Professional Documents

Culture Documents

Audprob Bonds Problem With Solutions 2

Audprob Bonds Problem With Solutions 2

Uploaded by

reviewrecord.rr20 ratings0% found this document useful (0 votes)

1 views4 pagesaudprob practice material

Original Title

AUDPROB-BONDS-PROBLEM-WITH-SOLUTIONS-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaudprob practice material

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views4 pagesAudprob Bonds Problem With Solutions 2

Audprob Bonds Problem With Solutions 2

Uploaded by

reviewrecord.rr2audprob practice material

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Quiz 2

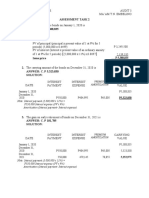

PROBLEM NO. 7 – Audit of bonds payable

On January 1, 2014, Thunder Corporation issued 2,000 of its 5-year, P1,000 face value, 11% bonds

dated January 1 at an effective annual interest rate(yield) of 9%. Interest is payable each December

31. Thunder uses the effective interest method of amortization. On December 31, 2015, the 2,000

bonds were extinguished early through acquisition in the open market by Thunder for P 1,980,000

plus accrued interest.

Jan 1, 2014 - Issuance

Cash 2,155, 534

Bonds Payable 2,000,000

Bonds Premium 155,534

Dec 31, 2014 – Interest

Interest Expense 220,000

Cash 220,000

Premium on Bonds 26,002

Interest Expense 26,002

Dec 31, 2015 – Amortization of premium until retirement

Premium on Bonds 28,342

Interest Expense 28,342

Bonds Payable 2,000,000

Premium on Bonds 101, 190

Interest Expense 220,000

Cash 2,200,000

Gain on early retirement 121, 190

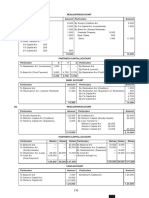

On July 1, 2014, thunder issued 5,000 of its 6-year, P1,000 face value, 10% convertible bonds at

par. Interest is payable every June 30 and December 31. On the date of issue, the prevailing market

interest rate for similar debt without the conversion option is 12%. On July 1, 2015, an investor in

Thunder’s convertible bonds tendered 1,500 bonds for conversion into 15,000 ordinary shares of

Thunder, which had a fair value of P105 and a par value of P1 at the date of conversion.

July 1, 2014 – Issuance

Cash 4,580,950

Discount on Bonds Payable 419,050

Bonds Payable 5,000,000

Dec 31, 2014 – Interest

Interest Expense 250,000

Cash 250,000

Dec 31, 2014 – Amortization ([4,580,950 x 6%] -250,000)

Interest Expense 24,857

Discount on BP 24,857

July 1, 2015 - Conversion

Bonds Payable 5,000,000

Discount on BP

REQUIRED:

Based on the above and the result of your audit, determine the following:

(Round off present value factors to four decimal places)

1. Issue price of the 2,000 5 year bonds

2. Carrying amount of the 2,000 5 year bonds at December 31, 2014

3. Gain on early retirement of bonds on December 31, 2015

4. Equity component of the 6-year bonds

5. Increase share premium as a result of the conversion of the 1,500 6-year

SOLUTION:

Requirement No. 1

PV of principal (P2,000,000 x 0.6499) 1,299,800

PV of interest [(P2,000,000 x .11) x 3.8897] 855,734

Issue price 2,155,534

Requirement No. 2

Carrying amount, 1/1/11 (see no. 1) 2,155,534

Less premium amortization for 2011:

Nominal interest (P2,000,000 x .11) 220,000

Effective interest (P2,155,534 x .09) 193,998 26,002

Carrying amount, 12/31/11 2,129,532

Alternative computation:

PV of principal (P2,000,000 x 0.7084) 1,416,800

PV of interest [(P2,000,000 x .11) x 3.2397] 712,734

Carrying amount, 12/31/11 2,129,534

Requirement No. 3

Retirement price 1,980,000

Carrying amount,

12/31/12:

Carrying amount, 12/31/11 (see no. 1) 2,129,532

Less premium amortization for 2012:

Nominal interest (P2,000,000 x .11) 220,000

Effective interest (P2,129,532 x .09) 191,658 28,342 2,101,190

Gain early retirement of bonds 121,190

Alternative computation:

PV of principal (P2,000,000 x 0.7722) 1,544,400

PV of interest [(P2,000,000 x .11) x 2.5313] 556,886

Carrying amount, 12/31/10 2,101,286

Retirement price 1,980,000

Gain early retirement of bonds 121,286

Requirement No. 4

Total proceeds 5,000,000

Less liability component:

Present value of the principal (P5,000,000 x 0.4970) 2,485,000

Present value of the interest [(P5,000,000 x .05 x

8.3838) 2,095,950 4,580,950

Equity component 419,050

Requirement No. 5

PV of principal (P1,500,000 x 0.5584) 837,600

PV of interest [(P1,500,000 x .05) x 7.3601] 552,008

Carrying amount, 7/1/12 1,389,608

Par value of shares issued (15,000 shares x P1) (15,000 )

