Professional Documents

Culture Documents

(2018) SGHC 214

(2018) SGHC 214

Uploaded by

Jacelyn LeeCopyright:

Available Formats

You might also like

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats92% (12)

- Bankruptcy 2Document11 pagesBankruptcy 2Praveena PeterNo ratings yet

- ReeeDocument36 pagesReeedrpmyNo ratings yet

- NCLAT OrderDocument32 pagesNCLAT OrderShiva Rama Krishna BeharaNo ratings yet

- WONG CHU LAI v. WONG HO ENTERPRISE SDN BHD CLJ - 2020 - 4 - 120 - Cljkuim1 PDFDocument10 pagesWONG CHU LAI v. WONG HO ENTERPRISE SDN BHD CLJ - 2020 - 4 - 120 - Cljkuim1 PDFFitriah RabihahNo ratings yet

- (2018) SGHC 133Document42 pages(2018) SGHC 133DormKangNo ratings yet

- Ruling NCLATDocument31 pagesRuling NCLATCA Pallavi KNo ratings yet

- Periasamy Palani Gounder and Ors Vs Radhakrishnan NL2022150322171212327COM850540Document53 pagesPeriasamy Palani Gounder and Ors Vs Radhakrishnan NL2022150322171212327COM850540RAMA PRIYADARSHINI PADHYNo ratings yet

- Consolidated Digest of Case Laws Jan 2013 March 2013Document179 pagesConsolidated Digest of Case Laws Jan 2013 March 2013Ankit DamaniNo ratings yet

- AXA Insurance V Chiu Teng (2021) SGCA 62Document23 pagesAXA Insurance V Chiu Teng (2021) SGCA 62Frank860610No ratings yet

- NBFCDocument6 pagesNBFCSandeep KhuranaNo ratings yet

- 2660 2021 33 1502 27520 Judgement 15-Apr-2021Document64 pages2660 2021 33 1502 27520 Judgement 15-Apr-2021Richa KesarwaniNo ratings yet

- IFCI Ltd. V BS Ltd.Document7 pagesIFCI Ltd. V BS Ltd.Sachika VijNo ratings yet

- Von Roll V Ssi and Others Final PDFDocument54 pagesVon Roll V Ssi and Others Final PDFssingaram1965No ratings yet

- Tutorial 8Document7 pagesTutorial 8Sharifah Aishah SofiaNo ratings yet

- ChristopherDocument27 pagesChristopherSyifaa' NajibNo ratings yet

- Rohit MotiwatDocument6 pagesRohit MotiwatarundhatiNo ratings yet

- In The Supreme Court of India Civil Appellate Jurisdiction: ReportableDocument68 pagesIn The Supreme Court of India Civil Appellate Jurisdiction: ReportableElated TarantulaNo ratings yet

- Sec10A Period of Default 1715772988Document10 pagesSec10A Period of Default 1715772988advsakthinathanNo ratings yet

- National Company Law Appellate Tribunal Principal Bench, New DelhiDocument11 pagesNational Company Law Appellate Tribunal Principal Bench, New DelhiNivasNo ratings yet

- 1958 34 ITR 10 SC 25-04-1958 Badridas Daga Vs Commissioner of Income TaxDocument9 pages1958 34 ITR 10 SC 25-04-1958 Badridas Daga Vs Commissioner of Income TaxAnanya SNo ratings yet

- (2021) SGHC 55Document31 pages(2021) SGHC 55namira shabrina azirwanNo ratings yet

- (2021) SGHC 1Document32 pages(2021) SGHC 1Nizam BashirNo ratings yet

- Tanzalasa LTD Vs Tractors LTD (Misc Commercial Case 11 of 2022) 2023 TZHCComD 60 (10 March 2023)Document27 pagesTanzalasa LTD Vs Tractors LTD (Misc Commercial Case 11 of 2022) 2023 TZHCComD 60 (10 March 2023)Koka dicklanNo ratings yet

- (2022) Sgca (I) 10Document55 pages(2022) Sgca (I) 10abhidakNo ratings yet

- Clean Slate, Sec. 31, Balance Sheet - Ghanshyam MishraDocument139 pagesClean Slate, Sec. 31, Balance Sheet - Ghanshyam MishraNitin AsatiNo ratings yet

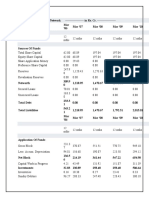

- Cygnus - 13.12.2023 OrderDocument59 pagesCygnus - 13.12.2023 OrderNikhil MaanNo ratings yet

- Petitioner Vs Vs Respondent: First DivisionDocument6 pagesPetitioner Vs Vs Respondent: First DivisionButch MaatNo ratings yet

- Landmark Cases 439Document17 pagesLandmark Cases 439Anand Kumar KediaNo ratings yet

- (2023) Sgca 24Document25 pages(2023) Sgca 24dpoet1No ratings yet

- CasesDocument79 pagesCasesJoel MendozaNo ratings yet

- I. Case Reference: Facts of The CaseDocument15 pagesI. Case Reference: Facts of The CaseSparsh JainNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument21 pagesPetitioner vs. vs. Respondent: Second DivisionJoannah SalamatNo ratings yet

- NCALT Order dt.28.09.2020 Indian Overseas Bank Vs Arvind Kumar - Margin Money Used For Payment of Invoked Bank Guarantees DuDocument8 pagesNCALT Order dt.28.09.2020 Indian Overseas Bank Vs Arvind Kumar - Margin Money Used For Payment of Invoked Bank Guarantees DuMohit JainNo ratings yet

- Cimmissioner V MahindraDocument13 pagesCimmissioner V MahindraGaurangi MehrotraNo ratings yet

- Avoidance of DispositionsDocument31 pagesAvoidance of DispositionsndegwajohnadvNo ratings yet

- Deccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchDocument14 pagesDeccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchSachika VijNo ratings yet

- TBT &upremt Qcourt: La - Epu&Ut of L LantlaDocument14 pagesTBT &upremt Qcourt: La - Epu&Ut of L LantlaThe Supreme Court Public Information OfficeNo ratings yet

- (2022) SGHC 35Document26 pages(2022) SGHC 35Michel KlunzingerNo ratings yet

- (153-21A) Sime Darby Energy Solution SDN BHD v. RZH Setia Jaya SDN BHD (Gunalan Muniandy)Document25 pages(153-21A) Sime Darby Energy Solution SDN BHD v. RZH Setia Jaya SDN BHD (Gunalan Muniandy)Ashmini GnanasegaranNo ratings yet

