Professional Documents

Culture Documents

VAT - Is A Tax On The Value Added by Every Seller To The Purchase Price or

VAT - Is A Tax On The Value Added by Every Seller To The Purchase Price or

Uploaded by

wangdywndaveCopyright:

Available Formats

You might also like

- Business and Transfer Taxation by BanggawanDocument38 pagesBusiness and Transfer Taxation by BanggawanBryan Orbina Fruto67% (24)

- Suzuki InvoiceDocument1 pageSuzuki InvoiceMUKESH KUMAR0% (3)

- Value Added Tax in The PhilippinesDocument14 pagesValue Added Tax in The Philippinesagathe laurent100% (1)

- Intero Enterprises: Total Value 69,502.00Document1 pageIntero Enterprises: Total Value 69,502.00Ashish AgarwalNo ratings yet

- Mamalateo Part 1 VATDocument12 pagesMamalateo Part 1 VATPeterNo ratings yet

- SlideshowDocument37 pagesSlideshowBhavesh AgrawalNo ratings yet

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezNo ratings yet

- WWW - Bir.gov - PHDocument4 pagesWWW - Bir.gov - PHRoy Amigo Jr.No ratings yet

- Value-Added Tax PDFDocument118 pagesValue-Added Tax PDFRazel MhinNo ratings yet

- Tax Ii - Value Added Tax: APRIL 27, 2018Document82 pagesTax Ii - Value Added Tax: APRIL 27, 2018Ronald VillanuevaNo ratings yet

- TAXATION - Value-Added TaxDocument10 pagesTAXATION - Value-Added TaxJohn Mahatma Agripa100% (2)

- Value Added TaxDocument9 pagesValue Added TaxĴõ ĔĺNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- Lecture VAT With ExercisesDocument82 pagesLecture VAT With ExercisesAko C JamzNo ratings yet

- Vat PDFDocument81 pagesVat PDFAudrey DeguzmanNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- Unit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Document23 pagesUnit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Bizu AtnafuNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelNo ratings yet

- Gimenez Jose Mari CDocument14 pagesGimenez Jose Mari CMari Calica GimenezNo ratings yet

- Business TaxDocument33 pagesBusiness TaxKiro ParafrostNo ratings yet

- Vat System and OptDocument15 pagesVat System and Optlyra21No ratings yet

- VatDocument50 pagesVatnikolaevnavalentinaNo ratings yet

- Comprehensive VAT TAXATION (3!31!14)Document166 pagesComprehensive VAT TAXATION (3!31!14)dereckriveraNo ratings yet

- VATPT For PicpaDocument73 pagesVATPT For PicpaJoy Superales SalaoNo ratings yet

- Business TaxesDocument100 pagesBusiness Taxeslynne tahilNo ratings yet

- VALUE ADDED TAX Goods Properties and ServicesDocument65 pagesVALUE ADDED TAX Goods Properties and ServicesPrincess LimNo ratings yet

- Vat On Sales of Goods or PropertiesDocument10 pagesVat On Sales of Goods or Propertiesgoerginamarquez100% (1)

- VAT Casasola NotesDocument7 pagesVAT Casasola NotesCharm AgripaNo ratings yet

- VAT Powerpoint PDFDocument202 pagesVAT Powerpoint PDFRuchie EtolleNo ratings yet

- Accounting For Indirect TaxesDocument40 pagesAccounting For Indirect TaxesSabaa if100% (1)

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- Notes On VATDocument15 pagesNotes On VATErnest Benz Sabella DavilaNo ratings yet

- Value-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDocument27 pagesValue-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDon CabasiNo ratings yet

- VAT Questions For Professional Stage Knowledge LevelDocument14 pagesVAT Questions For Professional Stage Knowledge LevelFahimaAkterNo ratings yet

- Vat IiDocument19 pagesVat IiPCNo ratings yet

- Business TaxDocument34 pagesBusiness Taxprecy.calusaNo ratings yet

- 8VATDocument70 pages8VATNoelNo ratings yet

- Notes On Vat On Importation Feb 09 2023Document2 pagesNotes On Vat On Importation Feb 09 2023barneyaguilar8732No ratings yet

- VatDocument70 pagesVatPETERWILLE CHUANo ratings yet

- Value Added Tax (Cap 476)Document15 pagesValue Added Tax (Cap 476)Triila manillaNo ratings yet

- Taxn03b Vat IntroDocument20 pagesTaxn03b Vat IntroTrishamae legaspiNo ratings yet

- Export Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesDocument13 pagesExport Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesTricia Rozl PimentelNo ratings yet

