Professional Documents

Culture Documents

Al-Fadl 1 Limited Financial Statement For The Year End July 2023

Al-Fadl 1 Limited Financial Statement For The Year End July 2023

Uploaded by

SkymoonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Al-Fadl 1 Limited Financial Statement For The Year End July 2023

Al-Fadl 1 Limited Financial Statement For The Year End July 2023

Uploaded by

SkymoonCopyright:

Available Formats

Al-Fadl1 Limited Approved

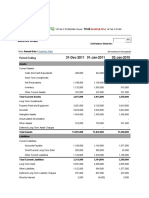

Profit & Loss Account 31/07/2023 31/07/2022

Revenue

Sales - 385,000

Rent 6,480 4,320

Rent - Previouse Owner - 1,800

Total Sales 6,480 391,120

Direct Expenses

Purchases - 420,000

Total Direct Expenses - 420,000

Gross Profit/(Loss) 6,480 (28,880)

Gross Profit/(Loss) Margin 100% -7%

Bank Charges 63 -

Sundry - 12

Subscriptions 26 -

Total Administrative Expenses 89 12

Profit/(Loss) before Tax 6,391 (28,892)

Corporation tax Payable/(Refund) - 0

Net Profit/(Loss) after Tax 6,391 (28,892)

Net Profit/(Loss) Margin 99% -7%

SDLT Ismail Paid 4,250

Tax should have been paid 1,214 1,161

Total Tax Should have been paid 2,375 1,161

Al-Fadl1 Limited

Balance Sheet As At 31/07/2023 31/07/2022

Fixed Assets GBP GBP

FA - land and buildings - b/fwd 180,000 -

FA - Land and buildings Cost - additions - 600,000

FA - land and buildings - Cost - disposals - (420,000)

Total Fixed Assets 180,000 180,000

Current Assets

Bank Account

Current account 3,654 8,562

Total Current Assets 3,654 8,562

Total Assets 183,654 188,562

Current Liabilities

Suppliers 26 -

Rent Deduction for Reserve 2,542 -

Dr Mohammad Saleem 30,750 30,750

Shareholders Loan 178,500 178,500

Shareholders Loan to Repay - 1,786

Ismail Multani 5,004 4,918

Shareholders Rent Payments (12,167) -

Corporation tax - -

Total Current Liabilities 204,655 215,954

Total Assets less Liabilities (21,001) (27,392)

Capital & Reserves

Share Capital - B/F 1,500 -

Shares issued - 1,500

Current Profit & Loss 6,391 (28,892)

Retained Earnings b/f (28,892) -

Capital & Reserves (21,001) (27,392)

- -

Stamp duty and repair Loss on Sale of 70% to Ismail 35,000

Loss of £35k adjusted towards Ismail paid £4250 Stamp duty - 4,250

Remaining Loss left in Dr Saleem Account tobe used in future 30,750

Al Fadl 600000

Market -550000

-385000

You might also like

- Last Bill This Bill Total Amount DueDocument7 pagesLast Bill This Bill Total Amount DueDjibzlae100% (1)

- Kunci Jawaban ICAEW Part 2Document4 pagesKunci Jawaban ICAEW Part 2Dendi RiskiNo ratings yet

- Exam Paper 2012 ZAB CommentariesDocument35 pagesExam Paper 2012 ZAB Commentariesamna666No ratings yet

- Loads IbfDocument14 pagesLoads IbfhipptsNo ratings yet

- Financial Statement Analysis Group-3Document19 pagesFinancial Statement Analysis Group-3MostakNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Bishop Group (IAS-21 + Cashflow) : Cfap 1: A A F RDocument1 pageBishop Group (IAS-21 + Cashflow) : Cfap 1: A A F R.No ratings yet

- Apollo Ar19Document72 pagesApollo Ar19Wen Xin GanNo ratings yet

- Introduction To Business Finance Feasibility Plan of Skydiving in KarachiDocument18 pagesIntroduction To Business Finance Feasibility Plan of Skydiving in KarachiAsad HaiderNo ratings yet

- MARCH 2020 AnswerDocument16 pagesMARCH 2020 AnswerXianFa WongNo ratings yet

- CORPORATE REPORTING - ND2022 - Suggested - AnswersDocument15 pagesCORPORATE REPORTING - ND2022 - Suggested - AnswersMohammad FaridNo ratings yet

