Professional Documents

Culture Documents

Null 9

Null 9

Uploaded by

Nitesh GargCopyright:

Available Formats

You might also like

- Beyond Countless Doorways - A Planar SourcebookDocument226 pagesBeyond Countless Doorways - A Planar SourcebookPilotgod123100% (8)

- Tax BuletinDocument40 pagesTax BuletinBHASKAR MOHAPATRANo ratings yet

- Salman Beg Project Report On TaxDocument81 pagesSalman Beg Project Report On TaxAnonymous OqKK1jQi3No ratings yet

- Tax Bulletin 143Document48 pagesTax Bulletin 143deepakasopaNo ratings yet

- Handbook of Profession Tax E-ServicesDocument55 pagesHandbook of Profession Tax E-ServicesRajendra D AdsulNo ratings yet

- GSTproject2 DDocument47 pagesGSTproject2 DKhanjan SiddhpuraNo ratings yet

- Faceless Assessment GNDocument51 pagesFaceless Assessment GNP Mathavan RajkumarNo ratings yet

- Bulletin: The Institute of Cost Accountants of IndiaDocument68 pagesBulletin: The Institute of Cost Accountants of IndiaSrinivasa RaoNo ratings yet

- Sibani Internship ProjectDocument41 pagesSibani Internship Projectamitratha77No ratings yet

- Don't Miss The Bus - Sabka Vishwas Scheme A Unique Opportunity For Businesses To Clean Tax Slate - The Financial ExpressDocument3 pagesDon't Miss The Bus - Sabka Vishwas Scheme A Unique Opportunity For Businesses To Clean Tax Slate - The Financial ExpressAditya KumarNo ratings yet

- GST Registration ProcessDocument11 pagesGST Registration ProcessSalil BoranaNo ratings yet

- Final Black Book ProjectDocument53 pagesFinal Black Book ProjectHamzah ShaikhNo ratings yet

- Tax BulletinDocument60 pagesTax BulletinharishNo ratings yet

- How To Register For GST OnlineDocument11 pagesHow To Register For GST Onlinerishank52No ratings yet

- E-Filing of Income Tax and GST-1Document67 pagesE-Filing of Income Tax and GST-1omkarshinde.7743No ratings yet

- Idt AacDocument177 pagesIdt AacVinay KumarNo ratings yet

- Madam,: of CentralDocument4 pagesMadam,: of CentralMohammad MehdiNo ratings yet

- Faceless AssessmentDocument61 pagesFaceless AssessmentRa VanaNo ratings yet

- Bulletin: The Institute of Cost Accountants of IndiaDocument44 pagesBulletin: The Institute of Cost Accountants of IndiaABC 123No ratings yet

- SWAPNIL PROJECT MBA Final Xerox 2121Document60 pagesSWAPNIL PROJECT MBA Final Xerox 2121sadhana karapeNo ratings yet

- Kaiynat 3rd Semester Project-1Document54 pagesKaiynat 3rd Semester Project-1amanrizvi3125No ratings yet

- Pradeep Koranga ProjectinternDocument58 pagesPradeep Koranga ProjectinternMayank Singh KarkiNo ratings yet

- Risk ManagementDocument23 pagesRisk Managementaadarshshaw2345671890No ratings yet

- Amit Internship ProjectDocument45 pagesAmit Internship Projectamitratha77No ratings yet

- Internship Report On E-1Document113 pagesInternship Report On E-1YOGESH KUMARNo ratings yet

- Internship Report of Sonali YadavDocument62 pagesInternship Report of Sonali Yadavsonali YadavNo ratings yet

- GST Invoice Details I Essential InformationDocument7 pagesGST Invoice Details I Essential InformationShaik MastanvaliNo ratings yet

- Taxation Sec B May 2024 1703584499Document8 pagesTaxation Sec B May 2024 1703584499abhishekkapse654No ratings yet

- Chapter 1 - Introduction To GST: Applicability of Utgst ActDocument7 pagesChapter 1 - Introduction To GST: Applicability of Utgst ActSoul of honeyNo ratings yet

- Caef Aditya SonkarDocument41 pagesCaef Aditya Sonkarmessisingh1706No ratings yet

- Income TaxDocument48 pagesIncome Tax044Lohar Veena GUNI VMPIMNo ratings yet

- Project Work Notice - Sem 6Document3 pagesProject Work Notice - Sem 6Mintu MondalNo ratings yet

- S T S B: Internship ReportDocument47 pagesS T S B: Internship ReportJayedNo ratings yet

- Final Report Kunvardeep SinghDocument59 pagesFinal Report Kunvardeep SinghKunvar MattewalNo ratings yet

- Project On Goods & Service TaxDocument26 pagesProject On Goods & Service TaxRiddhi SoniNo ratings yet

- Caef Anubhav MishraDocument41 pagesCaef Anubhav Mishramessisingh1706No ratings yet

- BreakingNews FMSpeech 05312010Document6 pagesBreakingNews FMSpeech 05312010Abhisshek GautamNo ratings yet

- B Tax & VAT MGT PDFDocument2 pagesB Tax & VAT MGT PDFmayan_treasure9625No ratings yet

- E-Invoicing FAQs - Frequently Asked QuestionsDocument14 pagesE-Invoicing FAQs - Frequently Asked QuestionsAman JainNo ratings yet

- Maharashtra National Law University, Aurangabad: Law of Taxation-Income Tax ProjectDocument15 pagesMaharashtra National Law University, Aurangabad: Law of Taxation-Income Tax ProjectSoumiki GhoshNo ratings yet

- GST 7th Edition With CorrectionsDocument512 pagesGST 7th Edition With CorrectionsMemeswale BhaiyaaaNo ratings yet

- E-Filingofincome Taxreturns in India - Anoverview Suman GhoshDocument10 pagesE-Filingofincome Taxreturns in India - Anoverview Suman GhoshSuman GhoshNo ratings yet

- Step-By-step Guide To File Your Income Tax Return Online - Economic TimesDocument3 pagesStep-By-step Guide To File Your Income Tax Return Online - Economic TimesBiswa Prakash NayakNo ratings yet

- Form GSTR 9 9CDocument212 pagesForm GSTR 9 9Cwareva7754No ratings yet

- GST 9th Edition BookDocument542 pagesGST 9th Edition BookLalli DeviNo ratings yet

- Goods and Services Tax Refund Tutorial PDFDocument27 pagesGoods and Services Tax Refund Tutorial PDFMOHANNo ratings yet

- Tax Bulletin 94Document48 pagesTax Bulletin 94umasankarNo ratings yet

- Guidance Note On Annual Return of GSTDocument124 pagesGuidance Note On Annual Return of GSTABC 123No ratings yet

- E InvoicingDocument20 pagesE Invoicingpawan dhokaNo ratings yet

- Chapter - 10Document21 pagesChapter - 10Hritika GuptaNo ratings yet

- Ca Education: 8 EditionDocument478 pagesCa Education: 8 Editionankit singhNo ratings yet

- All About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDocument4 pagesAll About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDINESH CHANCHALANINo ratings yet

- A Project Report ON "Financial Accounting & Taxation"Document56 pagesA Project Report ON "Financial Accounting & Taxation"MayankRohillaNo ratings yet

- Tax Bulletin 34 PDFDocument56 pagesTax Bulletin 34 PDFCma Karan BaggaNo ratings yet

- GST ProjectDocument42 pagesGST ProjectAyush ModiNo ratings yet

- GSTR-3B Filing On GST Portal - Step by Step Return Filing ProcedureDocument26 pagesGSTR-3B Filing On GST Portal - Step by Step Return Filing ProcedureCA Naveen Kumar BalanNo ratings yet

- Bulletin: The Institute of Cost Accountants of IndiaDocument40 pagesBulletin: The Institute of Cost Accountants of IndiaABC 123No ratings yet

- Factsheet For Commercial Tax Services-1Document6 pagesFactsheet For Commercial Tax Services-1bullNo ratings yet

- Bulletin: The Institute of Cost Accountants of IndiaDocument40 pagesBulletin: The Institute of Cost Accountants of IndiaABC 123No ratings yet

- Tax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorFrom EverandTax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorNo ratings yet

- Colleen M. Nutter v. Kansas State University, and Its Representatives, Lou Ann Smith, Judith E. Banks, 930 F.2d 34, 10th Cir. (1991)Document3 pagesColleen M. Nutter v. Kansas State University, and Its Representatives, Lou Ann Smith, Judith E. Banks, 930 F.2d 34, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- China As A Rising Global PowerDocument11 pagesChina As A Rising Global PoweranggrainytreeseptianNo ratings yet

- Keerthi Question BankDocument65 pagesKeerthi Question BankKeerthanaNo ratings yet

- Vitamin B2Document10 pagesVitamin B2Rida IshaqNo ratings yet

- Application of Value Analysis and Value Engineering For Cost Reduction of Global Pumping UnitDocument8 pagesApplication of Value Analysis and Value Engineering For Cost Reduction of Global Pumping UnitVINOD PAKHARENo ratings yet

