Professional Documents

Culture Documents

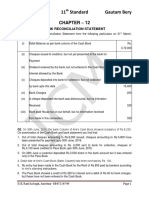

Bank Reconciliation Statement Practice Problems

Bank Reconciliation Statement Practice Problems

Uploaded by

Haya DanishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation Statement Practice Problems

Bank Reconciliation Statement Practice Problems

Uploaded by

Haya DanishCopyright:

Available Formats

Bank Reconciliation Statement Practice Problems

1. From the following particulars of Mr. Vinod, prepare bank reconciliation

statement as on March 31, 2014.

1. Bank balance as per cash book Rs. 50,000.

2. Cheques issued but not presented for payment Rs. 6,000.

3. . The bank had directly collected dividend of Rs. 8,000 and credited to bank

account but was not entered in the cash book.

4. Bank charges of Rs. 400 were not entered in the cash book.

5. A cheques for Rs. 6,000 was deposited but not collected by the bank.

2. On March 31, 2014, Rakesh had on overdraft of Rs. 8,000 as shown by his

cash book. Cheques amounting to Rs. 2,000 had been paid in by him but

were not collected by the bank. He issued cheques of Rs. 800 which were not

presented to the bank for payment. There was a debit in his passbook of Rs.

60 for interest and Rs. 100 for bank charges. Prepare bank reconciliation

statement.

3. On March 31, 2014 the bank column of the cash book of Agrawal Traders

showed a credit balance of Rs. 1,18,100 (Overdraft). On examining of the

cash book and the bank statement, it was found that : 1. Cheques received

and recorded in the cash book but not sent to the bank of collection Rs.

12,400. 2. Payment received from a customer directly by the bank Rs. 27,300

but no entry was made in the cash book. 3. Cheques issued for Rs. 1,75,200

not presented for payment. Interest of Rs. 8,800 charged by the bank was not

entered in the cash book. Prepare bank reconciliation statement.

4. The bank overdraft of Smith Ltd., on December 31, 2014 as per cash book

is Rs.18,000 From the following information, asscertain the adjusted cash

balance and prepare bank reconciliation statement Rs. (i) Unpresented

cheques 6,000 (ii) Uncleared cheques 3,400 (iii) Bank interest debited in the

passbook only 1,000 (iv) Bills collected and credited in the passbook only

1,600 (v) Cheque of Arun traders dishonoured 1,000 (vi) Cheque issued to

Kapoor & Co. not yet entered in the 600 of cash book.

5. The cash book shows a bank balance of Rs. 7,800. On comparing the cash

book with passbook the following discrepancies were noted : (a) Cheque

deposited in bank but not credited Rs. 3,000 (b) Cheque issued but not yet

present for payment Rs. 1,500 (c) Insurance premium paid by the bank Rs.

2,000 (d) Bank interest credit by the bank Rs. 400 (e) Bank charges Rs. 100

(d) Directly deposited by a customer Rs. 4,000

6. On comparing the cash book with passbook of Naman it is found that on

March 31, 2014, bank balance of Rs. 40,960 showed by the cash book differs

from the bank balance with regard to the following : (a) Bank charges Rs 100

on March 31, 2014, are not entered in the cash book. (b) On March 21, 2014,

a debtor paid Rs. 2,000 into the company’s bank in settlement of his account,

but no entry was made in the cash book of the company in respect of this. (c)

Cheques totaling Rs. 12,980 were issued by the company and duly recorded

in the cash book before March 31, 2014, but had not been presented at the

bank for payment until after that date. (d) A bill for Rs. 6,900 discounted with

the bank is entered in the cash book with recording the discount charge of Rs.

800. (e) Rs. 3,520 is entered in the cash book as paid into bank on March

31st , 2014, but not credited by the bank until the following day. (f) No entry

has been made in the cash book to record the dishon or on March 15, 2014 of

a cheque for Rs. 650 received from Bhanu. Prepare a reconciliation statement

as on March 31, 2014.

