Professional Documents

Culture Documents

BIR Ruling No. 389-16 - Department of Public Works and Highways

BIR Ruling No. 389-16 - Department of Public Works and Highways

Uploaded by

Omie AmpangOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Ruling No. 389-16 - Department of Public Works and Highways

BIR Ruling No. 389-16 - Department of Public Works and Highways

Uploaded by

Omie AmpangCopyright:

Available Formats

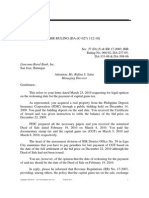

3/22/24, 11:12 AM BIR Ruling No.

389-16 | Department of Public Works and Highways

November 14, 2016

BIR RULING NO. 389-16

RA 10752; Secs. 24 (D) (1) & 196 of the NIRC, as

amended

Department of Public Works and Highways

Central Office

Manila

Attention: Estrella T. Decena-Zaldivar

Director IV, Legal Service

Gentlemen :

This refers to your letter dated October 26, 2016 requesting for official computation of capital gains

tax (CGT) and documentary stamps tax (DST) in connection with the negotiated contracts entered into by

the Department of Public Works and Highways (DPWH) under Republic Act (RA) No. 10752.

It is represented that your legal staff, Atty. Girlie C. Mahinay-Mendoza inquired with Revenue District

Office (RDO) No. 24-Valenzuela on the correct computation of the CGT and DST on the negotiated sale of

property under RA No. 10752; that the RDO No. 24-Valenzuela submitted an official computation for the

said taxes, grossing up the Net Actual Consideration (NAC) from 92.5% to arrive at the Actual Consideration

(AC), formulated as follows:

AC = NAC + CGT + DST

AC = NAC + 6% AC + 1.5% AC

AC = NAC + 7.5% AC

92.5% AC = NAC

Therefore: AC = NAC/92.5

and that you would like to seek on opinion/confirmation if the above formula is applicable to all BIR District

Offices and to all related transactions under RA No. 10752.

In reply, please be informed that Section 5 (c) of RA No. 10752, provides that:

Sec. 5. Rules on Negotiated Sale. — . . .

(c) With regard to the taxes and fees relative to the transfer of title of the property to the

Republic of the Philippines through negotiated sale, the implementing agency shall pay, for the

account of the seller, the capital gains tax, as well as the documentary stamp tax, transfer tax

and registration fees, while the owner shall pay any unpaid real property tax. DETACa

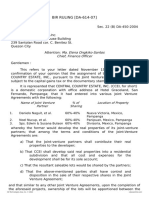

https://premium.cdasiaonline.com/document?type=law&id=1cd8e52a&queryStr="negotiated sale" AND land&title=Department of Public Works and Highways&ref… 1/3

3/22/24, 11:12 AM BIR Ruling No. 389-16 | Department of Public Works and Highways

The above Section is implemented by Section 6.9 of the Implementing Rules and Regulations of RA

No. 10752, which provides that:

"6.9. Taxes and Fees. —

As provided in Section 5(c) of the Act, the IA shall pay for account of the seller/owner, the

Capital Gains Tax (CGT), as well as the Documentary Stamp Tax (DST), transfer tax and

registration fees, while the owner shall pay any unpaid real property tax.

The IA shall pay the CGT to the Bureau of Internal Revenue (BIR) based on the actual

consideration stated in the Deed of Sale, as expressed below:

AC = NAC + CGT

Where:

AC = Actual Consideration indicated in the Deed of Sale to be appropriated and paid out by the

IA for the negotiated sale,

NAC = Compensation Price as offered by the IA to the property owner in accordance with

Section 6.1 of this IRR, net of CGT, and

CGT = Capital Gains Tax to be paid by the IA to the BIR, for the account of the owner.

Since CGT = x% of AC,

Then NAC = AC - CGT = 100% AC - x% AC = (100% - x%) AC,

and, therefore, AC = NAC (100% - x%)

Annex B shows an illustrative example in computing the AC, NAC, and CGT for a hypothetical

property affected by a ROW to be acquired through negotiated sale.

The above provisions pertaining to CGT does not apply to the sale of property classified as

ordinary assets. The latter is subject to the existing BIR rules and regulations.

In addition, the DST, transfer tax and registration fees for the negotiated sale shall be paid by

the IA in accordance with pertinent laws and regulations. Upon the request of the property

owner, the IA shall remit to the LGU concerned the amount corresponding to any unpaid real

property tax, subject to the deduction of this amount from the total negotiated price, provided

that the said amount is not more than the negotiated price."