- Signature Not VerifiedDocument54 pagesSignature Not Verifiedbogere robertNo ratings yet

- Amrop India Pvt. Ltd. vs. The Hi-Tech Gears Ltd. - NCLAT New DelhiDocument16 pagesAmrop India Pvt. Ltd. vs. The Hi-Tech Gears Ltd. - NCLAT New DelhiSachika VijNo ratings yet

- 2014 Tax Bar QADocument20 pages2014 Tax Bar QAMo RockyNo ratings yet

- 01 General Credit Corporation Vs Alsons DevelopmentDocument16 pages01 General Credit Corporation Vs Alsons DevelopmentIronFaith19No ratings yet

- 1 CIR Vs Stand Ins (Full)Document9 pages1 CIR Vs Stand Ins (Full)Atty Richard TenorioNo ratings yet

- Convertion of Debentures Into EquityDocument21 pagesConvertion of Debentures Into Equitydivya20barotNo ratings yet

- CIT, Kolkata V Smifs SecuritiesDocument4 pagesCIT, Kolkata V Smifs SecuritiesBar & BenchNo ratings yet

- CIR vs. AICHI PDFDocument20 pagesCIR vs. AICHI PDFpa0l0sNo ratings yet

- NCLAT - MAIF CCD JudgementDocument16 pagesNCLAT - MAIF CCD JudgementMudit KediaNo ratings yet

- Jaipur Trade Expocentre Pvt. Ltd. NCLATDocument9 pagesJaipur Trade Expocentre Pvt. Ltd. NCLATSachika VijNo ratings yet

- Sanam Fashion & Design Exchange Ltd. Vs KtexDocument20 pagesSanam Fashion & Design Exchange Ltd. Vs KtexSachika VijNo ratings yet

- Rollatainers LTDDocument5 pagesRollatainers LTDmydearg1305No ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- DisputeDocument15 pagesDisputeSandeep KhuranaNo ratings yet

- (2021) Sgca 61Document61 pages(2021) Sgca 61lengyianchua206No ratings yet

- Pembinaan Lian Keong SDN BHD v. Yip Fook Thai (2005) 6 CLJ 34Document27 pagesPembinaan Lian Keong SDN BHD v. Yip Fook Thai (2005) 6 CLJ 34IzaDalilaNo ratings yet

- The Meaning of Solvent For Purposes of Liquidation in Terms of The Companies Act 71 of 2008 Boschpoort Ondernemings (Pty) LTD V Absa Bank LTDDocument3 pagesThe Meaning of Solvent For Purposes of Liquidation in Terms of The Companies Act 71 of 2008 Boschpoort Ondernemings (Pty) LTD V Absa Bank LTDTshepang R LebetheNo ratings yet

- HC 2020 Rentak Arena Competing LiquidatorsDocument10 pagesHC 2020 Rentak Arena Competing LiquidatorsAkio ChingNo ratings yet

- (2023) Sgca 17Document39 pages(2023) Sgca 17dpoet1No ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- A Survey of Islamic Finance Research - Influences and InfluencersDocument17 pagesA Survey of Islamic Finance Research - Influences and InfluencersDISPERKIM KOTA SEMARANGNo ratings yet

- The Brazilian EconomyDocument37 pagesThe Brazilian Economyرامي أبو الفتوحNo ratings yet

- Business Income IllustrationsDocument12 pagesBusiness Income IllustrationsPatricia NjeriNo ratings yet

- Caf 7 ST 2022Document258 pagesCaf 7 ST 2022M. UsmanNo ratings yet

- Working Capital ManagementDocument55 pagesWorking Capital ManagementSamina Ashrabi UpomaNo ratings yet

- Transfer of Property Act - UditanshuDocument25 pagesTransfer of Property Act - UditanshuKrishna Ahuja100% (1)

- Accountancy Term-2 MVP 2023-24Document7 pagesAccountancy Term-2 MVP 2023-24Cp GpNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Rauf MariaDocument90 pagesRauf MariaAhmad FrazNo ratings yet

- Con N: RulingDocument38 pagesCon N: Rulingstunner_1994No ratings yet

- Republic Planters Bank VS CaDocument2 pagesRepublic Planters Bank VS CaaxvxxnNo ratings yet

- Bank of The Philippine Islands v. YuDocument2 pagesBank of The Philippine Islands v. YucelestialfishNo ratings yet

- Practice MC Questions CH 16Document3 pagesPractice MC Questions CH 16business docNo ratings yet

- Article 1838 This Provision Speaks of The Right of The Partner To Rescind Contract of PartnershipDocument23 pagesArticle 1838 This Provision Speaks of The Right of The Partner To Rescind Contract of PartnershipMuni CoffeeNo ratings yet

- Fabm2 Q1mod5 Cash Flow Statement Denver Aliwana Bgo v2Document28 pagesFabm2 Q1mod5 Cash Flow Statement Denver Aliwana Bgo v2Monina Durana LegaspiNo ratings yet

- Introduction To Financial Accounting: T I C A PDocument5 pagesIntroduction To Financial Accounting: T I C A PadnanNo ratings yet

- Finance ShitDocument8 pagesFinance ShitTan JohnsonNo ratings yet

- 5FC004 - John Budha Magar - 2054155Document12 pages5FC004 - John Budha Magar - 2054155Saim KhanNo ratings yet

- Financial Management 1.2Document8 pagesFinancial Management 1.2Sashwat AgarwalNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementVora JeetNo ratings yet

- High Credit RatingDocument2 pagesHigh Credit RatingRajesh KumarNo ratings yet

- Balance Sheet of Sun TV NetworkDocument2 pagesBalance Sheet of Sun TV NetworkMehadi NawazNo ratings yet

- ECN4001 - Tutorial 3 - Questions - For Students - The Bond Market - Worksheet 3 - AnswersDocument6 pagesECN4001 - Tutorial 3 - Questions - For Students - The Bond Market - Worksheet 3 - AnswersShann BevNo ratings yet

- CPA 14-Public Sector Accounting & ReportingDocument15 pagesCPA 14-Public Sector Accounting & ReportingManit MehtaNo ratings yet

- Accounting Equation and Double Entry QuestionsDocument9 pagesAccounting Equation and Double Entry Questionsamosoundo59No ratings yet

- INSURANCE (NOTES - For - Exam) 2Document29 pagesINSURANCE (NOTES - For - Exam) 2MrinalBhatnagarNo ratings yet

- Bank and Nonbank Institution 100611Document77 pagesBank and Nonbank Institution 100611Marienella NavarroNo ratings yet

