Professional Documents

Culture Documents

Monetary Policy

Monetary Policy

Uploaded by

Pallavi RawatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monetary Policy

Monetary Policy

Uploaded by

Pallavi RawatCopyright:

Available Formats

11.

Monetary Policy

1. The Bank of Canada

a) Core Functions

(1)

(2)

(3)

(4)

Note:

(5)

Bank of Canada (relative) independence:

ECON 102 Page 1

b) The Monetary Policy Framework

Objective:

Policy:

𝑖𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 𝑟𝑎𝑡𝑒 𝑡𝑎𝑟𝑔𝑒𝑡𝑖𝑛𝑔

Policy Instrument: Overnight money market interest rate

ECON 102 Page 2

2. The Conduct of Monetary Policy

a) The Overnight Money Market

□ 16 participating banks in Lynx (high-value payment system)

□ Multilateral netting at end of day

►

supply

𝑖

∗

𝑖

demand

𝑟𝑒𝑠𝑒𝑟𝑣𝑒𝑠

ECON 102 Page 3

b) Setting the Policy Rate

(1) Cut off demand with deposit and bank rate

𝑑𝑒𝑝𝑜𝑠𝑖𝑡 𝑟𝑎𝑡𝑒

ECON 102 Page 4

(2) Fine tune supply with open-market operations

𝑠𝑢𝑝𝑝𝑙𝑦 𝑠𝑒𝑡 𝑏𝑦 𝐶𝐵

Repo:

(1)

(2)

(3)

ECON 102 Page 5

Reverse Repo: CB sells bond, buys it back tomorrow

(1)

(2)

(3)

Note:

c) Propagation of short-term to long-term interest rates

Option 1: 2-year term Option 2: 2 times 1-year term

(1 + 𝑖 )𝐵

Both should yield the same return, but option 1 is riskier:

!

(1 + 𝑖 ) =

□ Expectations theory of interest rates:

!

(1 + 𝑖 ) = (1 − 𝑖 ) 1 + 𝑖 1+𝑖 1+𝑖 …+ 𝛾

!

(1 + 𝑖 ) = 1+𝑖 +𝛾

ECON 102 Page 6

ECON 102 Page 7

3. Monetary Policy Transmission

a) Conventional Monetary Policy

□ Transmission Channels

(1)

(2)

(3)

(4)

ECON 102 Page 8

□ The Taylor Rule

𝑟 +𝛾 𝑀𝑃𝑅

𝛾

𝑟∗

π∗ 𝜋

𝑖 = 𝑟∗ + 𝜋 + 𝜙 (π − π∗ ) + ϕ (𝑦 − 𝑦)

( )

ECON 102 Page 9

b) Non-Conventional Monetary Policy

□ The Liquidity Trap

IS-MP

𝑟

𝑀𝑃

𝐼𝑆

0 𝑦

Solution:

(1) Negative Interest Rates

IS-MP

𝑟 •

𝑀𝑃

𝐼𝑆

0 𝑦

ECON 102 Page 10

(2) Quantitative Easing

ECON 102 Page 11

(3) Forward Guidance

(1 + 𝑖 ) = (1 − 𝑖 ) 1+𝑖 1+𝑖 1+𝑖 …+𝛾

Note:

ECON 102 Page 12

You might also like

- Chase Credit Card StatementDocument1 pageChase Credit Card StatementMike McKinseyNo ratings yet

- Sample Paper CAIIB BRBL by Dr. MuruganDocument94 pagesSample Paper CAIIB BRBL by Dr. MuruganMarshall Mathers100% (1)

- 0901 Be-Ii (MB1B4)Document24 pages0901 Be-Ii (MB1B4)api-19916064No ratings yet

- Fei2123PS2 PDFDocument4 pagesFei2123PS2 PDFMarco ChanNo ratings yet

- 0810 FM (Cfa540)Document26 pages0810 FM (Cfa540)CAVIENCRAZY10No ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerhossain ronyNo ratings yet

- Aggregate Supply and EquilibriumDocument13 pagesAggregate Supply and EquilibriumPallavi RawatNo ratings yet

