Professional Documents

Culture Documents

Some Major Impediments of Sustainable Rural Development Through Rural Banking in Bangladesh: An Exploratory Study

Some Major Impediments of Sustainable Rural Development Through Rural Banking in Bangladesh: An Exploratory Study

Uploaded by

Khandker Rahat MahmudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Some Major Impediments of Sustainable Rural Development Through Rural Banking in Bangladesh: An Exploratory Study

Some Major Impediments of Sustainable Rural Development Through Rural Banking in Bangladesh: An Exploratory Study

Uploaded by

Khandker Rahat MahmudCopyright:

Available Formats

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

Some Major Impediments of Sustainable Rural

Development through Rural Banking in

Bangladesh: An Exploratory Study

Khandker Rahat Mahmud

Senior Principal Officer at Rupali Bank Limited, Bangladesh

Abstract: The majority people of Bangladesh, who producing foods, vegetables and other household products for urban people, are

living in rural areas. Desired balanced development of rural economy can help the path to gear up the sustainable development of

Bangladesh. Rural Banking is being considered as an important element of rural development. The main objective of this paper is to

find out the causes behind the poor rural banking systems so that concern policy makers and the government can adopt proper

measures for development of rural economy to sustain the development of Bangladesh. To discuss some factors of rural banking,

qualitative data have been used. Since this is a desk research, secondary sources along with some primary sources of data have been

analyzed and interpreted. Financial inclusion of rural people to the Modern Financial Technology (FINTECH) system, must be

ensured for balanced and fast development of country’s economy and infrastructural situation. Rural-urban income disparity must be

lessened for smooth development of economy. This research will help the policy makers, financial thinkers, rural people, NGOs,

Bankers to take decision about management of money and credit by using modern banking channel in rural areas. This is also help the

academician for further research in future.

Keywords: Rural Banking, sustainability, rural economy, Fintech, Mortgage, farmers, village, season money need banking, infrastructure,

urban banking.

1. Introduction (BKB, established in 1973) and RajshahiKrishiUnnayan

Bank (RAKUB, founded in 1987) open their wings every

Bangladesh is a densely populated country with an area of corner of the country and extended their helping hand in the

56977 square miles or 147570 square kilometer. It is growth process of the country. Commercial banks,

inhabited with 87, 316 villages. According to World Bank especially state-owned commercial Banks (SOCBs) are also

data, in 2020 calendar year, 61.823 percent of total extending their hands to develop the rural economy by

population live rural area. People live in rural areas are investing huge amount of money among the rural people and

mostly engaged directly or indirectly with agriculture or agro based industries. Since the economy of Bangladesh is

agriculture related sectors. Agriculture is one of the main mainly agro based and most of population are living in the

sources of food and nutrition. This sector is also a main rural areas, rural banking can play a vital role to ensure

source of employment for rural population. According to sustainable development, balanced geographical growth as

Bangladesh Bureau of Statistics (BBS) agriculture well as growth of GDP and to eradicate poverty from

contributes about 13.47 percent to Gross Domestic Product Bangladesh.

(GDP) in FY 2020-2021. So, rural economy is playing an

important role in increasing productivity, food security and As per policy taken by Bangladesh Bank, half of the

creating employment opportunities in rural areas. Robert branches opened in a calendar year must be in rural areas.

Chambers says, “Rural development is a strategy to enable a According to Bangladesh Bank Statistics, from January 2019

specific group of people, poor rural women and men to gain to January 2022, in 3 years, number of bank new branches

for themselves and their children more of what they want increased to 655, of which 327 branches operating in rural

and need. ” areas with fully online banking facilities and 328 branches

operating in urban areas with online facilities also. From

Easy availability of credit in due time plays an important 1990 to 2021 year bank new branches increased to 5400

role for rural investors who want to utilize money for rural whereas total branches increased from 5539 to 10939. (http:

development by developing own enterprise (s) particularly //dsce. edu. bd/db/Banking_in_Bangladesh) . . There are 61

under the condition when resources are limited. Lack of schedule banks and 5 non-schedule banks are operating in

education in rural population, is one of the main obstacles Bangladesh. But still now a vast population in rural areas

for taking rural banking services. Saving tendency among have remained unbanked.

the rural population is less than that of urban population.

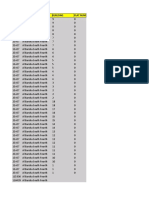

Lack of saving facilities for rural people is also sitting on the Figure: Number of bank branches increased in 4 years.

driver seat to rely on inconvenient and costly alternatives. Total Branch

Period

Credit from financial institutions like banks can be Urban Rural Total

prudential solution for this perspective. December 21 5700 5239 10939

December 20 5522 5149 10671

December 19 5541 5027 10568

Rural banking started since the establishment of banking

December 18 5372 4909 10281

sector in Bangladesh. Rural Banks in those days mainly

Source: Bangladesh Bank.

focused upon the agro sector. Bangladesh Krishi Bank

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 301

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

A sustained development of Bangladesh is largely dependent Moreover, essential factors that influence rural banking

on rural population betterment, but fewer studies have been acceptance will also be talked about here.

done about finding the cause behind poor rural banking

scenarios. In this article, we will try to focus on rural The World Bank data (2014) shows that in the high-income

banking system, its potentialities, contribution to national group countries 73% of the population (age 15+) has bank

economy, major problems faced by the sector and its account, and 126% of the population (age 15+) has mobile

possible solutions which may help banks to provide better phone subscription; but in low to middle income countries

contribution to rural economic development through rural about 53% of the population (age 15+) has bank account

banking services. while 90% of the population (age 15+) has mobile access.

On the other hand, in Bangladesh, 29% of the population

2. Concept of rural Banking (age 15+) has a bank account while 76% of the population

(age 15+) has mobile access. According to World Bank data

Rural banking is such kind of banking that is done in areas (2018), in 2017, account ownership at financial institution or

that are not close to towns or cities, making it difficult for with a mobile-money-service provider richest 60% (% of

those who need to conduct banking business. Now a days population age 15+) in Bangladesh is 56.68 and account

some bank agents have come to the rural area to offer basic ownership at financial institution or with a mobile-money-

banking services. The goals of rural banking system should service provider poorest 40% (% of population age 15+) in

be to provide banking services to the rural population of Bangladesh is 40.079

Bangladesh.

