Professional Documents

Culture Documents

Features of Flexi Loan

Features of Flexi Loan

Uploaded by

Md ArifCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Features of Flexi Loan

Features of Flexi Loan

Uploaded by

Md ArifCopyright:

Available Formats

Features of Flexi Loan:

A Flexi Loan is similar to an Overdraft facility provided by Lender. As a borrower, you can withdraw

the amount you require from the credit limit pre-approved by the Lender.

You can make a prepayment as per your convenience N number of times with ZERO Charges.

The interest rate on the Flexi Loan depends on the amount you use and for the term period

you use the amount.

You get the flexibility to pay the outstanding loan amount as and when you want to pay, but

you need to pay the interest every month if you will utilize the amount.

For Ex- If you will use 1 lac for 10 days than you need to pay ROI for just 10 days not for full 30

days.

How does the Flexi Loan work?

It works just like the Overdraft facility where the lender pre-approves a loan amount, and you

can withdraw the needed funds within the allotted credit limit. You can use the amount for

any purpose, and the interest is charged only on the amount you wish to use. The remaining

amount does not accrue any interest. Any salaried individual can apply for the Flexi Loan. The

eligibility criteria may vary from one lender to another.

If you’re looking to avail of instant funds, a Flexi Loan would be the right choice.

The following are the benefits of the loan type:

If ever you’re in a financial crisis, this loan type would be an ideal choice as you get access to

funds quickly. You can withdraw the amount whenever the need arises.

You can prepay the loan amount when you have excess funds. This helps you reduce the

burden of the principal amount.

Since the bank pre-approves the credit limit, you are entitled to withdraw anytime depending

on your emergency.

A Flexi Loan requires Minimum documentation, without any guarantors and collateral value,

as it is a pre-approved credit facility.

The interest is levied on the amount you withdraw. For instance, if you have your limit

approved for Rs <10> lakh amount and you withdraw only Rs <1> lakh, the interest rate is

applicable only on the withdrawn amount. This means your loan repayment will be easy.

For withdrawn amount from Your virtual account once limit got approved you no need to pay

any charges.

One time upfront and flexi charges will applicable at the time of limit sanction.

You will get virtual account access with human friendly net banking facility through that you

can transfer fund from your Virtual account to your link account.

ROI will be from 14% to 15% depend on the limit you will get; 1-month ROI is 1.16% to 1.25%

applicable on daily basis if amount will be utilized.

Limit you will get for next 5 or 7 year depend on the eligibility, max limit you will get up to 25

lac and minimum of 1 lac.

You might also like

- Managing and Marketing in The Global ArenaDocument17 pagesManaging and Marketing in The Global ArenaPrashanthNo ratings yet

- Workwear Express Trade Application FormDocument4 pagesWorkwear Express Trade Application FormWorkwearExpressNo ratings yet

- Sample FDCPA Debt Verification LetterDocument2 pagesSample FDCPA Debt Verification LetterwicholacayoNo ratings yet

- Chapter 3 - Excel Spreadsheet SolutionsDocument6 pagesChapter 3 - Excel Spreadsheet SolutionsYounes HJNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Majorprjctppt 1Document3 pagesMajorprjctppt 1raghavilathaNo ratings yet

- Overdraftfacility 200217101408Document9 pagesOverdraftfacility 200217101408Stephan RachelNo ratings yet

- Payday Loans With No Credit Check in 5 Minutes - Direct MoneyDocument20 pagesPayday Loans With No Credit Check in 5 Minutes - Direct MoneyDirect Money (South Africa)No ratings yet

- Adjoining Areas of Islamabad Including Hattar, Taxila and WahDocument2 pagesAdjoining Areas of Islamabad Including Hattar, Taxila and Wahaamir_110No ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiarickyNo ratings yet

- Personal Loan ProjectDocument7 pagesPersonal Loan ProjectSudhakar GuntukaNo ratings yet

- Flexi Loan-NewDocument8 pagesFlexi Loan-Newpreeetiii111222No ratings yet

- 423348" 6 Online Communities Over 40000 Lenen Je Moet Meedoen"Document2 pages423348" 6 Online Communities Over 40000 Lenen Je Moet Meedoen"lavellv4qaNo ratings yet