- Percentage Tax in The PhilippinesDocument3 pagesPercentage Tax in The PhilippinesfrazieNo ratings yet

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezNo ratings yet

- Business TaxesDocument51 pagesBusiness TaxesLuna CakesNo ratings yet

- Notes in Value Added TaxDocument52 pagesNotes in Value Added Taxedelyn roncalesNo ratings yet

- Tax and Basic Common TaxesDocument13 pagesTax and Basic Common TaxesDENGDENG HUANGNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Taxation Report2Document22 pagesTaxation Report2Ritchelyn ArbonNo ratings yet

- VAT AnnotatedDocument46 pagesVAT AnnotatedDr SafaNo ratings yet

- Tax UpdatesDocument19 pagesTax UpdatesYeoh MaeNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- Business Taxation 2 Lesson 1Document5 pagesBusiness Taxation 2 Lesson 1Darlyn Dalida San PedroNo ratings yet

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Affidavit of Contractor License and BondingDocument2 pagesAffidavit of Contractor License and BondingfirsttenorNo ratings yet

- RCM On Residential DwellingDocument5 pagesRCM On Residential Dwellingashok babuNo ratings yet

- FORM47Document2 pagesFORM47TMRCHS TMRCHSNo ratings yet

- TheMomsCo Invoice 1658466994-76Document1 pageTheMomsCo Invoice 1658466994-76Aravind KrishNo ratings yet

- Qi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Document9 pagesQi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Dharma kurraNo ratings yet

- Salary Slip MainDocument1 pageSalary Slip MainVineetBaliyan100% (1)

- Destruction FormDocument2 pagesDestruction FormHanabishi RekkaNo ratings yet

- July 2022Document6 pagesJuly 2022Alexis sanchesNo ratings yet

- 3 - 2551442 - Salary - Illustration - 7 - 19 - 2022 9 - 16 - 28 PMDocument1 page3 - 2551442 - Salary - Illustration - 7 - 19 - 2022 9 - 16 - 28 PMShauryaNo ratings yet

- Accra V CA G.R. No. 96322 December 20, 1991Document2 pagesAccra V CA G.R. No. 96322 December 20, 1991Felicia AllenNo ratings yet

- SummaryDocument2 pagesSummaryASWIN.M.MNo ratings yet

- 200 ReceivedDocument1 page200 ReceivedMANI BHARATHINo ratings yet

- 1081 Supporting BillDocument2 pages1081 Supporting BillAshirwad BanerjeeNo ratings yet

- Air Canada v. CIR - Taxation Law - DebtDocument3 pagesAir Canada v. CIR - Taxation Law - DebtMichael Villalon100% (1)

- Mepco Online Billl PDFDocument1 pageMepco Online Billl PDFArslanNo ratings yet

- IDBI Bank LTD.: Application Print E-Receipt Print Tax InvoiceDocument1 pageIDBI Bank LTD.: Application Print E-Receipt Print Tax InvoicePratik DalwadiNo ratings yet

- #60 CIR vs. TMX SalesDocument2 pages#60 CIR vs. TMX SalesJan Rhoneil SantillanaNo ratings yet

- Presentation On Income TaxDocument9 pagesPresentation On Income TaxUnnati GuptaNo ratings yet

- E-Payslip Advice: Eco Green City SDN BHDDocument1 pageE-Payslip Advice: Eco Green City SDN BHDNur Jannah Marwa HamdanNo ratings yet

- UDA Avenue - Employee Self ServiceDocument1 pageUDA Avenue - Employee Self ServiceAliffNo ratings yet

- Od429286320133715100 1Document1 pageOd429286320133715100 1ANDREW CENANo ratings yet

- InvoiceDocument2 pagesInvoiceRK userNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Sample IRSTax Return TranscriptDocument6 pagesSample IRSTax Return TranscriptnowayNo ratings yet

- BS Pack 3 Flat CAP 20 - BSC20: Mushak: 6.3Document1 pageBS Pack 3 Flat CAP 20 - BSC20: Mushak: 6.3Onek KothaNo ratings yet

- Notes Class XDocument2 pagesNotes Class XmailinspectoryadavNo ratings yet

- Flipkart izTDLqDhhUGmP4d9CTVuPGDocument79 pagesFlipkart izTDLqDhhUGmP4d9CTVuPGAI TOOLS FOR BUSINESSNo ratings yet

- Assignment 1Document4 pagesAssignment 111dylan97No ratings yet

VAT - Is A Tax On The Value Added by Every Seller To The Purchase Price or

VAT - Is A Tax On The Value Added by Every Seller To The Purchase Price or

Uploaded by

wangdywndaveOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT - Is A Tax On The Value Added by Every Seller To The Purchase Price or

VAT - Is A Tax On The Value Added by Every Seller To The Purchase Price or

Uploaded by

wangdywndaveCopyright:

Available Formats

VAT - is a tax on the value added by every seller to the purchase price or

cost in the sale or lease of goods, property or service in the ordinary course of

trade and business.

