Professional Documents

Culture Documents

AFAR1-Liquidation-Problem 5

AFAR1-Liquidation-Problem 5

Uploaded by

Maccy ManCopyright:

Available Formats

You might also like

- Ratio Analysis WorksheetDocument5 pagesRatio Analysis WorksheetAnish AroraNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav181% (31)

- f1 Cima Workbook Q & A PDFDocument276 pagesf1 Cima Workbook Q & A PDFYounus KhanNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Utmost Good FaithDocument43 pagesUtmost Good FaithHarsh SharmaNo ratings yet

- PAZ C. SANIDAD, v. ATTY. JOSEPH JOHN GERALD M. AGUASDocument2 pagesPAZ C. SANIDAD, v. ATTY. JOSEPH JOHN GERALD M. AGUASRizza Angela Mangalleno0% (1)

- Solution DDL Partnership Practice Problem Cash Priority Program v2Document1 pageSolution DDL Partnership Practice Problem Cash Priority Program v2Josephine YenNo ratings yet

- Thornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Document3 pagesThornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Joannah maeNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- Carrying Amount of Asset Sold 182,400Document4 pagesCarrying Amount of Asset Sold 182,400Serenity CarlyeNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Chapter 4 - Partnership Liquidation Practice ExercisesDocument3 pagesChapter 4 - Partnership Liquidation Practice ExercisessanjoeNo ratings yet

- Tugas AkuntansiDocument12 pagesTugas AkuntansiLia RahmawatiNo ratings yet

- Lump SumDocument4 pagesLump Sumlexfred55No ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- KELOMPOK 2-Patnership Liquidation - Soal 2Document10 pagesKELOMPOK 2-Patnership Liquidation - Soal 2leli trisnaNo ratings yet

- Case StudyDocument21 pagesCase StudyTalib Hussain RajaNo ratings yet

- 9.1 2. SOLUTIONS - Course ChallengeDocument21 pages9.1 2. SOLUTIONS - Course Challengedrey baxterNo ratings yet

- Fabm 1Document5 pagesFabm 1Lady Aleah Naharah P. AlugNo ratings yet

- ACCTG12 CSN PartnershipDocument5 pagesACCTG12 CSN PartnershipJhane XiNo ratings yet

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- Dfi 356 Revision QuestionsDocument6 pagesDfi 356 Revision QuestionsBassamNo ratings yet

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Adobe Scan Apr 28, 2024Document3 pagesAdobe Scan Apr 28, 2024turboblade42838No ratings yet

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanNo ratings yet

- Partnership - Lump Sump and IL Final Exam 2023KEYSDocument4 pagesPartnership - Lump Sump and IL Final Exam 2023KEYSmcseenpiaNo ratings yet

- Working Paper Part 2Document3 pagesWorking Paper Part 2KEITH JEROME VIERNESNo ratings yet

- Joseph LandscapeDocument20 pagesJoseph LandscapeJoshua KhoNo ratings yet

- Interpretation of Financial StatementsDocument2 pagesInterpretation of Financial StatementsTimilehin OgundareNo ratings yet

- Agabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cDocument7 pagesAgabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cJasmine Cate JumillaNo ratings yet

- Cash Flow Statement SampleDocument1 pageCash Flow Statement Samplewaqas akramNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizNo ratings yet

- Spring 2024 Mgt401 1 SolDocument3 pagesSpring 2024 Mgt401 1 SolIrfan AhmedNo ratings yet

- Master Budgeting - Blades Pty LTDDocument14 pagesMaster Budgeting - Blades Pty LTDAdi KurniawanNo ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Act5 Topia Acctg2Document2 pagesAct5 Topia Acctg2devy mar topiaNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Name: - Yr. and SectionDocument4 pagesName: - Yr. and SectionClarisse AlimotNo ratings yet

- Akun PT. Polonia PT. Sepinggan Eliminasi Kosolidasi Debit KreditDocument2 pagesAkun PT. Polonia PT. Sepinggan Eliminasi Kosolidasi Debit KreditNoveNo ratings yet

