Professional Documents

Culture Documents

Course Syllabus Peachtree

Course Syllabus Peachtree

Uploaded by

sami ullahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Course Syllabus Peachtree

Course Syllabus Peachtree

Uploaded by

sami ullahCopyright:

Available Formats

te

u

it

st

In

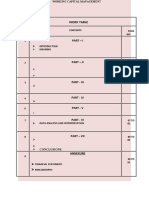

COURSE SYLLABUS

u

H

it

Computerized Accounting

C

st

Course: Peachtree

TE

In

V

50 Cragwood Rd, Suite 35

H

South Plainfield, NJ 07080

A

Victoria Commons, 613 Hope Rd Building #5,

TE

Eatontown, NJ 07724

130 Clinton Rd,

Fairfield, NJ 07004

V

A

Peachtree Syllabus

te

Avtech Institute of Technology Course

Instructor:

u

Course Duration:

Date/Time:

Training Location:

it

Course Description

st

This course will teach the essentials of Peachtree to utilize powerful features for successful small

businesses to get up and running quickly, handle accounting basics to streamline operations,

including invoicing and bill paying, Check & Forms, Credit Card Processing, and Peachtree

In

Payroll solutions, Online Bill Payment, Fixed Assets Management, Offsite Data Storage, Remote

Data Access, Time & Billing Management, and how to use Web Site Tools & Third-Party Add-

Ons, as well as many more advanced features, such as powerful reporting, basic inventory, and

u

analysis elements, Recurring Transactions with Year End Rollover, Integration with Microsoft

Word, Schedule Memorized Transactions, E-mails Generated by Alerts, forms Design

improvement Filtering reports using custom fields, Create and Print Deposit Tickets, and

H

it

Customize your Task Screens.

The standard accounting basics, such as General Ledger, Accounts Receivable, Accounts

C

Payable, Inventory, and Payroll solutions will be covered in this course, as well as the features of

st

Peachtree, such as Create Assemblies, Track Item Detail, Powerful Inventory, Multiple Costing

Methods, Write Checks Fast, Purchase on Time, Vendor Credit Memos, the Analysis and

TE

Reporting, Get finances in a Flash, Add Attachments, the Cash Flow Time Savers and

In

Customization, Quick Entry Account Register, Internal Accounting Review, Comparative

Budget Spreadsheet Creator rapid Access Reports, Year-End Wizard to save time and follow the

correct steps during the critical process of closing the fiscal year, and much more will also be

oriented in detail.

V

Learning Objectives

H

A

1.0 Peachtree Overview

C

1.1. Open Company and Set up company

1.1.1. Customers

TE

1.1.2. Vendors

1.1.3. Items and Services

1.1.4. Employees

1.1.5. Chart of Accounts

V

1.1.6. User Security

A

Avtech Technology Institute Page 2

Peachtree Syllabus

te

1.1.7. Set up Chart of Accounts (or General Ledger)

1.1.8. Set up the beginning balance for Customers, Vendors, Inventory Items (Inventory

Amount and Costing Information), Employees (Employee Information and year to-

u

date withholding), and Jobs

1.1.9. Set up Fiscal Year and business starting date

1.2.(Online) Back up and Restore, Maintenance and Update, and remote access

it

1.3. Import & Export of data and report

1.4. Transactions and Jobs, Invoice and Purchase Order

st

1.5. Payroll & Taxes

1.6. Account, Purchase, Sales, revenue, and inventory

1.7.Cash, Collection, payment, and Finance

In

1.8. General Ledger, Financial Statement, Forms and Report

1.9. Accounts Payable, Accounts Receivable, Accounts Reconciliations, Income Statement,

u

Trial Balance, and Balance Sheet

H

it

2.0 Navigation Peachtree

ž The Navigation Bars of Peachtree offers access to seven pages “navigation Centers”.

C

They provide information about and access to the Peachtree programs

st

2.1. Business Status

2.2. Customers & Sales

TE

2.3. Vendors & Purchases

In

2.4. Inventory & Services

2.5. Employees & Payroll

V

2.6. Banking

2.7. Company

H

A

3.0 Business Status

C

ž Peachtree Business Status give you a quick picture of how is your business doing. It

includes Accounting balance, revue figures, payable and receivable data. Peachtree

Accounting tracks the transactions and gives feedback and analysis of how business is

TE

doing.

3.1. Home Page

3.1.1. Beginning Account Balances

V

A

Avtech Technology Institute Page 3

Peachtree Syllabus

te

3.1.1.1. Account List (Petty Cash, Cash o Hand, Regular Checking Account,

Payroll checking Account, Savings Account, and Accounts Receivable)

and Account Description

u

3.1.1.2. Year to Date Revenue Figures

3.1.1.3. Receivable & Payable data finding and display

3.1.1.4. List of Print a Peachtree Report

it

3.2. Accounts Reconciliation

3.2.1. Reconcile Accounts & Import Bank Statement

st

3.2.2. View Balance Sheets, Customize Reports

3.3. Reports and Forms: A feature let you find, display, and lets you print your Forms, List

and reports

In

4.0 Customers & Sales Navigation Center

u

ž Show the flow of customer-related tasks & takes you where you need to go to perform

the tasks. Its also includes a summary of customer information, access to recently used

customer reports, and an overview of your company’s aged receivables.

H

it

4.1. Summary of customer information

4.2. Customer & Sales Tasks

C

st

4.2.1. Customers, Jobs, Sales Taxes

4.2.2. Quotes, Sales Orders, Sales Invoices, Finance Charges, Receive Money, Bank

TE

Deposits

4.2.3. Customer Statements, Credit and Returns

In

4.3. (Recently Used) Customer Reports

4.3.1. Aged Receivables

V

4.3.2. Sales Journal

H

4.3.3. Cash Receipts Journal

A

4.3.4. Customer Transaction History

C

4.3.5. Invoice Register

4.4. Peachtree solutions

TE

4.4.1. Checks & forms

4.4.2. Credit Card Service

4.4.3. Time & billing

5.0 Vendors & Purchases

V

A

Avtech Technology Institute Page 4

Peachtree Syllabus

te

ž Pay your bills. Track your credit cards. Write checks. Learn how QuickBooks can help

you track and manage your expenses

5.1. Vendors & Purchases Tasks

u

5.1.1. Vendors, Write Checks, 1099s

5.1.2. Purchase Orders, Enter Bills, Pay Bills

it

5.1.3. Void Checks, Credit and Returns

5.2. (Recently used) Vendor Reports

st

5.2.1. Aged Payable

5.2.2. Cash Disbursements Journal

5.2.3. Purchase Journal

In

5.2.4. Check Register

5.2.5. Vendor Transaction History

u

5.3. Peachtree solutions

5.3.1. Checks & forms

H

it

6.0 Inventory & Services

C

ž Manage your inventory and track your stock on hand. Learn how to run your business

st

efficiently using the Inventory feature

6.1. Inventory & Service Tasks

TE

6.1.1. Inventory Items, company Service, Assemblies

In

6.1.2. Purchase Orders---Receive Inventory

6.1.3. Inventory Count and Inventory Adjustments

V

6.2. Inventory List: Description, No. Unit sold, Quantity on Hand

6.3. Inventory & Services Reports

H

6.3.1. Item costing Report

A

6.3.2. Inventory Adjustment Journal

C

6.3.3. Inventory Stock Status Report

6.3.4. Physical Inventory List

TE

6.4. Inventory Profitability Report --- Cost of Sales Trend: Revenue, Cost of Sales, Gross

Profit

7.0 Employees & Payroll

V

ž Learn how to pay your employees, pay payroll taxes and liabilities, and file tax forms

