Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsShort-Term Financing Reviewer

Short-Term Financing Reviewer

Uploaded by

SeleenaFinancial Management - Short-term Financing Reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- RSM230 Cheat SheetDocument2 pagesRSM230 Cheat Sheets_786886338No ratings yet

- Loan PricingDocument57 pagesLoan PricingSudhansuSekharNo ratings yet

- Module 2.2 - Fixed Income ValuationDocument10 pagesModule 2.2 - Fixed Income ValuationGerald RamiloNo ratings yet

- Mary Croft Spiritual Economics NowDocument22 pagesMary Croft Spiritual Economics NowZodiacal Horoscopos100% (4)

- Cost of CapitalDocument74 pagesCost of CapitalHarnitNo ratings yet

- 015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Document3 pages015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Zatsumono YamamotoNo ratings yet

- FakeDocument13 pagesFakePedroNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- Business FinanceDocument20 pagesBusiness Financegracella oktaviaNo ratings yet

- MidtermsDocument108 pagesMidtermsdumpyforhimNo ratings yet

- Financial Management 1 Sources of Short-Term FinancingDocument2 pagesFinancial Management 1 Sources of Short-Term FinancingJherryMigLazaroSevillaNo ratings yet

- Chapter 5 Short Term Long Term FinancingDocument40 pagesChapter 5 Short Term Long Term Financingshawal hamzahNo ratings yet

- Loan ReceivablesDocument4 pagesLoan ReceivablesEyra MercadejasNo ratings yet

- Short-Term FinancingDocument15 pagesShort-Term FinancingyukiNo ratings yet

- 2020 Level I OnDemandVideo SS14 R43 Module 2Document4 pages2020 Level I OnDemandVideo SS14 R43 Module 2Arturos lanNo ratings yet

- 8.sources of Short-Term FinancingDocument26 pages8.sources of Short-Term FinancingJohann BonillaNo ratings yet

- G7 Fund ManagementDocument43 pagesG7 Fund ManagementKim Andrea TupasNo ratings yet

- Unsecured Sources of Short Term Loans, Madronero, Lorainne AnneDocument13 pagesUnsecured Sources of Short Term Loans, Madronero, Lorainne AnneAldrin Jon Madamba, MAED-ELMNo ratings yet

- Short-Term Sources For FinancingDocument15 pagesShort-Term Sources For FinancingClaire Agnes MitraNo ratings yet

- Banking Awareness EbookDocument13 pagesBanking Awareness EbookPavan HebbarNo ratings yet

- Loans Receivable: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncDocument20 pagesLoans Receivable: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncShergie GozumNo ratings yet

- Effective Interest MethodDocument2 pagesEffective Interest MethodKurt Del RosarioNo ratings yet

- Reviewer in Business FinanceDocument3 pagesReviewer in Business FinancebaekhyunNo ratings yet

- Topic 8 Lecture PDFDocument24 pagesTopic 8 Lecture PDFAnastasiaNo ratings yet

- Capital Struchoices (Modified)Document16 pagesCapital Struchoices (Modified)mogibol791No ratings yet

- Credit Risk Analysis and InterpretationDocument46 pagesCredit Risk Analysis and InterpretationComennius YayoNo ratings yet

- Chapter19 - Financial Asset at Amortized CostDocument3 pagesChapter19 - Financial Asset at Amortized CostShai100% (1)

- Short Term FinancingDocument12 pagesShort Term FinancingNischal Jung0% (1)

- Business Finance ReviewerDocument6 pagesBusiness Finance ReviewerMarc Lawrence LagascaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Lesson 5 - Notes and Loans ReceivableDocument5 pagesLesson 5 - Notes and Loans ReceivableKatrina MarzanNo ratings yet

- Cost of CapitalDocument75 pagesCost of CapitalManisha SanghviNo ratings yet

- Damodaran On Cap StructureDocument145 pagesDamodaran On Cap Structuregioro_miNo ratings yet

- Loan PricingDocument46 pagesLoan PricingMaham Fatima100% (1)

- Receivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableDocument2 pagesReceivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableJonathan NavalloNo ratings yet

- CH 07 Account Receivables and Inventory MGTDocument61 pagesCH 07 Account Receivables and Inventory MGTElisabeth LoanaNo ratings yet