Digital technology like Mobile banking is one of the best

Bangladesh Bureau of Statistics (BBS) in its survey, ways to reach unbanked population to for financial

Agriculture and Rural Statistics Survey (ARSS) Project- inclusion. According to data of www.sttistica. com number

2017, defines rural area as rural area consists of the whole of mobile cellular subscriptions per 100 inhabitants in

area of the country excluding City Corporation, Paurashava Bangladesh in 2020 is 103.31 in 2019 and 2018 it was

and restricted area. More than 10 crore people live in rural 101.55 and 100.24 respectively. This type of data indicates

areas are mostly engaged directly or indirectly with that people in the high-income group have higher banking

agriculture or agriculture related sectors. So for sustainable and mobile access than that of lower and middle-income

development of Bangladesh, rural banking is being groups or nations also.

considered as an important issue. By the name rural banking

refers to banking services provided to the individual living The Dhaka Tribune, in December 21, 2021 said, “With a

in rural areas. This rural banking has become an integral part significant portion of Bangladesh’s population unbanked and

of financial systems of Bangladesh with majority of the having little or no access to financial services. Financial

population living in rural or semi urban areas. The technology can be the answer to incubating financial

government of Bangladesh and the central bank, Bangladesh inclusions among micro-enterprises through access to

bank jointly have been working relentlessly for financial finances. Leveraging fintech will also reduce loan

inclusion of this unbanked rural population. The main disbursement costs and eliminate other barriers existed

objective of rural banking is to collect deposit from rural among most micro and small entrepreneurs such as

people and to provide credit and othermodern banking providing collateral against bank loans, maintaining

facilities, like fintech etc. to the small farmers, landless financial accounts or transaction records, or undergoing a

destitute people, agricultural laborers as well as all sorts of complex loan application process. In Bangladesh, the

people live in rural areas for accelerating rural economy. number MFS users reached 10.81 crore, representing

Without desired balance development of rural population, 59.62% of the country’s total mobile phone users. MFS

sustainable development of the country will never be transactions reached the second-highest at tk 67.5 thousand

achieved. crore in October from Tk.65.1 thousand crore in September.

”

3. Literature Review

World Bank blog published by Anir Chowdhury in March

Financial Service is witnessing varieties of changes like new 15, 2017 cited that the branch-based banking system fails at

products, new concept, new entrants, mergers and inclusion since rural villagers deal mostly in cash. But the

acquisition all over the world. Bangladesh is not out of the cost of these cash transactions will have to be passed on to

situation. Internet has given a new dimension to the financial the customers, meaning that they would end up having high

services given by the financial institutions. Internet banking service charges to cover the overhead of rural branches of

system makes banking easy but a great portion of people banks. Difficult as it is, to bring the poor illiterate rural

especially in rural areas may not use the system in spite of farmer into thefold of a formal financial system, a high

their availability. So, it is necessarily important to point out service charge would make it next to impossible. Digital

the factors that determine the acceptance of digital banking tools towards the same goals are accepted to be far more

service or internet banking service. In this chapter, rural effective for rural populace. Towards that end, electronic

banking concept and obstacles for inclusion of rural people cash cards, agent banking, mobile phones and other digital

to banking service will be analyzed and discussed. In means are opening up the possibility to connect rural

addition, relevant information of land digitalization will be households with reliable financial services and tools.

discussed in this chapter. The position of FINTECH services

in rural economy will also be discussed in this chapter. The daily Financial Express published January 15, 2020

writes, “Bangladesh has made significant progress in

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 302

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

financial inclusion over the past eight years, with as much as is very high. Rural people also collect money from their

48 percent of the adult population now under the banking friends and relatives.

umbrella. Yet, there are many things to do as a large number

of the people still remains out of any formal financial Shortage supply of money to the rural people leads them

services. Rural market and people are still outside major away from availing the advantages of advanced technology

banking services. ” to produce their valuable goods or agricultural products. Due

to poor banking infrastructure in rural areas, standard of

Main obstacles of rural economic development is a great living of the rural people is undermined.

inconsistency between the real needs of economy and

exiting structure of education and vocational training. 5. Methodology of the Study

Qualified and professional knowledge based personnel

needed for growing sectors is not sufficient in rural This is a secondary research. To carry out the research,

economies. Sustainability of rural economic development is mainly secondary sources of data are used for analysis and

hindered by backwardness (Sandor Magda, Robert Magda interpretation. Some primary data such as number of RTGS,

and SandorMarselek, 2009) ATMs transactions are also used. Secondary sources include

Government organizations, Non-Government Organizations,

Since it is very crucial to develop the rural economy for International Organizations, newspaper, books, journals,

sustainable development, a lot of study is required for internet, etc. Descriptive statistics has been adopted to

development of time befitting rural banking system in analyze data and deductive approach is used to derive the

Bangladesh. Though many countries of the world have done objective in the paper. To understand rural banking scenario,

a lot of research on the rural banking system, but some important factors are taken to describe rural banking

unfortunately Bangladesh does not have sufficient research practice in Bangladesh.

on it. This research paper will add theoretical value about

rural banking system for sustainable development of rural 6. Objective of the Study

economy.

The objective of this research is to identify the key

4. Statement of problem impediments of Sustainable rural development through rural

banking system among rural population in Bangladesh. To

For attainment of sustainable development process, measure the performance and to identify the major

Bangladesh needs to bring rural population under the roadblocks of rural banking following specific objectives

banking channel to perform their daily economic activities. have been designed. Possible solutions are also discussed at

In Bangladesh, Most of the people of the rural areas, the same time.

exchanging their daily needs money on basis of relation to To find out causes behind unwillingness about banking

each other parties. A needy man in rural areas borrowed among rural people.

money from a financially solvent family giving the promise To evaluate the use of internet for rural banking through

or condition to give it back within certain period with or Modern FINTECH system in Bangladesh.

without paying interest depends on the situation. Such To find out rural credit as a factor of rural Banking and

incidents indicate rural people doing their economic development of rural economy.

activities without maintaining proper banking channel.

To evaluate land digitalization to accelerate rural

Banking investment.