- 1Document5 pages1Parag ShrivastavaNo ratings yet

- Personal Loan Is An Unsecured Loan Which DoesnDocument15 pagesPersonal Loan Is An Unsecured Loan Which Doesnnitin7_jNo ratings yet

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- Various Investment Avenues in IndiaDocument74 pagesVarious Investment Avenues in IndiaRakeshNo ratings yet

- 36378" de 13 Beste Pinterest Boards Voor Leren Over Geldshop"Document2 pages36378" de 13 Beste Pinterest Boards Voor Leren Over Geldshop"karionqudrNo ratings yet

- Revolving Credit ManagementDocument2 pagesRevolving Credit ManagementmirehoNo ratings yet

- Features of OverdraftDocument2 pagesFeatures of OverdraftAnuj GuptaNo ratings yet

- Mortgage Loan CalculatorDocument2 pagesMortgage Loan CalculatorAmerica's Loan AdvisorsNo ratings yet

- Loan AskedDocument4 pagesLoan AskedAhmed MohammedNo ratings yet

- Features of Fixed DepositsDocument4 pagesFeatures of Fixed DepositsBeula Heidy19 071No ratings yet

- Home Improvement Loans: FeaturesDocument6 pagesHome Improvement Loans: Featuresshailabanumh256No ratings yet

- RBI Cuts Repo Rate, How Much Would You Save On Home Loan?Document5 pagesRBI Cuts Repo Rate, How Much Would You Save On Home Loan?Dynamic LevelsNo ratings yet

- Types of LoanDocument2 pagesTypes of LoanBEHINDS MAINNo ratings yet

- Unit 05 - Principles of Bank LendingDocument18 pagesUnit 05 - Principles of Bank LendingSayak GhoshNo ratings yet

- Kfs Secured Personal LoansDocument6 pagesKfs Secured Personal Loansrealtestemail1No ratings yet

- MMW Lesson 14 Week 14 MATHEMATICS OF FINANCE CREDIT CARDS AND CONSUMER LOANSDocument9 pagesMMW Lesson 14 Week 14 MATHEMATICS OF FINANCE CREDIT CARDS AND CONSUMER LOANStuazonkyla7No ratings yet

- Insta Loan On Card TCDocument2 pagesInsta Loan On Card TCpearlNo ratings yet

- Walk Into Your Dream Home: #OnestepcloserDocument13 pagesWalk Into Your Dream Home: #OnestepcloserMark Adam TevesNo ratings yet

- Can I Afford A LoanDocument7 pagesCan I Afford A LoanBorisNo ratings yet

- Project Final AltafDocument60 pagesProject Final AltafVirendra BhavsarNo ratings yet

- Interest RateDocument14 pagesInterest RatePriya RishiNo ratings yet

- DownloadDocument3 pagesDownloadRavi Teja GarimellaNo ratings yet

- Chapter 7. Consumer CreditDocument27 pagesChapter 7. Consumer CreditshitalNo ratings yet

- LoansDocument7 pagesLoansmba departmentNo ratings yet

- Cash Account Bank: Loan Against Bank DepositDocument1 pageCash Account Bank: Loan Against Bank Depositnikhiljain19743No ratings yet

- AKPKDocument9 pagesAKPKFlower TotsNo ratings yet

- 3.BANKING SECTOR - Nishtha ChhabraDocument83 pages3.BANKING SECTOR - Nishtha ChhabraHarshal FuseNo ratings yet

- Object ObjectDocument4 pagesObject ObjectSean LeeNo ratings yet

- Accounting, Finance and Operations - Chapter 4Document9 pagesAccounting, Finance and Operations - Chapter 4Biswajit MohantyNo ratings yet

- Urgent Cash LoansDocument1 pageUrgent Cash LoansrogergibsonNo ratings yet

- T.Y.Bbi Personal LoanDocument47 pagesT.Y.Bbi Personal LoanRIYA JAINNo ratings yet

- Project Report On Bank Deposit Schemes: Types of Deposit AccountsDocument3 pagesProject Report On Bank Deposit Schemes: Types of Deposit AccountsAmit SinghNo ratings yet

