Professional Documents

Culture Documents

ITC January 2024 Paper 3 Question FutureAfrica

ITC January 2024 Paper 3 Question FutureAfrica

Uploaded by

franskasangaCopyright:

Available Formats

You might also like

- Investment PropertyDocument7 pagesInvestment PropertyKate Fernandez50% (4)

- Car Lease Policy MyntraDocument11 pagesCar Lease Policy MyntraertytrythytyNo ratings yet

- CGL - PbasDocument2 pagesCGL - PbasRobbyNo ratings yet

- FAR 1 3rd Mock - ComprehensiveDocument4 pagesFAR 1 3rd Mock - Comprehensiveahsanalipalipoto17No ratings yet

- China Evergrande DISCLOSEABLE TRANSACTION DISPOSAL OF INTERESTS IN PROJECT COMPANYDocument7 pagesChina Evergrande DISCLOSEABLE TRANSACTION DISPOSAL OF INTERESTS IN PROJECT COMPANYchukingfungNo ratings yet

- 10 IFRS 16 Question BankDocument38 pages10 IFRS 16 Question BankthamsanqamanciNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- BCOM - Accounting 3Document6 pagesBCOM - Accounting 3Ntokozo Siphiwo Collin DlaminiNo ratings yet

- FAR2 Assignment EID MUBARAKDocument6 pagesFAR2 Assignment EID MUBARAKAli nawazNo ratings yet

- Review Material - ACCE 411Document5 pagesReview Material - ACCE 411zee abadillaNo ratings yet

- Acro Misr Mohamed GamalDocument35 pagesAcro Misr Mohamed Gamalmoh.gamalaaibNo ratings yet

- IP and PPEDocument3 pagesIP and PPEElaine Joyce GarciaNo ratings yet

- 1 Corporate ReportingDocument6 pages1 Corporate Reportingswarna dasNo ratings yet

- Bacc 233 Assignment 1 Jan-June 2023Document3 pagesBacc 233 Assignment 1 Jan-June 2023emmanuel.mazivireNo ratings yet

- Fitch Egypt Infrastructure Report - 2022-09-27Document53 pagesFitch Egypt Infrastructure Report - 2022-09-27Ziad SaeedNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- Transfer Pricing Class Practice QuestionDocument4 pagesTransfer Pricing Class Practice QuestionTadiwanashe MaringireNo ratings yet

- FAR 1 Mock 4 - FinalDocument4 pagesFAR 1 Mock 4 - Finalahsanalipalipoto17No ratings yet

- Quiz 1 Far510 MFRS120 123 PDFDocument4 pagesQuiz 1 Far510 MFRS120 123 PDFiirene.ntshNo ratings yet

- AFARicpaDocument23 pagesAFARicpaRegine YbañezNo ratings yet

- Final Exam W MCQDocument12 pagesFinal Exam W MCQPatrick SalvadorNo ratings yet

- Corporate Reporting Paper 3.1 July 2023Document32 pagesCorporate Reporting Paper 3.1 July 2023Prof. OBESENo ratings yet

- True or False: - Write True If The Statement Is Correct. Otherwise, Write FalseDocument3 pagesTrue or False: - Write True If The Statement Is Correct. Otherwise, Write FalseElaine Joyce GarciaNo ratings yet

- Lease Accounting Lecture in Power PointDocument22 pagesLease Accounting Lecture in Power PointEjaz AhmadNo ratings yet

- FAC3764 - Assessment 01Document2 pagesFAC3764 - Assessment 01mandisanomzamo72No ratings yet

- Institute of Business Administration: Diploma in Taxation-Batch 4 Provincial Sales Tax On Services AssignmentDocument3 pagesInstitute of Business Administration: Diploma in Taxation-Batch 4 Provincial Sales Tax On Services AssignmentALI HUSSAINNo ratings yet

- Aafr Ifrs 15 Icap Past Papers With SolutionDocument10 pagesAafr Ifrs 15 Icap Past Papers With SolutionAqib Sheikh0% (1)

- ACC2143ACC2543 Test 1 2023Document9 pagesACC2143ACC2543 Test 1 2023kamichidorahNo ratings yet

- ACCT 302 TS - Fin InstDocument4 pagesACCT 302 TS - Fin InstbismarkkwadzokpoNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- Comprehensive Financial Reporting QuestionDocument18 pagesComprehensive Financial Reporting QuestionBrain MangoroNo ratings yet

- Assessment 3 RemovedDocument6 pagesAssessment 3 RemovedTariro ManyikaNo ratings yet

- Topic 4 - Borrowing Cost - MFRS 123Document21 pagesTopic 4 - Borrowing Cost - MFRS 1232023105069No ratings yet

- A Project Report On Technical Analysis of Automobile Sector at Geojit PNB ParibasDocument62 pagesA Project Report On Technical Analysis of Automobile Sector at Geojit PNB ParibasBabasab Patil (Karrisatte)No ratings yet

- Borrowing CostsDocument4 pagesBorrowing CostsAila Mae SuarezNo ratings yet

- Final Mock by TSB CFAP6 S2020Document5 pagesFinal Mock by TSB CFAP6 S2020Umar FarooqNo ratings yet