- Working Capital FinanceDocument5 pagesWorking Capital Financenainaniharshita03No ratings yet

- Intacc 1 Reviewer FinalsDocument13 pagesIntacc 1 Reviewer Finalscelynah.rheudeNo ratings yet

- Session. 2. Bank Profitability & ViabilityDocument23 pagesSession. 2. Bank Profitability & Viability7psnkjnx5hNo ratings yet

- Cost of Capital NotesDocument34 pagesCost of Capital Notesyahspal singhNo ratings yet

- Tema 5 SOURCES OF FINANCING FOR THE COMPANYDocument101 pagesTema 5 SOURCES OF FINANCING FOR THE COMPANYzulfakhri1108No ratings yet

- Chapter-4: Sources and Uses of Funds, Performance Evaluation and Bank FailureDocument16 pagesChapter-4: Sources and Uses of Funds, Performance Evaluation and Bank FailureEEL KfWBMZ2.1No ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- Short Term FinancingDocument15 pagesShort Term FinancingJoshua Cabinas100% (1)

- IFA Lesson 3 Slides (Financial Liabilities & Equity)Document53 pagesIFA Lesson 3 Slides (Financial Liabilities & Equity)zengruiqi20000302No ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument35 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global Editionpatrecia 1896No ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- Financial Management - Cost of CapitalDocument29 pagesFinancial Management - Cost of Capitalndim betaNo ratings yet

- Bonds Payable ReviewerDocument4 pagesBonds Payable ReviewerHazel TanongNo ratings yet

- Loans Receivable: Effective RateDocument2 pagesLoans Receivable: Effective RateJonathan NavalloNo ratings yet

- Sources of FinanceDocument10 pagesSources of FinanceHhh LlllNo ratings yet

- Fair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair ValueDocument6 pagesFair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair Valuedump acctNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document14 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- 13 Financial Asset at Amortized CostDocument5 pages13 Financial Asset at Amortized CostLara Jane Dela CruzNo ratings yet

- Chap10 - Student (Revised)Document15 pagesChap10 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- Two-Date Bank Reconciliation Receivables: Example Format OnlyDocument2 pagesTwo-Date Bank Reconciliation Receivables: Example Format Onlymagic costaNo ratings yet

- Chapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesDocument5 pagesChapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesKyleRhayneDiazCaliwagNo ratings yet

- Far 4104Document8 pagesFar 4104Alrahjie AnsariNo ratings yet

- Accounting ResearchDocument10 pagesAccounting ResearchDave AlereNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 7Document28 pagesFINANCE MANAGEMENT FIN420 CHP 7Yanty Ibrahim100% (3)

- READINGS 3 & 4 Business Finance - StudentsDocument4 pagesREADINGS 3 & 4 Business Finance - Studentswilhelmina romanNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Data Mining and Warehousing Quizzes Compilation - Answer KeyDocument5 pagesData Mining and Warehousing Quizzes Compilation - Answer KeySeleenaNo ratings yet

- Intermediate Accounting 1 - Cash and Cash Items SummaryDocument14 pagesIntermediate Accounting 1 - Cash and Cash Items SummarySeleenaNo ratings yet

- Related Paragraphs From CFAS and PAS 1Document6 pagesRelated Paragraphs From CFAS and PAS 1SeleenaNo ratings yet

- Securities and Regulations CodeDocument67 pagesSecurities and Regulations CodeSeleenaNo ratings yet

- Introduction To Cost AccountingDocument7 pagesIntroduction To Cost AccountingSeleenaNo ratings yet

- Investigating The Factors Affecting The Investment Decision in Residential DevelopmentDocument82 pagesInvestigating The Factors Affecting The Investment Decision in Residential DevelopmentSweetee DoolubNo ratings yet

- Certified Finance Specialist: Course BookDocument0 pagesCertified Finance Specialist: Course BookMayank K JainNo ratings yet

- NISMVAImportant QuestionsDocument396 pagesNISMVAImportant QuestionsKartheek Chandra100% (1)

- Case Study of The Gap, Inc.Document6 pagesCase Study of The Gap, Inc.nioriatti8924No ratings yet

- Risk Management Theory: A Comprehensive Empirical AssessmentDocument31 pagesRisk Management Theory: A Comprehensive Empirical AssessmentTki NeweNo ratings yet