The amount of money, what the rural people saved by

To explore rural infrastructure for giving banking

various activities, cannot take part to contribute into

services in rural areas of Bangladesh.

mainstream money activities like money market, capital

market etc. This kind of non-banking activities would be

marked as an impediment for sustainable development of 7. Analysis and Discussion

rural areas or Bangladesh as a whole.

7.1To find out causes behind unwillingness about

According to Bangladesh Bank recent report 61 banks have banking among rural people

now been operating in Bangladesh, out of which 6 state

owned commercial Banks (SOCBs), 3 Specialized Krishi To analyze the cause behind reluctances about banking in

Banks, one development Bank, and rest of them are private rural people in Bangladesh many factors has to be

commercial Banks (PCB). Most of thc PCBs doing their considered. But, here we give emphasis three elements-

business mainly in urban areas showing less interest to go income factors, location of bank, Education and some

rural areas fearing business losses. misperception about banking. A wide range of income

disparity exists in Bangladesh economy. According to World

The SOCBs and specialized banks are mainly giving Inequality report 2022, 1% of Bangladesh’s population holds

services to the rural people with low capabilities. As getting 16.3 percent of the total national income generated in 2021.

loan from commercial banks is time consuming and This report also showed that 44 percent of total income is

cumbersome matter still now, most of the rural people take held by only 10 percent of the population of this country.

their season based little amount of money from non- Though Bangladesh achieved notable progress to alleviate

government Organizations (NGOs) spending very short time poverty in last decade, income inequality is seen very high.

with easy process though interest imposed on the loan given The following table shows the scenario of income inequality

between rural and urban areas:

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 303

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

Monthly household nominal income, expenditure and 7.2 To evaluate the use of internet for rural banking

consumption by residence HIES 2016 through Modern FINTECH system in Bangladesh

Survey Year Residence Average Monthly (taka) Once upon a time, all bank branches irrespective to rural or

2016 income Expenditure Consumption urban, did their daily banking process manually, i. e.

National 15, 945 15, 715 15, 420 keeping long ledger book on a long high table. All

Rural 13, 353 14, 156 13, 868 transactions are written down with black and white on the

Urban 22, 565 19, 697 19, 383 ledger. Now, the time has changed. All the banks perform in

Source: Preliminary report on Household income and Bangladesh, run digitally or online process. In online

expenditure survey 2016 process customer can banking their needs sitting anywhere

in Bangladesh even if in outside of the country by using

This income inequality creates a major impediment for FINTECH or mobile applications.

regular banking of rural people. What rural people earn, has

to spend to accommodate daily life. A few people of rural Bangladesh started internet in early 1990 with dial-up

areas have some idle money to deposit in a Bank. The connections which was limited to some people especially

following chart shows the poverty line as per HIES 2016 urban people took the benefit of the internet. But the

report. situation drastically changed with the inception of Mobile

data network. People from all sort of living enjoy the benefit

Head Count Rate of Incidence of Poverty HIES 2016 and of internet by using just a mobile phone. Though the mobile

HIES 2010 by Residence phone in first time was expensive, now for adopting policy

Upper Poverty line Lower poverty line support from government end, in December 2020 the total

Residence

2016 2010 2016 2010 number of mobile phone users in Bangladesh reached 170.1

National 24.3 31.5 12.9 17.6 million. On the other hand, internet users increased to 111.8

Rural 26.4 35.2 14.9 21.1

million at the end of December 2020 of which 102.3 million

Urban 18.9 21.3 7.6 7.7

users use internet through mobile operators. According to

Source: Preliminary report on Household income and

GSMA report 41 percent of mobile phone users had

expenditure survey 2016

smartphone in Bangladesh. The internet speed in rural areas

is not equal to the urban people enjoyed. According to a

7.1.1Location of Branch

study by Asian Development Bank Institute (ADBI), an

To make rural people bank oriented, location of bank branch

increase of 1 % point number of internet users would help

plays an important role. The farmer does not want to spend

Bangladesh’s Gross Domestic Product (GDP) grow by

enough time for banking. If a bank branch is located far

0.11%.

away from the village the bank may not have made enough

customers for daily banking. Because, it causes loss of

Digital technologies, especially payment systems by using

money and time of a man simultaneously. Infrastructural

mobile devices, isnow very important to achieve Sustainable

developments, especially roads and vehicles have also very

Development Goals (SDGs) and to implement government’s

important rule for banking in rural areas.

2041 Perspective Plan as well. So, it is necessary to take

proper measures for equal internet opportunity for rural and

7.1.2. Education

urban people of the country.

Education is the backbone of a nation. In Bangladesh 25

percent people are illiterate and unable to read and write in

We have to recognize that the role of banks in economic

Bangla-the first and national language of Bangladesh.

development is fast changing. Technology makes banking

UNESCO defines literacy as –the ability to understand what

easy. By using apps one can do business, pay utilities or

one reads and writes in their first language and the ability to

other banking needs from home by just one click.

keep day-to-day accounts related to household income and

Technological development opens potential doors for

expenditure. The literacy rate, according to Ministry of

banking services industry. The emergence of new

Primary and Mass Education, in urban and rural areas were

technology allows access to banking and banking related

81.7 percent and 67.3 percent respectively in 2019. This

services without physical direct presence to bank premise by

wide gap shows impoverished rural areas get more illiterate

the customers. The Automated Teller Machines (ATM) is

people than urban areas. This illiteracy in rural areas is also

the best and well known example of this technological

an impediment to increase rate of people availing rural

advancement. Though most of the ATMs are now

banking facilities as some misconceptions (such as huge

established in urban oriented area in our country, it should

bank charges, amount deposited with bank will reduced after

be scattered widely in semi-urban and rural areas to expedite

a certain period etc.,) and some sort of fear or uneasiness (i.

the economic development of under developed areas.

e banking environment, how to speak with bank officers

etc.,) works on their mind.

