Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsOpt Notes

Opt Notes

Uploaded by

Rica BalajadiaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Section 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Document12 pagesSection 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Dennie Vieve IdeaNo ratings yet

- RR 13-00Document2 pagesRR 13-00saintkarri100% (2)

- Other Percentage TaxDocument58 pagesOther Percentage TaxApple AppleNo ratings yet

- Axis Factsheet April 2020Document57 pagesAxis Factsheet April 2020GNo ratings yet

- Corporation TRAIN and CREATE LawDocument8 pagesCorporation TRAIN and CREATE LawdgdeguzmanNo ratings yet

- Irect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Document3 pagesIrect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Washim Alam50CNo ratings yet

- Uganda Tax Amendment Bills For 2018Document10 pagesUganda Tax Amendment Bills For 2018jadwongscribdNo ratings yet

- Customs Duty & GSTDocument23 pagesCustoms Duty & GSTkakki1088No ratings yet

- Module 5Document19 pagesModule 5Jisung ParkNo ratings yet

- Module 5Document21 pagesModule 5Krisly Erica DALISAYNo ratings yet

- Percentage TaxDocument7 pagesPercentage Taxyatot carbonelNo ratings yet

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- ProjectDocument37 pagesProjectcontactnilkanth123No ratings yet

- Morales Taxation Topic 10 Other Percentages TaxDocument14 pagesMorales Taxation Topic 10 Other Percentages TaxMary Joice Delos santosNo ratings yet

- Uganda Issues Tax Amendment Bills 2020Document6 pagesUganda Issues Tax Amendment Bills 2020harryNo ratings yet

- Taxflash 2019 01Document4 pagesTaxflash 2019 01Haryo BagaskaraNo ratings yet

- CGST LawDocument30 pagesCGST LawPranit Anil ChavanNo ratings yet

- CPAR OPT Batch 93 HandoutDocument14 pagesCPAR OPT Batch 93 Handout6wv84xgwnbNo ratings yet

- Amendment Final N2020 BGSirDocument30 pagesAmendment Final N2020 BGSirAfnan KhanNo ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- 96 2015 TT BTCDocument41 pages96 2015 TT BTCKhánh Vy VũNo ratings yet

- CREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Document28 pagesCREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Abbey Agno PerezNo ratings yet

- Income Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)Document5 pagesIncome Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)gdmurugan2k7No ratings yet

- GST On Real Estate Converted 1Document4 pagesGST On Real Estate Converted 1jvnraoNo ratings yet

- Percentage TaxesDocument11 pagesPercentage TaxesAce Hulsey TevesNo ratings yet

- 94-12 OPT - HandoutDocument14 pages94-12 OPT - HandoutMj BauaNo ratings yet

- A Kinds of Percentage TaxesDocument9 pagesA Kinds of Percentage TaxesCPAREVIEWNo ratings yet

- FOURTH SEMESTER GSTDocument6 pagesFOURTH SEMESTER GSTKenny PhilipsNo ratings yet

- VAT Overview - RevDocument62 pagesVAT Overview - RevZachary BañezNo ratings yet

- Corporate Tax IndiaDocument6 pagesCorporate Tax IndiaAmit GargNo ratings yet

- Circular 98 17 2019 GSTDocument4 pagesCircular 98 17 2019 GSTBS Nanjunda SwamyNo ratings yet

- 4 Chapter04Document40 pages4 Chapter04Kalkidan ZerihunNo ratings yet

- Suraj Sir 1Document8 pagesSuraj Sir 1Avinash YadavNo ratings yet

- Other Percentage TaxesDocument11 pagesOther Percentage TaxesmavslastimozaNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- OL 4 - BLT Study Text Suppliment 2021 - On New Tax AmmendmentsDocument28 pagesOL 4 - BLT Study Text Suppliment 2021 - On New Tax Ammendmentshte19031No ratings yet

- Cma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsDocument358 pagesCma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsSarath KumarNo ratings yet

- Other Percentage Taxes: Sec. 116. Persons Exempt From VATDocument22 pagesOther Percentage Taxes: Sec. 116. Persons Exempt From VATMakoy BixenmanNo ratings yet

- .My-Salient Points of RPGT 2010 GuidelinesDocument23 pages.My-Salient Points of RPGT 2010 GuidelinesFitri KhalisNo ratings yet

- CH 2 TAXATION ON INDIVIDUALS Slide 43 71Document8 pagesCH 2 TAXATION ON INDIVIDUALS Slide 43 71Casandra Nicole AldecoaNo ratings yet

- Corporate Recovery Tax Incentives Enterprises Act: AND FORDocument2 pagesCorporate Recovery Tax Incentives Enterprises Act: AND FORAl-jbr Tub SarNo ratings yet

- March 2022 Factsheet With Direct PlanDocument115 pagesMarch 2022 Factsheet With Direct PlanPraveen KNNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Salient Features CustomsDocument5 pagesSalient Features Customssaqlain3210No ratings yet

- Nepal Budget Highlights - 79-80 - APM & AssociatesDocument89 pagesNepal Budget Highlights - 79-80 - APM & Associatesaasthapoddar155No ratings yet

- Input Tax Credit Under GSTDocument4 pagesInput Tax Credit Under GSTharshadaphandge165No ratings yet

- 3108 Deductions From Gross IncomeDocument17 pages3108 Deductions From Gross IncomeMae Angiela TansecoNo ratings yet

- Samilcommentary Dec2023 enDocument10 pagesSamilcommentary Dec2023 enhekele9111No ratings yet

- Creba V RomuloDocument18 pagesCreba V RomuloJuhainah TanogNo ratings yet

- First City Providential College: Corporation Part 2Document8 pagesFirst City Providential College: Corporation Part 2Arjhay CruzNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)Document4 pagesTax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)thepoetsedgeNo ratings yet

