Professional Documents

Culture Documents

Paperwise Exemption Syllabus17

Paperwise Exemption Syllabus17

Uploaded by

taufiquerahaman2073Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paperwise Exemption Syllabus17

Paperwise Exemption Syllabus17

Uploaded by

taufiquerahaman2073Copyright:

Available Formats

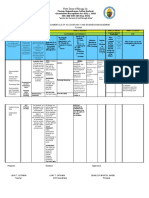

ATTENTION STUDENTS!

PAPERWISE EXEMPTION ON THE BASIS OF HIGHER QUALIFICATIONS

The Council of The Institute of Company Secretaries of India (ICSI), in its 252 nd

Meeting held on March 28th, 2018 and 253rd Meeting held on June 30th , 2018, has

decided that the students enrolling to Company Secretary (CS) Course under New

Syllabus, 2017 shall be eligible for paper-wise exemption (s) based on the higher

qualifications acquired by them, as under:

Basis of Exemption Exemption in paper(s) covered Exemption in paper(s)

Qualification under Executive Programme covered under Professional

Programme

Passed LL.B. (Three Years Module- 1 No paper-wise exemption is

Degree Course / or Five available for this

Years integrated Law Paper-1: Jurisprudence, qualification in any paper

Course) from a Interpretation & General Laws covered under Professional

recognized University / (Paper Code – 421) Programme

Institute either constituted

under an Act of Parliament

or approved by AICTE/AIU

and having secured 50%

or more marks in the

aggregate.

(Qualification Code : 47)

Final Pass Students of the Module-1 Module 1

Institute of Cost

Accountants of India Paper 4: Tax Laws (Paper Code: Paper 2: Advanced Tax Laws

424) (Paper Code : 432)

Qualification Code : 44

Module-2 Module 3

Paper 5 : Corporate & Paper 7: Corporate Funding

Management Accounting (Paper & Listing in the Stock

Code:425) Exchanges (Paper Code :

437)

Module-2

Paper 8 : Financial & Strategic

Management (Paper Code:428)

“IMPORTANT INSTRUCTIONS FOR STUDENTS FOR CLAIMING PAPER-WISE

EXEMPTION:

1. Students are required to apply for paper wise exemption in desired subject through

‘Online Smash Portal on website https://smash.icsi.edu and for procedure please

follow the link

https://smash.icsi.edu/Documents/Qualification_Based_Subject_ExemptionandCancellation_Student.pdf

2. Fee for paper wise exemption is Rs.1000/- (per subject) and is to be paid through

‘Online Smash Portal https://smash.icsi.edu using Credit/Debit card or Net banking.

3. Students who have been granted exemption in Executive Programme Stage on

the basis of having passed Final Course of The Institute of Cost Accountants of India

are required to submit their request for exemptions afresh for papers covered under

the Professional Programme Stage & the same are not granted automatically.

4. Students need to upload scanned attested copies of mark sheets of all

parts/semesters of LLB degree or scanned attested copies of final pass certificate of

the Institute of Cost Accountants of India.

5. Last date of applying for exemption is 9th April for June Session of Examinations

and 10th October for December session of Examinations.”

You might also like

- IIBF - FIMMDA - Certified Treasury Dealer PDFDocument16 pagesIIBF - FIMMDA - Certified Treasury Dealer PDFAshish mNo ratings yet

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- FA2 Syllabus and Study Guide 2020-21 FINAL PDFDocument15 pagesFA2 Syllabus and Study Guide 2020-21 FINAL PDFFazeel08 MangiNo ratings yet

- Smoke Extraction System Sample CalculationDocument5 pagesSmoke Extraction System Sample Calculationsmcsaminda100% (3)

- Paperwise Exemption Syllabus17-1Document2 pagesPaperwise Exemption Syllabus17-1ShubhamNo ratings yet

- Paperwise Exemption ForHighQualDocument1 pagePaperwise Exemption ForHighQualAyush BishtNo ratings yet

- Paper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Document1 pagePaper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Shubham MaheshwariNo ratings yet