A

Avtech Technology Institute Page 5

Peachtree Syllabus

te

7.1. Employees & Payroll Tasks

7.1.1. Employees, User Security, 1099s

7.1.2. Pay Employees, direct Deposit, Print payroll Checks

u

7.1.3. Payroll Tax Tables and Forms

7.2. Employees & Payroll Reports

it

7.2.1. Payroll Register

7.2.2. Payroll Check Register

st

7.2.3. Tax Liability Report

7.2.4. Current Earnings Report

7.2.5. Payroll Journal

In

7.3. Peachtree Solutions

7.3.1. Full-Service Payroll

u

7.3.1.1. Peachtree Direct Deposit

7.3.1.2. Checks & Forms

H

it

7.3.1.3. Tax Update Service

7.3.1.4. e-filing Service

C

7.3.2. For Payroll Subscribers (additional fees apply)

st

TE

8.0 Banking

8.1.Banking Tasks

In

8.1.1. Write Checks, Account Register, Budgets, Chart of Accounts

8.1.2. Receive Money, Bank Deposits, Enter Bills, Pay bills

V

8.1.3. Reconcile Account, General Journal Entries

H

8.1.4. Void Checks

A

8.2. Account List, Bills to Pay and Account Balances

8.3. Reconcile Account, Balance Sheet

C

8.4. All Banking Reports

8.4.1. Account Register

TE

8.4.2. Bank Deposit Report

8.4.3. Account Reconciliation

8.4.4. Deposits in Transit

8.4.5. Outstanding Checks

V

8.5. Peachtree solutions

A

Avtech Technology Institute Page 6

Peachtree Syllabus

te

8.5.1. Credit Card Service

8.5.1.1. Accept credit card payments by phone, on-line, or in person

8.5.1.2. Seamless integration with your Peachtree software

u

8.5.1.3. Expand your customer's payment options

8.5.2. Peachtree Payroll Solutions

it

8.5.2.1. In-House Payroll

8.5.2.1.1. Peachtree Payroll Tax Update

st

8.5.2.1.2. Service1e-Filing Advantage2

8.5.2.2. Full-Service Payroll

8.5.2.2.1. Peachtree Payroll Service

In

9.0 Company

u

ž Learn how to pay your employees, pay payroll taxes and liabilities, and file tax forms

9.1. Employees & Payroll Tasks

H

it

9.1.1. Company Tasks: Set up Guide, User Security, Chart of Accounts

9.1.2. Data Maintenance: Back up company data, restore a backup, verify that company

C

files are not missing or damaged, purged unused or inactive data, Import and

st

Export data from other applications

9.1.3. Check for Peachtree Update

TE

9.1.4. year End Wizard

In

9.1.5. General Journal Entry

9.1.6. Synchronize Peachtree Data on the Web

V

9.2. Company Information and Company Reports

9.2.1. General Ledger, Cash Account Register, Find Transaction Report, Daily Register,

H

Internal Accounting Review

A

9.3. All Financial Statement: Income Statement,: Income/Budget, Income Statement,

C

Balance Sheet, Income 2 years

10.0 New Features

TE

10.1. Outlooks Synchronization

10.2. Run Cash Requirement Report

10.3. Print & display Federal & State Tax Forms

V

A

Avtech Technology Institute Page 7

Peachtree Syllabus

te

Prerequisite

Familiar with PC and Windows OS

u

Co-requisite

it

Contact Hours

______ Contact Hours (Lecture ___ Hours / Lab ____ Hours)

Semester Credit Hours

st

In

__________ semester credit hours

u

Text / Lab Books

Recommended:

H

it

C

st

TE

Teaching Strategies

In

A variety of teaching strategies may be utilized in this course, including but not limited to,

lecture, discussion, written classroom exercises, written lab exercises, performance based lab

exercises, demonstrations, quizzes and examinations. Some quizzes may be entirely or contain

V

lab based components. A mid-course and end course examination will be given.

H

Method of Evaluating Students

A

Grade Distribution

C

Class Attendance 10

Mid Term 30

TE

Finals 50

Special Projects / Makeup projects 10

Total 100%

V

A

Avtech Technology Institute Page 8

Peachtree Syllabus

te

Grading Policy

At the end of each course, each student is assigned a final grade as follows:

u

Point Range Interpretation Grade Quality Points

90 – 100 Excellent A 4.0

it

80 – 89 Very Good B 3.0 – 3.9

70 – 79 Average C 2.0 – 2.9

st

60 – 69 Poor D 1.0 – 1.9

Below 60 Failure F 0

N/A Withdrawal W 0

In

N/A Pass P 0

N/A Incomplete I 0

u

A student earning a grade of D or above is considered to have passed the course and is eligible to

H

it

pursue further studies. A student receiving a grade of F has failed the course. A failed course

must be repeated and passed to meet Avtech Institute’s graduation requirements, in addition to

an overall program GPA of 2.0.