- They can be subject to other percentage tax if it’s exempted from business

taxes like subsistence or livelihood goods or service

VATABLE TRANSACTION

- Vatable sales of goods and services (actual sales, transaction deemed

sales)

- Sales to Government

- Zero-Rated Sales

VAT EXEMPT TRANSACTIONS

Vatable sale of goods and services ( Regular Sales)

- Transaction (VAT subject) actual gross sales or receipts exceed to general

threshold of 3,000,000

- Special threshold of 10,000,000

- Output (12%) , Input ( 2% transitional, 4% presumptive or 12% regular) ,

Either VAT payable or Excess Input Tax

Zero-Rated Sales

- Vatable Sales with 0% output tax with benefit of input tax credit

- Output (0%) , Input (12%) , Excess Input Tax

Sales to Government

- Vatable sales with different allowable input tax credit

- Output (12%) , Input (7% Standard) , Zero

VAT-exempt Sales

- Sales of Goods, Properties or service, and the use or lease of properties that

are not subject to VAT (Output Tax) and the seller or lessor is not allowed to

put any tax credit on VAT (Input Tax on purchase

- All Exempted

OUTPUT TAX

- VAT Due on the sale, lease or exchange of taxable goods or properties or

service

- Its a Ad valorem tax charged on the SELLING PRICE of taxable goods and

services and is payable by customer.

INPUT TAX

- VAT Due from PURCHASE of goods, properties or services, including lease

or use of property in course of his trade and business.

- IMPORTATION of goods

- Output - Input = VAT Payable , Called Tax Credit Approach

OPTIONAL REGISTRATION

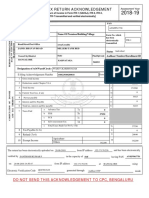

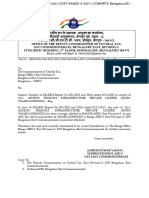

Mandatory Registration

- gross sales or receipt exceed 3,000,000 for past 12 months

- reasons to believe that the gross sales or receipt will exceed 3,000,000

-They can benefit to input tax credit if they fail register they will not receive the

credit

- TV and/or radio broadcasting companies exceed 10,000,000

Optional Registration

- VAT-exempt or not required to required to register for VAT

- If the avail the VAT, they can’t canceled it for the next 3 years

- TV and/or Radio, If not exceeded 10,000,000 but if exceed then they are

automatically subject to VAT

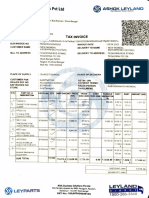

Invoicing Requirements

- VAT invoice for every sale, barter or exchange of goods or properties

- VAT official receipt for every lease of goods or properties and every sales,

barter or exchange of goods and properties

- VAT register taxpayer may issue a single invoice/receipt involving VAT

- Non-VAT has a invoice/receipt the breakdown of what are taxable and not

SOURCES OF OUTPUT VAT

- Actual Sales (Domestic Sale)

- Transaction deemed sales

- Zero-Rated Sales (Export Sale)

SOURCES OF INPUT VAT

- Local purchases of goods and services

- Acquisition of Capital Goods

- Importation

- Presumptive Input VAT

- Transitional Input VAT

- Creditable withholding VAT

Kinds of Excise Tax

- Only specific goods like (Tobacco, fuel, and alcohol)

- Known as Tax on production, sales or consumption of commodity in a

country, including certain services

- Certain goods made or produced in the Philippines for domestic sale

- “ ” goods imported

- “ “ services performed in the Philippines

- Value added tax under Title iv of the Tax Code

Specific Tax

- Made weight and volume capacity or any physical measurement

- 34. 6864

NO. UNIT / OTHER MEASUREMENT X SPECIFIC TAX RATE

Ad Valorem Tax

- Selling price or other specified value or goods/articles.