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 304

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

Source: Two branches of Rupali Bank-one urban & one rural.

horizon in payment system of banks. The minimum limit of

Credit Card, another development of banking industry is a RTGS transaction is set at BDT 1, 00, 000.00 taka whereas

getting popularity in our country like other countries of the there is no limit in case of government payment. Data of

world. This credit card service should reach rural areas for Bangladesh bank indicates that more than 10250 online

economics choice of freedom. Many banks are now giving branches of scheduled banks are currently connected to this

loan within very short time against credit card limit with system.14.62 lakh crore taka was transacted through 24.49

interest. This type of facility can meet up urgent needs of lakh transactions in 2020 year. RTGS means Real Time

business if the service made available in rural areas. To Gross Settlement. For Bangladesh it is called BD-RTGS.

spread virtual banking or internet banking in rural areas, BD-RTGS is a real time interbank large value electronic

electricity and telecom connectivitymust be continuous and fund transfer system. At present, BD-RTGS system is

supplies do not interrupt especially banking hours. operating in local currency inside the country. Real time

means transaction done the bank is not subjected to any

The central Bank of Bangladesh, Bangladesh Bank launched waiting period. Gross settlement indicates the transaction is

BD-RTGS system on 29th October 2015 to facilitate safe, booked in central bank’s account on one to one basis without

secure and efficient interbank payment system as a part of netting any other transaction.

digitalization initiative. BD-RTGS system introduced a

Source: Two branches of Rupali Bank Limited-one urban and one rural

But rural people do not have well enough knowledge about system. BEFTN allows customer sent money any bank

the RTGS system. They don’t know money can be sent from branches irrespective of amount. To deposit money, rural

one bank branch to another bank branch through RTGS or people has to go to the respective bank branch by spending

Bangladesh Electronic fund transfer network (BEFTN)

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 305

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

time and money. Rural people can save their money and a Non-government organizations (NGO) working with the

time by using digital platform like RTGS, BEFTN etc. recent technology, to sustain rural banking and latest

technology must be used in branches already existed and

There are some rural people who are the customer of banks new one also. Manpower given to the rural branches must be

situated at urban areas doing baking electronically. Many technologically sound enough. By an extensive survey,

banks of Bangladesh are now giving e-banking applications potential rich rural and semi-rural areas to be find out to set

for their valued customer to pay bills, transfer money among up new branches to expedite sustained development of rural

account, check account, and download account statement economy.

and many more modern services. But all the services are

interrupted by slow internet and telecom connectivity in 7.3 To find out rural credit as a factor of rural Banking

rural areas. High speed internet connectivity can be a change and development of rural economy

maker in rural areas.

According to World Bank report 61.823 percent of total

A long banking experience of this writer finds that most of people lived in rural areas in 2020 while 164.7 million

the rural people want to keep their deposit with the bank in people lived in Bangladesh at the same time. Rural people

long term basis – three to five years, even if it may goes up are mostly concentrated in agricultural sector or agriculture

to eight years so that the money they deposited matured with related sectors. The central Bank of Bangladesh, Bangladesh

double or triple figure. Rural people want to use this double Bank declared 1: 1 policy to open a new branch for rural and

or triple figure of money in some important occasions like urban area. That means if any bank keen to open new branch

marriage ceremony of daughter. in an urban area, it has to open a new branch in rural area

within same calendar year.

By using this long term fund bank can easily meet up loan

demand for business entities. As many financial entities like

Source: Bangladesh Bank.

To give financial help to the farmer, Bangladesh bank report up to 2.5 lakh taka new or renewal of agriculture and

announced 28, 391 crore taka as agriculture and rural credit rural credit loan. The agriculture and rural credit loan would

for 2021-2022 financial year which is 7.98 percent higher be helpful to achieve food security, poverty alleviation,

than previous 2020-2021 financial year. Beside this, lifestyle development, job opportunity if farmers get the loan

Bangladesh Samabaya Bank Ltd and Bangladesh amount in time. In 2020-2021 financial year, 30, 55, 160

PolliUnnayan Board (BRDP) will disburse 25 crore and rural people got 25, 511.35 crore taka (which is 97.03% of

1062.50 crore taka from their own fund as agriculture and target) agri and rural loan against the targeted amount of 26,

rural credit facility. 292 crore.

2.5 percent of total loan outstanding of all private banks and The availability of loan, though the amount is small, from

foreign banks is being consider as agriculture and rural banks with very little papers or guarantees and without any

credit. Bangladesh Bank gives a strict direction about harassment creates good attitude in the mind of rural people

disbursement of agricultural loan mainly in three sectors – about banks and banking, plays a crucial role for sustainable

Crops, fisheries and livestock. If any bank fails to disburse development of rural economy.

the targeted amount, undisbursed amount or 3% of loan

amount to be deposited with Bangladesh bank without Bangladesh Bank has taken an initiative for farmers to open

demanding any interest thereon. The central bank has given a bank account with any bank only by depositing taka 10 to

directive to the banks to disburse at least 60% of crop loan disburse agriculture and rural credit through this account.

target along with to disburse at least 10% fisheries and Farmers can use this type of no frill account for their daily

livestock loan target. To expedite agriculture and rural loan banking needs including receiving foreign remittances from

disbursement among rural people Bangladesh bank has different countries across the world. This time befitting step

given a waiver to collect Credit Information Bureau (CIB)

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 306

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

makes a positive sign about bank and banking among the Cadastral survey prepared the Records of Right (ROR/

rural people. Khatian). The CS Khatian covered the name of the owners

(then Zamidaar-feudal lords, occupants, narrative of land,

7.4 To explore tough Chain of Document rules for getting amount of revenue given and all the other exacting facts of

loan for development process. lands. By enacting ‘The East Bengal States Acquisition and

Tenancy Act, 1950’, the Zamidaari system was abolished.

