Professional Documents

Culture Documents

Suzlon Energy LTD Initiation

Suzlon Energy LTD Initiation

Uploaded by

myself69Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suzlon Energy LTD Initiation

Suzlon Energy LTD Initiation

Uploaded by

myself69Copyright:

Available Formats

2

Suzlon Energy Ltd: Buy Note

India’s announcement that it aims to reach net zero emissions by 2070 and to meet fifty percent of its

electricity requirements from renewable energy sources by 2030 is a hugely significant moment for

the global fight against climate change. Most of the growth in demand this decade would have to be

met with low carbon energy sources in the renewables space. Renewables growth is expected to be

driven by Wind and Solar. In its plan to achieve the goal of 500GW of renewable energy by 2030, GOI

is targeting 100GW from wind energy (currently at 43GW).

The two decades crown of debt laden business and saga’s around Suzlon energy have now come an

end. The business has witnessed change due to various debt restructuring activities along with sectoral

tailwinds and government push towards renewables energy. The company with 33% market share in

the wind segment, wind and solar being the lowest cost optimal solution for a decarbonised grid as

per the ministry of power; Suzlon Energy became the natural beneficiary of the tailwinds; Reduced

interest costs, enhanced efficiencies, consistent OMC business cashflows, up to date technology and

constant deployment in R&D; Suzlon is well equipped to leverage the market opportunity arising from

energy transition. Thus, we initiate a “BUY” on Suzlon Industries on August 28, 2023.

About Suzlon

The Suzlon Group is one of the leading renewable energy solutions providers in the world with more

than 20 GW* of wind energy capacity installed across 17 countries. A vertically integrated organisation,

with in-house research and development (R&D) centres in Germany, the Netherlands, Denmark and

India, Suzlon’s world-class manufacturing facilities are spread across 14 locations in India. With over

28 years of operational track record, the Group has a diverse workforce of nearly 6,000 employees.

Suzlon is also India’s No. 1 wind energy service company with the largest service portfolio of over 14

GW of wind energy assets. The Group has ~6 GW of installed capacity outside India. The 3 MW Series

wind turbine technology platform is the latest addition to its comprehensive product portfolio.

Wind Turbine Generators: Suzlon is the leading manufacturer of wind turbine components. It also

focuses on the integrated design, engineering, development, and manufacture of technologically

advanced wind turbine generators (“WTGs”). The largest wind installed base as a wind energy OEM

with 14.16 GW of installed capacity in India as at June 30, 2023, contributing towards approximately

33% of India’s wind installed base as at that date, and an installed capacity of 5.96 GW outside India,

aggregating to a global installed capacity of 20.12 GW, as at June 30, 2023.

Operation and Maintenance Services: Suzlon has ~14GW of wind power plant capacity under O&M

services. Company’s service business contributes ~30% of the total revenue as of March 23, and has

been growing at a steady rate. Suzlon’s services business yields higher margins than pure turbine

manufacturing and offers steady long-term growth. This business has remained resilient to cyclicality

and uncertainty in the wind power projects business.

Forgings and foundry components: Through its subsidiary, SE Forge Limited (SEFL), Suzlon

manufactures forging and foundry components that are required for the manufacture of WTGs and

their components. Suzlon Energy caters to captive as well as external companies through this segment.

Key Investment Thesis

1. Business with great ingredients to become a business in its second innings. Rarely do we see

businesses do well once they have been overburdened with debt. Suzlon is one of the rare

businesses which has showcased a comeback. During the entire debt saga for Suzlon, its OMS

Purnartha Investment Advisers Pvt Ltd

CIN: U72200PN2011PTC 138994

32/33 Rachna, Dr Ketkar Road, Off Karve Road, Erandwane, Pune - 411 004 servicedesk@purnartha.com|www.purnartha.com

Non-Individual Investment Advisor|IA SEBI Regn. No: INA000000672|Validity: Perpetual | SEBI Regn. No: INP000007021|Validity:

Perpetual | Email: principalofficer-IA@purnartha.com I Telephone: Principal officer-020 49127100|Call Us at +919011055553

For the complete list of office addresses and corresponding SEBI regional/local offices, please refer our website www.purnartha.com

3

Business segments provided a strong cushion, maintained cash flows generation capability

throughout the misfortunes of the wind turbines segment. Approx 1800Cr+ revenue has been

generated from the OMS segment consistently in the past 5+ years and consistently growing

at 4-5%.