- FORMAT OF THE TRADING Account With The AdjustmentsDocument2 pagesFORMAT OF THE TRADING Account With The AdjustmentsTajay Kadeem ThomasNo ratings yet

- Sources of Finance Question Answers.Document14 pagesSources of Finance Question Answers.suyashjaiswal889No ratings yet

- Stock Market and Its Functioning Executive SummaryDocument81 pagesStock Market and Its Functioning Executive Summarykunal kotak100% (1)

(2018) SGHC 214

(2018) SGHC 214

Uploaded by

Jacelyn LeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(2018) SGHC 214

(2018) SGHC 214

Uploaded by

Jacelyn LeeCopyright:

Available Formats

IN THE HIGH COURT OF THE REPUBLIC OF SINGAPORE

[2018] SGHC 214

Companies Winding Up No 156 of 2018

Between

The Working Capitol

(Robinson) Pte Ltd (in

liquidation)

… Plaintiff

And

Capitol Concepts Pte Ltd

… Defendant

GROUNDS OF DECISION

[Companies] — [Winding up]

Version No 1: 27 Oct 2020 (22:40 hrs)

TABLE OF CONTENTS

INTRODUCTION............................................................................................1

BACKGROUND FACTS ................................................................................2

THE LOANS FROM THE PLAINTIFF TO THE DEFENDANT .............2

PARTIES’ ARGUMENTS ..............................................................................3

MY DECISION ................................................................................................4

THE APPLICABLE LEGAL PRINCIPLES ...............................................................4

WHETHER THERE WAS A SUBSTANTIAL AND BONA FIDE DISPUTE OVER THE

DEBT................................................................................................................6

The implied contractual set off agreement within the Group ....................6

The tripartite agreement between the Plaintiff, the Defendant and TWC

Ventures....................................................................................................12

WHETHER THE PRESUMPTION OF INSOLVENCY WAS REBUTTED .....................14

WHETHER THE COURT SHOULD EXERCISE ITS DISCRETION TO DISMISS THE

WINDING UP APPLICATION .............................................................................15

MISCELLANEOUS ...........................................................................................16

CONCLUSION...............................................................................................17

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

This judgment is subject to final editorial corrections approved by the

court and/or redaction pursuant to the publisher’s duty in compliance

with the law, for publication in LawNet and/or the Singapore Law

Reports.

The Working Capitol (Robinson) Pte Ltd (in liquidation)

v

Capitol Concepts Pte Ltd

[2018] SGHC 214

High Court — Companies Winding Up No 156 of 2018

Dedar Singh Gill JC

7 September 2018

4 October 2018

Dedar Singh Gill JC:

Introduction

1 This was an application by the plaintiff, The Working Capitol

(Robinson) Pte Ltd (in liquidation) (“the Plaintiff”) to wind up the defendant,

Capitol Concepts Pte Ltd (“the Defendant”), on the basis that it was unable to

pay its debts.

2 At the conclusion of the hearing on 7 September 2018, I granted the

Plaintiff’s application and ordered that the Defendant be wound up. The

Defendant has since appealed. I now set out the full grounds of my decision.

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

Background facts

3 The Defendant is the parent company of a group of companies which

includes the Plaintiff. Specifically, the Plaintiff is a wholly-owned subsidiary of

TWC Ventures Pte Ltd (“TWC Ventures”), which is in turn a wholly-owned

subsidiary of the Defendant. The full structure of the group of companies (“the

Group”) is as follows:

4 The Plaintiff (prior to its liquidation) and The Working Capitol (Keong

Saik) Pte Ltd (“TWCKS”) were the only entities in the Group that generated

revenue. All other entities are dormant.

The loans from the Plaintiff to the Defendant

5 Between July 2017 and February 2018, the Plaintiff extended five loans

to the Defendant, totalling $599,200:

S/N Date Loan amount ($)

1 25 July 2017 468,000

2 11 October 2017 100,000

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

3 12 December 2017 30,000

4 27 December 2017 100

5 13 February 2018 1,100

Total 599,200

6 Between October 2017 and December 2017, the Defendant repaid a total

of $40,520.51:

S/N Date Repayment amount ($)

1 30 October 2017 40,000

2 19 December 2017 520.51

Total 40,520.51

7 On 2 March 2018, the Plaintiff was compulsorily wound up.

8 On 27 June 2018, the liquidator of the Plaintiff served a statutory

demand for the sum of $558,679.49 (being $599,200 less $40,520.51) on the

Defendant. Three weeks lapsed without the Defendant paying the sum owed, or

securing or compounding the same to the reasonable satisfaction of the Plaintiff.

9 On 20 July 2018, the Plaintiff filed the present application for the

Defendant to be wound up.

Parties’ arguments

10 In support of its case that the Defendant should be wound up, the

Plaintiff relied on two alternative grounds:1

1 Plaintiff’s Written Submissions, para 13.

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

(a) First, that the Defendant is deemed to be insolvent and unable to

pay its debts, pursuant to s 254(2)(a) read with s 254(1)(e) of the

Companies Act (Cap 50, 2006 Rev Ed) (“the CA”).

(b) Second, that it is just and equitable that the Defendant be wound

up, under s 254(1)(i) of the CA.

11 In resisting the application, the main plank of the Defendant’s case was

that there was a substantial and bona fide dispute as to the alleged debt of

$558,679.49 owed to the Plaintiff. I will elaborate on this below at [17].

My decision

12 In my judgment, the Defendant failed to establish any substantial and

bona fide dispute as to the sum of $558,679.49 owed to the Plaintiff. I also found

that the Defendant failed to rebut the presumption of insolvency under

s 254(2)(a) of the CA, and that there were no other reasons why this court should

exercise its discretion not to grant the winding up order sought by the Plaintiff.

The applicable legal principles

13 I begin by setting out a brief summary of the applicable legal principles

in respect of a winding up application, some of which are fairly trite

propositions. A company may be wound up under an order of court on the

application of a creditor of the company: s 253(1)(b) of the CA. The court may

order the winding up if one of the grounds under s 254(1) of the CA is satisfied.

For present purposes, we need only concern ourselves with the ground in

s 254(1)(e), ie, that the company is unable to pay its debts.

14 Pursuant to s 254(2)(a) of the CA, a company shall be deemed unable to

pay its debts if a creditor to whom the company is indebted in a sum exceeding

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

$10,000 then due has served a statutory demand on the company requiring it to

pay the sum so due, and the company has for three weeks thereafter neglected

to pay the sum or to secure or compound it to the reasonable satisfaction of the

creditor. I refer to this as the “presumption of insolvency”. Where the

presumption applies and the debt is undisputed, the creditor is ordinarily entitled

to a winding up order (see Metalform Asia Pte Ltd v Holland Leedon Pte Ltd

[2007] 2 SLR(R) 268 (“Metalform”) at [61]).

