Professional Documents

Culture Documents

GSTR3B 32aamca3298h2zi 032018

GSTR3B 32aamca3298h2zi 032018

Uploaded by

eyochenCopyright:

Available Formats

You might also like

- GSTR3B 36aoupg4539a1zx 062022Document2 pagesGSTR3B 36aoupg4539a1zx 062022abhi ramNo ratings yet

- GSTR3B 33alapv4527e1za 012020Document2 pagesGSTR3B 33alapv4527e1za 012020hakkim satharNo ratings yet

- RecordstatementDocument18 pagesRecordstatementSanthoshNo ratings yet

- GSTR3B 36aigpy2941j1zs 102020Document2 pagesGSTR3B 36aigpy2941j1zs 102020Md YounusNo ratings yet

- GSTR3B April 2018Document2 pagesGSTR3B April 2018Kunal ChoudharyNo ratings yet

- GSTR3B 08absfa0925d1zk 092021Document2 pagesGSTR3B 08absfa0925d1zk 092021YOGESH JOSHINo ratings yet

- GSTR3B 36fjypk4832a1zy 072022Document2 pagesGSTR3B 36fjypk4832a1zy 072022saiakhiltataNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- GSTR3B 19azwpd2404n1zx 062023Document3 pagesGSTR3B 19azwpd2404n1zx 062023ho.ubiquityNo ratings yet

- GSTR3B 32almph4268c1zc 122021Document2 pagesGSTR3B 32almph4268c1zc 122021efile.hco3No ratings yet

- Recordstatement 2Document18 pagesRecordstatement 2SanthoshNo ratings yet

- GSTR3B 19bahph8899e1z2 122022Document3 pagesGSTR3B 19bahph8899e1z2 122022Pawan KanuNo ratings yet

- GSTR3B 33aespt6851j1zr 072023Document3 pagesGSTR3B 33aespt6851j1zr 072023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 19azwpd2404n1zx 042023Document3 pagesGSTR3B 19azwpd2404n1zx 042023ho.ubiquityNo ratings yet

- GSTR3B 33aespt6851j1zr 102023Document3 pagesGSTR3B 33aespt6851j1zr 102023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B Matha MobilesDocument2 pagesGSTR3B Matha MobilesBRIGHT TAX CENTERNo ratings yet

- GSTR3B 33aespt6851j1zr 092023Document3 pagesGSTR3B 33aespt6851j1zr 092023Vignesh KrishnamoorthyNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B 37adcfs8516j1zp 032020Document2 pagesGSTR3B 37adcfs8516j1zp 032020ravi kiranNo ratings yet

- GSTR3B 23apjps3159l1zg 032022Document2 pagesGSTR3B 23apjps3159l1zg 032022sales candoNo ratings yet

- MH GSTR3B Nov'22Document3 pagesMH GSTR3B Nov'22crmfinance.tnNo ratings yet

- GSTR3B 18agppi9704c1za 022023Document3 pagesGSTR3B 18agppi9704c1za 022023ABDUL KHALIKNo ratings yet

- GSTR3B 33aeqpy3870g1zy 082023Document3 pagesGSTR3B 33aeqpy3870g1zy 082023Durai kannuNo ratings yet

- GSTR3B 19azwpd2404n1zx 072023Document3 pagesGSTR3B 19azwpd2404n1zx 072023ho.ubiquityNo ratings yet

- GSTRDocument3 pagesGSTRfliz1889No ratings yet

- GSTR3B 10CKPPK6612R1ZP 082022Document3 pagesGSTR3B 10CKPPK6612R1ZP 082022Saurav KumarNo ratings yet

- Feb 23-24Document3 pagesFeb 23-24crmfinance.tnNo ratings yet

- GSTR3B 19bahph8899e1z2 022023Document3 pagesGSTR3B 19bahph8899e1z2 022023Pawan KanuNo ratings yet

- May GSTR3B - 27AAJCB3358E1ZP - 052023Document2 pagesMay GSTR3B - 27AAJCB3358E1ZP - 052023calmincometax36No ratings yet