- Test 4 Revision Class Question - 2023Document3 pagesTest 4 Revision Class Question - 2023Given RefilweNo ratings yet

- Assignment 1Document2 pagesAssignment 1chrislupinjrNo ratings yet

- VR CF Proj Group 5Document9 pagesVR CF Proj Group 5sandeep singhNo ratings yet

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- Naqdown Final Round 2013Document8 pagesNaqdown Final Round 2013MJ YaconNo ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- Godo - 22!12!14 TOR For Business ConsultingDocument16 pagesGodo - 22!12!14 TOR For Business ConsultingRisaa TubeNo ratings yet

- Group 1 - 7 (110722)Document8 pagesGroup 1 - 7 (110722)JACOB MAZHANGANo ratings yet

- Fa May June - 2019Document5 pagesFa May June - 2019xodic49847No ratings yet

- Bravado June 2009Document3 pagesBravado June 2009Tian YinNo ratings yet

- Foreign Direct Investments: by Prof. Augustin AmaladasDocument33 pagesForeign Direct Investments: by Prof. Augustin AmaladasPooja MehraNo ratings yet

- Msa 1Document132 pagesMsa 1ehteshamanwar444No ratings yet

- Sino CasoniDocument35 pagesSino CasoniYetnayet ZerfuNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAleenaSheikhNo ratings yet

- Bacc 236 Ass 2 Semester 1 of 2024 (MU TIPLE CHOICE)Document8 pagesBacc 236 Ass 2 Semester 1 of 2024 (MU TIPLE CHOICE)TarusengaNo ratings yet

- Accounting StandardDocument33 pagesAccounting StandardPooja BaghelNo ratings yet

- IntAcc 2 For Prac. SolvingDocument2 pagesIntAcc 2 For Prac. Solvingrachel banana hammockNo ratings yet

- ACCT 302 Tutorial Set 7 and AnswersDocument10 pagesACCT 302 Tutorial Set 7 and AnswersPrince AgyeiNo ratings yet

- FR RTP May 22Document32 pagesFR RTP May 22Utkarsh SharmaNo ratings yet

- RTO Programme Pitchbook 20191213Document7 pagesRTO Programme Pitchbook 20191213Kung FooNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- Utkarsh 2023 For PromotionDocument167 pagesUtkarsh 2023 For PromotionAmit GagraniNo ratings yet

- Vasilia 1Document25 pagesVasilia 1Feline FrevrNo ratings yet

- Facility AgreementDocument52 pagesFacility AgreementIlyes JerbiNo ratings yet

- NEW Defintion of Withholding Tax Keys (PER-53-2009) Old Definition of Withholding Tax KeysDocument2 pagesNEW Defintion of Withholding Tax Keys (PER-53-2009) Old Definition of Withholding Tax KeysKauam SantosNo ratings yet

- Barrons 06 09 2021Document80 pagesBarrons 06 09 2021glauber silvaNo ratings yet

- Mortgage Refi Script 101Document4 pagesMortgage Refi Script 101bluewhaleoutsourcingNo ratings yet

- Cancellation FormDocument2 pagesCancellation FormAnuradha AmjuriNo ratings yet

- CA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamDocument48 pagesCA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamKapil MeenaNo ratings yet

- Single AmountDocument26 pagesSingle AmountYejiNo ratings yet

- Topic 3 - Internal Control System - Part 2-StudentDocument9 pagesTopic 3 - Internal Control System - Part 2-StudentThinh NguyenNo ratings yet

- Financial Accounting and Reporting - QUIZ 7Document4 pagesFinancial Accounting and Reporting - QUIZ 7JINGLE FULGENCIONo ratings yet

- Project Finance Performance of SBIDocument39 pagesProject Finance Performance of SBIManmohan SahuNo ratings yet

- Marine Insurance: Free of Capture and SeizureDocument2 pagesMarine Insurance: Free of Capture and SeizurevinxoxNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- Banks and Banking 1: What Kind of Services Do Banks Offer?Document4 pagesBanks and Banking 1: What Kind of Services Do Banks Offer?Karima MammeriNo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- Table B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012Document5 pagesTable B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012shipra1305No ratings yet

- 2nd Year Reviewer Midterms (Compatibility)Document11 pages2nd Year Reviewer Midterms (Compatibility)Louie De La Torre0% (1)

- FA3 - Article - Phillips Et Al. (2003) - Earnings Management New Evidence Based On Deferred Tax ExpenseDocument32 pagesFA3 - Article - Phillips Et Al. (2003) - Earnings Management New Evidence Based On Deferred Tax Expense吕沁珂No ratings yet

- Liabilities: Chart of Accounts AssetsDocument39 pagesLiabilities: Chart of Accounts AssetsDiana Rose OrlinaNo ratings yet

- ACC 102 Chapter 16 Review QuestionsDocument3 pagesACC 102 Chapter 16 Review QuestionsKaitlyn MakiNo ratings yet

- BankmedDocument6 pagesBankmedJoele shNo ratings yet

- AtmDocument127 pagesAtmPuja Ghosh100% (3)

- Keys VaultsDocument37 pagesKeys VaultsAsfar Khan100% (1)

- Xii Mcqs CH - 15 Ratio AnalysisDocument6 pagesXii Mcqs CH - 15 Ratio AnalysisJoanna GarciaNo ratings yet