C

st

Requirements for Successful Completion of the Course

TE

At a minimum, students must achieve the following:

• A passing grade of D or above

In

• Completion of all required examinations

• Submission of all required lab exercises and projects and;

V

• Adherence to the school attendance policy.

H

Equipment Needed

A

Industry standard desktop computer for lab exercises.

C

Equipment Breakdown Lab room

Videos and Projector

TE

Library Assignments

To be determined by the instructor.

V

A

Avtech Technology Institute Page 9

Peachtree Syllabus

te

Portfolio Assignment

Student program outcome portfolios are required to demonstrate student competencies. In

conjunction with your course structure, please select a project/paper that best demonstrates what

u

you have learned in this course and add it to your program portfolio.

Course Policies

it

Disruptive Behavior

Disruptive behavior is an activity that interferes with learning and teaching. Inappropriate

talking during class, surfing inappropriate website, tardiness, cheating, alcohol or drug use, use

st

of cell phone, playing lout music during class, etc. all disrupt the learning process.

Copyright Infringement

Specific exemptions to copyright infringement are made for student use in the context of learning

In

activities. Graphic design students often download images from the Internet, or scan images

from publications. As long as this work is for educational purpose, and subject to faculty

permission, this is not a problem.

u

Plagiarism

Faculty cannot tolerate the misrepresentation of work as the student’s own. This often involves

H

it

the use by one student or another student’s design, whether voluntarily or involuntarily. In the

event that plagiarism is evident and documented, all students involved in the conscious decision

to misrepresent work must receive an F as the grade for the project. A second occurrence may

C

st

result in suspension for the rest of the quarter, and return to the school only after a review by the

Academic Standards Committee.

TE

Attendance

In

Attendance and Lateness

In education and the workplace, regular attendance is necessary if individuals are to excel. There

is a direct correlation between attendance and academic success. Attendance is mandatory. All

V

students must arrive on time and prepared to learn at each class session. At the faculty member’s

discretion, students may be marked absent if they arrive more than 15 minutes late to any class.

H

More that five absences in a class that meets twice per week or more that two absences in a class

that meets once per week may result in a failure.

A

Make-Up Work

Late Projects and Homework

TE

All projects and homework must be handed in on time. Homework should be emailed to your

instructor if you are going to miss a class. Work that is submitted one week late will result in the

loss of one full grade; and work that is submitted two weeks late will result in the loss of two full

grades; more than two weeks late you will receive a failing grade on the project.

V

A

Avtech Technology Institute Page 10

You might also like

- College Accounting A Career Approach 13th Edition Scott Solutions ManualDocument35 pagesCollege Accounting A Career Approach 13th Edition Scott Solutions ManualCalvinMataazscm100% (17)

- Quick Reference To Managerial AccountingDocument2 pagesQuick Reference To Managerial AccountingAmilius San Gregorio100% (1)

- Fabm 2 Practice SetDocument33 pagesFabm 2 Practice SetJen Trixie Gallardo57% (7)

- Quiz KTTCDocument64 pagesQuiz KTTCChi NguyenNo ratings yet

- CBSE Accountancy Class 11 Term 1 Objective Question BankDocument141 pagesCBSE Accountancy Class 11 Term 1 Objective Question BankMohammed Roshan73% (11)

- R12.2 Oracle Receivables Management Fundamentals: DurationDocument4 pagesR12.2 Oracle Receivables Management Fundamentals: DurationVijendra MlNo ratings yet

- Fundamentals of Accounting-I New Course OutlineDocument3 pagesFundamentals of Accounting-I New Course OutlineGedion100% (2)

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Quickbooks in The Classroom - Lesson Exercises With Answers: WWW - Intuiteducation.CaDocument50 pagesQuickbooks in The Classroom - Lesson Exercises With Answers: WWW - Intuiteducation.CaMarjocristNo ratings yet

- ACCT 1026 Lesson ONEDocument13 pagesACCT 1026 Lesson ONEAnnie RapanutNo ratings yet

- Dwnload Full College Accounting A Career Approach 13th Edition Scott Solutions Manual PDFDocument20 pagesDwnload Full College Accounting A Career Approach 13th Edition Scott Solutions Manual PDFraisable.maugerg07jpg100% (17)

- Recorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksDocument52 pagesRecorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksAnnie RapanutNo ratings yet

