Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsKaiser Benefits

Kaiser Benefits

Uploaded by

Walyn NagaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Prucash PremierDocument14 pagesPrucash PremierJaboh LabohNo ratings yet

- Basic Reinsurance Guide PDFDocument80 pagesBasic Reinsurance Guide PDFKandeel AfzalNo ratings yet

- Ultimate Kaiser Health BuilderDocument30 pagesUltimate Kaiser Health BuilderOmeng Tawid100% (7)

- Igain Iii - Investment Plan: FeaturesDocument8 pagesIgain Iii - Investment Plan: FeaturesShankar VasuNo ratings yet

- Lifelong BrochureDocument10 pagesLifelong BrochureSambaiahMallelaNo ratings yet

- Standardized Product: TrainingDocument44 pagesStandardized Product: TrainingHannington KondeNo ratings yet

- Smartkid RPDocument6 pagesSmartkid RPRajbir Singh YadavNo ratings yet

- KaiserDocument26 pagesKaiserPeriod Ampersand AsteriskNo ratings yet

- CignaTTK ProHealth Vs Star ComprehensiveDocument9 pagesCignaTTK ProHealth Vs Star Comprehensivemaakabhawan26No ratings yet

- SUN Fit and Well Advantage 20Document9 pagesSUN Fit and Well Advantage 20John Jefferson LegaspiNo ratings yet

- Takaful Health2Document34 pagesTakaful Health2yusofprubsnNo ratings yet

- 80C Deductions: LIC, PF, PPF EtcDocument6 pages80C Deductions: LIC, PF, PPF EtcMerwyn DsouzaNo ratings yet

- Kotak Surakshit JeevanDocument12 pagesKotak Surakshit JeevanHiten VajariyaNo ratings yet

- RNL Star BrochureDocument24 pagesRNL Star BrochureAnuj KumarNo ratings yet

- Fulfil The Smaller Joys in Life, Through Regular IncomeDocument8 pagesFulfil The Smaller Joys in Life, Through Regular IncomeSajeed ShaikhNo ratings yet

- Receive Payouts Once Every 5 YearsDocument6 pagesReceive Payouts Once Every 5 YearsSheetal IyerNo ratings yet

- 2024-2025 Resident and Fellow Salary Benefits Sheet FULL (1)Document37 pages2024-2025 Resident and Fellow Salary Benefits Sheet FULL (1)Brian HelbigNo ratings yet

- SBI Life - Saral Retirement Saver - BrochureDocument14 pagesSBI Life - Saral Retirement Saver - BrochureNitin KumarNo ratings yet

- SSGML Products Exclusive April 2012Document9 pagesSSGML Products Exclusive April 2012synergygroupNo ratings yet

- SSGML Products Exclusive April 2012Document9 pagesSSGML Products Exclusive April 2012synergygroupNo ratings yet

- Onby Pa Adp 133rd BatchDocument53 pagesOnby Pa Adp 133rd BatchSreemon P VNo ratings yet

- Notes About Finance in SGDocument7 pagesNotes About Finance in SGYeo JhNo ratings yet

- Kaiser LTC OverviewDocument12 pagesKaiser LTC OverviewLloyd Leonell LabsoNo ratings yet

- CignaTTK ProHealth Vs Religare CareDocument9 pagesCignaTTK ProHealth Vs Religare Caremaakabhawan26No ratings yet

- Name: Faisal SB Age: 43 Yrs: Endowment AssuranceDocument5 pagesName: Faisal SB Age: 43 Yrs: Endowment AssuranceTehniyat RizwanNo ratings yet

- Grow Your Wealth, Protect Your FutureDocument16 pagesGrow Your Wealth, Protect Your Futureamrisha_1No ratings yet

- AIA - Smart Wealth EDocument6 pagesAIA - Smart Wealth Ethagi.lkNo ratings yet

- PruCash Double Reward BrochureDocument31 pagesPruCash Double Reward BrochureDavid ChungNo ratings yet

- Kotak Assured Income PlanDocument9 pagesKotak Assured Income Plandinesh2u85No ratings yet

