Professional Documents

Culture Documents

Riber 9-1 02b t19-021 38-50

Riber 9-1 02b t19-021 38-50

Uploaded by

manishchaudhary3537Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Riber 9-1 02b t19-021 38-50

Riber 9-1 02b t19-021 38-50

Uploaded by

manishchaudhary3537Copyright:

Available Formats

Review of Integrative Business and Economics Research, Vol.

9, Issue 1 38

The Impact of Dividend Policy on Shareholder

Wealth: A Study on the Retailing Industry of

Australia

Bandula Nambukara-Gamage*

James Cook University, Brisbane campus, Australia

Sheanda Terrina Peries

CQUniversity, Brisbane campus, Australia

ABSTRACT

The impact of dividend policy on shareholder wealth has been a debatable topic for

decades. The principal objective of this research is to examine the impact of dividend

policy on shareholder wealth. It was grounded on a sample of 13 companies in the

Australian retailing industry, listed on the Australian Stock Exchange (ASX) for the

period 2012-2017. Dividend payout ratio was used as the proxy variable to measure

dividend policy, whereas the market value of a share was the proxy variable for

measuring shareholder wealth. The study covered secondary data, employing

regression analysis for the purpose of analyzing the data. Previous literature has

discussed this association between dividend policy and its impact on shareholder wealth.

Studies have proven strong relationships, whereas some criticized the theories and

findings. The results of this study established that dividend policy has a positive,

moderate relationship with shareholder wealth. This was found to be consistent with

the dividend relevance, bird-in-the-hand and signaling theories.

Keywords: Dividend payout ratio, Dividend policy, Market value of share, Shareholder

wealth.

Received 22 August 2018 | Revised 14 January 2019 | Accepted 20 February 2019.

1. INTRODUCTION

The rapid advancement in information technology, together with globalisation have

raised grave concerns across all professions. For this reason, all companies attempt, not

only to increase their profitability, but also to survive in the competitive landscape. As

a result, companies will be motivated to maximise shareholder wealth, which is the

principal goal of an organisation (Jensen, 2010). There is considerable discussion on

whether dividend policy has an impact on attaining this goal (Baker & Weigand, 2015).

However, this goal conflicts with the need to maximise the value of a company (Jensen,

2010) and thus, requires a company to determine an appropriate strategy to balance the

conflicting forces (Baker & Weigand, 2015).

Baker and Weigand (2015) defined dividend policy as a strategy of a company

determining its distribution of earnings to its shareholders over time. Numerous

researches have attempted to examine the impact of dividend policy on shareholder

wealth and yet, it remains uncertain to date (Farrukh, Irshad, Shams Khakwani, Ishaque,

& Ansari, 2017). Dividend policy is a debatable topic in corporate finance and is

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 39

essential to both potential and existing investors and is also imperative for management

prosperity (Farrukh et al., 2017). In spite of the criticality of this policy, less research

is conducted to examine the effect of dividend policy on shareholder wealth in the

Australian retailing industry. Hence, this study is an endeavour to assess the impact of

dividend policy on shareholder wealth in the retailing of Australia.

The progression of the study is as follows; beginning with the introduction

incorporating the research aim and question, it then leads on to the literature review.

Subsequently, the research methodology as well as findings and discussion of the

results is presented. It closes with a conclusion discussing limitations and future

avenues of research.

1.1 PROBLEM STATEMENT

The successful operation of a business is required in order to generate earnings, which

in turn will provide a company with the ability to pay dividends (Zafar, Chaubey, &

Khalid, 2012). However, the management of a company will need to determine an

optimum level between the amount of dividends paid out and the amount reinvested in

a company (Zafar et al., 2012). This sends a signal to the market about the financial

health of a company and consequently, is used as an indicator of the performance of a

company (Zafar et al., 2012). Zafar et al. (2012) highlighted that even stable companies

consider offering dividends to shareholders as rewarding as opposed to reinvesting.

Nevertheless, the impact of dividend policy on the wealth of shareholders is a topic that

remains unresolved and would result in diverse findings for numerous geographical

contexts (Farrukh et al., 2017). Can the findings of these studies be reproduced in the

Australian retailing industry? Thus, this study fills the void by determining the effect

of the dividend policy on the wealth of shareholders in the aforesaid industry.

1.2 RESEARCH AIM AND RESEARCH QUESTION

The principal aim of this research is to assess the impact of dividend policy (variable

being dividend payout ratio) on shareholder wealth (variable being market value of a

share) in the retailing industry of Australia.

The following research question is developed in attaining the above aim;

RQ: Is there a relationship between dividend policy and shareholder wealth in the

retailing industry of Australia? In the event there is a relationship, does it have a

significant impact?

2. LITERATURE REVIEW

Numerous scholars have studied the impact of dividend policy on shareholder wealth,

resulting in contrasting perspectives, as discussed below.

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 40

2.1 DIVIDEND IRRELEVANCE THEORY

The dividend irrelevance theory, founded by Miller and Modigliani (1961), one of the

pioneers in studying this association, established that the dividend policy of a firm is

irrelevant to the current valuation of a share, and instead, it is exclusively influenced by

the investment policy of a firm. However, it is important to note that this theory was

arrived at based on certain assumptions, and hence, the validity was questioned by other

scholars.

One of the main assumptions of this theory was the existence of perfect capital markets.

This was strongly opposed by the study conducted by Baker and Jabbouri (2016) who

concluded that higher dividends were not entirely incorporated into the market values

of shares due to the inefficiencies in the market, thereby rejecting Miller and

Modigliani’s theory. Hussainey, Oscar Mgbame, and Chijoke-Mgbame (2011) stated

that the theory assumes that the best agents of shareholders are managers. However, in

reality, this thought process is questioned due to the conflicting interests of the owners

and agents (management), resulting in agency costs underlined by Hussainey et al.

