Professional Documents

Culture Documents

Listing Secondaire

Listing Secondaire

Uploaded by

48abhinavmittal0 ratings0% found this document useful (0 votes)

24 views4 pagesStocks

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStocks

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

24 views4 pagesListing Secondaire

Listing Secondaire

Uploaded by

48abhinavmittalStocks

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Dat of 1st # of secondary fund raised AUM Raised (in million Last secondary fund raised /

since 2010 €) Geographical (Biggest Fund raised)

Ranking Management Company Location Secondary

Focus

fund Equity Infra RE Credit Since 2010 Total Name Amount Date

Blackstone Strategic Blackstone Strategic Partners Real Estate VIII 2 600 M$ Live

1 US 2003 6 2 3 55 749 62 694 Global

Partners (Blackstone Strategic Partners IX) (22 200 M$) (Jan-23)

Ardian Secondary Fund IX 20 000 M$ Live

2 Ardian France 1999 4 3 43 318 47 658 Global

(Ardian Secondary Fund VIII) (14 000 M$) (Jun-20)

GS Vintage Real Estate Partners III ??? Live

3 Goldman Sachs AIMS US 2001 4 1 2 38 876 49 287 Global

(Goldman Sachs Vintage Fund IX) (14 200 M$) (Sept-23)

Lexington Partners Lexington Capital Partners X 22 700 M$ (Jan- 24)

4 US 2001 6 33 234 38 635 Global

(Franklin Templeton) (Lexington Capital Partners IX) (14 000 M$) (Jan-20)

Coller International Partners IX 12 000 M$ Live

5 Coller Capital UK 1996 3 1 21 607 29 498 Global

(Coller International Partners VIII) (9 000 M$) (Jan-21)

Landmark Real Estate Fund IX 3 300 M$ Dec-23

Ares Management (ex Ares Secondaries Infrastructure Solutions III 2 000 M$ Live

6 US 1993 4 1 3 Live 19 814 24 196 Global

Landmark Partners) Ares Secondaries Credit Solutions ??? Live

(Landmark Equity Partners XVI) (7 000 M$) (Sept-18)

AlpInvest Secondaries Program VIII 10 000 M$

Alpinvest Partners Live Live

7 Netherlands 2002 4 17 056 20 823 Global Alpinvest Atom Fund 500 M$

(Carlyle) (Dec-20)

(AlpInvest Secondaries Program VII) (9 000 M$)

HarbourVest Dover Street XI 12 000 M$ Live

8 HarbourVest Partners US 1999 3 15 406 19 380 Global

(HarbourVest Dover Street X) (8 100 M$) (Oct-20)

Partners Group RE Secondary 2021 ??? Live

9 Partners Group Switzerland 2004 3 3 13 433 17 433 Global

(Partners Group Secondary 2020) (3 200 M$) (2021?)

Pantheon Global Infrastructure IV 3 500 M$ Jan-24

10 Pantheon UK 2000 4 3 3 12 402 15 532 Global Pantheon Global Secondary Fund VII 3 250 M$ Nov-23

(Pantheon Global Secondary Fund V) (3 080 M$) (Jun-16)

LGT Crown Global Secondaries VI LGT Crown 6 000 M$ Live

11 LGT Capital Partners Switzerland 2010 6 11 698 11 698 Global Secondaries Special Opp. III > 2 000 M$ Live

(LGT Crown Global Secondaries V) (4 500 M$) (May-21)

Glendower Capital

12 UK 2007 4 10 068 10 793 Global Glendower Secondary Opp. Fund V 5 800 M$ juil-23

(CVC)

NB Strategic Capital Fund II 2 500 M$ Live

13 Neuberger Berman US 2008 4 9 683 11 245 Global

(NB Secondary Opportunities Fund V) (4 900 M$) (Sept-22)