- FEAPA Guidelines EnglischDocument4 pagesFEAPA Guidelines EnglischMarta MoreiraNo ratings yet

- 2016 Closing The Gap ReportDocument64 pages2016 Closing The Gap ReportAllan ClarkeNo ratings yet

- Arch AddDocument96 pagesArch AddDeepak RDNo ratings yet

- Bahasa Inggris Ganjil Kelas X ABCDocument12 pagesBahasa Inggris Ganjil Kelas X ABCNazwarNo ratings yet

- Pcol MnemonicsDocument12 pagesPcol MnemonicsJustine Rubillete Mendoza MarianoNo ratings yet

- De Los Santos II v. BarbosaDocument8 pagesDe Los Santos II v. BarbosaApril IsidroNo ratings yet

- Multilocularis) - The Oncosphere Develops Into A Multi-ChamberedDocument2 pagesMultilocularis) - The Oncosphere Develops Into A Multi-Chamberedzoology qauNo ratings yet

- Viktoria Saat FPDocument41 pagesViktoria Saat FPdidacbrNo ratings yet

- BPI v. CBP, G.R. No. 197593, October 12, 2020Document9 pagesBPI v. CBP, G.R. No. 197593, October 12, 2020Reynald CruzNo ratings yet

- Open The Book-Bible Quiz ChildrenDocument4 pagesOpen The Book-Bible Quiz ChildrenradhikaNo ratings yet

- 2021 MATHCOUNTS National Competition Results Answer Booklet 1Document24 pages2021 MATHCOUNTS National Competition Results Answer Booklet 1ChainLinkNo ratings yet

- GraduatingresumeDocument3 pagesGraduatingresumeapi-277434369No ratings yet

- How Payal Kadakia Danced Her Way To A $600 Million Start-Up - The New York TimesDocument4 pagesHow Payal Kadakia Danced Her Way To A $600 Million Start-Up - The New York TimesRadhika SwaroopNo ratings yet

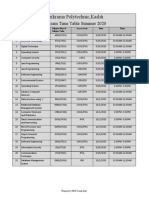

- Parikrama Polytechnic, Kashti: MSBTE TH Exam Time Table Summer 2020Document1 pageParikrama Polytechnic, Kashti: MSBTE TH Exam Time Table Summer 2020pratiksha khamkarNo ratings yet

- Chapter 3 - SQL NotesDocument25 pagesChapter 3 - SQL NotesDibyeshNo ratings yet

- 5.00 FD An1 s1 CE Chemistry 23-24Document4 pages5.00 FD An1 s1 CE Chemistry 23-24imsNo ratings yet

- Department of Education: Schools Division of Ozamiz CityDocument3 pagesDepartment of Education: Schools Division of Ozamiz CityDoone Heart Santander Cabuguas100% (1)

- 077154C Hses Epcc1 001 PDFDocument218 pages077154C Hses Epcc1 001 PDFMathi MukilanNo ratings yet

- Alternative Energy SourcesDocument12 pagesAlternative Energy SourcesArodis GomezNo ratings yet

- Electrical of 6 Class Room .Dwg-POWDocument1 pageElectrical of 6 Class Room .Dwg-POWSayed WafiNo ratings yet

- Clean and Unclean Among Jews Christians Brahmins of Kerala: Pollution IdeaDocument13 pagesClean and Unclean Among Jews Christians Brahmins of Kerala: Pollution IdeaGeorge MenacheryNo ratings yet

- Advisory Board By-LawsDocument3 pagesAdvisory Board By-LawsViola GilbertNo ratings yet

- Martinez Vs Van BuskirkDocument2 pagesMartinez Vs Van BuskirkMinato NamikazeNo ratings yet

- War Poetry 1Document4 pagesWar Poetry 1Tabassum ShaikhNo ratings yet

Null 9

Null 9

Uploaded by

Nitesh GargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Null 9

Null 9

Uploaded by

Nitesh GargCopyright:

Available Formats

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

HANDS-ON-LESSONS

ON

GSTN-BO

Compiled By:

Akhilesh Kumar

Superintendent of Central Tax

CGST & CX

Ranchi Commissionerate

Mobile: 99738-22622

Email: akhilesh.kumar.cgst@gov.in

USERS ARE REQUESTED

PLEASE DO NOT TAKE PRINT.

PLEASE KEEP IT IN YOUR ELECTRONIC DEVICES.

LINKS ARE PROVIDED FOR EASY NAVIGATION BETWEEN TOPICS.

PLEASE HELP US IN SAVING TREES FOR BETTERMENT OF OUR PLANET.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 1 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

PREFACE

I, Akhilesh Kumar, Superintendent, CGST Ranchi Commissionerate had published

“Hands-on-Lessons on e-Office” at Antarang Portal in 2021, soon after launch of e-Office for the

Departmental Tax Officials. It was widely accepted by all the Tax Officials and was highly useful on

various aspects of e-Office. This publication is still available at the Antarang, which can be

downloaded through Tax Official’s login.

The “Hands-on-Lessons on e-Office” was just created as a step-by-step procedure

on all the topics of e-Office. The manual provided by NIC is the basic book on e-Office and it

contains many screenshots for clear understanding and use. But, it is a big book and requires multiple

reading to understand all topics. This inspired me to think to create a simple step-by-step procedural

booklet for the Departmental Tax Officials.

Now, GSTN-BO for Tax Official’s login at the GST portal is launched on 3rd May

2024, I have tried to prepare “Hands-on-Lessons on GSTN-BO” for easy understanding and use of the

Portal efficiently and effectively by our Departmental Tax Officials. It is also uploaded at Antarang

Portal and may also be downloaded from there.

ACKNOWLEDGEMENT

I was chosen as Key Master Trainer for Ranchi Commissionerate by Sri Suven

Dasgupta, Additional Commissioner, CGST, Ranchi. Later on, I was given responsibility as Nodal

Tax Official for Ranchi Commissionerate by CCO, Ranchi Zone, Patna. I had got training as Master

Trainer at NACIN Zonal Training Institute Kolkata from 15th January 2024 to 19th January 2024 on

GSTN-BO. I am highly thankful to the Tax Officials of NACIN ZTI Kolkata, specially Sri Ashok

Kumar Das, Course Director for excellent arrangement of the Course. The two faculties, namely Sri

Ikesh Nagpal and Sri Himanshu Sethi left no stone unturned in giving knowledge of all aspects of

GSTN-BO. Later on, after two months, Sri K B Satheswaran along with his team gave additional

Inputs on GSTN-BO. I am highly thankful to these personalities for all their efforts in making me

understand the basic aspects of GSTN-BO.

DISCLAIMER

As I have yet not done Hands-on-Practice on GSTN-BO on any Topic, there are

possibilities of errors in this compilation. It is requested that necessary suggestions may please be

forwarded to be at akhilesh.kumar.cgst@gov.in and on whatsapp at 99738-22622. I will try my best to

incorporate them for creation of a useful handy booklet on GSTN-BO for the Departmental Tax

Officials.

PLEASE REMEMBER

WHILE TRANSITION FROM CBIC-GST APPLICATION TO GSTN-BO APPLICATION,

TAX OFFICIAL WILL HAVE TO LEARN MANY NEW THINGS.

AT THE SAME TIME, TAX OFFICIAL WILL HAVE TO UN-LEARN MANY THINGS.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 2 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

INDEX

Lesson-1 LOGIN TO DEPARTMENTAL GST WEBSITE BY TAX Page-4

OFFICIAL

Lesson-2 REGISTER DIGITAL SIGNATURE CERTIFICATE Page-5

Lesson-3 VIEWING YOUR DASHBOARD Page-6

Lesson-4 GENERATION OF REFERENCE NUMBER “RFN” Page-8

Lesson-5 SEARCH GSTIN and TAXPAYER DETAILS Page-9

Lesson-6 SEARCH RECORDS OF TAXPAYERS Page-10

Lesson-7 SEARCH RECORDS OF RETURNS FILED BY Page-10

TAXPAYERS

Lesson-8 UTILIZING CASH/ ITC FOR PAYMENT OF DEMAND ON Page-11

BEHALF OF TAXPAYER

Lesson-9 TO KNOW WORK ITEMS ASSIGNED TO TAX OFFICIAL Page-11

Lesson-10 RE-ASSIGN WORK ITEMS TO OTHER TAX OFFICIAL Page-12

IN CASE OF YOUR NON-AVAILABILITY TO COMPLETE

A TASK

Lesson-11 RE-ASSIGN WORK ITEMS TO OTHER TAX OFFICIAL Page-12

IN THE ROLE OF RE-ASSIGN CASES

Lesson-12 MODULE-1: REGISTRATION Page-13

Lesson-13 MODULE-2: SHOW-CAUSE-NOTICE AND Page-21

ADJUDICATION

Lesson-14 MODULE-3: SCRUTINY OF RETURNS Page-25

Lesson-15 MODULE-4: DEMAND AND COLLECTION REGISTER Page-28

Lesson-16 MODULE-5: REFUND Page-29

Lesson-17 MODULE-6: ENFORCEMENT Page-35

Lesson-18 MODULE-7: RECOVERY Page-48

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 3 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-1: LOGIN TO DEPARTMENTAL GST WEBSITE BY TAX OFFICIAL:

[Back to Index]

Step-1: Please ensure that the login is being done at the PC under departmental domain. Tax

Official cannot login at any other PC.