2. The company would move from 1 GW to 3GW capacity in the WTG over the 3 years which

would be the highest market share within the Indian wind energy space. With reduced

financing costs, these additions would increase earning over the next 2-3 years over and above

the OMC segment. Forgins and Foundry business receives maximum business from outside

the Suzlon group. Thus, WTG growth coupled with OMC and forgings business would lead to

high PAT growth.

3. India continues to be one of the cheapest in terms of cost per unit of electricity. As we witness

these going up, along with continuous capacity addition and technology upgradation, the

realisation per unit should see and uptick.

The Second Innings story: Journey from debt heavy to net cash

Since 2000 the company’s growth was on back of steroids: - raise money, grow capacities, and acquire

companies. However, post the global financial crises, Suzlon saw decline in installations, project

cancellations and deferrals leading to working capital challenges and huge losses.

After FY 15, Suzlon decided to focus on domestic market and exit from all international markets. The

company initiated its first stage of debt reduction in FY15-17 by selling its subsidiary Senvion SE to

Centerbridge Partners generating Rs.72Bn. Shift from feed in tariff regime for wind projects to e-

reverse bidding mechanism led to sharp reduction in wind installation. Thus, the company continued

to report losses betweenFY20-FY22.

In the second stage of its debt restructuring, it reduced its debt from Rs.130Bn to Rs.19Bn between

FY20-FY23 by converting its debt to equity and raising Rs.12Bn through rights issue. The company

continues to reduce debt through selling non-core assets.

The company recently has approved a Rs.20Bn QIP to complete its final stage of debt reducing

strategies to become a net cash business.

Exhibit: Suzlon’s Debt over years (in Crore), Annual Reports

Suzlon's Debt position over years (In Crore)

20,000

17,811

18,000 17,052

16,000 15,191

14,034

14,000

11,120 11,605

12,000

9,624 9,759

10,000

8,000 6,917 6,465

6,269

6,000

4,000

1,938

2,000

0

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Purnartha Investment Advisers Pvt Ltd

CIN: U72200PN2011PTC 138994

32/33 Rachna, Dr Ketkar Road, Off Karve Road, Erandwane, Pune - 411 004 servicedesk@purnartha.com|www.purnartha.com

Non-Individual Investment Advisor|IA SEBI Regn. No: INA000000672|Validity: Perpetual | SEBI Regn. No: INP000007021|Validity:

Perpetual | Email: principalofficer-IA@purnartha.com I Telephone: Principal officer-020 49127100|Call Us at +919011055553

For the complete list of office addresses and corresponding SEBI regional/local offices, please refer our website www.purnartha.com

4

Industry Tailwinds

Not a pick between solar and wind; Wind a mandatory requirement

The lowest-cost solution for an optimal decarbonised grid is a mix of wind, solar and battery storage

capacities. Wind generates power in monsoon and nights when solar generation is low. Higher wind

will lead to lower battery storage requirement for a decarbonised grid. The national goal of 500GW of

renewable energy by 2030, is targeting 100GW to come from wind energy (currently at 43GW).

Wind Solar Hybrid Segment : SECI has come up with project tenders which are in form of hybrid,

round-the-clock, and peak power supply projects. To term a project as hybrid, the minimum required

share of solar/ wind technology is 33%. Also, Utility scale battery technology is still in the nascent

stages and is relatively expensive at the current stage of evolution. While the cost of battery storage is

likely to reduce, storage is still going to be a costly affair. As of now, storage is 3x costlier than wind

power. Battery storage remains the best long-term solution towards decarbonisation; however, it is

still an economically unviable solution for India due to high costs.