Net increase in share premium 1,374,608

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- IA ReviewerDocument8 pagesIA ReviewerKaren Clarisse Alimot0% (2)

- 11 Picks From Warren Buffett's BookshelfDocument4 pages11 Picks From Warren Buffett's Bookshelfgrh04No ratings yet

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Noncurrent Liabilities - PROBLEMS: B. A DiscountDocument12 pagesNoncurrent Liabilities - PROBLEMS: B. A DiscountIra Grace De Castro67% (3)

- 2018 Level II Mock Exam PMDocument26 pages2018 Level II Mock Exam PMHui GuoNo ratings yet

- Bonds Problem With Solutions 2Document4 pagesBonds Problem With Solutions 2reviewrecord.rr2No ratings yet

- Quiz 2 BP With Answers PDFDocument4 pagesQuiz 2 BP With Answers PDFspur iousNo ratings yet

- Quiz 2 BP With AnswersDocument4 pagesQuiz 2 BP With Answersspur iousNo ratings yet

- Quiz 2 BPDocument4 pagesQuiz 2 BPspur iousNo ratings yet

- AP-LIABS-3 (With Answers)Document4 pagesAP-LIABS-3 (With Answers)Kendrew SujideNo ratings yet

- Audprob Bonds Problem With SolutionsDocument4 pagesAudprob Bonds Problem With Solutionsreviewrecord.rr2No ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Compound Financial InstrumentDocument2 pagesCompound Financial Instrumenthae1234No ratings yet

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- January 1, 2020 P5,388,835 December 31, 2020 P550,000 P484,995 P65,005Document7 pagesJanuary 1, 2020 P5,388,835 December 31, 2020 P550,000 P484,995 P65,005gazer beamNo ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Nfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Document18 pagesNfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Merliza Jusayan100% (1)

- Effective Interest MethodDocument31 pagesEffective Interest MethodMikaela LacabaNo ratings yet

- Bonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ADocument8 pagesBonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ACamille BacaresNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- Assessment Task 3Document5 pagesAssessment Task 3Christian N MagsinoNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Name: Michelle J. Sabit Section Code: B6 Date: 02/24/2024Document3 pagesName: Michelle J. Sabit Section Code: B6 Date: 02/24/2024sabit.michelle0903No ratings yet

- Note Payable Irrevocably Designated As at Fair Value Through Profit or LossDocument4 pagesNote Payable Irrevocably Designated As at Fair Value Through Profit or Lossnot funny didn't laughNo ratings yet

- Notes ReceivableDocument47 pagesNotes ReceivableAlexandria Ann FloresNo ratings yet

- DocumentDocument3 pagesDocumentsabit.michelle0903No ratings yet

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- Intermediate Accounting 2Document4 pagesIntermediate Accounting 2MARRIETTE JOY ABADNo ratings yet

- 2020 Spring Midterm II A AnsKey PDFDocument12 pages2020 Spring Midterm II A AnsKey PDFEunice GuoNo ratings yet

- Me AnswersDocument9 pagesMe Answersgabprems11No ratings yet

- Ia PPT 6Document20 pagesIa PPT 6lorriejaneNo ratings yet

- Prob.2 Classroom Discussion BP OCDocument4 pagesProb.2 Classroom Discussion BP OCWenjunNo ratings yet

- Investments in Debt SecuritiesDocument34 pagesInvestments in Debt SecuritiesNobu NobuNo ratings yet

- Sol. Man. - Chapter 3 Bonds Payable & Other ConceptsDocument23 pagesSol. Man. - Chapter 3 Bonds Payable & Other ConceptsMiguel Amihan100% (1)

- T5 - Qs and SolutionDocument15 pagesT5 - Qs and SolutionCalvin MaNo ratings yet

- Homework 4 - 5th EdDocument4 pagesHomework 4 - 5th EdNandini GoyalNo ratings yet

- Sol. Man. - Chapter 3 Bonds Payable Other ConceptsDocument21 pagesSol. Man. - Chapter 3 Bonds Payable Other ConceptsJasmine Nouvel Soriaga Cruz86% (7)

- Assignment 1 - SolutionsDocument8 pagesAssignment 1 - SolutionsSiying GuNo ratings yet

- AFM RevisionDocument8 pagesAFM RevisionSomabhizinisi MazibukoNo ratings yet

- Anathi LukweDocument10 pagesAnathi Lukwetivanani baloyiNo ratings yet

- Problem 6: For Classroom Discussion: Requirement (A)Document6 pagesProblem 6: For Classroom Discussion: Requirement (A)Nikky Bless LeonarNo ratings yet

- Inter AccDocument6 pagesInter AccshaylieeeNo ratings yet

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- Tutorial 13 14 Answer MFRS9Document4 pagesTutorial 13 14 Answer MFRS9NavaneetaNo ratings yet

- 7 Loan ReceivableDocument10 pages7 Loan ReceivableAYEZZA SAMSONNo ratings yet

- Debt Financing SolutionsDocument3 pagesDebt Financing SolutionsSleepy marshmallowNo ratings yet