- Ora Cer Pay ContentDocument3 pagesOra Cer Pay ContentVinod PasupuletiNo ratings yet

- Rolo Company - Comprehensive Accounting ProblemDocument29 pagesRolo Company - Comprehensive Accounting ProblemFaith SindanumNo ratings yet

- ED Unit 3Document28 pagesED Unit 3sg.2312002No ratings yet

- Financial Accounting For ManagersDocument170 pagesFinancial Accounting For ManagersRamji Gupta100% (1)

- Accounting Cycle Assignment HelpDocument6 pagesAccounting Cycle Assignment Helpfpxmfxvlf100% (1)

- Accounting Book SampleDocument105 pagesAccounting Book SampleShreyaa SinghNo ratings yet

- ch3 PDFDocument86 pagesch3 PDFArnoldo 'Oz' OlmosNo ratings yet

- 3 Chapter 1Document13 pages3 Chapter 1nurzbiet8587No ratings yet

- Dwnload Full Accounting Information Systems 2nd Edition Hurt Solutions Manual PDFDocument35 pagesDwnload Full Accounting Information Systems 2nd Edition Hurt Solutions Manual PDFga437yboyd100% (21)

- Accounting Information Systems 2nd Edition Hurt Solutions ManualDocument35 pagesAccounting Information Systems 2nd Edition Hurt Solutions Manualnubilegoggler.i8cm100% (17)

- Accounts Volume 1Document503 pagesAccounts Volume 1Utkarsh100% (1)

- AccountingDocument20 pagesAccountingKim CaNo ratings yet

- CML 102 Foundations of Accounting (Notes)Document170 pagesCML 102 Foundations of Accounting (Notes)Wesley100% (2)

- ch03 Part1Document6 pagesch03 Part1Sergio HoffmanNo ratings yet

- Accounting Cycle For PostingDocument14 pagesAccounting Cycle For PostingJerrald Meyer L. BayaniNo ratings yet

- 4 Recording Business TransactionsDocument20 pages4 Recording Business TransactionsJohn Alfred CastinoNo ratings yet

- Chapter 1 IntroductionDocument30 pagesChapter 1 IntroductionVivek GargNo ratings yet

- CL 1.2 Financial AccountingDocument267 pagesCL 1.2 Financial AccountingnushathNo ratings yet

- Learning Outcome and Programme Learning Objectives (Plos)Document64 pagesLearning Outcome and Programme Learning Objectives (Plos)ANGEL ROBIN RCBSNo ratings yet

- Slide ACC101 ACC101 Slide 01Document18 pagesSlide ACC101 ACC101 Slide 01vincent froyaldeNo ratings yet

- ACCT1002 U2-20150826nprDocument15 pagesACCT1002 U2-20150826nprSaintNo ratings yet

- Xi Accountancy Syllabus 23-24Document8 pagesXi Accountancy Syllabus 23-24GauriNo ratings yet

- ChapterDocument47 pagesChapteralfyomar79No ratings yet

- Curricullem Accounts and Budget Support Level IIIDocument70 pagesCurricullem Accounts and Budget Support Level IIIMebrahatu Gebrewahad100% (1)

- Financial Accounting Questions and Answers 1Document45 pagesFinancial Accounting Questions and Answers 1ScribdTranslationsNo ratings yet

- Finance and Accounting Study AidDocument155 pagesFinance and Accounting Study AidSharon Amondi100% (1)

- Acc 101 PDFDocument6 pagesAcc 101 PDFalizaNo ratings yet

- ACCT2511 Topic 1 T1 2023 Lecture NotesDocument71 pagesACCT2511 Topic 1 T1 2023 Lecture NotesKJSAdNo ratings yet

- Module 3 & 4 - Business Accounting 2001Document24 pagesModule 3 & 4 - Business Accounting 2001Archill YapparconNo ratings yet

- Chap. 2Document1 pageChap. 2Shoyo HinataNo ratings yet

- 22 - AE - 111 - Module - 3 - Recording - Business - TransactionsDocument23 pages22 - AE - 111 - Module - 3 - Recording - Business - TransactionsEnrica BalladaresNo ratings yet