- Whodoirelyon When I Encounter Medical Emergencies?: Bharti Axa Life Hospi Cash Benefit RiderDocument18 pagesWhodoirelyon When I Encounter Medical Emergencies?: Bharti Axa Life Hospi Cash Benefit RiderpradiphdasNo ratings yet

- ProHealth - Cash - Accordion - March2021 - V3 - V4Document8 pagesProHealth - Cash - Accordion - March2021 - V3 - V4hiteshmohakar15No ratings yet

- Group No. 2: Abhishek Das Indu Shekhar Mani Shukla Shaleen Agarwal Vikrant AroraDocument31 pagesGroup No. 2: Abhishek Das Indu Shekhar Mani Shukla Shaleen Agarwal Vikrant AroraIndu ShekharNo ratings yet

- Why Decreasing Term Life InsuranceDocument12 pagesWhy Decreasing Term Life InsurancepatelshreyasNo ratings yet

- Prubsn ProtectDocument19 pagesPrubsn ProtectYusof PrubsnNo ratings yet

- What Is A Term Insurance Plan? What Are The Key Features of A Term Insurance Plan?Document5 pagesWhat Is A Term Insurance Plan? What Are The Key Features of A Term Insurance Plan?akhileshwar KumarNo ratings yet

- Jeevan Anurag: Assured BenefitDocument10 pagesJeevan Anurag: Assured BenefitMandheer ChitnavisNo ratings yet

- Prosperity For LifeDocument8 pagesProsperity For LifeUsmAn MajeedNo ratings yet

- 2014-15 Ag-Pro Final New Hire Benefit BookletDocument20 pages2014-15 Ag-Pro Final New Hire Benefit BookletkellifitzgeraldNo ratings yet

- All You Wanted To Know About Pension Plans!: Share ThisDocument10 pagesAll You Wanted To Know About Pension Plans!: Share ThisAbhi SharmaNo ratings yet

- Retire - Smart - Brochure - Brand ReimagineDocument16 pagesRetire - Smart - Brochure - Brand Reimagineneop lopianNo ratings yet

- Brochure SUD Life Jeevan AshrayDocument6 pagesBrochure SUD Life Jeevan Ashrayayushman rajNo ratings yet

- Elite Secure Bond BrochureDocument7 pagesElite Secure Bond BrochureAbhishek RamNo ratings yet

- HDFC Life Super Income Plan SHAREDocument6 pagesHDFC Life Super Income Plan SHARESandeep MookerjeeNo ratings yet

- CignaTTK ProHealth Vs Max Bupa HeartBeatDocument9 pagesCignaTTK ProHealth Vs Max Bupa HeartBeatmaakabhawan26No ratings yet

- Blessings: For A Lifetime & BeyondDocument8 pagesBlessings: For A Lifetime & Beyondayushman rajNo ratings yet

- FAQ One Medical Takaful (Eng)Document6 pagesFAQ One Medical Takaful (Eng)Yiiuk Hong WangNo ratings yet

- Aia Retirement Saver IVDocument12 pagesAia Retirement Saver IVwhazisNo ratings yet

- CFG Reference GuideDocument38 pagesCFG Reference GuideStefan IonescuNo ratings yet

- SBI Life - Retire Smart - Brochure - Ver03Document16 pagesSBI Life - Retire Smart - Brochure - Ver03Vishal kaushalendra Kumar singhNo ratings yet

- MM AssignmentDocument16 pagesMM AssignmentRahul ParasharNo ratings yet

- 80D DeductionDocument6 pages80D DeductionsedunairNo ratings yet

- Super Five Plus Final One PagerDocument6 pagesSuper Five Plus Final One PagerAditya Singh0% (1)

- LIC Jeevan Anurag PDFDocument6 pagesLIC Jeevan Anurag PDFshyam_inkNo ratings yet

- Jubilee Smart Life Education PlanDocument7 pagesJubilee Smart Life Education PlanqasimhkNo ratings yet

- IPru Easy Retirement Leaflet PDFDocument6 pagesIPru Easy Retirement Leaflet PDFRameshNo ratings yet

- Help Your Child Today. To Become The Champ of Tomorrow.: Exide LifeDocument4 pagesHelp Your Child Today. To Become The Champ of Tomorrow.: Exide LifearulkumarNo ratings yet