Section 5 (c) of RA No. 10752 must be read in relation to Sections 24 (D) (1) and 196 of the Tax

Code of 1997, as amended, which provide that:

"Section 24. Income Tax Rates. —

(D) Capital Gains from Sale of Real Property. —

(1) In General. — The provisions of Section 39(B) notwithstanding, a final tax of six percent

(6%) based on the gross selling price or current fair market value as determined in

accordance with Section 6(E) of this Code, whichever is higher, is hereby imposed upon capital

gains presumed to have been realized from the sale, exchange, or other disposition of real

property located in the Philippines, classified as capital assets, including pacto de retro sales

https://premium.cdasiaonline.com/document?type=law&id=1cd8e52a&queryStr="negotiated sale" AND land&title=Department of Public Works and Highways&ref… 2/3

3/22/24, 11:12 AM BIR Ruling No. 389-16 | Department of Public Works and Highways

and other forms of conditional sales, by individuals, including estates and trusts: . . . ."

(Emphasis supplied)

xxx xxx xxx

SEC. 196. Stamp tax on Deeds of Sale and Conveyances of Real Property. — On all

conveyances, deeds, instruments, or writings, other than grants, patents or original certificates

of adjudication issued by the Government, whereby any land, tenement, or other realty sold

shall be granted, assigned, transferred or otherwise conveyed to the purchaser, or purchasers,

or to any other person or persons designated by such purchaser or purchasers, there shall be

collected a documentary stamp tax, at the rates herein below prescribed, based on the

consideration contracted to be paid for such realty or on its fair market value determined in

accordance with Section 6(E) of this Code, whichever is higher: Provided, That when one of the

contracting parties is the Government the tax herein imposed shall be based on the actual

consideration.

Hence, the tax base of CGT, in case of negotiated transfer of right-of-way site or location for National

Government Infrastructure Projects shall be gross selling price or zonal value of the real property as

determined in accordance with Section 6 (E) of the Tax Code of 1997, as amended, whichever is higher.

Thus for purposes of computing the CGT, the following formula shall be observed:

AC = NAC + CGT

Where:

NAC = gross selling price or the fair market value (FMV) as determined by the BIR Commissioner or

the FMV as shown in the schedule of values of the Provincial and City Assessors, whichever is highest.

With regard to the computation of the DST, Sec. 196 of the Tax Code of 1997, as amended, provides

that when one of the contracting parties is the Government, the DST shall be based on the actual

consideration thereof. Thus, the following formula shall be followed:

AC = NAC + DST

Where:

NAC = gross selling price.

Accordingly, this Office affirms the official computation of RDO No. 24-Valenzuela by grossing up the

NAC from 92.5% to arrive at the AC.

Please be guided accordingly.

Very truly yours,

(SGD.) CAESAR R. DULAY

Commissioner of Internal Revenue

https://premium.cdasiaonline.com/document?type=law&id=1cd8e52a&queryStr="negotiated sale" AND land&title=Department of Public Works and Highways&ref… 3/3

You might also like

- The Saturn Time Cube SimulationDocument67 pagesThe Saturn Time Cube Simulationtriple7inc100% (3)

- RR 4-99Document3 pagesRR 4-99matinikkiNo ratings yet

- An Introduction To TattvasDocument13 pagesAn Introduction To TattvasTemple of the stars83% (6)

- Mapiful - How To Make Your Home More YouDocument35 pagesMapiful - How To Make Your Home More YouElina100% (1)

- RR 8-98Document3 pagesRR 8-98matinikkiNo ratings yet

- Bir 363-14Document5 pagesBir 363-14msdivergentNo ratings yet

- Technical Note Guidance On Corrosion Assessment of Ex EquipmentDocument7 pagesTechnical Note Guidance On Corrosion Assessment of Ex EquipmentParthiban NagarajanNo ratings yet

- Electrolytic Silver Refining ProcessDocument8 pagesElectrolytic Silver Refining ProcessPamo Caytano100% (1)

- 12.01.13 MOCK - Real Estate Taxation SolutionsDocument4 pages12.01.13 MOCK - Real Estate Taxation SolutionsMiggy Zurita100% (5)

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- RMC No 19-2018Document2 pagesRMC No 19-2018Paul GeorgeNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- VAT Theory Question Answer by Subash NepalDocument13 pagesVAT Theory Question Answer by Subash Nepalssah4155No ratings yet

- DST-CTA-gr 221655 2021Document5 pagesDST-CTA-gr 221655 2021Teresita TibayanNo ratings yet

- Fort Bonifacio V CirDocument4 pagesFort Bonifacio V CirJasNo ratings yet

- Republic v. SorianoDocument3 pagesRepublic v. SorianoEllis LagascaNo ratings yet