Step-2: Navigate to website https://boweb.internal.gst.gov.in/boservices/login for login.

Step-3: Click the Login link at top-right-hand corner.

Step-4: Click First-time login link at “here” at the bottom of page.

Step-4: Enter your Credentials in various fields. Click on “SUBMIT TO RECEIVE OTP”

Step-5: On next page, enter Username & OTP and Click “LOGIN”.

Step-6: System will direct to create password. Create password of Minimum 8 to 15 digit

only, at least one digit is capital and one digit is small, one numeric and one special

character.

Step-7: From next-time onwards, Tax Official can login with user-id and password at the

website https://boweb.internal.gst.gov.in/boservices/login under departmental

domain. No need to Navigate to First-time login link.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 4 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-2: REGISTER DIGITAL SIGNATURE CERTIFICATE: [Back to Index]

Step-1: Please ensure to have installed Java Runtime Environment version 1.6 or above on

your machine.

Step-2: Please download emSigner 2.6 or above as under:

i. Navigate to the Login page. Scroll down to the blue area and Click “System

Requirements” under “Help and Taxpayer Facilities”.

ii. At next page, Scroll down to serial no. 3 and Click “DSC Registration” link.

iii. At next page, download the software

Step-3: Install Emsigner. Emsigner icon will be available at Desktop on successful

installation.

Step-4: Right Click the icon and Click “Run as administrator”. A message will be displayed

on successful set up

Step-5: Login to GST Portal with user-ID and password followed by OTP.

Step-6: Click at your name at right-top-corner and then at “My Profile”.

Step-7: Click “Register DSC”. On next page, Click “Advanced”. On next page Click “Add

Exception”. A pop-up will come to confirm it. Then, Tick the check-box

“Permanently store this exception” and Click “Confirm Security Exception”.

Step-8: Return to DSC Register page and Click “REGISTER”.

Step-9: Select the DSC certificate and Click “Sign”. Enter your PIN to validate DSC.

Step-10: The message “Your DSC is registered” indicates that your DSC is ready for use.

Step-11: If want to RE-REGISTER, then follow all steps above.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 5 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-3: VIEWING YOUR DASHBOARD: [Back to Index]

View-1: On successful Login, various Modules are available for Pending actions in the form

of big icons. On selecting any Module, Tax Official gets task-list against each

Module below the Module tabs. These Modules are available depending upon the

roles assigned to the Tax Official.

View-2: Hyperlinks are available for each Pending action.

View-3: Click any hyperlink. The Tax Official gets the list of ARNs for action.

View-4: The task-list gives the total count as well as critical count of no. of days available

pending for completion of task.

View-5: Alerts against each task are available at right-side of page.

View-6: Below Alerts, Notifications are available at right-side of page.

View-7: Tax Official can apply for any kind of Leave at dashboard itself.

Step-1: At bottom of page, under Services block, Click “Internal/Official > Leave

Application”

Step-2: Click “Apply leave” and fill details of your Leave. Upload Leave

application.

Step-3: Select Link Tax Official and Confirm Linkage.

Step-4: Click “Submit” and again Confirm.

Step-5: To Revoke/Modify Leave application Click “Internal/Official > Leave

History”

Step-6: Revoke/Modify your application and Confirm.

Step-7: Leave application will be viewed by Approving authority. He may

approve/reject the leave application and Confirm.

Step-8: Link Tax Official will be activated for taking actions. After the Leave

period, link Tax Official will be deactivated and jurisdictional Tax Official

will be activated.

View-8: Holiday Calender: Click Help > Holiday Calendar to view it.

View-9: Taxpayer Profile: Click “Taxpayer Profile/360°” available at Top-right Corner.

Enter GSTIN of taxpayer. Now, Tax Official can see all data of taxpayer, in the

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 6 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

same manner in which a Taxpayer views his data. Moreover, the whole profile

Summary is also available.

View-10: Bank Account Addition Defaulters: Navigate to “Registration > Bank Account

Addition – Defaulters” in the left side of Portal. List of taxpayers, who have not

added Bank details even after 45 days is displayed. Tax Official can act for suo-

moto cancellation.

View-11: In order to issue Notice under 3A, go at bottom of page to “Quick Links > Notice

to Return Defaulters (GSTR-3A)”. Click “Search”. List is displayed, which can be

downloaded in MS-Excel.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 7 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-4: GENERATION OF REFERENCE NUMBER “RFN”: [Back to Index]

Similar to DIN, a Reference Number “RFN” can be generated at the GSTN-

BO portal for sending Correspondences or Notices Offline to the Taxpayer. It may

be validated by the Taxpayer at the portal in their login.

Step-1: Navigate at top of Dashboard to Services > RFNGeneration

Step-2: Select Module and type of Communication

Step-3: Enter all fields in the next page and click “Generate RFN” and “Confirm”.

Step-4: earlier generated RFN may be searched from the Tab “Search RFN”. The fields

“From date of RFB Generation” and “From date of RFB Generation” are

mandatory.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 8 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-5: SEARCH GSTIN and TAXPAYER DETAILS: [Back to Index]

Topic-1: Search GSTIN

Step-1: Navigate at bottom of Dashboard to Services > Taxpayer Account > Find GSTIN

Step-2: Enter PAN and Click Search.

Step-3: Similarly “Advance Search” for GSTIN may be obtained.

Topic-2: Search Temp-ID: Details of Temporary ID can be obtained from Services >

Taxpayer Account > Get temporary ID Details.

Topic-3: Search ARN: Navigate at bottom of Dashboard to Services > Taxpayer Account >

Search ARN Details

Topic-4: Search taxpayer Details, when GSTIN is known

Step-1: For Taxpayer details, Navigate to Services > Taxpayer Account > Search

Taxpayer Details

Step-2: Click on Hyperlinks to view

(a) Electronic Cash Ledger

(b) Electronic Credit ledger

(c) Electronic Liability Register (Related to Return)

(d) Electronic Liability Register (not Related to Return)

(e) Negative Liability Statement.

Step-3: Details of Registration, Address details, Authorised Signatory, owners etc and each

Ledger can be seen from “Quick Links” available in Right side.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 9 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-6: SEARCH RECORDS OF TAXPAYERS: [Back to Index]

The Record may be any ARN, CPIN, GSTR-2A, ITC, auto-populated Records

etc.

Step-1: For searching any particular Record Navigate at bottom of Dashboard to Services >

Taxpayer Account > Record Search

Step-2: Keeping Toggle Button as “No”, if Application Reference number “ARN” is not

known. If ARN is available, then Keep Toggle Button as “Yes”.

Step-3: Keeping Toggle Button as “No”, enter “GSTIN” from Drop-down. It is mandatory

field.

Step-4: Keeping Toggle Button as “No”, select “Document Type” from Drop-down. It is

mandatory field.

Step-5: Keeping Toggle Button as “No”, select “Related to” from Drop-down. It is

mandatory field.

Step-6: Tax Official may enter ARN and/or Year for further filtration of Records search.

These are not mandatory.

Step-7: Click Search. The various ARNs will be displayed.

Step-8: Click ARN for further Search. The concerned Return will be displayed on new page.

LESSON-7: SEARCH RECORDS OF RETURNS FILED BY TAXPAYERS:

[Back to Index]

Step-1: For searching any particular Record, Navigate at bottom of Dashboard to Services >

Taxpayer Account > Record Search (Returns)

Step-2: Enter GSTIN (mandatory field) and Enter Year (mandatory field). Click “Search”

Step-3: Click on Hyperlink to view a particular Return.

Step-4: To view Tax Liability and ITC Comparison page, Click the hyperlink “Tax liabilities

and ITC comparison (GSTR-1, GSTR-3B andGSTR-2A/2B)”. The page is

displayed.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 10 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-8: UTILIZING CASH/ ITC FOR PAYMENT OF DEMAND ON BEHALF

OF TAXPAYER: [Back to Index]

Step-1: Navigate at bottom of Dashboard to Services > Taxpayer Account > Get Taxpayer

Details

Step-2: Enter GSTIN and Click “Go”.

Step-3: Click “Quick Links” available in the Right side of the page.

Step-4: Click the link “Payment towards demand”.

Step-5: The “Outstanding Demand page” is displayed. The numbers displayed under the

major heads will be in Hyperlink text, which may be clicked to see further details, if

required.

Step-6: Click “Select” on the right-side against aby ARN. The following blocks will be seen:

(a) Outstanding Demand in Left side.

(b) Amount intended to be paid on Right side

(c) Cash Ledger Balance in Left side below (a)

(d) Amount to be paid by Cash in Right side below (a)

(e) Credit Ledger Balance in Left side below (b)

(f) Amount to be paid by ITC in Right side below (b)

Step-7: Enter the amounts above and Click “SET-OFF”.

Step-8: Click “Confirm” on pop-up page.

LESSON-9: TO KNOW WORK ITEMS ASSIGNED TO TAX OFFICIAL:

[Back to Index]

Step-1: Navigate at bottom of Dashboard to Services> Internal/Official > My Work Items

Step-2: Three Links are available

1. List Assigned to Tax Official

2. List Assigned from Tax Official’s Desk to other Tax Official

3. List Assigned to Tax Official from Other Tax Official’s Desk.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 11 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-10: RE-ASSIGN WORK ITEMS TO OTHER TAX OFFICIAL IN CASE OF

YOUR NON-AVAILABILITY TO COMPLETE A TASK: [Back to Index]

Task-1: To assign a particular Task to other Tax Official

Step-1: Navigate at bottom of Dashboard to Services> Internal/Official > My Work Items

Step-2: Select Relevant Module

Step-3: Select Relevant ARN

Step-4: Search for the Tax Official

Step-5: Click “Allocate” and the Click “Confirm” in pop-up.

Task-2: To assign all Tasks to other Tax Official

In Step-2 above, Select “Reassign All” hyperlink in the Right side.

LESSON-11: RE-ASSIGN WORK ITEMS TO OTHER TAX OFFICIAL IN THE

ROLE OF RE-ASSIGN CASES: [Back to Index]

For getting list of Tasks assigned to One Tax Official:

Step-1: Navigate at bottom of Dashboard to Services> Internal/Official > Reassign Work

Items

Step-2: Search for the Tax Official

Step-3: Select Relevant Module and select ARN

Step-4: Click “Re-assign”

Now, for getting list of Tax Officials to whom work is to be re-allocated:

Step-5: Search for the Tax Official, to whom work is to be reallocated.

Step-6: Click “ALLOCATE”

Step-7: Click “Confirm” in pop-up.

If all ARNs to be re-assigned, then Click Reassign All in Step-4 above.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 12 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-12: MODULE-1: REGISTRATION: [Back to Index]

The various Topics in this Module are:

A. PROCESSING OF NEW REGISTRATION: [Go to Steps]

B. PROCESSING APPLICATION:REGISTRATION AMENDMENT [Go to Steps]

C. PROCESSING APPLICATION:REGISTRATION CANCELLATION [Go to Steps]

D. PROCESSING SUO-MOTO REGISTRATION CANCELLATION [Go to Steps]

E. PROCESSING APPLICATION: CANCELLED REGISTRATION REVOCATION

[Go to Steps]

F: PROCESSING APPLICATION: REPORTING FAKE GSTINs AGAINST THE

PAN [Go to Steps]

G: RESET OF EMAIL ADDRESS AND MOBILE PHONE NUMBER OF

AUTHORIZED SIGNATORY [Go to Steps]

H: CORRECTION OF JURISDICTION BEFORE APPROVAL [Go to Steps]

I. COMPULSORY WITHDRAWAL FROM COMPOSITION LEVY [Go to Steps]

A. PROCESSING OF NEW REGISTRATION: [Back to Lesson-12]

Step-1: At the Dashboard, select the module “Registration”.

Step-2: On the left side, a box contains list of major Heads for “Tax Official Actions”.

Step-3: List of various tasks pending with Total Count & Critical Count is displayed.

Step-4: Click to Select “Application for Registration”. Various ARNs will be displayed.

Due date and Status will be displayed against each ARN.

Step-5: Click to select any ARN.

Step-6: Assistant Commissioner will click any ARN to assign task of field visit to

Superintendent. Select the Tax Official and Click “Submit”. Now, the task will

move to Login of Superintendent.

Step-7: Superintendent will see the list of ARNs through Step-1 to Step-5 above. Now, Click

to select any ARN.

Step-8: Option-1: Existing Registration, Option-2: Flag for Field Visit, Option-3: Correct

Jurisdiction are available at top of the page.

Option-1: List of Existing Registrations on same PAN are visible. These may be verified.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 13 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Option-2: The ARN may be flagged for Field visit.

Option-3: The ARN may be transferred to other Tax Official of correct jurisdiction. Select

the correct jurisdiction and Click “FORWARD”. See Lesson 12.H for details

Step-9: There are 11 Tabs in verification process. Check each Tab. Once verified, Click

“VERIFY & CONTINUE”. A tick will be marked on the verified Tab and will turn

blue.

Step-10: 9th Tab is for authentication of Aadhar. Click “View” to see details. Click “VERIFY

& CONTINUE”.

Step-11: 10th Tab is for Remarks. These Remarks will not be visible to Applicant. There are

options to “ADD REMARKS”, “GENERATE SCN”, “REJECT” and

“APPROVE”.

Step-12: Select as Required out of Options above. Approval through DSC Dongle is required

for any of options at Step-11. Click OK and ARN will be closed.

Tips: In cases where the Tax Official wants to raise Query on any

Tab during verification, there is option to click “MONITOR” icon below each tab.

Click the icon and “ADD QUERY”

B. PROCESSING OF APPLICATION: AMENDMENT IN REGISTRATION

[Back to Lesson-12]

Tax Official has options to “Generate SCN” or “Approve”. If SCN is generated

and Taxpayer submits reply, Tax Official has options to “Approve” or “Reject”.

For raising Query, click the “MONITOR” icon and proceed. Choose field of

Query and click “ADD QUERY”.

Step-1: At the Dashboard, select the module “Registration”.

Step-2: On the left side, a box contains list of major Heads for “Tax Official Actions”.

Step-3: List of various tasks pending with Total Count & Critical Count is displayed.

Step-4: Click to Select “Application for Amendment”. Various ARNs will be displayed.

Due date and Status will be displayed against each ARN.

Step-5: Click to select any ARN.

Step-6: There are 6 Tabs in verification process. Check each Tab. Once verified, Click

“VERIFY & CONTINUE”. A tick will be marked on the verified Tab and will turn

blue.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 14 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-7: For final Approval of Amendment request, Click “APPROVE”. Order for

amendment is generated.

Step-8: Click “GENERATE ORDER”. Click “PROCEED” and sign with DSC.

C. PROCESSING OF APPLICATION: CANCELLATION OF REGISTRATION

[Back to Lesson-12]

Step-1, 2 & 3: same as B. above

Step-4: Click to Select “Cancellation proceedings of Registration”. Various ARNs will be

displayed. Due date and Status will be displayed against each ARN.

Step-5: Click to select any ARN.

Step-6: There are 6 Tabs in verification process. Check each Tab. Once verified, Click

“VERIFY & CONTINUE”. A tick will be marked on the verified Tab and will turn

blue.

Step-7: For final Approval of Amendment request, Click “APPROVE”. Order for

amendment is generated.

Step-8: Click “GENERATE ORDER”. Click “PROCEED” and sign with DSC.

D. PROCESSING OF SUO-MOTO CANCELLATION OF REGISTRATION

[Back to Lesson-12]

Tax Official has options to “Generate SCN” only. If SCN is generated and

Taxpayer submits reply, Tax Official has options to “Drop proceedings” or “cancel

Registration”.

For raising Query, click the “MONITOR” icon and proceed. Choose field of

Query and click “ADD QUERY”.

Case-1: For Return Defaulters:

Step-1: At the Dashboard, select the module “Registration”.

Step-2: On the left side, a box contains list of major Heads for “Tax Official Actions”.

Step-3: List of various tasks pending with Total Count & Critical Count is displayed.

Step-4: Click Initiate Cancellation for Return Defaulters.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 15 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Note: If all Returns are filed within 30 days of generation of SCN, then

proceedings will be automatically dropped.

Proceed with Step-5 below.

Case-2: For other Reasons:

Step-1: Generate SCN: Click Registration > Cancellation > Cancel Registration on top of

Home page.

Alternatively,

Step-1: At the Dashboard, select the module “Registration”.

Step-2: On the left side, a box contains list of major Heads for “Tax Official Actions”.

Step-3: List of various tasks pending with Total Count & Critical Count is displayed.

Step-4: Click “Suo-moto Cancellation proceedings”

Step-5: On next page, select various parameters from the drop-down list. Click “Search”.

Various ARNs will be displayed on the basis of the parameters selected.

Step-6: Click an ARN. Select type of Taxpayer from the drop-down list.

Step-7: Select Form type for REG-17 or REG-31. Click “INITIATE CANCELLATION”.

Step-8: If REG-17 is selected, format for REG-17 for ‘Intimation for suspension and notice

for cancellation of Registration’ is displayed. Select the REASONS from the check-

box in the format. Multiple reasons can be selected. Enter OBSERVATIONS.

Step-9: Enter date and time for Personal Hearing. Supporting document may be uploaded,

although not mandatory.

Step-10: Click “GENERATE SCN” and proceed to sign with DSC.

Alternatively,

Step-8: If REG-31 is selected, format for REG-31 for ‘SCN for cancellation of Registration’

is displayed. Select the REASONS from the drop-down box in the format. Multiple

reasons can be selected.