- 01 Lap KeuanganDocument1 page01 Lap Keuanganachmad rachmadiNo ratings yet

- Jimmy Lim - Perbaikan UAS ICAEWDocument9 pagesJimmy Lim - Perbaikan UAS ICAEWJimmy LimNo ratings yet

- Income StatementDocument3 pagesIncome StatementneetsasneetuNo ratings yet

- Income StatementDocument3 pagesIncome StatementneetsasneetuNo ratings yet

- CR - MA-2023 - Suggested - AnswersDocument15 pagesCR - MA-2023 - Suggested - AnswersfahadsarkerNo ratings yet

- NIVS. 2009 SAIC Filing TranslatedDocument3 pagesNIVS. 2009 SAIC Filing Translatedwensley2001No ratings yet

- Ratio Excercise 2Document1 pageRatio Excercise 2Marwan AqrabNo ratings yet

- MODULE 19 - Group Statements - Chapter 5 (Class Question 2 - SS)Document5 pagesMODULE 19 - Group Statements - Chapter 5 (Class Question 2 - SS)Zwivhuya MaimelaNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- Case StudyDocument10 pagesCase StudyMani ManandharNo ratings yet

- Balance SHDocument2 pagesBalance SHRaj GoyalNo ratings yet

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- Access Full Year Financials 2020 WebDocument2 pagesAccess Full Year Financials 2020 WebFuaad DodooNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- Assets: Balance Sheet As of September 31, 2020Document91 pagesAssets: Balance Sheet As of September 31, 2020Glennizze GalvezNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Balance Sheet: Annual DataDocument4 pagesBalance Sheet: Annual DataJulie RayanNo ratings yet

- Oxford Street OutreachDocument4 pagesOxford Street OutreachAhmerNo ratings yet

- Bkal1013 Business Accounting (Group Project)Document19 pagesBkal1013 Business Accounting (Group Project)Chin EnNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- SOLUTION TO SCHEDULE 3gDocument4 pagesSOLUTION TO SCHEDULE 3gKrushna Omprakash MundadaNo ratings yet

- FM M-Apriandito YP61CDocument2 pagesFM M-Apriandito YP61CMuhammad AprianditoNo ratings yet

- Financial Statement 7EDocument9 pagesFinancial Statement 7ENurin SyazarinNo ratings yet

- Ceylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021Document14 pagesCeylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021hvalolaNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- FS - G.P Tech - 2079-80Document11 pagesFS - G.P Tech - 2079-80ANISH KAFLENo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- EWI Q2-2019 ResultsDocument27 pagesEWI Q2-2019 ResultskimNo ratings yet

- Professional Examination IiDocument55 pagesProfessional Examination IiFuchoin ReikoNo ratings yet

- AFA ESE 2022 SolutionsDocument8 pagesAFA ESE 2022 Solutionssebastian mlingwaNo ratings yet

- Professional - May 2021Document173 pagesProfessional - May 2021Jason Baba KwagheNo ratings yet

- Solution Additional Exercise 1 Chapter 6 7Document3 pagesSolution Additional Exercise 1 Chapter 6 7Doreen OngNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Oxford Street OutreachDocument4 pagesOxford Street OutreachAhmerNo ratings yet

- Dashboard - SAI - PreviewReports - 2011Document73 pagesDashboard - SAI - PreviewReports - 2011Oh Oh OhNo ratings yet

- Oxford Street Outreach Statements of Activities (Income Statement) For The Years Ending 2018 & 2019 Unrestricted Public Support & RevenuesDocument5 pagesOxford Street Outreach Statements of Activities (Income Statement) For The Years Ending 2018 & 2019 Unrestricted Public Support & RevenuesAhmerNo ratings yet

- Statements of Comprehensive Income: For The Financial Year Ended 31 December 2019Document5 pagesStatements of Comprehensive Income: For The Financial Year Ended 31 December 2019nfarzana.jefriNo ratings yet

- Group Stts Qsns and Answers-UnisaDocument69 pagesGroup Stts Qsns and Answers-UnisaNokutenda KachereNo ratings yet

- RSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022Document69 pagesRSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022AlfiNo ratings yet

- Superlon Holdings Berhad (Incorporated in Malaysia)Document12 pagesSuperlon Holdings Berhad (Incorporated in Malaysia)Gan ZhiHanNo ratings yet

- Business Taxation: (Malawi)Document8 pagesBusiness Taxation: (Malawi)angaNo ratings yet

