Professional Documents

Culture Documents

Bretton Woods Agreement

Bretton Woods Agreement

Uploaded by

lipsitabastia392Copyright:

Available Formats

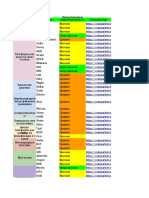

You might also like

- Critical Numerical Test - Data SheetDocument2 pagesCritical Numerical Test - Data SheetOana Alexandra CorleanNo ratings yet

- Chapter 5: The Market For Foreign ExchangeDocument19 pagesChapter 5: The Market For Foreign ExchangeDang ThanhNo ratings yet

- International FinanceDocument14 pagesInternational FinanceMariaHameedNo ratings yet

- The Bretton Woods System Was An International Monetary SystemDocument2 pagesThe Bretton Woods System Was An International Monetary Systemsangeethamadesh2468No ratings yet

- Bretton Wood SystemDocument6 pagesBretton Wood SystemLegends FunanzaNo ratings yet

- Breton Wood AgreementDocument4 pagesBreton Wood Agreementyasser lucman100% (1)

- Bretton Woods SystemDocument25 pagesBretton Woods Systemmendoza3rixNo ratings yet

- The Bretton Woods SystemDocument2 pagesThe Bretton Woods SystemMuhammad FaizanNo ratings yet

- Bretton Wood SystemDocument12 pagesBretton Wood SystemKiara RuelaNo ratings yet

- Brettonwoods SystemDocument7 pagesBrettonwoods SystemZainab IrfanNo ratings yet

- Bretton Woods SystemDocument25 pagesBretton Woods SystemCarmelo TarigaNo ratings yet

- Bretton Woods Agreement and SystemDocument2 pagesBretton Woods Agreement and SystemVictoria BîrgăuNo ratings yet

- Unit 4 World Financial EnvironmentDocument6 pagesUnit 4 World Financial EnvironmentTharun VelammalNo ratings yet

- Bretton Wood CaseDocument11 pagesBretton Wood CaseMaham WasimNo ratings yet

- International Financial InstitutionsDocument9 pagesInternational Financial InstitutionsgzalyNo ratings yet

- International Finance: THE GOLD STANDARD (1876-1913)Document20 pagesInternational Finance: THE GOLD STANDARD (1876-1913)sujata11No ratings yet

- Navigation Search International Monetary Systems LTDDocument6 pagesNavigation Search International Monetary Systems LTDInnovative AkibNo ratings yet

- Activities For Lesson 2Document7 pagesActivities For Lesson 2KATHLEEN BALBOANo ratings yet

- 08 Chpt-8 The International Monetary and Finance SystemDocument50 pages08 Chpt-8 The International Monetary and Finance SystemalikazimovazNo ratings yet

- Vostro AccountDocument2 pagesVostro Accountrameshsnr9No ratings yet

- International BankingDocument62 pagesInternational BankingDjSunil SkyNo ratings yet

- Unit XI-Role of International OrganizationsDocument13 pagesUnit XI-Role of International Organizationsdeepakarora201188No ratings yet

- IMF and INDIa FileDocument23 pagesIMF and INDIa FilehocordinatoreNo ratings yet

- Group 6, IFM, CT2, AssignmentDocument7 pagesGroup 6, IFM, CT2, AssignmentParas JainNo ratings yet

- ImfDocument30 pagesImfvigneshkarthik23No ratings yet

- The Bretton Woods SystemDocument15 pagesThe Bretton Woods SystemYash VoraNo ratings yet

- International Monetary Fund: Submitted To: Lurai Rongmai Lecturer-DBA SMSDocument24 pagesInternational Monetary Fund: Submitted To: Lurai Rongmai Lecturer-DBA SMSGairik DebNo ratings yet

- International Monetary SystemDocument6 pagesInternational Monetary SystemPragya KasanaNo ratings yet