(2011). This was further affirmed by Ali, Jan, and Sharif (2015, p. 63) who labelled the

assumptions as being grounded on “impractical rules”. The theory that dividend policy

and firm’s market value are independent is challenged by Nizar Al-Malkawi (2007)

since the actual market practices have depicted an association between the dividend

policy and shareholder wealth. Nevertheless, it is important to note that Miller and

Modigliani (1961, p. 430) counter argued the incompatibilities of the theory whereby a

change in the market price of a share could be merely due to the “informational content”

of dividends, rather than the effect of the dividend policy.

2.2 DIVIDEND RELEVANCE THEORY

For many decades, the view that dividends do impact shareholder wealth and are

reflected in the value of a share has been discussed.

Lintner (1956), in his study, established that dividends are vital in determining share

prices, since dividends are linked to permanent increases in earnings. It was also

established that due to the brisk reactions by shareholders, managers are hesitant to cut

dividends (Lintner, 1956) and this was consistent with Bulan and Hull’s research (2012).

Lintner’s findings were supported by many studies including Baker, Veit, and Powell

(2001) and Brav, Graham, Harvey and Michaely (2005). It is noteworthy to mention

that years later, Lintner’s model was described as the “best description of the dividend

setting process available” by Benartzi, Michaely, and Thaler (1997, p. 1032), which

was further acknowledged by a more recent study by Baker and Weigand (2015) who

identified that the model is consistently used in the shaping of dividend policies to date.

However, the validity to date was questioned by Brav et al. (2005) due to the

introduction of repurchases that has come into existence since many theories decades

ago.

2.3 BIRD-IN-THE-HAND THEORY

Lintner (1956) and Gordon (1959) established that investors would desire to have

dividends rather than capital gains since they are risk averse owing to the uncertainty

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 41

and information asymmetry in future cashflows and its impact on share price. These

findings were supported by many scholars such as Walter (1963), including more recent

studies conducted by Hussainey et al. (2011) and Ali et al. (2015) who established that

dividend payout ratio had a substantial positive relationship with share price. A point

to consider is that since these studies have been conducted over a range of years,

whether it is applicable to date is questioned.

On the other hand, Nizar Al-Malkawi (2007) presents the argument that this theory has

received less empirical support and has been criticized, backing his argument with the

lack of consideration of the tax implications on dividends and share prices. Similarly,

Bhattacharya (1979) argues that this theory is flawed under perfect capital markets.

2.4 SIGNALLING THEORY

Miller and Modigliani’s study (1961) formed the basis for the signalling theory.

Chaabouni (2017) supported this theory by elaborating on how dividends are

considered as a signalling device, since an announcement on dividends result in

potential and existing investors foreseeing the position of an organisation in a

profitability perspective (Farrukh et al., 2017). This implies the importance of the

information contained in a dividend announcement (Novianti, Medyawati, & Yunanto,

2013). In addition, dividend payments enhance the reputation and goodwill of a

company in the eyes of the investor, causing share prices to increase in value (Al-Hasan,

Asaduzzaman, & Karim, 2013).

Conversely, Brav et al. (2005) found little support for this theory. Dividends were

regarded as a costly signal to express the true value of a firm and the notion that

dividends were used for this purpose was rejected (Brav et al., 2005). Similarly, Baker

and Weigand (2015) questioned prior studies for ignoring the other strategies involved

in dividend initiations. It is also important to note that Nizar Al-Malkawi (2007)

emphasised that only good-quality firms are capable of using dividends to send signals

to markets and vice versa. How is a ‘good-quality’ firm defined? Where is the line

drawn to differentiate between good-quality and bad-quality? Regardless of the

findings of the aforementioned studies, they are not relatable on a similar level since

different approaches have been undertaken (Nizar Al-Malkawi, 2007).

3. RESEARCH METHODOLOGY

This section describes the methodology utilised in attaining the objectives of this

research. It presents the data collection, the theoretical framework including the

hypothesis and the variables.

3.1 DATA COLLECTION AND SAMPLING

This study was grounded on secondary data figures of 13 companies in the retailing

industry of Australia. The focus was on retail companies that are listed on ASX

(https://www.asx.com.au) and have paid dividends for five consecutive years, from

2012 to 2017. The purpose of this study is to assess the impact of the dividend policy

on shareholder wealth and hence, only the companies that paid dividends have been

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 42

exclusively selected for this study. Any companies that have not paid consecutive

dividends in this period have been eliminated from the sample. This data was composed

from the annual reports of each company, which is publicly available and on the ASX

website, and was considered on an annual basis.

In order to determine this association, the study employed simple regression analysis

using Excel. This statistical technique was used since it provides the direction of the

relationship (positive or negative) as well as the significance of the relationship,

addressing both aspects of the research question.

3.2 CONCEPTUAL FRAMEWORK

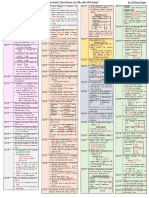

The following conceptual framework, as illustrated in Fig. 1, was used as a basis in

determining the association between the dividend policy and shareholder wealth of a

company.

Figure 1

Conceptual Framework

Independent Variable Dependent Variable

DIVIDEND POLICY SHAREHOLDER WEALTH

Dividend Payout Ratio Market Value of Share

For the purpose of determining the above association, the following regression model

has been established;

𝑀𝑀𝑀𝑀𝑀𝑀𝑖𝑖,𝑡𝑡 = 𝛽𝛽0 + 𝛽𝛽1 𝐷𝐷𝐷𝐷𝐷𝐷𝑖𝑖,𝑡𝑡 + 𝜀𝜀𝑖𝑖,𝑡𝑡 (1)

where;

MVS = Market Value of Share,

i = ith company,

t = time period,

β 1 DPR = Coefficient of Dividend Payout Ratio,

ε = error term.

As illustrated in the conceptual framework and the regression model above, the market

value of a share, which is the proxy for measuring shareholder wealth, is the dependent

variable. The dividend payout ratio, which is the proxy to measure dividend policy, is

the independent variable.

