Professional Documents

Culture Documents

Document 14

Document 14

Uploaded by

Sumaya Nimat Khan0 ratings0% found this document useful (0 votes)

3 views3 pagesOriginal Title

Document 14 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views3 pagesDocument 14

Document 14

Uploaded by

Sumaya Nimat KhanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Department of Business Administration

Assignment

Course Title: Financial Accounting

Course code: ACN 501

Submitted to:

Prof. Dr. Ali Noor

Pro-Vice Chancellor (BUBT)

Submitted by:

Sumaya Nimat Khan

Registration no: 23206031

Program: Master of Business Administration

Date: 27 April 2024

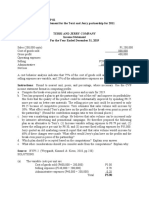

(!) Cost of goods sold:

Sales 110*18 1980

50*20 1000

40*18 720

Total 3700

Less: Sales return 10*18 180

Net cost of goods sold 3520

Calculation of sales:

Sales 110*28 3080

90*32 2880

Total 5960

Less: Sales return 10*28 280

Net sales 5680

(!!!) Gross profit:

Net sales 5680

Less: Cost of goods sold 3520

Gross profit 2160

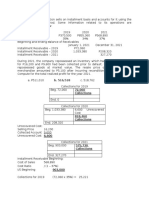

(!) Cost of goods sold:

Sales 100*15 1500

10*18 180

90*18 1620

Total 3300

Less: Sales return 10*18 180

Net cost of goods sold 3120

Calculation of sales:

Sales 110*28 3080

90*32 2880

Total 5960

Less: Sales return 10*28 280

Net sales 5680

(!!!) Gross profit:

Net sales 5680

Less: Cost of goods sold 3120

Gross profit 2560

Addition:

1. This period is inflationary because the price is decreasing.

2. During the inflationary period, company should follow LIFO method, as it will charge

more costs against sales and its shows less profit.

3. (!) If a company wants to show more profit, then they should follow the FIFO

method.

(!!) If a company wants to pay less tax, then they should follow LIFO method.

(!!!) If a company wants to sell shares in the market, then they should follow the FIFO

method because it shows more profit.

(!v) If a company wants to purchase share from the market, they should follow both LIFO

and FIFO methods.

You might also like

- Tugas Personal 1 - Diaz Hesron Deo Simorangkir - 2602202526Document6 pagesTugas Personal 1 - Diaz Hesron Deo Simorangkir - 2602202526Diaz Hesron Deo SimorangkirNo ratings yet

- Questionnaire On Cement BrandDocument4 pagesQuestionnaire On Cement Branddigvijay_b201283% (12)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Chapter 7-The Regular Output VatDocument7 pagesChapter 7-The Regular Output VatJamaica DavidNo ratings yet

- Group ONE Final Report Import Process at KUEHNE NAGEL CO. LTD OfficialDocument40 pagesGroup ONE Final Report Import Process at KUEHNE NAGEL CO. LTD OfficialTrần Khã NhiNo ratings yet

- BT Chương 3Document8 pagesBT Chương 3trangnguyen.31221021691No ratings yet

- Akuntansi Tugas 1 NDocument2 pagesAkuntansi Tugas 1 NRala SuriNo ratings yet

- CBE June 2021 - ADocument7 pagesCBE June 2021 - ANguyễn Hồng NgọcNo ratings yet

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- Akm 3Document5 pagesAkm 3naylaphuiamazonaNo ratings yet

- Theme 11-b SlidesDocument112 pagesTheme 11-b Slidess.azeemshah s.zulfiqarshahNo ratings yet

- Tugas Income StatementDocument4 pagesTugas Income StatementhaniNo ratings yet

- ACCT 203 (Assignment 3)Document4 pagesACCT 203 (Assignment 3)koftaNo ratings yet

- Statement of Comprehensive Income Sample PDFDocument2 pagesStatement of Comprehensive Income Sample PDFVinella SantosNo ratings yet

- Income Statement For Year: 1 Using Absorption Costing ApproachDocument5 pagesIncome Statement For Year: 1 Using Absorption Costing ApproachMak PussNo ratings yet

- Salary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Document5 pagesSalary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Samia AkterNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- 105 - Activity 1 - Cash FlowDocument11 pages105 - Activity 1 - Cash FlowElla DavisNo ratings yet

- Business NotesDocument18 pagesBusiness Notesshally tanNo ratings yet

- Accounting Fifo LifoDocument7 pagesAccounting Fifo LifoFariha tamannaNo ratings yet