- MH GSTR3B Dec'22Document3 pagesMH GSTR3B Dec'22crmfinance.tnNo ratings yet

- GSTR3B 36agnpa1483e1zm 122021Document2 pagesGSTR3B 36agnpa1483e1zm 122021uslprocess1No ratings yet

- GSTR3B 06effpm8326p1zs 102023Document3 pagesGSTR3B 06effpm8326p1zs 102023Prahlad JhaNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 082022Document3 pagesGSTR3B 27BCGPS7468K1ZR 082022Aman JaiswalNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 092022Document3 pagesGSTR3B 27BCGPS7468K1ZR 092022Aman JaiswalNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B 03jpaps1346b1za 112023Document3 pagesGSTR3B 03jpaps1346b1za 112023advocate.atul0001No ratings yet

- GSTR3B 27apapd6950p1zj 052022Document2 pagesGSTR3B 27apapd6950p1zj 052022Arun NaikwadeNo ratings yet

- GSTR3B 08absfa0925d1zk 122021Document2 pagesGSTR3B 08absfa0925d1zk 122021YOGESH JOSHINo ratings yet

- GSTR3B 33aespt6851j1zr 082023Document3 pagesGSTR3B 33aespt6851j1zr 082023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 07ahepk2148n1z5 112022Document3 pagesGSTR3B 07ahepk2148n1z5 112022Rishabh Naresh JainNo ratings yet

- GSTR3B 32aamca3298h2zi 012018Document2 pagesGSTR3B 32aamca3298h2zi 012018eyochenNo ratings yet

- GSTR3B 33anppm7249d1zt 052023Document3 pagesGSTR3B 33anppm7249d1zt 052023Logesh Waran KmlNo ratings yet

- GSTR3B 03jpaps1346b1za 062023Document3 pagesGSTR3B 03jpaps1346b1za 062023advocate.atul0001No ratings yet

- GSTR3B 10eofpk9217c1zd 042023Document3 pagesGSTR3B 10eofpk9217c1zd 042023Pratik RajNo ratings yet

- GSTR3B 09humps0863q1zf 072023Document3 pagesGSTR3B 09humps0863q1zf 072023mahtab begNo ratings yet

- GSTR3B 18alipd4509l1zz 022023Document3 pagesGSTR3B 18alipd4509l1zz 022023Gaurav Ujjal BharaliNo ratings yet

- GSTR3B_33AJWPV3781A1ZU_122023Document3 pagesGSTR3B_33AJWPV3781A1ZU_122023selvamoilNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B 10cespr1366g1ze 012023Document3 pagesGSTR3B 10cespr1366g1ze 012023Mega GuideNo ratings yet

- GSTR3B 27avhpk4246l1z8 052022Document2 pagesGSTR3B 27avhpk4246l1z8 052022Rohit GoleNo ratings yet

- GSTR3B 37BWZPT3110J1ZW 082023Document3 pagesGSTR3B 37BWZPT3110J1ZW 082023satyathirumani5No ratings yet

- GSTR3B 03cuzpr6190r2z9 012024Document3 pagesGSTR3B 03cuzpr6190r2z9 012024kunal3152No ratings yet

- GSTR3B 01bropg6451k1zp 062023Document2 pagesGSTR3B 01bropg6451k1zp 062023Ishtiyaq RatherNo ratings yet

- GSTR3B 07ahepk2148n1z5 082023Document2 pagesGSTR3B 07ahepk2148n1z5 082023Rishabh Naresh JainNo ratings yet

- GSTR3B 07ahepk2148n1z5 052023Document3 pagesGSTR3B 07ahepk2148n1z5 052023PKCL027 Rishabh JainNo ratings yet

- 8 GSTR-3B - Nov 21-22Document2 pages8 GSTR-3B - Nov 21-22ArbindraNo ratings yet

- GSTR3B 03alnpk4728k1zv 072021Document2 pagesGSTR3B 03alnpk4728k1zv 072021Harish VermaNo ratings yet