15 Where the debt is disputed, the court may dismiss the winding up

application on the ground that the locus standi of the petitioner as a creditor is

in question, and it is an abuse of process of the court for the applicant to try to

enforce a disputed debt in this way (see Metalform at [62]). However, a

company cannot stave off a winding up application merely by alleging that there

is a substantial and bona fide dispute over the debt claimed by the applicant-

creditor. It is the duty of the court to evaluate whatever evidence the company

has raised and come to a conclusion on whether the alleged dispute exists. With

regard to the applicable standard of proof, the debtor-company must raise triable

issues: see Pacific Recreation Pte Ltd v S Y Technology Inc and another appeal

[2008] 2 SLR(R) 491 (“Pacific Recreation”) at [17] and [23]. Simply put, there

must be a dispute which involves to a substantial extent disputed questions of

fact which demand viva voce evidence, and the company must adduce evidence

which supports its contention that there is a substantial dispute (see Pacific

Recreation at [19], citing Andrew R Keay, McPherson’s Law of Company

Liquidation (Sweet & Maxwell, 2001) at para 3.67, p 122).

16 Although the statutory grounds for winding up may be technically

established, the court retains the residual discretion to consider all the relevant

factors, including the utility, propriety and effect of a winding up order as well

as the overall fairness and justice of the case, before deciding whether to wind

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

up the company (see Lai Shit Har v Lau Yu Man [2008] 4 SLR(R) 348 at [33]).

As observed by the Court of Appeal in BNP Paribas v Jurong Shipyard Pte Ltd

[2009] 2 SLR(R) 949, where a petition to wind up a temporarily insolvent but

commercially viable company is filed, many other economic and social interests

may be affected, such as those of its employees, the non-petitioning creditors,

as well as the company’s suppliers, customers and shareholders. These are

interests that the court may legitimately take into account in deciding whether

or not to wind up the company (at [19]).

Whether there was a substantial and bona fide dispute over the debt

17 As mentioned, the Defendant disputed the debt of $558,679.49 owed to

the Plaintiff. Specifically, the Defendant alleged that there was at least a triable

issue that the debt had been set off pursuant to an implied contractual set off

agreement within the Group and/or, in any event, a tripartite agreement between

itself, the Plaintiff and TWC Ventures.2 I will address each of these arguments

in turn.

The implied contractual set off agreement within the Group

18 On the first argument, the Defendant emphasised that the Group was a

family-run business whose entities shared a symbiotic relationship. Allegedly,

the Group had a long extant practice of extending loans to its constituent entities

in need of funds to meet their operating costs, creating a web of inter-company

loans. Further, where appropriate and/or required, these entities would set off or

write off mutual debts owed to each other. The Defendant argued that there was

at least a triable issue as to whether the Group’s practice of setting off and/or

writing off inter-company loans could form the basis for an implied contractual

set off agreement within the Group.3

2 Defendant’s Written Submissions, paras 14–22.

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

19 At this juncture, I highlight that the sole piece of evidence the Defendant

placed before this court in support of the existence of the Group’s alleged

practice was TWCKS’s Statement of Financial Position for January to

December 2017 (“TWCKS’s 2017 Statement”). I reproduce below an excerpt

from Mr Benjamin Gattie’s affidavit dated 28 August 2018:4

SET-OFF OF INTERCOMPANY LOANS

28. CC Group also has a practice of setting off and/or

netting off intercompany debts.

29. To illustrate, I refer to TWCKS’s Statement of Financial

Position for the year 2017 (“TWCKS’s 2017 Statement”), a copy

of which is now produced and shown to me marked as TAB 4 of

BG-1. TWCKS’s 2017 Statement is a clear example of the set-

offs of intercompany loans applied within CC Group:

S/N Date Description Amount

1 March 2017 Write-off amount due from S$535.00

[TWC (Alexandra)]

2 December Write-off amount due from S$316,422.55

2017 [TWC (Robinson)]

3 December Write-off loan to [Kumo S$75,000.00

2017 (Pasir Panjang)]

4 December Write-off amount payable S$2,464.92

2017 to [TWC (Robinson)]

5 December Write-off amount payable S$19.345.00

2017 to [TWC (Circular)]

20 Proceeding on the basis that such a set off arrangement existed, the

Defendant then sought to argue that various transactions between the Plaintiff

and the Defendant could be set off against each other. The Defendant said that

in 2017, it had extended various loans to the Plaintiff, as well as “made various

payments of [the Plaintiff’s] expenses on behalf of [the Plaintiff]”. I reproduce

below the list of transactions as set out in Mr Gattie’s affidavit:5

3 Defendant’s Written Submissions, para 17.

4 Affidavit of Benjamin Gattie dated 28 August 2018, paras 28–29; pp 54–55.

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

S/N Date Description Amount ($)

1 30 June 2017 Accrual for Brookfield 21,187.90

Pass Through Costs Inv

80755

2 5 July 2017 Loan 282,000

3 18 September Recognition of Brookfield 103,257.03

2017 Inv 84553 (Cleaning Feb to

Jun 2017)

4 22 September Deposit to Straits Law 5,030

2017 (Tarkus) paid by the

Defendant on behalf

5 1 November Loan 40,000

2011

6 19 December Loan 520.51

2017

7 31 December Accrual for Brookfield 5,960.18

2017 Pass Through Costs Inv

101198

Total 457,955.62

As the loan of $282,000 (in S/N 2 above) had already been repaid, the Plaintiff

only owed the Defendant $175,955.62 (ie, $457,955.62 less $282,000).

21 The Defendant then said that pursuant to the Group’s practice, this sum

of $175,955.62 could be set off against the loans of $599,200 that the Plaintiff

had extended to the Defendant (see [5] above). Thus, any alleged indebtedness

to the Plaintiff was only in the sum of $423,244.38, and not $558,679.49 as the

5 Affidavit of Benjamin Gattie dated 28 August 2018, para 22; pp 44–46.

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

Plaintiff alleged.6

22 As can be seen from the above, the Defendant’s argument on the

“implied contractual set off agreement” required it to first establish the

necessary factual substratum – ie, that the Group had a practice of setting off

inter-company loans. If established, this course of conduct or dealings between

the parties and other relevant circumstances could form the basis for a contract

to be implied, including a multi-party contract to set off (see, generally,

Cooperatieve Centrale Raiffeisen-Boerenleenbank BA (trading as Rabobank

International), Singapore Branch v Motorola Electronics Pte Ltd [2011] 2 SLR

63 at [46]–[50]). I hasten to add, however, that the Defendant was not required

to affirmatively prove the existence of such a practice on a balance of

probabilities. At this stage, the standard of proof is one of triable issues.