- Short Questions-Central BankDocument6 pagesShort Questions-Central BanksadNo ratings yet

- Maybank Islamic Mastercard Ikhwan Card-I Agreement: Humanising Financial ServicesDocument25 pagesMaybank Islamic Mastercard Ikhwan Card-I Agreement: Humanising Financial ServicesEjang GutNo ratings yet

- Insurance Code Reviewer 2014Document31 pagesInsurance Code Reviewer 2014Samantha ReyesNo ratings yet

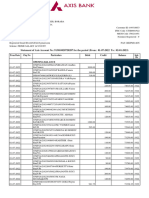

- Statement of Axis Account No:913010028728287 For The Period (From: 01-07-2022 To: 02-01-2023)Document41 pagesStatement of Axis Account No:913010028728287 For The Period (From: 01-07-2022 To: 02-01-2023)Shreshtha Suffix Financial ServicesNo ratings yet

ITC January 2024 Paper 3 Question FutureAfrica

ITC January 2024 Paper 3 Question FutureAfrica

Uploaded by

franskasangaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITC January 2024 Paper 3 Question FutureAfrica

ITC January 2024 Paper 3 Question FutureAfrica

Uploaded by

franskasangaCopyright:

Available Formats

QUESTION 100 marks

Ignore valued-added tax

1 Background

The Future Afrika Group is structured as follows:

Future Afrika Xelerate

51% 49%

Infinite Structures

100% 100% 65%

Letsopa Imagination Beyond New Heights

Future Afrika is a Chinese company and exclusively a tax resident of China. Future Afrika

holds a controlling interest in Infinite Structures. Xelerate is the Broad-Based Black Economic

Empowerment (B-BBEE) partner of Infinite Structures.

Infinite Structures is a South African investment holding company with controlling interests in

construction and infrastructural development companies operating on the African continent.

Infinite Structures does not trade. All trading activities are undertaken by its subsidiaries.

Infinite Structures has the South African rand (ZAR) as its functional and presentation

currency.

New Heights is a Nigerian company. Infinite Structures obtained its controlling interest in New

Heights in 2018. New Heights presents its financial information in the Nigerian naira (NGN),

which is its functional and presentation currency. New Heights is exclusively a tax resident of

Nigeria.

The remainder of the companies within the group are South African resident companies.

All entities have a 31 December financial year end and prepare their financial statements in

accordance with International Financial Reporting Standards (IFRS).

2 Investment in Imagination Beyond

On 1 January 2023, Infinite Structures acquired a 100% controlling interest in Imagination

Beyond (Pty) Ltd (‘Imagination Beyond’), a South African-based company in the construction

industry. Imagination Beyond has the ZAR as its functional and presentation currency.

The acquisition of Imagination Beyond was financed as follows:

● Issue of 10 000 8% ZAR1 000 bonds to third parties for cash.

Paper 3 1 (of 8) © SAICA 2024

o The bonds were issued on 1 January 2023 at their nominal value, which is equal

to their fair value.

o Interest is payable annually on 31 December.

o The bonds will be settled at a premium of 5% of the nominal value on 31 December

2027.

● Own available cash reserves of ZAR7,5 million.

Infinite Structures paid legal, consultancy and broker fees of ZAR170 000 to third parties for

the acquisition of Imagination Beyond and ZAR96 000 to third parties for the issue of the

bonds. These payments were made from available cash reserves.

On 1 January 2023, the cash balance of Imagination Beyond amounted to ZAR2,7 million and

the carrying amount of Imagination Beyond’s land amounted to ZAR4,1 million. On the

acquisition date, all the assets and liabilities of Imagination Beyond were fairly valued, except

for land that was considered to be ZAR500 000 more than the carrying amount. Imagination

Beyond did not process any adjustments in respect of the land on 1 January 2023. Imagination

Beyond subsequently revalued the land on 31 December 2023 by ZAR620 000. During the

financial year ended 31 December 2023 (FY2023), Imagination Beyond purchased a section

of land amounting to ZAR1,5 million for cash.

The auditors of Infinite Structures are Auditors Extreme Inc. (‘AE’), who have been the auditors

since 2021. AE hired Mr Stephen Stew as the auditor’s expert, on the recommendation of

Infinite Structures’ financial director, to assist AE in auditing the purchase price allocation of

the identifiable assets acquired and liabilities assumed at their acquisition-date fair values in

accordance with IFRS 3 Business Combinations. This included any goodwill arising from the

acquisition of Imagination Beyond.

AE only had a virtual call with Stephen to discuss what approach he would follow. No further

audit procedures were conducted by AE, apart from an email received from Stephen in which

he listed how the purchase price was to be allocated to the various identifiable assets and

liabilities.

3 Investment in Letsopa (Pty) Ltd

On 30 November 2023, Infinite Structures acquired a 100% controlling interest in a cement-

producing company, Letsopa (Pty) Ltd (‘Letsopa’). Letsopa is a South African-based company

with the ZAR as its functional and presentation currency.

