Professional Documents

Culture Documents

Week 5 Portfolio (kèm ảnh)

Week 5 Portfolio (kèm ảnh)

Uploaded by

qwqjkm9bfrCopyright:

Available Formats

You might also like

- Kagan MillionDollarWeekend CHP 1Document15 pagesKagan MillionDollarWeekend CHP 1Gideon UsmanNo ratings yet

- Factory Acceptance TestDocument1 pageFactory Acceptance TestMuhammadPurnamaSugiri100% (3)

- Sherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018Document15 pagesSherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018laale dijaanNo ratings yet

- Case 06 Financial Detective 2016 F1763XDocument6 pagesCase 06 Financial Detective 2016 F1763XJosie KomiNo ratings yet

- BUMA 20023 - Strategic ManagementDocument104 pagesBUMA 20023 - Strategic ManagementAllyson VillalobosNo ratings yet

- Problems: Problem 12 - 2Document9 pagesProblems: Problem 12 - 2Jein PNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- TEST 3 SolutionDocument3 pagesTEST 3 SolutionlusandasithembeloNo ratings yet

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- 16 DT Group: Carrying Amount Tax Base Temporary DifferencesDocument2 pages16 DT Group: Carrying Amount Tax Base Temporary DifferencesJohn WickNo ratings yet

- GQ 6.2 SolDocument1 pageGQ 6.2 SolnessamuchenaNo ratings yet

- Apollo Tyres Ltd.Document3 pagesApollo Tyres Ltd.Nishant HardiyaNo ratings yet

- Test 8 SolutionDocument2 pagesTest 8 SolutionJanie HookeNo ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- Sol. Man. - Chapter 9 Income TaxesDocument15 pagesSol. Man. - Chapter 9 Income TaxesMiguel Amihan100% (1)

- Lebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra SessionDocument6 pagesLebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra Sessionjad NasserNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- June 2021Document3 pagesJune 2021akshay kausaleNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- 02 - Assignment Integration Exercise - SolutionDocument4 pages02 - Assignment Integration Exercise - SolutionAgustín RosalesNo ratings yet

- Sample FS Schedule 3 Tool For CompaniesDocument20 pagesSample FS Schedule 3 Tool For CompaniesGirish HNo ratings yet

- Ratio Analysis SumsDocument8 pagesRatio Analysis Sumshabibi 101No ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- Fidelity Engineering Reported Pretax Accounting IncomeDocument2 pagesFidelity Engineering Reported Pretax Accounting IncomeJalaj GuptaNo ratings yet

- Case Study 2 - Example (Handout 1)Document3 pagesCase Study 2 - Example (Handout 1)Nikoleta TrudovNo ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Projected P&L and BSDocument9 pagesProjected P&L and BSbipin kumarNo ratings yet

- Cma & DSCRDocument10 pagesCma & DSCRSaranNo ratings yet

- Statement of Profit and Loss: For The Year Ended 31st March, 2021Document2 pagesStatement of Profit and Loss: For The Year Ended 31st March, 2021Only For StudyNo ratings yet

- 9 Cash Flow Navneet EnterpriseDocument5 pages9 Cash Flow Navneet EnterpriseChanchal MisraNo ratings yet

- Return of Income: Basic InformationDocument11 pagesReturn of Income: Basic InformationShuvro PaulNo ratings yet

- 2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplateDocument8 pages2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplatesantiagoNo ratings yet

- Mock Answers Far-1 Autumn 2022Document13 pagesMock Answers Far-1 Autumn 2022rana m harisNo ratings yet

- Draft ReportDocument8 pagesDraft Report0264192238No ratings yet

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- Case Study 2 - Example Solution (Handout 2)Document4 pagesCase Study 2 - Example Solution (Handout 2)Nikoleta TrudovNo ratings yet

- Compilation Pyq - Far570Document109 pagesCompilation Pyq - Far570Nur SyafiqahNo ratings yet

- Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25Document1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25rahul_ransureNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Examination: Subject SA3 - General Insurance Specialist ApplicationsDocument13 pagesExamination: Subject SA3 - General Insurance Specialist Applicationsdickson phiriNo ratings yet

- Act370 Tax Form SowasifDocument16 pagesAct370 Tax Form SowasifAbuboker MahadyNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- Group Activity 2 Answer KeyDocument4 pagesGroup Activity 2 Answer Keykrisha milloNo ratings yet

- Chapter 6 Deferred TaxDocument109 pagesChapter 6 Deferred Taxlindokuhlentuli75No ratings yet

- Fs Credo Ye 2017Document38 pagesFs Credo Ye 2017AzerNo ratings yet

- FM16 Ch27 Tool KitDocument5 pagesFM16 Ch27 Tool KitAdamNo ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Problem 3 Accounts ReceivableDocument11 pagesProblem 3 Accounts ReceivableAngelie Bocala CatalanNo ratings yet

- CAF 5 Autumn 2023Document7 pagesCAF 5 Autumn 2023Hammad ShahidNo ratings yet

- PA - Group Assignment T1.2023Document6 pagesPA - Group Assignment T1.2023kkNo ratings yet

- Asian Paints Annual Report 2016-17Document2 pagesAsian Paints Annual Report 2016-17Amit Pandey0% (1)

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- Cae05-Chapter 10 Income Tax Problem DiscussionDocument37 pagesCae05-Chapter 10 Income Tax Problem Discussioncris tellaNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Cash Flow Explanatory SheetDocument4 pagesCash Flow Explanatory SheetTony DarwishNo ratings yet

- ASX Release: 23 August 2021Document40 pagesASX Release: 23 August 2021Peper12345No ratings yet

- SPS Chit Funds Private Limited Profit-Loss Fy2021-22Document1 pageSPS Chit Funds Private Limited Profit-Loss Fy2021-22Basker BillaNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Example 1 - Over and Under Provision of Current TaxDocument14 pagesExample 1 - Over and Under Provision of Current TaxPui YanNo ratings yet

- Work Sheet AnalysisDocument7 pagesWork Sheet AnalysisMUHAMMAD ARIF BASHIRNo ratings yet

- Apology Letter For Late Delivery of OrderDocument1 pageApology Letter For Late Delivery of OrderSumaiyaLimi0% (1)

- Management Flashcards - QuizletDocument3 pagesManagement Flashcards - Quizletanis athirahNo ratings yet

- Business Economics Objective Type Questions Chapter - 1 Choose The Correct AnswerDocument11 pagesBusiness Economics Objective Type Questions Chapter - 1 Choose The Correct AnswerPraveen Perumal PNo ratings yet

- Power of AttorneyDocument3 pagesPower of Attorneyumair aqibNo ratings yet

- 19 - Attachment File 19 Hazard Analaysis and Risk AssesmentDocument10 pages19 - Attachment File 19 Hazard Analaysis and Risk AssesmentSana IdreesNo ratings yet

- Oblicon - BPI Vs CA, REYESDocument1 pageOblicon - BPI Vs CA, REYESChi KoyNo ratings yet

- Lesson 1 Introduction To PRDocument21 pagesLesson 1 Introduction To PRNorhayati Hj BasriNo ratings yet

- Labour Licence ChittorDocument3 pagesLabour Licence ChittorGaurav SinghNo ratings yet

- IT211 PPT Research PaperDocument10 pagesIT211 PPT Research Paperb88f5wbdbvNo ratings yet

- Digital Platforms Contribution To Improvement of Service Provision To Citizens in NampulaDocument13 pagesDigital Platforms Contribution To Improvement of Service Provision To Citizens in NampulaIJAERS JOURNALNo ratings yet

- Walmart Case StudyDocument28 pagesWalmart Case StudychandanNo ratings yet

- Notes (LA 12B) 28-02-2018 - AcceptanceDocument3 pagesNotes (LA 12B) 28-02-2018 - AcceptanceBrian PetersNo ratings yet