Exhibit 1: Power Generating Cost across different modes

Mode of Generation Energy Cost/Unit BESS/Unit Tariff

Solar 2.5 7.5 10

Wind 3 7 10

Solar +Wind 2.7 2.7

Conventional 4 4

Policy Initiatives:

• Reverse e-bidding process which had led to decline in capacity addition is discontinued,

replaced by two envelope bidding.

• Introducing wind-specific renewable purchase obligations (RPOs). By 2030, 7% of the total

requirement of power by the Ministry would be purchased from wind energy. (Currently at

0.8%). Over and above this there is a sizeable chunk of C&I (Commercial & Industrial)

customers who are obligated for RPO fulfilment which will further add to RE installations in

the country.

• Apex electricity planning authority has advocated 8GW of capacity addition p.a. and bids of

10GW across states with a cap of 2GW p.a. between FY24-FY28.

• Pooled wind power from various states to be passed on at blended cost under the PPAs to

Discoms.

Ageing Capacity

India started wind energy installation in 2003. Several turbines are old and of lower capacities leading

to suboptimal utilisation of the wind resources at the site. Wind turbines are expected to lose 1-1.5%

of their output per year. An aged fleet also necessitates condition-based monitoring to predict the

maintenance issues pre- and post-repowering. There is already a policy in place for repowering of

turbines by the MNRE. Moreover, repowering costs less than a new project because existing land and

infrastructure are being used. It also reduces the risk associated with worn out assets. Thus, aged

assets and repowering poses a great opportunity for O&M services.

Purnartha Investment Advisers Pvt Ltd

CIN: U72200PN2011PTC 138994

32/33 Rachna, Dr Ketkar Road, Off Karve Road, Erandwane, Pune - 411 004 servicedesk@purnartha.com|www.purnartha.com

Non-Individual Investment Advisor|IA SEBI Regn. No: INA000000672|Validity: Perpetual | SEBI Regn. No: INP000007021|Validity:

Perpetual | Email: principalofficer-IA@purnartha.com I Telephone: Principal officer-020 49127100|Call Us at +919011055553

For the complete list of office addresses and corresponding SEBI regional/local offices, please refer our website www.purnartha.com

5

Market leader to become natural beneficiary

Constant R&D Upgradation: The company has been constantly investing in R&D and has kept up with

global innovations at its R&D centre in Germany. It launched a 3MW turbine with a hybrid lattice

tubular tower which will have higher realisations per MW (than earlier versions) and will have wider

rotor diameter, delivering higher energy output at lower cost. Out of the current order book of

1542MW, 780MW is for the new 3 MW series. Company continues to introduce improved machines

which can operate at sites with low wind speed.

Exhibit:2 Technological development and higher energy output for the WTG

Operating and Maintenance Business: Suzlon has ~14GW of wind power plant capacity under O&M

services. Company’s service business contributes ~30% of the total revenue, and has been growing at

a steady rate. Suzlon’s services business yields higher margins than pure turbine manufacturing and

offers steady long-term growth. Suzlon has retained 100% of its existing O&M contracts that come up

for renewal each year vs 75% each for competitors like Vestas and Gamesa, the global wind turbine

manufacturers

Reducing Interest cost: Suzlon’s gross debt has reduced drastically from Rs130bn in FY20 to Rs19bn as

of Mar’23. Thus, owing to reduced debt, the interest cost burden would moderate from here onwards.