- GSTR3B 36bmypp9150m1zx 012023Document3 pagesGSTR3B 36bmypp9150m1zx 012023RAJESH DNo ratings yet

- Acceptance - Lecture Handout Acceptance - Lecture HandoutDocument4 pagesAcceptance - Lecture Handout Acceptance - Lecture Handoutماتو اریکاNo ratings yet

- Essay Class 09 NotesDocument3 pagesEssay Class 09 NotesDurga SinghNo ratings yet

- A Galaxy Called 'Mikrokosmos' - A Composer's View (Andre Hadju)Document21 pagesA Galaxy Called 'Mikrokosmos' - A Composer's View (Andre Hadju)thomas.patteson6837100% (1)

- Happy To Help Rs 364.72 19.12.12: Vodafone No. 9962985001Document9 pagesHappy To Help Rs 364.72 19.12.12: Vodafone No. 9962985001supriyaNo ratings yet

- Project Proposal (University Management System) PDFDocument3 pagesProject Proposal (University Management System) PDF2K18/SE/014 AJAY KUMARNo ratings yet

- Role of Merchant Banking in Portfolio Management and Issue Management'Document85 pagesRole of Merchant Banking in Portfolio Management and Issue Management'Rinkesh SutharNo ratings yet

- NEP Education Policy by V.Sree NandanDocument19 pagesNEP Education Policy by V.Sree NandanSreeNandan HomeNo ratings yet

- Advert - Regional Nutrition OfficerDocument2 pagesAdvert - Regional Nutrition Officermoses ochiengNo ratings yet

- ISG 2020 BookDocument528 pagesISG 2020 BookKatya GeorgievaNo ratings yet

- Rule 27 Petition - Brink'sDocument8 pagesRule 27 Petition - Brink'sdcodreaNo ratings yet

- Meling vs. MelendrezDocument2 pagesMeling vs. MelendrezArshie Mae Uy RicaldeNo ratings yet

- Bach Flower RemediesDocument21 pagesBach Flower RemediesTrupti Patil100% (4)

- Mesr 2003Document14 pagesMesr 2003SureshkumaryadavNo ratings yet

- Form 4 Choice of SubjectsDocument33 pagesForm 4 Choice of Subjectsapi-484150872No ratings yet

- Backgroundfile 35427Document15 pagesBackgroundfile 35427sladurantayeNo ratings yet

- Condominium: Living SpacesDocument15 pagesCondominium: Living SpacesAditya JainNo ratings yet

- Nfpa Codes & StandardsDocument9 pagesNfpa Codes & StandardsPradip SharmaNo ratings yet

- 9 000 Years of The Goddess in Anatolia PDFDocument20 pages9 000 Years of The Goddess in Anatolia PDFEduardo Figueroa100% (3)

- Character Analysis (Mill On The Floss) Direct CharacterizationDocument2 pagesCharacter Analysis (Mill On The Floss) Direct CharacterizationzainNo ratings yet

- Urban Rural DetailsDocument20 pagesUrban Rural Detailsakibpagla001No ratings yet

- FINAL TERM - HIS8482-260 LMoranDocument1 pageFINAL TERM - HIS8482-260 LMoranLeyla MoranNo ratings yet

- CC++Programming Project 1styearDocument12 pagesCC++Programming Project 1styearNguyễn Đỗ Hoàng MinhNo ratings yet

- ABAKADA v. ErmitaDocument2 pagesABAKADA v. ErmitaWiem Marie Mendez BongancisoNo ratings yet

- Indigenous Peoples Displacement To The Urban Areas and Its Effects A Case StudyDocument4 pagesIndigenous Peoples Displacement To The Urban Areas and Its Effects A Case StudyIJBSS,ISSN:2319-2968No ratings yet

- PSPD 2018-19 (Final) PDFDocument356 pagesPSPD 2018-19 (Final) PDFhaseebNo ratings yet