Based on the above conceptual framework, the following hypothesis have been

developed.

H 0 : There is no relationship between the dividend payout ratio (dividend policy) and

market value of a share (shareholder wealth).

H 1 : There is a relationship between the dividend payout ratio (dividend policy) and

market value of a share (shareholder wealth).

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 43

3.3 VARIABLES

The objective of this study is to examine the impact of the dividend policy on

shareholder wealth. As a result, it consists of two main variables, one of which is

independent (dividend payout ratio) and the other is dependent (market value of share),

as demonstrated in Figure 1.

3.3.1 DIVIDEND PAYOUT RATIO

Dividend payout ratio is described as the relative amount of dividends distributed to

shareholders to the amount of earnings of a business (Ali et al., 2015). The average of

the dividend payout ratios over the years was utilised for this study. It can be calculated

using the following formula.

𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝑃𝑃𝑃𝑃𝑃𝑃 𝑆𝑆ℎ𝑎𝑎𝑎𝑎𝑎𝑎 (𝐷𝐷𝐷𝐷𝐷𝐷)

𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅 = (2)

𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 𝑃𝑃𝑃𝑃𝑃𝑃 𝑆𝑆ℎ𝑎𝑎𝑎𝑎𝑎𝑎 (𝐸𝐸𝐸𝐸𝐸𝐸)

The data was collected from the annual reports of the respective companies. In the event

the ratio was readily available in the annual report, it was directly utilised for the study.

On the contrary, if it was not readily available, it will be calculated using the above

formula. For this purpose, no special dividends declared has been considered in the

DPS figures and the basic EPS, rather than the diluted EPS, have been utilised. Ali et

al. (2015) have also used dividend payout ratio as an independent variable.

3.3.2 MARKET VALUE OF SHARE

The market value of a share represents the price of an individual share in a company. It

reflects the amount an individual is willing to pay for a share. The market value of the

share of a company was derived from the ASX website (https://www.asx.com.au). The

market values of the respective company in the sample at the end of each financial year

was taken into consideration from 2012 to 2017. There were no modifications to the

values, and the data was directly applied for the study. Ali et al. (2015) too have used

share price as a dependent variable.

4. FINDINGS AND DISCUSSION

Table 1 represents the results of the estimated regression of 13 companies in the

retailing industry of Australia from 2012 to 2017.

Table 1

Summary of Regression Results

Variable Co-efficient Standard Error P-Value R2

Dividend payout ratio 0.587091 10.488603 0.034902 0.344676

The correlation co-efficient produces information about the association between two

variables. The results of the co-efficient (r=0.587091) report that there is a positive

relationship between dividend payout and the market value of a share. This indicates

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 44

that an increase in the dividend payout will have a positive effect on the market value

of a share. Accordingly, a 1% increase in the dividend payout ratio will result in a

0.5871% increase in the market value of a share. This is coherent with the results of

Farrukh et al.’s study (2017) based on Pakistani firms, although dividend per share and

dividend yield were used as proxies in measuring dividend policy. Similarly,

Chaabouni’s study (2017) also found a positive relationship, though the study was

based on the period 2014-2015. Can this study provide a holistic view with a limited

timeframe? Regardless of a similar result, it is noteworthy to mention that the statistical

analysis used in Chaabouni’s study (2017) was not regression, but event study

methodology.

Furthermore, the co-efficient result not being at the extremes of 0 and 1 denotes that

there is a moderate relationship between the two variables. This is reinforced by Ali et

al. (2015) who also established a moderate relationship (0.5848%) between the same

variables, although it was claimed to have a ‘significant positive relationship’. Al-

Hasan et al.’s findings (2013) concluded that dividend policy had a significant effect

on share price, in the context of Bangladesh. It is worth noting that the sample size used

in Al-Hasan et al.’s study (2013) was more than double the size of this study in question.

Nevertheless, when a company develops and maintains a positive image and a good

reputation, this will attract potential investors and will keep existing investors content,

causing an increase in the funds of a company through the issue of new shares. This

will create a ripple effect and the earnings of a company will increase. Resultantly, it

will reflect positively in the market value of a share. Nizar Al-Malkawi’s (2007)

objection to the signalling effect needs to be taken into account here, since the research

was based on multiple industries from 1989-2000. This information could possibly be

outdated, raising concerns on its validity. The fact that the research consisted of

companies that were de-listed from the stock exchange during the study period raises

concerns on the comparability.

It is noteworthy to mention that one of the companies in the sample, Vita Group Limited

to be precise, had a negative dividend payout ratio in the year ended 2014 as a result of

the loss incurred in the respective period. This could have potentially impacted the

significance of the relationship between dividend policy and shareholder wealth for the

Australian retailing industry.

The standard error of $10.49 indicates an estimation of the variation of the observed

market values of shares. The p-value is essential in determining if the null hypothesis

should be rejected. It is also helpful in determining if the relationship observed in the

sample exists in the population. If the p-value is less than the significance level, the null

hypothesis (H0) will need to be rejected. In this case, p-value of 0.03 is less than the

significance level of 0.05 (95% confidence level was used). As a result, the null

hypothesis will be rejected and the alternate hypothesis (H1) will be accepted.

Therefore, it can be implied that this study is in line with the dividend relevance (Lintner,

1956), bird-in-the-hand (Gordon, 1959; Lintner, 1956) and signalling theories

(Chaabouni, 2017). Furthermore, the above results based on the sample, can be inferred

to the population of the Australian retailing industry.

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 45

Additionally, Table 1 also states R2, which is the coefficient of determination. As

explained in the regression model, this signifies the proportion of variation in the data.

In other words, 34.5% of the variation in the market value of a share is caused by the

dividend payout of a firm. Thus, 65.5% of the variation in the market value of a firm is

caused by other factors that have not been accounted for in this model. On the contrary

to this study, Al-Hasan et al. (2013) recognised that 76.3% of the share price depends

on dividend policy, whereas only 23.7% is accounted for by other variables.