- KMC Should Prepare Corporate Income Tax For ThatDocument3 pagesKMC Should Prepare Corporate Income Tax For Thatgatete samNo ratings yet

- Company Profile: Marketing StrategyDocument5 pagesCompany Profile: Marketing StrategyMark PachuchuNo ratings yet

- Carol Majestica-01012190047-PR Pertemuan 02Document6 pagesCarol Majestica-01012190047-PR Pertemuan 02nadila ika sefiraNo ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- 48 Profitability RatiosDocument7 pages48 Profitability Ratiossaanu7870No ratings yet

- Financial Statement Analysis Midterm Assignment AssignmentDocument5 pagesFinancial Statement Analysis Midterm Assignment AssignmentHaidar NuraNo ratings yet

- Financial Statement Analysis - Illustrative Problem - FOR STUDENTSDocument6 pagesFinancial Statement Analysis - Illustrative Problem - FOR STUDENTShobi stanNo ratings yet

- BE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnDocument10 pagesBE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnNguyễn Linh NhiNo ratings yet

- Tugas 6 - Aulia KhairaniDocument3 pagesTugas 6 - Aulia KhairaniadvokesmahmmbNo ratings yet

- Module 3 Problems On Income StatementDocument8 pagesModule 3 Problems On Income StatementShruthi PNo ratings yet

- Mock Test - 2023Document3 pagesMock Test - 2023Phuoc TruongNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument4 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaNo ratings yet

- Answer Key - Income Tax Peer Tutoring Quiz (Chapter 4)Document4 pagesAnswer Key - Income Tax Peer Tutoring Quiz (Chapter 4)Jahz Aira GamboaNo ratings yet

- F3 - ACCA Chapter-23-1Document15 pagesF3 - ACCA Chapter-23-1Nile NguyenNo ratings yet

- Assignment-2 FA PDFDocument3 pagesAssignment-2 FA PDFrajNo ratings yet

- Nok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Document4 pagesNok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Risma AmeliaNo ratings yet

- Trial Balance As at 30 September 2008Document1 pageTrial Balance As at 30 September 2008MOHAMED USAIDNo ratings yet

- Answers FAR - CASE ANALYSISDocument4 pagesAnswers FAR - CASE ANALYSISJaquelyn ClataNo ratings yet

- Chap 5 Prob 1 3Document10 pagesChap 5 Prob 1 3Nyster Ann RebenitoNo ratings yet

- Flat No. 403 Madina Manzil Nayabad Khadda Market Muhammad IrfanDocument6 pagesFlat No. 403 Madina Manzil Nayabad Khadda Market Muhammad IrfanIbrahim MemonNo ratings yet

- Chapter 3 Value Added Tax Sale of Good PropertiesDocument8 pagesChapter 3 Value Added Tax Sale of Good PropertiesMary Grace BaquiranNo ratings yet

- Chapter 8 Output Vat Zero-Rated SalesDocument8 pagesChapter 8 Output Vat Zero-Rated SalesJamaica DavidNo ratings yet

- B. 516,518 72,060 CollectionsDocument2 pagesB. 516,518 72,060 CollectionsMichelle Galapon LagunaNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- Takehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Document3 pagesTakehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Sharmaine SurNo ratings yet

- Computaion Pre FinalDocument4 pagesComputaion Pre FinalPaupauNo ratings yet

- Financial Statements - Part ADocument36 pagesFinancial Statements - Part AHussain AhmedNo ratings yet

- Calculating Profit - Extra ExercisesDocument4 pagesCalculating Profit - Extra ExercisesРустам РажабовNo ratings yet

- Tutorial 8-CIT3-2024 - AnswerDocument15 pagesTutorial 8-CIT3-2024 - Answercaduong0109No ratings yet

- Finman P1 Compilation PDFDocument33 pagesFinman P1 Compilation PDFJev CastroverdeNo ratings yet

- PERMALINO - Learning Activity 12 - Short Term BudgetingDocument2 pagesPERMALINO - Learning Activity 12 - Short Term BudgetingAra Joyce PermalinoNo ratings yet

- Seminar 2 Spreadsheet Answers-1Document29 pagesSeminar 2 Spreadsheet Answers-1Leeanna NDNo ratings yet

- Problem Solving 1: RequirementsDocument4 pagesProblem Solving 1: RequirementsMariz TimarioNo ratings yet

- Business Tax - Output VAT ActivityDocument4 pagesBusiness Tax - Output VAT ActivityDrew BanlutaNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- 03RATIO ANALYSIS MbaDocument18 pages03RATIO ANALYSIS MbaAbid XargarNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- T&D-U&N.PPT FinalDocument18 pagesT&D-U&N.PPT FinalSumaya Nimat Khan100% (1)