- Week 1 - 11Document35 pagesWeek 1 - 11asdasdNo ratings yet

- Building ComponentsDocument41 pagesBuilding ComponentsKainaz ChothiaNo ratings yet

- Origin of Clause AaaaDocument2 pagesOrigin of Clause AaaaRizky NugrohoNo ratings yet

- IEC Name of ExporterDocument20 pagesIEC Name of ExporterUday kumarNo ratings yet

- Growth Vs ScalingDocument3 pagesGrowth Vs Scalingmichelle dizonNo ratings yet

- Amazon's Alexa Spaghetti StrategyDocument10 pagesAmazon's Alexa Spaghetti StrategyShubham SinghNo ratings yet

- ANURAG R KANOJIYA PROJECT - Anurag KanojiyaDocument44 pagesANURAG R KANOJIYA PROJECT - Anurag Kanojiyadipak tighareNo ratings yet

- Competition and Efficiency in Banking. Behavioural Evidence From GhanaDocument27 pagesCompetition and Efficiency in Banking. Behavioural Evidence From GhanaKingston Nkansah Kwadwo EmmanuelNo ratings yet

- Tax - Cargill Philippines Inc Vs CIR DigestDocument2 pagesTax - Cargill Philippines Inc Vs CIR DigestDyannah Alexa Marie RamachoNo ratings yet

- Peningkatan Dan Pengembangan Produk Olahan Kopi Di Desa BrunosariDocument13 pagesPeningkatan Dan Pengembangan Produk Olahan Kopi Di Desa BrunosariRendy StarsNo ratings yet

- Customer Relationship Management - Chapter 1Document40 pagesCustomer Relationship Management - Chapter 1leni th100% (1)

- Holy Angel University: School of Business and Accountancy Holy Angel University Angeles City ACADEMIC YEAR 2021-2022Document10 pagesHoly Angel University: School of Business and Accountancy Holy Angel University Angeles City ACADEMIC YEAR 2021-2022Mae Justine Joy TajoneraNo ratings yet

- Financial DerivativesDocument23 pagesFinancial DerivativesKriti MarwahNo ratings yet

- Lt234.Tvp (Il-II) Question Cma May-2023 Exam.Document7 pagesLt234.Tvp (Il-II) Question Cma May-2023 Exam.Arif HossainNo ratings yet

- Wise Transaction Invoice Transfer 503629724 589929159 enDocument3 pagesWise Transaction Invoice Transfer 503629724 589929159 enHanna PyzhovaNo ratings yet

Week 5 Portfolio (kèm ảnh)

Week 5 Portfolio (kèm ảnh)

Uploaded by

qwqjkm9bfrCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 5 Portfolio (kèm ảnh)

Week 5 Portfolio (kèm ảnh)

Uploaded by

qwqjkm9bfrCopyright:

Available Formats

(a) Calculation of taxable income and its current tax consequences for year end 30 June 2020 ($'000)

Accounting Profit before tax 314

Permanent Differences:

Good-will impairment paid 12 Income

Tax Expense: 97.8

Temporary Differences:

Insurance Expenses 30

Insurance paid (23) 7

Warranty Expense 41

Warranty Cost paid (21) 20

LSL Expense 28

LSL Paid (46) (18)

Accounting Depreciation - Plant 80

Tax Depreciation (100) (20)

D.Debt Expense 21

D.Debt Written off (21) 0

Taxable Profit 315 Income

Tax Payable: 94.5

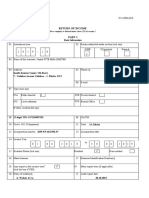

(ảnh chụp)

Prepaid Insurance

O/b 10

Insurance expense

Insurance paid 23

30

C/b 3

D. Debt Allowance

O/b 6

D.Debt Written off

D/d expense 21

21

C/b 6

Provision for warranty

O/b 25

Warranty cost paid Warranty Expense

21 41

C/b 45

Provision for LSL

O/b 20

LSL paid 46 LSL Expense 28

C/b 2

(b) Determine future tax consequences for year end 30 June 2020 ($'000)