However, I did not consider that the Defendant had crossed even this low

threshold. My reasons are as follows.

23 While I could accept that the various financial statements adduced in

Mr Gattie’s affidavit – specifically, the parties’ General Ledgers and Statements

of Financial Position – supported the Defendant’s assertion that the Group had

a practice of granting loans to each other, it did not necessarily follow that the

Group had a practice of setting off these inter-company loans. That was a point

which had to be proved separately.

24 In this regard, the sole piece of evidence cited by the Defendant,

TWCKS’s 2017 Statement (see [19] above), was not helpful. To begin with, the

transactions set out in the table at para 29 of Mr Gattie’s affidavit were in fact

write offs (as labelled in the table itself), and not set offs (as described in the

main body of para 29). Those are entirely distinct concepts, which the

6 Affidavit of Benjamin Gattie dated 28 August 2018, paras 25–27.

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

Defendant had erroneously conflated by using the terms interchangeably. I

digress to note that it would not have been at all surprising if many of these

inter-company loans had been written off, seeing as most of the entities in the

Group were insolvent, or at least in financial difficulties at the relevant time. It

was a completely different matter to say that those loans could or should be set

off against each other pursuant to a practice within the Group.

25 In any event, it should be highlighted that all these transactions involved

TWCKS and occurred between March and December 2017. Such evidence was

of limited utility in proving that the Group as a whole had a practice of setting

off inter-company loans, much less one which the Defendant claimed was “the

practice long before any winding up application had been taken out against the

[Defendant’s] Group entities”.7 In this regard, “practice” connotes a consistent

pattern of conduct. One would therefore have expected the Defendant to point

to a range of transactions spanning different time periods and involving different

parties. Instead, the Defendant cited a single piece of evidence involving just

one party and over a fairly limited period of time. This was, in my judgment,

clearly insufficient.

26 Furthermore, looking beyond what the Defendant had cited and

scrutinising the available affidavit evidence as a whole, I saw no indication that

inter-company loans had been set off against each other. The General Ledgers

of both the Plaintiff and Defendant only referred to loans being received and

repaid,8 but not that they had been set off. Likewise, their Statements of

Financial Positions only showed that the amounts due from other entities in the

Group varied in value and at times had been reduced to zero, but there was no

explanation provided for these variations.9 There was no reason to assume that

7 Defendant’s Written Submissions, para 15.

8 Affidavit of Benjamin Gattie dated 28 August 2018, pp 44–46 and 48–52.

10

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

these decreases were the result of set offs.

27 I digress to note that the lack of financial statements was a point of

complaint raised by the Plaintiff in the present application. According to the

Plaintiff, the Defendant had not filed its audited financial statements since

29 November 2016, in breach of s 201(1) of the CA.10 The Defendant did not

disclose for inspection, among other documents, the whole of its Statement of

Financial Position and its management accounts.11 The Defendant also did not

respond to the Plaintiff’s request of 3 September 2018 requesting for further

documents to support the Defendant’s claim of set off.12 I need not make more

of these points, save to comment that the absence of financial statements would

explain why the affidavit evidence presently before the court was so scant.

28 Having rejected the sole piece of evidence cited by the Defendant in

support of its contention that the Group had a practice of setting off inter-

company loans, and having found no indication of such a practice on review of

the rest of the affidavit evidence, what was left before the court was no more

than a bare assertion. Thus, applying the principles in Pacific Recreation that it

is for the defendant to produce evidence supporting its contention that there is a

substantial dispute so that the court can evaluate the evidence for itself and

conclude whether the alleged dispute exists (see [15] above), my conclusion –

in the light of the complete lack of evidence – was that there was no dispute as

to the debt on the ground of an implied contractual set off agreement within the

Group.

9 Affidavit of Benjamin Gattie dated 28 August 2018, pp 54–56.

10 Plaintiff’s Written Submissions, paras 30–31.

11 Plaintiff’s Written Submissions, paras 35–36.

12 Plaintiff’s Written Submissions, para 54.

11

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

The tripartite agreement between the Plaintiff, the Defendant and TWC

Ventures

29 The Defendant’s second argument was that in any event, its debt to the

Plaintiff had been set off pursuant to a tripartite agreement between the Plaintiff,

the Defendant and TWC Ventures. The Defendant referred to the Plaintiff’s

General Ledger for the period from 1 January 2017 to 28 February 2018 and

pointed out that the net position was that the Plaintiff owed TWC Ventures

$1,565,888.13 This sum was calculated by taking the ending balance of “Loan

from TWC Ventures” less the ending balance of “Amt due fr TWC Ventures”

(ie, $1,728,500 less $162,612).

30 The Defendant next referred to its Statement of Financial Position for

January to December 2017, which recorded payments to TWC Ventures

between May and August 2017 totalling $405,000.14 According to the

Defendant, although this sum was labelled a “loan”, it was in truth a repayment

made on the Plaintiff’s behalf, in partial settlement of the latter’s debt of

$1,565,888 to TWC Ventures.15 On this basis, the Defendant argued that there

was a triable issue as to what the payment of $405,000 to TWC Ventures

actually was, and that this issue could not be readily resolved on the affidavit

evidence before this court, but would take “an exercise in the examination of

the books and records of the entities involved, as well as the circumstances

leading up to the loan.”16

31 In my judgment, there was simply no factual basis to support the

Defendant’s argument that its payment of $405,000 to TWC Ventures in May

13 Affidavit of Benjamin Gattie dated 28 August 2018, para 35; pp 48 and 50–51.

14 Affidavit of Benjamin Gattie dated 28 August 2018, p 58.

15 Affidavit of Benjamin Gattie dated 28 August 2018, paras 35–37.

16 Defendant’s Written Submissions, paras 18 and 21–22.

12

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

to August 2017 was repayment on the Plaintiff’s behalf, pursuant to a tripartite

agreement between itself, the Plaintiff and TWC Ventures. As the Plaintiff

pointed out, on 1 June 2018, TWC Ventures had filed a proof of debt against

the Plaintiff for the sum of $1,565,931.17 This closely approximates $1,565,888,

which was the amount recorded in the Plaintiff’s General Ledger as owing to

TWC Ventures (see [29] above). This clearly showed that TWC Ventures did

not treat the Defendant’s payment of $405,000 as a repayment on the Plaintiff’s

behalf. More importantly, this was entirely consistent with the Defendant’s own

records: in its Statement of Financial Position, the Defendant’s payment of

$405,000 to TWC Ventures was recorded under the item “Loan to TWC

Ventures” instead of a repayment of the Plaintiff’s debt, as one would expect if

that were truly the case.

