Professional Documents

Culture Documents

Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022

Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022

Uploaded by

Mukunda MukundaCopyright:

Available Formats

You might also like

- Recurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Document20 pagesRecurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Lakis PolycarpouNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- Project Charter.. Hazelton Case StudyDocument6 pagesProject Charter.. Hazelton Case StudyManoj Iyer88% (8)

- Service Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- GSFC MpowerDocument2 pagesGSFC Mpowerneerajsibgh434No ratings yet

- DCB Benefit Savings AccountDocument2 pagesDCB Benefit Savings AccountDesikanNo ratings yet

- Value Based Schedule of Charges For Current Account 01112020Document2 pagesValue Based Schedule of Charges For Current Account 01112020J ANo ratings yet

- Wholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)Document2 pagesWholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)J ANo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- GSFC Kotak811 Apr17Document1 pageGSFC Kotak811 Apr17karthip08No ratings yet

- Business Essential AccountDocument4 pagesBusiness Essential Accountshekharsap284No ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- JIFI Charges PDFDocument2 pagesJIFI Charges PDFRamesh SinghNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- SOC DCB Classic Savings AccountDocument4 pagesSOC DCB Classic Savings AccountMohammed ZuhaibNo ratings yet

- Schedule of Benefits and Fees For DCB Privilege Savings AccountDocument4 pagesSchedule of Benefits and Fees For DCB Privilege Savings AccountYusuf KhanNo ratings yet

- SOC DCB Classic Current AccountDocument4 pagesSOC DCB Classic Current AccountpanditipabmaNo ratings yet

- Schedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Document4 pagesSchedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Sathishraam CPNo ratings yet

- Gib Savings Account Wef 01may2022Document3 pagesGib Savings Account Wef 01may2022Ankur VermaNo ratings yet

- SOC DCB Privilege Savings AccountDocument4 pagesSOC DCB Privilege Savings AccountBVS NAGABABUNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Schedule of Charges Yes Bank 5Document1 pageSchedule of Charges Yes Bank 5Sayantika MondalNo ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- CA Start Up GSFC Wef 01st September 2023Document5 pagesCA Start Up GSFC Wef 01st September 2023Ankit VishwakarmaNo ratings yet

- SOC DCB Premium Savings AccountDocument4 pagesSOC DCB Premium Savings Accountmadddy7012No ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- SOC DCB Privilege Current AccountDocument4 pagesSOC DCB Privilege Current Accountsunilverma202320No ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Digital Savings Account Effective July 2021Document3 pagesDigital Savings Account Effective July 2021Nikhil KumarNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- Glossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteDocument4 pagesGlossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteAlka RanjanNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- General Charges of Kotak BankDocument2 pagesGeneral Charges of Kotak BankSarafraj BegNo ratings yet

- Cash Current AccountDocument4 pagesCash Current Accountmajhi.deepashreeNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- Soc Home Loan Savings AccountDocument2 pagesSoc Home Loan Savings AccountModicare ConsultantNo ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Effective From 1st April, 2020Document2 pagesEffective From 1st April, 2020SundarNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Umang Account IdbiDocument4 pagesUmang Account Idbimajhi.deepashreeNo ratings yet

- Services ProvidedDocument15 pagesServices ProvidedParul AroraNo ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- For Customer ReferenceDocument4 pagesFor Customer ReferenceMaheshkumar AmulaNo ratings yet

- Unnati Business AccountDocument4 pagesUnnati Business Accountmajhi.deepashreeNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- BRM Que 2021Document5 pagesBRM Que 2021Mukunda MukundaNo ratings yet

- Process: Corporate Office: Plot No: 313, Udyog Vihar Phase-IV, Gurugram, Haryana-122015 Ph. 0124-4763400Document6 pagesProcess: Corporate Office: Plot No: 313, Udyog Vihar Phase-IV, Gurugram, Haryana-122015 Ph. 0124-4763400Mukunda MukundaNo ratings yet

- Mukunda SardarDocument1 pageMukunda SardarMukunda MukundaNo ratings yet

- Mukunda Account ProjectDocument38 pagesMukunda Account ProjectMukunda MukundaNo ratings yet

