Professional Documents

Culture Documents

IAS 19 New

IAS 19 New

Uploaded by

sehrish.cmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 19 New

IAS 19 New

Uploaded by

sehrish.cmaCopyright:

Available Formats

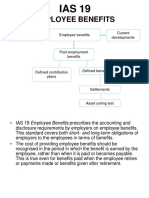

IAS 19 - Employee Benefits

IAS 19 - Employee Benefits

SCOPE - Applied to employee benefits Provided

Under legislative By those informal

Under formal

requirements or practices that

plans or other

through industry gives rise to

formal

arrangements constructive

agreements

obligation -

between entity

example 10

and individual

employees ko

employees, group

diya baaki roney

of employees and

lag gaye abh is se

their

representatives

relation kharab

hoga

C A

, A

ar

Employee benefits include

u m

Short term

h K Long term

benefits

benefits

expected to be

ke s

settled with in 12

months after the

M u Post

employement

benefits

Termination

benefits

period

s h

end of reporting

ka

Contribution plan Benefit plan

1. Payment to be

A

1. Salary

2. Bonuses

3. Leave

1. Provident fund 1. Gratuity fund

2. Pension fund

made to emploiyee

against his

encashment acceptance of

termination.

Whether provided to employee itself and their dependants ( whether full time or part time employee ).

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

1. Contribution Plan:

Company' policy is to contribute 10% of basic salary employe and employer in to Provident fund.

IAS 19 IAS 26

Company Provident fund

Sal exp 100 Cash 20

Sal pay 100 Member fund 20

Sal pay 100 Investment 5

Cash 90 Cash 5

Pay to PF 10 (Investments made out of funds)

(Employee contribution)

Sal exp 10

Investment

Fv gain

C

2

A 2

Pay to PF

(Employer contribution)

10

A

(Return on investment)

,

Pay to PF 20

Fair value gain

m ar

Member fund

2

2

Cash

(Payment to PF)

20

u

For understanding

K

s h

Question 1:

u ke

Zawahir limited have 15 employees on its payroll details of Salaries are:

h

Details of payrol per month: M

Employee name

ka s Grade Basic

Rent Fuel

Allowance allowance

Total

Hudaid

Wasi

Raza

A A

A

A

100,000

120,000

144,000

20,000

24,000

28,800

5,000

6,000

7,200

125,000

150,000

180,000

Muzammil B 80,000 16,000 4,000 100,000

Shahzar B 96,000 19,200 4,800 120,000

Myt B 115,200 23,040 5,760 144,000

Arfeen B 64,000 12,800 3,200 80,000

Laxman A 187,200 37,440 9,360 234,000

Sheikhar A 205,920 41,184 10,296 257,400

Rajan B 76,800 15,360 3,840 96,000

Parmar B 92,160 18,432 4,608 115,200

Vicky B 51,200 10,240 2,560 64,000

Rakesh A 150,000 30,000 7,500 187,500

Parmesh A 165,000 33,000 8,250 206,250

Ateeq A 181,500 36,300 9,075 226,875

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Further information:

1. Company operates defined contribution plan which has following terms:

- For Grade A employees, employee and employer contributes 5% of basic salary per month.

- For Grade B employees, employee and employer contributes 10% of basic salary per month.

2. Contribution of employee and employer related to last month of the year i.e. December 31, 2020 were

deposited upto 60%. 40% still payable.

Required:

Fill the following journal entry for the month of December 31, 2020:

Date Particulars DR CR

Salary expense

31-Dec-20

Salary payable

C A

Date Particulars

Salary payable

DR CR

, A

31-Dec-20 Cash

Payable to provident fund

m ar

Date Particulars DR

K u CR

31-Dec-20

PF exp / Salary exp

s h

ke

Payable to provident fund

2. Benefit Plan:

M u

h

- Contribution is only of employer

s

ka

- Employer promises that some % of salary will be paid for each year of service given .

Illustration 1:A

Concept 1: (without time value of money) % of present salary

Naseem Limited appointed Mr. Rajper on January 1, 2018.