- The IMF ! Monetary Catastrophe or An International Saviour (Chapter 1)Document7 pagesThe IMF ! Monetary Catastrophe or An International Saviour (Chapter 1)Team LeaderNo ratings yet

- Review of Literature The Role of The Imf in Peace and Security by James M. Boughton, 37 Stud. Transnat'L Legal Pol'Y 6 (2005)Document17 pagesReview of Literature The Role of The Imf in Peace and Security by James M. Boughton, 37 Stud. Transnat'L Legal Pol'Y 6 (2005)upendraNo ratings yet

- The International Monetary SystemDocument4 pagesThe International Monetary SystemGuia LeeNo ratings yet

- History and Functionality of The Bretton Woods AgreementDocument2 pagesHistory and Functionality of The Bretton Woods AgreementShikshya shresthaNo ratings yet

- Importance of The Bretton Woods InstitutionsDocument2 pagesImportance of The Bretton Woods InstitutionsAtharva MapuskarNo ratings yet

- Binter 1 STLH UtsDocument3 pagesBinter 1 STLH UtsAnggita DwiantariNo ratings yet

- Chapter Three IMF, WBDocument45 pagesChapter Three IMF, WBTasebe GetachewNo ratings yet

- Brettenwood System With Refrance To IMF & World BankDocument36 pagesBrettenwood System With Refrance To IMF & World BankBhavani SinghNo ratings yet

- International Monetry FundDocument21 pagesInternational Monetry FundRAGHAV GARGNo ratings yet

- Salvatore Study-Guide Ch21Document8 pagesSalvatore Study-Guide Ch21jesNo ratings yet

- The International Institution The Bretton Wood System General Agreement On GATT and The World Trade OrganizationDocument20 pagesThe International Institution The Bretton Wood System General Agreement On GATT and The World Trade OrganizationShanlane CoronelNo ratings yet

- Exchange Rate EvolutionDocument11 pagesExchange Rate EvolutionMontasif RashidNo ratings yet

- Bretton Woods SystemDocument9 pagesBretton Woods SystemAshish PatelNo ratings yet

- About The IMF: Bretton Woods System and ImfDocument8 pagesAbout The IMF: Bretton Woods System and ImfNilesh BhosaleNo ratings yet

- Q.1 Highlight The Role of International Monetary Fund (IMF) and World Bank in Economies of The Developing NationsDocument27 pagesQ.1 Highlight The Role of International Monetary Fund (IMF) and World Bank in Economies of The Developing NationsSheikh Fareed AliNo ratings yet

- Bretton Wood SystemDocument4 pagesBretton Wood SystemKaleli RockyNo ratings yet

- International Business: by Charles W.L. HillDocument36 pagesInternational Business: by Charles W.L. Hilllovelyday9876No ratings yet

- Tema 6. The End of Gold StandardDocument7 pagesTema 6. The End of Gold Standardot2023juantinNo ratings yet

- The Bretton Woods Conference - YusongcoDocument3 pagesThe Bretton Woods Conference - YusongcoJohn Carl YusongcoNo ratings yet

- Bretton Wood SystemDocument17 pagesBretton Wood SystemUmesh Gaikwad0% (1)

- The Bretton Woods SystemDocument7 pagesThe Bretton Woods System2001ramadhanputra200qNo ratings yet

- History Major ExamDocument10 pagesHistory Major ExamRohan MittalNo ratings yet

- Development, The IMF, & Institutional Investors: The Mexican Financial CrisisDocument24 pagesDevelopment, The IMF, & Institutional Investors: The Mexican Financial CrisisBhanu MehraNo ratings yet

- Lesson 5 PPTDocument15 pagesLesson 5 PPTKaye ChannelNo ratings yet

- The BrettonDocument2 pagesThe BrettonDraque TorresNo ratings yet

- Bretton Woods System & WORLD BANKDocument2 pagesBretton Woods System & WORLD BANKMohit SharmaNo ratings yet