Purnartha Investment Advisers Pvt Ltd

CIN: U72200PN2011PTC 138994

32/33 Rachna, Dr Ketkar Road, Off Karve Road, Erandwane, Pune - 411 004 servicedesk@purnartha.com|www.purnartha.com

Non-Individual Investment Advisor|IA SEBI Regn. No: INA000000672|Validity: Perpetual | SEBI Regn. No: INP000007021|Validity:

Perpetual | Email: principalofficer-IA@purnartha.com I Telephone: Principal officer-020 49127100|Call Us at +919011055553

For the complete list of office addresses and corresponding SEBI regional/local offices, please refer our website www.purnartha.com

6

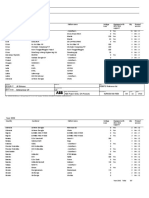

Exhibit: Financial Analysis of the company

Particulars (In Crores) Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23

Net Sales 21,359 18,914 20,403 19,954 9,483 12,714 8,116 5,025 2,973 3,346 6,582 5,971

WTG 20,953 18,654 20,117 19,709 7,654 10,256 5,388 2,849 595 1,193 4,376 3,781

OMS 1,665 1,755 1,754 1,907 1,995 1,885 1,825 1,889

Foundry & Forging 309 128 126 176 389 491 360 357 432 334 477 472

Others 43 22 12 10 34 603 1,273 88 22 9 8 7

Other Operating Revenue 277 170 191 118 54 22 42 46 40 51 62 24

Inter Segment -222 -61 -43 -59 -312 -412 -700 -222 -112 -127 -166 -202

COGS 14,074 13,640 14,435 13,619 5,604 7,543 5,116 2,998 1,874 1,577 4,332 3,783

Gross Profit 7,285 5,274 5,967 6,336 3,880 5,171 3,000 2,026 1,099 1,768 2,250 2,188

GP Margin 34% 28% 29% 32% 41% 41% 37% 40% 37% 53% 34% 37%

EBITDA ** 1,821 -1,296 -141 316 1,102 2,498 1,003 -8 -856 537 889 832

EBITDA Margin 8.5% -6.9% -0.7% 1.6% 11.6% 19.6% 12.4% -0.2% -28.8% 16.1% 13.5% 13.9%

Other Income 126 152 71 53 98 89 79 50 28 20 22 20

Exceptional Income/ (Exp) 227 -643 -487 -6,312 1,080 450 28 -66 805 83 2,721

Interest 1655 1855 2070 2065 1304 1288 1581 1270 1367 996 735 421

Depreciation 661 740 777 809 392 389 342 342 419 258 260 260

Profit After Tax *** -479 -4724 -3548 -9133 583 852 -384 -1537 -2692 104 -177 2887

CFO 839 556 568 1,119 -739 1,609 -109 1,267 -929 530 1,302 467

Debt 14,034 15,191 17,052 17,811 11,120 6,917 11,605 9,624 9,759 6,269 6,465 1,938

Net Debt 11,338 13,232 13,903 15,018 10,226 6,100 11,023 9,549 9,676 6,007 5,965 1,571

Total Equity 4,895 823 -439 -7,386 -7,533 -6,833 -6,957 -8,503 -11,042 -3,401 -3,562 1,099

*The segmental reporting is available only from March 2016.

***EBITDA before exceptional items

***Profit After Tax Includes minority interest

Outlook – The company is poised to witness revenue growth of around 30-35% for the next two years,

improving EBITDA margins inching 16-18%, from existing 13.9%, thus reporting PAT north of Rs.11Bn

and Rs.13Bn for FY24 and FY25 respectively. The stock is trading at 25X FY25 EPS, thus well placed to

capitalise on the tailwinds, deleveraged balance sheet and robust order book.

Recommendation

Over the years, Suzlon sold its foreign businesses and has decided to focus purely on the domestic

market. Government policy and the business environment for wind capacity is looking up after a long

time. Suzlon, being the market leader in the domestic market, is expected to be the natural beneficiary.

We expect Suzlon to add additional capacities to the extent of 3GW in the next 2-3 years, coupled with

strong OMC and forgings business, Higher revenue growth along with reduced debt burden, would

lead to higher PAT growth. Thus, we initiate a BUY on Suzlon.