In Mortgage Loan, borrower gives the commitment to pay Underthis act‘State Acquisition’ (SA) survey was conducted

back the lender within the stipulated time as per contract from 1956-1962. State Acquisition survey followed the CS

done. The Mortgage property serves as a collateral security blueprint and the records were handwritten which copies

to secure the loan given. Currently, Mortgage loan is a loan were stored in the district record room, Thana Revenue

used either purchasers of the real assets to increase fund to Offices, and Tahsil (Union Land) offices. After 50 years of

buy real estate or by the owners of the property to raise fund SA survey record, the Revisional Survey (RS) of land was

for various purposes putting a lien on property being conducted after independence in 1971. The latest survey of

mortgaged. land known as ‘Bangladesh Survey (BS) ’ started in 2010

and is an on-going survey. These BS surveys now have

Defaulted loan culture, encourages the banking systems to printed copies of document and are preserved in the Deputy

secure loan by taking immovable property, especially land Commissioners’ record room, Upazila Land Office and

as mortgage. Sometimes, banking entity or financial Union Land Office.

institution cannot recover the lending amount in full or

partial basis due to borrower inability or reluctance to repay 7.5.2 Registration of Land

the loan. The increase of Nonperforming Loan (NPL) Registration of land ownership came to the fore after

generates no income hampers the financial stability of the introduction of the ‘Transfer of Property Act, 1882’. Later,

financial institution. As defaulted loan decrease the ‘The Registration Act, 1908’ was introduced. Under this

efficiency, Banks provide loan against mortgage of Registration act land registers office establishand collect ‘ad

immovable property. In case of rural people, Mortgage valorem’ based on land registration fees, different land

process of immovable property which gained from transfer related taxes. Registration records under this act are

predecessor, narrow the line of opportunity of getting loan stored in registers at sub-registrar’s office. All these

from banks. Village people cannot collect all the papers processes were and are done manually still now. After a long

banks needed to take as mortgage, due to unconsciousness journey, government introduced the electronic management

about documentation of the property. Lack of chain of of the mutation of land, or e-mutation, in 485 upazila and 3,

documents act as a hindrance the rural people to access 617 union land offices of 61 districts, keeping away the

banking channel. In most of the rural people, transfer or three hill districts in the Chittagong Hill Tracts. Mutation, is

partition of land done among the family members settled a process by which name (s) of new land owner (s) inserted

verbally by setting with senior citizens which finally narrow instead of former owners partially or fully after transfer of

the road for getting loan against mortgage as only registered ownership of land. Mutation establishes the proprietary

deed of partition of land among the stakeholders acceptable rights. It allows the land owners to transfer and registration

to the bank. Only a few people of rural areas avail the of the land, and the payment of taxes for the land used. The

opportunity of loan facilities from banks against mortgage of electronic management of land mutation gives a step

land. Tough chain of documents requirements for land forward to stop corruption and bribery of some unscrupulous

property and lack of digitalization process of land offices people.

cause of deprive for getting loan for development process of

the rural people. This newly introduced electronic management of land

mutation is said to have some positive changes likequick and

7.5 To evaluate land digitalization for easy access of all due time disposal of applications for mutation, compared

stakeholders with the manual system. This process also reducedpublic

sufferings by way of less required land office visits. To give

Land is the main factor of production and source of wealth uninterruptedonline service to people especially in rural area

of the land owner and other people also. Since Land is optimum power supply and speedy internet connection to be

scarce always specially in densely populated country like insured by the concerned department. Though land mutation

Bangladesh, establishing ownership right over land is highly system is not enough to justify the land ownership, it is a

competitive. flagship for digitalization of land system of Bangladesh. To

Bangladesh is a small country with a huge population. give relief to service seekers and to curb corruption related

Bangladesh is generally known as an agriculture based to land management, it is necessary to bring whole of land

nation. Land for every people is very insignificant. So, management systems, including land records, under a digital

management of land system clutches a pivotal role in the platform.

economic and social aspects of the country. Most of the

conflicts or quarrels in rural or urban areas occur as a result A digital link or access between concern land sub-registry

of weak and corrupted land systems. office and AC land office to check the land latest records

before committing registration of transfer deed or finalizing

7.5.1 Survey, Record Keeping and Mutation of land mutation case will reduced the problems related to land

British colonial rulers, under the Survey Act, 1875 management.

conducted ‘The Cadastral Survey’ (CS) from 1888 to 1940

starting from Chattogram and ended with Dinajpur. This

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 307

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

If the Banker gets access to the online system to verify the convert this major population into resources and to sustain

land ownership, bank can invest money easily by taking the overall development, rural banking can be the best solution

property as mortgage having minimizing the risk of land for our economy. To make poverty free Bangladesh, the role

ownership. Bankers of Bangladesh now enjoy the access to of banks performing in rural areas of Bangladesh cannot be

verify National Identity Card (NID) or Smart Card that ignored. Bangladesh bank in this regard, has taken some

flatten the curve of address related issues or Know Your important steps like branch opening rule 1: 1 (for opening 1

Customer (KYC) issues. urban branch, 1 rural branch is to be opened) farmers are

allowed to open bank account with only 10 taka initial

8. Findings of the Study deposit, rural credit target achievement included in bank’s

CAMELS rating, mandatory participation in agriculture or

After conducting the research following issues have been rural credit disbursement for all banks, reducing provision

found out as major impediments for sustainable for rural credit etc. People of rural areas need the same

development of rural economy through current rural banking facilities and services from bank what people living in

system: important towns and cities avail. To deliver such similar

a) There is a tendency among therural population not to go banking services, government and concern authorities

not only to the banks but also any offices, unless should take effective and time befitting steps so that rural

seriously needed due to less education and invisible fear banking can expand in more rural areas to play a key role to

of corresponding which contributes poor rural banking ensure the economic development and socio-economic

development. empowerment of rural people. To balanced development of

b) Bank officials working in the rural branches need to the country, rural-urban income disparity must be lessened

extend more helping hands to the marginal people of the by taking proper steps. Advanced fintech system must be

rural areas. A periodic seminar or meeting among the introduced among rural population so that they can take the

parties can motivate rural people about banks and opportunity of modern technology based banking. Emphasis

banking system. must be given to make policy support for rural banking to

c) For most of the cases in rural areas the chain of attract the villagers to avail the available banking facilities in

documents of proposed mortgage property found guilty rural areas.

as ancestral property is orally distributed to the heirs,

violating the eisting rule of land registration. This oral References

distribution of property makes bank investment almost

impossible, which in terms, badly affects rural [1] Antoni F. Tulla, Ana Vera, NatàliaValldeperas,

economic development. CarlesGuirado (2017), New approaches to sustainable

d) Income disparity between rural and urban people also rural development: Social farming as an opportunity in

responsible for poor rural banking transactions. Europe? Human Geographies – Journal of Studies and

e) Rural people do not have enough knowledge to accept Research in Human Geography.