GM & Partners Inc. (‘GM’) are the auditors of Letsopa and have served as the auditors since

2018. GM has finalised the audit of Letsopa for FY2023.

Ms Selma Williams is one of AE’s first-year audit trainees. Mr John Donald, an audit senior of

AE, sent Selma the following email regarding the audit GM performed in respect of Letsopa:

Paper 3 2 (of 8) © SAICA 2024

To: SelmaW@AE.com

Date: 05 January 2024 8:45 AM

From: JohnD@AE.com

Subject: Re: Audit of Letsopa

Hi Selma

Thank you for your question as to whether we would be able to rely on the work performed

by Letsopa’s auditors regarding the latest Infinite Structures acquisition. Based on our group

audit strategy Letsopa is considered to be a significant component of the group.

With respect to the audit of the consolidated reporting pack (which includes the consolidated

financial statements) of Infinite Structures, we may rely on the unqualified audit opinion

issued by GM without conducting any further audit work on the results of Letsopa that have

been consolidated. We have already contacted GM’s audit partner in charge of the Letsopa

audit, and he has completed the required checklist we have sent him and has stated that

GM adheres to the International Standards on Auditing. Therefore, we can rely on the audit

of Letsopa’s separate financial statements which have been used in the preparation of

Infinite Structures’ consolidated reporting pack.

If you have any further questions, please feel free to email them to me.

Kind regards

John Donald

Third-year audit senior

4 Contract with PlantHire to lease specialised machinery

On 1 March 2023, Imagination Beyond entered into a contract with PlantHire, an unrelated

third party, in terms of which Imagination Beyond leased specialised, expensive and high-

demand cranes.

Imagination Beyond incurred and paid the following costs with regard to the lease:

Notes ZAR

Legal fees, commission, and lease documentation preparation

costs for the execution of the lease 1 102 000

Installation of the cranes and fixing them to the ground at

designated construction sites 73 500

Notes

1 An amount of ZAR36 000 relating to the fixed salary of Imagination Beyond’s full-time

internal legal counsel is included in the amount of ZAR102 000. This amount would be

payable to the legal counsel irrespective of whether the contract is successfully signed

or not.

The terms of the lease contract included the following conditions:

● Imagination Beyond is required to pay annual lease instalments of ZAR1,2 million in

advance, starting on 1 March 2023.

Paper 3 3 (of 8) © SAICA 2024

● Imagination Beyond is required to remove the cranes, return them to PlantHire, and to

restore the land surrounding the construction site to an environmentally friendly

landscape at the end of the lease on 28 February 2026. On 1 March 2023, it was

estimated that the removal and restoration costs would amount to ZAR470 000.

The rate implicit in the lease is 12% per annum.

At the commencement date of the lease, the average remaining useful life of the leased items

was estimated to be ten years.

5 Distribution warehouse

Imagination Beyond owns a distribution warehouse in the Coega Industrial Development Zone

in Gqeberha, which has been used as a storage and distribution channel for its construction

material around Southern Africa. The construction of the distribution warehouse commenced

on 1 July 2013, the same day that the funds from HBCS Bank were paid into the bank account

of Imagination Beyond (see details below about the loan). The construction was completed in

December 2013.

To finance the construction of the distribution warehouse for its own use, Imagination Beyond

took out a foreign loan of British pounds (GBP) 500 000 from HBCS Bank in the United

Kingdom. All the loan funds raised were earmarked and used specifically for the construction

of this distribution warehouse. The distribution warehouse is a qualifying asset in terms of IAS

23 Borrowing Costs. The loan bears interest at a market-related interest rate of 6,75% per

annum, payable annually in arrears. The loan capital is repayable after ten years, on 30 June

2023.

The construction of the distribution warehouse took place on land owned by Imagination

Beyond, acquired in 2011 for ZAR2 million. Until 1 July 2013 it was held for undetermined

future use. The fair value of the land was ZAR3,1 million on 1 July 2013 and it had not changed

by FY2023.

All the relevant costs for the construction were financed from the HBCS Bank loan and the full

loan amount was used for this construction. In addition, abnormal wastage costs resulting from

construction delays amounting to ZAR200 000 were incurred and paid in December 2013.

Following the completion of the construction of the distribution warehouse, ZAR80 000 was

incurred and paid for an opening celebration of this new facility. Various relevant government

officials and industry and business experts were invited to the celebration. These additional

costs were financed from Imagination Beyond’s cash reserves and not from the funds obtained

from HBCS Bank.

On completion of the construction of the distribution warehouse in December 2013,

Imagination Beyond estimated that the distribution warehouse would have a useful life of

30 years and a residual value of ZAR2 million. The distribution warehouse was available for

use as intended by management on 31 December 2013. However, it was only brought into

use on 1 February 2014 when business had returned to normal after the summer holidays.

Management of Imagination Beyond decided to sell the distribution warehouse, and all the

requirements of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations were

met on 1 July 2023. The fair value less costs to sell of the distribution warehouse, including

the value of land on 1 July 2023 and 31 December 2023, amounted to ZAR9 million and

ZAR8 875 000 respectively. The distribution warehouse is expected to be sold by March 2024.