Purnartha Investment Advisers Pvt Ltd

CIN: U72200PN2011PTC 138994

32/33 Rachna, Dr Ketkar Road, Off Karve Road, Erandwane, Pune - 411 004 servicedesk@purnartha.com|www.purnartha.com

Non-Individual Investment Advisor|IA SEBI Regn. No: INA000000672|Validity: Perpetual | SEBI Regn. No: INP000007021|Validity:

Perpetual | Email: principalofficer-IA@purnartha.com I Telephone: Principal officer-020 49127100|Call Us at +919011055553

For the complete list of office addresses and corresponding SEBI regional/local offices, please refer our website www.purnartha.com

7

Disclaimer: Purnartha Investment Advisers Pvt. Ltd provides advisory and portfolio management services under the brand

name “Purnartha”. Investments in securities markets are subject to market risks and there is no assurance or guarantee that

the objectives of the investments/investment products/clients will be achieved. Past performance is not indicative of future

returns. Investors are advised to review the Client Agreement and other related documents carefully and in its entirety and

consult their legal, tax and financial advisers to determine possible legal, tax and financial or any other consequences of

investing as per the investment advisory of Purnartha. Purnartha accepts no liability whatsoever for any direct or

consequential loss or damage arising from any use of any information in this document. Registration granted by SEBI,

membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any

assurance of returns to investor. There is no assurance or guarantee that the objectives of the investments / investment

products will be achieved. The information and content in this section of the website are subject to change without notice.

The brand names and/or logos used in this document are the intellectual property of the respective companies and the use of

the same is only for identification purpose.

All the summary, recommendations and comparisons are the independent expert opinion of Purnartha based on quarterly

results, press releases, etc. published by the respective companies, which are publicly available. While utmost diligence has

been exercised regarding the accuracy of information contained in this document, please independently verify such

information before relying on it.

The contents of this document are confidential and are intended for the recipient specified in the covering e-mail/letter of this

document only. This document or part thereof should not be shared without the written consent of Purnartha.

Purnartha Investment Advisers Pvt Ltd

CIN: U72200PN2011PTC 138994

32/33 Rachna, Dr Ketkar Road, Off Karve Road, Erandwane, Pune - 411 004 servicedesk@purnartha.com|www.purnartha.com

Non-Individual Investment Advisor|IA SEBI Regn. No: INA000000672|Validity: Perpetual | SEBI Regn. No: INP000007021|Validity:

Perpetual | Email: principalofficer-IA@purnartha.com I Telephone: Principal officer-020 49127100|Call Us at +919011055553

For the complete list of office addresses and corresponding SEBI regional/local offices, please refer our website www.purnartha.com

You might also like

- A320 EngineDocument4 pagesA320 Enginemorteeza1986100% (1)

- Solar Energy B Plan SampleDocument44 pagesSolar Energy B Plan Sampleakram100% (1)

- File 1686285992733Document20 pagesFile 1686285992733Tomar SahaabNo ratings yet

- Finance CaseDocument8 pagesFinance CaseGaurav KumarNo ratings yet

- National Stock Exchange of India Limited, BSE Limited,: Geetanjali Santosh VaidyaDocument21 pagesNational Stock Exchange of India Limited, BSE Limited,: Geetanjali Santosh VaidyaManish PatraNo ratings yet

- National Stock Exchange of India Limited, BSE Limited,: Geetanjali Santosh VaidyaDocument22 pagesNational Stock Exchange of India Limited, BSE Limited,: Geetanjali Santosh VaidyaManish PatraNo ratings yet

- FINANCIAL AnalystDocument54 pagesFINANCIAL AnalystZiyadNo ratings yet

- Suzlon Energy Call TranscriptDocument19 pagesSuzlon Energy Call TranscriptKishor TilokaniNo ratings yet

- Project Report (Corporatetek Technology)Document12 pagesProject Report (Corporatetek Technology)Aditya JaggiNo ratings yet

