Professional Documents

Culture Documents

Income Tax For Corporations

Income Tax For Corporations

Uploaded by

kjabbugaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax For Corporations

Income Tax For Corporations

Uploaded by

kjabbugaoCopyright:

Available Formats

Tax on Estates and Trusts

Estate: properties, rights and obligations including those properties, earnings, or obligations that have accrued thereto since the

opening of succession

Trust: administration of funds and properties on behalf of individuals

In the meantime that the property is not yet transferred to the successors or beneficiaries, the estate or trust can generate earnings

- Subject to income tax

- Determined in the same basis and manner as in the case of individual taxpayers

Special deductions: the estate is allowed to deduct the amount of income of the estate during the taxable year that is paid or credited to

the legatee, heir, or beneficiary, subject to creditable withholding tax of 15%

- The allowed deduction shall form part of the income of the recipient legatee, heir, or beneficiary, subject to creditable

withholding tax of 15%

- Trust administered in a foreign country, special deductions shall not be allowed and the amount of income included in the

return of the estate or trust shall not be included in the income of the beneficiaries

Income tax on Corporations

MCIT: Minimum corporate income tax: 2% of the gross income as of the end of the taxable year. beginning on the fourth taxable year

immediately following the year in which such corporation commenced its business operations, when the minimum income tax is greater

than the tax computed under Subsection (A) of this Section for the taxable year: Provided, That effective July 1, 2020 until June 30,

2023, the rate shall be one percent (1%).

- Any excess of the minimum corporate income tax over the normal income tax shall be carried forward and credited against the

normal income tax for the three (3) immediately succeeding taxable years.

- The Secretary of Finance is hereby authorized to suspend the imposition of the minimum corporate income tax on any

corporation which suffers losses on account of prolonged labor dispute, or because of force majeure, or because of legitimate business

reverses.

- Purpose is to forestall the prevailing practice of corporations in overclaiming deductions

Corporations not considered as corporations for income tax purposes: (TAX EXEMPT ENTITIES)

1. Joint construction venture

2. General professional partnership

3. Joint venture for engaging in petroleum, coal, geothermal and other energy operations pursuant to a consortium agreement

with the government

4. Tax exempt GOCCs: SSS, GSIS, Philhealth, Pag-Ibig, local water district

Corporations that are tax exempt: (Sec. 30)

1. Labor, agricultural or horticultural organizations

2. Mutual savings bank not having a capital stock represented by shares, and cooperative bank without capital stock organized

and operated for mutual purposes and without profit;

3. A beneficiary society, order or association, operating for the exclusive benefit of the members such as a fraternal organization

operating under the lodge system, or mutual aid association or a nonstock corporation organized by employees providing for the

payment of life, sickness, accident, or other benefits exclusively to the members of such society, order, or association, or nonstock

corporation or their dependents;

4. Cemetery company owned and operated exclusively for the benefit of its members;

5. Nonstock corporation or association organized and operated exclusively for religious, charitable, scientific, athletic, or cultural

purposes, or for the rehabilitation of veterans, no part of its net income or asset shall belong to or inure to the benefit of any member,

organizer, officer or any specific person;

6. Business league chamber of commerce, or board of trade, not organized for profit and no part of the net income of which

inures to the benefit of any private stock-holder, or individual;

7. Civic league or organization not organized for profit but operated exclusively for the promotion of social welfare;

8. A nonstock and nonprofit educational institution;

9. Government educational institution;

10. Farmers' or other mutual typhoon or fire insurance company, mutual ditch or irrigation company, mutual or cooperative

telephone company, or like organization of a purely local character, the income of which consists solely of assessments, dues, and fees

collected from members for the sole purpose of meeting its expenses; and

11. Farmers', fruit growers', or like association organized and operated as a sales agent for the purpose.

the income of whatever kind and character of the foregoing organizations from any of their properties, real or personal, or from any of

their activities conducted for profit regardless of the disposition made of such income, shall be subject to tax imposed under this Code.

Non-resident foreign Corporation

Source General Rule International air carrier and

Branch profit remittanceROHQ

international shipping

Tax Base Taxable income on all Gross Philippine total profits applied Gross rental or fees

sources within Billings or earmarked for within the

remittance without

any deduction for the tax

component

Tax Rate for RFC 25% effective 2.5% 15% Sec. 22 (DD)

January 1, 2021 exempt:

Sec. 22 (EE): 10% on

taxable income

(DD) The term 'regional or area headquarters' shall mean a branch established in the Philippines by multinational companies and which

headquarters do not earn or derive income from the Philippines and which act as supervisory, communications and coordinating center

for their affiliates, subsidiaries, or branches in the Asia-Pacific Region and other foreign markets.

