip.

Field Description

EARNINGS

This benefit is granted to eligible employees based on Amazon policy and work location. You can

Transit Reimb use the transportation allowance to pay for bus passes, parking, or bike credits. This is a taxable

earning.

This is the payout of your Vacation Premium. To learn more about vacation and vacation premium,

Vac Prem Pay

read this FAQ.

Vacation Payment related to used vacation.

TAXABLE BENEFITS

AD&D Accidental death and dismemberment insurance. This is the amount to be taxed.

EE Life Ins Employee life insurance. This is the amount to be taxed.

Sp/Dep Life Spouse/dependent life insurance. This is the amount to be taxed.

SPECIAL INFORMATION

Deferred Profit Sharing Plan. This pay element shows Amazon’s contributions to your retirement

DPSP

plan.

PRE-TAX DEDUCTIONS

Registered Retirement Savings Plan. This amount is a percentage of your eligible wages that you

RRSP%

contribute to your retirement plan.

Amazon Confidential Version date 29 September 2022 Page 4

Please note that not every employee is entitled to each type of payment listed below.

This is not a full list of all items that could appear on your payslip.

Field Description

TAXES

CPP The Canada Pension Plan is issued by the Government of Canada. This is a statutory deduction.

EI Employment insurance contribution. This is a statutory deduction.

Federal tax. This includes both federal and provincial taxes, except for Quebec. This is the income

Fed Tax

tax.

Prov Tax Provincial tax (Quebec only). This is the income tax.

POST-TAX DEDUCTIONS

LTD Long-term disability insurance. This is a private insurance plan for all Amazonians working in Canada.

The remaining value of Restricted Stock Units (RSU), after they are sold to cover tax expenses. You

Net stock

will find this amount (in CAD) in your selected broker’s account.

Repayment Deduction applied if you were previously overpaid by Amazon.

OTHER ELEMENTS

Net Pay Amount to be paid in your bank account or by check after all deductions and taxes are applied.

Institution number and transit number of your bank account (will see this if you are paid by direct

Bank & Trans

deposit).

Account # Last four digits of your bank account number (will see this if you are paid by direct deposit).

Help us improve this guide.

Version date 29 September 2022 Page 5

Send us your feedback at payslipguides@amazon.com

You might also like

- Capstone 2: Day 3 (Jump Inc.) SolutionDocument17 pagesCapstone 2: Day 3 (Jump Inc.) SolutionRohan BhateNo ratings yet

- Pega ProjectDocument16 pagesPega ProjectPrashanthNo ratings yet

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- IHCM2 - Self Service User GuideDocument12 pagesIHCM2 - Self Service User GuideC MacQuarrieNo ratings yet

- Distribution Channels in Life InsuranceDocument21 pagesDistribution Channels in Life Insurancefojack67% (3)

- Your Complete Guide To Canadian Payroll (2022)Document35 pagesYour Complete Guide To Canadian Payroll (2022)petitmar1No ratings yet

- How To Access and Understand Your PayslipDocument9 pagesHow To Access and Understand Your PayslipbucalaeteclaudialoredanaNo ratings yet

- De Ned Bene T Account Guide: Issued 28 February 2022Document24 pagesDe Ned Bene T Account Guide: Issued 28 February 2022Joyce SohNo ratings yet

- Deducting Expenses As An Employee: Self-Employment: Is It For You?Document11 pagesDeducting Expenses As An Employee: Self-Employment: Is It For You?The VaultNo ratings yet

- Business Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloDocument15 pagesBusiness Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloKim Yessamin MadarcosNo ratings yet

- Business Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloDocument15 pagesBusiness Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloKim Yessamin Madarcos100% (2)

- SJD Online: Instructions ManualDocument12 pagesSJD Online: Instructions ManualClke OGNo ratings yet

- 10 TAX Tips: For Small Business OwnersDocument14 pages10 TAX Tips: For Small Business OwnersnnauthooNo ratings yet

- 10 TAX Tips: For Real Estate ProfessionalsDocument14 pages10 TAX Tips: For Real Estate ProfessionalsnnauthooNo ratings yet

- 10taxtipstrades CompressedDocument14 pages10taxtipstrades CompressednnauthooNo ratings yet

- What Is Unearned Revenue?: Deferred Revenue Accrual AccountingDocument7 pagesWhat Is Unearned Revenue?: Deferred Revenue Accrual AccountingravisankarNo ratings yet

- Amazon ContractDocument7 pagesAmazon ContractBách Nguyễn XuânNo ratings yet

- Acct1130 EcDocument2 pagesAcct1130 EcTre WriNo ratings yet

- Recruiter Lite: Confirm Your Billing CycleDocument1 pageRecruiter Lite: Confirm Your Billing Cycleజయ సింహ కసిరెడ్డిNo ratings yet

