Professional Documents

Culture Documents

Formatting Guidelines For mt202 Mt202cov and mt103

Formatting Guidelines For mt202 Mt202cov and mt103

Uploaded by

Vic VerraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formatting Guidelines For mt202 Mt202cov and mt103

Formatting Guidelines For mt202 Mt202cov and mt103

Uploaded by

Vic VerraCopyright:

Available Formats

Formatting Guidelines

for MT202, MT202COV

and MT103(+)

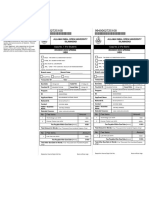

Incoming MT202 to the Nordics (NDEADKKK, NDEAFIHH, NDEANOKK, NDEASESS)

Recommended

M/O TAG Field name Comments

option

M 20 Transaction Reference Number 16x

M 21 Related Reference 16x

O 13C Time Indication /8c/4!n1!x4!n Only codeword "CLSTIME" is acted on.

M 32A Value Date, Currency Code, Amount 6!n3!a15d

O 52a Ordering Institution A Option A with BIC to be used.

O 53a Sender's Correspondent A or B Option A with BIC to be used. Account and BIC is allowed.

Option B with account number to be used in case of multiple

account relationships to identify the account to be debited.

Please only state the account number preceded with “/”

without any spaces or other data such as free text name or

BIC.

Option D is accepted but will cause non-STP and delay the

payment.

In case of the Sending Bank is not the owner of the account

held with the Receiving Bank (Nordea) e.g. in the scenario

where the Sending Bank is a branch of the account holder, a

proper debit Power of Attorney needs to be agreed and set-up

before sending any payments. If not in place the payment will

be rejected.

O 54a Receiver's Correspondent A Option A with BIC to be used.

Option D is accepted but will cause non-STP and delay the

payment.

O 56a Intermediary A Option A with BIC to be used.

This field is required if Account With Institution is a non-

Nordea client institution outside the Receiving Bank’s

(Nordea) country or not in local currency of the Receiving

Bank (Nordea).

O 57a Account With Institution A Field must be used if the Account With Institution is other than

the receiver (Nordea).

Field is not to be used if Account With Institution is the same

as the Receiving Bank (Nordea).

Option A with BIC to be used.

Option D is accepted but will cause non-STP and delay the

payment.

M 58a Beneficiary Institution A Option A with BIC to be used.

Account number to be preceded with “/” without any spaces.

Option D is accepted but will cause non-STP and delay the

payment.

O 72 Sender to Receiver Information 6*35x Usage of this field might prevent STP.

Only codewords /ACC/, /INS/, /REJT/ and /RETN/ are

accepted and others might generate non-STP fees unless

agreed otherwise with Nordea.

Cash Clearing Services — last reviewed on January 30, 2020

This document supersedes all the previous editions.

Incoming MT202COV to the Nordics (NDEADKKK, NDEAFIHH, NDEANOKK, NDEASESS)

M/O TAG Field name Recommended Comments

option

Mandatory sequence A / General information

M 20 Transaction Reference Number 16x

M 21 Related Reference 16x

O 13C Time Indication /8c/4!n1!x4!n Ignored if present.

M 32A Value Date, Currency Code, Amount 6!n3!a15d

O 52a Ordering Institution A Option A with BIC to be used.

O 53a Sender's Correspondent A or B Option A with BIC to be used. Account and BIC is allowed.

Option B with account number to be used in case of multiple

account relationships to identify the account to be debited.

Please only state the account number preceded with “/”

without any spaces or other data such as free text name or

BIC.

Option D is accepted but will cause non-STP and delay the

payment.

In case the Sending Bank is not the owner of the account held

with the Receiving Bank (Nordea) e.g. in the scenario where

the Sending Bank is a branch of the account holder, a proper

debit Power of Attorney needs to be agreed and set-up before

sending any payments. If not in place the payment will be

rejected.

O 54a Receiver's Correspondent A Option A with BIC to be used.