Carrying Tax Base Deductible Taxable Income Income

Amount Temporary Temporary Tax Tax

30 June 2020

Differences Differences Expense Payable

$ $ $ $ $ $

Assets

Cash 26 26

Inventory 105 105

Acc. Receivable -

129 135 6 (6)

Net

Prepaid Insurance 3 0 3 3

Plant - Net 240 200 40 40

Liabilities

Acc. Payable 74.5 74.5

Provision for

45 0 45 (45)

warranty

Provision for

2 0 2 (2)

LSL

Loan Payable 175 175

Temporary differences at period end 53 43 (10)

Less: Prior period amounts 51 30 (21)

Movement for the period 2 13 11

Tax affected 0.6 3.9 3.3

Tax on taxable income 94.5 94.5

Income tax adjustments required 0.6 3.9 97.8 94.5

(c)

30 June 2020

Deferred tax asset 0.6

Income tax expense 97.8

Deferred tax liability 3.9

Income tax payable 94.5

(To recognise current and deferred tax consequences for year 2020)

Deferred tax liability 12.9

Deferred tax asset 12.9

(To off-set DTA and DTL for reporting purposes)

DTA bal = O/bal 15.3 (DR) + Adjustment for the current year 0.6 (DR) = 15.9

DTL bal = O/bal 9 (CR) + Current year adjustment 3.9 (CR) = 12.9

The account with the smaller balance should be off-set to the account with the larger balance. So DTL

should be off-set to DTA

Tham khảo từ đáp án trong tutorial:

You might also like

- Kagan MillionDollarWeekend CHP 1Document15 pagesKagan MillionDollarWeekend CHP 1Gideon UsmanNo ratings yet

- Factory Acceptance TestDocument1 pageFactory Acceptance TestMuhammadPurnamaSugiri100% (3)

- Sherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018Document15 pagesSherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018laale dijaanNo ratings yet

- Case 06 Financial Detective 2016 F1763XDocument6 pagesCase 06 Financial Detective 2016 F1763XJosie KomiNo ratings yet

- BUMA 20023 - Strategic ManagementDocument104 pagesBUMA 20023 - Strategic ManagementAllyson VillalobosNo ratings yet

- Problems: Problem 12 - 2Document9 pagesProblems: Problem 12 - 2Jein PNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- TEST 3 SolutionDocument3 pagesTEST 3 SolutionlusandasithembeloNo ratings yet

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- 16 DT Group: Carrying Amount Tax Base Temporary DifferencesDocument2 pages16 DT Group: Carrying Amount Tax Base Temporary DifferencesJohn WickNo ratings yet

- GQ 6.2 SolDocument1 pageGQ 6.2 SolnessamuchenaNo ratings yet

- Apollo Tyres Ltd.Document3 pagesApollo Tyres Ltd.Nishant HardiyaNo ratings yet

- Test 8 SolutionDocument2 pagesTest 8 SolutionJanie HookeNo ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- Sol. Man. - Chapter 9 Income TaxesDocument15 pagesSol. Man. - Chapter 9 Income TaxesMiguel Amihan100% (1)

- Lebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra SessionDocument6 pagesLebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra Sessionjad NasserNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- June 2021Document3 pagesJune 2021akshay kausaleNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- 02 - Assignment Integration Exercise - SolutionDocument4 pages02 - Assignment Integration Exercise - SolutionAgustín RosalesNo ratings yet

- Sample FS Schedule 3 Tool For CompaniesDocument20 pagesSample FS Schedule 3 Tool For CompaniesGirish HNo ratings yet

- Ratio Analysis SumsDocument8 pagesRatio Analysis Sumshabibi 101No ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- Fidelity Engineering Reported Pretax Accounting IncomeDocument2 pagesFidelity Engineering Reported Pretax Accounting IncomeJalaj GuptaNo ratings yet