32 Further, as the Plaintiff pointed out, the sum of $405,000 was not

recorded in the Plaintiff’s books, nor was it recorded in TWC Ventures’ books

as a repayment of the monies owed to it from the Plaintiff.18 In contrast, where

there were repayments of loans between the Defendant and TWC Ventures,

these were specifically recorded in the Defendant’s General Ledger as “partial

repayment of loan”.19 The absence of similar records for the Plaintiff and TWC

Ventures strongly suggested that the Defendant’s payment of $405,000 was

simply what it was recorded as – a loan to TWC Ventures. Thus, having regard

to the evidence before the court, I found that there was no dispute as to the debt

on the ground of a tripartite agreement between the Plaintiff, the Defendant and

TWC Ventures.

33 In the premises, I concluded that the Defendant failed to raise any triable

17 Affidavit of Don Ho Mun-Tuke dated 4 September 2018, p 21.

18 Affidavit of Don Ho Mun-Tuke dated 4 September 2018, paras 34–35.

19 Affidavit of Don Ho Mun-Tuke dated 4 September 2018, p 43.

13

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

issues. There was therefore no substantial and bona fide dispute as to the debt

of $558,679.49 that it owed to the Plaintiff.

Whether the presumption of insolvency was rebutted

34 I turn now to consider whether the Defendant successfully rebutted the

presumption of insolvency under s 254(2)(a) of the CA, which arose when the

Defendant failed to pay, secure or compound the sum stated in the statutory

demand served on it, within three weeks. In this regard, the Defendant’s sole

argument was that it was not “hopelessly insolvent” because its total assets still

exceeded its total liabilities.20 However, as the Plaintiff pointed out, as of

December 2017, the Defendant’s total assets only exceeded its total liabilities

by a mere $122,026.65.21 This was by no means a large sum: it was insufficient

to pay off even the whole of the Defendant’s debt to the Plaintiff.

35 Further, it is important to bear in mind that insolvency may be

established as a fact in ways other than by a consideration of a company’s total

assets and liabilities. As noted by the High Court in Chip Thye Enterprises Pte

Ltd (in liquidation) v Phay Gi Mo and others [2004] 1 SLR(R) 434 at [17], under

s 254(2)(c) of the CA, the court may also look at the company’s accumulated

losses to see if they are in excess of its capital; the nature of assets of the

company; current liabilities over current assets; prospects of fresh capital or

financial support from shareholders and incoming payments from any source to

discharge the debts, including credit resources. Applying these guidelines, it

became quite apparent that the Defendant was insolvent. As of December 2017,

its current liabilities exceeded its current assets by $1,433,816.52, and its cash

20 Defendant’s Written Submissions, para 26.

21 Affidavit of Don Ho Mun-Tuke dated 4 September 2018, p 20; Affidavit of Benjamin

Gattie dated 28 August 2018, pp 58–59.

14

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

and cash equivalents fell far short of its total liabilities by $3,140,008.70.22

Overall, the Defendant was unable to meet its liabilities from its most liquid

assets, meaning that it could not pay its debts as they fell due.

36 In the premises, notwithstanding that its total assets exceeded its total

liabilities, I held that the Defendant failed to rebut the presumption of

insolvency, and thus the ground under s 254(1)(e) of the CA was established.

Whether the court should exercise its discretion to dismiss the winding up

application

37 The final issue pertained to whether this court should exercise its

discretion to dismiss the winding up application, even where grounds for

winding up had been established. The Defendant argued that the court should

not order a winding up because the entire Group would be put at risk of being

pushed into a state of insolvency. In particular, a winding up order would put

TWCKS, the only operationally active and revenue-generating entity in the

Group, at risk. The Defendant argued that it just needed “breathing space” to

extract itself from a “temporary cash crunch”.23

38 I disagreed with the Defendant. TWCKS may have been operationally

active, but it was quite clearly insolvent as well. As of December 2017, its total

liabilities exceeded its total assets by approximately $2.6 million; its current

liabilities exceeded its current assets by approximately $3.8 million; and its total

liabilities exceeded its cash and cash equivalents by slightly over $10 million.24

All other entities in the Group were dormant companies.25 Unlike what the

22 Affidavit of Don Ho Mun-Tuke dated 4 September 2018, p 20.

23 Defendant’s Written Submissions, paras 27–28.

24 Affidavit of Don Ho Mun-Tuke dated 4 September 2018, p 17.

25 Affidavit of Benjamin Gattie dated 28 August 2018, para 16; Affidavit of Don Ho

15

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

Defendant asserted, it was clear to me that this was not a situation of temporary

illiquidity that the Group, let alone the Defendant, could extricate itself from.

There was thus no reason not to grant the winding up order sought by the

Plaintiff.

Miscellaneous

39 For completeness, I should mention that the Plaintiff argued extensively

in its written submissions that its loans to the Defendant constituted unfair

preference transactions, and were liable to be clawed back by the liquidator.26 I

made no findings on this point as I did not consider it to be relevant to the

present application to wind up the Defendant.

Conclusion

40 For the foregoing reasons, I therefore granted the prayers sought by the

Plaintiff in the following terms:

(a) that a winding up order be made against the Defendant;

(b) that Mr Medora Xerxes Jamshid be appointed as liquidator of the

Defendant; and

(c) that the costs of the winding up proceedings are to be taxed, if

not agreed or fixed, and paid to the Plaintiff out of the assets of the

Defendant.

Mun-Tuke dated 4 September 2018, paras 6 and 8.

26 Plaintiff’s Written Submissions, paras 58–76.

16

Version No 1: 27 Oct 2020 (22:40 hrs)

The Working Capitol (Robinson) Pte Ltd v [2018] SGHC 214

Capitol Concepts Pte Ltd

Dedar Singh Gill

Judicial Commissioner

Pancharatnam Jeya Putra and Shakti Krishnaveni Sadashiv

(AsiaLegal LLC) for the plaintiff;

Qua Bi Qi and Yeo Lai Hock, Nichol (JLC Advisors LLP) for the

defendant.