Terms of employement includes:

1. Basic salary Rs. 100,000 per month.

2. Gratuity scheme entitlement in which he will be paid 10% of basic salary for each year of service given

3. Increment 10% per year.

4. Employement for 5 years

Required:

1. Calculate amount of Gratuity payable as at December 31, 2020.(assuming that employee remain in

employement since 2018 till now)

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Concept 1: (without time value of money) % of present salary

Illustration 2:

Hassan Limited appointed Mr. Alam on January 1, 2018.

Terms of employement includes:

1. Basic salary Rs. 120,000 per month.

2. Gratuity scheme entitlement in which he will be paid 12% of basic salary for each year of service given

3. Increment 12% per year.

4. Employement for 5 years

Required:

1. Calculate amount of Gratuity payable as at December 31, 2020.(assuming that employee remain in

employement since 2018 till now)

Concept 2: (with time value of money) % of final salary

Illustration 3:

C A

Shoaib Limited appointed Mr. Akhter on January 1, 2018.

, A

Terms of employement includes:

1. Basic salary Rs. 100,000 per month.

m ar

3. Increment 5% per year.

K u

2. Gratuity scheme entitlement in which he will be paid 15% of final salary for each year of service given

4. Employement for 4 years

s h

Discount rate 10%

u ke

Required:

h M

1. Calculate amount of Gratuity payable as at December 31, 2020.(assuming that employee remain in

s

employement since 2018 till now)

ka

Illustration 4:

A

First year annual salary is Rs. 500,000

Salary increment per year is 12%

Total service life 7 years

Discount rate 10%

Defined benefit formula:

15% of final salary for each year of service payable at the time of retirement.

Required:

1. Current service cost at the end 3rd year

2. PV of defined benefit obligation at the end of 3rd year

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Illustration 5:

First year annual salary is Rs. 800,000

Salary increment per year is 15%

Total service life 10 years

Discount rate 12%

Defined benefit formula:

10% of final salary, for each year of service payable at the time of retirement.

Required:

1. Current service cost at the end 4th year

2. PV of defined benefit obligation at the end of 4th year

Illustration 6:

C A

, A

m ar

K u

s h

u ke

h M

ka s

Required: A

1. Show the figures that would appear on the face of the statement of financial performance as at 31

December Year 3 and Year 4.

2. Construct a journal to explain the movement on the defined benefit net asset (or net liability) during the

year ended 31 December Year 4.

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Illustration 7:

C A

, A

mar

K u

s h

uke

h M

ka s

A

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Illustration 8:

C A

, A

mar

K u

s h

uke

h M

ka s

A

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Illustration 9: (Asset Ceiling):

Company maintains gratuity fund for its employess details of which are as follows:

Particulars 2018

Fair value of Defined benefit obligation 7,500,000

Fair value of net assets 8,200,000

Currect service cost 750,000

Benefit paid 500,000

Contribution made 800,000

Further information:

1. Discount rate is 10%.

2. Fair value of Defined Benefit liability and fair value of plan assets as at 31 december 2017 were

Rs. 6,500,000 and Rs. 6,800,000

3. Present value of economic benefits available in the form of future reductions or refund is RS.

300,000

C A

Requirement:

, A

1. Disclosures required by IAS 19

m

2. Net Defined Benefit Asset and Liability to be reported on Balance Sheet. ar

K u

Minimum funding requirement - IFRIC 14

Illustration 10:

s h

ke

X Limited has a post-employment plan subject to a minimum funding requirement (MFR) as a result of which

it has a statutory obligation to contribute Rs. 200m to the plan as at the reporting date:

M u

The plan rules permit a full refund of any surplus to the entity at the end of the life of the plan.

h

Year-end valuation of the plan is set out below:

s

ka

2018

Rs. In million

A

Market value of plan assets

Present value of plan obligation

1,200

(1,100)

Illustration 11:

X Limited has a post-employment plan subject to a minimum funding requirement (MFR) as a result of which

it has a statutory obligation to contribute Rs. 200m to the plan as at the reporting date:

The amounts in the plan are not available for refund in the future so there a liability in respect of the

minimum funding requirement is required

Year-end valuation of the plan is set out below:

2018

Rs. In million

Market value of plan assets 1,200

Present value of plan obligation (1,100)

100

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Illustration 12:

X Limited has a post-employment plan subject to a minimum funding requirement (MFR) as a result of which

it has a statutory obligation to contribute Rs. 200m to the plan as at the reporting date.