Stepstone VC Secondaries Fund VI 2 750 M$ Live

14 StepStone US 2013 8 2 8 988 8 988 Global / US StepStone Secondary Opp Fund V > 1 600 M$ Live

(Stepstone VC Secondaries Fund V) (2 600 M$) (Apr-22)

ICG Strategic Equity Fund V 6 000 M$ Live

15 ICG UK 2017 3 8 091 8 091 Global ICG LP Secondaries Fund 1 000 M$ Live

(ICG Strategic Equity Fund IV) (5 180 M$) (Jun-22)

Hamilton Lane Secondary Fund VI 5 000 M$ Live

16 Hamilton Lane US 2007 3 1 6 819 7 709 Global Hamilton Lane Infrastructure Opp. Fund II 1 000M$ Live

(Hamilton Lane Secondary Fund V) (3 900 M$) (Feb-21)

17 Pomona Capital US 1994 3 5 725 8 654 Global Pomona X 2 600 M$ Aug-22

Madison International

18 US 2011 5 5 262 5 546 Global Madison Int. RE Liquidity Fund VIII 1 700 M$ Sept-23

Realty

Newbury Equity Partners VI 2 500 M$ Live

19 Newbury Partners US 2007 4 5 207 5 864 Global

(Newbury Equity Partners V) (2 000 M$) (Dec-21)

Portfolio Advisors Secondary Fund V 3 500 M$ Live

20 Portfolio Advisors US 2009 3 4 770 5 827 Focus US Portfolio Advisors GP Solutions 750 M$ Live

(Portfolio Advisors Secondary IV) (2 670 M$) (Jan-22)

21 Hollyport Capital UK 2007 6 3 797 3 822 Global Hollyport Secondary Opp. Fund VIII 2 200 M$ Dec-22

22 Industry Ventures US 2007 5 3 391 3 737 US Industry Ventures secondary X 1 450 M$ Sept-23

Dat of 1st # of secondary fund raised AUM Raised (in million Last secondary fund raised /

since 2010 €) Geographical (Biggest Fund raised)

Ranking Management Company Location Secondary

Focus

fund Equity Infra RE Credit Since 2010 Total Name Amount Date

Committed Advisors Secondary V 2 400 M€ Live

23 Committed Advisors France 2011 4 3 386 3 386 Global

(Committed Advisors Secondary IV) (1 600 M€) (Nov-20)

Adams Street Global Secondary Fund 8 2 000 M$ Live

24 Adams Street Partners US 1988 3 3 208 7 670 Global

(Adams Street Global Secondary Fund 7) (1 330 M$) (May-23)

25 Morgan Stanley US 2019 2 2 970 2 970 Global Ashbridge Transformational Sec. Fund II 2 500 M$ Feb-23

HSBC Private Equity Opportunities III 738 M$ Mar-23

26 HSBC AM UK 2020 3 2 879 2 879 Global

(HSBC Private Equity Opportunities) (1 034 M$) (Dec-20)

Montana Capital Partners

27 Switzerland 2013 5 2 707 2 707 Global MCP Opportunity Secondary Program V 1 300 M€ janv-21

(PGIM)

Montauk TriGuard Fund IX 632 M$ 2022

28 Montauk TriGuard US 1999 5 2 520 3 212 Global

(Montauk TriGuard Fund VII) (660 M$) (Jul-16)

29 Willowridge Partners US 2005 4 2 292 2 680 Global Amberbrook IX 900 M$ Aug-23

BlackRock Sec. & Liquidity Solutions II 4 000 M$ Live

30 BlackRock US 2021 1 2 245 2 245 Global

(BlackRock Sec. & Liquidity Solutions) (2 400 M$) (Mar-21)

31 Northleaf Capital Partners Canada 2014 3 2 203 2 203 Global Northleaf Secondary Partners III 1 300 M$ Feb-23

32 LSV Advisors US 2005 5 2 065 2 084 Global LSV Special Opportunities Round VI 700 M$ 2022

Global /

33 Unigestion Switzerland 2011 6 2 020 2 020 Unigestion Secondary V 900 M€ juil-22

Europe

PineBridge Secondary Partners V 350 M$ Nov-20

34 PineBridge Investments US 2012 4 1 970 2 642 Global / US

(PineBridge Secondary Opp. Partners) (880 M$) (Oct-18)