- Suzlo N: Powering A Greener TomorrowDocument9 pagesSuzlo N: Powering A Greener TomorrowaralsemwalNo ratings yet

- Finance M-5Document30 pagesFinance M-5Vrutika ShahNo ratings yet

- Indonesia Renewables Report Q1 22 - FitchDocument17 pagesIndonesia Renewables Report Q1 22 - FitchFTNo ratings yet

- Press Release - Suzlon Maintains Lead With A Strong Order BacklogDocument3 pagesPress Release - Suzlon Maintains Lead With A Strong Order BacklogZeveNo ratings yet

- Silcasia Energy Project OverviewDocument2 pagesSilcasia Energy Project OverviewMohammed JowardharNo ratings yet

- Entrepreneurship and New Venture Creation Business Plan For: Group 6Document15 pagesEntrepreneurship and New Venture Creation Business Plan For: Group 6Gaurav KumarNo ratings yet

- FIN 444 Final ProjectDocument13 pagesFIN 444 Final ProjectAli Abdullah Munna 1410788030No ratings yet

- Akash Internship ProjectDocument68 pagesAkash Internship Projectmohittandel100% (1)

- Suzldn: Ational Tock Han of Ind I T D B M T DDocument249 pagesSuzldn: Ational Tock Han of Ind I T D B M T DNavneet SharmaNo ratings yet

- Suzlon Energy Analyst ReportDocument24 pagesSuzlon Energy Analyst ReportanupamrcNo ratings yet

- PBB Hartalega NGC Land 13 June 2013Document5 pagesPBB Hartalega NGC Land 13 June 2013Piyu MahatmaNo ratings yet

- Suzlon Annual ReportDocument154 pagesSuzlon Annual ReportcabhargavNo ratings yet

- Ipo For Rec: Financial Services and Institutions AssignmentDocument34 pagesIpo For Rec: Financial Services and Institutions AssignmentarchitkhareNo ratings yet

- INSOLARE EnergyDocument27 pagesINSOLARE EnergyManisheel GautamNo ratings yet

- MarketingDocument40 pagesMarketingnprash123No ratings yet

- 3 India 2007Document20 pages3 India 2007pmanikNo ratings yet

- BvfibibiDocument18 pagesBvfibibiAjNo ratings yet

- Suntech Energy Solutions: Quality Solar Systems, Survey, Instalation and RepairDocument30 pagesSuntech Energy Solutions: Quality Solar Systems, Survey, Instalation and RepairVincent KohNo ratings yet

- Rmcom 2329 PORTFOLIO ANALYSIS O STOCKDocument20 pagesRmcom 2329 PORTFOLIO ANALYSIS O STOCKSuraiya PatelNo ratings yet

- JSW CompanyDocument45 pagesJSW CompanyVrudra GadakhNo ratings yet

- Binging Big On BTG : BUY Key Take AwayDocument17 pagesBinging Big On BTG : BUY Key Take AwaymittleNo ratings yet

- BORORENEW - Investor Presentation - 06-May-22 - TickertapeDocument53 pagesBORORENEW - Investor Presentation - 06-May-22 - TickertapebhanupalavarapuNo ratings yet

- FS FinalDocument18 pagesFS FinalMohammed SobhyNo ratings yet

- Samnidhy Newsletter Vol 3 Issue 33 PDFDocument13 pagesSamnidhy Newsletter Vol 3 Issue 33 PDFAsanga KumarNo ratings yet

- Inox WindDocument15 pagesInox WindRaaakNo ratings yet

- Ptmail m1219 Ss Two Stock Special Report PDFDocument18 pagesPtmail m1219 Ss Two Stock Special Report PDFAaron MartinNo ratings yet

- Mercom India Cleantech Report Jul2023Document13 pagesMercom India Cleantech Report Jul2023aakashNo ratings yet