- Competition Brief World Green Building Week CelebrationsDocument2 pagesCompetition Brief World Green Building Week CelebrationsVIGNESHWARAN TAMILARASANNo ratings yet

- SIT40516 - Certificate IV in Commercial Cookery: Student HomeworkDocument5 pagesSIT40516 - Certificate IV in Commercial Cookery: Student HomeworkAmbika SuwalNo ratings yet

- Veiling The Superhero A Comparative AnalDocument12 pagesVeiling The Superhero A Comparative AnalVandercleo JuniorNo ratings yet

- KUS Project ItDocument35 pagesKUS Project ItArpit SinghalNo ratings yet

- Whichever Is Most Recent: LitnaDocument3 pagesWhichever Is Most Recent: Litnaarnab mandalNo ratings yet

GSTR3B 32aamca3298h2zi 032018

GSTR3B 32aamca3298h2zi 032018

Uploaded by

eyochenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR3B 32aamca3298h2zi 032018

GSTR3B 32aamca3298h2zi 032018

Uploaded by

eyochenCopyright:

Available Formats

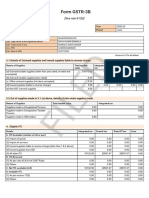

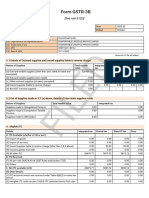

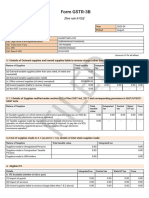

Form GSTR-3B

[See rule 61(5)]

Year 2017-18

Period March

1. GSTIN 32AAMCA3298H2ZI

2(a). Legal name of the registered person AVCON SOLUTIONS PRIVATE LIMITED

2(b). Trade name, if any AVCON SOLUTIONS PRIVATE LIMITED

2(c). ARN AA3203181484582

2(d). Date of ARN 09/11/2019

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

11760.00

0.00

0.00

0.00

0.00

tax

-

0.00

0.00

0.00

tax

1058.40

-

-

-

0.00

tax

1058.40

-

-

-

0.00

0.00

0.00

-

0.00

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

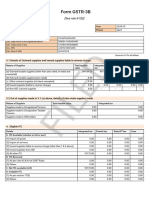

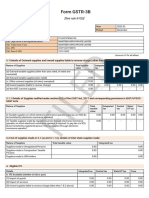

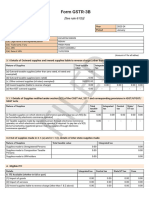

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 150.36 4544.27 4544.27 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 150.36 4544.27 4544.27 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 5000.00 5000.00 -

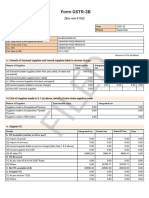

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid Late fee

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

tax

1058.00

1058.00

0.00

0.00

0.00

Integrated tax

-

0.00

150.00

0.00

ED

Central tax

-

-

-

0.00

908.00

State/UT tax

-

0.00

1058.00

-

-

Cess

-

-

-

0.00

cash

0.00

0.00

0.00

0.00

0.00

in cash

-

0.00

0.00

0.00

0.00

paid in cash

5000.00

5000.00

-

-

FIL

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

March 2018 0.00 1058.00 1058.00 0.00

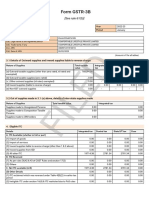

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 09/11/2019 Name of Authorized Signatory

GEORGE SEBASTIAN

Designation /Status

MANAGING DIRECTOR

You might also like

- GSTR3B 36aoupg4539a1zx 062022Document2 pagesGSTR3B 36aoupg4539a1zx 062022abhi ramNo ratings yet

- GSTR3B 33alapv4527e1za 012020Document2 pagesGSTR3B 33alapv4527e1za 012020hakkim satharNo ratings yet

- RecordstatementDocument18 pagesRecordstatementSanthoshNo ratings yet

- GSTR3B 36aigpy2941j1zs 102020Document2 pagesGSTR3B 36aigpy2941j1zs 102020Md YounusNo ratings yet