The plan rules allow for the refund of 60% of any surplus that arise according to IAS 19.

Year-end valuation of the plan is set out below:

2018

Rs. In million

Market value of plan assets 1,200

Present value of plan obligation (1,100)

100

Illustration 13:

it has a statutory obligation to contribute Rs. 300m to the plan as at the reporting date.

C A

X Limited has a post-employment plan subject to a minimum funding requirement (MFR) as a result of which

The plan rules allow for the refund of 60% of any surplus that arise as per IAS 19.

, A

ar

um

Year-end valuation of the plan is set out below:

2018

Market value of plan assets

h K Rs. In million

1,000

Present value of plan obligation

e s (1,100)

uk

(100)

Illustration 14:

Particulars

h M

Company maintains Pension Plan for its employess details of which are as follows:

2018

k a

Fair value of net assets s

Fair value of Defined benefit obligation 7,900,000

8,500,000

Benefit paid A

Currect service cost

Contribution made

550,000

500,000

700,000

Further information:

1. Discount rate is 12%.

2. Fair value of Defined Benefit liability and fair value of plan assets as at 31 december 2017 were Rs.

5,400,000 and Rs. 6,100,000

3. Plan is subject to minimum funding requirement as a result, it has to contrubute Rs. 1,000,000.

Requirement:

1. Disclosures required by IAS 19 if:

i. Refunds from the fund are 40%

ii. No Refunds

iii. Full Refund

2. Net Defined Benefit Asset and Liability to be reported on Balance Sheet (in each of the above cases).

By Akash Mukesh Kumar, ACA

IAS 19 - Employee Benefits

Illustration 15:

Company maintains Gratuity Plan for its employess details of which are as follows:

Particulars 2018

Fair value of Defined benefit obligation 6,300,000

Fair value of net assets 6,100,000

Currect service cost 435,000

Benefit paid 500,000

Contribution made 500,000

Further information:

1. Discount rate is 14%.

2. Fair value of Defined Benefit liability and fair value of plan assets as at 31 december 2017 were Rs.

6,500,000 and Rs. 6,000,000

3. Plan is subject to minimum funding requirement as a result, it has to contrubute Rs. 800,000.

Requirement:

1. Disclosures required by IAS 19 if:

C A

i. Refunds from the fund are 55%

ii. No Refunds

, A

iii. Full Refund

m ar

u

2. Net Defined Benefit Asset and Liability to be reported on Balance Sheet (in each of the above cases).

K

s h

u ke

h M

ka s

A

By Akash Mukesh Kumar, ACA

IAS 19 – Employee Benefits (Short Term Benefits)

Question 1:

Babu limited has an employee named Ustad.

Ustad is allowed to take 30 paid annual leaves. During the year he has taken 14 leaves.

Salary increment is 10%.

Annual Salary is Rs. 1,000,000.

Year is of 365 days.

Required:

Calculate provision for compensated absences if:

i. Leaves are accumulating and Ustad is entitled to Cash Payment if leaves are not used

(i.e. Vesting). Ustad is expected to use only 50% leaves balance next year.

ii. Leaves are accumulating and Ustad is not entitled to Cash Payment if leaves are not

used (i.e. Non-Vesting). Ustad is expected to use only 50% leaves balance next year

(leaves which are not taken will be lapsed).

iii. Leaves are non-accumulating.

Question 2: (Accumulating – Vesting V/S Non-vesting)

Umrani Limited has one employee. His name is Bilal.

Bilal is paid Rs. 365,000 per year, but this is expected to increase by 10% in 20X2.