Step-9: Enter date and time for Personal Hearing. Supporting document may be uploaded,

although not mandatory.

Step-10: Click “GENERATE SCN” and proceed to sign with DSC.

Note: Now, even after 30 days of generation of SCN, if no Reply is received

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 16 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-11: Click “Suo-moto Cancellation Proceedings” under Registration tab.

Step-12: Select ARN. Tax Official may “DROP PROCEEDINGS” or “CANCEL

REGISTRATION”.

Step-13: If tax official wants to Drop proceedings, enter the reasons for dropping and click

“DROP PROCEEDINGS”. Format of Form GST REG-05 for “Order of Rejection

of Application for cancellation of Enrolment” will be displayed.

Step-14: Enter details and Click “GENERATE ORDER”.

Step-14: Click “PROCEED” and sign with DSC.

Alternatively,

Step-13: If tax official wants to cancel Registration, enter the reasons for Cancellation and

click “CANCEL REGISTRATION”. Format of Form GST REG-19 for “Order for

cancellation of Registration” will be displayed.

Step-14: Enter details and Click “CANCEL REGISTRATION”.

Step-15: Click “PROCEED” and sign with DSC.

Note: After/within 30 days of generation of SCN, if Reply is received from Taxpayer :

Tax official is on discretion to Drop Proceedings or Cancel Registration.

E. PROCESSING OF APPLICATION: REVOCATION OF CANCELLED

REGISTRATION [Back to Lesson-12]

Step-1: At the Dashboard, select the module “Registration”.

Step-2: On the left side, a box contains list of major Heads for “Tax Official Actions”.

Step-3: List of various tasks pending with Total Count & Critical Count is displayed.

Step-4: Click to Select “Revocation of cancelled Registration”. Various ARNs will be

displayed. Due date and Status will be displayed against each ARN.

Step-5: Click to select any ARN.

Step-6: Status regarding KYC-verification of Aadhar will be displayed. Click “OK”.

Note-1: Tax Official has options to “Generate SCN” or “Approve”. If SCN is

generated and Taxpayer submits reply, Tax Official has options to “Approve” or

“Reject”.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 17 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-7: For raising Query, click the “MONITOR” button, select basic Details and Description

from drop-down list and Click “ADD QUERY”.

Step-8: For generating SCN, upload supporting document and Click “GENERATE SCN”.

Step-9: Form GST REG-03 will be displayed regarding “Show-Cause-Notice for rejection of

application for revocation of cancellation of registration”.

Step-10: Enter date and time of Personal Hearing.

Step-11: Click “GENERATE SCN” and proceed to sign with DSC.

Alternatively, if want to Approve the Revocation, then

Step-7: Click “APPROVE”

Step-8: Form GST REG-22 will be displayed. Click “APPROVE” and proceed to sign with

DSC.

Note: Upon Receipt of Reply against Generated SCN, Officer may approve or

Reject. For Approval, Form FEG-05 will be displayed. For Rejection, Form GST REG-

22 will be displayed.

F: PROCESSING APPLICATION: REPORTING FAKE GSTINs AGAINST THE

PAN [Back to Lesson-12]

Step-1: At the Dashboard, select the module “Registration”.

Step-2: On the left side, a box contains list of major Heads for “Tax Official Actions”.

Step-3: List of various tasks pending with Total Count & Critical Count is displayed.

Step-4: Click to Select “Application for Reporting Fake GSTINs against the PAN”.

Various ARNs will be displayed. Due date and Status will be displayed against each

ARN.

Step-5: Click to select any ARN. Enter Comments and upload supporting documents.

Step-6: Click “APPROVE” or “REJECT”, as per Tax Officials discretion. Proceed to sign

with DSC.

G: RESET OF EMAIL ADDRESS AND MOBILE PHONE NUMBER OF

AUTHORIZED SIGNATORY [Back to Lesson-12]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 18 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-1: Navigate at bottom of Dashboard to Services > Taxpayer Account > Update

Authorized signatory

Step-2: Enter GSTIN and Click “Go”.

Step-3: Click “View” to see the details of a particular GSTIN and Click “Close”.

Step-4: System will redirect to “Details of Authorized Signatory/Stakeholders” page.

Step-5: Click “EDIT” & change details and then upload Supporting documents.

Step-6: Click “UPDATE” and proceed to sign with DSC.

Note: Using “ADD NEW”, details of new Authorized signatory may be added.

H: CORRECTION OF JURISDICTION BEFORE APPROVAL [Back to Lesson-12]

Step-1: Please see Lesson 12.A Step-1 to Step-8 for option-3

Step-9: Tick the field “Correct Jurisdiction”. A pop-up will appear.

Step-10: Old jurisdiction as per application will be seen.

Step-11: Enter details of “New Jurisdiction”, enter Remarks and click “FORWARD”.

Note: The ARN will be forwarded to correct Jurisdictional Officer for processing.

There is no need to sign with DSC here.

I. COMPULSORY WITHDRAWAL FROM COMPOSITION LEVY

[Back to Lesson-12]

Step-1: At the Dashboard, select the module “Registration”.

Step-2: On the left side, a box contains list of major Heads for “Tax Official Actions”.

Step-3: List of various tasks pending with Total Count & Critical Count is displayed.

Step-4: Click “Compulsory Withdrawal from Composition Levy”. Various GSTINs will

be displayed, against whom process is initiated. Status will be displayed against each

GSTIN.

Step-5: At the bottom, enter GSTIN and Click “GENERATE SCN”.

Step-6: Select Reason for compulsory withdrawal on next page and enter Description.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 19 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-7: Enter date and time of Personal Hearing and Click “SAVE & PROCEED”.

Step-8: Form GST CMP-08 for “Notice for denial of option to pay tax under Section 10” will

be displayed. Click “GENERATE SCN” and proceed to sign with DSC.

Step-9: Select the GSTIN after 30 days or upon their reply.

Step-10: Form GST CMP-07 will be displayed. Select Reasons from the list and Click

“WITHDRAW COMPOSITION”.

Step-11: Proceed to sign with DSC.

Alternatively, in order to drop proceedings,

Step-8: Click “DROP PROCEEDINGS”.

Step-9: Select the GSTIN after 30 days or upon their reply.

Step-10: Form GST CMP-07 will be displayed. Select Reasons from the list and Click

“DROP PROCEEDINGS”.

Step-11: Proceed to sign with DSC.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 20 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-13: MODULE-2: SHOW-CAUSE-NOTICE AND ADJUDICATION

[Back to Index]

The various Topics involved are as under:

A. CREATION OF NEW CASE ID [Go to Steps]

B. SEARCH FOR OLD CASE ID [Go to Steps]

C. ISSUE INTIMATION IN FORM GST DRC-01A [Go to Steps]

D. ISSUE DRC-01 [Go to Steps]

E. STATEMENT IN FORM GST DRC-02 [Go to Steps]

F. REMINDER [Go to Steps]

G. ADJOURNMENT OF PERSONAL HEARINGS [Go to Steps]

H. VIEW REPLIES FILED BY TAXPAYER [Go to Steps]

I. RECORD OF PERSONAL HEARING [Go to Steps]

J ISSUE ASSESSMENT ORDER U/S 73 OR U/S 74 [Go to Steps]

K. DROP PROCEEDINGS [Go to Steps]

L. RECORD COMMUNICATIONS [Go to Steps]

A. CREATION OF NEW CASE ID: [Back to Lesson-13]

Step-1: Navigate to Statutory Functions > Assessment & Adjudication > Determination

of tax (Fraud/Other). Alternatively, Navigate to Assessment & Adjudication >

Determination of tax (Fraud/Other)

Step-2: On next page, Click “SUO-MOTO PROCEEDING”.

Step-3: Enter GSTIN and Click “GO”.

Step-4: Enter Financial Year, Tax Period and Click “CREATE”.

Step-5: A pop-up Success page comes up. Click “CONTINUE”. Case Details page is

displayed. It contains links on Left side for INTIMATIONS, NOTICES, REPLIES,

PROCEEDINGS, ORDERS and REFERENCES.

B. SEARCH FOR OLD CASE ID: [Back to Lesson-13]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 21 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

For already created Case-IDs, Search option is available at Step-2 above.

C. ISSUE INTIMATION IN FORM GST DRC-01A: [Back to Lesson-13]

Step-6: Click INTIMATION>ADD INTIMATION>INTIMATION GST DRC-01A on

Case Details page

Step-7: Intimation Details page comes up. Fill (a) Section Number, (b) Reference Number,

(c) Due date of payment, (d) Due date of Reply, (e) Financial Year, (f) Brief Facts,

(g) Grounds, (h) Overall Tax Period, (j) Tax period and amounts of tax, Interest,

Penalty etc for a month

Note1: Click “Generate Reference Number” for (b) above.

Note2: Repeat (i) and (j) of Step-7 for next month and Click “ADD”

Step-8: Click “Choose File” and Browse to upload documents.

Step-9: Click “PREVIEW” to view the FORM GST DRC-01A page.

Step-10: Go back to Intimation page and Click “PROCEED”.

