Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsMidterm C

Midterm C

Uploaded by

sanjeet_kaur_10Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- 4th Gr. CMLDocument54 pages4th Gr. CMLsanjeet_kaur_100% (1)

- 3rd Grade CML Answer KeyDocument29 pages3rd Grade CML Answer Keysanjeet_kaur_10No ratings yet

- CFP Mock Test Retirement PlanningDocument9 pagesCFP Mock Test Retirement PlanningDeep Shikha100% (4)

- Midterm BDocument4 pagesMidterm Bsanjeet_kaur_10No ratings yet

- Classwork Practice Cases: Case 1Document3 pagesClasswork Practice Cases: Case 1Yash DedhiaNo ratings yet

- Assignment No 1 SFA&DDocument4 pagesAssignment No 1 SFA&DSyed Osama Ali100% (1)

- Problems-Financial ManagementDocument13 pagesProblems-Financial ManagementGajendra Singh Raghav50% (2)

- Master of Business AdministrationDocument2 pagesMaster of Business AdministrationAnnieannaNo ratings yet

- DRM-CLASSWORK - 14th JuneDocument4 pagesDRM-CLASSWORK - 14th JuneSaransh MishraNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- CF Assignment - 2Document2 pagesCF Assignment - 2vishnu607No ratings yet

- RTPBDocument87 pagesRTPBKr PrajapatNo ratings yet

- Assignment No 1 CFDocument6 pagesAssignment No 1 CFAltaf HussainNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- Acc 501 Midterm Preparation FileDocument22 pagesAcc 501 Midterm Preparation FilesephienoorNo ratings yet

- ProblemsDocument4 pagesProblemsKritika SrivastavaNo ratings yet

- Economic NumericalDocument26 pagesEconomic NumericalSantosh ThapaNo ratings yet

- Assignment For Emba Students For FM Course by DR Narayan BaserDocument2 pagesAssignment For Emba Students For FM Course by DR Narayan Baserutkarsh KumarNo ratings yet

- Assignment No 1 SFA&DDocument6 pagesAssignment No 1 SFA&DSyed Shabbir RizviNo ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- Basic Excel Functions - ProblemsDocument31 pagesBasic Excel Functions - ProblemsSushma Jeswani TalrejaNo ratings yet

- FM Assignment 1Document3 pagesFM Assignment 1Joseph KingNo ratings yet

- Sac 407-Bsc Actuarial Science AssignmentDocument2 pagesSac 407-Bsc Actuarial Science AssignmentPatrick Mugo100% (1)

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- Financial Modeling: Financial Planning and InvestmentsDocument1 pageFinancial Modeling: Financial Planning and InvestmentsSuraj KumarNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Engineering Economics and Costing AssignmentDocument2 pagesEngineering Economics and Costing AssignmentSachin SahooNo ratings yet

- Parab (2013) Financial Management JBIMS 20130408Document19 pagesParab (2013) Financial Management JBIMS 20130408Vishal BaviskarNo ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- FPWM - Short Cases - Part I For ClassDocument2 pagesFPWM - Short Cases - Part I For ClassJashandeep MakkarNo ratings yet

- Assignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Document2 pagesAssignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Ramesh Chand GuptaNo ratings yet

- Assignment - 1 Time Value of MoneyDocument1 pageAssignment - 1 Time Value of MoneyPradnya WadiaNo ratings yet

- EBIT ProblemsDocument8 pagesEBIT ProblemsAmal JoseNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsVasim ShaikhNo ratings yet

- Assignment 2Document3 pagesAssignment 2SatyabrataNayakNo ratings yet

- DRM-CLASSWORK - 11th JuneDocument2 pagesDRM-CLASSWORK - 11th JuneSaransh MishraNo ratings yet

- Financial Modelling and EngineeringDocument1 pageFinancial Modelling and EngineeringjagritbudsocialdigitalNo ratings yet

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- Bus Fin Case StudyDocument6 pagesBus Fin Case StudyMT RANo ratings yet

- MFA Mock September 2023 - by Ahmed Raza Mir, FCADocument8 pagesMFA Mock September 2023 - by Ahmed Raza Mir, FCAAwais khanNo ratings yet

- Problems in Cost of CapitalDocument6 pagesProblems in Cost of CapitalJasonSpringNo ratings yet