- The year is 365 days.

- Bilal is owed 30 days leave per year.

- Bilal took 20 days leave in 20X1. Bilal’s leave is accumulating

Umrani Limited’s financial year-end is 31 December 20X1.

Required: Calculate any leave pay provision at 31 December 20X1 and show all journals

assuming:

A. the leave is accumulating and vesting (i.e. Bilal is entitled to convert his unused leave into

cash): past experience suggests that Bilal will only take 90% of his unused leave balance

before he finally either resigns or retires from Umrani Limited;

B. the leave is accumulating and non-vesting (i.e. Bilal may not convert unused leave into

cash): past experience suggests that Bilal will only take 90% of his unused leave balance

before he finally either resigns or retires from Umrani Limited;

C. the leave is accumulating for a limited period and non-vesting: it accumulates for one year

only after which unused leave will be forfeited: past experience suggests that Bilal will

take 3 days leave in 20X2 from his 20X1 leave entitlement carried forward.

Akash Mukesh Kumar, ACA Page 1

You might also like

- TEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 CompleteDocument70 pagesTEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 Completemarcuskenyatta275No ratings yet

- IAS 19-Employee BenefitsDocument46 pagesIAS 19-Employee Benefitsmdhuzzal100% (3)

- Notes IAS 19Document18 pagesNotes IAS 19Nasir IqbalNo ratings yet

- Pension Accounting PDFDocument8 pagesPension Accounting PDFMuhammad Faran KhanNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitsPaulo Emmanuel SantosNo ratings yet

- IAS 19 Employee BenefitDocument20 pagesIAS 19 Employee BenefitAklilNo ratings yet

- AC2201 CHAPTER 19 NotesDocument3 pagesAC2201 CHAPTER 19 NotesKemuel TantuanNo ratings yet

- Ind AS On Employee BenefitDocument81 pagesInd AS On Employee BenefitSanjay GohilNo ratings yet

- Computation Income From SalaryDocument15 pagesComputation Income From SalaryIzma HussainNo ratings yet

- Computation Income From SalaryDocument14 pagesComputation Income From SalaryHajra MalikNo ratings yet

- Employee Benefits: John Bo S. Cayetano, CPA, MBADocument110 pagesEmployee Benefits: John Bo S. Cayetano, CPA, MBABella IlaganNo ratings yet

- Postemployment BenefitsDocument3 pagesPostemployment BenefitsChristian John PardoNo ratings yet

- Chapter Summary Chapter 5Document10 pagesChapter Summary Chapter 5ellyzamae quiraoNo ratings yet

- Fund, Which Is Separate From The Reporting Entity For The Purpose ofDocument7 pagesFund, Which Is Separate From The Reporting Entity For The Purpose ofNaddieNo ratings yet

- Pensions and Other Postretirement BenefitsDocument40 pagesPensions and Other Postretirement BenefitsAlyssa Paula AltayaNo ratings yet

- AC 2202 CHAPTER 17 NotesDocument8 pagesAC 2202 CHAPTER 17 NotesKemuel TantuanNo ratings yet

- PDF 15aug23 0724 SplittedDocument1 pagePDF 15aug23 0724 SplittedAshish ChaudharyNo ratings yet

- Employee Benefits P201Document18 pagesEmployee Benefits P201krisha milloNo ratings yet

- As 15 - Employee BenefitsDocument22 pagesAs 15 - Employee BenefitsSHRADDHA RAUTNo ratings yet

- Employee Benefits P201Document17 pagesEmployee Benefits P201krisha milloNo ratings yet

- TDS 21-22Document25 pagesTDS 21-22dinesh kasnNo ratings yet

- Employee Provident Fund Act, 1952 (PF) : Scheme Employee's Contributio N Employer's ContributionDocument10 pagesEmployee Provident Fund Act, 1952 (PF) : Scheme Employee's Contributio N Employer's ContributionmahadeopgNo ratings yet

- Employee Benefits Part 1.1Document5 pagesEmployee Benefits Part 1.1Shanelle SilmaroNo ratings yet