- Dissolution of A Partnership FirmDocument11 pagesDissolution of A Partnership FirmRajeev Tekwani100% (1)

- WM Assessment of Ambuja CementDocument10 pagesWM Assessment of Ambuja CementAbhishek AgrawalNo ratings yet

- All Keys FIM 3Document194 pagesAll Keys FIM 3Hoang Hieu LyNo ratings yet

- Homework 3: Problem 1Document9 pagesHomework 3: Problem 1david AbotsitseNo ratings yet

- Credit Management of Agrani Bank LimitedDocument52 pagesCredit Management of Agrani Bank Limitedorda55555100% (7)

- 08a Slides - LBO and FinancingDocument68 pages08a Slides - LBO and FinancingValentinNo ratings yet

- Investment Module 4Document6 pagesInvestment Module 4miyanoharuka25No ratings yet

- Liquor Industry Risk Control MatrixDocument42 pagesLiquor Industry Risk Control MatrixAnupam BaliNo ratings yet

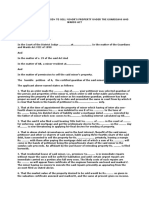

- Petition For Permission To Sell Minor's Property Under The Guardians and Wards Act - 1Document2 pagesPetition For Permission To Sell Minor's Property Under The Guardians and Wards Act - 1DHUP CHAND JAISWAL100% (5)

- Mgt-9 Extract of Annual ReturnDocument10 pagesMgt-9 Extract of Annual ReturnAnonymous zvVGv6No ratings yet

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020Document48 pagesCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020MohitNo ratings yet

- Ijsser 05 75Document65 pagesIjsser 05 75Ayoniseh CarolNo ratings yet

- Credit Rating: Fees Structure FEE Structure Initial Rating FeesDocument6 pagesCredit Rating: Fees Structure FEE Structure Initial Rating FeesWindowFashionNo ratings yet

- Celsius - Whitepaper March14 2Document38 pagesCelsius - Whitepaper March14 2Wid NetNo ratings yet

- Case Study: Financial Management of PTT After PrivatizationDocument4 pagesCase Study: Financial Management of PTT After PrivatizationGrand OverallNo ratings yet

- Assignment QuestionDocument3 pagesAssignment QuestionMohd Tajudin DiniNo ratings yet

- Ch04 P35 Build A ModelDocument17 pagesCh04 P35 Build A ModelAbhishek Surana100% (2)

- Ch. 15 Capital StructureDocument69 pagesCh. 15 Capital StructureScorpian MouniehNo ratings yet

- Cash Priority Program Acctg For Special Transactions ReportDocument11 pagesCash Priority Program Acctg For Special Transactions ReportCJ GranadaNo ratings yet

- Financial Management 3RD Degree AcctnDocument154 pagesFinancial Management 3RD Degree Acctnprimhaile assefaNo ratings yet

- Explaining Growth and Consolidation in RP Microfinance InstitutionsDocument70 pagesExplaining Growth and Consolidation in RP Microfinance InstitutionsJovi DacanayNo ratings yet

- Chua Guan Vs MagsasakaDocument2 pagesChua Guan Vs MagsasakaGeorge HabaconNo ratings yet

Short-Term Financing Reviewer

Short-Term Financing Reviewer

Uploaded by

Seleena0 ratings0% found this document useful (0 votes)

4 views3 pagesFinancial Management - Short-term Financing Reviewer

Original Title

Short-term Financing Reviewer

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial Management - Short-term Financing Reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views3 pagesShort-Term Financing Reviewer

Short-Term Financing Reviewer

Uploaded by

SeleenaFinancial Management - Short-term Financing Reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Seleena Lancee

05 SHORT-TERM

FINANCING

SHORT-TERM FINANCING Financing costs depends on the source of

The financing of a business from short-term financing. It usually includes interest

sources for a period of one year or less and payments, origination fees paid by borrower,

it assists the company in generating cash amortization of discount, etc.

for working capital and operating expenses

which are typically for a smaller amount. Net proceeds depends if the loan is

discounted or with compensating balance

Generating cash through online loans, requirement.

lines of credit, and invoice financing.