- TRAIN Law 2018Document27 pagesTRAIN Law 2018Solar PowerNo ratings yet

- Recent Developments in GSTDocument27 pagesRecent Developments in GSTAravindNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvoDocument3 pages2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvonathalie velasquezNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- NothingDocument14 pagesNothingitatchi regenciaNo ratings yet

- Dagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Document14 pagesDagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Reginald ValenciaNo ratings yet

- Overseas Mediclaim Policy (Business and Holiday) Policy ScheduleDocument6 pagesOverseas Mediclaim Policy (Business and Holiday) Policy Schedulemohamed arabathNo ratings yet

- HDFC Life Sanchay Plus Retail Brochure Final CTCDocument16 pagesHDFC Life Sanchay Plus Retail Brochure Final CTCPM LOgsNo ratings yet

- A Report On Institutional Training in K.K.P. Spinning Mills Pvt. LTD., NamakkalDocument37 pagesA Report On Institutional Training in K.K.P. Spinning Mills Pvt. LTD., Namakkalmap solutions100% (3)

- A Case Study On: Under The Guidance ofDocument27 pagesA Case Study On: Under The Guidance ofbatmanNo ratings yet

- Pol PacDocument35 pagesPol PacKaren de LeonNo ratings yet

- PolicySchedule 0303002816P108041301Document4 pagesPolicySchedule 0303002816P108041301Manojit SarkarNo ratings yet

- General ProposalDocument16 pagesGeneral ProposalS. M. JisanNo ratings yet

- Attachment J - Camilion Solutions Making The Case For Product Rationalization White PaperDocument9 pagesAttachment J - Camilion Solutions Making The Case For Product Rationalization White PaperJava CodeNo ratings yet

- General Manager Facilities in Los Angeles CA Resume Jeffrey BearmanDocument2 pagesGeneral Manager Facilities in Los Angeles CA Resume Jeffrey BearmanJeffreyBearmanNo ratings yet

- HESLOP V GENERAL ACCIDENT, FIRE AND LIFE ASSURANCE CORPORATION LTD 1962 (3) SA 511 (A)Document3 pagesHESLOP V GENERAL ACCIDENT, FIRE AND LIFE ASSURANCE CORPORATION LTD 1962 (3) SA 511 (A)kenny mbakhwaNo ratings yet

- 2classificationsocieties 111210064719 Phpapp01Document12 pages2classificationsocieties 111210064719 Phpapp01Samir Alshaar100% (1)

- QBO 2020 Math Revealed Chart of Accounts For ImportingDocument2 pagesQBO 2020 Math Revealed Chart of Accounts For ImportingTaniavami ClarisseNo ratings yet

- 12) Employee Benefits & ServicesDocument34 pages12) Employee Benefits & Servicesthehrmaven2013100% (1)

- Vehicle Loan Sanction LetterDocument4 pagesVehicle Loan Sanction LetterAshok GNo ratings yet

- 07c - Project Management AgreementDocument45 pages07c - Project Management AgreementtulsisdNo ratings yet

- TDS, TCS & Advance Payment of TaxDocument54 pagesTDS, TCS & Advance Payment of TaxFalak GoyalNo ratings yet

- Insurance AE CFC Underwriting Limited Lloyds Latest Version February 7th 2015Document15 pagesInsurance AE CFC Underwriting Limited Lloyds Latest Version February 7th 2015MA-DocNo ratings yet

- BASIX-BSFL Social Rating ReportDocument17 pagesBASIX-BSFL Social Rating Reportakhi_lesh001No ratings yet

- Bachrach V British American InsuranceDocument2 pagesBachrach V British American InsuranceakosierikaNo ratings yet

- V ' Exgv 'Vex DG©: Health Insurance Claim FormDocument2 pagesV ' Exgv 'Vex DG©: Health Insurance Claim Formjakaria emtiajNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument3 pagesHDFC ERGO General Insurance Company LimitedDhanush ChauhanNo ratings yet

- CIR Vs Arthur Henderson (1961, 1 SCRA 649)Document15 pagesCIR Vs Arthur Henderson (1961, 1 SCRA 649)KTNo ratings yet

- SR 4.2 - GSIS Health BenefitsDocument15 pagesSR 4.2 - GSIS Health BenefitsBudoy WashupapiNo ratings yet

- Principles of Management: Module - 1Document8 pagesPrinciples of Management: Module - 1Muhammad AkbarNo ratings yet

- Ruin TheoryDocument29 pagesRuin TheoryAnonymous M8Bvu4FExNo ratings yet

- Mr. Utpal Tyagi PolicyDocument2 pagesMr. Utpal Tyagi Policyghaziabad photostateNo ratings yet

- Kutler1947 PDFDocument2 pagesKutler1947 PDFAlex DaniNo ratings yet

- Perception of Employee Towards The Management in SMHFCDocument86 pagesPerception of Employee Towards The Management in SMHFChemal choksiNo ratings yet

- 10000001005Document242 pages10000001005Chapter 11 DocketsNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet

Opt Notes

Opt Notes

Uploaded by

Rica Balajadia0 ratings0% found this document useful (0 votes)

2 views13 pagesOriginal Title

OPT NOTES

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views13 pagesOpt Notes

Opt Notes

Uploaded by

Rica BalajadiaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 13

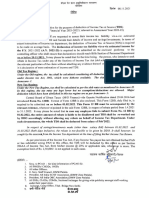

TRAIN CREATE EOPTA

Law Act

Enacted Dec. 19, Mar. 26, Jan. 5,

(NOTE: The amendment introduced by the TRAIN Law was vetoed by the

2017 2021 2024 President. The veto message reads:

C. Exemptions from percentage tax of gross

sales/receipts not exceeding five hundred thousand

Took Jan. 1, Apr. 11, *Jan. 22, pesos (P500,000 )= VETOED

effect 2018 2021 2024

I am constrained to veto the provision which provides for the

*EOPTA took effect 15 days after its publication on January 7, 2024. above under line 12 of Sec. 38 in the enrolled bill, to wit:

“And Beginning January 1, 2019, *Self-Employed and

*Professionals with Total Annual Gross Sales And/or Gross

TITLE V: OTHER PERCENTAGE TAXES Receipts Not exceeding Five Hundred Thousand Pesos

(P500,000). The Proposed exemption from percentage tax will

result in unnecessary erosion of revenues and would lead to

SEC. 116. Tax on Persons Exempt from abuse and leakages. The subject taxpayers under this provision

Value-Added Tax (VAT). [255] are already exempted from the VAT, thus, the lower three

percent percentage tax on gross sales or gross receipts is

June 30, 2020 3% considered as their fair share in contributing to the revenue

base of the country.)

July 1, 2020 – June 30, 2023 (CREATE Law) 1%

July 1, 2023 3%

- Any person whose (1) sales are exempt

under Section 109(CC) [116] of this Code

from the payment of value-added tax and who

is (2)not a VAT-registered person shall pay,

either electronically or manually, a tax

equivalent to three percent (3%) of his gross

quarterly sales: Provided, That cooperatives,

[117] shall be exempt from the three percent

(3%) tax herein imposed: Provided, further,

That effective July 1, 2020 until June 30,

2023, the rate shall be one percent (1[118]

SEC. 109(CC) Sale or lease of goods or properties or the performance of services other than the

transactions mentioned in the preceding paragraphs, the gross annual sales do not exceed the

amount of Three million pesos (P3,000,000.00): [107] Provided, That the amount herein stated

shall be adjusted to its present values using the consumer price index, as published by the

Philippine Statistics Authority (PSA) every three (3) years.

* Under TRAIN LAW

* GPP is not self-employed

* income from self-employment=business income=ordinary

course of business

*mixed income earner=no 250K deduction

*BASIS = RR 13-2018 (example); RR 8-2018 (guidelines)

*application of VAT = PROSPECTIVE APPLICATION

*RECOMPUTE the income tax using the GTT then DEDUCT all the PAID

*req. to be taxed at SEC. 116 is also the req. for you to avail at 8% 8% tax

*if you are qualified at 8% income tax rate you need to SIGNIFY intention

to use the 8% in the FIRST QUARTERLY INCOME TAX RETURN; if fails to

do that, you can’t use it anymore for the year.

*NOT ALL carriers are subject to CCT

* EX. School bus, taxi operators, bus operators, GRAB

* KEEPERS OF GARAGE - operator of a business that provides

storage space for vehicles. This includes garages that offer parking

services for vehicles use to transport PASSENGER by LAND.

- *Cars for rent or hire driven by the lessee,

*transportation contractors, including

*persons who transport passengers for

hire, and other (1) domestic carriers (2) by

land, [119] for the (3) transport of passengers

(except owners of bancas and owners of

animal-drawn two wheeled vehicle), and

*keepers of garages shall pay a tax

equivalent to three percent (3%) of their

quarterly gross sales.

SEC. 117. Percentage Tax on Domestic

Carriers and Keepers of Garages.[115] The gross sales of common carriers derived

from their incoming and outgoing freight

shall not be subjected to the local taxes

imposed under Republic Act No. 7160,

otherwise known as the Local Government

Code of 1991.

The provision “PROVIDED, THAT MICRO TAXPAYERS SHALL NOT BE REQUIRED

TO WITHHOLD TAXES UNDER SUBSECTION (B) OF THIS SECTION” was vetoed

by Pres. Ferdinand R. Marcos, Jr.

(A) International air carriers doing; business

in the Philippines on their gross sales derived

from transport of cargo from the Philippines

to another country shall pay a tax of three

percent (3%) of their quarterly gross sales.

(B) International shipping carriers doing

business in the Philippines on their gross

sales derived from transport of cargo from

the Philippines to another country shall pay a

tax equivalent to three percent (3%) of their

quarterly gross sales.

SEC. 119. Tax on Franchises.[115]

SEC. 118 Percentage Tax on International

*Franchises granted by the government through legislative grant

Carriers. – [256]

- Any provision of general or special law to the

contrary notwithstanding, there shall be

levied, assessed and collected in respect to

(1) all franchises on radio and/or television

broadcasting companies whose annual

gross sales of the preceding year do not

exceed Ten million pesos (P10,000.00),

subject to Section 236 of this Code, a tax of

three percent (3%) and (2) on gas and water

utilities, a tax of two percent (2%) on t he

gross sales derived from the business

covered by the law granting the franchise:

Provided, however, That radio and television

broadcasting companies referred to in this

Section shall *have an option to be registered

as a value-added taxpayer and *pay the tax

due thereon: Provided, further, That once the

option is exercised, said option shall be

irrevocable. [119]

The grantee shall file the return with, and pay

the tax due thereon to the Commissioner or

his duly authorized representative, in

accordance with the provisions of Section

128 of this Code, and the return shall be (B) Exemptions. - The tax imposed by this

subject to audit by the Bureau of Internal Section shall not apply to:

Revenue, any provision of any existing law to

1. Government. - Amounts billed for

the contrary notwithstanding.

messages transmitted by the

*Government of the Republic of the

Philippines or any of its *political

subdivisions or *instrumentalities;