- Hsslive Xii Model Exam Feb 2023 Economics Answer Key RajeshDocument7 pagesHsslive Xii Model Exam Feb 2023 Economics Answer Key Rajeshgamingnkt3No ratings yet

- Fixed Income ValuationDocument43 pagesFixed Income ValuationZonio Nina Bonita T.No ratings yet

- Economics Worksheet 4 Answer SheetDocument6 pagesEconomics Worksheet 4 Answer Sheetkgauheloselebano07No ratings yet

- A Quick Guide Through The Wondrous World of Financial ModellingDocument16 pagesA Quick Guide Through The Wondrous World of Financial Modellinganand_studyNo ratings yet

- Class PPT-Prelims Revision Classes Economy (Money Supply) Lecture-1 27-Mar-2023Document18 pagesClass PPT-Prelims Revision Classes Economy (Money Supply) Lecture-1 27-Mar-2023Tanay BansalNo ratings yet

- R3 Page5Document1 pageR3 Page5Benjamin ChillamNo ratings yet

- Inflation and MoneyDocument12 pagesInflation and MoneyPallavi RawatNo ratings yet

- Multiple Choice Questions: d) d) R d) θ (1−c) M θ) increaseDocument3 pagesMultiple Choice Questions: d) d) R d) θ (1−c) M θ) increaseHelen ToNo ratings yet

- Multiple Choice Questions: d) d) R d) θ (1−c) M θ) increaseDocument3 pagesMultiple Choice Questions: d) d) R d) θ (1−c) M θ) increaseHelen ToNo ratings yet

- Corporate Finance - 2023 - Chapter 2 - English 2 - 2Document31 pagesCorporate Finance - 2023 - Chapter 2 - English 2 - 2mabiboo.180103No ratings yet

- KARNAUGH MAPDocument45 pagesKARNAUGH MAPAnish ThomasNo ratings yet

- Multiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachDocument34 pagesMultiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachKaran KumarNo ratings yet

- Multiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachDocument81 pagesMultiple Choice Questions (MCQ) Q.1 - Q.10 Carry ONE Mark EachShadowmaster LegendNo ratings yet

- External 1 EcoDocument4 pagesExternal 1 Ecovinit tandelNo ratings yet

- 20220910170939HCTAN008C6b Topic6b Risk - MGTDocument57 pages20220910170939HCTAN008C6b Topic6b Risk - MGTnicholas wijayaNo ratings yet

- First Midterm Exam: Econ 435 - Financial EconomicsDocument14 pagesFirst Midterm Exam: Econ 435 - Financial EconomicsWill MillerNo ratings yet

- MBA32-Corporate Finance SharingDocument23 pagesMBA32-Corporate Finance SharingPhươngAnhNo ratings yet

- 3B.B.a. Sem.-Ii CC-111 Principles of Economics (Macro)Document2 pages3B.B.a. Sem.-Ii CC-111 Principles of Economics (Macro)FGEFGNo ratings yet

- Cbse Class 12 Economics Sample Paper Set 3 QuestionsDocument6 pagesCbse Class 12 Economics Sample Paper Set 3 QuestionsPhototronixNo ratings yet

- EOF Recitation 2 Slides - Two Period ModelDocument22 pagesEOF Recitation 2 Slides - Two Period Model碧莹成No ratings yet

- Module 2Document29 pagesModule 2Kurt Neo SambileNo ratings yet

- Corporate Finance - Lecture 3Document40 pagesCorporate Finance - Lecture 3Faraz BodaghiNo ratings yet

- Tutorial 2 Sessions 3 and 4 Capital Budgeting Decisions: Chara Kaffe Ck469@cam - Ac.ukDocument6 pagesTutorial 2 Sessions 3 and 4 Capital Budgeting Decisions: Chara Kaffe Ck469@cam - Ac.ukmichellekhcNo ratings yet

- +2 Economics EM DGE FinalDocument11 pages+2 Economics EM DGE FinalHariniNo ratings yet

- Lender-Borrower Relationships: A.TheoryDocument34 pagesLender-Borrower Relationships: A.TheoryFelipe QuinteroNo ratings yet