Paper 3 4 (of 8) © SAICA 2024

The following exchange rates were obtained from a reputable financial institution:

Date GBP1 : ZAR

1 July 2013 15,07

31 December 2013 17,31

31 December 2022 20,49

30 June 2023 24,40

Average rate 1 July 2013 – 31 December 2013 15,11

Average rate 1 January 2014 – 31 December 2022 19,12

Average rate 1 January 2023 – 30 June 2023 22,89

6 Management fees and local shareholder contribution fee

Future Afrika charges Imagination Beyond an annual management fee for technical and

management services for the benefit of the entire Infinite Structures Group. Future Afrika is

regarded as an expert in the Chinese building industry and provides the Infinite Structures

Group with advice relating to environmentally friendly building materials and the preservation

and restoration of historical buildings.

Future Afrika charged Imagination Beyond an amount of Chinese yuan (CNY) 1 million on

15 December 2023 for the FY2023 management fee. Imagination Beyond settled the invoice

on 15 December 2023. It is reliably estimated that 60% of the management fee relates to

advice provided for the benefit of Imagination Beyond, and the remaining 40% relates to New

Heights. Imagination Beyond does not receive any reimbursement from New Heights in

respect of the management fees. The Commissioner for the South African Revenue Service

accepted that the fee charged by Future Afrika is at arm’s length.

Xelerate charges Imagination Beyond an annual local shareholder contribution fee, which

benefits Imagination Beyond exclusively. This fee, among others, improves Imagination

Beyond’s black ownership score for B-BBEE certification purposes, thereby enabling

Imagination Beyond to compete for government infrastructure development contracts.

Xelerate charged Imagination Beyond ZAR3,5 million on 30 November 2023 for the FY2023

local shareholder contribution fee. The invoice was settled on 7 December 2023.

The following exchange rates were obtained from a reputable financial institution:

Date CNY1 : ZAR

15 December 2023 2,7422

31 December 2023 2,7714

Average rate 1 January 2023 – 31 December 2023 2,6850

Paper 3 5 (of 8) © SAICA 2024

7 Extract of the consolidated financial statements of the Infinite Structures Group

The following is an extract of the consolidated statement of profit or loss and other

comprehensive income for FY2023:

ZAR

Profit before tax 328 700 000

Taxation (87 105 500)

Current (95 670 550)

Deferred 8 565 050

Profit for the period 241 594 500

The consolidated profit before tax of ZAR328,7 million was calculated correctly after taking

into account the effects of all the above transactions and the following items:

ZAR

Profit on sale of land 220 000

Dividends received, from non-related parties 600 000

The following is an extract from the consolidated statement of financial position:

FY2023 FY2022

ZAR ZAR

ASSETS

Non-current assets

Land 3 350 000 2 200 000

Current liabilities

Shareholders for dividends 1 995 000 1 210 000

Income tax payable 11 120 000 8 750 000

The working capital for the Infinite Structures group increased by ZAR176,45 million during

FY2023.

8 Dividends

Dividends amounting to ZAR1 million and ZAR252 500 have been taken into account in

computing the consolidated retained earnings and non-controlling interest respectively.

9 Procedures followed by Imagination Beyond in the preparation of its

consolidation reporting pack

In order to prepare its consolidated financial statements, Infinite Structures has to obtain the

financial results from each of the subsidiaries it controls. Each subsidiary is required to

complete and submit a ‘consolidation reporting pack’ to Infinite Structures, which comprises

the following:

● Separate statement of financial position;

● Separate statement of profit or loss and other comprehensive income;

● Separate statement of changes in equity; and

● Certain detailed notes / disclosures.

Paper 3 6 (of 8) © SAICA 2024

The consolidation reporting pack is prepared from the detailed trial balance of each subsidiary

and each of the general ledger accounts in the trial balance is mapped to a specific financial

statement line item. For example, all the general ledger accounts relating to revenue are

aggregated and mapped to the revenue financial statement line item in the statement of profit

or loss and other comprehensive income.

The purpose of the consolidation reporting pack is to ensure that all subsidiaries are aligned

with the format which is used to prepare the consolidated financial statements of Infinite

Structures. Infinite Structures then aggregates the information in the consolidation reporting

packs it receives from each subsidiary and processes the necessary consolidation journal

entries in order to prepare its consolidated financial statements.

Process followed by the management of Imagination Beyond for the preparation of the

consolidation reporting pack that is sent to Infinite Structures:

1 The financial manager of the subsidiary exports the trial balance into Microsoft Excel

from the accounting system and then prints out the trial balance and reviews the financial

information. He/she then manually captures (inputs) the information into the

consolidation reporting pack.

2 The financial manager maps each general ledger account in the trial balance to the

consolidation reporting pack based on prior-year mapping.

3 Because they need to be eliminated, all intercompany receivables and payables as well

as the total of various types of transactions with other subsidiaries in the Infinite

Structures Group are identified and listed in the detailed note relating to intercompany

balances and transactions.

3.1 The note must include the name of the counterparty subsidiary, balance

outstanding and total transaction values.

3.2 The financial manager confirms the accuracy of the amounts of transactions and

outstanding balances with such subsidiaries by means of telephonic

conversations.

3.3 Where there is a difference, the financial manager accepts that his/her amount is

correct and leaves it at that.

3.4 The financial manager then authorises the intercompany outstanding balances

and transaction values (as confirmed) to be reversed in the consolidation reporting

pack.