17

Version No 1: 27 Oct 2020 (22:40 hrs)

You might also like

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats92% (12)

- Bankruptcy 2Document11 pagesBankruptcy 2Praveena PeterNo ratings yet

- ReeeDocument36 pagesReeedrpmyNo ratings yet

- NCLAT OrderDocument32 pagesNCLAT OrderShiva Rama Krishna BeharaNo ratings yet

- WONG CHU LAI v. WONG HO ENTERPRISE SDN BHD CLJ - 2020 - 4 - 120 - Cljkuim1 PDFDocument10 pagesWONG CHU LAI v. WONG HO ENTERPRISE SDN BHD CLJ - 2020 - 4 - 120 - Cljkuim1 PDFFitriah RabihahNo ratings yet

- (2018) SGHC 133Document42 pages(2018) SGHC 133DormKangNo ratings yet

- Ruling NCLATDocument31 pagesRuling NCLATCA Pallavi KNo ratings yet

- Periasamy Palani Gounder and Ors Vs Radhakrishnan NL2022150322171212327COM850540Document53 pagesPeriasamy Palani Gounder and Ors Vs Radhakrishnan NL2022150322171212327COM850540RAMA PRIYADARSHINI PADHYNo ratings yet

- Consolidated Digest of Case Laws Jan 2013 March 2013Document179 pagesConsolidated Digest of Case Laws Jan 2013 March 2013Ankit DamaniNo ratings yet

- AXA Insurance V Chiu Teng (2021) SGCA 62Document23 pagesAXA Insurance V Chiu Teng (2021) SGCA 62Frank860610No ratings yet

- NBFCDocument6 pagesNBFCSandeep KhuranaNo ratings yet

- 2660 2021 33 1502 27520 Judgement 15-Apr-2021Document64 pages2660 2021 33 1502 27520 Judgement 15-Apr-2021Richa KesarwaniNo ratings yet

- IFCI Ltd. V BS Ltd.Document7 pagesIFCI Ltd. V BS Ltd.Sachika VijNo ratings yet

- Von Roll V Ssi and Others Final PDFDocument54 pagesVon Roll V Ssi and Others Final PDFssingaram1965No ratings yet

- Tutorial 8Document7 pagesTutorial 8Sharifah Aishah SofiaNo ratings yet

- ChristopherDocument27 pagesChristopherSyifaa' NajibNo ratings yet

- Rohit MotiwatDocument6 pagesRohit MotiwatarundhatiNo ratings yet

- In The Supreme Court of India Civil Appellate Jurisdiction: ReportableDocument68 pagesIn The Supreme Court of India Civil Appellate Jurisdiction: ReportableElated TarantulaNo ratings yet

- Sec10A Period of Default 1715772988Document10 pagesSec10A Period of Default 1715772988advsakthinathanNo ratings yet

- National Company Law Appellate Tribunal Principal Bench, New DelhiDocument11 pagesNational Company Law Appellate Tribunal Principal Bench, New DelhiNivasNo ratings yet

- 1958 34 ITR 10 SC 25-04-1958 Badridas Daga Vs Commissioner of Income TaxDocument9 pages1958 34 ITR 10 SC 25-04-1958 Badridas Daga Vs Commissioner of Income TaxAnanya SNo ratings yet

- (2021) SGHC 55Document31 pages(2021) SGHC 55namira shabrina azirwanNo ratings yet

- (2021) SGHC 1Document32 pages(2021) SGHC 1Nizam BashirNo ratings yet

- Tanzalasa LTD Vs Tractors LTD (Misc Commercial Case 11 of 2022) 2023 TZHCComD 60 (10 March 2023)Document27 pagesTanzalasa LTD Vs Tractors LTD (Misc Commercial Case 11 of 2022) 2023 TZHCComD 60 (10 March 2023)Koka dicklanNo ratings yet

- (2022) Sgca (I) 10Document55 pages(2022) Sgca (I) 10abhidakNo ratings yet

- Clean Slate, Sec. 31, Balance Sheet - Ghanshyam MishraDocument139 pagesClean Slate, Sec. 31, Balance Sheet - Ghanshyam MishraNitin AsatiNo ratings yet

- Cygnus - 13.12.2023 OrderDocument59 pagesCygnus - 13.12.2023 OrderNikhil MaanNo ratings yet

- Petitioner Vs Vs Respondent: First DivisionDocument6 pagesPetitioner Vs Vs Respondent: First DivisionButch MaatNo ratings yet

- Landmark Cases 439Document17 pagesLandmark Cases 439Anand Kumar KediaNo ratings yet

- (2023) Sgca 24Document25 pages(2023) Sgca 24dpoet1No ratings yet

- CasesDocument79 pagesCasesJoel MendozaNo ratings yet

- I. Case Reference: Facts of The CaseDocument15 pagesI. Case Reference: Facts of The CaseSparsh JainNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument21 pagesPetitioner vs. vs. Respondent: Second DivisionJoannah SalamatNo ratings yet

- NCALT Order dt.28.09.2020 Indian Overseas Bank Vs Arvind Kumar - Margin Money Used For Payment of Invoked Bank Guarantees DuDocument8 pagesNCALT Order dt.28.09.2020 Indian Overseas Bank Vs Arvind Kumar - Margin Money Used For Payment of Invoked Bank Guarantees DuMohit JainNo ratings yet

- Cimmissioner V MahindraDocument13 pagesCimmissioner V MahindraGaurangi MehrotraNo ratings yet

- Avoidance of DispositionsDocument31 pagesAvoidance of DispositionsndegwajohnadvNo ratings yet

- Deccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchDocument14 pagesDeccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchSachika VijNo ratings yet

- TBT &upremt Qcourt: La - Epu&Ut of L LantlaDocument14 pagesTBT &upremt Qcourt: La - Epu&Ut of L LantlaThe Supreme Court Public Information OfficeNo ratings yet

- (2022) SGHC 35Document26 pages(2022) SGHC 35Michel KlunzingerNo ratings yet

- (153-21A) Sime Darby Energy Solution SDN BHD v. RZH Setia Jaya SDN BHD (Gunalan Muniandy)Document25 pages(153-21A) Sime Darby Energy Solution SDN BHD v. RZH Setia Jaya SDN BHD (Gunalan Muniandy)Ashmini GnanasegaranNo ratings yet

- Signature Not VerifiedDocument54 pagesSignature Not Verifiedbogere robertNo ratings yet

- Amrop India Pvt. Ltd. vs. The Hi-Tech Gears Ltd. - NCLAT New DelhiDocument16 pagesAmrop India Pvt. Ltd. vs. The Hi-Tech Gears Ltd. - NCLAT New DelhiSachika VijNo ratings yet