Option D is accepted but will cause non-STP and delay the

payment.

O 56a Intermediary A Option A with BIC to be used.

This field is required if Account With Institution is a non-

Nordea client institution outside the Receiving Bank (Nordea)

country or not in local currency of the Receiving Bank

(Nordea).

O 57a Account With Institution A Field must be used if the Account With Institution is other than

the receiver (Nordea).

Field is not to be used if Account With Institution is the same

as the Receiving Bank (Nordea).

Option A with BIC to be used.

Option D is accepted but will cause non-STP and delay the

payment.

M 58a Beneficiary Institution A Option A with BIC to be used. Account number to be preceded

with “/” without any spaces.

Option D is accepted but will cause non-STP and delay the

payment.

O 72 Sender to Receiver Information 6*35x Usage of this field might prevent STP.

Only codewords /ACC/, /INS/, /REJT/ and /RETN/ are

accepted and others might generate non-STP fees unless

agreed otherwise with Nordea.

End of sequence A / General information

Incoming MT202COV to the Nordics (NDEADKKK, NDEAFIHH, NDEANOKK, NDEASESS)

M/O TAG Field name Recommended Comments

option

Mandatory sequence B / Underlying customer credit transfer details

M 50a Ordering Customer A, F, or K To comply with applicable AML/CTF regulations the following

information must be provided:

- The payment account number of the Ordering Customer (or

a unique transactions identifier if applicable), preceded with

“/” without any spaces.

- The Ordering Customer’s full name and address (street

address, ZIP code, town and country code) or when

applicable, the official personal document number, customer

identification number or the date and place of birth.

O 52a Ordering Institution A Option A with BIC to be used.

Option D is to be avoided as the field is used to determine if a

payment is origin inside or outside EEA to apply applicable

regulations and it cannot be determined based on

unstructured data.

O 56a Intermediary Institution A, C, or D

O 57a Account With Institution A, B, C, or D

M 59a Beneficiary Customer No letter option, To comply with applicable AML/CTF regulations the following

information must be provided:

A, or F

- The payment account number of the Beneficiary Customer,

preceded with “/” without any spaces .

- The Beneficiary Customer’s full name and address (street

address, ZIP code, town and country code), address is optional

but strongly recommended in all cases.

No checking of account number compliance with the

Beneficiary Customer name provided.

O 70 Remittance Information 4*35x

O 72 Sender to Receiver Information 6*35x

O 33B Currency/Instructed Amount 3!a15d

End of sequence B / Underlying customer credit transfer details

Cash Clearing Services — last reviewed on January 30, 2020

This document supersedes all the previous editions.

Incoming MT103(+) to the Nordics (NDEADKKK, NDEAFIHH, NDEANOKK, NDEASESS)

Recommended

M/O TAG Field name Comments

option

M 20 Sender's Reference 16x

O 13C Time Indication /8c/4!n1!x4!n Ignored if present.

M 23B Bank Operation Code 4!c Only codeword "CRED" to be used.

O 23E Instruction Code 4!c[/30x] Only codewords "CORT", "INTC" and "SDVA" are acted on.

O 26T Transaction Type Code 3!c Ignored if present.

32A Value Date/Currency/Interbank 6!n3!a15d

M Settled Amount

O 33B Currency/Instructed Amount 3!a15d

O 36 Exchange Rate 12d

50a Ordering Customer A, F, or K To comply with applicable AML/CTF regulations the following

information must be provided:

- The payment account number of the Ordering Customer (or

a unique transactions identifier if applicable), preceded with

“/” without any spaces.

- The Ordering Customer’s full name and address (street

address, ZIP code, town and country code) or when

applicable, the official personal document number, customer

M identification number or the date and place of birth.

51A Sending Institution [/1!a][/34x]<crlf>4!a2!

O a2!c[3!c]

52a Ordering Institution A Option A with BIC to be used.

Option D is to be avoided as the field is used to determine if a

payment is origin inside or outside EEA to apply applicable

regulations and it cannot be determined based on

O unstructured data.