- Case Study 2 - Example (Handout 1)Document3 pagesCase Study 2 - Example (Handout 1)Nikoleta TrudovNo ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Projected P&L and BSDocument9 pagesProjected P&L and BSbipin kumarNo ratings yet

- Cma & DSCRDocument10 pagesCma & DSCRSaranNo ratings yet

- Statement of Profit and Loss: For The Year Ended 31st March, 2021Document2 pagesStatement of Profit and Loss: For The Year Ended 31st March, 2021Only For StudyNo ratings yet

- 9 Cash Flow Navneet EnterpriseDocument5 pages9 Cash Flow Navneet EnterpriseChanchal MisraNo ratings yet

- Return of Income: Basic InformationDocument11 pagesReturn of Income: Basic InformationShuvro PaulNo ratings yet

- 2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplateDocument8 pages2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplatesantiagoNo ratings yet

- Mock Answers Far-1 Autumn 2022Document13 pagesMock Answers Far-1 Autumn 2022rana m harisNo ratings yet

- Draft ReportDocument8 pagesDraft Report0264192238No ratings yet

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- Case Study 2 - Example Solution (Handout 2)Document4 pagesCase Study 2 - Example Solution (Handout 2)Nikoleta TrudovNo ratings yet

- Compilation Pyq - Far570Document109 pagesCompilation Pyq - Far570Nur SyafiqahNo ratings yet

- Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25Document1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25rahul_ransureNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Examination: Subject SA3 - General Insurance Specialist ApplicationsDocument13 pagesExamination: Subject SA3 - General Insurance Specialist Applicationsdickson phiriNo ratings yet

- Act370 Tax Form SowasifDocument16 pagesAct370 Tax Form SowasifAbuboker MahadyNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- Group Activity 2 Answer KeyDocument4 pagesGroup Activity 2 Answer Keykrisha milloNo ratings yet

- Chapter 6 Deferred TaxDocument109 pagesChapter 6 Deferred Taxlindokuhlentuli75No ratings yet

- Fs Credo Ye 2017Document38 pagesFs Credo Ye 2017AzerNo ratings yet

- FM16 Ch27 Tool KitDocument5 pagesFM16 Ch27 Tool KitAdamNo ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Problem 3 Accounts ReceivableDocument11 pagesProblem 3 Accounts ReceivableAngelie Bocala CatalanNo ratings yet

- CAF 5 Autumn 2023Document7 pagesCAF 5 Autumn 2023Hammad ShahidNo ratings yet

- PA - Group Assignment T1.2023Document6 pagesPA - Group Assignment T1.2023kkNo ratings yet

- Asian Paints Annual Report 2016-17Document2 pagesAsian Paints Annual Report 2016-17Amit Pandey0% (1)

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- Cae05-Chapter 10 Income Tax Problem DiscussionDocument37 pagesCae05-Chapter 10 Income Tax Problem Discussioncris tellaNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Cash Flow Explanatory SheetDocument4 pagesCash Flow Explanatory SheetTony DarwishNo ratings yet

- ASX Release: 23 August 2021Document40 pagesASX Release: 23 August 2021Peper12345No ratings yet

- SPS Chit Funds Private Limited Profit-Loss Fy2021-22Document1 pageSPS Chit Funds Private Limited Profit-Loss Fy2021-22Basker BillaNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Example 1 - Over and Under Provision of Current TaxDocument14 pagesExample 1 - Over and Under Provision of Current TaxPui YanNo ratings yet

- Work Sheet AnalysisDocument7 pagesWork Sheet AnalysisMUHAMMAD ARIF BASHIRNo ratings yet

- Apology Letter For Late Delivery of OrderDocument1 pageApology Letter For Late Delivery of OrderSumaiyaLimi0% (1)

- Management Flashcards - QuizletDocument3 pagesManagement Flashcards - Quizletanis athirahNo ratings yet

