Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsKey Industry Hunting List

Key Industry Hunting List

Uploaded by

Ravi TiwariCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Business PlanDocument11 pagesBusiness Plan陈文源100% (2)

- Learn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies using Python and advanced data analysisFrom EverandLearn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies using Python and advanced data analysisNo ratings yet

- Met A Trader 4 For DummiesDocument20 pagesMet A Trader 4 For Dummiesbirko6180% (5)

- A1 BSBMKG542 Establish and Monitor The Marketing MixDocument7 pagesA1 BSBMKG542 Establish and Monitor The Marketing Mixmanish gurungNo ratings yet

- Introduction To MetaTrader 5 and Programming With MQL5 (Rafael - F. - v. - C. - Santos)Document154 pagesIntroduction To MetaTrader 5 and Programming With MQL5 (Rafael - F. - v. - C. - Santos)Paulo Rogerio100% (5)

- Automated Crypto Trading BotDocument6 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- How Charting SoftwareDocument18 pagesHow Charting SoftwareZARAH MAE UÑADANo ratings yet

- A Beginners Guide To Algorithmic Trading 2017Document49 pagesA Beginners Guide To Algorithmic Trading 2017Anonymous KeU4gphVL5100% (4)

- Algotradingbestalgorithmictradingexamples 240128173442 A0a31ff1Document11 pagesAlgotradingbestalgorithmictradingexamples 240128173442 A0a31ff1saktirajNo ratings yet

- Hentak FXDocument2 pagesHentak FXmohamad hifzhanNo ratings yet

- Algo TradingDocument128 pagesAlgo TradingdishaNo ratings yet

- Sacjcbkjcbndonbwe OnDocument1 pageSacjcbkjcbndonbwe OnpannyformeNo ratings yet

- Bitgear - Io-Whitepaper v5Document16 pagesBitgear - Io-Whitepaper v5Sean TanNo ratings yet

- Www-Altredo-com-Interactive Brokers Mt4 Bridge Trade CopierDocument4 pagesWww-Altredo-com-Interactive Brokers Mt4 Bridge Trade CopierALTREDONo ratings yet

- Identify An Enterprise and Give The Snapshot of The Company Websites With LinksDocument8 pagesIdentify An Enterprise and Give The Snapshot of The Company Websites With LinksAbbas KhanNo ratings yet

- All Slides - Delhi Algo Traders ConferenceDocument129 pagesAll Slides - Delhi Algo Traders ConferencenithyaprasathNo ratings yet

- Introduction To Algo TradingDocument50 pagesIntroduction To Algo TradingMark Luther100% (4)

- (Case Study 2) Investment Hedge With Portfolio ProtectionDocument4 pages(Case Study 2) Investment Hedge With Portfolio Protectionsanjay sharmaNo ratings yet

- Algorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesFrom EverandAlgorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Introduction To Algo TradingDocument50 pagesIntroduction To Algo TradingEugeny KNo ratings yet

- Tradingbot SampleDocument34 pagesTradingbot SampleMauricio AlbiniNo ratings yet

- (Free Ebook) Best Crypto Trading Tools & SoftwaresDocument20 pages(Free Ebook) Best Crypto Trading Tools & SoftwaresHaseeb100% (1)

- Black and Teal Futuristic Welcome To Metaverse Presentation (W)Document1 pageBlack and Teal Futuristic Welcome To Metaverse Presentation (W)Forex SniperNo ratings yet

- Liste Noire Forex 16 Mai 2023 0Document5 pagesListe Noire Forex 16 Mai 2023 0gbanemansara2No ratings yet

- How To Become A Successful Forex TraderDocument4 pagesHow To Become A Successful Forex Tradercms marketingNo ratings yet

- Advanced Use of The Trading Platform Metatrader 5 Creating Trading Robots and Indicators With Mql5 and Python 3Rd Edition Timur MashninDocument70 pagesAdvanced Use of The Trading Platform Metatrader 5 Creating Trading Robots and Indicators With Mql5 and Python 3Rd Edition Timur Mashninmelonymae9f100% (6)