CLASSIFICATIONS OF SHORT-TERM FINANCING

COST OF SHORT-TERM FINANCING 1. SECURED SOURCES S-UNS

INTEREST Requires collateral

Financing cost from borrowed funds Receivable Financing

Inventory Financing

INTEREST RATE 2. UNSECURED

Indicate this cost or return as a Requires NO collateral

percentage of the amount you are Trade credit or spontaneous sources

borrowing. of financing

Commercial bank loan

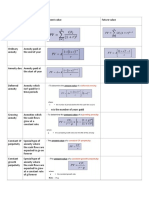

TYPES OF INTEREST RATE N-E-R Revolving Credit Agreement vs.

1. NOMINAL INTEREST RATE Credit Line

Basis of cash payments on borrowings Cost of Installment Loans

A.K.A. Stated Rate Commercial paper

2. EFFECTIVE INTEREST RATE UNSECURED SOURCES T-B-P

Basis of determining the interest expense 1. Trade Credit /Spontaneous Sources of

on borrowings Financing

AK.A. Discount Rate Financing that arises from the normal

course of business

3. REAL INTEREST RATE

Takes inflation into account unlike TRADE CREDIT

nominal rate

Trade Credit =

NOMINAL INTEREST RATE

%D 360 or 365 days

x

Nominal Interest Rate 100% - % D CP- % D

= (Interest/Principal) x Time

Where:

EFFECTIVE INTEREST RATE % D = Percentage Discount

Effective Interest Rate CP = Credit Period

= (Financing Cost/Net Proceeds) x

2. Commercial Bank Loans

(365/Credit Period)

Banks are major source of unsecured

REAL INTEREST RATE short-term loans to businesses.

Real Interest Rate P

= Nominal Rate - Inflation Factor

R T

ACT1124 | FInancial Management

Seleena Lancee

05 SHORT-TERM

FINANCING

2. Commercial Bank Loans COMMERCIAL BANK LOAN R - C

Banks are major source of unsecured 1. Revolving Credit Agreement

short-term loans to businesses. The lender sets aside funds that the

borrower can use at his discretion.

COST OF TERM LOAN/EIR

Borrowed portion - interest

Unborrowed portion - commitment

Cost of Term Loan/EIR =

fee

Interest Days in the Year

x 2. Credit Line

P - I - CB Days outstanding a one-time arrangement, and when the

credit line is paid off, the account is

Where: closed.

P = Principal

I = Interest PRIME RATE

CB = Compensating Balance The lowest rate of interest at which money

may be borrowed commercially.

*Only deduct the interest on the

COST OF INSTALLMENT LOANS

denominator if it is discounted (interest is

The borrowed amount is paid in equal

deducted in advance)

installments with interest.

PRINCIPAL/AMOUNT TO BE BORROWED

EFFECTIVE INTEREST ON INSTALLMENT LOAN

Principal/Amount to be borrowed =

Effective Interest on Installment =

Amount Needed 2 x No. of installments x Interest

( 1 - CB% - Interest% ) (1 + No. of installments) x Principal

Where:

Net Proceeds in Peso Monthly - 12

Quarterly - 4

Net proceeds in % Semi-annual - 2

Annual - 1

100% Principal COST OF COMMERCIAL PAPER

18% Interest A form of financing that consists of short-

15% Compensating Balance term, unsecured promissory notes issued by

67% Net Proceeds firms with a high credit standing.

Often non-interest bearing and are sold at a

discount.

D CB

COST OF COMMERCIAL PAPER

A Cost of commercial paper =

B D + FLC 360 or 365 days

x

C IP - FC CP - DP

ACT1124 | FInancial Management

Seleena Lancee

05 SHORT-TERM

FINANCING

Where: SECURED SOURCES

FLC = Flotation Cost 1. Revolving Credit Agreement

IP = Issue Price The lender sets aside funds that the

CP = Credit Period borrower can use at his discretion.

DP = Discount Period Borrowed portion - interest

Unborrowed portion - commitment

UNSECURED SOURCES SUMMARY

fee

Numerator > Financing Cost FC

2. Credit Line

Denominator > Net Proceeds NP

a one-time arrangement, and when the

credit line is paid off, the account is

The Lower the financing cost, the better.

closed.

SECURED SOURCES

PRIME RATE

1. Receivable Financing

The lowest rate of interest at which money

may be borrowed commercially.