- ManuCare Brochure (English)Document2 pagesManuCare Brochure (English)Phan Gia HuấnNo ratings yet

- ETLife Cashflow ProtectionDocument10 pagesETLife Cashflow Protectionnadhiya2007No ratings yet

- Key Features: Parameter DetailsDocument5 pagesKey Features: Parameter DetailsjannyrathodNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- Invitation-letter-for-SNHS-Mam EncinasDocument2 pagesInvitation-letter-for-SNHS-Mam EncinasWalyn NagaNo ratings yet

- BRIOSO and CELLS NuptialDocument3 pagesBRIOSO and CELLS NuptialWalyn NagaNo ratings yet

- ATD and LOA To Debit PremiumDocument2 pagesATD and LOA To Debit PremiumWalyn NagaNo ratings yet

- Red Cross September 11, 2009 Camarine Sur National High School ParticipantDocument2 pagesRed Cross September 11, 2009 Camarine Sur National High School ParticipantWalyn NagaNo ratings yet

- The Remnants of The Rechtsstaat An Ethnography of Nazi Law First Edition Edition Meierhenrich Full ChapterDocument67 pagesThe Remnants of The Rechtsstaat An Ethnography of Nazi Law First Edition Edition Meierhenrich Full Chapterrobert.prevatte420100% (7)

- Swaziland Press Freedom Annual Reviews 1997-2007 - IPIDocument20 pagesSwaziland Press Freedom Annual Reviews 1997-2007 - IPIRichard RooneyNo ratings yet

- SGC Documentation Report OrientationDocument7 pagesSGC Documentation Report OrientationDiane RmrNo ratings yet

- CGT Rollover Relief - July 2023Document3 pagesCGT Rollover Relief - July 2023maharajabby81No ratings yet

- L5X Montage S6 V1 Notion of Responsibility DEF-EnDocument3 pagesL5X Montage S6 V1 Notion of Responsibility DEF-EnKroše KrsticNo ratings yet

- Lesson 4: The Philippine ConstitutionsDocument8 pagesLesson 4: The Philippine ConstitutionsChristopher PotenciandoNo ratings yet

- Giga Texas Vs Envt Groups LetterDocument4 pagesGiga Texas Vs Envt Groups LetterSimon AlvarezNo ratings yet

- Theme 4Document9 pagesTheme 4Abhishek CharanNo ratings yet

- Hoffman v. Red Owl StoresDocument8 pagesHoffman v. Red Owl StoresICNo ratings yet

- Allah - Bux.soomro Apostle - Of.secular - Harmony Khadim - Soomro. (2006) .CsDocument205 pagesAllah - Bux.soomro Apostle - Of.secular - Harmony Khadim - Soomro. (2006) .CsAnonymous lviObMpprNo ratings yet

- Gebregeorgis v. Gonzales, 4th Cir. (2006)Document3 pagesGebregeorgis v. Gonzales, 4th Cir. (2006)Scribd Government DocsNo ratings yet

- July 2019 Mahithi Monthly MagazineDocument148 pagesJuly 2019 Mahithi Monthly MagazinejeevitharkgNo ratings yet

- Law 125 Syllabus PDFDocument5 pagesLaw 125 Syllabus PDFnhizza dawn DaligdigNo ratings yet

- Amazon Lockers in Chicago ParksDocument2 pagesAmazon Lockers in Chicago ParksMina BloomNo ratings yet

- International Business Assignment PDFDocument7 pagesInternational Business Assignment PDFAyesha RashidNo ratings yet

- Mart Susi's Internet Balancing FormulaDocument14 pagesMart Susi's Internet Balancing FormulaLoretoPazNo ratings yet

- Week 6 - HISTORICAL DEVELOPMENT OF PHILIPPINE DEMOCRATIC POLITICSDocument26 pagesWeek 6 - HISTORICAL DEVELOPMENT OF PHILIPPINE DEMOCRATIC POLITICSShen Eugenio100% (1)

- Benda (1966)Document18 pagesBenda (1966)Ma Antonetta Pilar SetiasNo ratings yet

- Guardianship - WA Enduring PowerDocument32 pagesGuardianship - WA Enduring PowerRobin CullenNo ratings yet

- CIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825Document2 pagesCIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825bestie bushNo ratings yet

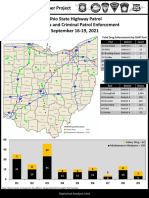

- The OSHP Breakdown of Ohio's Participation in The 6-State-Trooper-ProjectDocument1 pageThe OSHP Breakdown of Ohio's Participation in The 6-State-Trooper-ProjectNevin SmithNo ratings yet

- Jamaican Westminster System of GovernmentDocument77 pagesJamaican Westminster System of GovernmentKadane CoatesNo ratings yet

- Refugee Hearing Preparation: A Guide For Refugee ClaimantsDocument48 pagesRefugee Hearing Preparation: A Guide For Refugee Claimantsdcca calgaryNo ratings yet

- Edoardo TondangDocument15 pagesEdoardo TondangIntan RahayuNo ratings yet

- Nationalism in 19 Century Europe OF Rise THE AND Napoleon 8: UnitDocument20 pagesNationalism in 19 Century Europe OF Rise THE AND Napoleon 8: UnitPrince Jedi LucasNo ratings yet

- Criminal Justice Sequestration Sign-On Letter - 12-10-12 - Final With SignaturesDocument51 pagesCriminal Justice Sequestration Sign-On Letter - 12-10-12 - Final With SignaturesThe Vera Institute of JusticeNo ratings yet

- Maharashtra Acupuncture System Legal ReuqerimentsDocument18 pagesMaharashtra Acupuncture System Legal ReuqerimentsJesús VillegasNo ratings yet

- Philosophy and Science of Public Administration: MPA 621 CPSPA Graduate StudiesDocument248 pagesPhilosophy and Science of Public Administration: MPA 621 CPSPA Graduate StudiesMyreen L. GuzmanNo ratings yet

- Bank of Nova Scotia V GLT Corporation LTD Bank of Nova ScotiDocument6 pagesBank of Nova Scotia V GLT Corporation LTD Bank of Nova ScotiTyler ReneeNo ratings yet

Kaiser Benefits

Kaiser Benefits

Uploaded by

Walyn Naga0 ratings0% found this document useful (0 votes)

4 views3 pagesOriginal Title

KAISER BENEFITS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views3 pagesKaiser Benefits

Kaiser Benefits

Uploaded by

Walyn NagaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

NAME: RENZ RED REGAL

BIRTHDATE: SEPTEMBE 15, 1989

BENEFITS

Kaiser Plan

K-45

Contract Price

185,288

Payment Period

7 years

Contract Period

20 years

Age

32

Long-Term Care Benefit

At the end of 20 years, you will receive this amount, regardless of your utilization.

45,000

Term Insurance

You are insured for 20 years. If you die during the 20-year period, your beneficiary will receive this

amount. Php405,000 if the cause of death is accident.

202,500

Annual Benefit Limit

During the paying period, 1st year to 7th year, you have Php50,000 Annual Benefit Limit (ABL). During

the paying period, this is your in-patient benefit. You can avail this annual benefit if you need to be

confined in a hospital. I recommend you get short-term healthcare separate from this long-term

healthcare if you want to have a card that you can use for consultation/out-patient banefits.

50,000

Room & Board Benefit

Part of your in-patient benefit during the paying period (1st to 7th year).

600/day

* Annual Health Benefit

During the accumulation period, 8th year to 20th year, you have annual health benefit of Php4,500. If

unused, this annual benefit will accumulate with 10% interest per year.

4,500

* Total Annual Health Benefit

This refers to the total accumulated fund, Php4,500 per year plus 10% interest per year (8th year to 20th

year). Assuming you don’t use your health fund.

121,387

* Additional Health Benefits

During 8th to 20th year, on top of 10% interest on annual health benefit of Php4,500, your fund is

earning dividend ranging from 3% to 10% per year. This amount refers to pre-computed total dividends.

200,888

Total Health Benefit

367,276

Long-Term Care Bonus

If you don’t avail your in-patient benefits during paying period (1st to 7th year), you will receive bonus

on the 20th year. Bonus is 85% of total premium paid (Php185,288 x 85%)

157,500

Long-Term Care Benefit At Maturity Age

This refers to your total fund at the end of 20 years. You can withdraw this amount or retain with Kaiser.