- ZagTrader BrochureDocument6 pagesZagTrader Brochureshri.dxb0720No ratings yet

- Algorithmic Trading Directory - 2009 EditionDocument104 pagesAlgorithmic Trading Directory - 2009 Editionmotiwig6302100% (2)

- Liste Noire Forex 22 Aout 23Document5 pagesListe Noire Forex 22 Aout 23Junior Louis ChateilleNo ratings yet

- Liste Noire Forex 3 Novembre 2022 0Document5 pagesListe Noire Forex 3 Novembre 2022 0Aban ZOUNGRANANo ratings yet

- Thesis Algorithmic TradingDocument7 pagesThesis Algorithmic Tradingdianawalkermilwaukee100% (2)

- Xtrades Quick Start GuideDocument3 pagesXtrades Quick Start GuidePaljoNo ratings yet

- Financial Domain: Technology inDocument18 pagesFinancial Domain: Technology inRonitsinghthakur SinghNo ratings yet

- StabilityDocument2 pagesStabilityAhmad MukarramNo ratings yet

- Magic Quadrant For Trading Platforms, Gartner 12-2014Document32 pagesMagic Quadrant For Trading Platforms, Gartner 12-2014discomonkeeeee100% (1)

- Top10stockbroker 0 Comments: Online Trading - Meaning, Trading Process, Benefits, Order Types & MoreDocument8 pagesTop10stockbroker 0 Comments: Online Trading - Meaning, Trading Process, Benefits, Order Types & MoremuralikrishnavNo ratings yet

- Met A Trader Manual v1.01Document21 pagesMet A Trader Manual v1.01Santhosh KumarNo ratings yet

- An Introduction To "ALGORITHMIC" Trading: Rajeev RanjanDocument12 pagesAn Introduction To "ALGORITHMIC" Trading: Rajeev RanjanMots StingerNo ratings yet

- Investment AIDocument1 pageInvestment AIjoshikmohiitNo ratings yet

- Whitepaper QuopiDocument19 pagesWhitepaper Quopiliam veluNo ratings yet

- Releases Their Latest Algorithmic Trading System For S&P 500Document2 pagesReleases Their Latest Algorithmic Trading System For S&P 500PR.com100% (1)

- Liste Noire Forex 1er Juillet 2022 0Document4 pagesListe Noire Forex 1er Juillet 2022 0Diop IbrahimaNo ratings yet

- Investment Options: Trade In: Nse, Bse & MCX-SX, MCX, Ncdex, NmceDocument3 pagesInvestment Options: Trade In: Nse, Bse & MCX-SX, MCX, Ncdex, NmcePawan LohanaNo ratings yet

- PDF 1 - Instructions and Learning Module (Live Trading)Document18 pagesPDF 1 - Instructions and Learning Module (Live Trading)sundhar mohanNo ratings yet

- Copy Trading in Pakistan (Instructions)Document4 pagesCopy Trading in Pakistan (Instructions)IRP assignmentsNo ratings yet

- Algorithmic Trading: What Is, Why, How, When and WhereDocument11 pagesAlgorithmic Trading: What Is, Why, How, When and Wheresiulam1973gmNo ratings yet

- Algorithmic Trading Solutions: PE Cial EP OR TDocument15 pagesAlgorithmic Trading Solutions: PE Cial EP OR Taba3abaNo ratings yet

- Revolutionize Your Trading With Metaset - AiDocument2 pagesRevolutionize Your Trading With Metaset - AimetasetseoNo ratings yet

- The Technical Analyst WWW - Technicalanalyst.co - UkDocument2 pagesThe Technical Analyst WWW - Technicalanalyst.co - UkTUAN NGUYỄNNo ratings yet