- DEMANDMAR2322796944Document2 pagesDEMANDMAR2322796944Mukunda MukundaNo ratings yet

- Alert SMS From HDBFS MarDocument2 pagesAlert SMS From HDBFS MarMukunda MukundaNo ratings yet

- UntitledDocument2 pagesUntitledMukunda MukundaNo ratings yet

- Online Examination Result: Funds Flow Statement (Unit Iii) Dse 6.1 ADocument1 pageOnline Examination Result: Funds Flow Statement (Unit Iii) Dse 6.1 AMukunda MukundaNo ratings yet

- E Filing of Income Tax ReturnDocument51 pagesE Filing of Income Tax ReturnMukunda Mukunda100% (2)

- UPSC Mains 2019 - Paper IV - Solution PDFDocument27 pagesUPSC Mains 2019 - Paper IV - Solution PDFGautham KalivarapuNo ratings yet

- GGDocument50 pagesGGMukunda MukundaNo ratings yet

- Marketing Research PROJECTDocument41 pagesMarketing Research PROJECTMukunda MukundaNo ratings yet

- Vision IAS GS1 World History 2020Document245 pagesVision IAS GS1 World History 2020himal panth100% (1)

- IT MCQ (Bhalotia) Sem III PDFDocument41 pagesIT MCQ (Bhalotia) Sem III PDFMukunda MukundaNo ratings yet

- IT MCQ (Bhalotia) Sem III PDFDocument41 pagesIT MCQ (Bhalotia) Sem III PDFMukunda MukundaNo ratings yet

- Barnaparichay Part. 2, Bidyasagar, Iswarchandra, 56p, Language, Bengali (1930)Document51 pagesBarnaparichay Part. 2, Bidyasagar, Iswarchandra, 56p, Language, Bengali (1930)Mukunda MukundaNo ratings yet

- Marketing Research Project: TopicDocument35 pagesMarketing Research Project: TopicMukunda MukundaNo ratings yet

- IT MCQ (Bhalotia) Sem III PDFDocument41 pagesIT MCQ (Bhalotia) Sem III PDFMukunda MukundaNo ratings yet

- IT 3rd Semester Selected Portion PDFDocument71 pagesIT 3rd Semester Selected Portion PDFMukunda Mukunda100% (3)

- IT 3rd Semester Selected PortionDocument71 pagesIT 3rd Semester Selected PortionMukunda MukundaNo ratings yet

- Quantifying Economic Damages From Climate Change: Maximilian AuffhammerDocument20 pagesQuantifying Economic Damages From Climate Change: Maximilian AuffhammerRajesh MKNo ratings yet

- Difference Between AND: Marxism-Leninism Social DemocracyDocument17 pagesDifference Between AND: Marxism-Leninism Social DemocracyCatherine AmicanNo ratings yet

- Power Map of Eastern Region and States April17Document21 pagesPower Map of Eastern Region and States April17Erldc Control Room POSOCONo ratings yet

- TOR - Courier ServicesDocument5 pagesTOR - Courier ServicesAndile NtuliNo ratings yet

- Trends of Inflation in IndiaDocument20 pagesTrends of Inflation in Indiasamadshaikhh100% (2)

- Assignment On Rural DevelopmentDocument11 pagesAssignment On Rural DevelopmentShailesh Gururani80% (5)

- Degnis CoDocument3 pagesDegnis CoPubg DonNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument38 pagesChapter 1 Introduction To Consumption TaxesGenie Gonzales DimaanoNo ratings yet

- 5.2. Introduction To Payments For Ecosystem Services (PES) : Sheila Wertz-Kanounnikoff, CIFORDocument34 pages5.2. Introduction To Payments For Ecosystem Services (PES) : Sheila Wertz-Kanounnikoff, CIFOROllinNo ratings yet

- Important Insurance Financial Awareness QuestionsDocument11 pagesImportant Insurance Financial Awareness QuestionsJagannath JagguNo ratings yet