- Master of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsDocument4 pagesMaster of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsjyothishwethaNo ratings yet

- Mini CaseDocument15 pagesMini CaseSammir Malhotra0% (1)

- CFP RaipDocument3 pagesCFP RaipsinhapushpanjaliNo ratings yet

- Coporate Finance FIN 3433 Individual Assignment 2Document1 pageCoporate Finance FIN 3433 Individual Assignment 2Divya NandiniNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- The Time Value MoneyDocument4 pagesThe Time Value Moneycamilafernanda85No ratings yet

- 0ecd7tvm AssignDocument1 page0ecd7tvm AssignAman WadhwaNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneySocio Fact'sNo ratings yet

- Afm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Document2 pagesAfm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Abhishek BangNo ratings yet

- Time ValueDocument24 pagesTime ValueAditya BapnaNo ratings yet

- DR Bahaa Quizes CH 3&4 PDFDocument3 pagesDR Bahaa Quizes CH 3&4 PDFislam hamdyNo ratings yet

- Practice 4-Stock ValuationDocument1 pagePractice 4-Stock ValuationThuỳ LinhNo ratings yet

- Practice Stock ValuationDocument1 pagePractice Stock ValuationThuỳ LinhNo ratings yet

- Tutorial - I For FM-I: Effective Interest Rate (EIR)Document3 pagesTutorial - I For FM-I: Effective Interest Rate (EIR)Sriram VenkatakrishnanNo ratings yet

- Session 1 Handout ExDocument2 pagesSession 1 Handout ExasimmishraNo ratings yet

- Tutorial 40 Sem 2 20212022Document6 pagesTutorial 40 Sem 2 20212022Nishanthini 2998No ratings yet

- ACC501 Mid Term Preparation FileDocument28 pagesACC501 Mid Term Preparation FileMujtaba AhmadNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- guru-nanak-story-sequencing-cardsDocument4 pagesguru-nanak-story-sequencing-cardssanjeet_kaur_10No ratings yet

- Session 15 - Estimation of Cash FlowsDocument4 pagesSession 15 - Estimation of Cash Flowssanjeet_kaur_10No ratings yet

- Session 8 - Equity Valuation, Risk and ReturnDocument11 pagesSession 8 - Equity Valuation, Risk and Returnsanjeet_kaur_10No ratings yet

- Session 2 - Valuation ConceptsDocument24 pagesSession 2 - Valuation Conceptssanjeet_kaur_10No ratings yet

- Session 1 - IntroductionDocument24 pagesSession 1 - Introductionsanjeet_kaur_10No ratings yet

- Adventures in BookbindingDocument145 pagesAdventures in Bookbindingsanjeet_kaur_10No ratings yet

- Ginger Cook Basics The Dirty Dozen Insanely Easy Acrylic Painting TipsDocument1 pageGinger Cook Basics The Dirty Dozen Insanely Easy Acrylic Painting Tipssanjeet_kaur_10No ratings yet

- CBSE Class 4 Punjabi WorksheetDocument4 pagesCBSE Class 4 Punjabi Worksheetsanjeet_kaur_10No ratings yet

- Chocolate Cake Food Network Ina GartenDocument2 pagesChocolate Cake Food Network Ina Gartensanjeet_kaur_10No ratings yet

- CML Grade 4 SampleDocument2 pagesCML Grade 4 Samplesanjeet_kaur_10No ratings yet

Midterm C

Midterm C

Uploaded by

sanjeet_kaur_100 ratings0% found this document useful (0 votes)

2 views4 pagesOriginal Title

midterm C

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views4 pagesMidterm C

Midterm C

Uploaded by

sanjeet_kaur_10Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 4

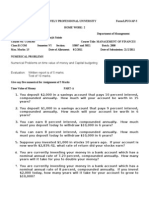

Name _______________________________________

Section________________ Roll Number ____________

1. You are 35 years old today and are considering your retirement needs.

You expect to retire at age 65 and your actuarial tables suggest that you

will live to be 95. You want to move to Mussoorie when you retire. You

estimate that it will cost you Rs 3,000,000 to make the move (on your 65th

birthday) and that your living expenses will be Rs 300,000 a year (starting

at the end of year 66 and continuing through the end of year 95) after that.