- Conveyancing Project WorkDocument3 pagesConveyancing Project WorkBenjamin Brian NgongaNo ratings yet

- 2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubDocument3 pages2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubRen Mar CruzNo ratings yet

- RR 05-09 (Sale of RP)Document7 pagesRR 05-09 (Sale of RP)joefieNo ratings yet

- Bir Vat (Case)Document16 pagesBir Vat (Case)Jay Ryan Sy BaylonNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- VAT ReviewerDocument72 pagesVAT ReviewerJohn Kenneth AcostaNo ratings yet

- Limcoma Rural Bank, Inc. June 25, 2010Document4 pagesLimcoma Rural Bank, Inc. June 25, 2010Ronnie RimandoNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- Value Added TaxDocument13 pagesValue Added TaxRyan AgcaoiliNo ratings yet

- VAT CasesDocument69 pagesVAT Casesrachel cayangaoNo ratings yet

- Closing of Real Estate Sale Transactions and Transfer of TitleDocument6 pagesClosing of Real Estate Sale Transactions and Transfer of TitleescaNo ratings yet

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- BIR RULING NO. 278-13: Noritake Porcelana MFG., IncDocument3 pagesBIR RULING NO. 278-13: Noritake Porcelana MFG., IncJoyceMendozaNo ratings yet

- Placer DomeDocument18 pagesPlacer DomeMaisie ZabalaNo ratings yet

- Cebu Portland Cement v. CIRDocument3 pagesCebu Portland Cement v. CIRKeila Garcia100% (1)

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- TARIFF CLASSIFICATION ADVANCE RULING - Nexus 42" Plasma TelevisionDocument4 pagesTARIFF CLASSIFICATION ADVANCE RULING - Nexus 42" Plasma TelevisionMikePMoffattNo ratings yet

- BIR Ruling 091-99 PDFDocument6 pagesBIR Ruling 091-99 PDFleahtabsNo ratings yet

- RR 17-03Document15 pagesRR 17-03firstdummyNo ratings yet

- BIR - Ruling DA-263-00 (20 June 2000)Document2 pagesBIR - Ruling DA-263-00 (20 June 2000)josephine.t.ycongNo ratings yet

- Dvat Amendments-2013Document37 pagesDvat Amendments-2013Dinesh SharmaNo ratings yet

- CREBA v. Executive SecretaryDocument35 pagesCREBA v. Executive Secretarydes_4562No ratings yet

- $VAT ResolutionDocument14 pages$VAT ResolutionKitty MoonsterNo ratings yet

- Rmo 1981Document228 pagesRmo 1981Mary graceNo ratings yet

- RR 04-99 PDFDocument3 pagesRR 04-99 PDFPeter Joshua OrtegaNo ratings yet

- Summary of LAW 843Document8 pagesSummary of LAW 843ScribdTranslationsNo ratings yet

- 1 DigestedDocument5 pages1 DigestedYvet KatNo ratings yet

- Taxation CasesDocument296 pagesTaxation CasesshelNo ratings yet

- RPGT A Comprehensive Guide To Real Property Gains Tax in MalaysiaDocument9 pagesRPGT A Comprehensive Guide To Real Property Gains Tax in Malaysiahekate.yantraNo ratings yet

- BIR Ruling DA-C-179 464-09 (18 August 2009)Document3 pagesBIR Ruling DA-C-179 464-09 (18 August 2009)josephine.t.ycongNo ratings yet

- Epufllic of TFL C Urt Affjials: U ZQWC NDocument8 pagesEpufllic of TFL C Urt Affjials: U ZQWC NIriz BelenoNo ratings yet

- H. Taxation Other Inherent To Escape From Taxation CasesDocument36 pagesH. Taxation Other Inherent To Escape From Taxation CasesErwin April MidsapakNo ratings yet

- Fort Bonifacio v. CIRDocument17 pagesFort Bonifacio v. CIRPaul Joshua SubaNo ratings yet

- Possibilities in Taxation For The 2017 Bar Examinations: (Project Phoenix)Document54 pagesPossibilities in Taxation For The 2017 Bar Examinations: (Project Phoenix)Ihon BaldadoNo ratings yet

- Fort Bonifacio Development Vs CIR GR No 158885Document3 pagesFort Bonifacio Development Vs CIR GR No 158885Alfonso Dimla100% (1)

- Progressive Development Corporation vs. Quezon City, GR No. L-36081 Dated April 24, 1989Document5 pagesProgressive Development Corporation vs. Quezon City, GR No. L-36081 Dated April 24, 1989EdvangelineManaloRodriguezNo ratings yet