It is noteworthy to highlight that all the prior studies discussed in this section dispute

Miller and Modigliani’s (1961) theory through the establishment of a relationship

between the aforementioned variables. Additionally, the comparability of the findings

of some of these studies based on developing countries to Australia is debateable since

the true performance of a company may not particularly be reflected due to the poor

accounting standards in the developing countries (Rashid & Rahman, 2008). The

varying sample sizes, together with the timeframes, questions the applicability of the

respective theories to the Australian retailing industry. In essence, this is caused by the

fact that no two companies are the same (Deegan, 2012).

5. CONCLUSION

The principle aim of this research is to examine the relationship between dividend

policy (dividend payout ratio) and shareholder wealth (market value of a share). This

was done based on a sample of 13 companies in the retailing industry of Australia for

the period 2012 to 2017, employing regression analysis. With reference to the research

question mentioned above, the empirical findings indicate that there is a positive,

moderate relationship between dividend policy and shareholder wealth. These results

are consistent with the dividend relevance (Lintner, 1956), bird-in-the-hand (Gordon,

1959; Lintner, 1956) and signalling theories (Chaabouni, 2017).

5.1 PRACTICAL IMPLICATIONS AND RECOMMENDATIONS

Companies need to be cautious when formulating their dividend policies. It is

recommended that companies develop stable dividend policies since it will accelerate

the market values of shares, resulting in a positive impact on shareholder wealth (Ali et

al., 2015; Farrukh et al., 2017). Additionally, firms should have appropriate disclosure

on its dividend policies since it guides the investment decisions of shareholders

(Farrukh et al., 2017).

5.2 LIMITATIONS

The scope of this study is limited to the firms listed on the ASX in the retailing industry

of Australia for the time period 2012-2017. The proposed sample size of 50 companies

were not met since some of the companies were not listed on ASX since 2012, whereas

some companies did not make consecutive dividend payments for the respective years.

Since the sample size was only 13 companies, the generalizability of the findings to

other industries is limited. Additionally, dividend policy was measured using a single

proxy variable of dividend payout ratio. All other factors such as firm size and growth

remain constant in this study. Chiang, Frankfurter, Kosedag, and Wood (2006)

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 46

underlined that motivations behind dividends are ignored when using statistical analysis

on published financial data. This would ideally be crucial in gaining an insight into

dividend policy (Chiang et al., 2006)

5.3 FUTURE AVENUES OF RESEARCH

This study can be expanded in the future to include multiple proxy variables for the

measurement of dividend policy as well as shareholder wealth. For example, dividend

per share and dividend yield (for dividend policy) and earnings per share (for

shareholder wealth) can be incorporated (Farrukh et al., 2017), which will provide a

broader and a holistic view of the impact of dividend policy on market value of a share.

An increased sample size will address the generalisability limitation.

Future research can be based on a variety of industries, including a combination of

industries similar to prior studies. They can be further grouped into sub-categories

differentiating between the regular and irregular dividend paying companies, the

financial and non-financial companies etc. The time period can also be increased

(Farrukh et al., 2017) to elevate the study. Dividend policy will presumably continue to

be a debatable topic in corporate finance. Thus, the avenues for future research are

endless.

APPENDIX

Data on dividend payout ratio and market value of shares

X (Dividend Payout Ratio

Company Name for the year ended)

2013 2014 2015 2016 2017

AUTOMOTIVE HOLDINGS GROUP LIMITED 0.78 0.78 0.77 0.77 1.12

AMA GROUP LIMITED 0.68 0.94 0.59 1.44 0.66

BREVILLE GROUP LIMITED 0.68 0.72 0.75 0.74 0.74

HARVEY NORMAN HOLDINGS LIMITED 0.67 0.70 0.82 0.96 0.64

JB HI-FI LIMITED 0.61 0.65 0.65 0.65 0.76

JOYCE CORPORATION LTD 1 0.90 0.53 0.38 1.58 1.16

NICK SCALI LIMITED 0.79 0.74 0.71 0.71 0.74

SUPPLY NETWORK LIMITED 0.56 0.48 2.10 0.76 0.57

TRADE ME GROUP LIMITED 0.80 0.79 0.80 0.89 0.78

VITA GROUP LIMITED 0.65 (1.42) 0.46 0.60 0.64

WEBJET LIMITED 1.49 0.56 0.62 0.55 0.33

1

http://joycecorp.com.au/index.php/download/annual-report-2017/?wpdmdl=779

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 47

WESFARMERS LIMITED 0.92 0.85 0.93 5.14 0.88

WOOLWORTHS GROUP LIMITED 0.70 0.70 0.68 0.66 0.76

Y (Market Value of a Share

Company Name as at 30th June)