Step-11: Issue DRC-01A through DSC by clicking “ISSUE WITH DSC”.

Step-12: Summary page comes up to say that Intimation is mailed to Taxpayer and also

available on his Dashboard. Click “OK”.

D. ISSUE DRC-01 OR STATEMENT & SUMMARY IN FORM GST DRC-02

[Back to Lesson-13]

Step-13: On Case Details page, Click NOTICES>ADD NOTICE>SCN u/s 73/74 and GST

DRC-01.

Step-14: SCN Display page comes up. Fill (a) Section Number, (b) Reference Number (c)

ARN, (d) Due Date of Reply, (e) Financial Year, (f) Act/Rules (g) Brief facts of the

case, (h) Grounds, (i) Overall Tax Period, (j) Tax period and amounts of tax,

Interest, Penalty etc for a month

Note1: Repeat (i) and (j) of Step-13 for next month and Click “ADD”

Note2: Tick Check-box and fill details for Personal hearing, if required. If not

required, Skip this Step.

Note3: In ARN field, select ARN, if applicable, Otherwise Skip this Step.

Note4: Fill date for “Due date of Reply” from calender.

Step-15: Click “Choose File” and Browse to upload documents.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 22 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-16: Click “PREVIEW” to view the FORM GST DRC-01 page.

Step-17: Go back to SCN page and Click “PROCEED”.

Step-18: Issue DRC-01 through DSC by clicking “ISSUE WITH DSC”.

Step-19: Summary page comes up to say that Intimation is mailed to Taxpayer and also

available on his Dashboard. Click “OK”.

Step-20: Updated case Details page is displayed.

E. STATEMENT IN FORM GST DRC-02 [Back to Lesson-13]

Step-21: On Case Details page, Click NOTICES>ADD NOTICE>SCN u/s 73/74 and

DRC-02.

Step-22: Proceed in similar manner as discussed above for DRC-01

F. REMINDER [Back to Lesson-13]

Step-23: On Case Details page, Click NOTICES>ADD NOTICE>REMINDER.

Step-24: Enter details in various fields & Proceed in similar manner as discussed above for

DRC-01

G. ADJOURNMENT OF PERSONAL HEARINGS [Back to Lesson-13]

Step-25: On Case Details page, Click NOTICES>ADD NOTICE>ADJOURNMENT

Step-26: Enter details in various fields & Proceed in similar manner as discussed above for

DRC-01

H. VIEW REPLIES FILED BY TAXPAYER [Back to Lesson-13]

Step-27: On Case Details page, Click REPLIES

Step-28: Click Hyperlink to view the Reply of Taxpayer

I. RECORD OF PERSONAL HEARING [Back to Lesson-13]

Step-29: On Case Details page, Click PROCEEDINGS >ADD PROCEEDINGS >

PERSONAL HEARING

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 23 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-30: Browse & Choose File to Upload. Click “SUBMIT”

J ISSUE ASSESSMENT ORDER U/S 73 OR U/S 74 [Back to Lesson-13]

Step-31: On Case Details page, Click ORDERS >ADD ORDER > Assessment Order and

GST DRC-07

Step-32: Assessment Order and GST DRC-07 page is displayed. Before issuing Order, if

Required, MIS Reports, Tax Liability & Tax Return History may be seen from Link

provided.

Step-33: “Order Details” Tab shows various fields auto-populated. Generate Reference

Number, fill Due date of Payment and Select Issue involved from drop-down box.

Click “CONTINUE”

Step-34: Select the Tab “Details of Goods and Services”. Fill various details and click

“CONTINUE”

Step-35: Select the Tab “Details of Demand”. Fill the various details and Click

“CONTINUE”

Step-36: Select the Tab “Attach documents”. Browse & Choose File to Upload.

Step-37: Click “PREVIEW” and then Click “PROCEED”.

Step-38: Issue the Order with “ISSUE WITH DSC” and click “OK”.

K. DROP PROCEEDINGS [Back to Lesson-13]

Alternatively,

Step-31: On Case Details page, Click ORDERS >ADD ORDER > DROP PROCEEDING

Step-32: Fields are auto-populated. Generate Reference Number, Choose file to upload ,

Click “PREVIEW” and Click “PROCEED”.

Step-33: Issue the Order with “ISSUE WITH DSC” and click “OK”.

L. RECORD COMMUNICATIONS [Back to Lesson-13]

Step-34: On Case Details page, Click REFERENCES >ADD REFERENCES >

COMMUNICATION

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 24 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-35: Fill various details and Click “SUBMIT”

Step-36: On Case Details page, Click REFERENCES >ADD REFERENCES >

REFERENCES OF CASE

Step-37: Fill various details and Click “SUBMIT”

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 25 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-14: MODULE-3: SCRUTINY OF RETURNS [Back to Index]

The various Topics involved are as under:

A. INITIATE SUO-MOTO PROCEEDING [Go to Steps]

B. SEARCH FOR ALREADY CREATED ARN/CASE ID [Go to Steps]

C. ISSUE/VIEW NOTICE [Go to Steps]

D. REMINDER [Go to Steps]

E. ADJOURNMENT [Go to Steps]

F. VIEW REPLIES FILED BY TAXPAYER [Go to Steps]

G. DROP PROCEEDINGS [Go to Steps]

H. UPLOAD COMMUNICATIONS [Go to Steps]

A. CREATION OF NEW CASE ID: [Back to Lesson-14]

Step-1: Navigate to Assessment & Adjudication > Scrutiny of Returns. Scrutiny of Returns

page is displayed.

Step-2: Click “SUO-MOTO PROCEEDINGS”. Fill the various fields and Click

“CREATE”. Click “CONTINUE”.

B. SEARCH FOR ALREADY CREATED ARN/CASE ID [Back to Lesson-14]

Step-3: Fill fields for Search and click “SEARCH”

Step-4: List of ARNs for action by tax Official is displayed.

C. ISSUE/VIEW NOTICE [Back to Lesson-14]

Step-5: Navigate to NOTICES>ADD NOTICE>NOTICE

Step-6: Fill the fields and upload File. Click “PREVIEW”. If OK, Click “PROCEED”.

Step-7: Click “ISSUE WITH DSC” and then “OK”.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 26 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

D. REMINDER [Back to Lesson-14]

Step-8: Navigate to NOTICES>ADD NOTICE>REMINDER

Step-9: Fill the fields and upload File. Click “PREVIEW”. If OK, Click “PROCEED”.

Step-10: Click “ISSUE WITH DSC” and then “OK”.

E. ADJOURNMENT [Back to Lesson-14]

Step-11: Navigate to NOTICES>ADD NOTICE>REMINDER

Step-12: Fill the fields and upload File. Click “PREVIEW”. If OK, Click “PROCEED”.

Step-13: Click “ISSUE WITH DSC” and then “OK”.

F. VIEW REPLIES FILED BY TAXPAYER [Back to Lesson-14]

Step-13: Navigate to NOTICES>REPLIES

Step-14: Download Attachments to ascertain the Contents.

G. DROP PROCEEDINGS [Back to Lesson-14]

Step-15: Navigate to NOTICES>ADD ORDER>DROP PROCEEDINGS

Step-16: Fill the fields and upload File. Click “PREVIEW”. If OK, Click “PROCEED”.

Step-17: Click “ISSUE WITH DSC” and then “OK”.

H. UPLOAD COMMUNICATIONS [Back to Lesson-14]

Step-15: Navigate to REFERENCES>ADD REFERNCE>COMMUNICATION

Step-16: Fill the fields and upload File. Click “SUBMIT”.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 27 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-15: MODULE-4: DEMAND AND COLLECTION REGISTER

[Back to Index]

A. View DCR [Back to Lesson-15]

Step-1: Navigate to Statutory Functions > Demand and Collection Register > View DCR

Step-2: Select either “Demand belonging to the Financial Year” Or “Demand created in

the Financial Year”

Step-3: Select the Filters as per Choice and Click “Search”.

Step-4: List is populated, which can be downloaded as pdf or xls file.

B. Creation of entry in DCR [Back to Lesson-15]

Step-1: Navigate to Statutory Functions > Demand and Collection Register > Create New

Entry in DCR

Step-2: On the new page, enter various details in the prescribed fields.

Step-3: Click “ADD”.

Step-4: In “Amount Confirmed in the Order” Section, enter the data. In “Amount

Recovered upto this Stage” Section, enter the data. In “Amount Pending for

Recovery” Section, Pending amount is displayed. Click “Yes” for “Recovery to be

initiated immediately”.

Step-5: Upload supporting document and Click “SUBMIT”.

C. Update Entry in DCR [Back to Lesson-15]

Step-1: Navigate to Statutory Functions>Demand and Collection Register>Update DCR

Step-2: Search the Demand from any of fields Demand ID/ GSTIN/Temporary ID/ Name

of taxpayer.