- 2016 Macro -Revised 答案Document8 pages2016 Macro -Revised 答案cyr13520301212No ratings yet

- Financial Feasibility Study For Investment Projects Case 2: The NCF and The Pay-Back Period of Project PE1 of CUCODocument3 pagesFinancial Feasibility Study For Investment Projects Case 2: The NCF and The Pay-Back Period of Project PE1 of CUCOMariam YasserNo ratings yet

- The Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010Document31 pagesThe Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010KeemeNo ratings yet

- Principles of FinanceDocument4 pagesPrinciples of Financehectorgm77No ratings yet

- Economics Mk Final Exam Jan 2021Document3 pagesEconomics Mk Final Exam Jan 2021Yus LindaNo ratings yet

- 811 Banking MS T1Document2 pages811 Banking MS T1nirmalabehera8No ratings yet

- Financial Accounting I 1005Document28 pagesFinancial Accounting I 1005meetwithsanjayNo ratings yet

- Corporate Investment PolicyDocument18 pagesCorporate Investment PolicyAANo ratings yet

- FIN2704 Week 3 Zoom Lecture SlidesDocument23 pagesFIN2704 Week 3 Zoom Lecture SlidesZenyuiNo ratings yet

- Financial Institutions and Markets: Session - 6Document45 pagesFinancial Institutions and Markets: Session - 6Arushi VermaNo ratings yet

- 4 SOLUTIONS - APPLICATIONS - Ch2Document4 pages4 SOLUTIONS - APPLICATIONS - Ch2rkswrt7t9dNo ratings yet

- B03013 Class3 TimeValueofMoneyDocument20 pagesB03013 Class3 TimeValueofMoneyLâm Thị Như ÝNo ratings yet

- CBSE Practice Paper 2022-23 MSDocument8 pagesCBSE Practice Paper 2022-23 MSPooja BediNo ratings yet

- Advanced Financial Management May 2016 Past Paper and Suggested Answers Wco8ooDocument17 pagesAdvanced Financial Management May 2016 Past Paper and Suggested Answers Wco8ookaragujsNo ratings yet

- Question Paper International Finance and Trade - I (221) : July 2005Document13 pagesQuestion Paper International Finance and Trade - I (221) : July 2005api-27548664No ratings yet

- What Is The Assumption We Usually Make When Forecasting Future Cash Flows Beyond The Explicit Forecast Horizon?Document4 pagesWhat Is The Assumption We Usually Make When Forecasting Future Cash Flows Beyond The Explicit Forecast Horizon?Nga PhươngNo ratings yet

- Lecture 2Document24 pagesLecture 2e.mahler1997No ratings yet

- Economics II 0105Document25 pagesEconomics II 0105meetwithsanjayNo ratings yet

- Capital Budgeting: © 2009 Cengage Learning/South-WesternDocument28 pagesCapital Budgeting: © 2009 Cengage Learning/South-WesternMarwah YaseenNo ratings yet

- Financial Management:: Investment Decision CriteriaDocument96 pagesFinancial Management:: Investment Decision CriteriaBen OusoNo ratings yet

- Investment and Financial Management Exam SolvedDocument12 pagesInvestment and Financial Management Exam SolvedSoumojit KumarNo ratings yet

- 14-MNC Capital BudgetingDocument22 pages14-MNC Capital BudgetingRoopa Shree100% (1)

- Cbleecpl 02Document8 pagesCbleecpl 02AdityaNo ratings yet

- Cbleecpl 06Document6 pagesCbleecpl 06AdityaNo ratings yet

- The Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010Document31 pagesThe Time Value of Money Lecture 3 and 4: Corporate Finance Ronald F. Singer Fall, 2010Kefira SlackaNo ratings yet

- Capital Bud NoteDocument35 pagesCapital Bud NoteKazi HasanNo ratings yet

- Chapter 21 - Teachers Manual - Aa Part 2 PDFDocument23 pagesChapter 21 - Teachers Manual - Aa Part 2 PDFSheed ChiuNo ratings yet

- Fundamental Economic Concepts: Risk-Adjusted Discount RatesDocument37 pagesFundamental Economic Concepts: Risk-Adjusted Discount Ratestanvir09No ratings yet