7. From the following particulars prepare a bank reconciliation statement

showing the balance as per cash book on December 31, 2014. (a) Two

cheques of Rs. 2,000 and Rs. 5,000 were paid into bank in October, 2014 but

were not credited by the bank in the month of December. (b) A cheque of Rs.

800 which was received from a customer was entered in the bank column of

the cash book in December 2014 but was omitted to be banked in December,

2014. (c) Cheques for Rs. 10,000 were issued into bank in November 2014

but not credited by the bank on December 31, 2014. (d) Interest on

investment Rs. 1,000 collected by bank appeared in the passbook. Balance

as per Passbook was Rs. 50,000.

8. Prepare bank reconciliation statement. (i) Overdraft shown as per cash

book on December 31, 2014 Rs. 10,000. (ii) Bank charges for the above

period also debited in the passbook Rs. 100. (iii) Interest on overdraft for six

months ending December 31, 2014 Rs. 380 debited in the passbook. (iv)

Cheques issued but not incashed prior to December 31, 2014 amounted to

Rs. 2,150. (v) Interest on Investment collected by the bank and credited in the

passbook Rs. 600. (vi) Cheques paid into bank but not cleared before

December, 31 2014 were Rs. 1,100.

9. On December 31, 2014, the cash book of Mittal Bros. Showed an overdraft

of Rs. 6,920. From the following particulars prepare a Bank Reconciliation

Statement and ascertain the balance as per passbook. (1) Debited by bank

for Rs. 200 on account of Interest on overdraft and Rs. 50 on account of

charges for collecting bills. (2) Cheques drawn but not encashed before

December, 31,2014 for Rs. 4,000. (3) The bank has collected interest and has

credited Rs. 600 in passbook. (4) A bill receivable for Rs. 700 previously

discounted with the bank had been dishonoured and debited in the passbook.

(5) Cheques paid into bank but not collected and credited before December

31, 2014 amounted Rs. 6,000.

10. Overdraft shown by the passbook of Mr. Murli is Rs. 20,000. Prepare bank

reconciliation statement on dated December 31, 2014. (i) Bank charges

debited as per passbook Rs. 500. (ii) Cheques recorded in the cash book but

not sent to the bank for collection Rs. 2,500. (iii) Received a payment directly

from customer Rs. 4,600. (iv) Cheque issued but not presented for payment

Rs. 6,980. (v) Interest credited by the bank Rs. 100. (vi) LIC paid by bank Rs.

2,500. (vii) Cheques deposited with the bank but not collected Rs. 3,500

You might also like

- Nelnet Statement GuideDocument2 pagesNelnet Statement Guideetrye77No ratings yet

- My CCPayDocument6 pagesMy CCPayMyCCPay customer service phone number100% (1)

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Practice Set BRSDocument15 pagesPractice Set BRSvishwajeetnmoreNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- BRS Practice QuestionsDocument2 pagesBRS Practice Questionssyed ali raza kazmiNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Problem 1Document7 pagesProblem 1tsegay169No ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

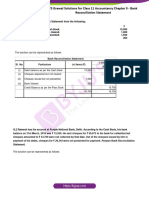

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Brs Practise SheetDocument1 pageBrs Practise Sheetapi-252642432No ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- BPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommerceDocument53 pagesBPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommercelembdaNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- Class Exercise Bank ReconciliationDocument6 pagesClass Exercise Bank ReconciliationDalia ElarabyNo ratings yet

- Class Exercise - Bank ReconciliationDocument5 pagesClass Exercise - Bank Reconciliationmoosanippp0% (2)

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- Test of BRSDocument3 pagesTest of BRSPervaiz AkhterNo ratings yet

- FA - Bank Rec. QuestionDocument2 pagesFA - Bank Rec. QuestionAshika JayaweeraNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- BRSDocument3 pagesBRSAimen ImranNo ratings yet

- 11 Accounts Final First Assessment 1Document4 pages11 Accounts Final First Assessment 1khush marooNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- BRS & Rectification of Errors SumsDocument7 pagesBRS & Rectification of Errors SumsGautam MehraNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Budgeting and Goal Setting 27715 20231031183226Document111 pagesBudgeting and Goal Setting 27715 20231031183226Nicolle MoranNo ratings yet

- IDFCFIRSTBankstatement AnjaliDocument4 pagesIDFCFIRSTBankstatement Anjalithink moveNo ratings yet

- 10 BANK RECONCILIATIONS (Questions)Document22 pages10 BANK RECONCILIATIONS (Questions)Zeeshan BakaliNo ratings yet

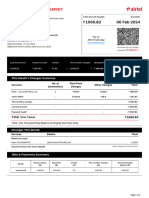

- Fiber Monthly Statement: This Month's Charges SummaryDocument5 pagesFiber Monthly Statement: This Month's Charges SummaryrfhutilNo ratings yet

- Bajaj Tiger CC MITC NewDocument12 pagesBajaj Tiger CC MITC NewMinatiNo ratings yet

- Premium Banking Programme of Kotak Mahindra BankDocument22 pagesPremium Banking Programme of Kotak Mahindra BankpritpalNo ratings yet

- NACH Mandate Final EnglishDocument2 pagesNACH Mandate Final EnglishShilpy SinhaNo ratings yet

- Peoplesoft Process FlowDocument79 pagesPeoplesoft Process FlowViju RajuNo ratings yet

- E-Wallet (Digital Payment)Document49 pagesE-Wallet (Digital Payment)MaxNo ratings yet

- Fifth Third Bank Open Up 2023Document2 pagesFifth Third Bank Open Up 2023Mac AppleNo ratings yet

- Module 9. Bank ReconciliationDocument22 pagesModule 9. Bank ReconciliationValerie De los ReyesNo ratings yet

- FA1 MOCK EXAM CHAPTER 1 To 5Document6 pagesFA1 MOCK EXAM CHAPTER 1 To 5Haris AhnedNo ratings yet

- Payment Centers & Payment Instructions: For School Fees Offsite Local PartnersDocument3 pagesPayment Centers & Payment Instructions: For School Fees Offsite Local PartnersCylvie AceNo ratings yet

- Application Form IciciDocument5 pagesApplication Form IciciEsuresh5454No ratings yet

- Accounts Process - 20170810Document73 pagesAccounts Process - 20170810FelixNo ratings yet

- Last Assignment of PRC-04 August 2022Document63 pagesLast Assignment of PRC-04 August 2022ali khanNo ratings yet

- Deseret First Credit Union Statement.Document6 pagesDeseret First Credit Union Statement.cathy clarkNo ratings yet

- Accounting ProcessDocument2 pagesAccounting ProcessKent Raysil PamaongNo ratings yet

- Internship ReportDocument17 pagesInternship ReportarumugamNo ratings yet

- Finacle 10 - Train The Trainer Guide India Post Payments BankDocument50 pagesFinacle 10 - Train The Trainer Guide India Post Payments BankDevendra GhodkeNo ratings yet

- Sample Question AnswerDocument57 pagesSample Question Answerসজীব বসুNo ratings yet

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- VJ Mini ProjectDocument10 pagesVJ Mini ProjectRAKESH VARMA100% (1)

- E Bank Statement AbbreviationsDocument4 pagesE Bank Statement AbbreviationsFar DinNo ratings yet

- Contoh Quotation Letter PKSDocument3 pagesContoh Quotation Letter PKSrian zezaNo ratings yet

- Master CardDocument13 pagesMaster CardNilotpal ChakmaNo ratings yet

- Mock Test of Jaiib Principles & Practices of Banking.: AnswerDocument12 pagesMock Test of Jaiib Principles & Practices of Banking.: Answeraao wacNo ratings yet

- Mathematics of Investment SemisDocument2 pagesMathematics of Investment SemisLhance Angelo Magsino AbarraNo ratings yet