- At The End of The Accounting PeriodDocument16 pagesAt The End of The Accounting PeriodAra ArinqueNo ratings yet

- Module 02 - Financial AccountingDocument11 pagesModule 02 - Financial AccountingJohn Martin L. AilesNo ratings yet

- General Ledger Department: Introduction and Overview Definition: TheDocument29 pagesGeneral Ledger Department: Introduction and Overview Definition: Thekanwal1234No ratings yet

- Mba ZC415 Course HandoutDocument11 pagesMba ZC415 Course HandoutareanNo ratings yet

- CH01-Fundamentals of Accounting Haftom1 AccountingDocument68 pagesCH01-Fundamentals of Accounting Haftom1 AccountingHaftom YitbarekNo ratings yet

- Acc SoftwareDocument2 pagesAcc SoftwareGebrekiros ArayaNo ratings yet

- @ Principles of Fundamentals Accounting IDocument506 pages@ Principles of Fundamentals Accounting IbashatigabuNo ratings yet

- Introduction To AccountingDocument361 pagesIntroduction To AccountingHAITHAM ALAZAZINo ratings yet

- Learning Outcomes No L01 L02 L03 L04 L05Document11 pagesLearning Outcomes No L01 L02 L03 L04 L05AbiNo ratings yet

- Lesson 1 Analyzing Recording TransactionsDocument6 pagesLesson 1 Analyzing Recording TransactionsklipordNo ratings yet

- Final Report 4th SemDocument18 pagesFinal Report 4th SemVidhi BatraNo ratings yet

- Introduction To Accounting Topic: Introduction To AccountingDocument2 pagesIntroduction To Accounting Topic: Introduction To AccountingDURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- Unit 1 - Accounting Cycle For A Service FirmDocument5 pagesUnit 1 - Accounting Cycle For A Service FirmJosh LeBlancNo ratings yet

- Principles of Accounts 7110 GCE O Level For Examination in 2008Document11 pagesPrinciples of Accounts 7110 GCE O Level For Examination in 2008mstudy123456No ratings yet

- 1030120969session 2015-16 Class Xi Accountancy Study Material PDFDocument189 pages1030120969session 2015-16 Class Xi Accountancy Study Material PDFharshika chachan100% (1)

- CH 2Document107 pagesCH 2api-308823932No ratings yet

- Dmgt104 Financial AccountingDocument317 pagesDmgt104 Financial Accountingpriya_psalms100% (3)

- DMGT104 Financial Accounting PDFDocument317 pagesDMGT104 Financial Accounting PDFNani100% (1)

- Study Material Accountancy Class 11th 2023-24-1Document138 pagesStudy Material Accountancy Class 11th 2023-24-1ganesh100% (1)

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- BCom-VI-INTERNATIONAL FINANCIAL MARKETSDocument4 pagesBCom-VI-INTERNATIONAL FINANCIAL MARKETSsami ullahNo ratings yet

- Ielts EasyDocument2 pagesIelts Easysami ullahNo ratings yet

- Intro of PSA-1Document47 pagesIntro of PSA-1sami ullahNo ratings yet

- Children in Rural Areas Easy Comprehensive IELTSDocument2 pagesChildren in Rural Areas Easy Comprehensive IELTSsami ullahNo ratings yet

- Undertaking For LAPTOPDocument1 pageUndertaking For LAPTOPsami ullahNo ratings yet

- Audit CommitteesDocument11 pagesAudit Committeessami ullahNo ratings yet

- CG Digital Assets 2022 - 0Document18 pagesCG Digital Assets 2022 - 0sami ullahNo ratings yet

- L.O.M ContentDocument4 pagesL.O.M Contentsami ullahNo ratings yet

- Managerial Accounting Chapter 24 SolutionsDocument24 pagesManagerial Accounting Chapter 24 Solutionssami ullahNo ratings yet

- Muhammad Nasir: June 2014Document1 pageMuhammad Nasir: June 2014sami ullahNo ratings yet

- Motivational LetterDocument1 pageMotivational Lettersami ullahNo ratings yet

- BC20 4thDocument8 pagesBC20 4thsami ullahNo ratings yet

- Document 124Document3 pagesDocument 124sami ullahNo ratings yet

- VerificationDocument2 pagesVerificationsami ullahNo ratings yet

- Banking Course Outline 6th SemesterDocument2 pagesBanking Course Outline 6th Semestersami ullahNo ratings yet