- Foriegn Companies That Deals in Unlisted SharesDocument4 pagesForiegn Companies That Deals in Unlisted SharesAman JainNo ratings yet

- Automated Crypto Trading BotDocument7 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- "Forex Social Networking": MR - Hitesh Thakkar Tarang Patel (IU1253000030)Document39 pages"Forex Social Networking": MR - Hitesh Thakkar Tarang Patel (IU1253000030)hardikNo ratings yet

- G.E.T.S Automated Product ProfileDocument13 pagesG.E.T.S Automated Product ProfileSatya PrasadNo ratings yet

- OInvest - An Online Platform For Trading With High LeverageDocument7 pagesOInvest - An Online Platform For Trading With High Leveragemarshy bindaNo ratings yet

- MetaTrader 4 101Document20 pagesMetaTrader 4 101liamsjunk100% (2)

- Algorithmic TradingDocument27 pagesAlgorithmic TradingSmita Shah83% (6)

- Company Profile SharekhanDocument7 pagesCompany Profile Sharekhangarima_rathi0% (2)

- Getting Started in Creating Your Own Forex RobotsFrom EverandGetting Started in Creating Your Own Forex RobotsRating: 1 out of 5 stars1/5 (1)

- Social Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesFrom EverandSocial Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesNo ratings yet

- Job Description - Edge Sales SpecialistDocument2 pagesJob Description - Edge Sales SpecialistRavi TiwariNo ratings yet

- Virtual Private Cloud: Product IntroductionDocument14 pagesVirtual Private Cloud: Product IntroductionRavi Tiwari100% (1)

- Auto Scaling: Product IntroductionDocument7 pagesAuto Scaling: Product IntroductionRavi TiwariNo ratings yet

- Auo Scaling 2Document16 pagesAuo Scaling 2Ravi TiwariNo ratings yet

- ZZZZDocument9 pagesZZZZRavi TiwariNo ratings yet

- AlibabaCloud ACPDocument8 pagesAlibabaCloud ACPRavi Tiwari100% (1)

- Ent131 Chapter 9Document23 pagesEnt131 Chapter 9Classic KachereNo ratings yet

- Quiz 2 PPT TextDocument10 pagesQuiz 2 PPT TextRachel LuberiaNo ratings yet

- q3 2nd Sem Entre SummativeDocument2 pagesq3 2nd Sem Entre Summativejoanna may pacificarNo ratings yet

- FlipkartDocument40 pagesFlipkartShone Philips ThomasNo ratings yet

- PBM Unit 01Document19 pagesPBM Unit 01Aditya Raj ShrivastavaNo ratings yet

- Case ReportDocument4 pagesCase ReportAhmer shaikhNo ratings yet

- Alstom Pursues Asset Sales After Warning On Cash FlowDocument1 pageAlstom Pursues Asset Sales After Warning On Cash FlownelsonashwheelerNo ratings yet

- Analysis Report On Stock Market Trend Before Indian ElectionDocument8 pagesAnalysis Report On Stock Market Trend Before Indian ElectionMukta KapoorNo ratings yet

- Accounting Standard (AS) 9 Revenue RecognitionDocument12 pagesAccounting Standard (AS) 9 Revenue RecognitionKhushi KumariNo ratings yet

- Chapter 4 - Partnership DissolutionDocument15 pagesChapter 4 - Partnership DissolutionXyzra AlfonsoNo ratings yet

- Full Chapter Digital Assets and The Law Fiat Money in The Era of Digital Curency First Edition Filippo Zatti Rosa Giovanna Barresi Editors PDFDocument54 pagesFull Chapter Digital Assets and The Law Fiat Money in The Era of Digital Curency First Edition Filippo Zatti Rosa Giovanna Barresi Editors PDFjoan.houghton686100% (4)

- Functions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)Document10 pagesFunctions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)abhishek pathakNo ratings yet

- Investment Decision RulesDocument7 pagesInvestment Decision RulesQuỳnh Anh TrầnNo ratings yet