Step-3: Click hyperlink for Demand ID and make necessary entries to update and Click

“SUBMIT”.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 28 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-16: MODULE-5: REFUND [Back to Index]

The various Topics involved in Refund are:

A. Search ARN for Refund Processing: [Go to Steps]

A (1). View Form GST RFD-01W

B. Take action using NOTICE/ ACKNOWLEDGEMENT tab: [Go to Steps]

B (1). Issue Form GST RFD-03 Deficiency Memo to the Taxpayer or [Go to Steps]

B (2). Issue Form GST RFD-02 Acknowledgement Notice to the Taxpayer [Go to Steps]

B (3). Issue Notice for rejection of application for refund or Recovery of erroneously granted

refund (GST RFD-08) [Go to Steps]

C. Take action using REPLIES tab: [Go to Steps]

C (1). View replies furnished by the taxpayer [Go to Steps]

C (2). Accept/Reject the Request for Extension of the Due Date of Reply to SCN or

Adjourning the Personal Hearing [Go to Steps]

D. Take action using ORDERS tab: [Go to Steps]

D (1). Issue Provisional Order in Form GST RFD-04 [Go to Steps]

D (2). Issue Payment Order in Form GST RFD-05 for Provisional Order [Go to Steps]

D (3). Issue Refund Sanction/ Rejection Order in Form GST RFD-06 [Go to Steps]

D (4). Issue Withhold Order in Form GST RFD-07A [Go to Steps]

D (5). Issue Release Order in Form GST RFD-07B [Go to Steps]

D (6). Issue Payment Order in Form GST RFD-05 for Refund Sanction Order [Go to Steps]

D (7). Issue Form GST PMT-03 for Rejected Amount [Go to Steps]

D (8). Issue Form GST PMT-03 for Sanctioned Amount [Go to Steps]

D (9). Issue Form GST PMT-03A [Go to Steps]

E. Take action using REFERENCE tab: Upload References of Case [Go to Steps]

F. Take action using AUDIT HISTORY tab: View Audit History [Go to Steps]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 29 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

A. Search ARN for Refund Processing [Back to Lesson-16]

Step-1: Navigate to “Refund” and Click “New Refund Applications Received”

Step-2: Click “SEARCH” after selecting criteria of Search.

Step-3: Click ARN and “Refund Processing case detail” page is displayed.

Step-4: Click “APPLICATIONS” to view the application of Taxpayer for Refund. If

withdrawn, then it can be viewed by Clicking “GST RFD-01W”

B. Take action using NOTICE/ ACKNOWLEDGEMENT tab [Back to Lesson-16]

B (1). Issue Form GST RFD-03 Deficiency Memo to the Taxpayer [Back to Lesson-16]

Step-5: On “Refund Processing case detail” page Navigate to

NOTICE/ACKNOWLEDGEMENT>ADD NOTICE>Deficiency Memo (GST RFD-03)

Step-6: Select Reason(s), View the “PREVIEW” and click “ISSUE DEFICIENCY

MEMO”.

Step-7: Click “ISSUE WITH DSC” and then “OK”.

B (2). Issue Form GST RFD-02 Acknowledgement Notice to the Taxpayer

[Back to Lesson-16]

Step-5: On “Refund Processing case detail” page Navigate to

NOTICE/ACKNOWLEDGEMENT>ADD NOTICE>Acknowledgement (GST RFD-02)

Step-6: Select Reason(s), View the “PREVIEW” and click “ISSUE

ACKNOWLEDGEMENT”.

Step-7: Click “ISSUE WITH DSC” and then “OK”.

B (3). Issue Notice for rejection of application for refund or Recovery of erroneously

granted refund (GST RFD-08) [Back to Lesson-16]

Step-5: On “Refund Processing case detail” page Navigate to

NOTICE/ACKNOWLEDGEMENT>ADD NOTICE>Notice for rejection of

application for refund or Recovery of erroneously granted refund (GST RFD-

08)

Step-6: Select Reason(s), View the “PREVIEW”

Step-7: Click “ISSUE WITH DSC” and then “OK”.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 30 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

C. Take action using REPLIES tab [Back to Lesson-16]

C (1). View replies furnished by the taxpayer [Back to Lesson-16]

Step-8: On “Refund Processing case detail” page Navigate to REPLIES

Step-9: Click Documents to download.

C (2). Accept/Reject the Request for Extension of the Due Date of Reply to SCN or

Adjourning the Personal Hearing [Back to Lesson-16]

Step-8: On “Refund Processing case detail” page Navigate to REPLIES

Step-9: If Taxpayer has made request for adjournment, then download “Extension Request”.

Step-10: Click either “ACCEPT” or “REJECT” or “MODIFY”.

Step-11: Click “ISSUE WITH DSC” and then “OK” to issue Order.

D. Take action using ORDERS tab: [Back to Lesson-16]

D (1). Issue Provisional Order in Form GST RFD-04 [Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Provisional Order (GST RFD-04)

Step-13: Fill all the fields on the new page of Provisional Order (GST RFD-04).

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE WITH DSC” and then “OK” to issue Order.

D (2). Issue Payment Order in Form GST RFD-05 for Provisional Order

[Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Provisional Order (GST RFD-05)

Step-13: Fill all the fields on the new page of Provisional Order (GST RFD-05).

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE WITH DSC” and then “OK” to issue Order.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 31 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

D (3). Issue Refund Sanction/ Rejection Order in Form GST RFD-06

[Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Rejection Order (GST RFD-06)

Step-13: Fill all the fields on the new page of Rejection Order (GST RFD-06).

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE WITH DSC” and then “OK” to issue Order.

D (4). Issue Withhold Order in Form GST RFD-07A [Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Withhold Order (GST RFD-07A)

Step-13: Fill all the fields on the new page of Withhold Order (GST RFD-07A).

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE ORDER” and “SUBMIT WITH DSC” and then “OK” to issue

Order.

D (5). Issue Release Order in Form GST RFD-07B [Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Release Order (GST RFD-07B)

Step-13: Fill all the fields on the new page of Release Order (GST RFD-07B).

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE ORDER” and “SUBMIT WITH DSC” and then “OK” to issue

Order.

D (6). Issue Payment Order in Form GST RFD-05 for Refund Sanction Order

[Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Payment Order (GST RFD-05)

Step-13: Fill all the fields on the new page of Payment Order (GST RFD-05).

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 32 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE ORDER” and “ISSUE WITH DSC” and then “OK” to issue Order.

D (7). Issue Form GST PMT-03 for Rejected Amount [Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Recredit Order for Sanction/Rejection Order GST PMT-03

Step-13: Fill all the fields on the new page of Recredit Order for Sanction/Rejection

Order GST PMT-03.

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE ORDER” and “ISSUE WITH DSC” and then “OK” to issue Order.

D (8). Issue Form GST PMT-03 for Sanctioned Amount [Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to ORDERS>ADD ORDER>

Sanction/Rejection Order GST PMT-03

Step-13: Fill all the fields on the new page of Sanction/Rejection Order GST PMT-03.

Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE ORDER” and “ISSUE WITH DSC” and then “OK” to issue Order.

D (9). Issue Form GST PMT-03A [Back to Lesson-16]

Step-12: Navigate to Services > Taxpayer Account > GST PMT-03A – Recredit ITC

Ledger

Step-13: Click “NEW PMT-03A” on GST PMT-03A – Recredit ITC Ledger page and fill

all the fields.

Step-14: Step-14: Upload File and view the PREVIEW.

Step-15: Click “ISSUE ORDER” and “ISSUE WITH DSC” and then “OK” to issue Order.

E. Take action using REFERENCE tab: [Back to Lesson-16]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 33 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-12: On “Refund Processing case detail” page Navigate to REFERENCES and Click

“ADD REFERENCES”

Step-13: Fill all the fields on the new page of REFERENCES.

F. Take action using AUDIT HISTORY tab: [Back to Lesson-16]

Step-12: On “Refund Processing case detail” page Navigate to AUDIT HISTORY

Step-13: View AUDIT HISTORY.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 34 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

LESSON-17: MODULE-6: ENFORCEMENT [Back to Index]

The various Topics involved in Enforcement are:

A. Creating an Enquiry Before a Case Creation [Go to Steps]

B. Creating an Enforcement Case ID and Conducting Subsequent Proceedings

[Go to Steps]

B1. Creating a new Enforcement Case ID [Go to Steps]

B2. Search for the Enforcement Case IDs [Go to Steps]

C. Entering uploading details of Past_Offline Enforcement Cases (GST and Pre-GST)

[Go to Steps]

C(1). Upload the Preliminary Report [Go to Steps]

C(2). Upload the Final Report [Go to Steps]

C(3). Close the Enforcement Case ID [Go to Steps]

C(4) Upload MOV-01 STATEMENT OF OWNER/DRIVER/PERSON-IN-CHARGE

[Go to Steps]

C(5) Issue MOV-03 EXTENSION OF INSPECTION TIME [Go to Steps]

C(6) Upload MOV-04 PHYSICAL VERIFICATION REPORT [Go to Steps]

C(7) Upload MOV-08 BOND FOR PROVISIONAL RELEASE OF G/C [Go to Steps]

C(8) Accept INS-04 BOND FOR RELEASE OF GOODS SEIZED [Go to Steps]