- Chamber of Real Estate and Builders' Association v. Romulo, SupraDocument18 pagesChamber of Real Estate and Builders' Association v. Romulo, SupraJMae MagatNo ratings yet

- Association of Customs Brokers v. Municipal Board, G.R. No. L-4376, May 22, 1953 FactsDocument24 pagesAssociation of Customs Brokers v. Municipal Board, G.R. No. L-4376, May 22, 1953 FactsFaith TangoNo ratings yet

- Amendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFDocument12 pagesAmendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFRomer LesondatoNo ratings yet

- Karnatka Vat RulesDocument49 pagesKarnatka Vat RulesshanoboghNo ratings yet

- CIR v. Placer DomeDocument9 pagesCIR v. Placer DomeKristineSherikaChyNo ratings yet

- Creba V Exec Sec RomuloDocument18 pagesCreba V Exec Sec RomuloAnonymous qVilmbaMNo ratings yet

- CREBA V RomuloDocument58 pagesCREBA V RomuloBuladasPukikiNo ratings yet

- Baniqued & Baniqued: VAT RULING NO. 007-06Document4 pagesBaniqued & Baniqued: VAT RULING NO. 007-06Charlene dela RosaNo ratings yet

- Bir Ruling No. JV-187-21Document4 pagesBir Ruling No. JV-187-21Ren Mar CruzNo ratings yet

- Bir Forms 1706 (99) Capital Gains Tax ReturnDocument5 pagesBir Forms 1706 (99) Capital Gains Tax ReturnArnel Melgar100% (2)

- SPM Linear LawDocument5 pagesSPM Linear LawNg YieviaNo ratings yet

- Amazon Intern Job DescriptionsDocument15 pagesAmazon Intern Job Descriptionschirag_dceNo ratings yet

- CDP 22 FinalDocument8 pagesCDP 22 FinalAnonymous GMUQYq8No ratings yet

- CR 48JACPAdrenalmediastinalcystDocument4 pagesCR 48JACPAdrenalmediastinalcystKartik DuttaNo ratings yet

- Ib 150 Al2Document16 pagesIb 150 Al2QasimNo ratings yet

- Lab 27Document3 pagesLab 27api-239505062No ratings yet

- OpAudCh02 CBET 01 501E ToraldeMa - KristineE.Document4 pagesOpAudCh02 CBET 01 501E ToraldeMa - KristineE.Kristine Esplana ToraldeNo ratings yet

- Singles NumericDocument27 pagesSingles Numericestevaocanan85No ratings yet

- TLNB SeriesRules 7.35Document24 pagesTLNB SeriesRules 7.35Pan WojtekNo ratings yet

- Fiber-Reinforced Concrete - WikipediaDocument1 pageFiber-Reinforced Concrete - WikipediamongreatNo ratings yet

- Moist Heat Sterilization Validation and Requalification STERISDocument4 pagesMoist Heat Sterilization Validation and Requalification STERISDany RobinNo ratings yet

- Warid Telecom ReportDocument49 pagesWarid Telecom ReporthusnainjafriNo ratings yet

- Product Life Cycle Explained Stage and ExamplesDocument11 pagesProduct Life Cycle Explained Stage and ExamplesAkansha SharmaNo ratings yet

- PHP Security CPanelDocument5 pagesPHP Security CPanelManiMegalaiNo ratings yet

- rr320305 Design of Machine Members IIDocument8 pagesrr320305 Design of Machine Members IISRINIVASA RAO GANTANo ratings yet

- Stem Cells InformationDocument2 pagesStem Cells InformationPauline ZwanikkenNo ratings yet

- m50d-hd (ZF S5-42) TransmissionDocument13 pagesm50d-hd (ZF S5-42) Transmissiondeadruby20060% (1)

- Workers of The World UNITE!Document2 pagesWorkers of The World UNITE!Dominique A.M. Juntado100% (1)

- The Kinston Waterfront Now!Document46 pagesThe Kinston Waterfront Now!Kofi BooneNo ratings yet

- BPO - Bank Payment ObligationDocument2 pagesBPO - Bank Payment ObligationshreyaNo ratings yet

- China and EnvironmentDocument2 pagesChina and EnvironmentAndrea CalcagniNo ratings yet

- Royal College Grade 07 English Second Term Paper (221119 110652Document10 pagesRoyal College Grade 07 English Second Term Paper (221119 110652sandeepsubasinghe23No ratings yet

- Gloss 1Document8 pagesGloss 1api-3723109No ratings yet

- Ss T ConductmnbvjkbDocument7 pagesSs T ConductmnbvjkbFelix PartyGoerNo ratings yet

- Mongodb DocsDocument313 pagesMongodb DocsDevendra VermaNo ratings yet