- 2014 Tax Bar QADocument20 pages2014 Tax Bar QAMo RockyNo ratings yet

- 01 General Credit Corporation Vs Alsons DevelopmentDocument16 pages01 General Credit Corporation Vs Alsons DevelopmentIronFaith19No ratings yet

- 1 CIR Vs Stand Ins (Full)Document9 pages1 CIR Vs Stand Ins (Full)Atty Richard TenorioNo ratings yet

- Convertion of Debentures Into EquityDocument21 pagesConvertion of Debentures Into Equitydivya20barotNo ratings yet

- CIT, Kolkata V Smifs SecuritiesDocument4 pagesCIT, Kolkata V Smifs SecuritiesBar & BenchNo ratings yet

- CIR vs. AICHI PDFDocument20 pagesCIR vs. AICHI PDFpa0l0sNo ratings yet

- NCLAT - MAIF CCD JudgementDocument16 pagesNCLAT - MAIF CCD JudgementMudit KediaNo ratings yet

- Jaipur Trade Expocentre Pvt. Ltd. NCLATDocument9 pagesJaipur Trade Expocentre Pvt. Ltd. NCLATSachika VijNo ratings yet

- Sanam Fashion & Design Exchange Ltd. Vs KtexDocument20 pagesSanam Fashion & Design Exchange Ltd. Vs KtexSachika VijNo ratings yet

- Rollatainers LTDDocument5 pagesRollatainers LTDmydearg1305No ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- DisputeDocument15 pagesDisputeSandeep KhuranaNo ratings yet

- (2021) Sgca 61Document61 pages(2021) Sgca 61lengyianchua206No ratings yet

- Pembinaan Lian Keong SDN BHD v. Yip Fook Thai (2005) 6 CLJ 34Document27 pagesPembinaan Lian Keong SDN BHD v. Yip Fook Thai (2005) 6 CLJ 34IzaDalilaNo ratings yet

- The Meaning of Solvent For Purposes of Liquidation in Terms of The Companies Act 71 of 2008 Boschpoort Ondernemings (Pty) LTD V Absa Bank LTDDocument3 pagesThe Meaning of Solvent For Purposes of Liquidation in Terms of The Companies Act 71 of 2008 Boschpoort Ondernemings (Pty) LTD V Absa Bank LTDTshepang R LebetheNo ratings yet

- HC 2020 Rentak Arena Competing LiquidatorsDocument10 pagesHC 2020 Rentak Arena Competing LiquidatorsAkio ChingNo ratings yet

- (2023) Sgca 17Document39 pages(2023) Sgca 17dpoet1No ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- A Survey of Islamic Finance Research - Influences and InfluencersDocument17 pagesA Survey of Islamic Finance Research - Influences and InfluencersDISPERKIM KOTA SEMARANGNo ratings yet

- The Brazilian EconomyDocument37 pagesThe Brazilian Economyرامي أبو الفتوحNo ratings yet

- Business Income IllustrationsDocument12 pagesBusiness Income IllustrationsPatricia NjeriNo ratings yet

- Caf 7 ST 2022Document258 pagesCaf 7 ST 2022M. UsmanNo ratings yet

- Working Capital ManagementDocument55 pagesWorking Capital ManagementSamina Ashrabi UpomaNo ratings yet

- Transfer of Property Act - UditanshuDocument25 pagesTransfer of Property Act - UditanshuKrishna Ahuja100% (1)

- Accountancy Term-2 MVP 2023-24Document7 pagesAccountancy Term-2 MVP 2023-24Cp GpNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Rauf MariaDocument90 pagesRauf MariaAhmad FrazNo ratings yet

- Con N: RulingDocument38 pagesCon N: Rulingstunner_1994No ratings yet

- Republic Planters Bank VS CaDocument2 pagesRepublic Planters Bank VS CaaxvxxnNo ratings yet

- Bank of The Philippine Islands v. YuDocument2 pagesBank of The Philippine Islands v. YucelestialfishNo ratings yet

- Practice MC Questions CH 16Document3 pagesPractice MC Questions CH 16business docNo ratings yet

- Article 1838 This Provision Speaks of The Right of The Partner To Rescind Contract of PartnershipDocument23 pagesArticle 1838 This Provision Speaks of The Right of The Partner To Rescind Contract of PartnershipMuni CoffeeNo ratings yet

- Fabm2 Q1mod5 Cash Flow Statement Denver Aliwana Bgo v2Document28 pagesFabm2 Q1mod5 Cash Flow Statement Denver Aliwana Bgo v2Monina Durana LegaspiNo ratings yet

- Introduction To Financial Accounting: T I C A PDocument5 pagesIntroduction To Financial Accounting: T I C A PadnanNo ratings yet

- Finance ShitDocument8 pagesFinance ShitTan JohnsonNo ratings yet

- 5FC004 - John Budha Magar - 2054155Document12 pages5FC004 - John Budha Magar - 2054155Saim KhanNo ratings yet

- Financial Management 1.2Document8 pagesFinancial Management 1.2Sashwat AgarwalNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementVora JeetNo ratings yet

- High Credit RatingDocument2 pagesHigh Credit RatingRajesh KumarNo ratings yet

- Balance Sheet of Sun TV NetworkDocument2 pagesBalance Sheet of Sun TV NetworkMehadi NawazNo ratings yet

- ECN4001 - Tutorial 3 - Questions - For Students - The Bond Market - Worksheet 3 - AnswersDocument6 pagesECN4001 - Tutorial 3 - Questions - For Students - The Bond Market - Worksheet 3 - AnswersShann BevNo ratings yet

- CPA 14-Public Sector Accounting & ReportingDocument15 pagesCPA 14-Public Sector Accounting & ReportingManit MehtaNo ratings yet

- Accounting Equation and Double Entry QuestionsDocument9 pagesAccounting Equation and Double Entry Questionsamosoundo59No ratings yet

- INSURANCE (NOTES - For - Exam) 2Document29 pagesINSURANCE (NOTES - For - Exam) 2MrinalBhatnagarNo ratings yet

- Bank and Nonbank Institution 100611Document77 pagesBank and Nonbank Institution 100611Marienella NavarroNo ratings yet

- FORMAT OF THE TRADING Account With The AdjustmentsDocument2 pagesFORMAT OF THE TRADING Account With The AdjustmentsTajay Kadeem ThomasNo ratings yet

- Sources of Finance Question Answers.Document14 pagesSources of Finance Question Answers.suyashjaiswal889No ratings yet

- Stock Market and Its Functioning Executive SummaryDocument81 pagesStock Market and Its Functioning Executive Summarykunal kotak100% (1)