PLEDGING ACCOUNTS RECEIVABLE

Occurs when a business uses its AR asset as COST OF INSTALLMENT LOANS

collateral on a loan, usually a line of credit. The borrowed amount is paid in equal

Under a pledging arrangement, the installments with interest.

company retains title to and is responsible

for collecting accounts receivable, not the EFFECTIVE INTEREST ON INSTALLMENT LOAN

lender.

Effective Interest on Installment =

COST OF PLEDGING OF RECEIVABLES 2 x No. of installments x Interest

Cost of commercial paper = (1 + No. of installments) x Principal

FNC 360 or 365 days Where:

x

Monthly - 12

NP CP

Quarterly - 4

*Same with commercial loans. Semi-annual - 2

Where: Annual - 1

FNC = Financing Cost COST OF COMMERCIAL PAPER

NP = Net Proceeds

A form of financing that consists of short-

CP = Credit Period

term, unsecured promissory notes issued by

2. Inventory Financing firms with a high credit standing.

Inventory financing is credit obtained by Often non-interest bearing and are sold at a

businesses to pay upfront for products that discount.

will not be sold immediately. The loan is COST OF COMMERCIAL PAPER

collateralized by the inventory it is used to

Cost of commercial paper =

purchase.

D + FC 360 or 365 days

x

IP - FC CP - DP

ACT1124 | FInancial Management

You might also like

- RSM230 Cheat SheetDocument2 pagesRSM230 Cheat Sheets_786886338No ratings yet

- Loan PricingDocument57 pagesLoan PricingSudhansuSekharNo ratings yet

- Module 2.2 - Fixed Income ValuationDocument10 pagesModule 2.2 - Fixed Income ValuationGerald RamiloNo ratings yet

- Mary Croft Spiritual Economics NowDocument22 pagesMary Croft Spiritual Economics NowZodiacal Horoscopos100% (4)

- Cost of CapitalDocument74 pagesCost of CapitalHarnitNo ratings yet

- 015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Document3 pages015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Zatsumono YamamotoNo ratings yet

- FakeDocument13 pagesFakePedroNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- Business FinanceDocument20 pagesBusiness Financegracella oktaviaNo ratings yet

- MidtermsDocument108 pagesMidtermsdumpyforhimNo ratings yet

- Financial Management 1 Sources of Short-Term FinancingDocument2 pagesFinancial Management 1 Sources of Short-Term FinancingJherryMigLazaroSevillaNo ratings yet

- Chapter 5 Short Term Long Term FinancingDocument40 pagesChapter 5 Short Term Long Term Financingshawal hamzahNo ratings yet

- Loan ReceivablesDocument4 pagesLoan ReceivablesEyra MercadejasNo ratings yet

- Short-Term FinancingDocument15 pagesShort-Term FinancingyukiNo ratings yet

- 2020 Level I OnDemandVideo SS14 R43 Module 2Document4 pages2020 Level I OnDemandVideo SS14 R43 Module 2Arturos lanNo ratings yet

- 8.sources of Short-Term FinancingDocument26 pages8.sources of Short-Term FinancingJohann BonillaNo ratings yet

- G7 Fund ManagementDocument43 pagesG7 Fund ManagementKim Andrea TupasNo ratings yet

- Unsecured Sources of Short Term Loans, Madronero, Lorainne AnneDocument13 pagesUnsecured Sources of Short Term Loans, Madronero, Lorainne AnneAldrin Jon Madamba, MAED-ELMNo ratings yet

- Short-Term Sources For FinancingDocument15 pagesShort-Term Sources For FinancingClaire Agnes MitraNo ratings yet

- Banking Awareness EbookDocument13 pagesBanking Awareness EbookPavan HebbarNo ratings yet

- Loans Receivable: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncDocument20 pagesLoans Receivable: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncShergie GozumNo ratings yet

- Effective Interest MethodDocument2 pagesEffective Interest MethodKurt Del RosarioNo ratings yet

- Reviewer in Business FinanceDocument3 pagesReviewer in Business FinancebaekhyunNo ratings yet

- Topic 8 Lecture PDFDocument24 pagesTopic 8 Lecture PDFAnastasiaNo ratings yet

- Capital Struchoices (Modified)Document16 pagesCapital Struchoices (Modified)mogibol791No ratings yet