Modern Financial Technology (FINTECH) system [2] Ahemd, Rias (2209) Rural Banking and Economic

transactions. Many mobile phone users of rural people Development, Millat publications. Bangladesh.

cannot avail the opportunity of Mobile Financial System [3] Ahmed Masoud, MazumderManjurulAlam, Md.

(MFS) transactions due to lack of education. Hossain Sahid, Financial Contribution: Rural Bank in

f) One kind of misperception exists among the rural Bangladesh, IOSRJournal of Economics and Finance

population that high bank charges and other deductions (IOSR-JEF) Volume 11, Issue 6 Ser. VI (Nov. –

will be imposed on their deposit which will finally Dec.2020), PP 17-23.

lessen the original deposited amount. [4] Bangladesh Bank, www.bb. org. bd

g) To set up a new branch in rural area bankers are [5] Bangladesh Bureau of Statistics, 2018, http:

looking for commercially successful places to make its //www.bbs. gov. bd/

business profitable which creates fear of communication [6] Bangladesh Krishi Bank, BKB, https:

fares and time among the villagers. //www.krishibank. org. bd/

h) Poor investment opportunity in rural areas is also a [7] Chowdhury, Mohammad Salahuddin, FCA Pal,

major obstacle to set up a new bank business. Chandon Kumar, Financial Stability and Mortgage

i) Infrastructure set up in rural areas is not well enough. Based Lending in Banks: Evidence from Bangladesh,

As a result, bankers have to think security of the rural Journal of Business Studies, Vol. XL, No.2, August

bank branches. 2019, page 177-192

j) Mobile Banking charge is high enough for rural people. [8] Chowdhury Md. NiazMurched, Hossain Md. Mobarak,

At least taka 10 (ten) has to pay per 1000 taka Poverty, income inequality and growth in Bangladesh:

withdrawal. This high rated charge discourse rural Revisited Karl-Marx.

people for MFS transactions. [9] Dr. Debnath, R. M., Business of Baking, 3rd Edition,

2013, Bangladesh.

9. Conclusion and recommendations [10] Dr. Rahman, Sultan Hafeez&Talukder, SumaiyaKabir,

(2016). The Costs and Benefits of Digitization of Land

The contribution of rural population in our GDP cannot be Records via Simplified Application Process.

ignored. A huge percentage of employees are directly [11] Ferrari, Aurora, (2008), World Bank, Increasing access

engaged in agriculture sector. Since major portion of total to ruralfinance in Bangladesh: the forgotten “missing

population of Bangladesh are living in rural areas and most middle” https: //openknowledge. worldbank.

of them are unskilled, illiterate and unbanked people so to org/handle/10986/6832

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 308

International Journal of Science and Research (IJSR)

ISSN: 2319-7064

SJIF (2022): 7.942

[12] Goh Mei Linga, Yeo SookFerna, Lim KahBoona, Tan

SengHuata, (2016), Understanding Customer

Satisfaction of Internet Banking: A Case Study In

Malacca, page 80-85

[13] Gregory L. Gregory, Richard L. Meyer, and Dale W

Adams (1989), Loan recovery in Bangladesh: An

empirical study usingrural bank branch data,

Economics and Sociology Occasional Paper No.1558,

Department of Agricultural Economics and Rural

Sociology. The Ohio State University, 2120, Fyffe

Road Columbus, Ohio, 43210.

[14] Mobile for development, https: //www.gsma.

com/mobilefordevelopment/

[15] Population Distribution and Internal Migration in

Bangladesh, volume 6, November 2015, Bangladesh

bureau of statistics (BBS).

[16] Rahman Mohammad Anisur, XuQib, Islam Md.

Tariqul (2016) Journal of Economic & Financial

Studies, Banking Access for the poor: Adoption and

strategies in rural areas of Bangladesh.

[17] Rahman Md. Motior, Bank Bankers Banking, 1st

Edition, 2016, Bangladesh

[18] Richard L. Meyer, M. A. BaquiKhalily, Leroy J.

Hushak, (1990), Bank branches and rural deposits:

Evidence from Bangladesh, Economics and Sociology,

Occasional Paper No.1763

[19] Rahman, Anisur, (2001), Women and Microcredit in

rural Bangladesh, Perseus.

[20] Rupali Bank Ltd. www.rupalibank. com. bd

[21] RajshahiKrishiUnnayan Bank, https: //www.rakub.

org. bd/

[22] Sándor Magda, Róbert Magda and SándorMarselek

(2017), Sustainable development of the rural economy,

Publisher: Applied Studies in Agribusiness and

Commerce – APSTRACTAgroinform Publishing

House, Budapest, p 31-36

[23] The Daily Financial Express, https:

//thefinancialexpress. com. bd/

[24] The Daily ProthomAlo, https: //www.prothomalo. com

[25] VarshneyP. N, Banking law and practice, 21 Edition,

2005, India

[26] World Bank, https: //www.worldbank. org/en/home

[27] Yunus, Muhammad (2008), Banker to the poor: Micro

lendingand the battle against World poverty, public

affairs

[28] Zahiduzzaman, Fintech, Second Edition, 2021,

Bangladesh

Volume 11 Issue 5, May 2022

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: SR22429151944 DOI: 10.21275/SR22429151944 309

You might also like

- Wells Fargo Everyday CheckingDocument3 pagesWells Fargo Everyday CheckingTest000001No ratings yet

- Econ 102 Final Exam NotesDocument12 pagesEcon 102 Final Exam NotesRohith NiranjanNo ratings yet

- Statement Message : Penyata AkaunDocument2 pagesStatement Message : Penyata AkaunAbdul Aziz JefriNo ratings yet

- Project On Rural BankingDocument49 pagesProject On Rural Bankingsanjay sharmaNo ratings yet

- 'Vault Guide To The Top 25 Investment Management EmployersDocument449 pages'Vault Guide To The Top 25 Investment Management EmployersPatrick AdamsNo ratings yet

- Financial Innovation: Socio-Economic Impact of Mobile Banking On Rural BangladeshDocument25 pagesFinancial Innovation: Socio-Economic Impact of Mobile Banking On Rural BangladeshshekstarNo ratings yet

