Professional Documents

Culture Documents

IA1-Chapter 3-Problem 3

IA1-Chapter 3-Problem 3

Uploaded by

Maccy Man0 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesIA1-Chapter 3-Problem 3

IA1-Chapter 3-Problem 3

Uploaded by

Maccy ManCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Chapter 3 Problem 3-3

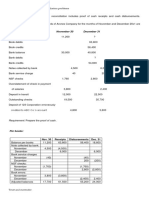

a. Reconciliation on July 1

Adjusted book balance 1,270,000

Balance per bank 1,720,000

Add: Deposit in transit 500,000

Total 2,220,000

Less: Outstanding checks 950,000

Adjusted bank balance 1, 270,000

Reconciliation on July 31

Balance per book 470,000

Add: Note collected by bank 1,500,000

Total 1, 970,000

Less: Bank service charge 20,000

Adjusted book balance 1,950,000

Balance per bank 2,700,000

Add: Deposit in transit 400,000

Total 3,100,000

Less: Outstanding check no. 107 650,000

108 500,000 1,150,000

Adjusted bank balance 1, 950,000

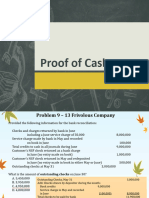

b. Adjusting entries

1. Cash 1,500,000

Note receivable 1,500,000

2. Bank service charge 20,000

Cash 20,000

Deposit in transit – July 1 500,000 (SQUEEZE)

Add: Cash receipts per book 3,400,000

Total 3,900,000

Less: Deposits credited by bank 3,500,000

Deposit in transit – July 31 400,000

Outstanding check – July 1 950,000 (SQUEEZE)

Add: Cash drawn by depositor 4,200,000

Total 5,150,000

Less: Checks paid by bank 4,000,000

Outstanding checks – July 31 1,150,000

You might also like

- Bank Reconciliations PROBLEMS With Solutions PDFDocument5 pagesBank Reconciliations PROBLEMS With Solutions PDFlei vera80% (5)

- Ch. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixDocument7 pagesCh. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixNathalie GetinoNo ratings yet

- Problem 3-3 Ajusted Book Balance Checks Drawn: Bank Statement Balance Per BankDocument3 pagesProblem 3-3 Ajusted Book Balance Checks Drawn: Bank Statement Balance Per BankNika Bautista100% (2)

- Bank ReconciliationDocument3 pagesBank Reconciliationalford sery Cammayo86% (7)

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaNo ratings yet

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Assignment 3Document4 pagesAssignment 3Bernadeth Adelaine DomingoNo ratings yet

- Assignment 3 ACFAR 1231 Proof of CashDocument2 pagesAssignment 3 ACFAR 1231 Proof of CashkakaoNo ratings yet

- Cfas Bsa1b Bank Recon ActivityDocument4 pagesCfas Bsa1b Bank Recon ActivityKristan EstebanNo ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- Problem 1Document13 pagesProblem 1Ghaill CruzNo ratings yet

- Beehive Company Bank Reconciliation For The Month of OctoberDocument2 pagesBeehive Company Bank Reconciliation For The Month of OctoberGilner PomarNo ratings yet

- Cash and Cash EquivalentsDocument7 pagesCash and Cash Equivalentszarnaih SmithNo ratings yet

- Bank Recon Solutions Exercise 2 3Document7 pagesBank Recon Solutions Exercise 2 3Kevin James Sedurifa OledanNo ratings yet

- Bank ReconciliationDocument9 pagesBank ReconciliationKailah Calinog100% (3)

- Solution To Quiz 1Document2 pagesSolution To Quiz 1Carmi FeceroNo ratings yet

- C3Document16 pagesC3Aaliyah Manuel100% (1)

- Bank Recon GoldDocument2 pagesBank Recon Goldcrisjay ramosNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Bank Recon Sample ProblemsDocument4 pagesBank Recon Sample ProblemsKathleen100% (1)

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenNo ratings yet

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocument4 pagesGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNo ratings yet

- IA Chapter 1 To 3Document12 pagesIA Chapter 1 To 3Blue SkyNo ratings yet

- ACTIVITYDocument3 pagesACTIVITYAerwyna AfarinNo ratings yet

- UntitledDocument5 pagesUntitledShevina Maghari shsnohsNo ratings yet

- HO 1 - Cash and Cash EquivalentsDocument8 pagesHO 1 - Cash and Cash EquivalentsCharmain ReganitNo ratings yet

- Adjusted Bank Balance 7,750,000Document3 pagesAdjusted Bank Balance 7,750,000fabyunaaaNo ratings yet

- Sol To BNK RecDocument10 pagesSol To BNK RecEDGAR ORDANELNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingYami HeatherNo ratings yet

- Samplepractice Exam 15 October 2020 Questions and AnswersDocument6 pagesSamplepractice Exam 15 October 2020 Questions and AnswersMartha Nicole MaristelaNo ratings yet

- Samplepractice Exam 15 October 2020, Questions and Answers - CHAPTER 13 Chapter 15 Bank - StudocuDocument1 pageSamplepractice Exam 15 October 2020, Questions and Answers - CHAPTER 13 Chapter 15 Bank - Studocumarcusmangawang3No ratings yet

- Valix Bank ReconDocument5 pagesValix Bank ReconEloiNo ratings yet

- Cash AssignmentDocument2 pagesCash Assignmentyjkq4byrj6No ratings yet

- Financial Accounting Review, Problem Preliminary Examination Problem 1Document16 pagesFinancial Accounting Review, Problem Preliminary Examination Problem 1John Emerson PatricioNo ratings yet

- Proof of Cash - 02Document19 pagesProof of Cash - 02Royu BreakerNo ratings yet

- Answer Sample Problems Cash1-12Document4 pagesAnswer Sample Problems Cash1-12Anonymous wwLoDau1aNo ratings yet

- Audit of CCE - Answers To Module From Sir MarkieDocument25 pagesAudit of CCE - Answers To Module From Sir MarkieMarkie GrabilloNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFJerald Jay CatacutanNo ratings yet

- Chapter 2-3, 2-6Document3 pagesChapter 2-3, 2-6XENA LOPEZNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Timing Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeDocument6 pagesTiming Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeannyeongNo ratings yet

- Illustration Bank ReconciliationDocument2 pagesIllustration Bank ReconciliationDaniellaNo ratings yet

- SolutionDocument5 pagesSolutionClariz Angelika EscocioNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- Assignment 2Document2 pagesAssignment 2Bernadeth Adelaine DomingoNo ratings yet

- Proof of Cash by LailaneDocument19 pagesProof of Cash by Lailanenaruto uzumakiNo ratings yet

- 5Document2 pages5yes yesnoNo ratings yet

- Proof of CashDocument20 pagesProof of CashKristen StewartNo ratings yet

- Nudjpia Far and Afar Solutions - CashDocument5 pagesNudjpia Far and Afar Solutions - CashKyla Artuz Dela CruzNo ratings yet

- Long QuizDocument6 pagesLong QuizRinconada Benori ReynalynNo ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationlucas lilaNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielNo ratings yet

- SPDocument28 pagesSPkrizzmaaaayNo ratings yet

- 33Document2 pages33yes yesnoNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet