Professional Documents

Culture Documents

AC 121 - Corp Acc. - Balones

AC 121 - Corp Acc. - Balones

Uploaded by

sdluague0 ratings0% found this document useful (0 votes)

3 views4 pagesOriginal Title

AC 121- Corp Acc.- Balones

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views4 pagesAC 121 - Corp Acc. - Balones

AC 121 - Corp Acc. - Balones

Uploaded by

sdluagueCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

AC 121

Corporation accounting application

Vos Malyk Balones

dated 4/16/2024

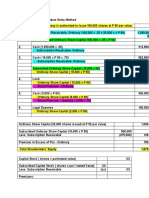

Description Debit Credit

Share issuances for cash

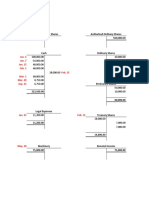

1. Issuing share capital @ par value

authorized share capital- 1,000,000.00

ordinary share

(10,000 shares x 100 par value)

note- issued 2,000 share @ par on cash basis

Entry:

Cash 200,000.00

Ordinary shares 200,000.00

(2,000 shares X 100 par)

2. Issuing share capital above par value

note- same case in #1 but sold at 150 per

share

Entry:

Cash 300,000.00

Ordinary share 200,000.00

Share premium 100,000.00

(2,000 share x 100 par- ordinary

shares)

(2,000 share x 50 par- share premium)

3. Issuing share capital (no par value)

2 classes of shares- preference shares and

no- par ordinary shares

5,000 ordinary shares were issued at

85,000.00

Entry:

Cash 85,000.00

Ordinary shares 85,000.00

4. no-par but with stated value

MST Co., no-par ordinary shares have a

stated value of 20.00 per share; entity issued

5,000 shares at 25.00 per share

4.1 entry

Cash 125,000.00

Ordinary shares 125,000.00

4.2 entry

Cash 125,000.00

Ordinary shares 100,000.00

Share premium 25,000.00

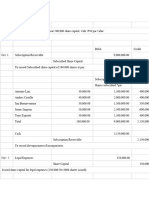

Subscription of shares

WAS Inc.

Sept 1, 20xx- 5,000 shares of 10.00 par value

ordinary shares sold on subscriptions at

12.00 per share

Sept 16: 24,000.00 subscription installment

Sept 30: 36,000.00 subscription installment

Entry 1: Sept 1 (entry related to

subscriptions)

Subscriptions Receivable 60,000.00

Subscribed ordinary shares 50,000.00

Share premium 10,000.00

Entry 2: Sept 16 (entry related to intial

installment)

Cash 24,000.00

Subscription Receivable 24,000.00

Entry 3.1: Sept 30 (entry related to final

installment)

Cash 36,000.00

Subscriptions receivable 36,000.00

Entry 3.2: Sept 30 ( entry related to issuance

of stock certificate)

Subscribed ordinary shares 50,000.00

Ordinary shares 50,000.00

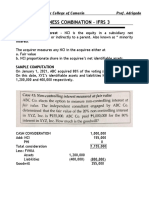

highest bidder illustration

WAS Inc.

Sept 1, 20xx: 5,000 shares of 10.00 par value

ordinary shares sold on subscriptions at

12.00 per share

note- subscriber failed to settle 48,000.00

Public auction:

offer price is 56,000.00

unpaid balance 48,000.00

accrued interest (interest revenue) 3,000.00

other expenses related to auction (aution

expenses) 5,000.00

56,000.00

bidders:

L bidder (highest bidder) 4300 shares

U bidder 4500 shares

W bidder 4700 shares

Entry 1: Sept 1 (entry related to

subscriptions)

Subscriptions Receivable 60,000.00

Subscribed ordinary shares 50,000.00

Share premium 10,000.00

Entry 2: Sept 16 (entry related to intial

installment)

Cash 12,000.00

Subscription Receivable 12,000.00

Entry 3: (entry related to accrued interest on

delinquent shares )

Receivable from highest bidder 3,000.00

Interest income 3,000.00

Entry 4: (entry related to auction expenses)

Receivable from highest bidder 5,000.00

cash 5,000.00

Entry 5.1: (entry related to L bidder, highest

bidder)

Cash 56,000.00

Receivable from highest bidder 8,000.00

Subscriptions Receivable 48,000.00

Entry 5.2: (entry related to issuance of stock

certificate)

Subscribed ordinary shares 50,000.00

Ordinary shares 50,000.00

if there is no bidder, the corporation will bid

for the delinquent shares and will be

considered as treasury shares, entry will be:

Treasury shares 56,000.00

Receivable from highest bidder 8,000.00

Subscriptions receivable 48,000.00

END

You might also like

- A Sample Car Service Center Business Plan TemplateDocument12 pagesA Sample Car Service Center Business Plan Templategealul100% (2)

- CHAPTER 15 - CORPORATION - Problem 4 - Multiple Choice - Page 569-572Document7 pagesCHAPTER 15 - CORPORATION - Problem 4 - Multiple Choice - Page 569-572Penelope Palcon100% (5)

- Name 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Document3 pagesName 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Katherine Borja100% (2)

- CORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Document9 pagesCORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Jasmine ActaNo ratings yet

- Hamid Construction Limited ProfileDocument17 pagesHamid Construction Limited ProfileAqib RafiNo ratings yet

- Outsourcing Security Case StudyDocument13 pagesOutsourcing Security Case StudyismakieNo ratings yet

- Finals SolutionsDocument24 pagesFinals SolutionsFrancine Esther CruzNo ratings yet

- Liabilities Rs. Assets Rs. Rs. Share Capital Fixed AssetsDocument2 pagesLiabilities Rs. Assets Rs. Rs. Share Capital Fixed Assetsakhiljohn1324No ratings yet

- ACCTG 124 Chapter 7Document5 pagesACCTG 124 Chapter 7John Vincent A DioNo ratings yet

- LeahDocument6 pagesLeahJoebin Corporal LopezNo ratings yet

- Quiz 14 SolutionsDocument16 pagesQuiz 14 SolutionsAlex OzfordNo ratings yet

- SHE IntaccDocument5 pagesSHE IntaccLavillaNo ratings yet

- SHE IntaccDocument5 pagesSHE IntaccLavillaNo ratings yet

- MR - Azmat Computation of Capital at End and at Start: Maarij Khan Bba 2Document10 pagesMR - Azmat Computation of Capital at End and at Start: Maarij Khan Bba 2Maarij KhanNo ratings yet

- Accounting For Business Combi SolutionDocument4 pagesAccounting For Business Combi SolutionSophia Anne Margarette NicolasNo ratings yet

- Accounting Quiz 2Document8 pagesAccounting Quiz 2Camille G.No ratings yet

- 5.3.2 Problems - Corporate LiquidationDocument16 pages5.3.2 Problems - Corporate LiquidationPaulina DocenaNo ratings yet

- Corporation Issuance of Shares Illutsrative ProblemDocument15 pagesCorporation Issuance of Shares Illutsrative ProblemHoney MuliNo ratings yet

- Valix Chapter 20Document22 pagesValix Chapter 20criszel4sobejanaNo ratings yet

- Shareholders Equity - PDF - Treasury Stock - Capital SurplusDocument15 pagesShareholders Equity - PDF - Treasury Stock - Capital SurplusRazel MhinNo ratings yet

- Chapter 1 Abc Suggested SolutionsDocument7 pagesChapter 1 Abc Suggested SolutionsAlthea Lyn ReyesNo ratings yet

- Lesson 3. Consolidated Financial StatementsDocument6 pagesLesson 3. Consolidated Financial StatementsKsUnlockerNo ratings yet

- 950k X 1/2 X 15 Per ShareDocument5 pages950k X 1/2 X 15 Per ShareNickey DickeyNo ratings yet

- Shareholders EquityDocument11 pagesShareholders EquityJasmine ActaNo ratings yet

- BusCom Part 1 Practice Set SolutionDocument10 pagesBusCom Part 1 Practice Set SolutionJude CumayaoNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Ifrs 4Document2 pagesIfrs 4Rochelle Joyce CosmeNo ratings yet

- ACCTG 124 Chapter 7-5 7-6 7-7Document20 pagesACCTG 124 Chapter 7-5 7-6 7-7John Vincent A DioNo ratings yet

- Particulars Debit CreditDocument10 pagesParticulars Debit CreditJasmine ActaNo ratings yet

- NP-accrued Interest 800/35000NP-accrued Interest 3500Document6 pagesNP-accrued Interest 800/35000NP-accrued Interest 3500TRCLNNo ratings yet

- Shareholders EquityDocument6 pagesShareholders EquityDe Guzman Olchondra Kimberly100% (1)

- Additional Illustrations 8Document16 pagesAdditional Illustrations 8Thulsi JayadevNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationAngela Marie PenarandaNo ratings yet

- Final Exam Bsma 1a June 15Document12 pagesFinal Exam Bsma 1a June 15Maeca Angela SerranoNo ratings yet

- Final Exam Bsma 1a June 15Document12 pagesFinal Exam Bsma 1a June 15Maeca Angela SerranoNo ratings yet

- Group 6 PDFDocument14 pagesGroup 6 PDFramuxeNo ratings yet

- Chapter 14 Fitria Windyasari - Tugas Manajemen Keuangan Payout PolicyDocument6 pagesChapter 14 Fitria Windyasari - Tugas Manajemen Keuangan Payout PolicyDhea Nuralifiani SafitriNo ratings yet

- Accounting For Price Level Changes 2Document9 pagesAccounting For Price Level Changes 2lil telNo ratings yet

- Sample Problems With Answer Key Inv. in Equity SecurityDocument23 pagesSample Problems With Answer Key Inv. in Equity SecurityyasherNo ratings yet

- Unrestricted Retained Earnings, Dec 31 445,000.00Document23 pagesUnrestricted Retained Earnings, Dec 31 445,000.00CmNo ratings yet

- AdditionalIllustrationPg 8 102-8 PDFDocument2 pagesAdditionalIllustrationPg 8 102-8 PDFSumant SharmaNo ratings yet

- Shareholders EquityDocument16 pagesShareholders Equitymirasolledesma7No ratings yet

- Chapter 1 Afar (Bus Com)Document24 pagesChapter 1 Afar (Bus Com)jajajaredredNo ratings yet

- Ia2 Ia2 Millan Solution - CompressDocument6 pagesIa2 Ia2 Millan Solution - CompressWynne RamosNo ratings yet

- Quiz On Pension, Equity Investments - Answer KeyDocument3 pagesQuiz On Pension, Equity Investments - Answer KeyAlthea RubinNo ratings yet

- Balance SheetDocument8 pagesBalance SheetCaryl Joyce OmboyNo ratings yet

- Assignment Bsma 1a May 27Document14 pagesAssignment Bsma 1a May 27Maeca Angela Serrano100% (1)

- Group Accounts 2 - Module AssessmentDocument25 pagesGroup Accounts 2 - Module AssessmentArn KylaNo ratings yet

- IA2 Chapter 20 ActivitiesDocument13 pagesIA2 Chapter 20 ActivitiesShaina TorraineNo ratings yet

- 1Document4 pages1NURHAM SUMLAYNo ratings yet

- Mahusay, Bsa 315, Module 1-CaseletsDocument9 pagesMahusay, Bsa 315, Module 1-CaseletsJeth MahusayNo ratings yet

- Accounting 7an Business CombinationDocument8 pagesAccounting 7an Business CombinationLabLab ChattoNo ratings yet

- Finalchapter 20Document11 pagesFinalchapter 20Jud Rossette ArcebesNo ratings yet

- Investment in Equity Securities - Problem 16-5 and 16-7Document4 pagesInvestment in Equity Securities - Problem 16-5 and 16-7Jessie Dela CruzNo ratings yet

- SolutionDocument8 pagesSolutionIts meh SushiNo ratings yet

- Prob 2 - Corporation ActDocument6 pagesProb 2 - Corporation ActDenise Jane DesoyNo ratings yet

- Castro, Geene - Activity 1 - Bsma 3205Document6 pagesCastro, Geene - Activity 1 - Bsma 3205Geene CastroNo ratings yet

- ASSIGNMENT CH 23 PROB 9 To 24Document5 pagesASSIGNMENT CH 23 PROB 9 To 24Georgina Francheska RamirezNo ratings yet

- DividendsDocument13 pagesDividendsTrixieNo ratings yet

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- Accounting - Corporation 1Document7 pagesAccounting - Corporation 1Chesca AlonNo ratings yet