4 Once completed, the consolidation reporting pack is sent via email to the group financial

manager and the chief financial officer of Infinite Structures, to ensure that they both

receive the financial information timeously.

5 The packs only include the following validation checks:

5.1 Verification that the numeric data adheres to specific formats and that any data

entries that do not meet the specific format criteria (e.g., brackets for negative

amounts and decimal places) are flagged.

5.2 Automatic population of the total from the statement of profit or loss and other

comprehensive income into the statement of financial position and the statement

of changes in equity. The statement of changes in equity totals are automatically

used to populate the statement of financial position. All sub-totals and totals in the

consolidation reporting pack are automatically cast.

10 Additional information

● The only investments that were made during the year were the investments in

Imagination Beyond and Letsopa.

● For all financial years under consideration, assume a normal tax rate of 27%.

Paper 3 7 (of 8) © SAICA 2024

● Investment property is measured using the fair value model in accordance with

IAS 40 Investment Property.

● All property, plant and equipment except for land is measured using the cost model in

accordance with IAS 16 Property, Plant and Equipment. Land is measured using the

revaluation model.

● Where applicable, assume an after-tax discount rate of 8,76% per annum (compounded

annually).

● It is the policy of Infinite Structures to measure the non-controlling interest at the

proportionate share of the acquiree’s identifiable net assets at the acquisition date.

● It is the policy of Future Afrika to present cash flows related to dividends and interest in

operating activities.

● Ignore any effects of the interest income on the GBP500 000 loan.

● All payments due were made on dates stipulated in the contract or agreement.

● All transactions and amounts are material.

Paper 3 8 (of 8) © SAICA 2024

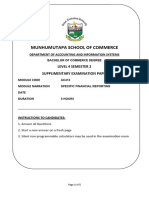

INITIAL TEST OF COMPETENCE, JANUARY 2024

PROFESSIONAL PAPER 3

This paper consists of two parts. Answer each part in a separate answer book.

Marks

PAPER 3 PART I – REQUIRED Sub-

Total

total

(a) Prepare, using the indirect method, an extract from the consolidated

statement of cash flows of the Infinite Structures Group for FY2023

in accordance with IAS 7 Statement of Cash Flows, in so far as the

given information allows. 48

• Do not prepare notes to the statement of cash flows.

• Round all amounts to the nearest rand.

• Do not provide comparative figures.

• Ignore the reconciliation at the bottom of the statement that

shows the opening balance and the closing balance of cash

and cash equivalents as well as the net increase (decrease) in

cash and cash equivalents.

Communication skills – presentation; layout and structure 2 50

Total for part I 50

Paper 3 part I required 1 (of 1) © SAICA 2024

INITIAL TEST OF COMPETENCE, JANUARY 2024

PROFESSIONAL PAPER 3

This paper consists of two parts. Answer each part in a separate answer book.

Marks

PAPER 3 PART II – REQUIRED Sub-

Total

total

(b) Discuss, with reference to the Imagination Beyond purchase price

allocation, whether AE has adequately performed its duties in

accordance with ISA 620 Using the Work of an Auditor’s Expert with

regard to the work carried out by Stephen.

For each matter that has not been performed adequately,

recommend one procedure to be performed by AE to obtain sufficient

appropriate audit evidence with regard to Stephen and the work

carried out by him. 8 8

(c) Discuss, with reference to the information in section 3, whether

John’s response on the audit of the Infinite Structures’ consolidation

reporting pack is appropriate with respect to Letsopa. 6

• Do not provide any details that should be included in the

communication with the component auditor. 6

(d) Compile, with reference to section 9, a report to the management of

Imagination Beyond in which you –

• discuss the weaknesses; and

• provide recommendations

with regard to the preparation of the consolidation reporting pack and

reporting process followed by Imagination Beyond to Infinite

Structures. 14

Communication skills – appropriate style; layout and structure 2 16

(e) Discuss, supported by calculations, the normal tax consequences for

Imagination Beyond arising from the loan received from HBCS Bank,

and the interest paid to HBCS Bank for the year of assessment ended

31 December 2023. 11

• Ignore withholding tax.

• Ignore the provisions of the double tax agreements between

South Africa and China and South Africa and the United Kingdom.

Communication skills – logical argument 1 12

(f) Discuss, with reference to relevant case law, whether Imagination

Beyond may deduct the management fee and local shareholder

contribution fee in terms of section 11(a) of the Income Tax Act for

the year of assessment ended 31 December 2023. 8 8

Total for part II 50

TOTAL FOR PAPER 3 100

Paper 3 part II required 1 (of 1) © SAICA 2024

Paper 3 part II required 2 (of 1) © SAICA 2024

You might also like

- Investment PropertyDocument7 pagesInvestment PropertyKate Fernandez50% (4)

- Car Lease Policy MyntraDocument11 pagesCar Lease Policy MyntraertytrythytyNo ratings yet

- CGL - PbasDocument2 pagesCGL - PbasRobbyNo ratings yet

- FAR 1 3rd Mock - ComprehensiveDocument4 pagesFAR 1 3rd Mock - Comprehensiveahsanalipalipoto17No ratings yet