(EE) The term 'regional operating headquarters' shall mean a branch established in the Philippines by multinational companies which

are engaged in any of the following services: general administration and planning; business planning and coordination; sourcing and

procurement of raw materials and components; corporate finance advisory services; marketing control and sales promotion; training

and personnel management; logistic services; research and development services and product development; technical support and

maintenance; data processing and communications; and business development.

Tax on certain income received by NRFC

1. Interest from Deposits and Yield or any other Monetary Benefit from Deposit Substitutes, Trust Funds and Similar

Arrangements and Royalties: 20%, 15%

2. Income Derived under the Expanded Foreign Currency Deposit System

3. CGT on sales of shares of stock not traded in the stock exchange

Offshore gaming license: The non-gaming revenues derived within the Philippines of foreign-based offshore gaming licensees as

defined and duly licensed by the Philippine Amusement and Gaming Corporation or any special economic zone authority or tourism

zone authority or freeport authority shall be subject to an income tax equivalent to twenty-five percent (25%) of the taxable income

derived during each taxable year.

Offshore banking Units: GR: Tax-exempt, Exc: 10% FT on transactions with residents

Non-resident foreign Corporation

Source General Rule Nonresident Cinematographic

NonresidentFilmOwner Nonresident

or Lessor ofOwner or Lessor of

Owner, Lessor or Distributor.

Vessels Chartered Aircraft,

by Philippine

Machineries and Other

Nationals Equipment.

Tax Base Gross income Gross income Gross rentals or Gross rental or

on all sources on all sources fees fees within the Ph

within within

Tax Rate for NRFC 25% effective 25% 4.5% 7.5%

January 1, 2021

Tax on certain income received by NRFC

1. Interest on foreign loans: 20% on the amount of foreign interest

2. Intercorporate dividends: 15% provided the foreign country also grants 15% (Reciprocity)

3. Sales of shares of stock not listed and traded through PSE: 15%

You might also like

- DCF Method (Instrict Value of A Stock) by Adam KhooDocument7 pagesDCF Method (Instrict Value of A Stock) by Adam KhooErvin Kërluku33% (3)

- The William Wrigley Jr. CompanyDocument12 pagesThe William Wrigley Jr. Company陳曄萱No ratings yet

- Week 7 Course Material For Income TaxationDocument14 pagesWeek 7 Course Material For Income Taxationjayannehipolito20No ratings yet

- Income Taxation Part 1 Tax On Corporations (Handouts)Document2 pagesIncome Taxation Part 1 Tax On Corporations (Handouts)Hershey ReyesNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document29 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Cbtax01 Chapter4Document11 pagesCbtax01 Chapter4Christelle JosonNo ratings yet

- Activity4 MPortarcosDocument14 pagesActivity4 MPortarcosMichaela T PortarcosNo ratings yet

- Chapter 5 Final Income TaxationDocument26 pagesChapter 5 Final Income TaxationJason MablesNo ratings yet

- Corporate Income TaxationDocument20 pagesCorporate Income TaxationCris Margot LuyabenNo ratings yet

- Taxation Reviewer - Percentage TaxDocument3 pagesTaxation Reviewer - Percentage TaxDaphne BarceNo ratings yet

- Tax On Corporation MaterialsDocument18 pagesTax On Corporation Materialsjdy managbanagNo ratings yet

- Final Income TaxationDocument4 pagesFinal Income TaxationJean Diane Jovelo100% (1)

- Business and Transfer TaxationDocument5 pagesBusiness and Transfer TaxationElizabeth OlaNo ratings yet

- Percentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedDocument4 pagesPercentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedAndrea TanNo ratings yet

- Deloitte On Sri Lanka BudgetDocument42 pagesDeloitte On Sri Lanka BudgetJehanNo ratings yet

- HumRes TaxDocument3 pagesHumRes TaxJob Noel BernardoNo ratings yet

- W11 Module 9 PPT Income Tax On CorporationsDocument32 pagesW11 Module 9 PPT Income Tax On Corporationscathleendfa13No ratings yet