- CA ProspectusDocument103 pagesCA ProspectusDigambar JangamNo ratings yet

- FAU Syllabus and Study Guide Dec 22-Jun 23Document12 pagesFAU Syllabus and Study Guide Dec 22-Jun 23Sai PhaniNo ratings yet

- 67080bos54079 M1ipDocument17 pages67080bos54079 M1iprnathNo ratings yet

- Ordinance V (4A&B) & Curriculum For: Bachelor of Business AdministrationDocument190 pagesOrdinance V (4A&B) & Curriculum For: Bachelor of Business AdministrationUttkarsh JainNo ratings yet

- MA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 DatesDocument14 pagesMA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 Datesgranbacha1017No ratings yet

- Bos 54380 M 1 IpDocument14 pagesBos 54380 M 1 IpShubham krNo ratings yet

- Managing Costs and Finance (MA2) : Syllabus and Study GuideDocument13 pagesManaging Costs and Finance (MA2) : Syllabus and Study GuideAmna jawaidNo ratings yet

- MA2 Syllabus and Study Guide - Sept 22-Aug 23Document13 pagesMA2 Syllabus and Study Guide - Sept 22-Aug 23amandaNo ratings yet

- Ieps 2 Information TechnoDocument63 pagesIeps 2 Information TechnofelixjmhNo ratings yet

- FA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 DatesDocument19 pagesFA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 Datesmyselftaha7No ratings yet

- IntroDocument18 pagesIntroDrishti PriyaNo ratings yet

- Business and Technology (BT/FBT) : Syllabus and Study GuideDocument18 pagesBusiness and Technology (BT/FBT) : Syllabus and Study GuideMeril JahanNo ratings yet

- 01 Inetial PagesDocument33 pages01 Inetial PagesTushar RathiNo ratings yet

- Paper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsDocument1 pagePaper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsKarandeep Singh TuliNo ratings yet

- MA2 Syllabus and Study Guide 2020-21 FINAL V2Document14 pagesMA2 Syllabus and Study Guide 2020-21 FINAL V2Mokoena RalesupiNo ratings yet

- Management Accounting (MA/FMA) : Syllabus and Study GuideDocument15 pagesManagement Accounting (MA/FMA) : Syllabus and Study Guideduong duongNo ratings yet

- IWCP Alternative Route How To Apply r10 May 2021Document4 pagesIWCP Alternative Route How To Apply r10 May 2021tauqeer salimNo ratings yet

- Exemptions From Appearing in Papers or Group of Chartered AccountancyDocument8 pagesExemptions From Appearing in Papers or Group of Chartered Accountancythe305boricuaNo ratings yet

- Revised Guidance NotesDocument12 pagesRevised Guidance NotesKc FungNo ratings yet

- Ma2 SyllabusDocument14 pagesMa2 Syllabusazizrehman15951No ratings yet

- Data Entry Operator CTS2.0 NSQF 3 NewDocument26 pagesData Entry Operator CTS2.0 NSQF 3 Newsanjit singhNo ratings yet

- Indirect Tax Laws: Final Course Study MaterialDocument17 pagesIndirect Tax Laws: Final Course Study MaterialoverclockthesunNo ratings yet

- MA2 Syllabus and Study Guide 2020-21 FINALDocument14 pagesMA2 Syllabus and Study Guide 2020-21 FINALRumaisha BatoolNo ratings yet

- Financial Reporting: Final Course Study Material P 1Document29 pagesFinancial Reporting: Final Course Study Material P 1Gopika CANo ratings yet

- Professional Qualification Syllabus: The Institute of Chartered Accountants (Ghana)Document81 pagesProfessional Qualification Syllabus: The Institute of Chartered Accountants (Ghana)Abdallah Abdul JalilNo ratings yet

- Idt Vol-1 May Nov 2021 Exam PDFDocument616 pagesIdt Vol-1 May Nov 2021 Exam PDFSri Pavan100% (1)

- CA Transition SchemeDocument47 pagesCA Transition SchemeBhavitha SiriNo ratings yet

- FA2 Syllabus and Study Guide - Sept 22-Aug 23Document14 pagesFA2 Syllabus and Study Guide - Sept 22-Aug 23Ahmed RazaNo ratings yet