Principalement Five Arrows Secondary Opportunities VI 1 500 M€ Live

35 Five Arrows France 2003 3 1 860 1 860

Europe + US (Five Arrows Secondary Opportunities V) (1 000 M€) (Jan-20)

36 RCP Advisors US 2013 4 1 846 1 846 US RCP Secondary Opportunity IV 797 M$ juil-23

37 GCM Grosvenor US 2015 3 1 738 1 738 Focus US GCM Grosvenor Secondary Opp. III 972 M$ janv-23

ACP Secondaries 5 1 300 M€ Live

38 Altamar Private Equity Spain 2009 3 1 716 1 781 Global

(ACP Secondaries 4) (1 025 M€) (Jan-22)

Aberdeen Standard

39 Scotland 2014 4 1 1 670 1 670 Global Aberdeen Standard SOF IV 556 M$ juin-21

(formerly SL Capital)

BentallGreenOak BGO Strategic CP Secondaries III 1 500 M$ Live

40 US 2016 2 1 637 1 637 US

(formerly Carlyle) (Carlyle Real Estate’s Secondaries II) (1 200 M$) (Jan-19)

Capital Dynamics Global Secondaries VI 850 M$ Live

41 Capital Dynamics Switzerland 2010 3 1 522 1 522 Global

(Capital Dynamics Global Secondaries V) (786 M$) (Mar-21)

Eurazeo Eurazeo Secondary Fund V 1 500 M€ Live

42 France 2012 4 1 474 1 474 Europe

(formerly Idinvest) (Idinvest Secondary Fund IV) (700 M€) (Jul-21)

Banner Ridge Secondary Fund V 1 400 M$ Live

43 Banner Ridge Partners US 2020 2 1 450 1 450 US

(Banner Ridge Secondary Fund IV) (1 000 M$) (Oct-21)

Kline Hill Partners Solutions 250 M$ Live

44 Kline Hill Partners US 2017 4 1 425 1 425 US

(Kline Hill Partners IV) (540 M$) (Jun-22)

Revelation Partners

45 (Leerink Revelation US 2015 4 1 288 1 288 US Revelation Healthcare Fund IV 608 M$ Oct-23

Partners)

Arcano Secondary Fund XIV 450 M€ Jan-23

46 Arcano Partners Spain 2011 4 1 254 1 254 Global

(Arcano Secondary Fund I) (560 M$) (Mar-11)

Cubera X ??? Live

47 Cubera Private Equity Norway 2009 5 1 244 1 296 Nordic

(Cubera IX) (524 M€) (Feb-20)

48 BEX Capital France 2014 4 1 227 1 227 Europe BEX Fund IV 765 M$ mars-22

CF Private Equity Commonfund Capital Secondary IV ??? Live

49 US 2016 3 1 212 1 212 Global

(formerly Commonfund) (Commonfund Capital Secondary III) (675 M$) (Sept-21)

Dat of 1st # of secondary fund raised AUM Raised (in million Last secondary fund raised /

since 2010 €) Geographical (Biggest Fund raised)

Ranking Management Company Location Secondary

Focus

fund Equity Infra RE Credit Since 2010 Total Name Amount Date

Stafford Infra Secondaries V 1 300 M€ Live

50 Stafford Capital Partners UK 2018 3 1 193 1 193 Global

(Stafford Infra Secondaries IV) (731 M€) (Aug-22)

Glouston Capital Partners Glouston Private Equity Opp. VII ??? Live

51 US 2002 3 1 115 1 442 US

(formerly Permal) (Permal Private Equity Opp. V) (465 M$) (Nov-16)