- International Political Economy in An Age of GlobalizationDocument8 pagesInternational Political Economy in An Age of GlobalizationMaheen AliNo ratings yet

- Finance IntroductionDocument12 pagesFinance IntroductionZiania CristhelNo ratings yet

- International Trade AssignmentDocument10 pagesInternational Trade AssignmentSaif RahmanNo ratings yet

- BrettonwoodsDocument5 pagesBrettonwoodscoachwrites4No ratings yet

- The Bretton Wood System-2Document11 pagesThe Bretton Wood System-2Ashwin RacerNo ratings yet

- IMFDocument23 pagesIMFrajivkumar2octNo ratings yet

- The Changing Role of Gold Within the Global Financial ArchictectureFrom EverandThe Changing Role of Gold Within the Global Financial ArchictectureNo ratings yet

- The Coins of Philip Ii and Alexander The Great and Their Pan-HellenicpropagandaDocument12 pagesThe Coins of Philip Ii and Alexander The Great and Their Pan-HellenicpropagandanaglaaNo ratings yet

- Dedollarization Via BricsDocument8 pagesDedollarization Via Bricsqureshi channelNo ratings yet

- Problem Set 2-EepiDocument4 pagesProblem Set 2-EepiARBAZNo ratings yet

- Challan 12346967Document1 pageChallan 12346967mehar umarNo ratings yet

- BCM CommissionDocument1 pageBCM CommissionchqaiserNo ratings yet

- Ta Da Format - TSRDocument26 pagesTa Da Format - TSRrabbidep1No ratings yet

- JavaprogramsDocument5 pagesJavaprogramsmonish anandNo ratings yet

- Chapter 12 - Practice SetDocument2 pagesChapter 12 - Practice SetKrystal shaneNo ratings yet

- Stu EG5 e CH 14Document15 pagesStu EG5 e CH 14Huzaifa Feroze ParwazNo ratings yet

- Lecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityDocument39 pagesLecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityTivinesh MorganNo ratings yet

- Forex Market in India: Project Report ONDocument21 pagesForex Market in India: Project Report ONHardik PatelNo ratings yet

- Assignment 2Document3 pagesAssignment 2AlbertoNo ratings yet

- Convert Digital Number Into Words in Excel 7Document4 pagesConvert Digital Number Into Words in Excel 7samNo ratings yet

- Gift-Cards# Text What Gift Cards Can I, in CoinGate Gift Card StoreDocument1 pageGift-Cards# Text What Gift Cards Can I, in CoinGate Gift Card StoreJulius MaryNo ratings yet

- An Investment in Knowledge Pays The Best Interest.": Benjamin FranklinDocument121 pagesAn Investment in Knowledge Pays The Best Interest.": Benjamin FranklinPRACHI DASNo ratings yet

- SPF 2000 Bill FormsDocument17 pagesSPF 2000 Bill Formskarunamoorthi_p220957% (7)

- SA110 LW200xxx ServiceanleitungDocument24 pagesSA110 LW200xxx ServiceanleitungKarl-Heinz WellerNo ratings yet

- Global Investing: Security Analysis and Portfolio ManagementDocument14 pagesGlobal Investing: Security Analysis and Portfolio ManagementNida AliNo ratings yet

- Alexander V. Avakov - Two Thousand Years of Economic Statistics - World Population, GDP and PPP (2010)Document403 pagesAlexander V. Avakov - Two Thousand Years of Economic Statistics - World Population, GDP and PPP (2010)ARIANA SCHNEIDERNo ratings yet

- Coingecko Q1 2021 Cryptocurrency ReportDocument56 pagesCoingecko Q1 2021 Cryptocurrency ReportElvin Chua100% (2)

- Indicative Deposit Profit Rates: PKR Savings AccountsDocument3 pagesIndicative Deposit Profit Rates: PKR Savings AccountsEjaz AhmadNo ratings yet

- Countries Capitals Currencies Download Free PDF CompressedDocument14 pagesCountries Capitals Currencies Download Free PDF CompressedSumair Khan MasoodNo ratings yet