- Akl 11Document1 pageAkl 11Via jyNo ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- Sba1501 Management Accounting Unit IiiDocument71 pagesSba1501 Management Accounting Unit Iiisandhya lakshmanNo ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Financial Statements: Problem 14-1: True or FalseDocument13 pagesFinancial Statements: Problem 14-1: True or FalseMichael Brian TorresNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiNo ratings yet

- Q10.2 - Raider LTD - SOLDocument5 pagesQ10.2 - Raider LTD - SOLnessamuchenaNo ratings yet

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- C. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Document1 pageC. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Shaira GampongNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- Probs 22Document3 pagesProbs 22kyle GNo ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- Assignment Business Law.2Document12 pagesAssignment Business Law.2Abe ManNo ratings yet

- Certificate of Ownership Template 05Document2 pagesCertificate of Ownership Template 05RichardwilsonNo ratings yet

- CCRA Session 15Document27 pagesCCRA Session 15VISHAL PATILNo ratings yet

- Acstran - Assignment 1.3Document2 pagesAcstran - Assignment 1.3Tricia Nicole DimaanoNo ratings yet

- Buying A BusinessDocument2 pagesBuying A BusinessDarwin Dionisio ClementeNo ratings yet

- Tan, Rachel - BUSE304MTH-HW2Document3 pagesTan, Rachel - BUSE304MTH-HW2Rachel Jane TanNo ratings yet

- Sl. No. ID No. Project Topic: National Law School of India University, BengaluruDocument3 pagesSl. No. ID No. Project Topic: National Law School of India University, BengaluruPreyashi ShrivastavaNo ratings yet

- Rent AgreementDocument3 pagesRent AgreementUsama Aziz.No ratings yet

- Ejercito vs. OrientalDocument3 pagesEjercito vs. OrientalMitchayNo ratings yet

- BLL Lecture 1Document24 pagesBLL Lecture 1Moazzam MangiNo ratings yet

- Pacific V CA GDocument3 pagesPacific V CA Gtops videosNo ratings yet

- Oblicon Case Digest 5Document15 pagesOblicon Case Digest 5LAWRENCE EDWARD SORIANONo ratings yet

- Company Accounts To StudentsDocument14 pagesCompany Accounts To StudentsIRUNGU BRENDA MURUGINo ratings yet

- Lien and MortgageDocument17 pagesLien and MortgageTharani BalajiNo ratings yet

- ChoksiDocument2 pagesChoksiGIANELLA FIORELA VALENTIN BARRETONo ratings yet

- Risk Liability and Insurance in Valuation Work 2nd Edition RicsDocument37 pagesRisk Liability and Insurance in Valuation Work 2nd Edition RicsKostasNo ratings yet

- Free Consent: Coercion, Undue Influence, Fraud, Misrepresentation and MistakeDocument26 pagesFree Consent: Coercion, Undue Influence, Fraud, Misrepresentation and MistakeVanshdeep Kaur SaranNo ratings yet

- Law On ParCor Sec. 35 58Document34 pagesLaw On ParCor Sec. 35 58Carlos VillanuevaNo ratings yet

- Elements of Marine Insurance ContractDocument6 pagesElements of Marine Insurance ContractSucharitaNo ratings yet

- CZ 56256 BN 564788Document2 pagesCZ 56256 BN 564788aman khatriNo ratings yet

- Committee of Creditors of Essar Steel India Limited Through Authorised Signatory VSDocument6 pagesCommittee of Creditors of Essar Steel India Limited Through Authorised Signatory VSMeghna SinghNo ratings yet

- Chapter 5 Officers of Company (Director) (Law485)Document50 pagesChapter 5 Officers of Company (Director) (Law485)TelsunTVNo ratings yet

- Contracts Management Session 1 - PresentationDocument47 pagesContracts Management Session 1 - PresentationShashi Pradeep100% (1)

- Nego Jan 7Document23 pagesNego Jan 7Michelle AsagraNo ratings yet

- Sales PowerpointDocument61 pagesSales Powerpointangelica valenzuelaNo ratings yet