- TOPIC 1 Accounting For Financial LiabilitiesDocument45 pagesTOPIC 1 Accounting For Financial LiabilitiesZe KhaiNo ratings yet

- Chapter 3 Bonds Payable Other ConceptsDocument20 pagesChapter 3 Bonds Payable Other ConceptsThalia Rhine AberteNo ratings yet

- Psa Financial Reporting AssignmentDocument8 pagesPsa Financial Reporting AssignmentNyara MakurumidzeNo ratings yet

- Acquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Document3 pagesAcquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Gray JavierNo ratings yet

- IA2 Chapter3 ExercisesDocument4 pagesIA2 Chapter3 Exercisesmarriette joy abadNo ratings yet

- Acctg34 Franchise Pret. Remaining Items AkeyDocument6 pagesAcctg34 Franchise Pret. Remaining Items AkeyDonna Mae SingsonNo ratings yet

- PQ3 BondsDocument2 pagesPQ3 BondsElla Mae MagbatoNo ratings yet

- AP 5902 Liability Supporting NotesDocument6 pagesAP 5902 Liability Supporting NotesMeojh Imissu100% (1)

- IA2Document9 pagesIA2Claire BarbaNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Quiz 2 Answers SolutionsDocument29 pagesQuiz 2 Answers SolutionsMarcus Monocay100% (2)

- Sol DissolutionDocument40 pagesSol DissolutionBlastik FalconNo ratings yet

- Wa0002.Document4 pagesWa0002.arviii63No ratings yet

- Pert 12 Intercorporate Investments Chapter15Document34 pagesPert 12 Intercorporate Investments Chapter15Chevalier ChevalierNo ratings yet

- Chapter 3 Economic Study MethodsDocument62 pagesChapter 3 Economic Study MethodsJohn Fretz AbelardeNo ratings yet

- Spice House Business PlanDocument9 pagesSpice House Business Plananon_22054856No ratings yet

- Emperical ResearchDocument63 pagesEmperical ResearchJatin BansalNo ratings yet

- Reading 31 Valuation of Contingent Claims - Answers.Document48 pagesReading 31 Valuation of Contingent Claims - Answers.NeerajNo ratings yet

- Primarry and Secondary MarketDocument7 pagesPrimarry and Secondary MarketDiyaNo ratings yet

- Finacial Analysis - PDF MRFDocument9 pagesFinacial Analysis - PDF MRFharshNo ratings yet

- BDHCH 13Document40 pagesBDHCH 13tzsyxxwhtNo ratings yet

- Acct Cheat SheetDocument3 pagesAcct Cheat SheetAllen LiouNo ratings yet

- JE vs. Memo Method IllustrationDocument2 pagesJE vs. Memo Method IllustrationccanapizingaboNo ratings yet

- 126105601chutuburu Jamshedpur 18Document3 pages126105601chutuburu Jamshedpur 18Sanjay KumarNo ratings yet

- Audit and Assuranc1Document5 pagesAudit and Assuranc1shaazNo ratings yet

- High Quality Dividend Investing Guide EbookDocument17 pagesHigh Quality Dividend Investing Guide EbookDelwitt CampeloNo ratings yet

- Pas 28 Investment in Associates and Joint VenturesDocument14 pagesPas 28 Investment in Associates and Joint VenturesGenivy SalidoNo ratings yet

- Martin J Rosenburgh CVDocument2 pagesMartin J Rosenburgh CVMartin RosenburghNo ratings yet

- Intermediate Accounting I - Investment Part 1Document3 pagesIntermediate Accounting I - Investment Part 1Joovs Joovho0% (3)

- FN2191 Commentary 2022Document27 pagesFN2191 Commentary 2022slimshadyNo ratings yet

- Tutorial - Depreciation 19 PDFDocument2 pagesTutorial - Depreciation 19 PDFSetsuna TeruNo ratings yet

- Restructuring at Neiman Marcus Group (A)Document33 pagesRestructuring at Neiman Marcus Group (A)Shaikh Saifullah KhalidNo ratings yet

- Day Count ConventionDocument11 pagesDay Count Conventiontimothy454No ratings yet

- Asset Turnover Ratio Definition - InvestopediaDocument4 pagesAsset Turnover Ratio Definition - InvestopediaBob KaneNo ratings yet

- U74999HR2017PTC066978 OTRE 143398915 Form-PAS-3-20012020 SignedDocument5 pagesU74999HR2017PTC066978 OTRE 143398915 Form-PAS-3-20012020 Signedakshay bhartiyaNo ratings yet

- RentechDocument31 pagesRentechjimNo ratings yet

- The Count - Rem - 3Document33 pagesThe Count - Rem - 3Scott BoogemansNo ratings yet

- Accept Less - Reject Greater: IRR Is The Interest Rate That Makes The NPV 0: 0 +$200 - $2501+IRR Solving For IRRDocument10 pagesAccept Less - Reject Greater: IRR Is The Interest Rate That Makes The NPV 0: 0 +$200 - $2501+IRR Solving For IRRAtheer Al-AnsariNo ratings yet