- Thesis Venture CapitalDocument7 pagesThesis Venture CapitalDaniel Wachtel100% (2)

- Conditionals ExercisesDocument2 pagesConditionals ExercisesKaterynaNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Revision WorksheetDocument2 pagesCBSE Class 11 Accountancy Worksheet - Revision Worksheetvarshitha reddyNo ratings yet

- Consumer Orientation Case StudyDocument2 pagesConsumer Orientation Case Studymalay.mahara20086No ratings yet

- BCIBF-102 Principles of Business ManagementDocument274 pagesBCIBF-102 Principles of Business ManagementS.M Documents SolutionsNo ratings yet

- 20 Difference Between Operating Leverage and Financial LeverageDocument2 pages20 Difference Between Operating Leverage and Financial LeverageVenkatsubramanian R IyerNo ratings yet

- Homebuying Step by Step Guide enDocument32 pagesHomebuying Step by Step Guide enPhil LNo ratings yet

- Harshit - Verma - PGFB2017Document59 pagesHarshit - Verma - PGFB2017harshkeshwani07No ratings yet

- Reynolds American Inc 5.85% 2045Document78 pagesReynolds American Inc 5.85% 2045jamesNo ratings yet

- ReSA Batch 47 ScheduleDocument1 pageReSA Batch 47 ScheduleyshizamNo ratings yet

- Reg Governing Emoney Issuers 2022Document74 pagesReg Governing Emoney Issuers 2022ice princeNo ratings yet

- Exercise 1Document3 pagesExercise 1Nor nimNo ratings yet

- 7893 28385 2 PBDocument12 pages7893 28385 2 PBk58 Duong Thi HangNo ratings yet

- Innovation and Entrepreneurship: PresentationDocument11 pagesInnovation and Entrepreneurship: PresentationPrachi AggarwalNo ratings yet

- ECON3007 Problem Set 2 2021-22Document2 pagesECON3007 Problem Set 2 2021-22barnestasha145No ratings yet

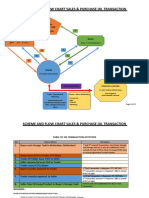

- FINAL - REVISED. Scheme and Flow Chart OIL TransactionDocument4 pagesFINAL - REVISED. Scheme and Flow Chart OIL TransactionPebb PondNo ratings yet

Key Industry Hunting List

Key Industry Hunting List

Uploaded by

Ravi Tiwari0 ratings0% found this document useful (0 votes)

3 views7 pagesOriginal Title

key industry hunting list

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views7 pagesKey Industry Hunting List

Key Industry Hunting List

Uploaded by

Ravi TiwariCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 7

company name website

iRage Capital http://iragecapital.com/

AlphaGrep http://www.alpha-grep.com/

Kivi Capital http://www.kivicapital.in/

Mansukh Securities http://www.moneysukh.com/

Algoji https://algoji.com/

Open Futures http://www.openfutures.in/

Dolat Capital http://www.dolatcapital.com/

MyFinDoc https://www.myfindoc.com/services/algo-trading

Kuants https://kuants.in/

TVISI Algo systems https://www.tvisi.in/about.asp

Algo profits https://algoprofits.in/

FinVAsia https://www.finvasia.com/

Quadeye https://www.quadeyesecurities.com/

Lares https://lares.co.in/about-company/

Trade Rays https://traderays.com/

Aigo Bulls https://algobulls.com/

info sales

iRageCapital specialize in High Frequency trading and Market making.

Interestingly they are hiring FPGA developers on LinkedIn. You use

FPGAs when you want your algorightms to run extremely fast and in

HFT that matters a lot. From their website it is not clear though whether

they provide algo trading as a service or they trade with their own money.

AlphaGrep is a proprietary trading firm focused on algorithmic trading in

asset classes across the globe. They are one of the largest firms by

trading volume on Indian exchanges.