- W14 Module 12withholding TaxesDocument7 pagesW14 Module 12withholding Taxescamille ducutNo ratings yet

- Special CorporationsDocument12 pagesSpecial CorporationsDinah BaluyutNo ratings yet

- Taxation Law Review Notes Corporation)Document9 pagesTaxation Law Review Notes Corporation)joycellemalabNo ratings yet

- Special CorporationsDocument25 pagesSpecial CorporationsHilarie JeanNo ratings yet

- Notes To Business Taxation: Corporate Income Tax Tax BaseDocument7 pagesNotes To Business Taxation: Corporate Income Tax Tax BaseAngela AralarNo ratings yet

- Bullet Notes 9 - Other Percentage TaxDocument4 pagesBullet Notes 9 - Other Percentage TaxFlores Renato Jr. S.No ratings yet

- Tax Table Corporations 2022Document4 pagesTax Table Corporations 2022Xandredg Sumpt LatogNo ratings yet

- Tax On CorporationsDocument37 pagesTax On CorporationsvanNo ratings yet

- Income Tax On Resident Foreign CorporationDocument6 pagesIncome Tax On Resident Foreign CorporationElaiNo ratings yet

- Chapter 2.1 - Income Subject To Final TaxDocument30 pagesChapter 2.1 - Income Subject To Final Taxjudel ArielNo ratings yet

- Tax Module 2 Unit 2Document10 pagesTax Module 2 Unit 2Beatriz LorezcoNo ratings yet

- Module No 3 - INCOME TAXATION PART1ADocument6 pagesModule No 3 - INCOME TAXATION PART1APrinces S. RoqueNo ratings yet

- CHAPTER 5 - Percentage TaxDocument2 pagesCHAPTER 5 - Percentage Taxnewlymade641No ratings yet

- Corporation As A TaxpayerDocument27 pagesCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- Income Tax On CorporationsDocument15 pagesIncome Tax On CorporationsJunivenReyUmadhay100% (1)

- Corp TaxDocument4 pagesCorp TaxMaster GTNo ratings yet

- Quarterly Percentage Tax Rates Table: Taxable Base Tax RateDocument4 pagesQuarterly Percentage Tax Rates Table: Taxable Base Tax RateKathrine CruzNo ratings yet

- Ch04 Taxation of Corp. TRAIN With Answers 1Document15 pagesCh04 Taxation of Corp. TRAIN With Answers 1Nicole100% (1)

- Other Percentage Tax DraftDocument9 pagesOther Percentage Tax Draftbeadineros8No ratings yet

- In Come Tax TableDocument9 pagesIn Come Tax TablejorjirubiNo ratings yet

- Lecture-Corporate-Income-Tax 2Document5 pagesLecture-Corporate-Income-Tax 2Ragelli Mae NatalarayNo ratings yet

- TaxDocument20 pagesTaxMae AstovezaNo ratings yet

- Week 3 TaxDocument4 pagesWeek 3 TaxslncrochetNo ratings yet

- Changes Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActDocument7 pagesChanges Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActYietNo ratings yet

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- TaxDocument26 pagesTaxParticia CorveraNo ratings yet

- Withholding Taxes Learning ObjectivesDocument8 pagesWithholding Taxes Learning ObjectivesAce AlquinNo ratings yet

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Document16 pagesReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Mark Lawrence YusiNo ratings yet

- Withholding Tax (WHT)Document16 pagesWithholding Tax (WHT)Nyaba NaimNo ratings yet

- Business TaxationDocument41 pagesBusiness TaxationKim AranasNo ratings yet

- Withholding Taxes 2023Document23 pagesWithholding Taxes 2023Antonette Frilles GibagaNo ratings yet

- Final Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Document109 pagesFinal Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Bien Bowie A. CortezNo ratings yet

- Tax Quiz BeeDocument10 pagesTax Quiz BeeMitchelle DumlaoNo ratings yet

- Annex B: Income Tax Tables: Table 1 Tax Rates For IndividualsDocument9 pagesAnnex B: Income Tax Tables: Table 1 Tax Rates For Individualshaze_toledo5077No ratings yet

- Other Percentage TaxDocument3 pagesOther Percentage Taxmira limNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- Sec. 2 of The Corporation Code of The Philippines. Batas Blg. 68Document6 pagesSec. 2 of The Corporation Code of The Philippines. Batas Blg. 68jetotheloNo ratings yet