O 53a Sender's Correspondent A or B Option A with BIC to be used. Account and BIC is allowed.

Option B with account number to be used in case of multiple

account relationships to identify the account to be debited.

Please only state the account number preceded with “/”

without any spaces or other data such as free text name or

BIC.

Option D is accepted but will cause non-STP and delay the

payment.

In case the Sending Bank is not the owner of the account held

with the Receiving Bank (Nordea) e.g. in the scenario where

the Sending Bank is a branch of the account holder, a proper

debit Power of Attorney needs to be agreed and set-up before

sending any payments. If not in place the payment will be

rejected.

O 54a Receiver's Correspondent A Option A with BIC to be used.

Option D is accepted but will cause non-STP and delay the

payment.

O 55a Third Reimbursement Institution A Option A with BIC to be used.

Option D is accepted but will cause non-STP and delay the

payment.

O 56a Intermediary Institution A Option A with BIC to be used.

This field is required if Account With Institution is a non-

Nordea client institution outside the Receiving Bank’s

(Nordea) country or not in local currency of the Receiving

Bank (Nordea).

Continues on the next page

Incoming MT103(+) to the Nordics (NDEADKKK, NDEAFIHH, NDEANOKK, NDEASESS)

Recommended

M/O TAG Field name Comments

option

O 57a Account With Institution A Field must be used if the Account With Institution is other than

the receiver (Nordea).

Field is not to be used if Account With Institution is the same

as the receiving bank (Nordea).

Option A with BIC to be used.

Option D is accepted but will cause non-STP and delay the

payment.

M 59a Beneficiary Customer No letter option, A, or Finland: IBAN required.

F

To comply with applicable AML/CTF regulations and allow STP

the following information must be provided:

- The payment account number of the Beneficiary Customer

(or a unique transactions identifier if applicable), preceded

with “/” without any spaces .

- The Beneficiary Customer’s full name and address (street

address, ZIP code, town and country code), address is optional

but strongly recommended in all cases.

O 70 Remittance Information 4*35x

M 71A Details of Charges 3!a, SHA, OUR or BEN

O 71F Sender's Charges 3!a15d

O 71G Receiver's Charges 3!a15d Only to be used if field 71A is equal to OUR and when the

Sending Bank has agreed with Nordea on pre-agreed charges.

Currency must be equal to field 32A.

O 72 Sender to Receiver Information 6*35x Usage of this field might prevent STP.

Only codewords /ACC/, /INS/, /REJT/ and /RETN/ are

accepted and others might generate non-STP fees unless

agreed otherwise with Nordea.

O 77B Regulatory Reporting 3*35x Ignored if present.

Cash Clearing Services — last reviewed on January 30, 2020

This document supersedes all the previous editions.

You might also like

- Electricity: Your Bill at A GlanceDocument1 pageElectricity: Your Bill at A GlanceJohnNo ratings yet

- Account Summary Payment InformationDocument4 pagesAccount Summary Payment InformationGenie TooNo ratings yet

- Credit Report Dispute FormDocument1 pageCredit Report Dispute FormJessica Ashley0% (1)

- Investment Portfolio Statement: CORINTSA SURVEYS AND PROJECTS (Pty) LTDocument3 pagesInvestment Portfolio Statement: CORINTSA SURVEYS AND PROJECTS (Pty) LTWisaniNo ratings yet

- STP Quick Guide Usd Mt202Document2 pagesSTP Quick Guide Usd Mt202codeblackNo ratings yet

- Service Request FormDocument2 pagesService Request Formmcwong_98No ratings yet

- Metropolitan Fabrics Inc. and Enrique Ang vs. Prosperity Credit Resources Inc., Domingo Ang and Caleb AngDocument3 pagesMetropolitan Fabrics Inc. and Enrique Ang vs. Prosperity Credit Resources Inc., Domingo Ang and Caleb AngMacky CaballesNo ratings yet

