Professional Documents

Culture Documents

Thi thử. Đề 01. 2023

Thi thử. Đề 01. 2023

Uploaded by

Nguyễn Thùy DungCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thi thử. Đề 01. 2023

Thi thử. Đề 01. 2023

Uploaded by

Nguyễn Thùy DungCopyright:

Available Formats

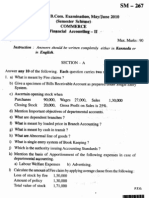

TEST NO.

QUES 1: (2p)

a. Distinguishing the accounting methods of purchasing raw materials for administrative & non-

business activities and business activities?

b. Explain true or false and give illustrative examples: all fixed assets used in the administrative

and non-business units are only required to calculate the wear & tear value?

QUES 2: (2p)

In an educational non-business unit in year N, there has following transactions:

1. Received the approval of the budget estimates for the year of 460,300

2. Provisional withdrawal from budget estimates to the cash fund 200,000; cash at bank 260,300

for non-business operational activities

3. Collected the other retanied income of 80,000; deposited into the treasury account

4. Calculated the salaries payable to employees 180,000

5. Calculated salary deductions according to current regulations

6. Paid salaries payable and other salary deductions by cash at bank

7. Expenses for non-business operational activities 120,000 by cash in hand and 80,000 by

withdrawal from other retained income at the treasury account

8. Paid electricity and water bills to the providers by cash at bank 38,000

9. Purchased raw materials 80,000 by cash in hand

Requirements: Prepare journal entries?

QUES 3: (2p)

Requirements: From Question 2

1. Make the end-of-period entries; knowing that closing inventory is 21,000?

2. Determine the income summary for educational non-business activities?

QUES 4: (2p)

Extracting accounting documents at a non-business unit in year N

1. Disposal of 1 car with original cost of 400,000 and wear & tear of 250,000. This car was

formed by the State budget, 8-year useful life, straight line method;

2. Purchased 1 blood test machine using the State budget source by withdrawal from Budget

estimates, paid the 10% VAT-exclusive price of 300,000, the wear & tear rate 10%, straight line

method;

3. Converted the multi-purpose hospital bed set into tool, original cost of 100,000, has worn out

90,000, knowing that this asset was budgeted and used for non-business activities, 10-year useful

life, straight line method;

4. Purchased 1 ultrasound machine with tax-inclusive price of 900,000, VAT 10%, paid by cash

at bank, useful life of 10 years, straight line method. This asset was invested by the non-business

development fund, used 50% for service business and 50% for non-business activities.

Requirements: Making journal entries?

QUES 5: (2p)

From question 4, perform year-end journal entries for these assets? (Wear & Tear

expense is 230,000 and no depreciation expense for year (N-1).)

Closed - book examination

Enclose this with your exam paper – Protors are not required to answer any question

You might also like

- Philadelphia 2024 State of The CityDocument29 pagesPhiladelphia 2024 State of The CityWHYY News100% (2)

- CPA 1 Past Paper 1 - Financial AccountingDocument8 pagesCPA 1 Past Paper 1 - Financial AccountingInnocent Won Aber65% (34)

- Questionnaire of Pizza Hut Fast Food RestaurantDocument5 pagesQuestionnaire of Pizza Hut Fast Food Restaurantxmyth8875% (4)

- Battery Storage Guidance Note 1 PDFDocument35 pagesBattery Storage Guidance Note 1 PDFOrlando ArayaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Cost Accounting Past PapersDocument66 pagesCost Accounting Past Paperssalamankhana100% (2)

- AA Chap 11 Rev May 2016Document3 pagesAA Chap 11 Rev May 2016jbsantos09No ratings yet

- Home Buyers Guide Standard BankDocument32 pagesHome Buyers Guide Standard Bank07961056320% (1)

- Diagnostic Exam 1.23 AKDocument13 pagesDiagnostic Exam 1.23 AKmarygraceomacNo ratings yet

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDocument22 pagesPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsSneha VermaNo ratings yet

- Exercises Chapter 2Document3 pagesExercises Chapter 2Phương NguyênNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- Moderator: Mr. L.J. Muthivhi (CA), SADocument11 pagesModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaNo ratings yet

- Clouie Jid Malino TLA 6.2Document9 pagesClouie Jid Malino TLA 6.2Raynon AbasNo ratings yet

- Accounts Important QuestionDocument3 pagesAccounts Important Questionankitchauhan9630No ratings yet

- Chapter 10 Noncurrent Assets: Discussion QuestionsDocument6 pagesChapter 10 Noncurrent Assets: Discussion QuestionskietNo ratings yet

- Question Paper1 2005 AccountsDocument12 pagesQuestion Paper1 2005 Accountspankhaniahirensv150No ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2009Document8 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2009mouryastudypointNo ratings yet