2013 2014 2015 2016 2017

AUTOMOTIVE HOLDINGS GROUP LIMITED 3.37 3.63 4.26 3.77 3.16

AMA GROUP LIMITED 0.28 0.26 0.61 0.88 0.97

BREVILLE GROUP LIMITED 7.24 8.11 6.72 7.49 10.69

HARVEY NORMAN HOLDINGS LIMITED 2.36 2.91 4.70 4.51 3.77

JB HI-FI LIMITED 15.57 17.88 20.36 22.76 22.83

JOYCE CORPORATION LTD 0.36 0.47 0.96 1.01 1.58

NICK SCALI LIMITED 2.06 2.54 3.48 4.52 6.18

SUPPLY NETWORK LIMITED 1.16 2.06 2.00 2.11 2.48

TRADE ME GROUP LIMITED 3.97 3.25 3.21 4.38 4.93

VITA GROUP LIMITED 0.60 0.71 1.80 4.05 1.03

WEBJET LIMITED 4.20 2.34 3.07 6.79 12.31

WESFARMERS LIMITED 38.38 41.80 40.90 40.24 40.79

WOOLWORTHS GROUP LIMITED 32.20 36.31 27.04 21.22 25.83

Results of regression analysis

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.58709118

R Square 0.34467605

Adjusted R 0.28510115

Square

Standard Error 10.4886034

Observations 13

ANOVA

df SS MS F Significance F

Regression 1 636.477541 636.477541 5.78559135 0.03490206

Residual 11 1210.11882 110.010801

Total 12 1846.59636

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 48

Coeffi Standar t Stat P- Lowe Uppe Lower Upper

cients d Error value r 95% r 95% 95.0% 95.0%

Intercept - 7.90770 - 0.319 - 9.154 - 9.1543

8.250 669 1.043 18098 25.65 36632 25.655 6632

3788 3339 5124 124

AVG 21.80 9.06495 2.405 0.034 1.852 41.75 1.8523 41.756

Dividend 41711 606 32562 90206 33731 60048 3731 0048

payout

RESIDUAL OUTPUT

Observation Predicted AVG Stock price Residuals Standard Residuals

1 10.1149381 -6.4769381 -0.6449802

2 10.5358202 -9.9378202 -0.9896184

3 7.57091824 0.47808176 0.04760787

4 8.28411644 -4.6339164 -0.4614502

5 6.28653292 13.5920671 1.35351205

6 11.5826953 -10.706095 -1.066124

7 7.86483797 -4.111638 -0.4094411

8 11.2921629 -9.3311629 -0.9292068

9 9.4517822 -5.5049822 -0.5481918

10 -4.2194996 5.85729957 0.58327593

11 7.18168849 -1.4404885 -0.1434453

12 29.7347109 10.6876891 1.06429109

13 6.99309598 21.527904 2.14377087

PROBABILITY OUTPUT

Percentile AVG Stock price

3.84615385 0.598

11.5384615 0.8766

19.2307692 1.6378

26.9230769 1.961

34.6153846 3.638

42.3076923 3.6502

50 3.7532

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 49

57.6923077 3.9468

65.3846154 5.7412

73.0769231 8.049

80.7692308 19.8786

88.4615385 28.521

96.1538462 40.4224

ACKNOWLEDGEMENT

We would like to show our gratitude to the school of Business and Law of

CQUniversity for sharing their pearls of wisdom with us during this research, although

any errors are our own and should not tarnish the reputation of this school or the

university.

REFERENCES

[1] Al-Hasan, M. A., Asaduzzaman, M., & Karim, R. A. (2013). “The effect of

dividend policy on share price: An evaluative study”. IOSR Journal of Economics

and Finance, 1(4), 6–66.

[2] Ali, A., Jan, F. A., & Sharif, I. (2015). “Effect of dividend policy on stock

prices”. Business & Management Studies: An International Journal, 3(1), 56-87.

[3] Baker, H., & Jabbouri, I. (2016). “How Moroccan managers view dividend

policy”. Managerial Finance, 42(3), 270-288.

[4] Baker, H., & Weigand, R. (2015). “Corporate dividend policy

revisited”. Managerial Finance, 41(2), 126-144.

[5] Baker, H., Veit, E., & Powell, G. (2001). “Factors influencing dividend policy

decisions of Nasdaq firms”. Financial Review, 36(3), 19-38.

[6] Benartzi, S., Michaely, R., & Thaler, R. (1997). “Do changes in dividends signal

the future or the past?”. Journal of Finance, 52(3), 1007-1034.

[7] Bhattacharya, S. (1979). “Imperfect information, dividend policy, and "the bird

in the hand" policy”. Bell Journal of Economics, 10(1), 259-270.

[8] Brav, A., Graham, J. R., Harvey, C. R., & Michaely, R. (2005). “Payout policy

in the 21st century”. Journal of Financial Economics, 77(3), 483-527.

[9] Bulan, L., & Hull, T. (2012). “The impact of technical defaults on dividend

policy”. Journal of Banking and Finance, 37(3), 814-823.

[10] Chaabouni, I. (2017). “Impact of dividend announcement on stock return: A study

on listed companies in the Saudi Arabia financial markets”. International Journal

of Information, Business and Management, 9(1), 37-44.

[11] Chiang, K., Frankfurter, G., Kosedag, A., & Wood, B. (2006). “The perception

of dividends by professional investors”. Managerial Finance, 32(1), 60-81.

[12] Deegan, C. (2012). Australian financial accounting (7th ed.). North Ryde,

N.S.W.: McGraw-Hill Australia.

[13] Farrukh, K., Irshad, S., Shams Khakwani, M., Ishaque, S., & Ansari, N. (2017).

“Impact of dividend policy on shareholders wealth and firm performance in

Pakistan”. Cogent Business & Management, 4(1), 1-11.

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Review of Integrative Business and Economics Research, Vol. 9, Issue 1 50

[14] Gordon, M. (1959). “Dividends, earnings, and stock prices”. Review of

Economics and Statistics, 41(2), 99-105.

[15] Hussainey, K., Oscar Mgbame, C., & Chijoke-Mgbame, A. (2011). “Dividend

policy and share price volatility: UK evidence”. The Journal of Risk

Finance, 12(1), 57-68.

[16] Jensen, M. C. (2010). “Value maximization, stakeholder theory, and the corporate

objective function”. Journal of Applied Corporate Finance, 22(1), 32-42.

[17] Lintner, J. (1956). “Distribution of incomes of corporations among dividends,

retained earnings, and taxes”. The American Economic Review, 46(2), 97-118.

[18] Miller, M., & Modigliani, F. (1961). “Dividend policy, growth, and the valuation

of shares”. The Journal of Business: B, 34(4), 411-433.

[19] Nizar Al-Malkawi, H. A. (2007). “Determinants of corporate dividend policy in

Jordan: An application of the Tobit model”. Journal of Economic and

Administrative Sciences,23(2), 44-70.