Auda Secondary Fund V 500 M$? Live

52 HQ Capital International Allemagne 2010 3 982 982 Global

(Auda Secondary Fund IV) (503 M$) (May-18)

Apogem Capital

53 US 2018 3 955 955 US PA Secondary Fund VI 614 M$ juin-22

(formerly PA Capital)

Churchill Asset

54 US 2021 1 935 935 US Churchill Secondary Partners 1 000 M$ Sept-21

Management

Schroders Capital

55 Switzerland 2010 4 876 876 Global Schroders Private Equity Secondaries IV 410 M$ Nov-23

(formerly Schroder Adveq)

New 2ND Capital Fund III 600 M$ Live

56 New 2ND Capital US 2019 2 810 810 US

(New 2ND Capital Fund II) (572 M$) (Jun-21)

eQ PE SF IV 151 M€ Dec-22

57 eQ Asset Management Finland 2017 4 565 565 Europe

(eQ PE SF III) (155 M€) (Jun-20)

CBRE Investment

58 US 2022 1 560 560 Global CBRE Global Special Situations Fund 599 M$ May-22

Management

Headlands Capital Secondary IV 400 M$ Live

59 Headlands Capital US 2015 3 555 555 Global

(Headlands Capital Secondary III) (284 M$) (Dec-21)

Headway Investment Partners V 500 M€ Live

60 Headway Capital Partners UK 2005 2 547 749 Global

(Headway Investment Partners IV) (372 M€) (Oct-19)

Abbott Secondaries Opportunities III 450 M$ Live

61 Abbott Capital US 2017 2 545 545 US

(Abbott Secondaries Opportunities II) (375 M$) (2021)

62 Mill Reef Capital Switzerland 2021 2 530 530 Europe Mill Reef Capital Fund II 350 M€ Sept-23

Live Brookfield Real Estate Secondaries 3 000 M$ Live

63 Brookfield Canada 2021 1 514 514 Global

(DWS Private Equity Solutions) (550 M$) (Oct-21)

European Secondary Dev. VI 201 M€ 2020?

64 Arcis Group France 1998 2 511 1 134 Europe

(European Secondary Fund IV) (354 M€) (2008)

Flexstone Partners Flexstone Select Opportunities III 200 M€ Live

65 France 2016 2 430 430 Europe

(Natixis) (Flexstone Select Opportunities II) (300 M€) (Jul-19)

Mantra Investment

66 France 2015 3 380 380 Europe Mantra Secondary Opportunities III 180 M€ Dec-21

Partners

Tikehau Private Debt Secondaries II 1 000 M$ Live

67 Tikehau Capital France 2022 1 374 374 Global

(Tikehau Private Debt Secondaries I) (400 M$) (Q3 2022)

Sweetwater Secondaries Fund III 550 M$ Live

68 Sweetwater Private Equity US 2020 1 327 327 US

(Sweetwater Secondaries Fund II) (350 M$) (Oct-20)

Keyhaven Secondaries Fund III 500 M€ Live

69 Keyhaven Capital UK 2012 2 319 319 Europe

(Keyhaven Secondaries Fund II) (250 M€) (Dec-17)

North Sky Clean Growth Fund VI 350 M$ Live

70 North Sky US 2017 3 287 287 Global

(North Sky Clean Growth Fund V) (220 M$) (Aug-19)

Golding Secondaries 2022 500 M€ Live

71 Golding Capital Partners Allemagne 2022 1 280 280 Global

(Golding Secondaries 2019) (280 M€) (Dec-21)

ODDO BHF Secondaries Fund II 500 M€ Live

72 ODDO BHF AM France 2020 1 240 240 Global

(ODDO BHF Secondaries Fund) (240 M€) (Jul-20)