- Tasnim TabassumDocument181 pagesTasnim TabassumSumaya Nimat Khan100% (1)

- Mba 2020 21Document141 pagesMba 2020 21Sumaya Nimat KhanNo ratings yet

- Annual Report 2022 Abridge VersionDocument145 pagesAnnual Report 2022 Abridge VersionSumaya Nimat KhanNo ratings yet

- Report WritingDocument7 pagesReport WritingSumaya Nimat KhanNo ratings yet

- Financial Accounting Math SolutionDocument3 pagesFinancial Accounting Math SolutionSumaya Nimat KhanNo ratings yet

- Eim Solutions Best Sap ConsultingDocument10 pagesEim Solutions Best Sap ConsultingeimsolutionsNo ratings yet

- Comprehensive Case Scenario Wilson BrosDocument8 pagesComprehensive Case Scenario Wilson BrosMe MeNo ratings yet

- Acc 112 - Partnership LiquidationDocument19 pagesAcc 112 - Partnership LiquidationJIYAN BERACISNo ratings yet

- Looking GoodDocument36 pagesLooking GoodDanNo ratings yet

- Software Services VDocument1 pageSoftware Services Vwalid elalaouiNo ratings yet

- Integrated Cost and Risk Analysis Using Monte Carlo Simulation of A CPM ModelDocument4 pagesIntegrated Cost and Risk Analysis Using Monte Carlo Simulation of A CPM ModelPavlos Vardoulakis0% (1)

- BSC Toolkit Short PicDocument23 pagesBSC Toolkit Short PicnilamgajiwalaNo ratings yet

- Limitation of ScopeDocument2 pagesLimitation of ScopeTan Xian TjoeNo ratings yet

- Reese Wholesale Retail 0606Document21 pagesReese Wholesale Retail 0606Zalmon PynadathNo ratings yet

- Debit - Credit Auto-Debit Authrisation FormDocument1 pageDebit - Credit Auto-Debit Authrisation FormWan Muhammad ZamyrNo ratings yet

- Chapter 7 AIS James HallDocument45 pagesChapter 7 AIS James HallheyheyNo ratings yet

- Retailing Wholesaling: Chapter PreviewDocument34 pagesRetailing Wholesaling: Chapter PreviewMikaelaNo ratings yet

- Become A Fiverr SuperheroDocument34 pagesBecome A Fiverr SuperheroSpray.10 AhmNo ratings yet

- 3 - The Internal EnvironmentDocument49 pages3 - The Internal EnvironmentAdie FakhriNo ratings yet

- Dereje MekonnenDocument104 pagesDereje Mekonnenjoseph andrewNo ratings yet

- Curriculum Vitae: Aishwarya SrivastavaDocument3 pagesCurriculum Vitae: Aishwarya SrivastavaSwati MishraNo ratings yet

- Tenderdocumentphase 1Document66 pagesTenderdocumentphase 1ashwin tripathiNo ratings yet

- Company Analysis DELLDocument16 pagesCompany Analysis DELLVidyasagar Tiwari67% (3)

- Contribution MarginDocument6 pagesContribution Marginajeng.saraswatiNo ratings yet

- Fundamentals of Corporate Finance 7th Edition Ross Solutions ManualDocument10 pagesFundamentals of Corporate Finance 7th Edition Ross Solutions Manualomicronelegiac8k6st100% (22)

- NPCC Architect East SaraikelaDocument62 pagesNPCC Architect East Saraikelarajveer raj singhNo ratings yet

- MANP005 Individual Report - EditedDocument21 pagesMANP005 Individual Report - EditedMeshy EnlightmentNo ratings yet

- Ehs FinalmanualDocument229 pagesEhs FinalmanualrishiNo ratings yet

- Round Rock Independent School District: Human ResourcesDocument6 pagesRound Rock Independent School District: Human Resourcessho76er100% (1)

- Finance Resume SamplesDocument4 pagesFinance Resume Samplesf5b2q8e3100% (2)

- Managing A Professional Services FirmDocument37 pagesManaging A Professional Services FirmSaurabh MehrotraNo ratings yet

- How To Create Killer Sales Playbooks GuideDocument14 pagesHow To Create Killer Sales Playbooks GuideLeonie Newbury100% (1)

- Fire Engineering PDFDocument6 pagesFire Engineering PDFAli Mokhtar ConsultantsNo ratings yet