Assume a discount rate of 10%.

a. How much will you need to have saved by your retirement

date to be able to afford this course of action?

b. You already have Rs 500,000 in savings. If you can invest

money, tax-free, at 8% a year, how much would you need to

save each year for the next 30 years to be able to afford this

retirement plan?

2. ABCom Ltd’s share has a beta of 1.5. The 10 year RBI bond rate is 8%.

The historical return on the market portfolio has been 16%.

a. Estimate the expected return on the stock for an investor in

the company.

b. If the previous dividend per share of ABCom was Rs 2.00 and

the company’s dividend and earnings are expected to grow at

8%, what should be the intrinsic value per share of the stock?

3. Trueman Ltd has Rs 2.7 billion worth of bonds outstanding and the market

value of equity is Rs 3.5 billion. The current corporate tax rate is 35%. If

the company’s shareholders expect a return of 15% and the company has

issued fresh bonds today at 12% annual coupon, what is the weighted

average cost of capital of the company ?

You might also like

- 4th Gr. CMLDocument54 pages4th Gr. CMLsanjeet_kaur_100% (1)

- 3rd Grade CML Answer KeyDocument29 pages3rd Grade CML Answer Keysanjeet_kaur_10No ratings yet

- CFP Mock Test Retirement PlanningDocument9 pagesCFP Mock Test Retirement PlanningDeep Shikha100% (4)

- Midterm BDocument4 pagesMidterm Bsanjeet_kaur_10No ratings yet

- Classwork Practice Cases: Case 1Document3 pagesClasswork Practice Cases: Case 1Yash DedhiaNo ratings yet

- Assignment No 1 SFA&DDocument4 pagesAssignment No 1 SFA&DSyed Osama Ali100% (1)

- Problems-Financial ManagementDocument13 pagesProblems-Financial ManagementGajendra Singh Raghav50% (2)

- Master of Business AdministrationDocument2 pagesMaster of Business AdministrationAnnieannaNo ratings yet

- DRM-CLASSWORK - 14th JuneDocument4 pagesDRM-CLASSWORK - 14th JuneSaransh MishraNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- CF Assignment - 2Document2 pagesCF Assignment - 2vishnu607No ratings yet

- RTPBDocument87 pagesRTPBKr PrajapatNo ratings yet

- Assignment No 1 CFDocument6 pagesAssignment No 1 CFAltaf HussainNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- Acc 501 Midterm Preparation FileDocument22 pagesAcc 501 Midterm Preparation FilesephienoorNo ratings yet

- ProblemsDocument4 pagesProblemsKritika SrivastavaNo ratings yet

- Economic NumericalDocument26 pagesEconomic NumericalSantosh ThapaNo ratings yet

- Assignment For Emba Students For FM Course by DR Narayan BaserDocument2 pagesAssignment For Emba Students For FM Course by DR Narayan Baserutkarsh KumarNo ratings yet

- Assignment No 1 SFA&DDocument6 pagesAssignment No 1 SFA&DSyed Shabbir RizviNo ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- Basic Excel Functions - ProblemsDocument31 pagesBasic Excel Functions - ProblemsSushma Jeswani TalrejaNo ratings yet

- FM Assignment 1Document3 pagesFM Assignment 1Joseph KingNo ratings yet

- Sac 407-Bsc Actuarial Science AssignmentDocument2 pagesSac 407-Bsc Actuarial Science AssignmentPatrick Mugo100% (1)

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- Financial Modeling: Financial Planning and InvestmentsDocument1 pageFinancial Modeling: Financial Planning and InvestmentsSuraj KumarNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Engineering Economics and Costing AssignmentDocument2 pagesEngineering Economics and Costing AssignmentSachin SahooNo ratings yet

- Parab (2013) Financial Management JBIMS 20130408Document19 pagesParab (2013) Financial Management JBIMS 20130408Vishal BaviskarNo ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- FPWM - Short Cases - Part I For ClassDocument2 pagesFPWM - Short Cases - Part I For ClassJashandeep MakkarNo ratings yet

- Assignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Document2 pagesAssignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Ramesh Chand GuptaNo ratings yet

- Assignment - 1 Time Value of MoneyDocument1 pageAssignment - 1 Time Value of MoneyPradnya WadiaNo ratings yet