- 20%

AD VALOREM = NO. UNITS / OTHER X SELLING PRICE OF ANY

SPECIFIC VALUE PER UNIT X AD VALOREM TAX RATE

PERSONS LIABLE TO EXCISE TAX

In General

A. Domestic or local articles

Manufacturer or producers

Owner or person having possession of articles removed from the palce of

production without the payment of the tax

B. Imported Articles

Importer

Owner

Person who is found in possession of articles which are exempt from

excise taxes other than those legally entitled to exemption

OTHERS

On indigenous petroleum, natural gas or liquefied natural gas

Local sale, Barter or Transfer

Exportation

You might also like

- Business and Transfer Taxation by BanggawanDocument38 pagesBusiness and Transfer Taxation by BanggawanBryan Orbina Fruto67% (24)

- Suzuki InvoiceDocument1 pageSuzuki InvoiceMUKESH KUMAR0% (3)

- Value Added Tax in The PhilippinesDocument14 pagesValue Added Tax in The Philippinesagathe laurent100% (1)

- Intero Enterprises: Total Value 69,502.00Document1 pageIntero Enterprises: Total Value 69,502.00Ashish AgarwalNo ratings yet

- Mamalateo Part 1 VATDocument12 pagesMamalateo Part 1 VATPeterNo ratings yet

- SlideshowDocument37 pagesSlideshowBhavesh AgrawalNo ratings yet

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezNo ratings yet

- WWW - Bir.gov - PHDocument4 pagesWWW - Bir.gov - PHRoy Amigo Jr.No ratings yet

- Value-Added Tax PDFDocument118 pagesValue-Added Tax PDFRazel MhinNo ratings yet

- Tax Ii - Value Added Tax: APRIL 27, 2018Document82 pagesTax Ii - Value Added Tax: APRIL 27, 2018Ronald VillanuevaNo ratings yet

- TAXATION - Value-Added TaxDocument10 pagesTAXATION - Value-Added TaxJohn Mahatma Agripa100% (2)

- Value Added TaxDocument9 pagesValue Added TaxĴõ ĔĺNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- Lecture VAT With ExercisesDocument82 pagesLecture VAT With ExercisesAko C JamzNo ratings yet

- Vat PDFDocument81 pagesVat PDFAudrey DeguzmanNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- Unit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Document23 pagesUnit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Bizu AtnafuNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelNo ratings yet

- Gimenez Jose Mari CDocument14 pagesGimenez Jose Mari CMari Calica GimenezNo ratings yet

- Business TaxDocument33 pagesBusiness TaxKiro ParafrostNo ratings yet

- Vat System and OptDocument15 pagesVat System and Optlyra21No ratings yet

- VatDocument50 pagesVatnikolaevnavalentinaNo ratings yet

- Comprehensive VAT TAXATION (3!31!14)Document166 pagesComprehensive VAT TAXATION (3!31!14)dereckriveraNo ratings yet

- VATPT For PicpaDocument73 pagesVATPT For PicpaJoy Superales SalaoNo ratings yet

- Business TaxesDocument100 pagesBusiness Taxeslynne tahilNo ratings yet

- VALUE ADDED TAX Goods Properties and ServicesDocument65 pagesVALUE ADDED TAX Goods Properties and ServicesPrincess LimNo ratings yet

- Vat On Sales of Goods or PropertiesDocument10 pagesVat On Sales of Goods or Propertiesgoerginamarquez100% (1)

- VAT Casasola NotesDocument7 pagesVAT Casasola NotesCharm AgripaNo ratings yet

- VAT Powerpoint PDFDocument202 pagesVAT Powerpoint PDFRuchie EtolleNo ratings yet

- Accounting For Indirect TaxesDocument40 pagesAccounting For Indirect TaxesSabaa if100% (1)

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- Notes On VATDocument15 pagesNotes On VATErnest Benz Sabella DavilaNo ratings yet

- Value-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDocument27 pagesValue-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDon CabasiNo ratings yet

- VAT Questions For Professional Stage Knowledge LevelDocument14 pagesVAT Questions For Professional Stage Knowledge LevelFahimaAkterNo ratings yet

- Vat IiDocument19 pagesVat IiPCNo ratings yet

- Business TaxDocument34 pagesBusiness Taxprecy.calusaNo ratings yet

- 8VATDocument70 pages8VATNoelNo ratings yet

- Notes On Vat On Importation Feb 09 2023Document2 pagesNotes On Vat On Importation Feb 09 2023barneyaguilar8732No ratings yet

- VatDocument70 pagesVatPETERWILLE CHUANo ratings yet

- Value Added Tax (Cap 476)Document15 pagesValue Added Tax (Cap 476)Triila manillaNo ratings yet

- Taxn03b Vat IntroDocument20 pagesTaxn03b Vat IntroTrishamae legaspiNo ratings yet

- Export Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesDocument13 pagesExport Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesTricia Rozl PimentelNo ratings yet

- Percentage Tax in The PhilippinesDocument3 pagesPercentage Tax in The PhilippinesfrazieNo ratings yet

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezNo ratings yet

- Business TaxesDocument51 pagesBusiness TaxesLuna CakesNo ratings yet

- Notes in Value Added TaxDocument52 pagesNotes in Value Added Taxedelyn roncalesNo ratings yet

- Tax and Basic Common TaxesDocument13 pagesTax and Basic Common TaxesDENGDENG HUANGNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Taxation Report2Document22 pagesTaxation Report2Ritchelyn ArbonNo ratings yet

- VAT AnnotatedDocument46 pagesVAT AnnotatedDr SafaNo ratings yet

- Tax UpdatesDocument19 pagesTax UpdatesYeoh MaeNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- Business Taxation 2 Lesson 1Document5 pagesBusiness Taxation 2 Lesson 1Darlyn Dalida San PedroNo ratings yet

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Affidavit of Contractor License and BondingDocument2 pagesAffidavit of Contractor License and BondingfirsttenorNo ratings yet

- RCM On Residential DwellingDocument5 pagesRCM On Residential Dwellingashok babuNo ratings yet

- FORM47Document2 pagesFORM47TMRCHS TMRCHSNo ratings yet

- TheMomsCo Invoice 1658466994-76Document1 pageTheMomsCo Invoice 1658466994-76Aravind KrishNo ratings yet

- Qi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Document9 pagesQi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Dharma kurraNo ratings yet

- Salary Slip MainDocument1 pageSalary Slip MainVineetBaliyan100% (1)

- Destruction FormDocument2 pagesDestruction FormHanabishi RekkaNo ratings yet

- July 2022Document6 pagesJuly 2022Alexis sanchesNo ratings yet

- 3 - 2551442 - Salary - Illustration - 7 - 19 - 2022 9 - 16 - 28 PMDocument1 page3 - 2551442 - Salary - Illustration - 7 - 19 - 2022 9 - 16 - 28 PMShauryaNo ratings yet

- Accra V CA G.R. No. 96322 December 20, 1991Document2 pagesAccra V CA G.R. No. 96322 December 20, 1991Felicia AllenNo ratings yet

- SummaryDocument2 pagesSummaryASWIN.M.MNo ratings yet

- 200 ReceivedDocument1 page200 ReceivedMANI BHARATHINo ratings yet

- 1081 Supporting BillDocument2 pages1081 Supporting BillAshirwad BanerjeeNo ratings yet

- Air Canada v. CIR - Taxation Law - DebtDocument3 pagesAir Canada v. CIR - Taxation Law - DebtMichael Villalon100% (1)

- Mepco Online Billl PDFDocument1 pageMepco Online Billl PDFArslanNo ratings yet

- IDBI Bank LTD.: Application Print E-Receipt Print Tax InvoiceDocument1 pageIDBI Bank LTD.: Application Print E-Receipt Print Tax InvoicePratik DalwadiNo ratings yet

- #60 CIR vs. TMX SalesDocument2 pages#60 CIR vs. TMX SalesJan Rhoneil SantillanaNo ratings yet

- Presentation On Income TaxDocument9 pagesPresentation On Income TaxUnnati GuptaNo ratings yet

- E-Payslip Advice: Eco Green City SDN BHDDocument1 pageE-Payslip Advice: Eco Green City SDN BHDNur Jannah Marwa HamdanNo ratings yet

- UDA Avenue - Employee Self ServiceDocument1 pageUDA Avenue - Employee Self ServiceAliffNo ratings yet

- Od429286320133715100 1Document1 pageOd429286320133715100 1ANDREW CENANo ratings yet

- InvoiceDocument2 pagesInvoiceRK userNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Sample IRSTax Return TranscriptDocument6 pagesSample IRSTax Return TranscriptnowayNo ratings yet

- BS Pack 3 Flat CAP 20 - BSC20: Mushak: 6.3Document1 pageBS Pack 3 Flat CAP 20 - BSC20: Mushak: 6.3Onek KothaNo ratings yet

- Notes Class XDocument2 pagesNotes Class XmailinspectoryadavNo ratings yet

- Flipkart izTDLqDhhUGmP4d9CTVuPGDocument79 pagesFlipkart izTDLqDhhUGmP4d9CTVuPGAI TOOLS FOR BUSINESSNo ratings yet

- Assignment 1Document4 pagesAssignment 111dylan97No ratings yet