2. Diplomatic Services. - Amounts

billed for messages transmitted by

any *embassy and *consular offices

of a foreign government;

SEC. 120. Tax on Overseas Dispatch, 3. International Organizations. -

Message or Conversation Originating from Amounts billed for messages

the Philippines.[115] *OCT Overseas Communications Tax transmitted by a *public

international organization or *any of

(A) Persons Liable. - There shall be its agencies based in the

collected upon every overseas Philippines enjoying privileges,

dispatch, message or conversation exemptions and immunities which the

transmitted from the Philippines by Government of the Philippines is

telephone, telegraph, telewriter committed to recognize pursuant to

exchange, wireless and other an international agreement; and

communication equipment service, 4. News Services. - Amounts billed for

a tax of ten percent (10%) on the messages from *any newspaper,

amount billed for such services. The press association, radio or television

tax imposed in this Section shall be newspaper, broadcasting agency, or

payable by the person paying for the newstickers services, *to any other

services rendered and shall be paid to newspaper, press association, radio

the person rendering the services or television newspaper broadcasting

who is required to collect and pay the agency, or newsticker service or *to a

tax within twenty (20) days after the bona fide correspondent, which

end of each quarter. messages *deal exclusively with the

collection of news items for, or the

*dissemination of news item

through, public press, radio or

television broadcasting or a

newsticker service furnishing a

general news service similar to that of - There shall be collected a tax on a gross

the public press. receipt derived from sources within the

*Cover local news as well as international news

agencies

Philippines by all banks and non-bank

financial intermediaries in accordance with

SEC. 121. Tax on Banks and Non-Bank the following schedule:

Financial Intermediaries Performing Quasi-

Banking Functions. (GRT Gross Receipts Tax) (a) On interest, commissions and discounts

from lending activities as well as income

from financial leasing, on the basis of

remaining maturities of instruments from

which such receipts are derived:

• Maturity period is five years or less (ST) 5%

• Maturity period is more than five years (LT) 1%

(b) On dividends and equity shares and net

income of subsidiaries 0%

(c) On royalties, rentals of property, real or

personal, profits, from exchange and all

other items treated as gross income under

Section 32 of this Code 7%

*SEC. 32. Gross Income.

(A) General Definition. - Except when otherwise provided in this

Title, gross income means all income derived from whatever

source, including (but not limited to) the following items:

1. Compensation for services in whatever form paid,

including, but not limited to fees, salaries, wages,

commissions, and similar items;

2. Gross income derived from the conduct of trade or

business or the exercise of a profession;

3. Gains derived from dealings in property;

4. Interests;

5. Rents;

6. Royalties;

7. Dividends;

8. Annuities;

9. Prizes and winnings;

10. Pensions; and

11. Partner's distributive share from the net income of

the general professional partnership.

(B) Exclusions from Gross Income. - The following items shall

not be included in gross income and shall be exempt from

taxation under this Title:

1. Life Insurance. - The proceeds of life

insurance policies paid to the heirs or

beneficiaries upon the death of the

insured, whether in a single sum or

otherwise, but if such amounts are held

by the insurer under an agreement to pay

interest thereon, the interest payments

shall be included in gross income.

2. Amount Received by Insured as Return of

Premium. - The amount received by the

insured, as a return of premiums paid by

him under life insurance, endowment, or

annuity contracts, either during the term

or at the maturity of the term mentioned

in the contract or upon surrender of the

contract.

3. Gifts, Bequests, and Devises. - The value

of property acquired by gift, bequest,

devise, or descent: Provided, however,

That income from such property, as well

as gift, bequest, devise or descent of

income from any property, in cases of

transfers of divided interest, shall be

included in gross income.

4. Compensation for Injuries or Sickness. -

amounts received, through Accident or

Health Insurance or under Workmen's

Compensation Acts, as compensation for

personal injuries or sickness, plus the

amounts of any damages received,

whether by suit or agreement, on account

of such injuries or sickness.

5. Income Exempt under Treaty. - Income of

any kind, to the extent required by any

treaty obligation binding upon the

Government of the Philippines.

6. Retirement Benefits, Pensions, Gratuities,

etc.

Provided, however, That in case the maturity

period referred to in paragraph (a) is

shortened thru pre-termination, then the

(7) Miscellaneous Items.

maturity period shall be reckoned to end as

of the date of pre-termination for purposes

of classifying the transaction and the correct

rate of tax shall be applied accordingly.

Provided, finally, That the generally accepted

accounting principles as may be prescribed

by the Bangko Sentral ng Pilipinas for the

bank or non-bank financial intermediary

performing quasi-banking functions shall

likewise be the basis for the calculation of

gross receipts. [121]

(d) On net trading gains within the taxable Nothing in this Code shall preclude the

year on foreign currency, debt securities, Commissioner from imposing the same tax

derivatives, and other similar financial herein provided on persons performing

instruments. 7% *FOREX Transaction similar banking activities.