You can retain the full amount or a portion of it. Amount you retain with Kaiser which could earn 10%

interest per year.

524,776

Long-Term Care Benefit at Age 60 (w/bonus)

Assuming you retain the P524,776 with Kaiser. This will become the total amount of your fund at age 60.

1,361,133

Annual Lifetime Health Care at Age 60 (w/bonus)

10% interest of your fund at age 60.

136,113

Long-Term Care Benefit at Age 65 (w/bonus)

Assuming you retain the P524,776 with Kaiser. This will become the total amount of your fund at age 65.

2,192,119

* Annual Lifetime Health Care at Age 65 (w/bonus)

10% interest of your fund at age 65.

219,212

Long-Term Care Benefit at Age 80 (w/bonus)

Assuming you retain the P524,776 with Kaiser. This will become the total amount of your fund at age 80.

9,157,024

* Annual Lifetime Health Care at Age 80 (w/bonus)

10% interest of your fund at age 80.

915,702

DISCLAIMER:

YEARLY HEALTH CARE HBL Actual increment may vary depending on prevailing market rates but

in no case less then 3% p.a. THE TOTAL YEARLY HEALTH CARE HBL is the accumulation of unused

YEARLY HEALTH CARE HBL.

The LONG TERM HEALTH CARE Experience Incentive HBL will be given upon maturity only, if the

member has no medical claim during the accumulation period other than Annual Physical Exam

and Dental Benefits.

Age 32 is used for the illustation for the EXTENDED BENEFIT BALANCE at ages 60 and 65. It is

also assumed that approximately 85% of the Total Membership Fee is the LONG-TERM HEALTH

CARE Experience Incentive HBL.

If floor is 6% there will be no additional YEARLY HEALTH CARE HBL.

Non-PHILHEALTH members will have to pay for the PHILHEALTH's covered expenses first before

KAISER.

The ROOM AND BOARD BENEFIT is covered only for the Accumulation Period. For the Extended

Period, your choice room and board budget will be charged to your YEARLY HEALTH CARE HBL.

For seven (7) year Payment, the annual policy is Php500 during the Accumulation Period and

Php3,500 for Spotcash.

Pre-existing Medical Conditions are not covered during the Accumulation Period.

For illustrative purposes only.

Version 1 of 2019. The Company reserves the exclusive right to change, update and revise prices

at any given time.

You might also like

- Prucash PremierDocument14 pagesPrucash PremierJaboh LabohNo ratings yet

- Basic Reinsurance Guide PDFDocument80 pagesBasic Reinsurance Guide PDFKandeel AfzalNo ratings yet

- Ultimate Kaiser Health BuilderDocument30 pagesUltimate Kaiser Health BuilderOmeng Tawid100% (7)

- Igain Iii - Investment Plan: FeaturesDocument8 pagesIgain Iii - Investment Plan: FeaturesShankar VasuNo ratings yet

- Lifelong BrochureDocument10 pagesLifelong BrochureSambaiahMallelaNo ratings yet

- Standardized Product: TrainingDocument44 pagesStandardized Product: TrainingHannington KondeNo ratings yet

- Smartkid RPDocument6 pagesSmartkid RPRajbir Singh YadavNo ratings yet

- KaiserDocument26 pagesKaiserPeriod Ampersand AsteriskNo ratings yet

- CignaTTK ProHealth Vs Star ComprehensiveDocument9 pagesCignaTTK ProHealth Vs Star Comprehensivemaakabhawan26No ratings yet

- SUN Fit and Well Advantage 20Document9 pagesSUN Fit and Well Advantage 20John Jefferson LegaspiNo ratings yet

- Takaful Health2Document34 pagesTakaful Health2yusofprubsnNo ratings yet

- 80C Deductions: LIC, PF, PPF EtcDocument6 pages80C Deductions: LIC, PF, PPF EtcMerwyn DsouzaNo ratings yet

- Kotak Surakshit JeevanDocument12 pagesKotak Surakshit JeevanHiten VajariyaNo ratings yet