- Straight Through Processing: Formatting Guidelines For New ZealandDocument8 pagesStraight Through Processing: Formatting Guidelines For New ZealandirfanNo ratings yet

- STP Formatting Guide 010707Document2 pagesSTP Formatting Guide 010707yeuhqhNo ratings yet

- Factsheet CS STPguidelineDocument2 pagesFactsheet CS STPguidelineswiftcenterNo ratings yet

- STP Format Requirements MT103 - 2018Document2 pagesSTP Format Requirements MT103 - 2018rakhimvaliev7No ratings yet

- Telegraphic Transfer GuideDocument12 pagesTelegraphic Transfer GuideBenedict Wong Cheng WaiNo ratings yet

- Remittance Application Sheet0000Document5 pagesRemittance Application Sheet0000Kafil MahmoodNo ratings yet

- BRD - Cash OTC v1 - With CommentsDocument7 pagesBRD - Cash OTC v1 - With CommentsAudrey AyosoNo ratings yet

- SWIFT Formatting Guidelines: For PaymentsDocument7 pagesSWIFT Formatting Guidelines: For Paymentslyes ٌRivestNo ratings yet

- Customer Request FormDocument2 pagesCustomer Request FormKathir JeNo ratings yet

- STP Quick Guide Usd Mt103Document3 pagesSTP Quick Guide Usd Mt103Ni Kadek SuastiniNo ratings yet

- Application For Advance Remittance Towards Direct Import BillsDocument2 pagesApplication For Advance Remittance Towards Direct Import Bills8h2677rdmnNo ratings yet

- Summary Manual 2Document20 pagesSummary Manual 2charan raoNo ratings yet

- Account Opening Form NR IndividualDocument2 pagesAccount Opening Form NR IndividualGraham EvansNo ratings yet

- DematclosuresDocument1 pageDematclosuresKartheek PatnanaNo ratings yet

- DematclosureDocument1 pageDematclosureVishal YadavNo ratings yet

- Dem at ClosureDocument1 pageDem at ClosureAkash MishraNo ratings yet

- Dem at ClosureDocument1 pageDem at ClosureSravan KumarNo ratings yet

- Dematclosure PDFDocument1 pageDematclosure PDFGaurav KumarNo ratings yet

- Dematclosure PDFDocument1 pageDematclosure PDFGaurav KumarNo ratings yet

- Dematclosure PDFDocument1 pageDematclosure PDFGaurav KumarNo ratings yet

- Waterfall in DetailDocument1 pageWaterfall in DetailAkash MishraNo ratings yet

- Dematclosure PDFDocument1 pageDematclosure PDFmohanNo ratings yet

- Ddmmyyyy: Signature of Sole/First Holder Signature of Second Holder Signature of Third HolderDocument1 pageDdmmyyyy: Signature of Sole/First Holder Signature of Second Holder Signature of Third Holderqq453911No ratings yet

- Dematclosure PDFDocument1 pageDematclosure PDFBibhash Chandra MistryNo ratings yet

- DematclosureDocument1 pageDematclosuresujit patraNo ratings yet

- Dematclosure PDFDocument1 pageDematclosure PDFPrateek GargNo ratings yet

- Random12013121 PDFDocument1 pageRandom12013121 PDFPrateek GargNo ratings yet

- Dem at ClosureDocument1 pageDem at ClosureSiddharth JainNo ratings yet

- Dem at ClosureDocument1 pageDem at ClosureVishal YadavNo ratings yet

- Dem at ClosureDocument1 pageDem at ClosureShadow GamingNo ratings yet

- Dem at ClosureDocument1 pageDem at ClosureVirat KohliNo ratings yet

- Waterfall in DetailDocument1 pageWaterfall in DetailAkash MishraNo ratings yet

- Part A: Account Opening FormDocument28 pagesPart A: Account Opening Formvenkat RNo ratings yet

- Quick Guide To PaymentsDocument16 pagesQuick Guide To PaymentsAriel DicoreñaNo ratings yet