- Credit Risk Analysis and InterpretationDocument46 pagesCredit Risk Analysis and InterpretationComennius YayoNo ratings yet

- Chapter19 - Financial Asset at Amortized CostDocument3 pagesChapter19 - Financial Asset at Amortized CostShai100% (1)

- Short Term FinancingDocument12 pagesShort Term FinancingNischal Jung0% (1)

- Business Finance ReviewerDocument6 pagesBusiness Finance ReviewerMarc Lawrence LagascaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Lesson 5 - Notes and Loans ReceivableDocument5 pagesLesson 5 - Notes and Loans ReceivableKatrina MarzanNo ratings yet

- Cost of CapitalDocument75 pagesCost of CapitalManisha SanghviNo ratings yet

- Damodaran On Cap StructureDocument145 pagesDamodaran On Cap Structuregioro_miNo ratings yet

- Loan PricingDocument46 pagesLoan PricingMaham Fatima100% (1)

- Receivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableDocument2 pagesReceivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableJonathan NavalloNo ratings yet

- CH 07 Account Receivables and Inventory MGTDocument61 pagesCH 07 Account Receivables and Inventory MGTElisabeth LoanaNo ratings yet

- Working Capital FinanceDocument5 pagesWorking Capital Financenainaniharshita03No ratings yet

- Intacc 1 Reviewer FinalsDocument13 pagesIntacc 1 Reviewer Finalscelynah.rheudeNo ratings yet

- Session. 2. Bank Profitability & ViabilityDocument23 pagesSession. 2. Bank Profitability & Viability7psnkjnx5hNo ratings yet

- Cost of Capital NotesDocument34 pagesCost of Capital Notesyahspal singhNo ratings yet

- Tema 5 SOURCES OF FINANCING FOR THE COMPANYDocument101 pagesTema 5 SOURCES OF FINANCING FOR THE COMPANYzulfakhri1108No ratings yet

- Chapter-4: Sources and Uses of Funds, Performance Evaluation and Bank FailureDocument16 pagesChapter-4: Sources and Uses of Funds, Performance Evaluation and Bank FailureEEL KfWBMZ2.1No ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- Short Term FinancingDocument15 pagesShort Term FinancingJoshua Cabinas100% (1)

- IFA Lesson 3 Slides (Financial Liabilities & Equity)Document53 pagesIFA Lesson 3 Slides (Financial Liabilities & Equity)zengruiqi20000302No ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument35 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global Editionpatrecia 1896No ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- Financial Management - Cost of CapitalDocument29 pagesFinancial Management - Cost of Capitalndim betaNo ratings yet

- Bonds Payable ReviewerDocument4 pagesBonds Payable ReviewerHazel TanongNo ratings yet

- Loans Receivable: Effective RateDocument2 pagesLoans Receivable: Effective RateJonathan NavalloNo ratings yet

- Sources of FinanceDocument10 pagesSources of FinanceHhh LlllNo ratings yet

- Fair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair ValueDocument6 pagesFair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair Valuedump acctNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document14 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- 13 Financial Asset at Amortized CostDocument5 pages13 Financial Asset at Amortized CostLara Jane Dela CruzNo ratings yet

- Chap10 - Student (Revised)Document15 pagesChap10 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- Two-Date Bank Reconciliation Receivables: Example Format OnlyDocument2 pagesTwo-Date Bank Reconciliation Receivables: Example Format Onlymagic costaNo ratings yet

- Chapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesDocument5 pagesChapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesKyleRhayneDiazCaliwagNo ratings yet

- Far 4104Document8 pagesFar 4104Alrahjie AnsariNo ratings yet

- Accounting ResearchDocument10 pagesAccounting ResearchDave AlereNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 7Document28 pagesFINANCE MANAGEMENT FIN420 CHP 7Yanty Ibrahim100% (3)

- READINGS 3 & 4 Business Finance - StudentsDocument4 pagesREADINGS 3 & 4 Business Finance - Studentswilhelmina romanNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Data Mining and Warehousing Quizzes Compilation - Answer KeyDocument5 pagesData Mining and Warehousing Quizzes Compilation - Answer KeySeleenaNo ratings yet

- Intermediate Accounting 1 - Cash and Cash Items SummaryDocument14 pagesIntermediate Accounting 1 - Cash and Cash Items SummarySeleenaNo ratings yet