- Bnef-Cif Fi Project 2030 Roadmap Slide Deck IndonesiaDocument41 pagesBnef-Cif Fi Project 2030 Roadmap Slide Deck Indonesianita SNo ratings yet

- Suz Lon Energy LimitedDocument31 pagesSuz Lon Energy LimitedSanjeev PaliseryNo ratings yet

- BHEL Q1FY20 ConCall Transcript 090819Document18 pagesBHEL Q1FY20 ConCall Transcript 090819Abhishek SoniNo ratings yet

- Prospects of Energy Transition in IndonesiaDocument30 pagesProspects of Energy Transition in IndonesiaPuspa LestariNo ratings yet

- Pragnes H Darji: Digitally Signed by Pragnesh Darji Date: 2022.12.27 15:56:44 +05'30'Document104 pagesPragnes H Darji: Digitally Signed by Pragnesh Darji Date: 2022.12.27 15:56:44 +05'30'virupakshudu kodiyalaNo ratings yet

- Be End21uwsl01c02 202304010016 Kashak AgarwalaDocument14 pagesBe End21uwsl01c02 202304010016 Kashak Agarwala202304010016No ratings yet

- Rcncwoblcs: Pragnes H DarjiDocument118 pagesRcncwoblcs: Pragnes H Darjivirupakshudu kodiyalaNo ratings yet

- Suzlon Enegry Ltd-11 Annual Report PDFDocument162 pagesSuzlon Enegry Ltd-11 Annual Report PDFVineet SinghNo ratings yet

- Q1 FY23 Earnings Conference Call TranscriptDocument13 pagesQ1 FY23 Earnings Conference Call TranscriptAbhishek Singh DeoNo ratings yet

- AR Summit 2016-17 PDFDocument184 pagesAR Summit 2016-17 PDFSumaiya RahmanNo ratings yet

- Company Outlook: by Pranav KhannaDocument4 pagesCompany Outlook: by Pranav Khannapranav khannaNo ratings yet

- Suzlon EnergyDocument14 pagesSuzlon Energyjanhavi aryaNo ratings yet

- Ieema Journal August 2015Document87 pagesIeema Journal August 2015Vepty whoopsNo ratings yet

- Power IPO Note (Updated)Document4 pagesPower IPO Note (Updated)Mostafa Noman DeepNo ratings yet

- Suzlon Energy IC Jun23Document46 pagesSuzlon Energy IC Jun23dpdhillonNo ratings yet

- Sembcorp AnnualReport 2010 2Document129 pagesSembcorp AnnualReport 2010 2Ahl BatchoneveeNo ratings yet

- What Is An IPO..??: Financial Management Project ONDocument19 pagesWhat Is An IPO..??: Financial Management Project ONShashank JainNo ratings yet

- LFT 5 Z 6Document25 pagesLFT 5 Z 6Quint WongNo ratings yet

- India Solar Handbook 2016 PDFDocument33 pagesIndia Solar Handbook 2016 PDFalkanm750No ratings yet

- AspireBuzz Issue-1Document4 pagesAspireBuzz Issue-1Sanskriti JainNo ratings yet

- LB5229 Business Study Report ExampleDocument28 pagesLB5229 Business Study Report ExampleSuriya PrasanthNo ratings yet

- Adani BuyDocument13 pagesAdani BuySunil BhunejaNo ratings yet

- Annual Report 2018-19Document252 pagesAnnual Report 2018-19Sutanu PatiNo ratings yet

- A Brighter Future for Maldives Powered by Renewables: Road Map for the Energy Sector 2020–2030From EverandA Brighter Future for Maldives Powered by Renewables: Road Map for the Energy Sector 2020–2030No ratings yet

- Main JournalDocument10 pagesMain JournalHOW ISNo ratings yet

- Mineral Exploration EssayDocument1 pageMineral Exploration Essayeli bermiNo ratings yet