- Your Vi Bill: Rs. 9,227.60 Rs. 8,552.64 Rs. 4,276.32 Rs. 4,233.84 Rs. 9,185.12Document1 pageYour Vi Bill: Rs. 9,227.60 Rs. 8,552.64 Rs. 4,276.32 Rs. 4,233.84 Rs. 9,185.12Tapendra PurohitNo ratings yet

- Dematclosure 230818 131447Document2 pagesDematclosure 230818 131447amit kumarNo ratings yet

- Cob 2024521 328Document2 pagesCob 2024521 328Asemahle MzuzuNo ratings yet

- Bemx 16 JB 3 Ymrarn 4 TCQ 474 Uqvjrz 78 Paw 8 CeDocument9 pagesBemx 16 JB 3 Ymrarn 4 TCQ 474 Uqvjrz 78 Paw 8 Cecoral33bbNo ratings yet

- 01.10 RemittancesDocument40 pages01.10 Remittancesmevrick_guyNo ratings yet

- Pending 1667646640 ForeclosureSimulationDocument2 pagesPending 1667646640 ForeclosureSimulationpramod roy0% (1)

- Chan Jun Hong No 3 Jalan Kenari 5 Taman Wawasan 85300 LABIS: Savings Account StatementDocument1 pageChan Jun Hong No 3 Jalan Kenari 5 Taman Wawasan 85300 LABIS: Savings Account StatementJunHong ChanNo ratings yet

- Banking For StartupsDocument19 pagesBanking For StartupsUtkarsh SinhaNo ratings yet

- FandC FLYER COREDocument1 pageFandC FLYER COREtech.filnipponNo ratings yet

- 2.4 Changes To Support Interchange Fee Amounts in BASE II Draft Data RecordsDocument11 pages2.4 Changes To Support Interchange Fee Amounts in BASE II Draft Data RecordsYasir RoniNo ratings yet

- E200333 Retentionletter 26 Oct 2021Document2 pagesE200333 Retentionletter 26 Oct 2021jyoti KanungoNo ratings yet

- Application For Closure of Demat Account (NSDL/CDSL) : DdmmyyyyDocument1 pageApplication For Closure of Demat Account (NSDL/CDSL) : DdmmyyyyP Venu Gopala RaoNo ratings yet

- 7) Introduction To T24 - Funds Transfer - T2ITC - Funds TransferDocument42 pages7) Introduction To T24 - Funds Transfer - T2ITC - Funds TransferMohamed HamdyNo ratings yet

- Swift Formatting Guidelines Mt103 Mt210Document3 pagesSwift Formatting Guidelines Mt103 Mt210PrasanthNo ratings yet

- Account Closer Form TradeBullsDocument1 pageAccount Closer Form TradeBullsDeepa MistryNo ratings yet

- Choose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageChoose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingElibom DnegelNo ratings yet

- POS Application Form (H2H Solution) : Merchant&Account&Term InalDocument1 pagePOS Application Form (H2H Solution) : Merchant&Account&Term InalAlphani BaziroNo ratings yet

- Account Closer Form - 2022Document1 pageAccount Closer Form - 2022Master Bhai BhaskarNo ratings yet

- Presentation on Know Your Demat AccountDocument46 pagesPresentation on Know Your Demat Accountankit124089No ratings yet

- Hsbcs Guide To Straight Through ProcessingDocument8 pagesHsbcs Guide To Straight Through ProcessingZayd Iskandar Dzolkarnain Al-HadramiNo ratings yet

- Handbook On DIGITAL Products 20210818110220Document29 pagesHandbook On DIGITAL Products 20210818110220omvir singhNo ratings yet

- Handbook On DIGITAL Products 20210815125103Document29 pagesHandbook On DIGITAL Products 20210815125103Neos EonsNo ratings yet

- Giro-Cards dbsv2Document1 pageGiro-Cards dbsv2Julius Putra Tanu SetiajiNo ratings yet

- As of 050120 - Essential Wedding Package 2020-21Document2 pagesAs of 050120 - Essential Wedding Package 2020-21Vic VerraNo ratings yet