SEC. 122. Tax on Other Non-Bank Financial

Intermediaries. [122] *not performing quasi banking functions

- There shall be collected a tax of five percent

(5%) on the gross receipts derived by other

non-bank financial intermediaries doing

business in the Philippines, from interests,

commissions, discounts and all other items

treated as gross income under this code.:

Provided, That interests, commissions and

discounts from lending activities, as well as

income from financial leasing, shall be taxed

on the basis of the remaining maturities of the - There shall be collected from every person,

instruments from which such receipts are company or corporation (except purely

derived, in accordance with the following cooperative companies or associations)

schedule: doing life insurance business of any sort in

the Philippines a tax of two percent (2%)

• Maturity period is five years or less 5% [124] of the total premium collected, whether

• Maturity period is more than five years 1%

such premiums are paid in money, notes,

Provided, however, That in case the maturity credits or any substitute for money; but

period is shortened thru pre-termination, *premiums refunded within six (6) months

then the maturity period shall be reckoned to after payment on account of *rejection of risk

end as of the date of pre-termination for or *returned for other reason to a person

purposes of classifying the transaction and insured shall not be included in the taxable

the correct rate of tax shall be applied receipts; nor shall any tax be paid upon

accordingly. *reinsurance by a company that has already

paid the tax; nor upon doing business outside

Provided, finally, That the generally accepted the Philippines on account of any life

accounting principles as may be prescribed insurance of the insured who is a

by the Securities and Exchange nonresident, if any tax on such premium is

Commission for other non-bank financial imposed by the foreign country where the

intermediaries shall likewise be the basis for branch is established nor upon premiums

the calculation of gross receipts. [123] collected or received on account of any

Nothing in this Code shall preclude the reinsurance , if the insured, in case of

Commissioner from imposing the same tax personal insurance, resides outside the

herein provided on persons performing Philippines, if any tax on such premiums is

similar financing activities. (Almost same as SEC. 121) imposed by the foreign country where the

original insurance has b124een issued or

perfected; nor upon that portion of the

premiums collected or received by the

insurance companies on variable contracts

(as defined in Section 232(2) of Presidential

Decree No. 612), in excess of the amounts

necessary to insure the lives of the variable

SEC. 123. Tax on Life Insurance Premiums.

contract workers.

SEC. 125. Amusement Taxes.

- There shall be collected from the (1)

proprietor, (2) lessee or (3) operator of

cockpits, cabarets, night or day clubs, boxing

exhibitions, professional basketball games,

Jai-Alai and racetracks (horse racing), a tax

equivalent to:

‘Cooperative companies or associations’

(a) Eighteen percent (18%) in the case of

are such as are conducted by the members

cockpits;

thereof with the money collected from among

themselves and solely for their own (b) Eighteen percent (18%) in the case of

protection and not for profit. cabarets, night or day clubs;

SEC. 124. Tax on Agents of Foreign

Insurance Companies. *agent of nonresident foreign

insurance company not authorized to operate in our country; NON

LIFE INSURANCE

- Every fire, marine or miscellaneous

insurance agent authorized under the

Insurance Code to procure policies of

insurance as he may have previously been

legally authorized to transact on risks located

in the Philippines for companies not

authorized to transact business in the

Philippines shall pay a tax equal to twice the

tax imposed in Section 123 (4%):

Provided, That the provision of this Section

shall not apply to reinsurance: Provided,

however, That the provisions of this Section (c) Ten percent (10%) in the case of boxing

shall not affect the right of an owner of exhibitions: Provided, however, That boxing

property to apply for and obtain for himself exhibitions wherein (1)*World or *Oriental

policies in foreign companies in cases where Championships in any division is at stake

said owner does not make use of the services shall be exempt from amusement tax:

of any agent, company or corporation residing Provided, further, That (2) at least one of the

or doing business in the Philippines. In all contenders for World or Oriental

cases where owners of property obtain Championship is a citizen[s] of the

insurance directly with foreign companies, Philippines and (3) said exhibitions are

it shall be the duty of said owners to report to promoted by a *citizen/s of the Philippines

the Insurance Commissioner and to the or by a *corporation or *association at least

Commissioner each case where insurance sixty percent (60%) of the capital of which is

has been so effected, and shall pay the tax of owned by such citizens;

five percent (5%) on premiums paid, in the

manner required by Section 123. (d) Fifteen percent (15%) in the case of

professional basketball games (PBA)as

envisioned in Presidential Decree No. 871: the end of each month: Provided, further, That

Provided, however, That the tax herein shall the Philippine Amusement and Gaming

be in lieu of all other percentage taxes of Corporation or any special economic zone

whatever nature and description; and authority or tourism zone authority or freeport

authority may impose regulatory fees on

(e) Thirty percent (30%) in the case of Jai-Alai

offshore gaming licensees which shall not

(sugal) and racetracks - of their gross

cumulatively exceed two percent (2%) of the

receipts, irrespective, of whether or not any

gross gaming revenue or receipts derived

amount is charged for admission.

from gaming operations and similar related

activities of all offshore gaming licensees or a

predetermined minimum guaranteed fee,

For the purpose of the amusement tax, the whichever is higher: Provided, furthermore,

term ‘gross receipts’ embraces all the That for purposes of this Section, gross

receipts of the proprietor, lessee or operator gaming revenue or receipts shall mean gross

of the amusement place. Said gross receipts wages less payouts: Provided, finally, That the

also *include income from television, radio taking of wagers made in the Philippines and

and motion picture rights, if any. A person or the grave failure to cooperate with the third-

entity or association conducting any activity party auditor shall result in the revocation of

subject to the tax herein imposed shall be the license of the offshore gaming licensee.

similarly liable for said tax with respect to

such portion of the receipts derived by him or “The Philippine Amusement and Gaming

it. Corporation or any special economic zone

authority or tourism zone authority or freeport

The *taxes imposed herein shall be payable at authority shall engage the services of a third-

the end of each quarter and it shall be the party audit platform that would determine the