- Partnership Liquidation: Answers To Questions 1Document31 pagesPartnership Liquidation: Answers To Questions 1Varil 1299No ratings yet

- TPB 3Document36 pagesTPB 3SupreethaNo ratings yet

- Topic 4 - Accounting For Derivative Instruments - A211Document94 pagesTopic 4 - Accounting For Derivative Instruments - A211Xiao Xuan100% (1)

AFAR1-Liquidation-Problem 5

AFAR1-Liquidation-Problem 5

Uploaded by

Maccy ManCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR1-Liquidation-Problem 5

AFAR1-Liquidation-Problem 5

Uploaded by

Maccy ManCopyright:

Available Formats

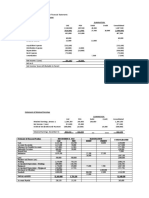

DSV Partnership

Statement of Partnership Realization and Liquidation -- Installment Liquidation

From July 1, 20x4 to September 30, 20x4

Capital Balances

Non-Cash DD SS VV

Cash Assets Liabilities (50%) (30%) (20%)

Balances before Liquidation 50,000 670,000 405,000 100,000 140,000 75,000

July:

Realization 390,000 (510,000) (60,000) (36,000) (24,000)

Liquidation expenses (2,500) (1,250) (750) (500)

Payment of liabilities (405,000) (405,000)

Balances before payment to

partners 32,500 160,000 -0- 38,750 103,250 50,500

Payment to partners (Sch. 1) (22,500) (22,500)

Balances after July 10,000 160,000 -0- 38,750 80,750 50,500

August:

Realization 22,000 (35,000) (6,500) (3,900) (2,600)

Liquidation expenses (2,500) (1,250) (750) (500)

Balances before payment to

partners 29,500 125,000 -0- 31,000 76,100 47,400

Payment to partners (Sch. 2) (19,500) (13,700) (5,800)

Balances after August 10,000 125,000 -0- 31,000 62,400 41,600

September:

Realization 55,000 (125,000) (35,000) (21,000) (14,000)

65,000 -0- -0- (4,000) 41,400 27,600

Allocation DD's deficit 4,000 (2,400) (1,600)

Liquidation expenses (2,500) (1,500) (1,000)

Balances before payment to

partners 62,500 -0- -0- -0- 37,500 25,000

Payments to partners (62,500) (37,500) (25,000)

Postliquidation balances -0- -0- -0- -0- -0- -0-

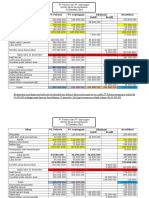

DSV Partnership

Schedule of Safe Payments

Schedule 1 - July 31, 20x4

DD SS VV

50% 30% 20%

Capital balances before payment to partners 38,750 103,250 50,500

Restricted interest for possible losses:

Unrealized noncash assets 160,000

Reserved cash 10,000

170,000 (85,000) (51,000) (34,000)

(46,250) 52,250 16,500

Assume DD's potential deficit 46,250 (27,750) (18,500)

-0- 24,500 (2,000)

Assume VV's potential deficit (2,000) 2,000

Safe payments to partner -0- 22,500 -0-

Schedule 2 - August 31, 20x4

DD SS VV

50% 30% 20%

Capital balances before payment to partners 31,000 76,100 47,400

Restricted interest for possible losses:

Unrealized noncash assets 125,000

Reserved cash 10,000

135,000 (67,500) (40,500) (27,000)

(36,500) 35,600 20,400

Assume DD's potential deficit 36,500 (21,900) (14,600)

Safe payments to partners -0- 13,700 5,800

You might also like

- Ratio Analysis WorksheetDocument5 pagesRatio Analysis WorksheetAnish AroraNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav181% (31)

- f1 Cima Workbook Q & A PDFDocument276 pagesf1 Cima Workbook Q & A PDFYounus KhanNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Utmost Good FaithDocument43 pagesUtmost Good FaithHarsh SharmaNo ratings yet