- Список Лучших Криптовалют На РынкеDocument6 pagesСписок Лучших Криптовалют На РынкеpavelNo ratings yet

- Water KitDocument56 pagesWater KitantalutanNo ratings yet

- Brian A. Eales (Auth.) - Financial Engineering-Macmillan Education UK (2000)Document301 pagesBrian A. Eales (Auth.) - Financial Engineering-Macmillan Education UK (2000)fiama.duarteNo ratings yet

- Mrunal's Economy For UPSC & Other Competitive Exams 2021: Baba Age AttemptDocument31 pagesMrunal's Economy For UPSC & Other Competitive Exams 2021: Baba Age AttemptPrakritiRoyNo ratings yet

- GTS 2Document3 pagesGTS 2venulaxman2010No ratings yet

- International Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Document4 pagesInternational Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Tanu GuptaNo ratings yet

Bretton Woods Agreement

Bretton Woods Agreement

Uploaded by

lipsitabastia392Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bretton Woods Agreement

Bretton Woods Agreement

Uploaded by

lipsitabastia392Copyright:

Available Formats

The Bretton Woods Agreement refers to an international monetary system established in 1944

during a conference held in Bretton Woods, New Hampshire, USA. The agreement laid the

foundation for the post-World War II global financial order and aimed to promote stability and

facilitate international trade and economic cooperation. Here are the key points about the Bretton

Woods Agreement:

1. Purpose: The primary goal of the agreement was to create a stable monetary system that would

prevent competitive currency devaluations and promote economic growth after the devastation of

the war.

2. Institutions: The Bretton Woods Agreement led to the establishment of two key international

institutions: the International Monetary Fund (IMF) and the World Bank. The IMF was created to

ensure stability in the international monetary system by providing loans and financial assistance to

member countries facing balance-of-payment difficulties. The World Bank aimed to promote

economic development by providing financial support for infrastructure projects and

reconstruction efforts.

3. Fixed Exchange Rates: The agreement introduced a system of fixed exchange rates, with the

U.S. dollar serving as the central currency. Each member country would tie its currency to the

U.S. dollar, and the dollar, in turn, would be linked to gold at a fixed price. This system aimed to

provide stability and predictability in international trade and investment.

4. Convertibility: Member countries were required to maintain the convertibility of their

currencies into U.S. dollars at the fixed exchange rate. This facilitated the smooth flow of

international transactions and trade.

5. Adjustments and Stabilization: In case a member country's currency was under pressure, the

IMF would provide financial assistance and guidance to help stabilize the currency and restore its

external balance.

6. Collapse: The Bretton Woods system began to face challenges in the 1960s due to economic

imbalances, increased capital flows, and the U.S. experiencing difficulties maintaining the fixed

gold convertibility of the dollar. In 1971, the United States unilaterally ended the convertibility of

the dollar to gold, leading to the collapse of the Bretton Woods system.

Despite its eventual demise, the Bretton Woods Agreement played a crucial role in shaping the

global monetary system and laying the groundwork for future international financial institutions. It

emphasized the importance of stable exchange rates, cooperation among nations, and the need for

financial assistance mechanisms to address economic challenges faced by member countries.

You might also like

- Critical Numerical Test - Data SheetDocument2 pagesCritical Numerical Test - Data SheetOana Alexandra CorleanNo ratings yet

- Chapter 5: The Market For Foreign ExchangeDocument19 pagesChapter 5: The Market For Foreign ExchangeDang ThanhNo ratings yet

- International FinanceDocument14 pagesInternational FinanceMariaHameedNo ratings yet

- The Bretton Woods System Was An International Monetary SystemDocument2 pagesThe Bretton Woods System Was An International Monetary Systemsangeethamadesh2468No ratings yet

- Bretton Wood SystemDocument6 pagesBretton Wood SystemLegends FunanzaNo ratings yet