- Related Paragraphs From CFAS and PAS 1Document6 pagesRelated Paragraphs From CFAS and PAS 1SeleenaNo ratings yet

- Securities and Regulations CodeDocument67 pagesSecurities and Regulations CodeSeleenaNo ratings yet

- Introduction To Cost AccountingDocument7 pagesIntroduction To Cost AccountingSeleenaNo ratings yet

- Investigating The Factors Affecting The Investment Decision in Residential DevelopmentDocument82 pagesInvestigating The Factors Affecting The Investment Decision in Residential DevelopmentSweetee DoolubNo ratings yet

- Certified Finance Specialist: Course BookDocument0 pagesCertified Finance Specialist: Course BookMayank K JainNo ratings yet

- NISMVAImportant QuestionsDocument396 pagesNISMVAImportant QuestionsKartheek Chandra100% (1)

- Case Study of The Gap, Inc.Document6 pagesCase Study of The Gap, Inc.nioriatti8924No ratings yet

- Risk Management Theory: A Comprehensive Empirical AssessmentDocument31 pagesRisk Management Theory: A Comprehensive Empirical AssessmentTki NeweNo ratings yet

- Dissolution of A Partnership FirmDocument11 pagesDissolution of A Partnership FirmRajeev Tekwani100% (1)

- WM Assessment of Ambuja CementDocument10 pagesWM Assessment of Ambuja CementAbhishek AgrawalNo ratings yet

- All Keys FIM 3Document194 pagesAll Keys FIM 3Hoang Hieu LyNo ratings yet

- Homework 3: Problem 1Document9 pagesHomework 3: Problem 1david AbotsitseNo ratings yet

- Credit Management of Agrani Bank LimitedDocument52 pagesCredit Management of Agrani Bank Limitedorda55555100% (7)

- 08a Slides - LBO and FinancingDocument68 pages08a Slides - LBO and FinancingValentinNo ratings yet

- Investment Module 4Document6 pagesInvestment Module 4miyanoharuka25No ratings yet

- Liquor Industry Risk Control MatrixDocument42 pagesLiquor Industry Risk Control MatrixAnupam BaliNo ratings yet

- Petition For Permission To Sell Minor's Property Under The Guardians and Wards Act - 1Document2 pagesPetition For Permission To Sell Minor's Property Under The Guardians and Wards Act - 1DHUP CHAND JAISWAL100% (5)

- Mgt-9 Extract of Annual ReturnDocument10 pagesMgt-9 Extract of Annual ReturnAnonymous zvVGv6No ratings yet

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020Document48 pagesCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020MohitNo ratings yet

- Ijsser 05 75Document65 pagesIjsser 05 75Ayoniseh CarolNo ratings yet

- Credit Rating: Fees Structure FEE Structure Initial Rating FeesDocument6 pagesCredit Rating: Fees Structure FEE Structure Initial Rating FeesWindowFashionNo ratings yet

- Celsius - Whitepaper March14 2Document38 pagesCelsius - Whitepaper March14 2Wid NetNo ratings yet

- Case Study: Financial Management of PTT After PrivatizationDocument4 pagesCase Study: Financial Management of PTT After PrivatizationGrand OverallNo ratings yet

- Assignment QuestionDocument3 pagesAssignment QuestionMohd Tajudin DiniNo ratings yet

- Ch04 P35 Build A ModelDocument17 pagesCh04 P35 Build A ModelAbhishek Surana100% (2)

- Ch. 15 Capital StructureDocument69 pagesCh. 15 Capital StructureScorpian MouniehNo ratings yet

- Cash Priority Program Acctg For Special Transactions ReportDocument11 pagesCash Priority Program Acctg For Special Transactions ReportCJ GranadaNo ratings yet

- Financial Management 3RD Degree AcctnDocument154 pagesFinancial Management 3RD Degree Acctnprimhaile assefaNo ratings yet

- Explaining Growth and Consolidation in RP Microfinance InstitutionsDocument70 pagesExplaining Growth and Consolidation in RP Microfinance InstitutionsJovi DacanayNo ratings yet

- Chua Guan Vs MagsasakaDocument2 pagesChua Guan Vs MagsasakaGeorge HabaconNo ratings yet