*duty of the proprietor, lessee or operator gross gaming revenues or receipts of offshore

concerned, as well as *any party liable, gaming licensees. To ensure that the proper

within twenty (20) days after the end of taxes and regulatory fees are levied, periodic

each quarter, to make a true and complete reports about the results of the operation

return of the amount of the gross receipts showing, among others, the gross gaming

derived during the preceding quarter and pay revenue or receipts of each offshore gaming

the tax due thereon. licensee shall be submitted to the Bureau of

SECTION 125-A Gaming Tax on Services Internal Revenue by the Philippine

Rendered by Offshore Gaming Licensees. Amusement and Gaming Corporation or any

special economic zone authority or tourism

- Any provision of existing laws, rules or zone authority or freeport authority as

regulations to the contrary notwithstanding, certified by their third-party auditor: Provided:

the entire gross gaming revenue or receipts That the third-party auditor shall be

or the agreed predetermined minimum independent, reputable, internationally-

monthly revenue or receipts from gaming, known, and duly accredited as such by an

whichever is higher, shall be levied, assessed, accreditor similar agency recognized by

and collected a gaming tax equivalent to industry experts: Provided, finally, That

(5%), yes: Provided, That the gaming tax shall nothing herein shall prevent the Bureau of

be directly remitted to the Bureau of Internal Internal Revenue and the Commission on

Revenue not later than the 20th day following Audit from undertaking a post-audit or

independent verification of the gross gaming (A) Tax on Sale, Barter or Exchange of

revenues determined by the third-party Shares of Stock Listed and Traded through

auditor. [20] the Local Stock Exchange. [4]

SEC. 126. Tax on Winnings. - There shall be levied, assessed and

collected on every sale, barter, exchange, or

- Every person who wins in horse races shall

other disposition of shares of stock listed and

pay a tax equivalent to ten percent (10%) of

traded through the local stock exchange

his winnings or 'dividends', the tax to be based

other than the sale by a dealer in

on the actual amount paid to him for every

securities, a tax at the rate of six-tenths of

winning ticket after deducting the cost of the

one percent (6/10 of 1%) [125] of the gross

ticket: Provided, That in the case of winnings

selling price or gross value in money of the

from double, forecast/quinella and trifecta

shares of stock sold, bartered, exchanged or

bets, the tax shall be four percent (4%). In the

otherwise disposed which shall be paid by

case of owners of winning race horses, the tax

the seller or transferor.

shall be ten percent (10%) of the prizes. *ang nagbenta ay either investor or shareholder

The tax herein prescribed shall be deducted

from the 'dividends' corresponding to each

winning ticket or the 'prize' of each winning

race horse owner and withheld by the

operator, manager or person in charge of the

horse races before paying the dividends or

prizes to the persons entitled thereto.

The operator, manager or person in charge of

horse races shall, within twenty (20) days

from the date the tax was deducted and

withheld in accordance with the second

paragraph hereof, file a true and correct

return with the Commissioner in the manner

or form to be prescribed by the Secretary of (B) Repealed under Section 6 of Republic

Finance, and pay within the same period the Act No. 11494, otherwise known as the

total amount of tax so deducted and "Bayanihan to Recover As One Act."

withheld.

(C) Return on Capital Gains Realized from

SEC. 127. Tax on Sale, Barter or Exchange of Sale of Shares of Stocks. –

Shares of Stock Listed and Traded through

(1) Return on Capital Gains Realized

the *Local Stock Exchange or through

from Sale of Shares of Stock Listed

*Initial Public Offering. *Stock Transaction

and Traded in the Local Stock

Tax

Exchange.- It shall be the duty of

every stock broker who effected the

sale subject to the tax imposed herein

to collect the tax and remit the same

to the Bureau of Internal Revenue

within five (5) banking days from the

date of collection thereof and to

submit on Mondays of each week to

the secretary of the stock exchange,

of which he is a member, a true and

complete return which shall contain a

declaration of all the transactions

effected through him during the

preceding week and of taxes collected

by him and turned over to the Bureau

Of Internal Revenue.

*Primary offering and secondary offering

(D) Common Provisions. - any gain derived

from the sale, barter, exchange or other

disposition of shares of stock under this

Section shall be (1) exempt from the tax

imposed in Sections 24(C), 27(D)(2),

28(A)(8)(c), and 28(B)(5)(c) of this Code and

(2) Return on Public Offerings of from the (2) regular individual or corporate

Shares of Stock.- In case of primary income tax. Tax paid under this Section shall

offering, the corporate issuer shall not be deductible for income tax purposes.

file the return and pay the

corresponding tax within thirty (30)

days from the date of listing of the

shares of stock in the local stock

exchange. In the case of secondary

offering, the provision of Subsection

(C) (1) of this Section shall apply as to

the time and manner of the payment

of the tax.

(3) Determination of Correct Sales or

Receipts. - When it is found that a person has

failed to issue receipts or invoices, or when

no return is filed, or when there is reason to

believe that the books of accounts or other

records do not correctly reflect the

declarations mad e or to be made in a return

required to be filed under the provisions of

this Code, the Commissioner, after taking into

account the sales, receipts or other taxable

SEC. 128. Returns and Payment of

base of other persons engaged in similar

Percentage Taxes. [254]

businesses under similar situations or

(A) Returns of Gross Sales or Earnings and circumstances, or after considering other

Payment of Tax. [4] - relevant information may prescribe a

minimum amount of such gross receipts,

(1) Persons Liable to Pay Percentage Taxes. -

sales and taxable base and such amount so

Every person subject to the percentage taxes

prescribed shall be prima facie correct for

imposed under this Title shall file, either

purposes of determining the internal revenue

electronically or manually, a quarterly return

tax liabilities of such person.

of the amount of the person's gross sales or

earnings and pay, either electronically or

manually, with any authorized agent bank,

(B) Where to File. - Except as the

Revenue District Office through Revenue

Commissioner otherwise permits, every

Collection Officer or authorized tax software

person liable to the percentage tax under this

provider, the tax due thereon within twenty-

Title shall file, either electronically or

five (25) days after the end of each taxable

manually, a consolidated return for all

quarter: Provided, That in the case of a person

branches or places of business with any

whose VAT registration is cancelled and who

authorized agent bank, Revenue District

becomes liable to the tax imposed in Section

Office through Revenue Collection Officer or

116 of this Code, the tax shall accrue from

authorized tax software provider..

the date of cancellation and shall be paid in

accordance with the provisions of this

Section.