- Simple Linear Regression Trading System PDFDocument37 pagesSimple Linear Regression Trading System PDFAly DianisNo ratings yet

- Chapter-3 Long Run Economic GrowthDocument33 pagesChapter-3 Long Run Economic GrowthNishan ShettyNo ratings yet

- VocabulariesDocument3 pagesVocabulariesTrần Quốc ViệtNo ratings yet

- ServletController PDFDocument1 pageServletController PDFAjay RaghunathNo ratings yet

- Dead or Alive - Rules For Outlaw Gangs in Necromunda - by Jake ThorntonDocument10 pagesDead or Alive - Rules For Outlaw Gangs in Necromunda - by Jake Thorntonweerer100% (2)

- Collections & Deposit Form 2023Document4 pagesCollections & Deposit Form 2023desiahgasconNo ratings yet

- Tentative Costing - 132kV - 1KMDocument4 pagesTentative Costing - 132kV - 1KManuragtiwari762No ratings yet

- 2013 Epub Revisiting Global Trends in Tvet Book PDFDocument356 pages2013 Epub Revisiting Global Trends in Tvet Book PDFDayanaFarzeehaAliNo ratings yet

- AP Electricity Tariff Fy2015-16Document8 pagesAP Electricity Tariff Fy2015-16somnath250477No ratings yet

- 416471087-1693247586810-Covumaiphuongtailieudikemkhoahoc Unit2 UrbanisationDocument3 pages416471087-1693247586810-Covumaiphuongtailieudikemkhoahoc Unit2 Urbanisationdoanthihoaingan0708097326No ratings yet

- I 014484235000054006 R PosDocument3 pagesI 014484235000054006 R PosdeepuhnNo ratings yet

- Technica Case StudyDocument9 pagesTechnica Case StudyEvan StoryNo ratings yet

- WIPO HandbookDocument494 pagesWIPO Handbooksontaycity100% (5)

- Taxation Law Mock Bar Exam AnswersDocument8 pagesTaxation Law Mock Bar Exam AnswersMark MartinezNo ratings yet

- Grade 10 - GlobalizationDocument12 pagesGrade 10 - Globalization6 Golden BootNo ratings yet

- Po 100011963Document2 pagesPo 100011963Prasanna KNo ratings yet

- Final-Varkala-Draft-Report-On - 25 July 14 PDFDocument126 pagesFinal-Varkala-Draft-Report-On - 25 July 14 PDFArchana Gopalsamy100% (1)

Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022

Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022

Uploaded by

Mukunda MukundaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022

Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022

Uploaded by

Mukunda MukundaCopyright:

Available Formats

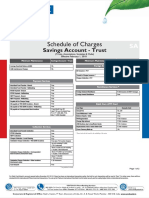

WHOLESALE BANKING PRODUCTS

Schedule of charges - Current Account Classic CABCA (w.e.f. July 01, 2022)

Monthly Average Balance (MAB) OR

MAB

Average Quarterly Balance (AQB)

Metro & Urban Branches (in `) 1,00,000

Semi-Urban & Rural Branches (in `) 50,000

Charges for Non-Maintenance (in `) 1500 if MAB> = 50% & 2500 if MAB<50%

Complimentary Benefits and Services

• DD/ PO Issuance • Chequebook Issuance • SMS alerts • Standing instructions setup • Certificate of Balance

Cash Deposit - Home &

Monthly limits & charges

Non-Home Branch (Combined)

Free Limit per month (in `)* 10 times MAB subject to minimum of

12 Lacs and maximum of 1 Cr

Above free limit and up to 50 lacs: 3/1000;

Charges (in `)