- FAR.2832 Employee Benefits YT PDFDocument4 pagesFAR.2832 Employee Benefits YT PDFJames ScoldNo ratings yet

- IAS 19 Employee BenefitsDocument14 pagesIAS 19 Employee BenefitsShiza ArifNo ratings yet

- C18 - Defined Benefit Plan PDFDocument23 pagesC18 - Defined Benefit Plan PDFKristine Diane CABAnASNo ratings yet

- Employee Benefit - 181121Document26 pagesEmployee Benefit - 181121KhansaFatinNo ratings yet

- Finacc ReviewerDocument4 pagesFinacc Reviewer200617No ratings yet

- Salary and Its TaxationDocument12 pagesSalary and Its TaxationBasit BandayNo ratings yet

- Chapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletDocument1 pageChapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletcathNo ratings yet

- Ind As 19Document25 pagesInd As 19shivam kukrejaNo ratings yet

- Provident FundDocument9 pagesProvident Fundmohammed umairNo ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- FAR.2932 - Employee Benefits.Document6 pagesFAR.2932 - Employee Benefits.Edmark LuspeNo ratings yet

- Chapter 6 Pension FundDocument53 pagesChapter 6 Pension FundMOHAMMAD BORENENo ratings yet

- Adobe Scan 02-Jul-2021Document1 pageAdobe Scan 02-Jul-2021The Unknown vloggerNo ratings yet

- Employee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Document10 pagesEmployee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Mica DelaCruzNo ratings yet

- 02 Ias19Document8 pages02 Ias19AANo ratings yet

- Ia 3Document3 pagesIa 3Auguste Anthony SisperezNo ratings yet

- Salary PDFDocument14 pagesSalary PDFNITESH SINGHNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Pas 19 Employee BenefitsDocument14 pagesPas 19 Employee BenefitsKelzarineah FludgeNo ratings yet

- PAS 19 Employee BenefitsDocument62 pagesPAS 19 Employee BenefitsBenj FloresNo ratings yet

- Income From SalariesDocument15 pagesIncome From SalariesAyesha MominNo ratings yet

- Accounting For Employee BenefitsDocument35 pagesAccounting For Employee BenefitsOnwuchekwa Chidi CalebNo ratings yet

- IAS 19 - Class Practice (Solutions)Document4 pagesIAS 19 - Class Practice (Solutions)Muhammed NaqiNo ratings yet

- Unit 4 Income TaxDocument34 pagesUnit 4 Income TaxHemal PanchalNo ratings yet

- Tally Tips - Accounting Heads of Incomes - ExpensesDocument12 pagesTally Tips - Accounting Heads of Incomes - ExpensescooNo ratings yet

- IAS19Document1 pageIAS19Chamil SureshNo ratings yet

- IA3 - Accounting For Employee BenefitsDocument6 pagesIA3 - Accounting For Employee BenefitsHannah Jane Arevalo LafuenteNo ratings yet

- Objectives: Chapter 5 - Employee Benefits - Ias 19Document82 pagesObjectives: Chapter 5 - Employee Benefits - Ias 19Tram NguyenNo ratings yet

- 19 Employee Benefits s22 - tesFINALDocument16 pages19 Employee Benefits s22 - tesFINALasiphileamagiqwa25No ratings yet

- PGBP ChartsDocument11 pagesPGBP ChartsMohitNo ratings yet

- Ifrs at A Glance IAS 19 Employee BenefitsDocument5 pagesIfrs at A Glance IAS 19 Employee BenefitsnanaNo ratings yet

- Unit 7Document19 pagesUnit 7vfcvhjNo ratings yet

- Dependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)Document3 pagesDependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)Niranjan JainNo ratings yet

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- Ind-AS 19Document42 pagesInd-AS 19amarNo ratings yet

- IA2 10 01 Employee Benefits PDFDocument17 pagesIA2 10 01 Employee Benefits PDFAzaria MatiasNo ratings yet