- Year 2009 2008: Johnson & Johnson Balance Sheet (In Millions of USD)Document14 pagesYear 2009 2008: Johnson & Johnson Balance Sheet (In Millions of USD)ujjwal26No ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- 14-Combining Financial Statements-Sept. 30, 07-Fin Com-ADocument4 pages14-Combining Financial Statements-Sept. 30, 07-Fin Com-ACOASTNo ratings yet

- Aaca 2Document2 pagesAaca 2honeylove uNo ratings yet

- Statements of Comprehensive Income: For The Financial Year Ended 31 December 2020Document5 pagesStatements of Comprehensive Income: For The Financial Year Ended 31 December 2020nfarzana.jefriNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 201335693Document64 pages201335693The Myanmar TimesNo ratings yet

- InvoiceDocument1 pageInvoicebalu.nitwNo ratings yet

- Bir Train PenaltiesDocument17 pagesBir Train PenaltiesNLainie OmarNo ratings yet

- Puerto Madero A Project CritqueDocument6 pagesPuerto Madero A Project CritqueSimonaNo ratings yet

- Belirn Essay Template BSBI Blank - Neeru GMM Ast1223Document22 pagesBelirn Essay Template BSBI Blank - Neeru GMM Ast1223jayeetad.m4392No ratings yet

- Petitioner vs. vs. Respondents Leovigildo Monasterial: Second DivisionDocument2 pagesPetitioner vs. vs. Respondents Leovigildo Monasterial: Second DivisionVMNo ratings yet

- Helicon TechDocument6 pagesHelicon TechEcho WackoNo ratings yet

- 01 - OPM-HRS-004 ST Terms and Conditions Rev 4 01032023Document7 pages01 - OPM-HRS-004 ST Terms and Conditions Rev 4 01032023Amit PachauriNo ratings yet

- ASP's - 2 (Simple Question)Document4 pagesASP's - 2 (Simple Question)ARPITHA PRASADNo ratings yet

- EU4 Vs EU3Document44 pagesEU4 Vs EU3Boris MateevNo ratings yet

- Ongc Product Experience.Document1 pageOngc Product Experience.harvinder singhNo ratings yet

- Tax Invoice: New No 30, Old No 24 Bhagirathi Ammal ST, T Nagar, Chennai 600017 CIN: U74900TN2011PTC083121 State Code: 33Document1 pageTax Invoice: New No 30, Old No 24 Bhagirathi Ammal ST, T Nagar, Chennai 600017 CIN: U74900TN2011PTC083121 State Code: 33golu84No ratings yet

- An Analysis of Self-Assesment Tax System in IndonesiaDocument5 pagesAn Analysis of Self-Assesment Tax System in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- NewsRecord15 04 01Document20 pagesNewsRecord15 04 01Kristina HicksNo ratings yet

- Paybill: Print PDFDocument1 pagePaybill: Print PDFNagagyNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- Gas Stove InvoiceDocument1 pageGas Stove Invoiceधांगड धिंगाNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountShiv RajNo ratings yet

- Applied Economics11 - q2 - Week 10 12 RemovedDocument32 pagesApplied Economics11 - q2 - Week 10 12 RemovedAmber Dela CruzNo ratings yet

- Oakland County Board of Commissioners ResolutionDocument10 pagesOakland County Board of Commissioners ResolutionAnonymous dp5b3X1NANo ratings yet

- Adoption of Digital Payments by Small Retail StoresDocument11 pagesAdoption of Digital Payments by Small Retail StoresmailbabuNo ratings yet

- Pajak Internasional 2017 1.0Document15 pagesPajak Internasional 2017 1.0asaNo ratings yet

- Deed of Partition-Deeds-Partition-953Document3 pagesDeed of Partition-Deeds-Partition-953Robin singhNo ratings yet

- HCLFoundation My Clean City ProgrammeDocument15 pagesHCLFoundation My Clean City Programmeneelam19rathoreNo ratings yet

- Form 4506 TDocument2 pagesForm 4506 Tbhill07No ratings yet

- Solved Question Paper For November 2018 EXAM (New Syllabus)Document21 pagesSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNo ratings yet

- Pintaras-AnnualReport 2000Document50 pagesPintaras-AnnualReport 2000Alex PutuhenaNo ratings yet

- Wood PolesDocument30 pagesWood Polesbig johnNo ratings yet