Above 50 lacs: 4/1000

Note: In case atleast 75% of required scheme MAB/AQB is not maintained, cash deposit free limits for the particular month will

become zero

Monthly Service Charge Monthly limits & charges

Charges (Fixed monthly in `) 100

NEFT/RTGS/IMPS transactions (Outward) Monthly limits & charges

NEFT- from branch (in `) Up to 10,000 - 2.50/- per txn

10,001 to 1 lakh - 5/- per txn

1 lakh to 2 lakhs - 15/- per txn

Above 2 lakhs -` 25/- per txn

NEFT - other digital channels Free

RTGS- from branch (in `) 2 lakhs to 5 lakhs - 25/- per txn

5 Lakhs and above - 50/- per txn

RTGS - other digital channels Free

IMPS fund transfer (in `) Upto 1,000 - 2.50/- per txn

1,000 to 1 lakh - 5/- per txn

1 lakh to 5 lakh - 10/- per txn

NEFT/RTGS/IMPS inwards transactions are free

Business Business Business Business Classic E-Debit

Debit Card Charges

Classic Platinumn Supreme virtual debit card^ Card^

ATM Charges - Cash Withdrawal

20 20 20** Nil Nil

(Non-Axis Bank only) (in Rs)

ATM Charges - Balance Enquiry

8.5 8.5 8.5** Nil Nil

(Non-Axis Bank only) (in Rs)

ATM Charges - Cash Withdrawal & Nil Nil

Nil Nil Nil

Balance Enquiry (Axis Bank ATMs) (in Rs)

Purchase Transaction (POS) charges (in Rs) Nil Nil Nil Nil Nil

Issuance Fees (in Rs) 250 500 1000 Nil 500

Annual Fees (in Rs) 250 500 1000 Nil 500

Replacement Fees (in Rs) 200 200 500 - -

**Free- First 5 transactions (including financial and non-financial).

^ Virtual debit cards are applicable only for individual current accounts opened through VCIP based digital onboarding journey.

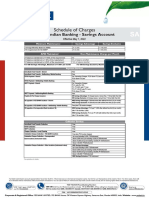

Penal Charges - Returns

Cheque Returns (Inward) - Issued by Customer `500 per instrument

Cheque Returns (Outward) - Deposited by Customer 1st return for the month –`50

2nd return onwards for the month –`100

Cheque Returns - Deposited by Customer for 50% of OSC commission;

Outstation Collection Minimum `50 / Cheque + Other bank charges if any

ECS (Debit) Returns `500 per instance

Standing Instruction Reject Fee SI reject due to Credit Card/Loans/

Auto Debit- `250 per reject

SI reject due to RD/MF/SIP- NIL

Other Charges

BNA Convenience charges (Applicable on cash deposit in `50 per transaction

Cash Deposit Machines (CDM) post office hours on working Exceeding `15,000 per month

days and entire day on bank holidays & state holidays) in either single or multiple transaction

Cash handling charges on cash deposited in 2% on the value of cash deposited in

Low Denomination Notes (LDN) Low Denomination Notes, Exceeding`10,000 per month

either single or multiple transaction

Demand Drafts (payable at Correspondent Bank locations `1/1,000; Min.`25 per DD

under Desk Drawing arrangement)

Demand Drafts purchased from other Banks Actual + `0.50/1,000; Min.`50 per DD

DD drawn on Axis Bank branches - Cancellation, `100/- per instance

Reissuance or Revalidation

DD drawn on Correspondent Bank branches - Cancellation, `100/- per instance + other bank's charges at actuals if any

Reissuance or Revalidation

Cheques Deposited at any Axis Bank branch for `100 per instrument

outstation collection

Stop Payment Charges Per Instrument: `50, Per Series: `100

Signature Verification Certificate `50 per verification

Account Statement - Duplicate statement from branch `100 per statement

Account Closure Charges Less than 14 days: Nil

Older than 14 days: `500

NOTE:

• All the terms are subject to change without any prior notice

• All the service charges will attract GST as applicable

• Charges are applicable as per the transactions done during charge cycle period. The charge cycle period shall be first of every month to the last day

of the same month for all scheme codes (e.g. 1 April to 30 April)

• Cheque Transactions are subject to 48 hour notice and Bank's confirmations for transaction exceeding`1 Crore a day where the destination branch

is a Non-RBI centre. (RBI centres are: Mumbai, Chennai, Kolkata, New Delhi, Ahmedabad, Hyderabad, Jaipur, Kanpur, Nagpur,Trivandrum, Bhubaneswar,

Chandigarh, Bangalore, Guwahati, Bhopal & Patna)

• All cash transaction of `10 Lacs and above on a single day will require prior intimation and approval of the Branch at least one working day in advance

• Maximum Non-Home Branch Cash Deposit / withdrawal per day shall be`1 Lac. Maximum third party deposit / withdrawal up to 50,000 per day.