- How Banks Use Financial Ratios To Measure Your PerformanceDocument4 pagesHow Banks Use Financial Ratios To Measure Your PerformanceEmelyNo ratings yet

- Aca Walai UuuDocument13 pagesAca Walai UuuJoel AcaNo ratings yet

- 1.2.2 Personal Income Statement 31 40Document10 pages1.2.2 Personal Income Statement 31 40Zurk erianNo ratings yet

- Working Insurance ComputationDocument1 pageWorking Insurance ComputationNidhi GuptaNo ratings yet

- Payroll Deductions-The Basics For An Employer - BDC - CaDocument3 pagesPayroll Deductions-The Basics For An Employer - BDC - CaIgor MirandaNo ratings yet

- Experis Key InformationDocument11 pagesExperis Key InformationTahir SamadNo ratings yet

- Are You Sure?: Let's Find OutDocument4 pagesAre You Sure?: Let's Find Outgbg@polka.co.zaNo ratings yet

- Individual Income Taxation Part 2Document5 pagesIndividual Income Taxation Part 2Febe TeleronNo ratings yet

- About Salary Sacrifice: How Does It Work? Is There A Limit On Salary Sacrifice Contributions?Document2 pagesAbout Salary Sacrifice: How Does It Work? Is There A Limit On Salary Sacrifice Contributions?bbyesNo ratings yet

- Small Business Builder 032011Document2 pagesSmall Business Builder 032011p_levineNo ratings yet

- Configure Terms of Payment in SAP S - 4HANA FICO - Work To LearnDocument10 pagesConfigure Terms of Payment in SAP S - 4HANA FICO - Work To LearnKapadia MritulNo ratings yet

- If YouDocument3 pagesIf YouIndiraNo ratings yet

- Insurance Audit AC211Document2 pagesInsurance Audit AC211adriannado jungNo ratings yet

- Swissport - Payslip GuideDocument4 pagesSwissport - Payslip Guideazaan2005No ratings yet

- An Overview of Itemized DeductionsDocument19 pagesAn Overview of Itemized DeductionsRock Rose100% (1)

- Amazon Rewards Program Agreement: 1. Important Information About The Program and This AgreementDocument8 pagesAmazon Rewards Program Agreement: 1. Important Information About The Program and This AgreementScottNo ratings yet

- INCTAX Chapter 8 Lecture NotesDocument4 pagesINCTAX Chapter 8 Lecture NotesJoshua LisingNo ratings yet

- UAE Salary ComponentDocument2 pagesUAE Salary ComponentJyoti GuptaNo ratings yet

- Payslip GuideDocument2 pagesPayslip GuidesarahvirzidesignsNo ratings yet

- 0968-Additional-Contributions-BrochureDocument3 pages0968-Additional-Contributions-Brochureravinder.lmhNo ratings yet

- Giap Sales BrochureDocument11 pagesGiap Sales BrochureAlfred MathewsNo ratings yet

- Loan Rebate ProcessingDocument20 pagesLoan Rebate ProcessingYu ShiyuanNo ratings yet

- RL09 OperationsDocument41 pagesRL09 Operationsvinoth51No ratings yet

- How Salaries and Packages Are Constructed in The UAEDocument4 pagesHow Salaries and Packages Are Constructed in The UAEsamiulla7No ratings yet

- Embedded Value Calculation For A Life Insurance CompanyDocument27 pagesEmbedded Value Calculation For A Life Insurance CompanyJoin RiotNo ratings yet

- How To Save Tax in Private Limited CompanyDocument3 pagesHow To Save Tax in Private Limited Companytaxqoof1No ratings yet

- Why You're A Shareholder: Read This Article OnlineDocument10 pagesWhy You're A Shareholder: Read This Article OnlineAdeNo ratings yet

- When Business Owners Shouldn't Make RRSP Contributions - Canadian BusinessDocument2 pagesWhen Business Owners Shouldn't Make RRSP Contributions - Canadian Businessgurunandanm9838No ratings yet

- l04 Tax Planning StrategiesDocument4 pagesl04 Tax Planning Strategiesapi-408733519No ratings yet

- Apurba Barua - Budget Project 2017Document18 pagesApurba Barua - Budget Project 2017api-390026059No ratings yet

- Understanding Your NHS Payslip 2022-2023Document20 pagesUnderstanding Your NHS Payslip 2022-2023UmasankarNo ratings yet

- Money Moves To Make Before Saying Bye Forever' To 2020 - TheskimmDocument1 pageMoney Moves To Make Before Saying Bye Forever' To 2020 - TheskimmElenaNo ratings yet

- Taxes Ebook 2022Document41 pagesTaxes Ebook 2022Huzefa SaifeeNo ratings yet

- Dividend To EmployeeDocument4 pagesDividend To EmployeeERIN KRISTINo ratings yet