- V30ZMUDocument26 pagesV30ZMUmanuelsaenzNo ratings yet

- Brayton Cycle Closed Cycle OnlyDocument2 pagesBrayton Cycle Closed Cycle OnlyAlvin LoocNo ratings yet

- Impreza Service ManualDocument95 pagesImpreza Service ManualTaxiarhis ZoubosNo ratings yet

- Leed GA Practice Questions - QuestionsDocument35 pagesLeed GA Practice Questions - QuestionsAl-Madinah Al-MunawarahNo ratings yet

- Tax CreditsDocument12 pagesTax CreditsAshton KhanchandaniNo ratings yet

- 21-22 PhO Test Paper SolDocument7 pages21-22 PhO Test Paper Sol1A22 LI SIU MAN 李兆旻No ratings yet

- WIDS-2000 (Water Ingress Detection System)Document4 pagesWIDS-2000 (Water Ingress Detection System)SAILING BLUESNo ratings yet

- Physics For Scientists and Engineers 3Rd Edition Fishbane Solutions Manual Full Chapter PDFDocument38 pagesPhysics For Scientists and Engineers 3Rd Edition Fishbane Solutions Manual Full Chapter PDFwadeperlid9d98k100% (11)

- Regulation No. 462 - 2012Document4 pagesRegulation No. 462 - 2012zekiNo ratings yet

- REB670 Reference ListDocument133 pagesREB670 Reference ListRaharjo YakinNo ratings yet

- Boiler Report ProjectDocument22 pagesBoiler Report ProjectAsad AyoubNo ratings yet

- Assignment 7 Quality Control ToolsDocument2 pagesAssignment 7 Quality Control ToolsrahmaNo ratings yet

- APU Tripac Maintenance ManualDocument1 pageAPU Tripac Maintenance Manualsamna6No ratings yet

- Leena&suryaDocument17 pagesLeena&suryamadesriNo ratings yet

- Geothermal Energy: Standard Terminology Relating ToDocument3 pagesGeothermal Energy: Standard Terminology Relating TopravkovoilaNo ratings yet

- Chicheng Tang ResumeDocument2 pagesChicheng Tang Resumeapi-705645954No ratings yet

- Infra & Energy PrelimsDocument18 pagesInfra & Energy PrelimsyogeshbNo ratings yet

- Digital 3 Phase Voltage Relay: DSP-DVR, DVR-M Main FeaturesDocument2 pagesDigital 3 Phase Voltage Relay: DSP-DVR, DVR-M Main FeaturesAngel MontoyaNo ratings yet

- Compressor Embraco 1 4 HP Emr80hlr R134a 220vDocument4 pagesCompressor Embraco 1 4 HP Emr80hlr R134a 220vPedro XppNo ratings yet

- Electronic ComponentsDocument17 pagesElectronic ComponentsEllieNo ratings yet

- Epd Pa66 gf25 Recycled EnglishDocument26 pagesEpd Pa66 gf25 Recycled EnglishShantha Kumar ParameswaranNo ratings yet

- Johns Manville - MinWool 1200 WR Lamella Tank WrapDocument2 pagesJohns Manville - MinWool 1200 WR Lamella Tank WrapLiu YangtzeNo ratings yet

- BASF CAT-002485 Sorbead Air Broschuere Update 03Document5 pagesBASF CAT-002485 Sorbead Air Broschuere Update 03Amir RahbariNo ratings yet

- CV YogiDocument3 pagesCV Yogiegi yugiNo ratings yet

- Instruction Manual Booster PumpDocument13 pagesInstruction Manual Booster PumpSyncroFlo IndonesiaNo ratings yet

- Installation Guide JAT710E 26Document136 pagesInstallation Guide JAT710E 26prasad kandavarapuNo ratings yet

- 45Mhz To 650Mhz, Integrated If Vcos With Differential OutputDocument15 pages45Mhz To 650Mhz, Integrated If Vcos With Differential OutputLeenus PeirisNo ratings yet