C(9) Update Arrest Details [Go to Steps]

C(10) Re-Opening of Closed Cases [Go to Steps]

C(11) Summon Proceedings [Go to Steps]

D. Uploading and Searching Taxpayer's Information for any Past offenses and Penal

actions_Prosecution [Go to Steps]

D(1). Issue MOV-07 NOTICE UNDER SECTION 129(3) [Go to Steps]

D(2). Issue MOV-10 NOTICE FOR CONFISCATION & LEVY OF PENALTY

[Go to Steps]

D(3). Issue "Notice Calling Information" [Go to Steps]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 35 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

D(4). Issue "Intimate Liability before SCN (DRC-01A- Part A)" [Go to Steps]

D(5). Issue "Reminder 1 - Notice Calling Information" or "Reminder 2 - Notice Calling

Information" or "Reminder 3 -Notice Calling Information" [Go to Steps]

D(6). Issue "Notice to Summon" [Go to Steps]

D(7). Issue "Notice for Adjournment of Summon" [Go to Steps]

D(8). Issue "Personal Hearing" Notice [Go to Steps]

D(9). Issue Show Cause Notice [Go to Steps]

D(10) Issue Miscellaneous Notice Reminder [Go to Steps]

E. Searching for Pending Enquiry and Responding to the Enquiry [Go to Steps]

F. Assigning Transfer of Cases, Information Request & Response [Go to Steps]

F(1) Issue MOV-02 ORDER FOR PHYSICAL VERIFICATION OF G/C [Go to Steps]

F(2) Issue MOV-05 RELEASE ORDER [Go to Steps]

F(3) Issue MOV-06 Detention Order [Go to Steps]

F(4) Issue MOV-09 ORDER OF DEMAND - TAX & PENALTY [Go to Steps]

F(5) Issue MOV-11 ORDER OF CONFISCATION [Go to Steps]

F(6). Issue GST INS -02 Order of Seizure [Go to Steps]

F(7) Issue GST INS -03 Order of Prohibition [Go to Steps]

F(8) Issue GST INS -05 Order of Release of Goods [Go to Steps]

F(9) Issue Order of Release of Goods [Go to Steps]

F(10) Issue Order of Release of Security [Go to Steps]

F(11). Issue Miscellaneous Order/Additional Appeal [Go to Steps]

F(12). Issue APL - 04/ Give Appeal effect [Go to Steps]

F(13) Issue Provisional Attachment Order DRC-22 [Go to Steps]

F(14) Issue Order of provisional attachment restoration DRC-23 [Go to Steps]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 36 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

G. Viewing and Taking Actions on Requests [Go to Steps]

H. Viewing or Accepting or Rejecting Recommended Cases from Other Modules

[Go to Steps]

A. Creating an Enquiry Before a Case Creation [Back to lesson-17]

This Tab is used for getting information by Enforcement Team from other

Officers of other jurisdiction.

Step-1: Navigate to Enforcement > Initiate New Enquiry

Step-2: Enter details in Initiate New Case page

Step-3: Click “CREATE”, Click “PROCEED” and then Click “OK”.

The Enquiry will be displayed in Dashboard of Officers other Jurisdiction,

which can be seen in his My Tasks & Updates Tab, upon Receipt of Reply.

Step-4: Navigate to Enforcement > ENQUIRY RESPONSE

Step-5: Till Reply received, the case details are available on Navigation to Enforcement >

Enquiry Search

B. Creating an Enforcement Case ID and Conducting Subsequent Proceedings

[Back to lesson-17]

B1. Creating a new Enforcement Case ID [Back to lesson-17]

Step-1: Navigate to Enforcement > Initiate New Case

Step-2: On the “Initiate New Case Page”, fill all the details and Click “PROCEED &

CREATE NEW CASE”.

B2. Search for the Enforcement Case IDs [Back to lesson-17]

Step-1: Navigate to Enforcement > Case Search

Step-2: On the “Case Search page”, fill all the details and Click “SEARCH”.

Step-3: Click “ARN/Case ID” link.

Step-4: “Enforcement Case Details Page” for a particular ARN is displayed.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 37 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-5: Click “VIEW”.

C. Take Action from the PROCEEDINGS tab: [Back to lesson-17]

C(1). Upload the Preliminary Report [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS>PRELIMINARY REPORT.

Step-2: On the “Preliminary Report page”, fill the details and Click “SUBMIT”. User may

view it through “PREVIEW” button.

Step-3: Close the “PREVIEW” and Click “SUBMIT”. Now, “Updated Preliminary

Report page” is displayed.

C(2). Upload the Final Report [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS>FINAL REPORT.

Step-2: Enter the details and Click “CALCULATE”.

Step-3: Enter further details and Click “GENERATE SUMMARY”.

Step-4: Click “PREVIEW” and “SUBMIT” and then “PROCEED”.

Step-5: Click “ISSUE WITH DSC” and then “OK”.

C(3). Close the Enforcement Case ID [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS>CLOSE CASE.

Step-2: Select grounds for Closure and Click “SUBMIT”.

C(4) Upload MOV-01 STATEMENT OF OWNER/DRIVER/PERSON-IN-CHARGE

[Back to lesson-17]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 38 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> MOV-01 STATEMENT OF

OWNER/DRIVER/PERSON-IN-CHARGE.

Step-2: Enter the details

Step-3: Click “PREVIEW” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

C(5) Issue MOV-03 EXTENSION OF INSPECTION TIME [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> MOV-03 EXTENSION OF

INSPECTION TIME.

Step-2: Enter the details

Step-3: Click “PREVIEW” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

C(6) Upload MOV-04 PHYSICAL VERIFICATION REPORT [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> MOV-04 PHYSICAL

VERIFICATION REPORT.

Step-2: Enter the details

Step-3: Click “PREVIEW” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

C(7) Upload MOV-08 BOND FOR PROVISIONAL RELEASE OF G/C

[Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> MOV-08 BOND FOR

PROVISIONAL RELEASE OF G/C.

Step-2: Enter the details

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 39 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-3: Click “PREVIEW” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

C(8) Accept INS-04 BOND FOR RELEASE OF GOODS SEIZED [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> INS-04 BOND FOR RELEASE OF

GOODS SEIZED.

Step-2: Enter the details

Step-3: Click “PREVIEW” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

C(9) Update Arrest Details [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> ADD/UPDATE ARREST

DETAILS.

Step-2: Enter the details

Step-3: Click “PREVIEW” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

C(10) Re-Opening of Closed Cases [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> Re-open Case (from Closed status).

Step-2: Enter the details

Step-3: Click “RE-OPEN CASE” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

C(11) Summon Proceedings [Back to lesson-17]

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 40 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click

PROCEEDINGS>ADD PROCEEDINGS> SUMMON PROCEEDINGS.

Step-2: Enter the details

Step-3: Click “RE-OPEN CASE” and “SUBMIT” and then “PROCEED”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

D. Take Action from the NOTICES tab: [Back to lesson-17]

D(1). Issue MOV-07 NOTICE UNDER SECTION 129(3) [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click NOTICES>ADD

NOTICES> MOV-07 NOTICE UNDER SECTION 129(3).

Step-2: Enter the details of Interception and Click “CALCULATE”

Step-3: Click “GENERATE SUMMARY” and “SAVE AS DRAFT”, then “PREVIEW”

and “SUBMIT”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

D(2). Issue MOV-10 NOTICE FOR CONFISCATION & LEVY OF PENALTY [Back

to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click NOTICES>ADD

NOTICES> MOV-10 NOTICE FOR CONFISCATION & LEVY OF

PENALTY.

Step-2: Enter the details of Interception and Click “CALCULATE”

Step-3: Click “GENERATE SUMMARY” and “SAVE AS DRAFT”, then “PREVIEW”

and “SUBMIT”.

Step-4: Click “ISSUE WITH DSC” and then “OK”.

D(3). Issue "Notice Calling Information" [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click NOTICES>ADD

NOTICES> NOTICE CALLING INFORMATION.

COMPILED BY: AKHILESH KUMAR, SUPERINTENDENT, CGST RANCHI COMMISSIONERATE

Page 41 of 51 Mobile: 99738-22622 Email: akhilesh.kumar.cgst@gov.in

HANDS-ON-LESSONS ON GSTN-BO APPLICATION UPDATED AS ON 10-05-2024

D(4). Issue "Intimate Liability before SCN (DRC-01A- Part A)" [Back to lesson-17]

Step-1: On “Enforcement Case Details Page” for a particular ARN, Click NOTICES>ADD

NOTICES>INTIMATE LIABILITY BEFORE SCN (DRC-01A-PART A)

Step-2: Click “GENERATE SUMMARY” and “SAVE AS DRAFT”, then “PREVIEW”

and “SUBMIT”.

Step-3: Click “ISSUE WITH DSC” and then “OK”.

D(5). Issue "Reminder 1 - Notice Calling Information" or "Reminder 2 - Notice Calling

Information" or "Reminder 3 -Notice Calling Information" [Back to lesson-17]