- Unit 03Document9 pagesUnit 03bobo tangaNo ratings yet

- FM16 Ch26 Tool KitDocument21 pagesFM16 Ch26 Tool KitAdamNo ratings yet

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Financial Statement Analysis 20101Document117 pagesFinancial Statement Analysis 20101konyatanNo ratings yet

- Tata Motors ReportDocument5 pagesTata Motors ReportrastehertaNo ratings yet

- Mutual FundDocument20 pagesMutual FundRupesh KekadeNo ratings yet

- 0 MasterfileDocument598 pages0 MasterfileAngel VenableNo ratings yet

- Wiley - The Revolution in Corporate Finance, 4th Edition - 978-1-405-10781-5Document2 pagesWiley - The Revolution in Corporate Finance, 4th Edition - 978-1-405-10781-5saghNo ratings yet

- Business Valuation M&a and Post Merger IntegrationDocument63 pagesBusiness Valuation M&a and Post Merger IntegrationKlaus LaurNo ratings yet

- Cost of CapitalDocument53 pagesCost of CapitalJaodat Mand KhanNo ratings yet

- PIALEFDocument1 pagePIALEFEileen LauNo ratings yet

- IFRS 15 SolutionsDocument12 pagesIFRS 15 SolutionsshakilNo ratings yet

- Financial Statement Analysis Lecture 5 - Cash FlowDocument17 pagesFinancial Statement Analysis Lecture 5 - Cash FlowKenan AbishovNo ratings yet

- Bsa 3101 - Accounting For Special Transactions Seatwork No. 2 InstructionsDocument2 pagesBsa 3101 - Accounting For Special Transactions Seatwork No. 2 InstructionsZihr EllerycNo ratings yet

- S SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexDocument64 pagesS SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexleenajaiswalNo ratings yet

- Week 1 Advanced Entrepreneurial FinanceDocument52 pagesWeek 1 Advanced Entrepreneurial FinanceElegi ZuhriNo ratings yet

- COMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BankDocument29 pagesCOMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BanknigusNo ratings yet

- Corporate FailureDocument44 pagesCorporate FailureChamunorwa MunemoNo ratings yet

- Chapter Eight: Functional and Activity-Based BudgetingDocument43 pagesChapter Eight: Functional and Activity-Based BudgetingRecki SeptiandaNo ratings yet

- Textbook Ebook Horngrens Financial and Managerial Accounting The Financial Chapters 5Th Global Edition Tracie L Miller Nobles All Chapter PDFDocument43 pagesTextbook Ebook Horngrens Financial and Managerial Accounting The Financial Chapters 5Th Global Edition Tracie L Miller Nobles All Chapter PDFemmett.day717100% (7)

- CH 12Document36 pagesCH 12anjo hosmerNo ratings yet

- L1 - Course Introduction - Apr23Document19 pagesL1 - Course Introduction - Apr23Fallen LeavesNo ratings yet

- FINMARKDocument18 pagesFINMARKIvan AnaboNo ratings yet

- HUBC List of Shareholders As of 30-06-2023Document16 pagesHUBC List of Shareholders As of 30-06-2023pagay66625No ratings yet

- Financial Performance Measures and Their Effects: ND NDDocument20 pagesFinancial Performance Measures and Their Effects: ND NDMERINANo ratings yet

- AlKhouri, Arouri - 2019 - The Effect of Diversification On Risk and Return in Banking Sector Evidence From The Gulf Cooperation Council-AnnotatedDocument29 pagesAlKhouri, Arouri - 2019 - The Effect of Diversification On Risk and Return in Banking Sector Evidence From The Gulf Cooperation Council-AnnotatedilunalbNo ratings yet

- Simulated Qualifying Exam ReviewerDocument10 pagesSimulated Qualifying Exam ReviewerJanina Frances Ruidera100% (1)

- AFIL - Monthly Trade Finace Note Ferbuary Product - DocumentDocument1 pageAFIL - Monthly Trade Finace Note Ferbuary Product - Documentsampsonbranson40No ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument36 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsHanh CaoNo ratings yet