- QuickGuide Setting Up Payroll CADocument8 pagesQuickGuide Setting Up Payroll CAchristien1tshikaNo ratings yet

- Qatar Leave Salary CalculatorDocument4 pagesQatar Leave Salary CalculatorAhamed SajeethNo ratings yet

- Benefits Amazon Enrollment InformationDocument31 pagesBenefits Amazon Enrollment InformationShira KreissNo ratings yet

- In Small Independent Businesses: Women Are Like Cats—Men Are Like DogsFrom EverandIn Small Independent Businesses: Women Are Like Cats—Men Are Like DogsNo ratings yet

- HeaderDocument5 pagesHeaderSudarsan Reddy Eragam ReddyNo ratings yet

- PaystubDocument7 pagesPaystubapi-299736788No ratings yet

- PAYROLLDocument64 pagesPAYROLLsouadNo ratings yet

- Financial 12. UnitDocument17 pagesFinancial 12. UnitBener GüngörNo ratings yet

- Effective Ways of Tax ReductionDocument16 pagesEffective Ways of Tax ReductionKashf AsadNo ratings yet

- Investor Presentation Q1FY22 INRDocument53 pagesInvestor Presentation Q1FY22 INRswag anokhaNo ratings yet

- Chapter 13 Part 2Document6 pagesChapter 13 Part 2Danielle Angel MalanaNo ratings yet

- 29 December 2021 Shubham Kumar Behind Hotel Corbet Madhuban Nag Ar Kashipur Dear ShubhamDocument6 pages29 December 2021 Shubham Kumar Behind Hotel Corbet Madhuban Nag Ar Kashipur Dear ShubhamShubham ChauhanNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Ak Iiap Mock-Exam-1Document8 pagesAk Iiap Mock-Exam-1joseph s. butawanNo ratings yet

- Q Forwards JP MorganDocument4 pagesQ Forwards JP MorganDavid DorrNo ratings yet

- Alexander Forbes Company Profile 2019Document17 pagesAlexander Forbes Company Profile 2019kunlekokoNo ratings yet

- DocumentDocument3 pagesDocumentAleli Joy Profugo DalisayNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima Yojana: Consent-Cum-Declaration Form For Office UseDocument7 pagesPradhan Mantri Jeevan Jyoti Bima Yojana: Consent-Cum-Declaration Form For Office UseChanduNo ratings yet

- Annie MaidhDocument11 pagesAnnie MaidhMadhurendra SinghNo ratings yet

- A Comparative Analysis Between LIC of India & Private Insurance CompanyDocument8 pagesA Comparative Analysis Between LIC of India & Private Insurance CompanyJaishree SahuNo ratings yet

- Birds & Blooms - March 2015 USADocument68 pagesBirds & Blooms - March 2015 USAIvanRadašinović100% (3)

- Letter of InstructionDocument4 pagesLetter of Instructionmptacly9152100% (1)

- Dr. Usha N. Patil MRP SummaryDocument4 pagesDr. Usha N. Patil MRP SummaryShree GuruNo ratings yet

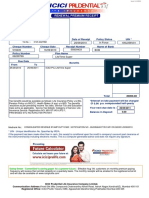

- ViewReport-icici Prem ReceiptDocument1 pageViewReport-icici Prem ReceiptPramod Shanker MathurNo ratings yet

- Bajaj Allianz Summer TrainingDocument46 pagesBajaj Allianz Summer TrainingAman BajajNo ratings yet

- Final Policy Doc AB RiderDocument5 pagesFinal Policy Doc AB RiderAlok RawatNo ratings yet

- Law of InsuranceDocument7 pagesLaw of InsuranceJack Dowson100% (1)

- Bajaj Allianz InsuranceDocument87 pagesBajaj Allianz InsuranceParshant GargNo ratings yet

- Insurance - Construction and PerfectionDocument3 pagesInsurance - Construction and Perfectionkenken320100% (2)

- Offer BreakUpDocument1 pageOffer BreakUpNaveenKumar S NNo ratings yet

- Billing FormatDocument18 pagesBilling Formatval2dawrldNo ratings yet

- Notes PDFDocument11 pagesNotes PDFPam AgtotoNo ratings yet

- Current AccountDocument17 pagesCurrent AccountBabarNo ratings yet

- OfferLetter - KakadePankaj - 04-Aug-2022 - 15 - 28 - 48Document20 pagesOfferLetter - KakadePankaj - 04-Aug-2022 - 15 - 28 - 48xf68wy6qmcNo ratings yet

- Law of InsuranceDocument37 pagesLaw of Insuranceshubham kumarNo ratings yet

- 2020NMBE Taxation With AnswersDocument21 pages2020NMBE Taxation With AnswersWilsonNo ratings yet

- New RMP PlanDocument54 pagesNew RMP Plancontactavnish100% (1)