- PAZ C. SANIDAD, v. ATTY. JOSEPH JOHN GERALD M. AGUASDocument2 pagesPAZ C. SANIDAD, v. ATTY. JOSEPH JOHN GERALD M. AGUASRizza Angela Mangalleno0% (1)

- Solution DDL Partnership Practice Problem Cash Priority Program v2Document1 pageSolution DDL Partnership Practice Problem Cash Priority Program v2Josephine YenNo ratings yet

- Thornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Document3 pagesThornado Partnership Statement of Liquidation August 1, 2016 To October 31, 2016Joannah maeNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- Carrying Amount of Asset Sold 182,400Document4 pagesCarrying Amount of Asset Sold 182,400Serenity CarlyeNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Chapter 4 - Partnership Liquidation Practice ExercisesDocument3 pagesChapter 4 - Partnership Liquidation Practice ExercisessanjoeNo ratings yet

- Tugas AkuntansiDocument12 pagesTugas AkuntansiLia RahmawatiNo ratings yet

- Lump SumDocument4 pagesLump Sumlexfred55No ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- KELOMPOK 2-Patnership Liquidation - Soal 2Document10 pagesKELOMPOK 2-Patnership Liquidation - Soal 2leli trisnaNo ratings yet

- Case StudyDocument21 pagesCase StudyTalib Hussain RajaNo ratings yet

- 9.1 2. SOLUTIONS - Course ChallengeDocument21 pages9.1 2. SOLUTIONS - Course Challengedrey baxterNo ratings yet

- Fabm 1Document5 pagesFabm 1Lady Aleah Naharah P. AlugNo ratings yet

- ACCTG12 CSN PartnershipDocument5 pagesACCTG12 CSN PartnershipJhane XiNo ratings yet

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- Dfi 356 Revision QuestionsDocument6 pagesDfi 356 Revision QuestionsBassamNo ratings yet

- Cash Flow Master Question With SolutionDocument6 pagesCash Flow Master Question With Solutionft2vny7nytNo ratings yet

- Adobe Scan Apr 28, 2024Document3 pagesAdobe Scan Apr 28, 2024turboblade42838No ratings yet

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanNo ratings yet

- Partnership - Lump Sump and IL Final Exam 2023KEYSDocument4 pagesPartnership - Lump Sump and IL Final Exam 2023KEYSmcseenpiaNo ratings yet

- Working Paper Part 2Document3 pagesWorking Paper Part 2KEITH JEROME VIERNESNo ratings yet

- Joseph LandscapeDocument20 pagesJoseph LandscapeJoshua KhoNo ratings yet

- Interpretation of Financial StatementsDocument2 pagesInterpretation of Financial StatementsTimilehin OgundareNo ratings yet

- Agabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cDocument7 pagesAgabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cJasmine Cate JumillaNo ratings yet

- Cash Flow Statement SampleDocument1 pageCash Flow Statement Samplewaqas akramNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizNo ratings yet

- Spring 2024 Mgt401 1 SolDocument3 pagesSpring 2024 Mgt401 1 SolIrfan AhmedNo ratings yet

- Master Budgeting - Blades Pty LTDDocument14 pagesMaster Budgeting - Blades Pty LTDAdi KurniawanNo ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Act5 Topia Acctg2Document2 pagesAct5 Topia Acctg2devy mar topiaNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Name: - Yr. and SectionDocument4 pagesName: - Yr. and SectionClarisse AlimotNo ratings yet

- Akun PT. Polonia PT. Sepinggan Eliminasi Kosolidasi Debit KreditDocument2 pagesAkun PT. Polonia PT. Sepinggan Eliminasi Kosolidasi Debit KreditNoveNo ratings yet

- Akl 11Document1 pageAkl 11Via jyNo ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- Sba1501 Management Accounting Unit IiiDocument71 pagesSba1501 Management Accounting Unit Iiisandhya lakshmanNo ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Financial Statements: Problem 14-1: True or FalseDocument13 pagesFinancial Statements: Problem 14-1: True or FalseMichael Brian TorresNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiNo ratings yet