- RNL Star BrochureDocument24 pagesRNL Star BrochureAnuj KumarNo ratings yet

- Fulfil The Smaller Joys in Life, Through Regular IncomeDocument8 pagesFulfil The Smaller Joys in Life, Through Regular IncomeSajeed ShaikhNo ratings yet

- Receive Payouts Once Every 5 YearsDocument6 pagesReceive Payouts Once Every 5 YearsSheetal IyerNo ratings yet

- 2024-2025 Resident and Fellow Salary Benefits Sheet FULL (1)Document37 pages2024-2025 Resident and Fellow Salary Benefits Sheet FULL (1)Brian HelbigNo ratings yet

- SBI Life - Saral Retirement Saver - BrochureDocument14 pagesSBI Life - Saral Retirement Saver - BrochureNitin KumarNo ratings yet

- SSGML Products Exclusive April 2012Document9 pagesSSGML Products Exclusive April 2012synergygroupNo ratings yet

- SSGML Products Exclusive April 2012Document9 pagesSSGML Products Exclusive April 2012synergygroupNo ratings yet

- Onby Pa Adp 133rd BatchDocument53 pagesOnby Pa Adp 133rd BatchSreemon P VNo ratings yet

- Notes About Finance in SGDocument7 pagesNotes About Finance in SGYeo JhNo ratings yet

- Kaiser LTC OverviewDocument12 pagesKaiser LTC OverviewLloyd Leonell LabsoNo ratings yet

- CignaTTK ProHealth Vs Religare CareDocument9 pagesCignaTTK ProHealth Vs Religare Caremaakabhawan26No ratings yet

- Name: Faisal SB Age: 43 Yrs: Endowment AssuranceDocument5 pagesName: Faisal SB Age: 43 Yrs: Endowment AssuranceTehniyat RizwanNo ratings yet

- Grow Your Wealth, Protect Your FutureDocument16 pagesGrow Your Wealth, Protect Your Futureamrisha_1No ratings yet

- AIA - Smart Wealth EDocument6 pagesAIA - Smart Wealth Ethagi.lkNo ratings yet

- PruCash Double Reward BrochureDocument31 pagesPruCash Double Reward BrochureDavid ChungNo ratings yet

- Kotak Assured Income PlanDocument9 pagesKotak Assured Income Plandinesh2u85No ratings yet

- Whodoirelyon When I Encounter Medical Emergencies?: Bharti Axa Life Hospi Cash Benefit RiderDocument18 pagesWhodoirelyon When I Encounter Medical Emergencies?: Bharti Axa Life Hospi Cash Benefit RiderpradiphdasNo ratings yet

- ProHealth - Cash - Accordion - March2021 - V3 - V4Document8 pagesProHealth - Cash - Accordion - March2021 - V3 - V4hiteshmohakar15No ratings yet

- Group No. 2: Abhishek Das Indu Shekhar Mani Shukla Shaleen Agarwal Vikrant AroraDocument31 pagesGroup No. 2: Abhishek Das Indu Shekhar Mani Shukla Shaleen Agarwal Vikrant AroraIndu ShekharNo ratings yet

- Why Decreasing Term Life InsuranceDocument12 pagesWhy Decreasing Term Life InsurancepatelshreyasNo ratings yet

- Prubsn ProtectDocument19 pagesPrubsn ProtectYusof PrubsnNo ratings yet

- What Is A Term Insurance Plan? What Are The Key Features of A Term Insurance Plan?Document5 pagesWhat Is A Term Insurance Plan? What Are The Key Features of A Term Insurance Plan?akhileshwar KumarNo ratings yet

- Jeevan Anurag: Assured BenefitDocument10 pagesJeevan Anurag: Assured BenefitMandheer ChitnavisNo ratings yet

- Prosperity For LifeDocument8 pagesProsperity For LifeUsmAn MajeedNo ratings yet

- 2014-15 Ag-Pro Final New Hire Benefit BookletDocument20 pages2014-15 Ag-Pro Final New Hire Benefit BookletkellifitzgeraldNo ratings yet

- All You Wanted To Know About Pension Plans!: Share ThisDocument10 pagesAll You Wanted To Know About Pension Plans!: Share ThisAbhi SharmaNo ratings yet

- Retire - Smart - Brochure - Brand ReimagineDocument16 pagesRetire - Smart - Brochure - Brand Reimagineneop lopianNo ratings yet