73 Timber Bay Partners US 2017 2 224 224 US Timber Bay Fund II 145 M$ Apr-21

74 Evoco Switzerland 2016 2 162 162 Europe Evoco TSE III 162 M€ Dec-21

75 Nordea Private Equity Danemark 2021 1 158 158 Europe Nordea Private Equity Secondary Fund I 158 M€ janv-21

76 Balderton Capital UK 2018 1 136 136 Europe Balderton Liquidity I 145 M$ Oct-18

Dat of 1st # of secondary fund raised AUM Raised (in million Last secondary fund raised /

since 2010 €) Geographical (Biggest Fund raised)

Ranking Management Company Location Secondary

Focus

fund Equity Infra RE Credit Since 2010 Total Name Amount Date

Morningside Vintage Secondary 2023 125-150 M$ Live

77 Morningside Capital US 2022 1 < 100 < 100 Global

(Morningside Vintage Secondary 2022) < 100 M$ Apr-22

Live

78 AllianzGI Allemagne - - - Global Allianz Private Debt Secondary Fund 500 M€ Live

Bellevue Asset Live

79 Switzerland - - - Global Bellevue Global Private Equity Fund 200 M$ Live

Management

Live

80 Blue Owl Capital US - - - Global Blue Owl Strategic Equity Strategy ??? Live

Live

81 Cambridge Associates US - - - Global CA Secondaries Aggregation Vehicle 250 M$ Live

Live

82 Clipway UK - - - Global Clipway Secondary Fund 4 000 M$ Live

Live

83 FEI Luxembourg - - - Europe AMUF European Secondaries 200 M€ Live

Live

84 Manulife IM Canada - - - Global Manulife Strategic Secondaries 750 M$ Live

Pinegrove Capital Partners Live

85 US - - - US Pinegrove Capital Partners 2 000 M$ Live

(Brookfield / Sequoia)

Live

86 TPG US - - - Global TPG GP Solutions 2 000 M$ Live

You might also like

- RealEstateTech TracxnFeedReport 07feb2020 - 1581314460268 PDFDocument228 pagesRealEstateTech TracxnFeedReport 07feb2020 - 1581314460268 PDFRohan SanejaNo ratings yet

- PPT-1 Introduction To Securities MarketsDocument50 pagesPPT-1 Introduction To Securities Marketssarvani malyavanthamNo ratings yet

- Part B FinalDocument7 pagesPart B FinalPeruriHarishNo ratings yet

- Hyundai E&CDocument17 pagesHyundai E&CabergeenNo ratings yet

- The Art of Put Selling PDFDocument23 pagesThe Art of Put Selling PDFChidambara StNo ratings yet

- Real Estate Tech - Tracxn Feed Report - 13 Aug 2020Document274 pagesReal Estate Tech - Tracxn Feed Report - 13 Aug 2020dessi purnamasariNo ratings yet

- FIN 30220: Macroeconomic Analysis: Capital MarketsDocument66 pagesFIN 30220: Macroeconomic Analysis: Capital MarketsPushpa KamatNo ratings yet

- FE-Seminar 10 15 2012Document38 pagesFE-Seminar 10 15 2012yerytNo ratings yet

- Sld20 External Growth Through MergerDocument14 pagesSld20 External Growth Through MergerChaztan RajNo ratings yet

- The Great Land Rush: Value Destruction Go It Alone American CaesarDocument22 pagesThe Great Land Rush: Value Destruction Go It Alone American CaesarstefanoNo ratings yet

- Top Business Models in United States Tech - 11 Aug 2023Document78 pagesTop Business Models in United States Tech - 11 Aug 2023ngotu142No ratings yet

- FinTech - Vietnam - Tracxn Geo Annual Report - 2023Document31 pagesFinTech - Vietnam - Tracxn Geo Annual Report - 2023maitranofficehcmNo ratings yet

- Case 1 MS1Document3 pagesCase 1 MS1Talha SajadNo ratings yet

- ST-GBOE Complaint AMENDEDDocument36 pagesST-GBOE Complaint AMENDEDPaulaGem607No ratings yet