- Role of Banks in Agricultural Development in BDDocument14 pagesRole of Banks in Agricultural Development in BDAsifNo ratings yet

- D0512832 PDFDocument5 pagesD0512832 PDFMd. Mahbub AlamNo ratings yet

- D0512832 PDFDocument5 pagesD0512832 PDFMd. Mahbub AlamNo ratings yet

- A Study On Challenges of Banking in Rural India: Immaniyelu YepuriDocument8 pagesA Study On Challenges of Banking in Rural India: Immaniyelu YepuriNIKHIL KUMAR AGRAWALNo ratings yet

- Rural & Urban Banking at Glance: Emerging BFSI Sector in Rural EconomyDocument4 pagesRural & Urban Banking at Glance: Emerging BFSI Sector in Rural EconomyDeepak DeshmukhNo ratings yet

- RF 4 Rural BankingDocument168 pagesRF 4 Rural Bankinggolden79034No ratings yet

- Innovation of Rural Banking in BDDocument5 pagesInnovation of Rural Banking in BDArpon SAUNo ratings yet

- INTRODUCTION: (MD, Ibrahim Kholilullah, AGRICULTURAL ECONOMICS, 2Document11 pagesINTRODUCTION: (MD, Ibrahim Kholilullah, AGRICULTURAL ECONOMICS, 2JIGAR SHAH100% (1)

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFDocument19 pagesSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree OFMOHAMMED KHAYYUMNo ratings yet

- Assignment FinalDocument31 pagesAssignment Finalchstu100% (1)

- Rural Banking in India PDFDocument49 pagesRural Banking in India PDFSuraj JadhavNo ratings yet

- Financial Inclusion ReportDocument14 pagesFinancial Inclusion Reportpawan patelNo ratings yet

- Executive Summery SONALI 11111111Document68 pagesExecutive Summery SONALI 11111111idealNo ratings yet

- SHEKAR - Rural BankingDocument20 pagesSHEKAR - Rural BankingkizieNo ratings yet

- Comparative Study On Regional Rural BankDocument8 pagesComparative Study On Regional Rural Bankzoyaansari11365No ratings yet

- RF4 Rural BankingDocument167 pagesRF4 Rural BankingKunal BagdeNo ratings yet

- The Success of Rural Microfinance at Grameen Bank in BangladeshDocument10 pagesThe Success of Rural Microfinance at Grameen Bank in BangladeshNafiz FahimNo ratings yet

- SILIVERU SHIVAKUMAR A Study On Rural Banking - SBIDocument19 pagesSILIVERU SHIVAKUMAR A Study On Rural Banking - SBIkizieNo ratings yet

- Promoting Financial Inclusion: Lets Connect Everyone'Document22 pagesPromoting Financial Inclusion: Lets Connect Everyone'Faruk SuryaNo ratings yet

- Untitled DocumentDocument11 pagesUntitled Documentsakshiludbe28No ratings yet

- Agent Banking in BangladeshDocument7 pagesAgent Banking in BangladeshYasir ArafatNo ratings yet

- Banking Sector in India An OverviewDocument3 pagesBanking Sector in India An OverviewMukesh MishraNo ratings yet

- Untitled DocumentDocument11 pagesUntitled Documentsakshiludbe28No ratings yet

- Microfinance Operations in Bangladesh-An OverviewDocument11 pagesMicrofinance Operations in Bangladesh-An OverviewAl-amin princeNo ratings yet

- Comparative Analysis of Bkash Limited With Other Mobile Banking InstitutionsDocument2 pagesComparative Analysis of Bkash Limited With Other Mobile Banking InstitutionsMazbahul IslamNo ratings yet

- Financial Inclusion: Banks Made Some Headway in 2010-11: Share Print T+Document6 pagesFinancial Inclusion: Banks Made Some Headway in 2010-11: Share Print T+arshrsNo ratings yet

- Micro Financing Implementation and Expansion Strategies of Grameen Bank in BangladeshDocument7 pagesMicro Financing Implementation and Expansion Strategies of Grameen Bank in BangladeshNijhum ChoudhuryNo ratings yet

- Banking Information Concept Banking Sector in UgandaDocument3 pagesBanking Information Concept Banking Sector in UgandaDakshesh PatelNo ratings yet

- Role of Banks in Agricultural Development in BD 1Document14 pagesRole of Banks in Agricultural Development in BD 1AsifNo ratings yet

- Total ProjectDocument77 pagesTotal Projectamitsonawane67% (3)

- A Study of Non-Performing Assets of Microfinance InstitutionsDocument11 pagesA Study of Non-Performing Assets of Microfinance InstitutionsPalak ParakhNo ratings yet

- Initiatives: Financial Inclusion and Financial Literacy: Andhra Bank'sDocument8 pagesInitiatives: Financial Inclusion and Financial Literacy: Andhra Bank'sJagamohan OjhaNo ratings yet

- Untitled DocumentDocument5 pagesUntitled Documentsakshiludbe28No ratings yet

- Financial Management A Project On Financial Inclusion and PMJDYDocument9 pagesFinancial Management A Project On Financial Inclusion and PMJDYNakshtra DasNo ratings yet

- Agec 12185Document12 pagesAgec 12185SharanonNo ratings yet

- Initiatives Syndicate Bank FinancialDocument5 pagesInitiatives Syndicate Bank Financialakshayk6No ratings yet

- Rural Banking in India PDFDocument49 pagesRural Banking in India PDFxpertseo33% (3)

- Challenges and Opportunities To Commercial Banks in RuralDocument16 pagesChallenges and Opportunities To Commercial Banks in RuralRaghav guptaNo ratings yet

- Inancial Inclusion: - A Path Towards India's Future Economic GrowthDocument30 pagesInancial Inclusion: - A Path Towards India's Future Economic GrowthAnkur JainNo ratings yet

- Cashless Rural Economy - A Dream or RealityDocument13 pagesCashless Rural Economy - A Dream or RealitySuriyaNo ratings yet

- Microfinance Industry, Tremendously Improving The Lives of People in Rural AreasDocument4 pagesMicrofinance Industry, Tremendously Improving The Lives of People in Rural Areasmrun94No ratings yet