- GSTR3B April 2018Document2 pagesGSTR3B April 2018Kunal ChoudharyNo ratings yet

- GSTR3B 08absfa0925d1zk 092021Document2 pagesGSTR3B 08absfa0925d1zk 092021YOGESH JOSHINo ratings yet

- GSTR3B 36fjypk4832a1zy 072022Document2 pagesGSTR3B 36fjypk4832a1zy 072022saiakhiltataNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- GSTR3B 19azwpd2404n1zx 062023Document3 pagesGSTR3B 19azwpd2404n1zx 062023ho.ubiquityNo ratings yet

- GSTR3B 32almph4268c1zc 122021Document2 pagesGSTR3B 32almph4268c1zc 122021efile.hco3No ratings yet

- Recordstatement 2Document18 pagesRecordstatement 2SanthoshNo ratings yet

- GSTR3B 19bahph8899e1z2 122022Document3 pagesGSTR3B 19bahph8899e1z2 122022Pawan KanuNo ratings yet

- GSTR3B 33aespt6851j1zr 072023Document3 pagesGSTR3B 33aespt6851j1zr 072023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 19azwpd2404n1zx 042023Document3 pagesGSTR3B 19azwpd2404n1zx 042023ho.ubiquityNo ratings yet

- GSTR3B 33aespt6851j1zr 102023Document3 pagesGSTR3B 33aespt6851j1zr 102023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B Matha MobilesDocument2 pagesGSTR3B Matha MobilesBRIGHT TAX CENTERNo ratings yet

- GSTR3B 33aespt6851j1zr 092023Document3 pagesGSTR3B 33aespt6851j1zr 092023Vignesh KrishnamoorthyNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B 37adcfs8516j1zp 032020Document2 pagesGSTR3B 37adcfs8516j1zp 032020ravi kiranNo ratings yet

- GSTR3B 23apjps3159l1zg 032022Document2 pagesGSTR3B 23apjps3159l1zg 032022sales candoNo ratings yet

- MH GSTR3B Nov'22Document3 pagesMH GSTR3B Nov'22crmfinance.tnNo ratings yet

- GSTR3B 18agppi9704c1za 022023Document3 pagesGSTR3B 18agppi9704c1za 022023ABDUL KHALIKNo ratings yet

- GSTR3B 33aeqpy3870g1zy 082023Document3 pagesGSTR3B 33aeqpy3870g1zy 082023Durai kannuNo ratings yet

- GSTR3B 19azwpd2404n1zx 072023Document3 pagesGSTR3B 19azwpd2404n1zx 072023ho.ubiquityNo ratings yet

- GSTRDocument3 pagesGSTRfliz1889No ratings yet

- GSTR3B 10CKPPK6612R1ZP 082022Document3 pagesGSTR3B 10CKPPK6612R1ZP 082022Saurav KumarNo ratings yet

- Feb 23-24Document3 pagesFeb 23-24crmfinance.tnNo ratings yet

- GSTR3B 19bahph8899e1z2 022023Document3 pagesGSTR3B 19bahph8899e1z2 022023Pawan KanuNo ratings yet

- May GSTR3B - 27AAJCB3358E1ZP - 052023Document2 pagesMay GSTR3B - 27AAJCB3358E1ZP - 052023calmincometax36No ratings yet

- MH GSTR3B Dec'22Document3 pagesMH GSTR3B Dec'22crmfinance.tnNo ratings yet

- GSTR3B 36agnpa1483e1zm 122021Document2 pagesGSTR3B 36agnpa1483e1zm 122021uslprocess1No ratings yet

- GSTR3B 06effpm8326p1zs 102023Document3 pagesGSTR3B 06effpm8326p1zs 102023Prahlad JhaNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 082022Document3 pagesGSTR3B 27BCGPS7468K1ZR 082022Aman JaiswalNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 092022Document3 pagesGSTR3B 27BCGPS7468K1ZR 092022Aman JaiswalNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B 03jpaps1346b1za 112023Document3 pagesGSTR3B 03jpaps1346b1za 112023advocate.atul0001No ratings yet