They are a proprietary quanitative trading firm specialised in developing

trading algorithms and its automatic execution.

Mansukh securities is primarily a brokerage and advisory firm. But they

do have algo trading operation and they are actively hiring python based

algo traders on Linkedin.

Algoji is a algo-trading platform which enables you to run your custom

strategies and execute them with broker of your choice (They support a

number of brokers). They can also provide you coding experts who can

develop strategies for you.

Open futures specializes in proprietary trading, money management and

technology solutions. They are among top 5 HFT firms in India.

Dolat Capital is a technology driven, multi-strategy quantitative trading

firm.

MyFinDoc provides multiple services and algo trading is one of them.

Kuants is platform and marketplace to create, backtest, buy and sell

strategies

TVISI algo systems focus onproviding technology consultancy on

algorithm or algorithmic trading, automated trading for Forex, Stocks or

Equities, Stocks Futures, Index Futures, Options, ETF, Commodities and

more.

Algo Profits help retail as well as enterprise clients in development of

high quality algorithmic trading systems.

A technology company which provides many services for capital markets

sector along with HFT and algo tradign services.

A proprietary trading firm which uses quantitative strategies for trading

Lares is a liquidity provider and Market Maker which also has desks for

Algo trading and HFT.

Trade rays focuss on creating products which aim to make algo trading

simple and user friendly.

AlgoBulls is a trading platform that provides automated trading

algorithms and has the ability deploy multiple trading strategies for

various asset classes like Equity, Commodities, Futures & Options,

Currency across multiple exchanges like NSE, BSE, MCX, etc. Clients

can select which algorithm strategies they want to follow and auto trade

OR they can get their customized trading strategies developed as

algorithms and get it deployed in live markets with the help of the

AlgoBulls platform. AlgoBulls platform supports multiple brokers.

follow up note

ISV

You might also like

- Business PlanDocument11 pagesBusiness Plan陈文源100% (2)

- Learn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies using Python and advanced data analysisFrom EverandLearn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies using Python and advanced data analysisNo ratings yet

- Met A Trader 4 For DummiesDocument20 pagesMet A Trader 4 For Dummiesbirko6180% (5)

- A1 BSBMKG542 Establish and Monitor The Marketing MixDocument7 pagesA1 BSBMKG542 Establish and Monitor The Marketing Mixmanish gurungNo ratings yet

- Introduction To MetaTrader 5 and Programming With MQL5 (Rafael - F. - v. - C. - Santos)Document154 pagesIntroduction To MetaTrader 5 and Programming With MQL5 (Rafael - F. - v. - C. - Santos)Paulo Rogerio100% (5)

- Automated Crypto Trading BotDocument6 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- How Charting SoftwareDocument18 pagesHow Charting SoftwareZARAH MAE UÑADANo ratings yet

- A Beginners Guide To Algorithmic Trading 2017Document49 pagesA Beginners Guide To Algorithmic Trading 2017Anonymous KeU4gphVL5100% (4)

- Algotradingbestalgorithmictradingexamples 240128173442 A0a31ff1Document11 pagesAlgotradingbestalgorithmictradingexamples 240128173442 A0a31ff1saktirajNo ratings yet

- Hentak FXDocument2 pagesHentak FXmohamad hifzhanNo ratings yet

- Algo TradingDocument128 pagesAlgo TradingdishaNo ratings yet

- Sacjcbkjcbndonbwe OnDocument1 pageSacjcbkjcbndonbwe OnpannyformeNo ratings yet

- Bitgear - Io-Whitepaper v5Document16 pagesBitgear - Io-Whitepaper v5Sean TanNo ratings yet

- Www-Altredo-com-Interactive Brokers Mt4 Bridge Trade CopierDocument4 pagesWww-Altredo-com-Interactive Brokers Mt4 Bridge Trade CopierALTREDONo ratings yet