- Mamalateo - Income and Withholding Taxes-2011Document95 pagesMamalateo - Income and Withholding Taxes-2011aL_2k100% (1)

- Ch04 Taxation of CorporationsDocument13 pagesCh04 Taxation of CorporationsKyla ArcillaNo ratings yet

- Other Perceentage TaxesDocument9 pagesOther Perceentage TaxesBrian Martin AnupolNo ratings yet

- Bsa1202 Ss2324e Individuals 08a AddendumDocument2 pagesBsa1202 Ss2324e Individuals 08a Addendumninarissi.05No ratings yet

- Comprehensive Income Taxation Somera (4!29!14)Document200 pagesComprehensive Income Taxation Somera (4!29!14)Moi Warhead0% (1)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- LeafletDocument4 pagesLeafletKate ShtankoNo ratings yet

- BalrampurChinni CaseStudy StockEdge 2010628Document34 pagesBalrampurChinni CaseStudy StockEdge 2010628Sureshbabu LakshminarayananNo ratings yet

- Stability StrategyDocument22 pagesStability StrategySid GargNo ratings yet

- Capital BudgetingDocument19 pagesCapital BudgetingJane Masigan50% (2)

- How The Adani Group Worked Its Way Around A Forensic AuditDocument2 pagesHow The Adani Group Worked Its Way Around A Forensic Auditdeyal32215No ratings yet

- Financial Markets and Instruments in GhanaDocument16 pagesFinancial Markets and Instruments in GhanaKwesi Banson Jnr100% (1)

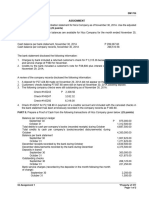

- 02 Assignment 1Document2 pages02 Assignment 1Louise LelisNo ratings yet

- Chapter 2 Cost Determination The Costing of Resource InputsDocument14 pagesChapter 2 Cost Determination The Costing of Resource InputsAlex HaymeNo ratings yet

- Solution Key To StudentsDocument2 pagesSolution Key To StudentsS M Prathik KumarNo ratings yet

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- Fringe Benefit TaxDocument30 pagesFringe Benefit Taxrav danoNo ratings yet

- Wyeth Formerly American Home Products Is A Global Leader inDocument1 pageWyeth Formerly American Home Products Is A Global Leader inLet's Talk With HassanNo ratings yet

- Greatec PUBLIC RESEARCHDocument4 pagesGreatec PUBLIC RESEARCHNicholas ChehNo ratings yet

- Audited Financial Statements 2020Document37 pagesAudited Financial Statements 2020Tan NguyenNo ratings yet

- Quikr India Private Limited: (700300) Disclosure of General Information About CompanyDocument243 pagesQuikr India Private Limited: (700300) Disclosure of General Information About CompanyLee DokyeomNo ratings yet

- MODULE Session 13 - The Role of AccountantsDocument24 pagesMODULE Session 13 - The Role of AccountantsOlivioNo ratings yet

- Afar JpiaDocument18 pagesAfar JpiaAken Lieram Ats AnaNo ratings yet

- Objectives of Financial ReportingDocument92 pagesObjectives of Financial ReportingSzabó BenceNo ratings yet

- Spice Communications - Idea Cellular MergerDocument25 pagesSpice Communications - Idea Cellular Mergerparijatsaurav100% (2)

- Summer Traning Report of Working Capital Manegment (CCBL)Document62 pagesSummer Traning Report of Working Capital Manegment (CCBL)PrabhatNo ratings yet

- FAR1 - PPE - Subsequent MeasurementDocument11 pagesFAR1 - PPE - Subsequent MeasurementErika Mae LegaspiNo ratings yet

- HonorariumDocument2 pagesHonorariumSherlock MalluNo ratings yet

- Universitas Klabat: Fakultas EkonomiDocument5 pagesUniversitas Klabat: Fakultas EkonomiIan SilaenNo ratings yet

- Acclaw QuizDocument4 pagesAcclaw QuizJasmine PeraltaNo ratings yet

- (WBS) Business - Management - Game - ENDocument21 pages(WBS) Business - Management - Game - ENwill.li.shuaiNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- W6 Module 5 Dupont System of AnalysisDocument14 pagesW6 Module 5 Dupont System of AnalysisDanica VetuzNo ratings yet

- About HCL EnterpriseDocument8 pagesAbout HCL EnterpriseSrinivasan ChandrasekarNo ratings yet