- Brochure SUD Life Jeevan AshrayDocument6 pagesBrochure SUD Life Jeevan Ashrayayushman rajNo ratings yet

- Elite Secure Bond BrochureDocument7 pagesElite Secure Bond BrochureAbhishek RamNo ratings yet

- HDFC Life Super Income Plan SHAREDocument6 pagesHDFC Life Super Income Plan SHARESandeep MookerjeeNo ratings yet

- CignaTTK ProHealth Vs Max Bupa HeartBeatDocument9 pagesCignaTTK ProHealth Vs Max Bupa HeartBeatmaakabhawan26No ratings yet

- Blessings: For A Lifetime & BeyondDocument8 pagesBlessings: For A Lifetime & Beyondayushman rajNo ratings yet

- FAQ One Medical Takaful (Eng)Document6 pagesFAQ One Medical Takaful (Eng)Yiiuk Hong WangNo ratings yet

- Aia Retirement Saver IVDocument12 pagesAia Retirement Saver IVwhazisNo ratings yet

- CFG Reference GuideDocument38 pagesCFG Reference GuideStefan IonescuNo ratings yet

- SBI Life - Retire Smart - Brochure - Ver03Document16 pagesSBI Life - Retire Smart - Brochure - Ver03Vishal kaushalendra Kumar singhNo ratings yet

- MM AssignmentDocument16 pagesMM AssignmentRahul ParasharNo ratings yet

- 80D DeductionDocument6 pages80D DeductionsedunairNo ratings yet

- Super Five Plus Final One PagerDocument6 pagesSuper Five Plus Final One PagerAditya Singh0% (1)

- LIC Jeevan Anurag PDFDocument6 pagesLIC Jeevan Anurag PDFshyam_inkNo ratings yet

- Jubilee Smart Life Education PlanDocument7 pagesJubilee Smart Life Education PlanqasimhkNo ratings yet

- IPru Easy Retirement Leaflet PDFDocument6 pagesIPru Easy Retirement Leaflet PDFRameshNo ratings yet

- Help Your Child Today. To Become The Champ of Tomorrow.: Exide LifeDocument4 pagesHelp Your Child Today. To Become The Champ of Tomorrow.: Exide LifearulkumarNo ratings yet

- ManuCare Brochure (English)Document2 pagesManuCare Brochure (English)Phan Gia HuấnNo ratings yet

- ETLife Cashflow ProtectionDocument10 pagesETLife Cashflow Protectionnadhiya2007No ratings yet

- Key Features: Parameter DetailsDocument5 pagesKey Features: Parameter DetailsjannyrathodNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- Invitation-letter-for-SNHS-Mam EncinasDocument2 pagesInvitation-letter-for-SNHS-Mam EncinasWalyn NagaNo ratings yet

- BRIOSO and CELLS NuptialDocument3 pagesBRIOSO and CELLS NuptialWalyn NagaNo ratings yet

- ATD and LOA To Debit PremiumDocument2 pagesATD and LOA To Debit PremiumWalyn NagaNo ratings yet

- Red Cross September 11, 2009 Camarine Sur National High School ParticipantDocument2 pagesRed Cross September 11, 2009 Camarine Sur National High School ParticipantWalyn NagaNo ratings yet

- The Remnants of The Rechtsstaat An Ethnography of Nazi Law First Edition Edition Meierhenrich Full ChapterDocument67 pagesThe Remnants of The Rechtsstaat An Ethnography of Nazi Law First Edition Edition Meierhenrich Full Chapterrobert.prevatte420100% (7)

- Swaziland Press Freedom Annual Reviews 1997-2007 - IPIDocument20 pagesSwaziland Press Freedom Annual Reviews 1997-2007 - IPIRichard RooneyNo ratings yet

- SGC Documentation Report OrientationDocument7 pagesSGC Documentation Report OrientationDiane RmrNo ratings yet

- CGT Rollover Relief - July 2023Document3 pagesCGT Rollover Relief - July 2023maharajabby81No ratings yet

- L5X Montage S6 V1 Notion of Responsibility DEF-EnDocument3 pagesL5X Montage S6 V1 Notion of Responsibility DEF-EnKroše KrsticNo ratings yet