- China Evergrande DISCLOSEABLE TRANSACTION DISPOSAL OF INTERESTS IN PROJECT COMPANYDocument7 pagesChina Evergrande DISCLOSEABLE TRANSACTION DISPOSAL OF INTERESTS IN PROJECT COMPANYchukingfungNo ratings yet

- 10 IFRS 16 Question BankDocument38 pages10 IFRS 16 Question BankthamsanqamanciNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- BCOM - Accounting 3Document6 pagesBCOM - Accounting 3Ntokozo Siphiwo Collin DlaminiNo ratings yet

- FAR2 Assignment EID MUBARAKDocument6 pagesFAR2 Assignment EID MUBARAKAli nawazNo ratings yet

- Review Material - ACCE 411Document5 pagesReview Material - ACCE 411zee abadillaNo ratings yet

- Acro Misr Mohamed GamalDocument35 pagesAcro Misr Mohamed Gamalmoh.gamalaaibNo ratings yet

- IP and PPEDocument3 pagesIP and PPEElaine Joyce GarciaNo ratings yet

- 1 Corporate ReportingDocument6 pages1 Corporate Reportingswarna dasNo ratings yet

- Bacc 233 Assignment 1 Jan-June 2023Document3 pagesBacc 233 Assignment 1 Jan-June 2023emmanuel.mazivireNo ratings yet

- Fitch Egypt Infrastructure Report - 2022-09-27Document53 pagesFitch Egypt Infrastructure Report - 2022-09-27Ziad SaeedNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- Transfer Pricing Class Practice QuestionDocument4 pagesTransfer Pricing Class Practice QuestionTadiwanashe MaringireNo ratings yet

- FAR 1 Mock 4 - FinalDocument4 pagesFAR 1 Mock 4 - Finalahsanalipalipoto17No ratings yet

- Quiz 1 Far510 MFRS120 123 PDFDocument4 pagesQuiz 1 Far510 MFRS120 123 PDFiirene.ntshNo ratings yet

- AFARicpaDocument23 pagesAFARicpaRegine YbañezNo ratings yet

- Final Exam W MCQDocument12 pagesFinal Exam W MCQPatrick SalvadorNo ratings yet

- Corporate Reporting Paper 3.1 July 2023Document32 pagesCorporate Reporting Paper 3.1 July 2023Prof. OBESENo ratings yet

- True or False: - Write True If The Statement Is Correct. Otherwise, Write FalseDocument3 pagesTrue or False: - Write True If The Statement Is Correct. Otherwise, Write FalseElaine Joyce GarciaNo ratings yet

- Lease Accounting Lecture in Power PointDocument22 pagesLease Accounting Lecture in Power PointEjaz AhmadNo ratings yet

- FAC3764 - Assessment 01Document2 pagesFAC3764 - Assessment 01mandisanomzamo72No ratings yet

- Institute of Business Administration: Diploma in Taxation-Batch 4 Provincial Sales Tax On Services AssignmentDocument3 pagesInstitute of Business Administration: Diploma in Taxation-Batch 4 Provincial Sales Tax On Services AssignmentALI HUSSAINNo ratings yet

- Aafr Ifrs 15 Icap Past Papers With SolutionDocument10 pagesAafr Ifrs 15 Icap Past Papers With SolutionAqib Sheikh0% (1)

- ACC2143ACC2543 Test 1 2023Document9 pagesACC2143ACC2543 Test 1 2023kamichidorahNo ratings yet

- ACCT 302 TS - Fin InstDocument4 pagesACCT 302 TS - Fin InstbismarkkwadzokpoNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- Comprehensive Financial Reporting QuestionDocument18 pagesComprehensive Financial Reporting QuestionBrain MangoroNo ratings yet

- Assessment 3 RemovedDocument6 pagesAssessment 3 RemovedTariro ManyikaNo ratings yet

- Topic 4 - Borrowing Cost - MFRS 123Document21 pagesTopic 4 - Borrowing Cost - MFRS 1232023105069No ratings yet

- A Project Report On Technical Analysis of Automobile Sector at Geojit PNB ParibasDocument62 pagesA Project Report On Technical Analysis of Automobile Sector at Geojit PNB ParibasBabasab Patil (Karrisatte)No ratings yet

- Borrowing CostsDocument4 pagesBorrowing CostsAila Mae SuarezNo ratings yet

- Final Mock by TSB CFAP6 S2020Document5 pagesFinal Mock by TSB CFAP6 S2020Umar FarooqNo ratings yet

- Test 4 Revision Class Question - 2023Document3 pagesTest 4 Revision Class Question - 2023Given RefilweNo ratings yet

- Assignment 1Document2 pagesAssignment 1chrislupinjrNo ratings yet

- VR CF Proj Group 5Document9 pagesVR CF Proj Group 5sandeep singhNo ratings yet

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- Naqdown Final Round 2013Document8 pagesNaqdown Final Round 2013MJ YaconNo ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- Godo - 22!12!14 TOR For Business ConsultingDocument16 pagesGodo - 22!12!14 TOR For Business ConsultingRisaa TubeNo ratings yet

- Group 1 - 7 (110722)Document8 pagesGroup 1 - 7 (110722)JACOB MAZHANGANo ratings yet