- NSQF - ELE - Q4701 - IT Coordinator in School - L4 - 0Document23 pagesNSQF - ELE - Q4701 - IT Coordinator in School - L4 - 0ShamsNo ratings yet

- Intermediate Course Study Material: TaxationDocument14 pagesIntermediate Course Study Material: Taxationtauseefalam917No ratings yet

- GST Icai BoookDocument789 pagesGST Icai Boooknsaiakshaya16No ratings yet

- 75282bos Transition Scheme NsetDocument54 pages75282bos Transition Scheme NsetPranay JaiswalNo ratings yet

- 74932bos Transition Scheme NsetDocument47 pages74932bos Transition Scheme NsetShubhamNo ratings yet

- Icag New Syllabus 2024Document98 pagesIcag New Syllabus 2024ekadanu CAGL100% (1)

- Cts Copa (Vi) Cts Nsqf-3Document39 pagesCts Copa (Vi) Cts Nsqf-3Lakhan Kaiwartya0% (1)

- Bos 41987 in It PagesDocument17 pagesBos 41987 in It PagesAnju TresaNo ratings yet

- 3 NITTT Scheme DocumentDocument6 pages3 NITTT Scheme DocumentLokesh SNo ratings yet

- Fa2 SyllabusDocument19 pagesFa2 Syllabusazizrehman15951No ratings yet

- OJT Journal 1.1Document33 pagesOJT Journal 1.1cheny presbiteroNo ratings yet

- Register of Public Health Nutritionists: BackgroundDocument2 pagesRegister of Public Health Nutritionists: BackgroundRubina HakeemNo ratings yet

- IPCE New May 2022 Guidance NotesDocument20 pagesIPCE New May 2022 Guidance Noteslove smileNo ratings yet

- Dipifr SG Dec22 Jun23Document14 pagesDipifr SG Dec22 Jun23PAPPU SWAROOP MAHADEV VU21MGMT0300006No ratings yet

- NCC Direct Entry and Exemptions 2012-2013Document39 pagesNCC Direct Entry and Exemptions 2012-2013Loveness MahamboNo ratings yet

- Accounting Study Material - UnlockedDocument925 pagesAccounting Study Material - UnlockedCan I Get 1000 Subscribers100% (1)

- Diploma in Banking & FinanceDocument10 pagesDiploma in Banking & FinanceJayashree JothivelNo ratings yet

- Latest Journal 2021 22Document35 pagesLatest Journal 2021 22Angelica Veron AlferezNo ratings yet

- MA1 - Sept 23-Aug 24 Syllabus and Study Guide - FinalDocument11 pagesMA1 - Sept 23-Aug 24 Syllabus and Study Guide - Finalmoni123456No ratings yet

- Guidelines and Policies For The School of I.T. and I.S. Ojt/Internship CoursesDocument18 pagesGuidelines and Policies For The School of I.T. and I.S. Ojt/Internship Coursesedwardgarcia333No ratings yet

- Initial PagesDocument17 pagesInitial PagesAadityaNo ratings yet

- BT - FBT Syllabus and Study Guide - Sept 22-Aug 23Document19 pagesBT - FBT Syllabus and Study Guide - Sept 22-Aug 23juliet nnajiNo ratings yet

- BT Syllabus and Study Guide 2020-21 FINALDocument19 pagesBT Syllabus and Study Guide 2020-21 FINALarpit soniNo ratings yet

- BT Syllabus and Study Guide 2020-21 FINALDocument19 pagesBT Syllabus and Study Guide 2020-21 FINALBondhu GuptoNo ratings yet

- IPC SC-11-02 Specification On Training Issue 2 2019Document16 pagesIPC SC-11-02 Specification On Training Issue 2 2019saladinNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- MCQ in Amplitude ModulationDocument10 pagesMCQ in Amplitude ModulationMohammed AbbasNo ratings yet

- 03 Product SpecificationDocument10 pages03 Product Specificationxor_45No ratings yet