- Chap16 ProblemsDocument20 pagesChap16 ProblemsYen YenNo ratings yet

- Credit Derivatives Pricing Models: Models, Pricing and ImplementationFrom EverandCredit Derivatives Pricing Models: Models, Pricing and ImplementationRating: 2 out of 5 stars2/5 (1)

- Turban Ec2010 Ch01Document39 pagesTurban Ec2010 Ch01Chris TengNo ratings yet

- Afzal 1511 3780 1 Lecture#5Document13 pagesAfzal 1511 3780 1 Lecture#5rabab balochNo ratings yet

- Long-Term Capital ManagementDocument2 pagesLong-Term Capital ManagementRohit AggarwalNo ratings yet

- Case 1Document2 pagesCase 1GA ZinNo ratings yet

- Hbfr2020ar enDocument252 pagesHbfr2020ar enhaspet777No ratings yet

- Unilateral Conduct Workbook Chapter 5: Exclusive DealingDocument39 pagesUnilateral Conduct Workbook Chapter 5: Exclusive DealingRoberto LoureiroNo ratings yet

- Abstract TBL ContentsDocument7 pagesAbstract TBL ContentsRichard Melvin GarciaNo ratings yet

- Motibhai Group Newsletter January 2020 Issue PDFDocument4 pagesMotibhai Group Newsletter January 2020 Issue PDFMotibhai GroupNo ratings yet

- SBEC 2463 Cost Studies: - Cost Data - Cost Model Cost InformationDocument33 pagesSBEC 2463 Cost Studies: - Cost Data - Cost Model Cost InformationKEE JIE HOOI A21BE0102No ratings yet

- Statement of PurposeDocument2 pagesStatement of PurposeNikunj AgrawalNo ratings yet

- Week 1 Formation Operation Dissolution 1 PDFDocument19 pagesWeek 1 Formation Operation Dissolution 1 PDFJuja FlorentinoNo ratings yet

- Demand TypesDocument18 pagesDemand TypesbonyNo ratings yet

- Based On Voice: Introduction To BpoDocument33 pagesBased On Voice: Introduction To BpoHiren ValeraNo ratings yet

- #Sales Force Effectiveness - Repsology - Tarek FarahatDocument14 pages#Sales Force Effectiveness - Repsology - Tarek FarahatNour GafarNo ratings yet

- Major Project Boat Chirag RaoDocument84 pagesMajor Project Boat Chirag Raochirag raoNo ratings yet

- CDM Process OverviewDocument23 pagesCDM Process OverviewSeema MishraNo ratings yet

- I Oniqua 12 Best Practices OG FINALDocument9 pagesI Oniqua 12 Best Practices OG FINALHasan Ali AssegafNo ratings yet

- Pas 37 38 40 41 PFRS 1Document5 pagesPas 37 38 40 41 PFRS 1LALALA LULULUNo ratings yet

- Jollibee Foods Corp The Champ of Fast FoodDocument12 pagesJollibee Foods Corp The Champ of Fast FoodRizan Jayson G. RomanoNo ratings yet

- Capital Goods As NotifiedDocument74 pagesCapital Goods As NotifiedRamesh RamNo ratings yet

- Exam QuestionsDocument7 pagesExam QuestionsElites ChoraleNo ratings yet

- Strategy Dynamics EssentialsDocument175 pagesStrategy Dynamics EssentialsnpuwitzlskrwqcnkshNo ratings yet

- Customergrievance Redressal PolicyDocument3 pagesCustomergrievance Redressal PolicySatyam PatilNo ratings yet

- Bank Nifty Intra 30min 1.0Document3 pagesBank Nifty Intra 30min 1.0jay makwanaNo ratings yet

- The SaaS CFO Finance-Accounting Tech Stack Survey v1.0Document22 pagesThe SaaS CFO Finance-Accounting Tech Stack Survey v1.0Marc ONo ratings yet

- Reporting and Analyzing Off-Balance Sheet FinancingDocument31 pagesReporting and Analyzing Off-Balance Sheet FinancingmanoranjanpatraNo ratings yet

- Media Release - Singapore and Costa Rica Sign Free Trade AgreementDocument2 pagesMedia Release - Singapore and Costa Rica Sign Free Trade Agreementrocker199No ratings yet