- GSTR3B 27apapd6950p1zj 052022Document2 pagesGSTR3B 27apapd6950p1zj 052022Arun NaikwadeNo ratings yet

- GSTR3B 08absfa0925d1zk 122021Document2 pagesGSTR3B 08absfa0925d1zk 122021YOGESH JOSHINo ratings yet

- GSTR3B 33aespt6851j1zr 082023Document3 pagesGSTR3B 33aespt6851j1zr 082023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 07ahepk2148n1z5 112022Document3 pagesGSTR3B 07ahepk2148n1z5 112022Rishabh Naresh JainNo ratings yet

- GSTR3B 32aamca3298h2zi 012018Document2 pagesGSTR3B 32aamca3298h2zi 012018eyochenNo ratings yet

- GSTR3B 33anppm7249d1zt 052023Document3 pagesGSTR3B 33anppm7249d1zt 052023Logesh Waran KmlNo ratings yet

- GSTR3B 03jpaps1346b1za 062023Document3 pagesGSTR3B 03jpaps1346b1za 062023advocate.atul0001No ratings yet

- GSTR3B 10eofpk9217c1zd 042023Document3 pagesGSTR3B 10eofpk9217c1zd 042023Pratik RajNo ratings yet

- GSTR3B 09humps0863q1zf 072023Document3 pagesGSTR3B 09humps0863q1zf 072023mahtab begNo ratings yet

- GSTR3B 18alipd4509l1zz 022023Document3 pagesGSTR3B 18alipd4509l1zz 022023Gaurav Ujjal BharaliNo ratings yet

- GSTR3B_33AJWPV3781A1ZU_122023Document3 pagesGSTR3B_33AJWPV3781A1ZU_122023selvamoilNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B 10cespr1366g1ze 012023Document3 pagesGSTR3B 10cespr1366g1ze 012023Mega GuideNo ratings yet

- GSTR3B 27avhpk4246l1z8 052022Document2 pagesGSTR3B 27avhpk4246l1z8 052022Rohit GoleNo ratings yet

- GSTR3B 37BWZPT3110J1ZW 082023Document3 pagesGSTR3B 37BWZPT3110J1ZW 082023satyathirumani5No ratings yet

- GSTR3B 03cuzpr6190r2z9 012024Document3 pagesGSTR3B 03cuzpr6190r2z9 012024kunal3152No ratings yet

- GSTR3B 01bropg6451k1zp 062023Document2 pagesGSTR3B 01bropg6451k1zp 062023Ishtiyaq RatherNo ratings yet

- GSTR3B 07ahepk2148n1z5 082023Document2 pagesGSTR3B 07ahepk2148n1z5 082023Rishabh Naresh JainNo ratings yet

- GSTR3B 07ahepk2148n1z5 052023Document3 pagesGSTR3B 07ahepk2148n1z5 052023PKCL027 Rishabh JainNo ratings yet

- 8 GSTR-3B - Nov 21-22Document2 pages8 GSTR-3B - Nov 21-22ArbindraNo ratings yet

- GSTR3B 03alnpk4728k1zv 072021Document2 pagesGSTR3B 03alnpk4728k1zv 072021Harish VermaNo ratings yet

- GSTR3B 36bmypp9150m1zx 012023Document3 pagesGSTR3B 36bmypp9150m1zx 012023RAJESH DNo ratings yet

- Acceptance - Lecture Handout Acceptance - Lecture HandoutDocument4 pagesAcceptance - Lecture Handout Acceptance - Lecture Handoutماتو اریکاNo ratings yet

- Essay Class 09 NotesDocument3 pagesEssay Class 09 NotesDurga SinghNo ratings yet

- A Galaxy Called 'Mikrokosmos' - A Composer's View (Andre Hadju)Document21 pagesA Galaxy Called 'Mikrokosmos' - A Composer's View (Andre Hadju)thomas.patteson6837100% (1)

- Happy To Help Rs 364.72 19.12.12: Vodafone No. 9962985001Document9 pagesHappy To Help Rs 364.72 19.12.12: Vodafone No. 9962985001supriyaNo ratings yet

- Project Proposal (University Management System) PDFDocument3 pagesProject Proposal (University Management System) PDF2K18/SE/014 AJAY KUMARNo ratings yet

- Role of Merchant Banking in Portfolio Management and Issue Management'Document85 pagesRole of Merchant Banking in Portfolio Management and Issue Management'Rinkesh SutharNo ratings yet

- NEP Education Policy by V.Sree NandanDocument19 pagesNEP Education Policy by V.Sree NandanSreeNandan HomeNo ratings yet

- Advert - Regional Nutrition OfficerDocument2 pagesAdvert - Regional Nutrition Officermoses ochiengNo ratings yet

- ISG 2020 BookDocument528 pagesISG 2020 BookKatya GeorgievaNo ratings yet

- Rule 27 Petition - Brink'sDocument8 pagesRule 27 Petition - Brink'sdcodreaNo ratings yet

- Meling vs. MelendrezDocument2 pagesMeling vs. MelendrezArshie Mae Uy RicaldeNo ratings yet

- Bach Flower RemediesDocument21 pagesBach Flower RemediesTrupti Patil100% (4)

- Mesr 2003Document14 pagesMesr 2003SureshkumaryadavNo ratings yet

- Form 4 Choice of SubjectsDocument33 pagesForm 4 Choice of Subjectsapi-484150872No ratings yet

- Backgroundfile 35427Document15 pagesBackgroundfile 35427sladurantayeNo ratings yet

- Condominium: Living SpacesDocument15 pagesCondominium: Living SpacesAditya JainNo ratings yet

- Nfpa Codes & StandardsDocument9 pagesNfpa Codes & StandardsPradip SharmaNo ratings yet

- 9 000 Years of The Goddess in Anatolia PDFDocument20 pages9 000 Years of The Goddess in Anatolia PDFEduardo Figueroa100% (3)

- Character Analysis (Mill On The Floss) Direct CharacterizationDocument2 pagesCharacter Analysis (Mill On The Floss) Direct CharacterizationzainNo ratings yet

- Urban Rural DetailsDocument20 pagesUrban Rural Detailsakibpagla001No ratings yet

- FINAL TERM - HIS8482-260 LMoranDocument1 pageFINAL TERM - HIS8482-260 LMoranLeyla MoranNo ratings yet

- CC++Programming Project 1styearDocument12 pagesCC++Programming Project 1styearNguyễn Đỗ Hoàng MinhNo ratings yet

- ABAKADA v. ErmitaDocument2 pagesABAKADA v. ErmitaWiem Marie Mendez BongancisoNo ratings yet

- Indigenous Peoples Displacement To The Urban Areas and Its Effects A Case StudyDocument4 pagesIndigenous Peoples Displacement To The Urban Areas and Its Effects A Case StudyIJBSS,ISSN:2319-2968No ratings yet

- PSPD 2018-19 (Final) PDFDocument356 pagesPSPD 2018-19 (Final) PDFhaseebNo ratings yet

- Competition Brief World Green Building Week CelebrationsDocument2 pagesCompetition Brief World Green Building Week CelebrationsVIGNESHWARAN TAMILARASANNo ratings yet

- SIT40516 - Certificate IV in Commercial Cookery: Student HomeworkDocument5 pagesSIT40516 - Certificate IV in Commercial Cookery: Student HomeworkAmbika SuwalNo ratings yet

- Veiling The Superhero A Comparative AnalDocument12 pagesVeiling The Superhero A Comparative AnalVandercleo JuniorNo ratings yet

- KUS Project ItDocument35 pagesKUS Project ItArpit SinghalNo ratings yet

- Whichever Is Most Recent: LitnaDocument3 pagesWhichever Is Most Recent: Litnaarnab mandalNo ratings yet