- Final 1Document41 pagesFinal 1Aphrodite ArgennisNo ratings yet

- Karur Vysya Bank: Key To SuccessDocument6 pagesKarur Vysya Bank: Key To SuccessShandeep Singh DhanoaNo ratings yet

- Bkash. mkt480Document16 pagesBkash. mkt480Redwan ShopanNo ratings yet

- Mobile Banking in IndiaDocument33 pagesMobile Banking in Indiaanir_1986No ratings yet

- Gramin Bank Rular BankingDocument66 pagesGramin Bank Rular BankingSuman KumariNo ratings yet

- Shahriar SME& BankingDocument8 pagesShahriar SME& BankingShahriar ObayedNo ratings yet

- Comparative Study On Regional Rural Banks - SreedharDocument16 pagesComparative Study On Regional Rural Banks - SreedharMohmmed KhayyumNo ratings yet

- 1118 - Final ReportDocument55 pages1118 - Final ReportAnamika SankhwarNo ratings yet

- 10 Barriers To Financial Inclusion in Bangladesh IdentifiedDocument4 pages10 Barriers To Financial Inclusion in Bangladesh IdentifiedSihinta AzraaNo ratings yet

- SSRN Id1532226Document3 pagesSSRN Id1532226sidwaghNo ratings yet

- CONTENT Microfinace-MergedDocument19 pagesCONTENT Microfinace-Mergedanjonsarkar2710No ratings yet

- Mokhamad Anwar, Sulaeman Rahman Nidar, Ratna Komara &. Analisis Perbandingan BPR Jabar Dan Bali. 10.1080@20430795.2020.1735220Document22 pagesMokhamad Anwar, Sulaeman Rahman Nidar, Ratna Komara &. Analisis Perbandingan BPR Jabar Dan Bali. 10.1080@20430795.2020.1735220Rizkie FathonieNo ratings yet

- Project On Rural BankingDocument49 pagesProject On Rural Bankingpratik100% (1)

- Tech'ing Banking To The Last Mile - Rural Customer ServicingDocument5 pagesTech'ing Banking To The Last Mile - Rural Customer ServicingPratik MohapatraNo ratings yet

- My ProjecpoppeeeeeeeeeeeestDocument52 pagesMy ProjecpoppeeeeeeeeeeeestpoppyNo ratings yet

- 220-Article Text-270-1-10-20200411 PDFDocument8 pages220-Article Text-270-1-10-20200411 PDFShihab Sharar KhanNo ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Sap New Cash Account Bank ReconciliationDocument9 pagesSap New Cash Account Bank ReconciliationAnandNo ratings yet

- Online Payment ProtocolsDocument29 pagesOnline Payment ProtocolsKartik GuptaNo ratings yet

- UBL Internship ReportDocument50 pagesUBL Internship ReportAmmarNo ratings yet

- Business and Organisation Structure of Standard Chartered BankDocument17 pagesBusiness and Organisation Structure of Standard Chartered BankHumaira Shafiq0% (1)

- Annexure Ii Questionnaire For Customers: Dear RespondentDocument7 pagesAnnexure Ii Questionnaire For Customers: Dear RespondentDominic SavioNo ratings yet

- RBIDocument32 pagesRBIAjay SinghNo ratings yet

- NPA History of IDBI Bank MainDocument7 pagesNPA History of IDBI Bank MainMonish SelvanayagamNo ratings yet

- Problem 14-7 QuickBooks Guide PDFDocument3 pagesProblem 14-7 QuickBooks Guide PDFJoseph SalidoNo ratings yet

- CBUAE Clarification and Guidelines Manual For Circular No 28 Website VersionDocument9 pagesCBUAE Clarification and Guidelines Manual For Circular No 28 Website VersionAbhishek RungtaNo ratings yet

- November 2018 Current Affairs Quick Review - Gr8AmbitionZDocument19 pagesNovember 2018 Current Affairs Quick Review - Gr8AmbitionZBansal ShikHarshNo ratings yet

- RFP For Consultancy On CBSDocument45 pagesRFP For Consultancy On CBSsamuel aduNo ratings yet

- Malerman DepositionDocument46 pagesMalerman DepositionStopGovt WasteNo ratings yet

- Business Loan ApplicationDocument6 pagesBusiness Loan Applicationcatipop450No ratings yet

- Andres Vs Manufacturers HanoverDocument2 pagesAndres Vs Manufacturers Hanoverazalea marie maquiranNo ratings yet

- Al Barsha South Fourth - JVCDocument4 pagesAl Barsha South Fourth - JVCamir sufyanNo ratings yet

- INSTITUTE-University School of Business Department - ManagementDocument30 pagesINSTITUTE-University School of Business Department - ManagementAbhishek kumarNo ratings yet

- Mba Summer Training 19 Update (2) 1Document8 pagesMba Summer Training 19 Update (2) 1Yugal SinghalNo ratings yet

- Degp aApplicationForm 2022 2023 DEGP 4059567Document1 pageDegp aApplicationForm 2022 2023 DEGP 4059567ABC Computer R.SNo ratings yet

- Self Help GroupsDocument8 pagesSelf Help GroupsManoj KumarNo ratings yet

- Fitch Ratings - Brief ProfileDocument41 pagesFitch Ratings - Brief ProfileSona PansariNo ratings yet

- Project Reports On Non Performing Assets NPAs in Banking IndustryDocument72 pagesProject Reports On Non Performing Assets NPAs in Banking IndustryRajpal Sheoran67% (6)

- Bangladesh Payment & Settlement System PDFDocument18 pagesBangladesh Payment & Settlement System PDFrokib0116No ratings yet

- Role of Education Loan in Indian Higher EducationDocument10 pagesRole of Education Loan in Indian Higher EducationJaspreetkakeNo ratings yet

- A Final Project For The Course Title "Monetary Policy and Central Banking"Document11 pagesA Final Project For The Course Title "Monetary Policy and Central Banking"Elle SanchezNo ratings yet

- SHGs PPT Final - Lalita Final1Document14 pagesSHGs PPT Final - Lalita Final1abhicueeNo ratings yet

- Rjy To HydDocument2 pagesRjy To HydSharif MdNo ratings yet