- Identify An Enterprise and Give The Snapshot of The Company Websites With LinksDocument8 pagesIdentify An Enterprise and Give The Snapshot of The Company Websites With LinksAbbas KhanNo ratings yet

- All Slides - Delhi Algo Traders ConferenceDocument129 pagesAll Slides - Delhi Algo Traders ConferencenithyaprasathNo ratings yet

- Introduction To Algo TradingDocument50 pagesIntroduction To Algo TradingMark Luther100% (4)

- (Case Study 2) Investment Hedge With Portfolio ProtectionDocument4 pages(Case Study 2) Investment Hedge With Portfolio Protectionsanjay sharmaNo ratings yet

- Algorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesFrom EverandAlgorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Introduction To Algo TradingDocument50 pagesIntroduction To Algo TradingEugeny KNo ratings yet

- Tradingbot SampleDocument34 pagesTradingbot SampleMauricio AlbiniNo ratings yet

- (Free Ebook) Best Crypto Trading Tools & SoftwaresDocument20 pages(Free Ebook) Best Crypto Trading Tools & SoftwaresHaseeb100% (1)

- Black and Teal Futuristic Welcome To Metaverse Presentation (W)Document1 pageBlack and Teal Futuristic Welcome To Metaverse Presentation (W)Forex SniperNo ratings yet

- Liste Noire Forex 16 Mai 2023 0Document5 pagesListe Noire Forex 16 Mai 2023 0gbanemansara2No ratings yet

- How To Become A Successful Forex TraderDocument4 pagesHow To Become A Successful Forex Tradercms marketingNo ratings yet

- Advanced Use of The Trading Platform Metatrader 5 Creating Trading Robots and Indicators With Mql5 and Python 3Rd Edition Timur MashninDocument70 pagesAdvanced Use of The Trading Platform Metatrader 5 Creating Trading Robots and Indicators With Mql5 and Python 3Rd Edition Timur Mashninmelonymae9f100% (6)

- ZagTrader BrochureDocument6 pagesZagTrader Brochureshri.dxb0720No ratings yet

- Algorithmic Trading Directory - 2009 EditionDocument104 pagesAlgorithmic Trading Directory - 2009 Editionmotiwig6302100% (2)

- Liste Noire Forex 22 Aout 23Document5 pagesListe Noire Forex 22 Aout 23Junior Louis ChateilleNo ratings yet

- Liste Noire Forex 3 Novembre 2022 0Document5 pagesListe Noire Forex 3 Novembre 2022 0Aban ZOUNGRANANo ratings yet

- Thesis Algorithmic TradingDocument7 pagesThesis Algorithmic Tradingdianawalkermilwaukee100% (2)

- Xtrades Quick Start GuideDocument3 pagesXtrades Quick Start GuidePaljoNo ratings yet

- Financial Domain: Technology inDocument18 pagesFinancial Domain: Technology inRonitsinghthakur SinghNo ratings yet

- StabilityDocument2 pagesStabilityAhmad MukarramNo ratings yet

- Magic Quadrant For Trading Platforms, Gartner 12-2014Document32 pagesMagic Quadrant For Trading Platforms, Gartner 12-2014discomonkeeeee100% (1)

- Top10stockbroker 0 Comments: Online Trading - Meaning, Trading Process, Benefits, Order Types & MoreDocument8 pagesTop10stockbroker 0 Comments: Online Trading - Meaning, Trading Process, Benefits, Order Types & MoremuralikrishnavNo ratings yet

- Met A Trader Manual v1.01Document21 pagesMet A Trader Manual v1.01Santhosh KumarNo ratings yet

- An Introduction To "ALGORITHMIC" Trading: Rajeev RanjanDocument12 pagesAn Introduction To "ALGORITHMIC" Trading: Rajeev RanjanMots StingerNo ratings yet