Beyond this the cash transactions may be carried out at the discretion of branch head where the cash is being deposited / withdrawn

• Maximum Non-Home Branch Cash Withdrawal is at the discretion of the Branch head where cash is being withdrawn

• For BNA convenience charges post office hours on working days to be considered as 5.00 PM to 9.30 AM and holidays to include all 2nd & 4th Saturdays,

Sundays and National & State Holidays

• Monthly charges applicable in a current account will be based on the scheme code of that account in the current month

• The customer hereby agrees and acknowledges that Bank shall have the right to recover any charges as may be payable by the customer to the Bank,

by debiting or making repeated attempts to recover the same, from any operative account held under same customer id, where funds are available.

• Monthly Average Balance (MAB) or Average Quarterly Balance (AQB) is the average of day end balance maintained by the customer for the duration

• BNA convenience charges are applicable in addition to scheme wise cash deposit charges

• Physical statements will not be sent for the current account where there are no transactions consecutively for 6 months

I / We have chosen to open a CABCA Current Account with Axis Bank and have understood the facilities and charges applicable to

the said product.

Customer Signature Signature of Branch Staff

Employee ID of Branch Staff

Charges effective from July 01, 2022

For cases processed through BYOD (Paperless Journey), wet signatures are not required on the SOC

You might also like

- Recurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Document20 pagesRecurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Lakis PolycarpouNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- Project Charter.. Hazelton Case StudyDocument6 pagesProject Charter.. Hazelton Case StudyManoj Iyer88% (8)

- Service Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- GSFC MpowerDocument2 pagesGSFC Mpowerneerajsibgh434No ratings yet

- DCB Benefit Savings AccountDocument2 pagesDCB Benefit Savings AccountDesikanNo ratings yet

- Value Based Schedule of Charges For Current Account 01112020Document2 pagesValue Based Schedule of Charges For Current Account 01112020J ANo ratings yet

- Wholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)Document2 pagesWholesale Banking Products: Schedule of Charges - Current Accounts (Value Based Schemes) (W.e.f. November 01, 2021)J ANo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- GSFC Kotak811 Apr17Document1 pageGSFC Kotak811 Apr17karthip08No ratings yet

- Business Essential AccountDocument4 pagesBusiness Essential Accountshekharsap284No ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- JIFI Charges PDFDocument2 pagesJIFI Charges PDFRamesh SinghNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- SOC DCB Classic Savings AccountDocument4 pagesSOC DCB Classic Savings AccountMohammed ZuhaibNo ratings yet

- Schedule of Benefits and Fees For DCB Privilege Savings AccountDocument4 pagesSchedule of Benefits and Fees For DCB Privilege Savings AccountYusuf KhanNo ratings yet

- SOC DCB Classic Current AccountDocument4 pagesSOC DCB Classic Current AccountpanditipabmaNo ratings yet

- Schedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Document4 pagesSchedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Sathishraam CPNo ratings yet

- Gib Savings Account Wef 01may2022Document3 pagesGib Savings Account Wef 01may2022Ankur VermaNo ratings yet

- SOC DCB Privilege Savings AccountDocument4 pagesSOC DCB Privilege Savings AccountBVS NAGABABUNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Schedule of Charges Yes Bank 5Document1 pageSchedule of Charges Yes Bank 5Sayantika MondalNo ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- CA Start Up GSFC Wef 01st September 2023Document5 pagesCA Start Up GSFC Wef 01st September 2023Ankit VishwakarmaNo ratings yet