- Fa May June - 2019Document5 pagesFa May June - 2019xodic49847No ratings yet

- Bravado June 2009Document3 pagesBravado June 2009Tian YinNo ratings yet

- Foreign Direct Investments: by Prof. Augustin AmaladasDocument33 pagesForeign Direct Investments: by Prof. Augustin AmaladasPooja MehraNo ratings yet

- Msa 1Document132 pagesMsa 1ehteshamanwar444No ratings yet

- Sino CasoniDocument35 pagesSino CasoniYetnayet ZerfuNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAleenaSheikhNo ratings yet

- Bacc 236 Ass 2 Semester 1 of 2024 (MU TIPLE CHOICE)Document8 pagesBacc 236 Ass 2 Semester 1 of 2024 (MU TIPLE CHOICE)TarusengaNo ratings yet

- Accounting StandardDocument33 pagesAccounting StandardPooja BaghelNo ratings yet

- IntAcc 2 For Prac. SolvingDocument2 pagesIntAcc 2 For Prac. Solvingrachel banana hammockNo ratings yet

- ACCT 302 Tutorial Set 7 and AnswersDocument10 pagesACCT 302 Tutorial Set 7 and AnswersPrince AgyeiNo ratings yet

- FR RTP May 22Document32 pagesFR RTP May 22Utkarsh SharmaNo ratings yet

- RTO Programme Pitchbook 20191213Document7 pagesRTO Programme Pitchbook 20191213Kung FooNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- Utkarsh 2023 For PromotionDocument167 pagesUtkarsh 2023 For PromotionAmit GagraniNo ratings yet

- Vasilia 1Document25 pagesVasilia 1Feline FrevrNo ratings yet

- Facility AgreementDocument52 pagesFacility AgreementIlyes JerbiNo ratings yet

- NEW Defintion of Withholding Tax Keys (PER-53-2009) Old Definition of Withholding Tax KeysDocument2 pagesNEW Defintion of Withholding Tax Keys (PER-53-2009) Old Definition of Withholding Tax KeysKauam SantosNo ratings yet

- Barrons 06 09 2021Document80 pagesBarrons 06 09 2021glauber silvaNo ratings yet

- Mortgage Refi Script 101Document4 pagesMortgage Refi Script 101bluewhaleoutsourcingNo ratings yet

- Cancellation FormDocument2 pagesCancellation FormAnuradha AmjuriNo ratings yet

- CA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamDocument48 pagesCA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamKapil MeenaNo ratings yet

- Single AmountDocument26 pagesSingle AmountYejiNo ratings yet

- Topic 3 - Internal Control System - Part 2-StudentDocument9 pagesTopic 3 - Internal Control System - Part 2-StudentThinh NguyenNo ratings yet

- Financial Accounting and Reporting - QUIZ 7Document4 pagesFinancial Accounting and Reporting - QUIZ 7JINGLE FULGENCIONo ratings yet

- Project Finance Performance of SBIDocument39 pagesProject Finance Performance of SBIManmohan SahuNo ratings yet

- Marine Insurance: Free of Capture and SeizureDocument2 pagesMarine Insurance: Free of Capture and SeizurevinxoxNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- Banks and Banking 1: What Kind of Services Do Banks Offer?Document4 pagesBanks and Banking 1: What Kind of Services Do Banks Offer?Karima MammeriNo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- Table B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012Document5 pagesTable B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012shipra1305No ratings yet

- 2nd Year Reviewer Midterms (Compatibility)Document11 pages2nd Year Reviewer Midterms (Compatibility)Louie De La Torre0% (1)

- FA3 - Article - Phillips Et Al. (2003) - Earnings Management New Evidence Based On Deferred Tax ExpenseDocument32 pagesFA3 - Article - Phillips Et Al. (2003) - Earnings Management New Evidence Based On Deferred Tax Expense吕沁珂No ratings yet

- Liabilities: Chart of Accounts AssetsDocument39 pagesLiabilities: Chart of Accounts AssetsDiana Rose OrlinaNo ratings yet

- ACC 102 Chapter 16 Review QuestionsDocument3 pagesACC 102 Chapter 16 Review QuestionsKaitlyn MakiNo ratings yet

- BankmedDocument6 pagesBankmedJoele shNo ratings yet

- AtmDocument127 pagesAtmPuja Ghosh100% (3)

- Keys VaultsDocument37 pagesKeys VaultsAsfar Khan100% (1)

- Xii Mcqs CH - 15 Ratio AnalysisDocument6 pagesXii Mcqs CH - 15 Ratio AnalysisJoanna GarciaNo ratings yet

- Short Questions-Central BankDocument6 pagesShort Questions-Central BanksadNo ratings yet

- Maybank Islamic Mastercard Ikhwan Card-I Agreement: Humanising Financial ServicesDocument25 pagesMaybank Islamic Mastercard Ikhwan Card-I Agreement: Humanising Financial ServicesEjang GutNo ratings yet

- Insurance Code Reviewer 2014Document31 pagesInsurance Code Reviewer 2014Samantha ReyesNo ratings yet

- Statement of Axis Account No:913010028728287 For The Period (From: 01-07-2022 To: 02-01-2023)Document41 pagesStatement of Axis Account No:913010028728287 For The Period (From: 01-07-2022 To: 02-01-2023)Shreshtha Suffix Financial ServicesNo ratings yet