[20] Novianti, M., Medyawati, H., & Yunanto, M. (2013). “Changes of return of

shares before and after ex-dividend date: Case study in Indonesia”. Review of

Integrative Business and Economics Research, 2(1), 511-520.

[21] Rashid, A., & Rahman, A. A. (2008). “Dividend policy and stock price volatility:

evidence from Bangladesh”. The Journal of Applied Business and

Economics, 8(4), 71-81.

[22] Walter, J. (1963). “Dividend policy: its influence on the value of the enterprise”.

Journal of Finance, 18(2), 280-291.

[23] Zafar, S. M. T., Chaubey, D. S., & Khalid, S. M. (2012). “A study on dividend

policy and its impact on the shareholders wealth in selected banking companies

in India”. International Journal of Financial Management, 2(3), 79-94.

[24] Zainudin, R., Mahdzan, N. S., & Yet, C. H. (2018). “Dividend policy and stock

price volatility of industrial products firms in Malaysia”. International Journal of

Emerging Markets, 13(1), 203-217.

Copyright 2020 GMP Press and Printing

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

You might also like

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- A Study On Profitability Management of Restaurants in TamilnaduDocument8 pagesA Study On Profitability Management of Restaurants in TamilnaduMohammad MiyanNo ratings yet

- Firm Performance Paper 4Document10 pagesFirm Performance Paper 4kabir khanNo ratings yet

- Sectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketDocument18 pagesSectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketChan Hui YanNo ratings yet

- Relationship Between Financial Leverage and Profitability Research PaperDocument16 pagesRelationship Between Financial Leverage and Profitability Research PaperDaksh BhandariNo ratings yet

- Div Policy and Firm PerformanceDocument13 pagesDiv Policy and Firm PerformanceRajan PaudelNo ratings yet

- Effect of Dividend Policy On Stock Prices: June 2019Document33 pagesEffect of Dividend Policy On Stock Prices: June 2019IzzatieNo ratings yet

- Rehman - Dividen 2Document18 pagesRehman - Dividen 2Fita Dwi LestariNo ratings yet

- Financial Indicators in Determining Market Share Prices of Healthcare Sector Companies Listed On BseDocument12 pagesFinancial Indicators in Determining Market Share Prices of Healthcare Sector Companies Listed On Bseindex PubNo ratings yet

- International Journal in Multidisciplinary and Academic Research (SSIJMAR) Vol. 3, No. 1, February-March - 2014 (ISSN 2278 - 5973)Document16 pagesInternational Journal in Multidisciplinary and Academic Research (SSIJMAR) Vol. 3, No. 1, February-March - 2014 (ISSN 2278 - 5973)Siva KalimuthuNo ratings yet

- The Impact of Ownership Structure On Dividend Policy: Evidence of Malaysian Listed FirmsDocument10 pagesThe Impact of Ownership Structure On Dividend Policy: Evidence of Malaysian Listed Firmslukman ahbrNo ratings yet

- Kathmandu University School of Management: Gwarko, LalitpurDocument27 pagesKathmandu University School of Management: Gwarko, LalitpurAnjali Paneru0% (1)

- ALİ, Jan, Sharif - 2015 - Effect of Dividend Policy On Stock PricesDocument32 pagesALİ, Jan, Sharif - 2015 - Effect of Dividend Policy On Stock Pricesmuhammad sami ullah khanNo ratings yet

- Impact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaDocument3 pagesImpact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaBilal AhmedNo ratings yet

- PolicyDocument15 pagesPolicyAbdullah AkhtarNo ratings yet

- Ownership Structure and Dividend Policy: I J C R BDocument24 pagesOwnership Structure and Dividend Policy: I J C R BHiral ShahNo ratings yet

- Nhom 5Document10 pagesNhom 5kinhdoanh282No ratings yet

- A Study On Relationship Between Profitability and Dividend Payment in Iron & Steel Industries in IndiaDocument9 pagesA Study On Relationship Between Profitability and Dividend Payment in Iron & Steel Industries in IndiadebasispahiNo ratings yet

- Chapter-I: 1.1 Background of The StudyDocument51 pagesChapter-I: 1.1 Background of The StudyCritical ViewNo ratings yet

- 1 PBDocument7 pages1 PBRinanti DANo ratings yet

- Dividend Policy Signal TheoryDocument30 pagesDividend Policy Signal TheoryAhmednoor HassanNo ratings yet

- Impact of Capital Structure and Dividend Policy On Firm ValueDocument18 pagesImpact of Capital Structure and Dividend Policy On Firm ValueSabrine IdrissiNo ratings yet

- Chapter3 FMDocument11 pagesChapter3 FMchandoraNo ratings yet

- Effect of Dividend On Stock Price in Emerging Stock Market: A Study On The Listed Private Commercial Banks in DSEDocument13 pagesEffect of Dividend On Stock Price in Emerging Stock Market: A Study On The Listed Private Commercial Banks in DSEFariha TasnimNo ratings yet

- An Empirical Analysis On Determinants of Dividend Policy of FMCG Sector in IndiaDocument22 pagesAn Empirical Analysis On Determinants of Dividend Policy of FMCG Sector in IndiaDr. B.B.MansuriNo ratings yet

- R Dividend Policy A Comparative Study of UK and Bangladesh Based Companies PDFDocument16 pagesR Dividend Policy A Comparative Study of UK and Bangladesh Based Companies PDFfahim zamanNo ratings yet

- The Impact of Dividend Policy On Firm Performance Under High or Low Leverage Evidence From PakistanDocument34 pagesThe Impact of Dividend Policy On Firm Performance Under High or Low Leverage Evidence From PakistanDevikaNo ratings yet

- Jurnal Labhane MahakudDocument20 pagesJurnal Labhane MahakudamandaNo ratings yet

- Divided Policy and Share Price Volatility: Dhaka Stock Exchange EvidenceDocument12 pagesDivided Policy and Share Price Volatility: Dhaka Stock Exchange EvidenceAsad HimuNo ratings yet