- Breton Wood AgreementDocument4 pagesBreton Wood Agreementyasser lucman100% (1)

- Bretton Woods SystemDocument25 pagesBretton Woods Systemmendoza3rixNo ratings yet

- The Bretton Woods SystemDocument2 pagesThe Bretton Woods SystemMuhammad FaizanNo ratings yet

- Bretton Wood SystemDocument12 pagesBretton Wood SystemKiara RuelaNo ratings yet

- Brettonwoods SystemDocument7 pagesBrettonwoods SystemZainab IrfanNo ratings yet

- Bretton Woods SystemDocument25 pagesBretton Woods SystemCarmelo TarigaNo ratings yet

- Bretton Woods Agreement and SystemDocument2 pagesBretton Woods Agreement and SystemVictoria BîrgăuNo ratings yet

- Unit 4 World Financial EnvironmentDocument6 pagesUnit 4 World Financial EnvironmentTharun VelammalNo ratings yet

- Bretton Wood CaseDocument11 pagesBretton Wood CaseMaham WasimNo ratings yet

- International Financial InstitutionsDocument9 pagesInternational Financial InstitutionsgzalyNo ratings yet

- International Finance: THE GOLD STANDARD (1876-1913)Document20 pagesInternational Finance: THE GOLD STANDARD (1876-1913)sujata11No ratings yet

- Navigation Search International Monetary Systems LTDDocument6 pagesNavigation Search International Monetary Systems LTDInnovative AkibNo ratings yet

- Activities For Lesson 2Document7 pagesActivities For Lesson 2KATHLEEN BALBOANo ratings yet

- 08 Chpt-8 The International Monetary and Finance SystemDocument50 pages08 Chpt-8 The International Monetary and Finance SystemalikazimovazNo ratings yet

- Vostro AccountDocument2 pagesVostro Accountrameshsnr9No ratings yet

- International BankingDocument62 pagesInternational BankingDjSunil SkyNo ratings yet

- Unit XI-Role of International OrganizationsDocument13 pagesUnit XI-Role of International Organizationsdeepakarora201188No ratings yet

- IMF and INDIa FileDocument23 pagesIMF and INDIa FilehocordinatoreNo ratings yet

- Group 6, IFM, CT2, AssignmentDocument7 pagesGroup 6, IFM, CT2, AssignmentParas JainNo ratings yet

- ImfDocument30 pagesImfvigneshkarthik23No ratings yet

- The Bretton Woods SystemDocument15 pagesThe Bretton Woods SystemYash VoraNo ratings yet

- International Monetary Fund: Submitted To: Lurai Rongmai Lecturer-DBA SMSDocument24 pagesInternational Monetary Fund: Submitted To: Lurai Rongmai Lecturer-DBA SMSGairik DebNo ratings yet

- International Monetary SystemDocument6 pagesInternational Monetary SystemPragya KasanaNo ratings yet

- The IMF ! Monetary Catastrophe or An International Saviour (Chapter 1)Document7 pagesThe IMF ! Monetary Catastrophe or An International Saviour (Chapter 1)Team LeaderNo ratings yet

- Review of Literature The Role of The Imf in Peace and Security by James M. Boughton, 37 Stud. Transnat'L Legal Pol'Y 6 (2005)Document17 pagesReview of Literature The Role of The Imf in Peace and Security by James M. Boughton, 37 Stud. Transnat'L Legal Pol'Y 6 (2005)upendraNo ratings yet

- The International Monetary SystemDocument4 pagesThe International Monetary SystemGuia LeeNo ratings yet

- History and Functionality of The Bretton Woods AgreementDocument2 pagesHistory and Functionality of The Bretton Woods AgreementShikshya shresthaNo ratings yet

- Importance of The Bretton Woods InstitutionsDocument2 pagesImportance of The Bretton Woods InstitutionsAtharva MapuskarNo ratings yet

- Binter 1 STLH UtsDocument3 pagesBinter 1 STLH UtsAnggita DwiantariNo ratings yet