- Retail 3Document27 pagesRetail 3Pravali SaraswatNo ratings yet

- And Suitability Letter: AdviceDocument2 pagesAnd Suitability Letter: Advicemdh5cqdq5zNo ratings yet

- This Service Is Free To All Our Custom Ers:) .: Self Employed Personsresident Indiansnrimerchant NavyDocument3 pagesThis Service Is Free To All Our Custom Ers:) .: Self Employed Personsresident Indiansnrimerchant Navyrahul_goel2No ratings yet

- 1.bank Credit 2.loans & Advances 3.cash Credit 4.overdraft 5.bills DiscountingDocument11 pages1.bank Credit 2.loans & Advances 3.cash Credit 4.overdraft 5.bills DiscountingPriyanka AdivarekarNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Presentation of Money and Banking FinalDocument25 pagesPresentation of Money and Banking FinalGHANI BUTTNo ratings yet

- Project Report On Convergence of Banking Sector To Housing FinanceDocument4 pagesProject Report On Convergence of Banking Sector To Housing FinanceHari PrasadNo ratings yet

- Introduction:-: Establishment For Custody of Money, Which It Pays Out On Customer's Order."Document12 pagesIntroduction:-: Establishment For Custody of Money, Which It Pays Out On Customer's Order."varunNo ratings yet

- 0030 PDFDocument4 pages0030 PDFNadeem QadirNo ratings yet

- 4 Types of Short-Term LoansDocument2 pages4 Types of Short-Term LoansQQ Loan MalaysiaNo ratings yet

- HDFC Insta Loan DetailsDocument3 pagesHDFC Insta Loan DetailsbalaNo ratings yet

- Terms & Conditions - Insta LoanDocument3 pagesTerms & Conditions - Insta LoanBharathNo ratings yet

- Bank Loans and OverdraftDocument2 pagesBank Loans and OverdraftRaghav SomaniNo ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- Modern Debt Management - The Most Effective Debt Management SolutionsFrom EverandModern Debt Management - The Most Effective Debt Management SolutionsNo ratings yet

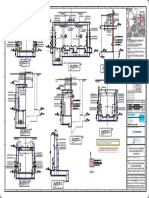

- CDCBP P086 Cp02a Jec SD Me 0002Document1 pageCDCBP P086 Cp02a Jec SD Me 0002Md ArifNo ratings yet

- SD 8-4-106 Rev 3 Structural NotesDocument1 pageSD 8-4-106 Rev 3 Structural NotesMd ArifNo ratings yet

- CDCBP P086 Cp02a Jec SD Me 0003Document1 pageCDCBP P086 Cp02a Jec SD Me 0003Md ArifNo ratings yet

- Central Doha & Corniche Beautification Project Package 2ADocument1 pageCentral Doha & Corniche Beautification Project Package 2AMd ArifNo ratings yet

- CDCBP P086 Cp02a Jec SD STR 1119 1Document1 pageCDCBP P086 Cp02a Jec SD STR 1119 1Md ArifNo ratings yet

- Section - 5 Section - 9 Section - 4: Key PlanDocument1 pageSection - 5 Section - 9 Section - 4: Key PlanMd ArifNo ratings yet

- Central Doha & Corniche Beautification - Package 2A Page 4 of 96 Microtunneling Shaft MT-3 Design Report CGD - Form.Tr - Rev02Document1 pageCentral Doha & Corniche Beautification - Package 2A Page 4 of 96 Microtunneling Shaft MT-3 Design Report CGD - Form.Tr - Rev02Md ArifNo ratings yet

- Design Calculation Structural Design Calculation For Lifting Beam (Heb400-S275) - 480KN LOADDocument4 pagesDesign Calculation Structural Design Calculation For Lifting Beam (Heb400-S275) - 480KN LOADMd ArifNo ratings yet

- Central Doha & Corniche Beautification - Package 2A Page 4 of 96 Microtunneling Shaft MT-3 Design Report CGD - Form.Tr - Rev02Document1 pageCentral Doha & Corniche Beautification - Package 2A Page 4 of 96 Microtunneling Shaft MT-3 Design Report CGD - Form.Tr - Rev02Md ArifNo ratings yet