- Lesson 4: The Philippine ConstitutionsDocument8 pagesLesson 4: The Philippine ConstitutionsChristopher PotenciandoNo ratings yet

- Giga Texas Vs Envt Groups LetterDocument4 pagesGiga Texas Vs Envt Groups LetterSimon AlvarezNo ratings yet

- Theme 4Document9 pagesTheme 4Abhishek CharanNo ratings yet

- Hoffman v. Red Owl StoresDocument8 pagesHoffman v. Red Owl StoresICNo ratings yet

- Allah - Bux.soomro Apostle - Of.secular - Harmony Khadim - Soomro. (2006) .CsDocument205 pagesAllah - Bux.soomro Apostle - Of.secular - Harmony Khadim - Soomro. (2006) .CsAnonymous lviObMpprNo ratings yet

- Gebregeorgis v. Gonzales, 4th Cir. (2006)Document3 pagesGebregeorgis v. Gonzales, 4th Cir. (2006)Scribd Government DocsNo ratings yet

- July 2019 Mahithi Monthly MagazineDocument148 pagesJuly 2019 Mahithi Monthly MagazinejeevitharkgNo ratings yet

- Law 125 Syllabus PDFDocument5 pagesLaw 125 Syllabus PDFnhizza dawn DaligdigNo ratings yet

- Amazon Lockers in Chicago ParksDocument2 pagesAmazon Lockers in Chicago ParksMina BloomNo ratings yet

- International Business Assignment PDFDocument7 pagesInternational Business Assignment PDFAyesha RashidNo ratings yet

- Mart Susi's Internet Balancing FormulaDocument14 pagesMart Susi's Internet Balancing FormulaLoretoPazNo ratings yet

- Week 6 - HISTORICAL DEVELOPMENT OF PHILIPPINE DEMOCRATIC POLITICSDocument26 pagesWeek 6 - HISTORICAL DEVELOPMENT OF PHILIPPINE DEMOCRATIC POLITICSShen Eugenio100% (1)

- Benda (1966)Document18 pagesBenda (1966)Ma Antonetta Pilar SetiasNo ratings yet

- Guardianship - WA Enduring PowerDocument32 pagesGuardianship - WA Enduring PowerRobin CullenNo ratings yet

- CIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825Document2 pagesCIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825bestie bushNo ratings yet

- The OSHP Breakdown of Ohio's Participation in The 6-State-Trooper-ProjectDocument1 pageThe OSHP Breakdown of Ohio's Participation in The 6-State-Trooper-ProjectNevin SmithNo ratings yet

- Jamaican Westminster System of GovernmentDocument77 pagesJamaican Westminster System of GovernmentKadane CoatesNo ratings yet

- Refugee Hearing Preparation: A Guide For Refugee ClaimantsDocument48 pagesRefugee Hearing Preparation: A Guide For Refugee Claimantsdcca calgaryNo ratings yet

- Edoardo TondangDocument15 pagesEdoardo TondangIntan RahayuNo ratings yet

- Nationalism in 19 Century Europe OF Rise THE AND Napoleon 8: UnitDocument20 pagesNationalism in 19 Century Europe OF Rise THE AND Napoleon 8: UnitPrince Jedi LucasNo ratings yet

- Criminal Justice Sequestration Sign-On Letter - 12-10-12 - Final With SignaturesDocument51 pagesCriminal Justice Sequestration Sign-On Letter - 12-10-12 - Final With SignaturesThe Vera Institute of JusticeNo ratings yet

- Maharashtra Acupuncture System Legal ReuqerimentsDocument18 pagesMaharashtra Acupuncture System Legal ReuqerimentsJesús VillegasNo ratings yet

- Philosophy and Science of Public Administration: MPA 621 CPSPA Graduate StudiesDocument248 pagesPhilosophy and Science of Public Administration: MPA 621 CPSPA Graduate StudiesMyreen L. GuzmanNo ratings yet

- Bank of Nova Scotia V GLT Corporation LTD Bank of Nova ScotiDocument6 pagesBank of Nova Scotia V GLT Corporation LTD Bank of Nova ScotiTyler ReneeNo ratings yet