(2) Person Retiring from Business. - Any

person retiring from a business subject to

percentage tax shall notify the nearest

internal revenue officer, file, either

electronically or manually, the person's return

and pay, either electronically or manually, the

tax due thereon within twenty (20) days after

closing the business.

You might also like

- Section 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Document12 pagesSection 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Dennie Vieve IdeaNo ratings yet

- RR 13-00Document2 pagesRR 13-00saintkarri100% (2)

- Other Percentage TaxDocument58 pagesOther Percentage TaxApple AppleNo ratings yet

- Axis Factsheet April 2020Document57 pagesAxis Factsheet April 2020GNo ratings yet

- Corporation TRAIN and CREATE LawDocument8 pagesCorporation TRAIN and CREATE LawdgdeguzmanNo ratings yet

- Irect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Document3 pagesIrect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Washim Alam50CNo ratings yet

- Uganda Tax Amendment Bills For 2018Document10 pagesUganda Tax Amendment Bills For 2018jadwongscribdNo ratings yet

- Customs Duty & GSTDocument23 pagesCustoms Duty & GSTkakki1088No ratings yet

- Module 5Document19 pagesModule 5Jisung ParkNo ratings yet

- Module 5Document21 pagesModule 5Krisly Erica DALISAYNo ratings yet

- Percentage TaxDocument7 pagesPercentage Taxyatot carbonelNo ratings yet

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- ProjectDocument37 pagesProjectcontactnilkanth123No ratings yet

- Morales Taxation Topic 10 Other Percentages TaxDocument14 pagesMorales Taxation Topic 10 Other Percentages TaxMary Joice Delos santosNo ratings yet

- Uganda Issues Tax Amendment Bills 2020Document6 pagesUganda Issues Tax Amendment Bills 2020harryNo ratings yet

- Taxflash 2019 01Document4 pagesTaxflash 2019 01Haryo BagaskaraNo ratings yet

- CGST LawDocument30 pagesCGST LawPranit Anil ChavanNo ratings yet

- CPAR OPT Batch 93 HandoutDocument14 pagesCPAR OPT Batch 93 Handout6wv84xgwnbNo ratings yet

- Amendment Final N2020 BGSirDocument30 pagesAmendment Final N2020 BGSirAfnan KhanNo ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- 96 2015 TT BTCDocument41 pages96 2015 TT BTCKhánh Vy VũNo ratings yet

- CREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Document28 pagesCREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Abbey Agno PerezNo ratings yet

- Income Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)Document5 pagesIncome Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)gdmurugan2k7No ratings yet

- GST On Real Estate Converted 1Document4 pagesGST On Real Estate Converted 1jvnraoNo ratings yet

- Percentage TaxesDocument11 pagesPercentage TaxesAce Hulsey TevesNo ratings yet

- 94-12 OPT - HandoutDocument14 pages94-12 OPT - HandoutMj BauaNo ratings yet

- A Kinds of Percentage TaxesDocument9 pagesA Kinds of Percentage TaxesCPAREVIEWNo ratings yet

- FOURTH SEMESTER GSTDocument6 pagesFOURTH SEMESTER GSTKenny PhilipsNo ratings yet

- VAT Overview - RevDocument62 pagesVAT Overview - RevZachary BañezNo ratings yet

- Corporate Tax IndiaDocument6 pagesCorporate Tax IndiaAmit GargNo ratings yet

- Circular 98 17 2019 GSTDocument4 pagesCircular 98 17 2019 GSTBS Nanjunda SwamyNo ratings yet

- 4 Chapter04Document40 pages4 Chapter04Kalkidan ZerihunNo ratings yet

- Suraj Sir 1Document8 pagesSuraj Sir 1Avinash YadavNo ratings yet

- Other Percentage TaxesDocument11 pagesOther Percentage TaxesmavslastimozaNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- OL 4 - BLT Study Text Suppliment 2021 - On New Tax AmmendmentsDocument28 pagesOL 4 - BLT Study Text Suppliment 2021 - On New Tax Ammendmentshte19031No ratings yet

- Cma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsDocument358 pagesCma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsSarath KumarNo ratings yet

- Other Percentage Taxes: Sec. 116. Persons Exempt From VATDocument22 pagesOther Percentage Taxes: Sec. 116. Persons Exempt From VATMakoy BixenmanNo ratings yet

- .My-Salient Points of RPGT 2010 GuidelinesDocument23 pages.My-Salient Points of RPGT 2010 GuidelinesFitri KhalisNo ratings yet

- CH 2 TAXATION ON INDIVIDUALS Slide 43 71Document8 pagesCH 2 TAXATION ON INDIVIDUALS Slide 43 71Casandra Nicole AldecoaNo ratings yet

- Corporate Recovery Tax Incentives Enterprises Act: AND FORDocument2 pagesCorporate Recovery Tax Incentives Enterprises Act: AND FORAl-jbr Tub SarNo ratings yet

- March 2022 Factsheet With Direct PlanDocument115 pagesMarch 2022 Factsheet With Direct PlanPraveen KNNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Salient Features CustomsDocument5 pagesSalient Features Customssaqlain3210No ratings yet

- Nepal Budget Highlights - 79-80 - APM & AssociatesDocument89 pagesNepal Budget Highlights - 79-80 - APM & Associatesaasthapoddar155No ratings yet