- Sunsynk Hybrid Inverter 3.6 5 UserManual v28 EnglishDocument81 pagesSunsynk Hybrid Inverter 3.6 5 UserManual v28 Englishprobeeriets6No ratings yet

- Category:UR Madam / Sir,: Please Affix Your Recent Passport Size Colour Photograph & Sign AcrossDocument2 pagesCategory:UR Madam / Sir,: Please Affix Your Recent Passport Size Colour Photograph & Sign AcrossVasu Ram JayanthNo ratings yet

- Exterior & Interior: SectionDocument44 pagesExterior & Interior: Sectiontomallor101No ratings yet

- User'S Manual: Doc. No. 4D060Document8 pagesUser'S Manual: Doc. No. 4D060Ra HulNo ratings yet

- M.bed Back WallDocument1 pageM.bed Back WallAMAZE INTERIORNo ratings yet

- Website ErrorDocument5 pagesWebsite ErrorJosé DavidNo ratings yet

- Pregnancy-Related Pelvic Girdle Pain: Second Stage of LabourDocument4 pagesPregnancy-Related Pelvic Girdle Pain: Second Stage of LabourSravan Ganji100% (1)

- Sales and Purchases 2021-22Document15 pagesSales and Purchases 2021-22Vamsi ShettyNo ratings yet

- TENSYMP - Special TRACK - Climate SmartDocument1 pageTENSYMP - Special TRACK - Climate SmartMayurkumar patilNo ratings yet

- 0399 PDFDocument243 pages0399 PDFOnCo TallaNo ratings yet

- Social Venture Inherent Constitution:: Perceptions of ValueDocument3 pagesSocial Venture Inherent Constitution:: Perceptions of ValuePallavi GuptaNo ratings yet

- SLEM - PC11AG - Quarter1 - Week6Document30 pagesSLEM - PC11AG - Quarter1 - Week6Madz MaitsNo ratings yet

- Sunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts-Not For Profit OrganisationDocument3 pagesSunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts-Not For Profit OrganisationHigi SNo ratings yet

- Notre Dame of Masiag, Inc.: What Formativ e Question S Shall Lead To The Completi On of Efaa? ToDocument2 pagesNotre Dame of Masiag, Inc.: What Formativ e Question S Shall Lead To The Completi On of Efaa? ToLANY T. CATAMINNo ratings yet

- The Equilibrium Constant For Bromothymol BlueDocument3 pagesThe Equilibrium Constant For Bromothymol BlueorjuelabernajhgNo ratings yet

- Full Download Elementary Statistics A Step by Step Approach Bluman 9Th Edition Solutions Manual PDFDocument49 pagesFull Download Elementary Statistics A Step by Step Approach Bluman 9Th Edition Solutions Manual PDFsteven.engelke246100% (21)

- Iphone DissertationDocument7 pagesIphone DissertationPapersWritingServiceCanada100% (1)

- Blake Problem ComputationDocument3 pagesBlake Problem ComputationNiño del Mundo75% (4)

- Human Behavior Management (Introduction)Document17 pagesHuman Behavior Management (Introduction)Paola QuintosNo ratings yet

- Braintree 15Document6 pagesBraintree 15paypaltrexNo ratings yet

- Bou Stead 2012Document16 pagesBou Stead 2012huynhvanchauNo ratings yet

- Bunker & FW Supply ChecklistDocument3 pagesBunker & FW Supply ChecklistSampetua StmrgNo ratings yet

- Free Bhel Transformer Book PDFDocument4 pagesFree Bhel Transformer Book PDFMilan ShahNo ratings yet

- Three Phase Induction Motor - Squirrel Cage: Data SheetDocument6 pagesThree Phase Induction Motor - Squirrel Cage: Data Sheetjulio100% (1)

- PAFLU Vs Sec of LaborDocument1 pagePAFLU Vs Sec of LaborMavic Morales100% (1)

- EC 03 - Archetypes - GM BinderDocument128 pagesEC 03 - Archetypes - GM BinderLeonxdNo ratings yet

- Serial AcquirersDocument54 pagesSerial AcquirersArturo OrtegaNo ratings yet