- Ulster County IDA Kingstonian Cost Benefit AnalysisDocument24 pagesUlster County IDA Kingstonian Cost Benefit AnalysisDaily FreemanNo ratings yet

- Kingstonian Impact Analysis by DevelopersDocument64 pagesKingstonian Impact Analysis by DevelopersDaily FreemanNo ratings yet

- J17 DipIFR - AnswersDocument8 pagesJ17 DipIFR - Answers刘宝英No ratings yet

- Nubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserDocument5 pagesNubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserFelipe AreiaNo ratings yet

- PL 4312 CLASS 1 Development Feasibility AnalysisDocument54 pagesPL 4312 CLASS 1 Development Feasibility AnalysisWana PurnaNo ratings yet

- Chapter 12 Partnership - XLSX - Formation OperationDocument2 pagesChapter 12 Partnership - XLSX - Formation Operationmhrzyn27No ratings yet

- Group Presentation Feb 2023Document56 pagesGroup Presentation Feb 2023Jay PrajapatiNo ratings yet

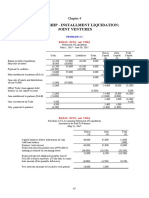

- Partnership - Installment Liquidation Joint Ventures: Roxas, Soto, and TodaDocument27 pagesPartnership - Installment Liquidation Joint Ventures: Roxas, Soto, and TodamarieieiemNo ratings yet

- Bbrief Etf Bitcoin - GabpDocument7 pagesBbrief Etf Bitcoin - GabpLuisDmCruzNo ratings yet

- Vietnam Startup Investment Insight:: 2017 in SnapshotDocument8 pagesVietnam Startup Investment Insight:: 2017 in Snapshothungnguyen2332No ratings yet

- Case 1 MS4Document2 pagesCase 1 MS4Talha SajadNo ratings yet

- 1 - HSE Impact On Industrial Companies - ESPE2023Document9 pages1 - HSE Impact On Industrial Companies - ESPE2023KETENo ratings yet

- Group Presentation Feb 2023Document56 pagesGroup Presentation Feb 2023Nishit VermaNo ratings yet

- Bailout Tally ReportDocument20 pagesBailout Tally Reportapi-26393375No ratings yet

- EBACsDocument46 pagesEBACshv9742233No ratings yet

- Casio Annual Report 2018Document35 pagesCasio Annual Report 2018Sarah LoNo ratings yet

- Chapter 13 Akun Keuangan TugasDocument2 pagesChapter 13 Akun Keuangan Tugassegeri kec0% (1)

- Ias 21 Example Basic Translation Foreign Operation 01Document4 pagesIas 21 Example Basic Translation Foreign Operation 01devanand bhawNo ratings yet

- Horizontal E-Commerce Exit Landscape - 2023Document422 pagesHorizontal E-Commerce Exit Landscape - 2023Pawandeep SethiNo ratings yet

- Investment Currency Vintage Year Commitment (USD) : Private Income - June 30, 2020Document2 pagesInvestment Currency Vintage Year Commitment (USD) : Private Income - June 30, 2020Vishnu MohananNo ratings yet

- Economic Impact of Toyota Motor Manufacturing, Texas: Jim WisemanDocument12 pagesEconomic Impact of Toyota Motor Manufacturing, Texas: Jim WisemansengsenNo ratings yet

- Pindi YulinarRosita - Chapter 15 IA 2Document10 pagesPindi YulinarRosita - Chapter 15 IA 2Pindi YulinarNo ratings yet

- Main - Gar 30 Table 2023 - Web by Gar - InfogramDocument2 pagesMain - Gar 30 Table 2023 - Web by Gar - InfogramFarshadNo ratings yet

- Top 100 RE ManagementDocument4 pagesTop 100 RE ManagementCosimoNo ratings yet

- ACT FormDocument1 pageACT Formnurul ibrahimNo ratings yet

- Use The Following Information For The Next Seven Questions:: Total LiabilitiesDocument7 pagesUse The Following Information For The Next Seven Questions:: Total LiabilitiesRoss John JimenezNo ratings yet

- V3 Fiat Group and CASE CE HeritageDocument17 pagesV3 Fiat Group and CASE CE HeritageEng Ahmed ABasNo ratings yet

- Phillips, Hager & North Global Equity Fund F: Growth of 10,000 10-09-2009 - 10-09-2019 Morningstar Risk MeasuresDocument3 pagesPhillips, Hager & North Global Equity Fund F: Growth of 10,000 10-09-2009 - 10-09-2019 Morningstar Risk MeasuresRoger SongNo ratings yet

- Mike Beveridge - Doing Business Under The OceanDocument18 pagesMike Beveridge - Doing Business Under The OceanGiacomo CalligarisNo ratings yet

- Words From The Wise Jack Bogle On Building A Better Investment IndustryDocument32 pagesWords From The Wise Jack Bogle On Building A Better Investment IndustryRichard DennisNo ratings yet

- 300 - PEI - Jun 2019 - DigiDocument24 pages300 - PEI - Jun 2019 - Digimick ryanNo ratings yet

- Banking - Citi - Original File1Document16 pagesBanking - Citi - Original File1Xiaochen TangNo ratings yet

- Tutorial 40F - Suggested SolutionDocument4 pagesTutorial 40F - Suggested Solutionmusa morinNo ratings yet

- MC KinseyDocument2 pagesMC KinseyChandan KumarNo ratings yet

- Tax 2 Final Cheat Sheet 1.2Document2 pagesTax 2 Final Cheat Sheet 1.2HelloWorldNowNo ratings yet

- Breakfast Presentation Jan 26 2010Document23 pagesBreakfast Presentation Jan 26 2010vanessa3937No ratings yet

- NABARDDocument1 pageNABARDNitin PatelNo ratings yet

- World Capitalist System UCSPDocument7 pagesWorld Capitalist System UCSPVIRGILIO JR FABINo ratings yet

- Bridgewater Associates - WikipediaDocument14 pagesBridgewater Associates - WikipediaJavier NietoNo ratings yet

- Goldman Sachs Global Millennials Equity Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVDocument4 pagesGoldman Sachs Global Millennials Equity Portfolio: A Sub-Fund of Goldman Sachs Funds, SICAVMario FighetosteNo ratings yet

- Q2 2021 Manhattan Sublease Market OverviewDocument29 pagesQ2 2021 Manhattan Sublease Market OverviewKevin ParkerNo ratings yet

- Balance Sheet Abstract & Company'S General Business Profile: I. Registration DetailsDocument3 pagesBalance Sheet Abstract & Company'S General Business Profile: I. Registration Detailsravibhartia1978No ratings yet

- Napco Taylor GrossmannDocument30 pagesNapco Taylor Grossmanndeepshika kourNo ratings yet

- Financial Reporting (United Kingdom) : Wednesday 13 June 2012Document10 pagesFinancial Reporting (United Kingdom) : Wednesday 13 June 2012Huệ LêNo ratings yet

- Role of HR in M&ADocument36 pagesRole of HR in M&Amintimanali50% (2)

- Balance Sheet Abstract & Company'S General Business Profile: I. Registration DetailsDocument2 pagesBalance Sheet Abstract & Company'S General Business Profile: I. Registration Detailsravibhartia1978No ratings yet

- Kahoot!Document6 pagesKahoot!Federico NiciferoNo ratings yet

- Investor Presentation: Bharti Airtel Limited Bharti Airtel LimitedDocument29 pagesInvestor Presentation: Bharti Airtel Limited Bharti Airtel LimitedAnand BatraNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Valuation of Securities (With Formula)Document21 pagesValuation of Securities (With Formula)Hema ShreeNo ratings yet

- 10 - Different Types of BondsDocument4 pages10 - Different Types of BondsNaeem GulNo ratings yet

- ASSIGNMENT 407 - Audit of InvestmentsDocument3 pagesASSIGNMENT 407 - Audit of InvestmentsWam OwnNo ratings yet

- Assignment On Function of Derivative MarketDocument6 pagesAssignment On Function of Derivative MarketKarthik Karthi0% (1)

- Fixed Income SecuritiesDocument3 pagesFixed Income SecuritiesPRAPTI TIWARINo ratings yet

- LifePlan by SundarDocument28 pagesLifePlan by SundarSundar KumarNo ratings yet

- Sun Pharmaceutical Industries Limited: Draft Letter of OfferDocument77 pagesSun Pharmaceutical Industries Limited: Draft Letter of OfferVenkat ChowdaryNo ratings yet

- BootstrappingDocument34 pagesBootstrappingHarshit DwivediNo ratings yet

- AssignmentDocument5 pagesAssignmentDao DuongNo ratings yet

- Notice To Shareholders of Jb&Zjmy Company 8-7-17Document2 pagesNotice To Shareholders of Jb&Zjmy Company 8-7-17Daniel ErdNo ratings yet

- 2.3 Fra and Swap ExercisesDocument5 pages2.3 Fra and Swap ExercisesrandomcuriNo ratings yet

- JPM Mortgage ResearchDocument30 pagesJPM Mortgage ResearchflhaliliNo ratings yet

- Assignment Program - Bba Semester 5 Subject Code & Name Bb0022 Capital and Money MarketDocument16 pagesAssignment Program - Bba Semester 5 Subject Code & Name Bb0022 Capital and Money MarketMrinal KalitaNo ratings yet

- Market Reaction To Multiple Buybacks in IndiaDocument32 pagesMarket Reaction To Multiple Buybacks in Indiagautam_gujral3088488No ratings yet

- 25-26 FIN 201 - Vong BophaDocument2 pages25-26 FIN 201 - Vong BophaBopha vongNo ratings yet

- Chapter7-Stock Price Behavior & Market EfficiencyDocument9 pagesChapter7-Stock Price Behavior & Market Efficiencytconn8276No ratings yet

- Structured Note Hedging: Non-Inversion Notes (Nins) Characteristics and SizesDocument5 pagesStructured Note Hedging: Non-Inversion Notes (Nins) Characteristics and SizesmattwallNo ratings yet

- Fin 501 Payout PolicyDocument14 pagesFin 501 Payout Policyovi_hassan74No ratings yet

- Tradebulls Securities (P) Limited Tradebulls Commodities Broking (P) LimitedDocument16 pagesTradebulls Securities (P) Limited Tradebulls Commodities Broking (P) LimitedKedar UkidveNo ratings yet

- Presented By:: Shubham Bhutada Aurangabad (MH)Document30 pagesPresented By:: Shubham Bhutada Aurangabad (MH)1986anu100% (1)

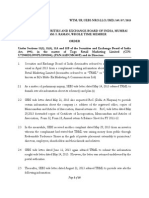

- Interim Order in The Matter of Togo Retail Marketing LimitedDocument16 pagesInterim Order in The Matter of Togo Retail Marketing LimitedShyam SunderNo ratings yet

- Initial Public Offering - WikipediaDocument12 pagesInitial Public Offering - WikipediajubsNo ratings yet

- Geojit Project Cover PageDocument7 pagesGeojit Project Cover PageMadhav ManmohanNo ratings yet

- Session 08-09 - Dividend Policy & Firm ValueDocument37 pagesSession 08-09 - Dividend Policy & Firm ValueMohit KhokharNo ratings yet

- The Following Quotes Are From Mihir Bhattacharya Convertible Securities andDocument1 pageThe Following Quotes Are From Mihir Bhattacharya Convertible Securities andAmit PandeyNo ratings yet

- LBO Valuation Model PDFDocument101 pagesLBO Valuation Model PDFAbhishek Singh100% (3)

- V41 C05 611ungeDocument10 pagesV41 C05 611ungeZen TraderNo ratings yet