- Business Economics Objective Type Questions Chapter - 1 Choose The Correct AnswerDocument11 pagesBusiness Economics Objective Type Questions Chapter - 1 Choose The Correct AnswerPraveen Perumal PNo ratings yet

- Power of AttorneyDocument3 pagesPower of Attorneyumair aqibNo ratings yet

- 19 - Attachment File 19 Hazard Analaysis and Risk AssesmentDocument10 pages19 - Attachment File 19 Hazard Analaysis and Risk AssesmentSana IdreesNo ratings yet

- Oblicon - BPI Vs CA, REYESDocument1 pageOblicon - BPI Vs CA, REYESChi KoyNo ratings yet

- Lesson 1 Introduction To PRDocument21 pagesLesson 1 Introduction To PRNorhayati Hj BasriNo ratings yet

- Labour Licence ChittorDocument3 pagesLabour Licence ChittorGaurav SinghNo ratings yet

- IT211 PPT Research PaperDocument10 pagesIT211 PPT Research Paperb88f5wbdbvNo ratings yet

- Digital Platforms Contribution To Improvement of Service Provision To Citizens in NampulaDocument13 pagesDigital Platforms Contribution To Improvement of Service Provision To Citizens in NampulaIJAERS JOURNALNo ratings yet

- Walmart Case StudyDocument28 pagesWalmart Case StudychandanNo ratings yet

- Notes (LA 12B) 28-02-2018 - AcceptanceDocument3 pagesNotes (LA 12B) 28-02-2018 - AcceptanceBrian PetersNo ratings yet

- Week 1 - 11Document35 pagesWeek 1 - 11asdasdNo ratings yet

- Building ComponentsDocument41 pagesBuilding ComponentsKainaz ChothiaNo ratings yet

- Origin of Clause AaaaDocument2 pagesOrigin of Clause AaaaRizky NugrohoNo ratings yet

- IEC Name of ExporterDocument20 pagesIEC Name of ExporterUday kumarNo ratings yet

- Growth Vs ScalingDocument3 pagesGrowth Vs Scalingmichelle dizonNo ratings yet

- Amazon's Alexa Spaghetti StrategyDocument10 pagesAmazon's Alexa Spaghetti StrategyShubham SinghNo ratings yet

- ANURAG R KANOJIYA PROJECT - Anurag KanojiyaDocument44 pagesANURAG R KANOJIYA PROJECT - Anurag Kanojiyadipak tighareNo ratings yet

- Competition and Efficiency in Banking. Behavioural Evidence From GhanaDocument27 pagesCompetition and Efficiency in Banking. Behavioural Evidence From GhanaKingston Nkansah Kwadwo EmmanuelNo ratings yet

- Tax - Cargill Philippines Inc Vs CIR DigestDocument2 pagesTax - Cargill Philippines Inc Vs CIR DigestDyannah Alexa Marie RamachoNo ratings yet

- Peningkatan Dan Pengembangan Produk Olahan Kopi Di Desa BrunosariDocument13 pagesPeningkatan Dan Pengembangan Produk Olahan Kopi Di Desa BrunosariRendy StarsNo ratings yet

- Customer Relationship Management - Chapter 1Document40 pagesCustomer Relationship Management - Chapter 1leni th100% (1)

- Holy Angel University: School of Business and Accountancy Holy Angel University Angeles City ACADEMIC YEAR 2021-2022Document10 pagesHoly Angel University: School of Business and Accountancy Holy Angel University Angeles City ACADEMIC YEAR 2021-2022Mae Justine Joy TajoneraNo ratings yet

- Financial DerivativesDocument23 pagesFinancial DerivativesKriti MarwahNo ratings yet

- Lt234.Tvp (Il-II) Question Cma May-2023 Exam.Document7 pagesLt234.Tvp (Il-II) Question Cma May-2023 Exam.Arif HossainNo ratings yet

- Wise Transaction Invoice Transfer 503629724 589929159 enDocument3 pagesWise Transaction Invoice Transfer 503629724 589929159 enHanna PyzhovaNo ratings yet