- Investment AIDocument1 pageInvestment AIjoshikmohiitNo ratings yet

- Whitepaper QuopiDocument19 pagesWhitepaper Quopiliam veluNo ratings yet

- Releases Their Latest Algorithmic Trading System For S&P 500Document2 pagesReleases Their Latest Algorithmic Trading System For S&P 500PR.com100% (1)

- Liste Noire Forex 1er Juillet 2022 0Document4 pagesListe Noire Forex 1er Juillet 2022 0Diop IbrahimaNo ratings yet

- Investment Options: Trade In: Nse, Bse & MCX-SX, MCX, Ncdex, NmceDocument3 pagesInvestment Options: Trade In: Nse, Bse & MCX-SX, MCX, Ncdex, NmcePawan LohanaNo ratings yet

- PDF 1 - Instructions and Learning Module (Live Trading)Document18 pagesPDF 1 - Instructions and Learning Module (Live Trading)sundhar mohanNo ratings yet

- Copy Trading in Pakistan (Instructions)Document4 pagesCopy Trading in Pakistan (Instructions)IRP assignmentsNo ratings yet

- Algorithmic Trading: What Is, Why, How, When and WhereDocument11 pagesAlgorithmic Trading: What Is, Why, How, When and Wheresiulam1973gmNo ratings yet

- Algorithmic Trading Solutions: PE Cial EP OR TDocument15 pagesAlgorithmic Trading Solutions: PE Cial EP OR Taba3abaNo ratings yet

- Revolutionize Your Trading With Metaset - AiDocument2 pagesRevolutionize Your Trading With Metaset - AimetasetseoNo ratings yet

- The Technical Analyst WWW - Technicalanalyst.co - UkDocument2 pagesThe Technical Analyst WWW - Technicalanalyst.co - UkTUAN NGUYỄNNo ratings yet

- Foriegn Companies That Deals in Unlisted SharesDocument4 pagesForiegn Companies That Deals in Unlisted SharesAman JainNo ratings yet

- Automated Crypto Trading BotDocument7 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- "Forex Social Networking": MR - Hitesh Thakkar Tarang Patel (IU1253000030)Document39 pages"Forex Social Networking": MR - Hitesh Thakkar Tarang Patel (IU1253000030)hardikNo ratings yet

- G.E.T.S Automated Product ProfileDocument13 pagesG.E.T.S Automated Product ProfileSatya PrasadNo ratings yet

- OInvest - An Online Platform For Trading With High LeverageDocument7 pagesOInvest - An Online Platform For Trading With High Leveragemarshy bindaNo ratings yet

- MetaTrader 4 101Document20 pagesMetaTrader 4 101liamsjunk100% (2)

- Algorithmic TradingDocument27 pagesAlgorithmic TradingSmita Shah83% (6)

- Company Profile SharekhanDocument7 pagesCompany Profile Sharekhangarima_rathi0% (2)

- Getting Started in Creating Your Own Forex RobotsFrom EverandGetting Started in Creating Your Own Forex RobotsRating: 1 out of 5 stars1/5 (1)

- Social Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesFrom EverandSocial Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesNo ratings yet

- Job Description - Edge Sales SpecialistDocument2 pagesJob Description - Edge Sales SpecialistRavi TiwariNo ratings yet

- Virtual Private Cloud: Product IntroductionDocument14 pagesVirtual Private Cloud: Product IntroductionRavi Tiwari100% (1)

- Auto Scaling: Product IntroductionDocument7 pagesAuto Scaling: Product IntroductionRavi TiwariNo ratings yet

- Auo Scaling 2Document16 pagesAuo Scaling 2Ravi TiwariNo ratings yet

- ZZZZDocument9 pagesZZZZRavi TiwariNo ratings yet

- AlibabaCloud ACPDocument8 pagesAlibabaCloud ACPRavi Tiwari100% (1)

- Ent131 Chapter 9Document23 pagesEnt131 Chapter 9Classic KachereNo ratings yet

- Quiz 2 PPT TextDocument10 pagesQuiz 2 PPT TextRachel LuberiaNo ratings yet

- q3 2nd Sem Entre SummativeDocument2 pagesq3 2nd Sem Entre Summativejoanna may pacificarNo ratings yet