- ECONOMICS P1 MEMO GR12 JUNE 2022_EnglishDocument15 pagesECONOMICS P1 MEMO GR12 JUNE 2022_EnglishmaunatlalakagisoNo ratings yet

- Vanishing Deductions X Estate Tax ComputationDocument2 pagesVanishing Deductions X Estate Tax ComputationShiela Mae OblanNo ratings yet

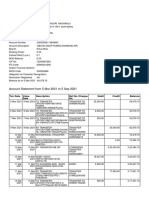

- 5 Mar 2021 To 5 Sep 2021Document13 pages5 Mar 2021 To 5 Sep 2021KanakaReddyKannaNo ratings yet

- U.S. Individual Income Tax Return: (See Instructions.)Document2 pagesU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezNo ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- COMPARE - Auto LoansDocument3 pagesCOMPARE - Auto Loansrobr5604No ratings yet

- Asynchronous Assignment Bank Management: Submitted byDocument6 pagesAsynchronous Assignment Bank Management: Submitted bytanyaNo ratings yet

- StatementOfAccount 448055144 29012024 144527Document2 pagesStatementOfAccount 448055144 29012024 144527ravikumarjaladiNo ratings yet

- Summary of Accounts Held Under Customer ID: XXXXX8745 As On February 29, 2024 I. Operative Account in INRDocument1 pageSummary of Accounts Held Under Customer ID: XXXXX8745 As On February 29, 2024 I. Operative Account in INRadityayadavasyNo ratings yet

- The Value of Money ConceptDocument58 pagesThe Value of Money ConceptNehemia T MasiyaziNo ratings yet

- Acquiring New Knowledge: Module 5 Employee Benefits Learning ObjectivesDocument11 pagesAcquiring New Knowledge: Module 5 Employee Benefits Learning ObjectivesErine ContranoNo ratings yet

- RRL Research Design and Instrument.Document23 pagesRRL Research Design and Instrument.Leah BausinNo ratings yet

- A3Document16 pagesA3Varsha VarshaNo ratings yet

- $2,731,323 - Experian Credit ReportDocument1 page$2,731,323 - Experian Credit Reportlarry-612445100% (1)

- Englishbest - Financial and Bank ExpressionsDocument2 pagesEnglishbest - Financial and Bank ExpressionsJari JariNo ratings yet

- REVIEW AND PRACTICE Chapter 8 Accounting For ReceivablesDocument3 pagesREVIEW AND PRACTICE Chapter 8 Accounting For Receivablesukandi rukmanaNo ratings yet

- Make Wire Transfers Through Online Banking From AnywhereDocument2 pagesMake Wire Transfers Through Online Banking From AnywhereDani PermanaNo ratings yet

- TermsKFS 7652940900Document11 pagesTermsKFS 7652940900pankajprajapati000078666No ratings yet

- Funds Transfers - OverviewDocument7 pagesFunds Transfers - OverviewCajita FelizNo ratings yet

- BANK STATEMENT 07.05.2023Document4 pagesBANK STATEMENT 07.05.2023salmankuttysk1995No ratings yet

- Module 2 Paper 5 CRILW PI Book PDFDocument328 pagesModule 2 Paper 5 CRILW PI Book PDFShakti PanigrahiNo ratings yet

- Banking and Financial Awareness - GKDocument3 pagesBanking and Financial Awareness - GKbhslegion1498No ratings yet

- Revision of Axis Bank Credit Card Terms and Conditions For AffluentDocument4 pagesRevision of Axis Bank Credit Card Terms and Conditions For AffluentArman TamboliNo ratings yet

- TV FullDocument77 pagesTV FullShrivathsan KSNo ratings yet

- Budgeting and Goal Setting 27715 20231031183226Document111 pagesBudgeting and Goal Setting 27715 20231031183226Nicolle MoranNo ratings yet

- Course Outline - Law of InsolvencyDocument17 pagesCourse Outline - Law of InsolvencyokotjananetumNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSMariem JabberiNo ratings yet

- Intro Finance QuestionsDocument3 pagesIntro Finance QuestionsstanleyNo ratings yet