- Firm Size, Profit After Tax and Dividend Policy of Quoted Manufacturing Companies in NigeriaDocument29 pagesFirm Size, Profit After Tax and Dividend Policy of Quoted Manufacturing Companies in NigeriaolapetersNo ratings yet

- The Determinants of Dividend Policy: Evidence From Malaysian FirmsDocument20 pagesThe Determinants of Dividend Policy: Evidence From Malaysian FirmsIzzatieNo ratings yet

- Dividend and FactorsDocument8 pagesDividend and FactorsAnggiNo ratings yet

- Impact of Dividend Policy On Share PricesDocument16 pagesImpact of Dividend Policy On Share PricesAli JarralNo ratings yet

- Chapter - 2 Literature ReviewDocument23 pagesChapter - 2 Literature ReviewMotiram paudelNo ratings yet

- Dividend Policy As A Corporate Communication and Its Impact On Firm Value Evidences From Listed Companies in Qatar Stock ExchangeDocument10 pagesDividend Policy As A Corporate Communication and Its Impact On Firm Value Evidences From Listed Companies in Qatar Stock ExchangeAbderrahim El AzharNo ratings yet

- The Impact of Earnings Management On Dividend Policy: Evidence From KuwaitDocument9 pagesThe Impact of Earnings Management On Dividend Policy: Evidence From KuwaitHai Ha NguyenNo ratings yet

- Dividend Declaration and Stock Price Behavior: Indian EvidencesDocument11 pagesDividend Declaration and Stock Price Behavior: Indian EvidencesAKASHNo ratings yet

- Effect of Managerial Ownership, Financial Leverage, Profitability, Firm Size, and Investment Opportunity On Dividend Policy and Firm ValueDocument13 pagesEffect of Managerial Ownership, Financial Leverage, Profitability, Firm Size, and Investment Opportunity On Dividend Policy and Firm ValueTrâm Tạ Hoàng BảoNo ratings yet

- Dividend, Dividend Irrelevance Theory, Earning Per Share, Return On Equity, Stock PriceDocument14 pagesDividend, Dividend Irrelevance Theory, Earning Per Share, Return On Equity, Stock Pricerabin sahaNo ratings yet

- Nnadi Et Tanna 2011 Multivariate Analyses of Factors Affecting Dividend Policy of AcquiredDocument20 pagesNnadi Et Tanna 2011 Multivariate Analyses of Factors Affecting Dividend Policy of AcquiredismailNo ratings yet

- Determinants of Dividend Policy in Saudi Listed CompaniesDocument10 pagesDeterminants of Dividend Policy in Saudi Listed CompaniesChickenrock TangerangNo ratings yet

- The Mediating Role of Debt and Dividend Policy On The Effect Profitability Toward Stock PriceDocument10 pagesThe Mediating Role of Debt and Dividend Policy On The Effect Profitability Toward Stock PriceAAMINA ZAFARNo ratings yet

- Review of LiteratureDocument6 pagesReview of LiteratureAkhilesh v50% (2)

- Dividend Policy A Comparative Study of UK and Bangladesh Based CompaniesDocument16 pagesDividend Policy A Comparative Study of UK and Bangladesh Based CompaniesMehedi HasanNo ratings yet

- Priya - DividenDocument12 pagesPriya - DividenFita Dwi LestariNo ratings yet

- CorporateSustainability Firstevidenceonmateriality Khan Serafeim Yoon February2015Document34 pagesCorporateSustainability Firstevidenceonmateriality Khan Serafeim Yoon February2015carpeNo ratings yet

- The Effect of Corporate Governance On Corporate Payout Policy On Egyptian FirmsDocument12 pagesThe Effect of Corporate Governance On Corporate Payout Policy On Egyptian FirmscuonghienNo ratings yet

- Farah Amir 358 (P. 41-58)Document18 pagesFarah Amir 358 (P. 41-58)International Journal of Management Research and Emerging SciencesNo ratings yet

- Determinants of Dividend Policy of Indian Companies: A Panel Data AnalysisDocument20 pagesDeterminants of Dividend Policy of Indian Companies: A Panel Data Analysisshital_vyas1987No ratings yet

- Capital StructureDocument15 pagesCapital StructureGavesha SilvaNo ratings yet

- Determinants of Dividend Policy: A Study of Sensex Incorporated CompaniesDocument7 pagesDeterminants of Dividend Policy: A Study of Sensex Incorporated CompaniesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Inter 1 PDFDocument12 pagesInter 1 PDFrizki efendiNo ratings yet

- Manneh NaserDocument11 pagesManneh NaseramandaNo ratings yet

- Determination of Dividend PolicyDocument21 pagesDetermination of Dividend PolicyFifa 21No ratings yet

- Factors Affecting Dividend Payout: Evidence From Listed Non-Financial Firms of Karachi Stock ExchangeDocument17 pagesFactors Affecting Dividend Payout: Evidence From Listed Non-Financial Firms of Karachi Stock ExchangeZohaib AhmedNo ratings yet

- Ali, T., & Waheed, N. (2017)Document8 pagesAli, T., & Waheed, N. (2017)AWash LaundryNo ratings yet

- CFM AssignmentDocument23 pagesCFM AssignmentLAU CHENG JIANo ratings yet

- MPRA Paper 36046Document30 pagesMPRA Paper 36046LiYi ChenNo ratings yet

- Determinants of Dividend Payout: Evidence From Financial Sector of PakistanDocument12 pagesDeterminants of Dividend Payout: Evidence From Financial Sector of PakistanMayaz AhmedNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- Frequently Used Words by Tarun GroverDocument194 pagesFrequently Used Words by Tarun GroverLove RadhakrishnaNo ratings yet

- Manish Singh ProjectDocument70 pagesManish Singh Projectmanishchaudhary3537No ratings yet

- A Case Study On The Growth of Rural Banking in India: IjcsbeDocument12 pagesA Case Study On The Growth of Rural Banking in India: IjcsbeHarivenkatsai SaiNo ratings yet