- FlipkartDocument40 pagesFlipkartShone Philips ThomasNo ratings yet

- PBM Unit 01Document19 pagesPBM Unit 01Aditya Raj ShrivastavaNo ratings yet

- Case ReportDocument4 pagesCase ReportAhmer shaikhNo ratings yet

- Alstom Pursues Asset Sales After Warning On Cash FlowDocument1 pageAlstom Pursues Asset Sales After Warning On Cash FlownelsonashwheelerNo ratings yet

- Analysis Report On Stock Market Trend Before Indian ElectionDocument8 pagesAnalysis Report On Stock Market Trend Before Indian ElectionMukta KapoorNo ratings yet

- Accounting Standard (AS) 9 Revenue RecognitionDocument12 pagesAccounting Standard (AS) 9 Revenue RecognitionKhushi KumariNo ratings yet

- Chapter 4 - Partnership DissolutionDocument15 pagesChapter 4 - Partnership DissolutionXyzra AlfonsoNo ratings yet

- Full Chapter Digital Assets and The Law Fiat Money in The Era of Digital Curency First Edition Filippo Zatti Rosa Giovanna Barresi Editors PDFDocument54 pagesFull Chapter Digital Assets and The Law Fiat Money in The Era of Digital Curency First Edition Filippo Zatti Rosa Giovanna Barresi Editors PDFjoan.houghton686100% (4)

- Functions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)Document10 pagesFunctions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)abhishek pathakNo ratings yet

- Investment Decision RulesDocument7 pagesInvestment Decision RulesQuỳnh Anh TrầnNo ratings yet

- Thesis Venture CapitalDocument7 pagesThesis Venture CapitalDaniel Wachtel100% (2)

- Conditionals ExercisesDocument2 pagesConditionals ExercisesKaterynaNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Revision WorksheetDocument2 pagesCBSE Class 11 Accountancy Worksheet - Revision Worksheetvarshitha reddyNo ratings yet

- Consumer Orientation Case StudyDocument2 pagesConsumer Orientation Case Studymalay.mahara20086No ratings yet

- BCIBF-102 Principles of Business ManagementDocument274 pagesBCIBF-102 Principles of Business ManagementS.M Documents SolutionsNo ratings yet

- 20 Difference Between Operating Leverage and Financial LeverageDocument2 pages20 Difference Between Operating Leverage and Financial LeverageVenkatsubramanian R IyerNo ratings yet

- Homebuying Step by Step Guide enDocument32 pagesHomebuying Step by Step Guide enPhil LNo ratings yet

- Harshit - Verma - PGFB2017Document59 pagesHarshit - Verma - PGFB2017harshkeshwani07No ratings yet

- Reynolds American Inc 5.85% 2045Document78 pagesReynolds American Inc 5.85% 2045jamesNo ratings yet

- ReSA Batch 47 ScheduleDocument1 pageReSA Batch 47 ScheduleyshizamNo ratings yet

- Reg Governing Emoney Issuers 2022Document74 pagesReg Governing Emoney Issuers 2022ice princeNo ratings yet

- Exercise 1Document3 pagesExercise 1Nor nimNo ratings yet

- 7893 28385 2 PBDocument12 pages7893 28385 2 PBk58 Duong Thi HangNo ratings yet

- Innovation and Entrepreneurship: PresentationDocument11 pagesInnovation and Entrepreneurship: PresentationPrachi AggarwalNo ratings yet

- ECON3007 Problem Set 2 2021-22Document2 pagesECON3007 Problem Set 2 2021-22barnestasha145No ratings yet

- FINAL - REVISED. Scheme and Flow Chart OIL TransactionDocument4 pagesFINAL - REVISED. Scheme and Flow Chart OIL TransactionPebb PondNo ratings yet