- Financial Aid Application 20 21Document4 pagesFinancial Aid Application 20 21sami ullahNo ratings yet

- Manual de Candidatura Online 22-23 EN cPTHVAODocument21 pagesManual de Candidatura Online 22-23 EN cPTHVAOsami ullahNo ratings yet

- Country-List 2019Document1 pageCountry-List 2019sami ullahNo ratings yet

- 1 Application Form-1Document2 pages1 Application Form-1sami ullahNo ratings yet

- Levi Booklet 9x9 FINAL 12-5-19 WEBDocument8 pagesLevi Booklet 9x9 FINAL 12-5-19 WEBsami ullahNo ratings yet

- UFLEX - Docx FinalDocument60 pagesUFLEX - Docx FinalNeha Ahuja ChadhaNo ratings yet

- Working Capital ManagementDocument80 pagesWorking Capital ManagementVijeshNo ratings yet

- PT. MULTIMEDIA TECHNOLOGY COMP (BB) - Dikonversi PDFDocument2 pagesPT. MULTIMEDIA TECHNOLOGY COMP (BB) - Dikonversi PDFBulan julpi suwelly100% (1)

- Minggu 34 - Audit of Acc ReceivableDocument77 pagesMinggu 34 - Audit of Acc ReceivableDelin ChristiNo ratings yet

- Receivable Financing Sample ProblemDocument3 pagesReceivable Financing Sample ProblemKathleen FrondozoNo ratings yet

- BRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches VizDocument5 pagesBRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches Vizsohansharma75No ratings yet

- Lec03a - Bsa 1101 - 011920Document5 pagesLec03a - Bsa 1101 - 011920MARIABEVIELEN SUAVERDEZNo ratings yet

- Pe - 2Document29 pagesPe - 2Matt KNo ratings yet

- Collection Development and Management Collection Objectives and StructureDocument26 pagesCollection Development and Management Collection Objectives and StructureHarlene BulaongNo ratings yet

- D J Fletcher A Trusted Employee of Bluestem Products FoundDocument1 pageD J Fletcher A Trusted Employee of Bluestem Products Foundtrilocksp SinghNo ratings yet

- Period End ClosingDocument10 pagesPeriod End ClosingailcpNo ratings yet

- Chap 006Document56 pagesChap 006fadikaradshehNo ratings yet

- Oracle Financial AuditingT3Document171 pagesOracle Financial AuditingT3Bamidele KobaNo ratings yet

- Gecl 3.0 AutofillDocument63 pagesGecl 3.0 Autofillshyam krishnaNo ratings yet

- Exam 2nd Year Without ANSWERDocument7 pagesExam 2nd Year Without ANSWERJohnAllenMarillaNo ratings yet

- Aaca Receivables and Sales ReviewerDocument13 pagesAaca Receivables and Sales ReviewerLiberty NovaNo ratings yet

- Completing Test On Sales and Collection Cycles: Account ReceivableDocument14 pagesCompleting Test On Sales and Collection Cycles: Account ReceivableunigaluhNo ratings yet

- Finance Assistant CV TemplateDocument2 pagesFinance Assistant CV TemplateTeddy RusliNo ratings yet

- Principles of Accounting RevisionDocument99 pagesPrinciples of Accounting RevisionHoang Khanh Linh NguyenNo ratings yet

- Analysis of Working Capital Management Ankush NanavatiDocument85 pagesAnalysis of Working Capital Management Ankush Nanavatisachindixit46No ratings yet

- 12 The Revenue Cycle - Sales To Cash CollectionDocument18 pages12 The Revenue Cycle - Sales To Cash CollectionayutitiekNo ratings yet

- Chapter 5 QuizextraDocument5 pagesChapter 5 QuizextraAra AlcantaraNo ratings yet

- Provision For Doubtful DebtsDocument28 pagesProvision For Doubtful DebtsGeneva GomezNo ratings yet

- ICMA Questions Dec 2009Document49 pagesICMA Questions Dec 2009Asadul Hoque100% (1)

- Reviewer FAR3Document17 pagesReviewer FAR3AnonymousWriter34870% (10)