- P1 AssessmentDocument26 pagesP1 AssessmentRay Jhon OrtizNo ratings yet

- MBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016Document3 pagesMBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016ISLAMICLECTURESNo ratings yet

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanNo ratings yet

- Ias 16Document6 pagesIas 16Noman Anser0% (1)

- Advanced AccountingDocument13 pagesAdvanced AccountingprateekfreezerNo ratings yet

- Deepak QuestionsDocument5 pagesDeepak Questionsvivek ghatbandheNo ratings yet

- Accounting For ManagersDocument6 pagesAccounting For ManagerskartikbhaiNo ratings yet

- Accounting For Decision Making Mid TermDocument5 pagesAccounting For Decision Making Mid Termumer12No ratings yet

- MCQ of FinanceDocument17 pagesMCQ of FinanceRajveer RathodNo ratings yet

- Acct 2005 Practice Exam 1Document16 pagesAcct 2005 Practice Exam 1laujenny64No ratings yet

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- Extra AfaDocument5 pagesExtra AfaJesmon RajNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- If, Cost of Machine Rs.400, 000 Useful Life 5 Years Rate of Depreciation 40%Document13 pagesIf, Cost of Machine Rs.400, 000 Useful Life 5 Years Rate of Depreciation 40%Narang NewsNo ratings yet

- Account Question 12Document5 pagesAccount Question 12Kapildev SubediNo ratings yet

- P5 Syl2012 InterDocument27 pagesP5 Syl2012 InterViswanathan SrkNo ratings yet

- CFR Quiz 1 # 1 - SolDocument3 pagesCFR Quiz 1 # 1 - SolKshitij SharmaNo ratings yet

- Liabilities Are Decreased When: The Owner Pays The Existing Debt of Her Business From His Personal MoneyDocument12 pagesLiabilities Are Decreased When: The Owner Pays The Existing Debt of Her Business From His Personal Moneyalexis chimNo ratings yet

- Test Paper 2 CA Inter CostingDocument8 pagesTest Paper 2 CA Inter CostingtchargeipatchNo ratings yet

- Fo A I Assignment1Document2 pagesFo A I Assignment1solomon tadeseNo ratings yet

- Journal Entries To FSDocument3 pagesJournal Entries To FSJadon MejiaNo ratings yet

- Level 4 ModelDocument7 pagesLevel 4 Modelsolomon asfawNo ratings yet

- ICMA Questions Aug 2011Document57 pagesICMA Questions Aug 2011Asadul Hoque100% (1)

- Cash Flow Statements Questions PDFDocument51 pagesCash Flow Statements Questions PDFRaj AgrawalNo ratings yet

- Cost Accounting RTP CAP-II June 2016Document31 pagesCost Accounting RTP CAP-II June 2016Artha sarokarNo ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekera100% (1)

- E. Chapter 4.NVL - BT.SVDocument14 pagesE. Chapter 4.NVL - BT.SVHoàng NhiNo ratings yet

- 2016 Accountancy IDocument4 pages2016 Accountancy IDanish RazaNo ratings yet

- Case of Mahesh Foods LTD.: Weekend AssignmentDocument1 pageCase of Mahesh Foods LTD.: Weekend AssignmentMukeshKumawatNo ratings yet

- Test Papers: FoundationDocument23 pagesTest Papers: FoundationUmesh TurankarNo ratings yet

- Old QPDocument4 pagesOld QPRiteshHPatelNo ratings yet

- Analyze The Effects of The Transactions On The Accounting Equation.eDocument4 pagesAnalyze The Effects of The Transactions On The Accounting Equation.eShesharam ChouhanNo ratings yet

- Chapter 10 Change in Accounting EstimateDocument35 pagesChapter 10 Change in Accounting Estimateai kawaii90% (10)

- AccountingDocument4 pagesAccountingNaiya JoshiNo ratings yet

- Esperanza Executive Summary 2018Document5 pagesEsperanza Executive Summary 2018Ma. Danice Angela Balde-BarcomaNo ratings yet

- (Semester Sdteqte) Commerce FLN Tneial Accottnfibg-Il ,,'Document16 pages(Semester Sdteqte) Commerce FLN Tneial Accottnfibg-Il ,,'zingcemNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Handbook for Developing Joint Crediting Mechanism ProjectsFrom EverandHandbook for Developing Joint Crediting Mechanism ProjectsNo ratings yet

- Compendium of Supply and Use Tables for Selected Economies in Asia and the PacificFrom EverandCompendium of Supply and Use Tables for Selected Economies in Asia and the PacificNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Writing ProcessDocument57 pagesWriting ProcessNguyễn Thùy DungNo ratings yet