- Q10.2 - Raider LTD - SOLDocument5 pagesQ10.2 - Raider LTD - SOLnessamuchenaNo ratings yet

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- C. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Document1 pageC. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Shaira GampongNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- Probs 22Document3 pagesProbs 22kyle GNo ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- Assignment Business Law.2Document12 pagesAssignment Business Law.2Abe ManNo ratings yet

- Certificate of Ownership Template 05Document2 pagesCertificate of Ownership Template 05RichardwilsonNo ratings yet

- CCRA Session 15Document27 pagesCCRA Session 15VISHAL PATILNo ratings yet

- Acstran - Assignment 1.3Document2 pagesAcstran - Assignment 1.3Tricia Nicole DimaanoNo ratings yet

- Buying A BusinessDocument2 pagesBuying A BusinessDarwin Dionisio ClementeNo ratings yet

- Tan, Rachel - BUSE304MTH-HW2Document3 pagesTan, Rachel - BUSE304MTH-HW2Rachel Jane TanNo ratings yet

- Sl. No. ID No. Project Topic: National Law School of India University, BengaluruDocument3 pagesSl. No. ID No. Project Topic: National Law School of India University, BengaluruPreyashi ShrivastavaNo ratings yet

- Rent AgreementDocument3 pagesRent AgreementUsama Aziz.No ratings yet

- Ejercito vs. OrientalDocument3 pagesEjercito vs. OrientalMitchayNo ratings yet

- BLL Lecture 1Document24 pagesBLL Lecture 1Moazzam MangiNo ratings yet

- Pacific V CA GDocument3 pagesPacific V CA Gtops videosNo ratings yet

- Oblicon Case Digest 5Document15 pagesOblicon Case Digest 5LAWRENCE EDWARD SORIANONo ratings yet

- Company Accounts To StudentsDocument14 pagesCompany Accounts To StudentsIRUNGU BRENDA MURUGINo ratings yet

- Lien and MortgageDocument17 pagesLien and MortgageTharani BalajiNo ratings yet

- ChoksiDocument2 pagesChoksiGIANELLA FIORELA VALENTIN BARRETONo ratings yet

- Risk Liability and Insurance in Valuation Work 2nd Edition RicsDocument37 pagesRisk Liability and Insurance in Valuation Work 2nd Edition RicsKostasNo ratings yet

- Free Consent: Coercion, Undue Influence, Fraud, Misrepresentation and MistakeDocument26 pagesFree Consent: Coercion, Undue Influence, Fraud, Misrepresentation and MistakeVanshdeep Kaur SaranNo ratings yet

- Law On ParCor Sec. 35 58Document34 pagesLaw On ParCor Sec. 35 58Carlos VillanuevaNo ratings yet

- Elements of Marine Insurance ContractDocument6 pagesElements of Marine Insurance ContractSucharitaNo ratings yet

- CZ 56256 BN 564788Document2 pagesCZ 56256 BN 564788aman khatriNo ratings yet

- Committee of Creditors of Essar Steel India Limited Through Authorised Signatory VSDocument6 pagesCommittee of Creditors of Essar Steel India Limited Through Authorised Signatory VSMeghna SinghNo ratings yet

- Chapter 5 Officers of Company (Director) (Law485)Document50 pagesChapter 5 Officers of Company (Director) (Law485)TelsunTVNo ratings yet

- Contracts Management Session 1 - PresentationDocument47 pagesContracts Management Session 1 - PresentationShashi Pradeep100% (1)

- Nego Jan 7Document23 pagesNego Jan 7Michelle AsagraNo ratings yet

- Sales PowerpointDocument61 pagesSales Powerpointangelica valenzuelaNo ratings yet

- Partnership Liquidation: Answers To Questions 1Document31 pagesPartnership Liquidation: Answers To Questions 1Varil 1299No ratings yet

- TPB 3Document36 pagesTPB 3SupreethaNo ratings yet

- Topic 4 - Accounting For Derivative Instruments - A211Document94 pagesTopic 4 - Accounting For Derivative Instruments - A211Xiao Xuan100% (1)