- Chapter Three IMF, WBDocument45 pagesChapter Three IMF, WBTasebe GetachewNo ratings yet

- Brettenwood System With Refrance To IMF & World BankDocument36 pagesBrettenwood System With Refrance To IMF & World BankBhavani SinghNo ratings yet

- International Monetry FundDocument21 pagesInternational Monetry FundRAGHAV GARGNo ratings yet

- Salvatore Study-Guide Ch21Document8 pagesSalvatore Study-Guide Ch21jesNo ratings yet

- The International Institution The Bretton Wood System General Agreement On GATT and The World Trade OrganizationDocument20 pagesThe International Institution The Bretton Wood System General Agreement On GATT and The World Trade OrganizationShanlane CoronelNo ratings yet

- Exchange Rate EvolutionDocument11 pagesExchange Rate EvolutionMontasif RashidNo ratings yet

- Bretton Woods SystemDocument9 pagesBretton Woods SystemAshish PatelNo ratings yet

- About The IMF: Bretton Woods System and ImfDocument8 pagesAbout The IMF: Bretton Woods System and ImfNilesh BhosaleNo ratings yet

- Q.1 Highlight The Role of International Monetary Fund (IMF) and World Bank in Economies of The Developing NationsDocument27 pagesQ.1 Highlight The Role of International Monetary Fund (IMF) and World Bank in Economies of The Developing NationsSheikh Fareed AliNo ratings yet

- Bretton Wood SystemDocument4 pagesBretton Wood SystemKaleli RockyNo ratings yet

- International Business: by Charles W.L. HillDocument36 pagesInternational Business: by Charles W.L. Hilllovelyday9876No ratings yet

- Tema 6. The End of Gold StandardDocument7 pagesTema 6. The End of Gold Standardot2023juantinNo ratings yet

- The Bretton Woods Conference - YusongcoDocument3 pagesThe Bretton Woods Conference - YusongcoJohn Carl YusongcoNo ratings yet

- Bretton Wood SystemDocument17 pagesBretton Wood SystemUmesh Gaikwad0% (1)

- The Bretton Woods SystemDocument7 pagesThe Bretton Woods System2001ramadhanputra200qNo ratings yet

- History Major ExamDocument10 pagesHistory Major ExamRohan MittalNo ratings yet

- Development, The IMF, & Institutional Investors: The Mexican Financial CrisisDocument24 pagesDevelopment, The IMF, & Institutional Investors: The Mexican Financial CrisisBhanu MehraNo ratings yet

- Lesson 5 PPTDocument15 pagesLesson 5 PPTKaye ChannelNo ratings yet

- The BrettonDocument2 pagesThe BrettonDraque TorresNo ratings yet

- Bretton Woods System & WORLD BANKDocument2 pagesBretton Woods System & WORLD BANKMohit SharmaNo ratings yet

- International Political Economy in An Age of GlobalizationDocument8 pagesInternational Political Economy in An Age of GlobalizationMaheen AliNo ratings yet

- Finance IntroductionDocument12 pagesFinance IntroductionZiania CristhelNo ratings yet

- International Trade AssignmentDocument10 pagesInternational Trade AssignmentSaif RahmanNo ratings yet

- BrettonwoodsDocument5 pagesBrettonwoodscoachwrites4No ratings yet

- The Bretton Wood System-2Document11 pagesThe Bretton Wood System-2Ashwin RacerNo ratings yet

- IMFDocument23 pagesIMFrajivkumar2octNo ratings yet

- The Changing Role of Gold Within the Global Financial ArchictectureFrom EverandThe Changing Role of Gold Within the Global Financial ArchictectureNo ratings yet

- The Coins of Philip Ii and Alexander The Great and Their Pan-HellenicpropagandaDocument12 pagesThe Coins of Philip Ii and Alexander The Great and Their Pan-HellenicpropagandanaglaaNo ratings yet