- Unit 3. Speaking PlaceDocument82 pagesUnit 3. Speaking PlaceNguyễn Thùy DungNo ratings yet

- IELTS A Reading + Listening HW For A 28513Document20 pagesIELTS A Reading + Listening HW For A 28513Nguyễn Thùy DungNo ratings yet

- Unit 1 - Improving Academic Writing StyleDocument7 pagesUnit 1 - Improving Academic Writing StyleNguyễn Thùy DungNo ratings yet

- Should Students Have To Wear School UniformsDocument2 pagesShould Students Have To Wear School UniformsAoi Miyu Shino100% (1)

- Yavana Soldier On Bharhut Frieze An InduDocument6 pagesYavana Soldier On Bharhut Frieze An InduR. FortalNo ratings yet

- MR - MD Samiullah: Page 1 of 1 M-2263937Document1 pageMR - MD Samiullah: Page 1 of 1 M-2263937Notty AmreshNo ratings yet

- Christmas Sermon PDFDocument2 pagesChristmas Sermon PDFcombination_soupNo ratings yet

- Extremism in The Ranks Stand-Down Training SlidesDocument51 pagesExtremism in The Ranks Stand-Down Training SlidesCDR SalamanderNo ratings yet

- Cms Application FormDocument5 pagesCms Application FormShyam VimalKumarNo ratings yet

- Types of Retail OutletsDocument5 pagesTypes of Retail OutletsVinoth KannanNo ratings yet

- India - WikipediaDocument67 pagesIndia - WikipediaRonaldbrzNo ratings yet

- Cadet Handbook: Itizenchip Dvancement RainingDocument17 pagesCadet Handbook: Itizenchip Dvancement RainingManu Emelon McBulosNo ratings yet

- The Nyaya DarshanaDocument106 pagesThe Nyaya Darshanasimhan743640No ratings yet

- Week 4 Assignment FNCE UCWDocument3 pagesWeek 4 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Api 510Document249 pagesApi 510Muhammad Asim BaigNo ratings yet

- Mobil Bible School FinalDocument7 pagesMobil Bible School FinalHassan KoromaNo ratings yet

- Polythecnic University of The Philippines Sta - Mesa, Manila College of Business Department of MarketingDocument2 pagesPolythecnic University of The Philippines Sta - Mesa, Manila College of Business Department of MarketingJade HuescaNo ratings yet

- Life Studies: Robert LowellDocument18 pagesLife Studies: Robert LowellLeaMaroni100% (2)

- Following Are The Honda Atlas' Important Strengths, Weaknesses, Opportunities and ThreatsDocument3 pagesFollowing Are The Honda Atlas' Important Strengths, Weaknesses, Opportunities and ThreatsSaad MajeedNo ratings yet

- C. Minor-To-Moderate Impacts Project Template: Transportation Management Plan (TMP) Template 1Document11 pagesC. Minor-To-Moderate Impacts Project Template: Transportation Management Plan (TMP) Template 1Engr Nissar KakarNo ratings yet

- Shelter Island Reporter Classifieds: Sept. 11, 2014Document2 pagesShelter Island Reporter Classifieds: Sept. 11, 2014TimesreviewNo ratings yet

- Instant Download Ebook PDF Essential Procedures For Emergency Urgent and Primary Care Settings A Clinical Companion PDF ScribdDocument41 pagesInstant Download Ebook PDF Essential Procedures For Emergency Urgent and Primary Care Settings A Clinical Companion PDF Scribdandrew.harrell532100% (55)

- Export Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal KeotDocument45 pagesExport Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal Keotjunet123123No ratings yet

- Fay FootprintsDocument2 pagesFay FootprintskoryandcaraNo ratings yet

- Putty For QNAPDocument8 pagesPutty For QNAPMohan RajNo ratings yet

- Module 2: Oversight Government Official For Micro EnterprisesDocument17 pagesModule 2: Oversight Government Official For Micro EnterprisesJamiella CristobalNo ratings yet

- Joe Billy Toles v. Mr. C.E. Jones (Warden) and The Attorney General of The State of Alabama, 951 F.2d 1200, 11th Cir. (1992)Document16 pagesJoe Billy Toles v. Mr. C.E. Jones (Warden) and The Attorney General of The State of Alabama, 951 F.2d 1200, 11th Cir. (1992)Scribd Government DocsNo ratings yet

- Participant Observation As A Data Collection Method (2005)Document19 pagesParticipant Observation As A Data Collection Method (2005)VKNo ratings yet

- Deed of Adjudication of Heirs With Absolute SaleDocument3 pagesDeed of Adjudication of Heirs With Absolute SaleSelurongNo ratings yet