- EBIT ProblemsDocument8 pagesEBIT ProblemsAmal JoseNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsVasim ShaikhNo ratings yet

- Assignment 2Document3 pagesAssignment 2SatyabrataNayakNo ratings yet

- DRM-CLASSWORK - 11th JuneDocument2 pagesDRM-CLASSWORK - 11th JuneSaransh MishraNo ratings yet

- Financial Modelling and EngineeringDocument1 pageFinancial Modelling and EngineeringjagritbudsocialdigitalNo ratings yet

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- Bus Fin Case StudyDocument6 pagesBus Fin Case StudyMT RANo ratings yet

- MFA Mock September 2023 - by Ahmed Raza Mir, FCADocument8 pagesMFA Mock September 2023 - by Ahmed Raza Mir, FCAAwais khanNo ratings yet

- Problems in Cost of CapitalDocument6 pagesProblems in Cost of CapitalJasonSpringNo ratings yet

- Master of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsDocument4 pagesMaster of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsjyothishwethaNo ratings yet

- Mini CaseDocument15 pagesMini CaseSammir Malhotra0% (1)

- CFP RaipDocument3 pagesCFP RaipsinhapushpanjaliNo ratings yet

- Coporate Finance FIN 3433 Individual Assignment 2Document1 pageCoporate Finance FIN 3433 Individual Assignment 2Divya NandiniNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- The Time Value MoneyDocument4 pagesThe Time Value Moneycamilafernanda85No ratings yet

- 0ecd7tvm AssignDocument1 page0ecd7tvm AssignAman WadhwaNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneySocio Fact'sNo ratings yet

- Afm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Document2 pagesAfm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Abhishek BangNo ratings yet

- Time ValueDocument24 pagesTime ValueAditya BapnaNo ratings yet

- DR Bahaa Quizes CH 3&4 PDFDocument3 pagesDR Bahaa Quizes CH 3&4 PDFislam hamdyNo ratings yet

- Practice 4-Stock ValuationDocument1 pagePractice 4-Stock ValuationThuỳ LinhNo ratings yet

- Practice Stock ValuationDocument1 pagePractice Stock ValuationThuỳ LinhNo ratings yet

- Tutorial - I For FM-I: Effective Interest Rate (EIR)Document3 pagesTutorial - I For FM-I: Effective Interest Rate (EIR)Sriram VenkatakrishnanNo ratings yet

- Session 1 Handout ExDocument2 pagesSession 1 Handout ExasimmishraNo ratings yet

- Tutorial 40 Sem 2 20212022Document6 pagesTutorial 40 Sem 2 20212022Nishanthini 2998No ratings yet

- ACC501 Mid Term Preparation FileDocument28 pagesACC501 Mid Term Preparation FileMujtaba AhmadNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- guru-nanak-story-sequencing-cardsDocument4 pagesguru-nanak-story-sequencing-cardssanjeet_kaur_10No ratings yet

- Session 15 - Estimation of Cash FlowsDocument4 pagesSession 15 - Estimation of Cash Flowssanjeet_kaur_10No ratings yet

- Session 8 - Equity Valuation, Risk and ReturnDocument11 pagesSession 8 - Equity Valuation, Risk and Returnsanjeet_kaur_10No ratings yet

- Session 2 - Valuation ConceptsDocument24 pagesSession 2 - Valuation Conceptssanjeet_kaur_10No ratings yet

- Session 1 - IntroductionDocument24 pagesSession 1 - Introductionsanjeet_kaur_10No ratings yet

- Adventures in BookbindingDocument145 pagesAdventures in Bookbindingsanjeet_kaur_10No ratings yet

- Ginger Cook Basics The Dirty Dozen Insanely Easy Acrylic Painting TipsDocument1 pageGinger Cook Basics The Dirty Dozen Insanely Easy Acrylic Painting Tipssanjeet_kaur_10No ratings yet

- CBSE Class 4 Punjabi WorksheetDocument4 pagesCBSE Class 4 Punjabi Worksheetsanjeet_kaur_10No ratings yet

- Chocolate Cake Food Network Ina GartenDocument2 pagesChocolate Cake Food Network Ina Gartensanjeet_kaur_10No ratings yet

- CML Grade 4 SampleDocument2 pagesCML Grade 4 Samplesanjeet_kaur_10No ratings yet