- SOC DCB Premium Savings AccountDocument4 pagesSOC DCB Premium Savings Accountmadddy7012No ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- SOC DCB Privilege Current AccountDocument4 pagesSOC DCB Privilege Current Accountsunilverma202320No ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Digital Savings Account Effective July 2021Document3 pagesDigital Savings Account Effective July 2021Nikhil KumarNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- Glossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteDocument4 pagesGlossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteAlka RanjanNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- General Charges of Kotak BankDocument2 pagesGeneral Charges of Kotak BankSarafraj BegNo ratings yet

- Cash Current AccountDocument4 pagesCash Current Accountmajhi.deepashreeNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- Soc Home Loan Savings AccountDocument2 pagesSoc Home Loan Savings AccountModicare ConsultantNo ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Effective From 1st April, 2020Document2 pagesEffective From 1st April, 2020SundarNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Umang Account IdbiDocument4 pagesUmang Account Idbimajhi.deepashreeNo ratings yet

- Services ProvidedDocument15 pagesServices ProvidedParul AroraNo ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- For Customer ReferenceDocument4 pagesFor Customer ReferenceMaheshkumar AmulaNo ratings yet

- Unnati Business AccountDocument4 pagesUnnati Business Accountmajhi.deepashreeNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- BRM Que 2021Document5 pagesBRM Que 2021Mukunda MukundaNo ratings yet

- Process: Corporate Office: Plot No: 313, Udyog Vihar Phase-IV, Gurugram, Haryana-122015 Ph. 0124-4763400Document6 pagesProcess: Corporate Office: Plot No: 313, Udyog Vihar Phase-IV, Gurugram, Haryana-122015 Ph. 0124-4763400Mukunda MukundaNo ratings yet

- Mukunda SardarDocument1 pageMukunda SardarMukunda MukundaNo ratings yet

- Mukunda Account ProjectDocument38 pagesMukunda Account ProjectMukunda MukundaNo ratings yet

- DEMANDMAR2322796944Document2 pagesDEMANDMAR2322796944Mukunda MukundaNo ratings yet

- Alert SMS From HDBFS MarDocument2 pagesAlert SMS From HDBFS MarMukunda MukundaNo ratings yet

- UntitledDocument2 pagesUntitledMukunda MukundaNo ratings yet

- Online Examination Result: Funds Flow Statement (Unit Iii) Dse 6.1 ADocument1 pageOnline Examination Result: Funds Flow Statement (Unit Iii) Dse 6.1 AMukunda MukundaNo ratings yet

- E Filing of Income Tax ReturnDocument51 pagesE Filing of Income Tax ReturnMukunda Mukunda100% (2)

- UPSC Mains 2019 - Paper IV - Solution PDFDocument27 pagesUPSC Mains 2019 - Paper IV - Solution PDFGautham KalivarapuNo ratings yet

- GGDocument50 pagesGGMukunda MukundaNo ratings yet

- Marketing Research PROJECTDocument41 pagesMarketing Research PROJECTMukunda MukundaNo ratings yet

- Vision IAS GS1 World History 2020Document245 pagesVision IAS GS1 World History 2020himal panth100% (1)

- IT MCQ (Bhalotia) Sem III PDFDocument41 pagesIT MCQ (Bhalotia) Sem III PDFMukunda MukundaNo ratings yet

- IT MCQ (Bhalotia) Sem III PDFDocument41 pagesIT MCQ (Bhalotia) Sem III PDFMukunda MukundaNo ratings yet

- Barnaparichay Part. 2, Bidyasagar, Iswarchandra, 56p, Language, Bengali (1930)Document51 pagesBarnaparichay Part. 2, Bidyasagar, Iswarchandra, 56p, Language, Bengali (1930)Mukunda MukundaNo ratings yet

- Marketing Research Project: TopicDocument35 pagesMarketing Research Project: TopicMukunda MukundaNo ratings yet

- IT MCQ (Bhalotia) Sem III PDFDocument41 pagesIT MCQ (Bhalotia) Sem III PDFMukunda MukundaNo ratings yet

- IT 3rd Semester Selected Portion PDFDocument71 pagesIT 3rd Semester Selected Portion PDFMukunda Mukunda100% (3)

- IT 3rd Semester Selected PortionDocument71 pagesIT 3rd Semester Selected PortionMukunda MukundaNo ratings yet