- Dedollarization Via BricsDocument8 pagesDedollarization Via Bricsqureshi channelNo ratings yet

- Problem Set 2-EepiDocument4 pagesProblem Set 2-EepiARBAZNo ratings yet

- Challan 12346967Document1 pageChallan 12346967mehar umarNo ratings yet

- BCM CommissionDocument1 pageBCM CommissionchqaiserNo ratings yet

- Ta Da Format - TSRDocument26 pagesTa Da Format - TSRrabbidep1No ratings yet

- JavaprogramsDocument5 pagesJavaprogramsmonish anandNo ratings yet

- Chapter 12 - Practice SetDocument2 pagesChapter 12 - Practice SetKrystal shaneNo ratings yet

- Stu EG5 e CH 14Document15 pagesStu EG5 e CH 14Huzaifa Feroze ParwazNo ratings yet

- Lecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityDocument39 pagesLecture 8 (Chapter7) - International Arbitrage and Interest Rate ParityTivinesh MorganNo ratings yet

- Forex Market in India: Project Report ONDocument21 pagesForex Market in India: Project Report ONHardik PatelNo ratings yet

- Assignment 2Document3 pagesAssignment 2AlbertoNo ratings yet

- Convert Digital Number Into Words in Excel 7Document4 pagesConvert Digital Number Into Words in Excel 7samNo ratings yet

- Gift-Cards# Text What Gift Cards Can I, in CoinGate Gift Card StoreDocument1 pageGift-Cards# Text What Gift Cards Can I, in CoinGate Gift Card StoreJulius MaryNo ratings yet

- An Investment in Knowledge Pays The Best Interest.": Benjamin FranklinDocument121 pagesAn Investment in Knowledge Pays The Best Interest.": Benjamin FranklinPRACHI DASNo ratings yet

- SPF 2000 Bill FormsDocument17 pagesSPF 2000 Bill Formskarunamoorthi_p220957% (7)

- SA110 LW200xxx ServiceanleitungDocument24 pagesSA110 LW200xxx ServiceanleitungKarl-Heinz WellerNo ratings yet

- Global Investing: Security Analysis and Portfolio ManagementDocument14 pagesGlobal Investing: Security Analysis and Portfolio ManagementNida AliNo ratings yet

- Alexander V. Avakov - Two Thousand Years of Economic Statistics - World Population, GDP and PPP (2010)Document403 pagesAlexander V. Avakov - Two Thousand Years of Economic Statistics - World Population, GDP and PPP (2010)ARIANA SCHNEIDERNo ratings yet

- Coingecko Q1 2021 Cryptocurrency ReportDocument56 pagesCoingecko Q1 2021 Cryptocurrency ReportElvin Chua100% (2)

- Indicative Deposit Profit Rates: PKR Savings AccountsDocument3 pagesIndicative Deposit Profit Rates: PKR Savings AccountsEjaz AhmadNo ratings yet

- Countries Capitals Currencies Download Free PDF CompressedDocument14 pagesCountries Capitals Currencies Download Free PDF CompressedSumair Khan MasoodNo ratings yet

- Список Лучших Криптовалют На РынкеDocument6 pagesСписок Лучших Криптовалют На РынкеpavelNo ratings yet

- Water KitDocument56 pagesWater KitantalutanNo ratings yet

- Brian A. Eales (Auth.) - Financial Engineering-Macmillan Education UK (2000)Document301 pagesBrian A. Eales (Auth.) - Financial Engineering-Macmillan Education UK (2000)fiama.duarteNo ratings yet

- Mrunal's Economy For UPSC & Other Competitive Exams 2021: Baba Age AttemptDocument31 pagesMrunal's Economy For UPSC & Other Competitive Exams 2021: Baba Age AttemptPrakritiRoyNo ratings yet

- GTS 2Document3 pagesGTS 2venulaxman2010No ratings yet

- International Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Document4 pagesInternational Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Tanu GuptaNo ratings yet