- GLM TPL Ugc 01 GC Ol T 601Document39 pagesGLM TPL Ugc 01 GC Ol T 601Md ArifNo ratings yet

- Design Calculation of Thrustblock: Central Doha & Corniche Beautification Package 2ADocument1 pageDesign Calculation of Thrustblock: Central Doha & Corniche Beautification Package 2AMd ArifNo ratings yet

- Tour ExpencesDocument1 pageTour ExpencesMd ArifNo ratings yet

- Address PDFDocument1 pageAddress PDFMd ArifNo ratings yet

- Ankit Tyagi Final Draft Law of Taxation-IDocument13 pagesAnkit Tyagi Final Draft Law of Taxation-IAnkit TyagiNo ratings yet

- Shaka RehemaDocument8 pagesShaka RehemaKafonyi JohnNo ratings yet

- Development Bank of The Philippines V CA 1998Document2 pagesDevelopment Bank of The Philippines V CA 1998Thea P PorrasNo ratings yet

- GNDA Plot SchemeDocument15 pagesGNDA Plot Schemealokkumar1902063673No ratings yet

- 2007-Garcia - v. - Social - Security - Commission - Legal and Collection PDFDocument13 pages2007-Garcia - v. - Social - Security - Commission - Legal and Collection PDFKatrina BarrionNo ratings yet

- Accounts Assignment 2Document12 pagesAccounts Assignment 2shoaiba167% (3)

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaDocument42 pagesFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaShivam Thakur0% (1)

- Airbnb Agreement Full TextDocument7 pagesAirbnb Agreement Full TextJustin SpeersNo ratings yet

- Extension in Payment of FeeDocument3 pagesExtension in Payment of FeePrince SharmaNo ratings yet

- 1780 (4) Effective Interest RatesDocument33 pages1780 (4) Effective Interest RatesIsam BitarNo ratings yet

- Non-S 42 Exceptions To IndefeasibilityDocument42 pagesNon-S 42 Exceptions To IndefeasibilitynegromansirnmNo ratings yet

- BPSM 1Document6 pagesBPSM 1anjankumarNo ratings yet

- Module 2 (Managing Personal Finance - Philosophy in Personal Finance) - A Guide For StudentsDocument5 pagesModule 2 (Managing Personal Finance - Philosophy in Personal Finance) - A Guide For StudentsJanielle Lacandalo100% (1)

- Deed of Real Estate Mortgage-VeneracionDocument2 pagesDeed of Real Estate Mortgage-VeneracionHarold EstacioNo ratings yet

- Pharma Case Excel File For StudentsDocument53 pagesPharma Case Excel File For StudentsJerodNo ratings yet

- (Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionDocument2 pages(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionHRish BhimberNo ratings yet

- Tata Motors Notes Forming Part of Financial StatementsDocument36 pagesTata Motors Notes Forming Part of Financial StatementsSwarup RanjanNo ratings yet

- Financial Ratios Used To Measure Risk (My Report)Document9 pagesFinancial Ratios Used To Measure Risk (My Report)PASSO MiaCaoresNo ratings yet

- 2007 Nicolet National Bank Annual ReportDocument14 pages2007 Nicolet National Bank Annual ReportNicolet BankNo ratings yet

- Starting and Managing Ngo EbookDocument57 pagesStarting and Managing Ngo EbookSamuel Oloyede Oriowo100% (1)

- Objectivequestionanswersontvm 2944Document6 pagesObjectivequestionanswersontvm 2944AksNo ratings yet

- Daytradetheworld BrochureDocument5 pagesDaytradetheworld Brochurecancelthis0035994No ratings yet

- Lecture 2 Origins of SCPDocument51 pagesLecture 2 Origins of SCPjckli2No ratings yet

- Trading System in Stock ExchangeDocument19 pagesTrading System in Stock ExchangeMohan KumarNo ratings yet

- Sales Digest MIDDocument10 pagesSales Digest MIDDessa ReyesNo ratings yet

- Sps. Pen v. Sps. JulianDocument1 pageSps. Pen v. Sps. JuliandelayinggratificationNo ratings yet