- Quantifying Economic Damages From Climate Change: Maximilian AuffhammerDocument20 pagesQuantifying Economic Damages From Climate Change: Maximilian AuffhammerRajesh MKNo ratings yet

- Difference Between AND: Marxism-Leninism Social DemocracyDocument17 pagesDifference Between AND: Marxism-Leninism Social DemocracyCatherine AmicanNo ratings yet

- Power Map of Eastern Region and States April17Document21 pagesPower Map of Eastern Region and States April17Erldc Control Room POSOCONo ratings yet

- TOR - Courier ServicesDocument5 pagesTOR - Courier ServicesAndile NtuliNo ratings yet

- Trends of Inflation in IndiaDocument20 pagesTrends of Inflation in Indiasamadshaikhh100% (2)

- Assignment On Rural DevelopmentDocument11 pagesAssignment On Rural DevelopmentShailesh Gururani80% (5)

- Degnis CoDocument3 pagesDegnis CoPubg DonNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument38 pagesChapter 1 Introduction To Consumption TaxesGenie Gonzales DimaanoNo ratings yet

- 5.2. Introduction To Payments For Ecosystem Services (PES) : Sheila Wertz-Kanounnikoff, CIFORDocument34 pages5.2. Introduction To Payments For Ecosystem Services (PES) : Sheila Wertz-Kanounnikoff, CIFOROllinNo ratings yet

- Important Insurance Financial Awareness QuestionsDocument11 pagesImportant Insurance Financial Awareness QuestionsJagannath JagguNo ratings yet

- Simple Linear Regression Trading System PDFDocument37 pagesSimple Linear Regression Trading System PDFAly DianisNo ratings yet

- Chapter-3 Long Run Economic GrowthDocument33 pagesChapter-3 Long Run Economic GrowthNishan ShettyNo ratings yet

- VocabulariesDocument3 pagesVocabulariesTrần Quốc ViệtNo ratings yet

- ServletController PDFDocument1 pageServletController PDFAjay RaghunathNo ratings yet

- Dead or Alive - Rules For Outlaw Gangs in Necromunda - by Jake ThorntonDocument10 pagesDead or Alive - Rules For Outlaw Gangs in Necromunda - by Jake Thorntonweerer100% (2)

- Collections & Deposit Form 2023Document4 pagesCollections & Deposit Form 2023desiahgasconNo ratings yet

- Tentative Costing - 132kV - 1KMDocument4 pagesTentative Costing - 132kV - 1KManuragtiwari762No ratings yet

- 2013 Epub Revisiting Global Trends in Tvet Book PDFDocument356 pages2013 Epub Revisiting Global Trends in Tvet Book PDFDayanaFarzeehaAliNo ratings yet

- AP Electricity Tariff Fy2015-16Document8 pagesAP Electricity Tariff Fy2015-16somnath250477No ratings yet

- 416471087-1693247586810-Covumaiphuongtailieudikemkhoahoc Unit2 UrbanisationDocument3 pages416471087-1693247586810-Covumaiphuongtailieudikemkhoahoc Unit2 Urbanisationdoanthihoaingan0708097326No ratings yet

- I 014484235000054006 R PosDocument3 pagesI 014484235000054006 R PosdeepuhnNo ratings yet

- Technica Case StudyDocument9 pagesTechnica Case StudyEvan StoryNo ratings yet

- WIPO HandbookDocument494 pagesWIPO Handbooksontaycity100% (5)

- Taxation Law Mock Bar Exam AnswersDocument8 pagesTaxation Law Mock Bar Exam AnswersMark MartinezNo ratings yet

- Grade 10 - GlobalizationDocument12 pagesGrade 10 - Globalization6 Golden BootNo ratings yet

- Po 100011963Document2 pagesPo 100011963Prasanna KNo ratings yet

- Final-Varkala-Draft-Report-On - 25 July 14 PDFDocument126 pagesFinal-Varkala-Draft-Report-On - 25 July 14 PDFArchana Gopalsamy100% (1)