- A Study On Marketing Tax & GST in Jaiswal Yash & AssociatesDocument72 pagesA Study On Marketing Tax & GST in Jaiswal Yash & Associatesmanishchaudhary3537No ratings yet

- Customer Satisfaction - Meaning and Methods of Measuring: June 2011Document21 pagesCustomer Satisfaction - Meaning and Methods of Measuring: June 2011Nikhil PatilNo ratings yet

- Important Questions For Company LawDocument1 pageImportant Questions For Company Lawmanishchaudhary3537No ratings yet

- Comprehension Check - 1Document2 pagesComprehension Check - 1manishchaudhary3537No ratings yet

- Formation of A CompanyDocument3 pagesFormation of A Companymanishchaudhary3537No ratings yet

- Human ValuesDocument5 pagesHuman Valuesmanishchaudhary3537No ratings yet

- Nature and Types of Companies 1Document28 pagesNature and Types of Companies 1manishchaudhary3537No ratings yet

- Prospectus 2Document7 pagesProspectus 2manishchaudhary3537No ratings yet

- Share 3Document19 pagesShare 3manishchaudhary3537No ratings yet

- Company Law Important Qu..Document1 pageCompany Law Important Qu..manishchaudhary3537No ratings yet

- Final Year FileDocument8 pagesFinal Year Filemanishchaudhary3537No ratings yet

- Ias 16Document33 pagesIas 16Kiri chris100% (1)

- Bal Bharati Mid Term XIi - 2023-24Document9 pagesBal Bharati Mid Term XIi - 2023-24Thakur ShikharNo ratings yet

- Reading 13 Integration of Financial Statement Analysis TechniquesDocument15 pagesReading 13 Integration of Financial Statement Analysis Techniquestaichinhtientien62aNo ratings yet

- File'5: GAIL (India) LimitedDocument2 pagesFile'5: GAIL (India) Limitedvirupakshudu kodiyalaNo ratings yet

- Jepretan Layar 2023-09-27 Pada 10.49.00Document3 pagesJepretan Layar 2023-09-27 Pada 10.49.00Ardyannur DewaNo ratings yet

- Fundamentals of Corporate Finance Australasian 2nd Edition Parrino Solutions ManualDocument30 pagesFundamentals of Corporate Finance Australasian 2nd Edition Parrino Solutions Manualmutchkinstandod3No ratings yet

- Electronic Cash LedgerDocument4 pagesElectronic Cash LedgerManjunathNo ratings yet

- Toa 34 36Document16 pagesToa 34 36Aubrey Shaiyne OfianaNo ratings yet

- FAP 3e 2021 PPT CH 3 Adjusting AccountsDocument50 pagesFAP 3e 2021 PPT CH 3 Adjusting Accountstrinhnq22411caNo ratings yet

- Consolidated Financial Statements - IntercomapnyDocument6 pagesConsolidated Financial Statements - IntercomapnyCORNADO, MERIJOY G.No ratings yet

- Behavioral Corporate Finance 2nd Edition Shefrin Solutions ManualDocument9 pagesBehavioral Corporate Finance 2nd Edition Shefrin Solutions ManualStephanieParkerexbf100% (50)

- Limits Chart - May 2023Document2 pagesLimits Chart - May 2023KingNo ratings yet

- Specific Project 1 and 2 On Bajaj ElectricalsDocument6 pagesSpecific Project 1 and 2 On Bajaj Electricalschokeplayer15No ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument5 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions ManualChristopherDyerkczqw100% (15)

- Profitability Analysis of Sanima Bank Limited: A Project ReportDocument40 pagesProfitability Analysis of Sanima Bank Limited: A Project ReportSurya Satore0% (1)

- Incomplete Records Homewok AnswersDocument3 pagesIncomplete Records Homewok AnswersCharisma CharlesNo ratings yet

- Filinvest ReitDocument75 pagesFilinvest ReitAtty. Rheneir MoraNo ratings yet

- CAG v.11.0 1st Wave QuestionsDocument7 pagesCAG v.11.0 1st Wave QuestionsIan Paolo CaylanNo ratings yet

- Intangible AssetsDocument87 pagesIntangible AssetsNoor fatimaNo ratings yet

- Cpa Review School of The Philippines: Advanced Financial Accounting and Reporting German and ValixDocument24 pagesCpa Review School of The Philippines: Advanced Financial Accounting and Reporting German and ValixCAROLINE BALDOZNo ratings yet

- Financial Result For Q2 Ended On 30.09.2023Document22 pagesFinancial Result For Q2 Ended On 30.09.2023Hari K NeelambariNo ratings yet

- Chapter 1 - Accounting in ActionDocument68 pagesChapter 1 - Accounting in ActionNgân TrươngNo ratings yet

- Comparable Companies 3E TemplateDocument22 pagesComparable Companies 3E TemplateLohith Kumar ReddyNo ratings yet

- Merchandising Bus Prub Periodic MethodDocument2 pagesMerchandising Bus Prub Periodic MethodChristopher Keith BernidoNo ratings yet

- CH 1 FIN101 MahnoorDocument13 pagesCH 1 FIN101 Mahnoora b siddique rifatNo ratings yet

- RHB RHB RHB RHB Bank Berhad Bank Berhad Bank Berhad Bank Berhad 結账单 結账单 結账单 結账单Document3 pagesRHB RHB RHB RHB Bank Berhad Bank Berhad Bank Berhad Bank Berhad 結账单 結账单 結账单 結账单along rienaNo ratings yet

- 47 CounterDocument102 pages47 CounterkannnamreddyeswarNo ratings yet

- 6 - IasDocument25 pages6 - Iasking brothersNo ratings yet

- FAR08.01d-Presentation of Financial StatementsDocument7 pagesFAR08.01d-Presentation of Financial StatementsANGELRIEH SUPERTICIOSONo ratings yet