- Mae Ungcad EconomicsDocument141 pagesMae Ungcad EconomicsVic VerraNo ratings yet

- Governor's Drive, General Trias, Cavite Contact Number: (046) .484.8091 To 94 Website: WWW - Lpu.edu - PHDocument1 pageGovernor's Drive, General Trias, Cavite Contact Number: (046) .484.8091 To 94 Website: WWW - Lpu.edu - PHVic VerraNo ratings yet

- Development Trust of Barangay JavaleraDocument9 pagesDevelopment Trust of Barangay JavaleraVic VerraNo ratings yet

- Questions: " - ! You're Stepping On My Foot." (Expressing Pain) A. B. C. D. EDocument7 pagesQuestions: " - ! You're Stepping On My Foot." (Expressing Pain) A. B. C. D. EVic VerraNo ratings yet

- Bills Payment 04262021Document6 pagesBills Payment 04262021Richard DuranNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNanu PatelNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- The Governor Bank of Tanzania: Governoroffice@bot - Go.tzDocument2 pagesThe Governor Bank of Tanzania: Governoroffice@bot - Go.tzMKUTA PTBLDNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument75 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancesharmashubham170295No ratings yet

- Innkeeper's Lodge Stockport, Heaton Chapel InvoiceDocument1 pageInnkeeper's Lodge Stockport, Heaton Chapel InvoiceAnonymous rUGTU2No ratings yet

- EBW SampleDocument8 pagesEBW SampleArianna GarciaNo ratings yet

- IFFEM Lesson I (Prof. Schlitzer)Document59 pagesIFFEM Lesson I (Prof. Schlitzer)Mau EmbateNo ratings yet

- BarBill Bezdicek 2022.08.26Document2 pagesBarBill Bezdicek 2022.08.26Miroslav MathersNo ratings yet

- Savyu - Your Business Loyalty SolutionDocument18 pagesSavyu - Your Business Loyalty SolutionLê Hữu TríNo ratings yet

- Udipta Energy & Equipment Pvt. LTDDocument3 pagesUdipta Energy & Equipment Pvt. LTDParesh NayakNo ratings yet

- Iib Fakes, Scams InstrumentssDocument39 pagesIib Fakes, Scams InstrumentssCentro turistico Los rosalesNo ratings yet

- List One: Currency, Fund and Precious Metal Codes: Entity Currency Alphabetic Code Numeric Code Minor UnitDocument7 pagesList One: Currency, Fund and Precious Metal Codes: Entity Currency Alphabetic Code Numeric Code Minor UnitWu ThaNo ratings yet

- Ecs Debit Mandate Form PDFDocument1 pageEcs Debit Mandate Form PDFSanjay BelosheNo ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadAfzAal GraphicNo ratings yet

- Quarter 2, Module 1Document1 pageQuarter 2, Module 1Kristel CahiligNo ratings yet

- Secondary Functions of State BankDocument5 pagesSecondary Functions of State BankKirangmNo ratings yet

- Corporation Resolution To Open A Bank AccountDocument2 pagesCorporation Resolution To Open A Bank AccountEdmond Aragon PareñasNo ratings yet

- Marlon Dave Quindipan Calva: Statement of AccountDocument4 pagesMarlon Dave Quindipan Calva: Statement of AccountMerlyCalvaNo ratings yet

- B8Document3 pagesB8shadabNo ratings yet

- Bank of Punjab ReportDocument20 pagesBank of Punjab ReportUneeb Roll no 18No ratings yet

- Registered TrusteesDocument2 pagesRegistered TrusteesEffy SaifulNo ratings yet

- General Mathematics: Week 11Document10 pagesGeneral Mathematics: Week 11Maria CaneteNo ratings yet

- CFM - 29october Intimation PDFDocument1 pageCFM - 29october Intimation PDFLakshay SharmaNo ratings yet

- Banking and AMLADocument26 pagesBanking and AMLAMosarah AltNo ratings yet