- Input Tax Credit Under GSTDocument4 pagesInput Tax Credit Under GSTharshadaphandge165No ratings yet

- 3108 Deductions From Gross IncomeDocument17 pages3108 Deductions From Gross IncomeMae Angiela TansecoNo ratings yet

- Samilcommentary Dec2023 enDocument10 pagesSamilcommentary Dec2023 enhekele9111No ratings yet

- Creba V RomuloDocument18 pagesCreba V RomuloJuhainah TanogNo ratings yet

- First City Providential College: Corporation Part 2Document8 pagesFirst City Providential College: Corporation Part 2Arjhay CruzNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)Document4 pagesTax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)thepoetsedgeNo ratings yet

- TRAIN Law 2018Document27 pagesTRAIN Law 2018Solar PowerNo ratings yet

- Recent Developments in GSTDocument27 pagesRecent Developments in GSTAravindNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvoDocument3 pages2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvonathalie velasquezNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- NothingDocument14 pagesNothingitatchi regenciaNo ratings yet

- Dagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Document14 pagesDagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Reginald ValenciaNo ratings yet

- Overseas Mediclaim Policy (Business and Holiday) Policy ScheduleDocument6 pagesOverseas Mediclaim Policy (Business and Holiday) Policy Schedulemohamed arabathNo ratings yet

- HDFC Life Sanchay Plus Retail Brochure Final CTCDocument16 pagesHDFC Life Sanchay Plus Retail Brochure Final CTCPM LOgsNo ratings yet

- A Report On Institutional Training in K.K.P. Spinning Mills Pvt. LTD., NamakkalDocument37 pagesA Report On Institutional Training in K.K.P. Spinning Mills Pvt. LTD., Namakkalmap solutions100% (3)

- A Case Study On: Under The Guidance ofDocument27 pagesA Case Study On: Under The Guidance ofbatmanNo ratings yet

- Pol PacDocument35 pagesPol PacKaren de LeonNo ratings yet

- PolicySchedule 0303002816P108041301Document4 pagesPolicySchedule 0303002816P108041301Manojit SarkarNo ratings yet

- General ProposalDocument16 pagesGeneral ProposalS. M. JisanNo ratings yet

- Attachment J - Camilion Solutions Making The Case For Product Rationalization White PaperDocument9 pagesAttachment J - Camilion Solutions Making The Case For Product Rationalization White PaperJava CodeNo ratings yet

- General Manager Facilities in Los Angeles CA Resume Jeffrey BearmanDocument2 pagesGeneral Manager Facilities in Los Angeles CA Resume Jeffrey BearmanJeffreyBearmanNo ratings yet

- HESLOP V GENERAL ACCIDENT, FIRE AND LIFE ASSURANCE CORPORATION LTD 1962 (3) SA 511 (A)Document3 pagesHESLOP V GENERAL ACCIDENT, FIRE AND LIFE ASSURANCE CORPORATION LTD 1962 (3) SA 511 (A)kenny mbakhwaNo ratings yet

- 2classificationsocieties 111210064719 Phpapp01Document12 pages2classificationsocieties 111210064719 Phpapp01Samir Alshaar100% (1)

- QBO 2020 Math Revealed Chart of Accounts For ImportingDocument2 pagesQBO 2020 Math Revealed Chart of Accounts For ImportingTaniavami ClarisseNo ratings yet

- 12) Employee Benefits & ServicesDocument34 pages12) Employee Benefits & Servicesthehrmaven2013100% (1)

- Vehicle Loan Sanction LetterDocument4 pagesVehicle Loan Sanction LetterAshok GNo ratings yet

- 07c - Project Management AgreementDocument45 pages07c - Project Management AgreementtulsisdNo ratings yet

- TDS, TCS & Advance Payment of TaxDocument54 pagesTDS, TCS & Advance Payment of TaxFalak GoyalNo ratings yet

- Insurance AE CFC Underwriting Limited Lloyds Latest Version February 7th 2015Document15 pagesInsurance AE CFC Underwriting Limited Lloyds Latest Version February 7th 2015MA-DocNo ratings yet

- BASIX-BSFL Social Rating ReportDocument17 pagesBASIX-BSFL Social Rating Reportakhi_lesh001No ratings yet

- Bachrach V British American InsuranceDocument2 pagesBachrach V British American InsuranceakosierikaNo ratings yet

- V ' Exgv 'Vex DG©: Health Insurance Claim FormDocument2 pagesV ' Exgv 'Vex DG©: Health Insurance Claim Formjakaria emtiajNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument3 pagesHDFC ERGO General Insurance Company LimitedDhanush ChauhanNo ratings yet

- CIR Vs Arthur Henderson (1961, 1 SCRA 649)Document15 pagesCIR Vs Arthur Henderson (1961, 1 SCRA 649)KTNo ratings yet

- SR 4.2 - GSIS Health BenefitsDocument15 pagesSR 4.2 - GSIS Health BenefitsBudoy WashupapiNo ratings yet

- Principles of Management: Module - 1Document8 pagesPrinciples of Management: Module - 1Muhammad AkbarNo ratings yet

- Ruin TheoryDocument29 pagesRuin TheoryAnonymous M8Bvu4FExNo ratings yet

- Mr. Utpal Tyagi PolicyDocument2 pagesMr. Utpal Tyagi Policyghaziabad photostateNo ratings yet

- Kutler1947 PDFDocument2 pagesKutler1947 PDFAlex DaniNo ratings yet

- Perception of Employee Towards The Management in SMHFCDocument86 pagesPerception of Employee Towards The Management in SMHFChemal choksiNo ratings yet

- 10000001005Document242 pages10000001005Chapter 11 DocketsNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet