Professional Documents

Culture Documents

Assignment 2 Far110

Assignment 2 Far110

Uploaded by

AisyahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2 Far110

Assignment 2 Far110

Uploaded by

AisyahCopyright:

Available Formats

FAR110

GROUP ASSIGNMENT 2: PROBLEM BASED

LEARNING

SEMESTER OCTOBER 2020 – FEBRUARY

2021

GROUP MEMBERS STUDENT NO. GROUP

1.

2.

3.

4.

Hijau Rimba Entreprise keeps a complete set of records. The business closes its accounts on 31

October annually. However, some of them were destroyed in August 2020. Therefore, the business is

preparing the records again from available resources.

1. Several staff managed to safe records of previous accounting period and provide you the

Statement of Financial Position as at 31 October 2019.

STATEMENT OF FINANCIAL POSITION AS AT 31 OCTOBER 2019

NON-CURRENT ASSE COST (RM) ACC. DEPRECIATION CARRYING VALUE

(RM) (RM)

Land and building 500,000 - 25,000 475,000

Motor vehicles 80,000 - 8,000 72,000

547,000

CURRENT ASSETS

Inventory 25,300

Account receivable 18,600

bank 80,000

cash 5,000 128,900

675,900

FINANCED BY: OWNER'S EQUITY

Opening capital 450,000

add: net profit 204,000

less: drawings - 3,000

closing capital 651,000

CURRENT LIABILITIES

Account payable 19,900

Short term loan 5,000 24,900

675,900

2. Bank statements for the current accounting periods are also available. The summary in

relation to receipts and payments by cheques and online transactions is as below:

Receipts Amount (RM) NOTE

Interest on fixed deposit 333 The business only received

part of the interest income.

Sales 12,000

Collection from trade debtors - No collection of payment was

made during the accounting

period.

Loan 70,000 The loan was granted to the

business on 1 May 2020. The

business did not pay any

interest on loan at all during

the year. The amount was

RM1,050.

Payments Amount (RM) NOTE

Utilities 770 RM 840 was still outstanding

at the end of the accounting

period.

Salary & wages 15,000 RM 5,000 was still unpaid at

the end of the year.

Advertisements 6,500

Salesmen’s commission 2,600

Purchases 4,400

Payment to trade creditors - No payment to trade

creditors was made during

the year.

Personal use 8,000

Office equipment 25,000 It was purchased on 25 June

2020 from IKEAH Mall.

Transfer into fixed deposit account 50,000 The interest rate is 4% p.a

and was deposited into the

fixed deposit account on 1

July 2020

Short term loan 5,000 The short term loan was zero-

rated interest loan. The

business fully settled the loan

during the current year.

3. Information on the receipts and payments by cash is also available as follows:

Receipts Amount (RM) NOTE

Commission received 440 The business sold some goods

of other businesses and

received sales commission.

Rental received 600 The business partially rented

out its business premise to

another business.

Payments Amount (RM) NOTE

Transportation charges 590 RM250 was incurred in order

to bring goods to Hijau Rimba

Entreprise from the suppliers’

premises. The balance was

amount incurred to send

goods to the clients.

Medical expenses for staff 880 RM200 was for the next

accounting period.

Repair & maintenance 500 The repair and maintenance

was incurred for the motor

vehicle.

Donations 200

4. The policy of depreciation charges on the non-current assets are:

a) Building – 5% p.a, yearly basis, straight line method.

b) Motor vehicles – 10% p.a, yearly basis, reducing balance method.

c) Office equipment- 10% p.a, yearly basis, straight line method.

5. Other relevant information for the year ended 31 October 2020 is as shown below:

a) The business owner took some inventories worth RM3,000 for his personal use.

b) The business received cash discounts of RM400.

c) The business returned inventories to the suppliers worth RM800.

d) The business provided cash discounts worth RM600 to its customers.

e) The business issued credit notes worth RM900.

6. As at 31 October 2020, only the following information is available:

a) Inventory RM11,540

b) Trade creditors RM24,000

c) Trade receivables RM21,000

INSTRUCTIONS

A. You are required to prepare the followings:

a) Statement of Profit or Loss for the year ended 31 October 2020

(20 marks)

b) Statement of Financial Position as at 31 October 2020

(20 marks)

Show all workings and round up your calculation to the nearest RM.

B. One of the staff think that it is acceptable not to have a complete set of records since the

business has to incur additional costs to regenerate the financial reports. As a team of

accounting department, discuss:

a) The importance of having a full set of accounts for each accounting period.

(6 marks)

b) The impacts of failing to prepare the full set of accounts.

(4 marks)

(Total: 50 marks)

END OF QUESTION

You might also like

- M&ADocument2 pagesM&AishuNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

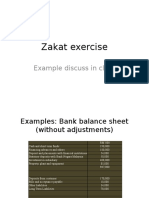

- Zakat ExercisesDocument5 pagesZakat Exercisesnor saidahNo ratings yet

- Running Head: Problems and Solutions For Nike Inc. 1Document31 pagesRunning Head: Problems and Solutions For Nike Inc. 1LattaNo ratings yet

- 高一簿记模拟试卷Document6 pages高一簿记模拟试卷Carpenters ForeverNo ratings yet

- Topic 5 - Preparation of Financial StatementsDocument37 pagesTopic 5 - Preparation of Financial StatementsSYAZANA HUDA MOHD AZLINo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- L03 - Accounting Classification and EquationsDocument29 pagesL03 - Accounting Classification and EquationsmardhiahNo ratings yet

- Statement of Cash Flows - Homework - Finacc5Document1 pageStatement of Cash Flows - Homework - Finacc5CRISZA MAE BERINo ratings yet

- CSOCF Acquisition Both Methods Malim Nawar BHDDocument7 pagesCSOCF Acquisition Both Methods Malim Nawar BHDSyafahani SafieNo ratings yet

- BAAB1014 Assignment EliteDocument5 pagesBAAB1014 Assignment Elitejinosini ramadasNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- PDF 04Document7 pagesPDF 04Hiruni LakshaniNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- Additional Questions On Financial Statements and Cash BookDocument5 pagesAdditional Questions On Financial Statements and Cash BookBoi NonoNo ratings yet

- Assignment FpTlBLN8uwDocument7 pagesAssignment FpTlBLN8uwMadhuram SharmaNo ratings yet

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- Consolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000Document1 pageConsolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000.No ratings yet

- 2017 S2 (final) (尊孔)Document5 pages2017 S2 (final) (尊孔)Khor Xing TienNo ratings yet

- Statement Of: Financial PositionDocument22 pagesStatement Of: Financial PositionZyriece Camille CentenoNo ratings yet

- Final Accounts From Single Entry NotesDocument5 pagesFinal Accounts From Single Entry NotesBamidele AdegboyeNo ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Principles of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceDocument2 pagesPrinciples of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceCindy SweNo ratings yet

- Far CH7.P7 CH8.P5&7Document4 pagesFar CH7.P7 CH8.P5&7she kioraNo ratings yet

- Amended - Final - Unit 5 - AAB-Accounting Principles - A2Document6 pagesAmended - Final - Unit 5 - AAB-Accounting Principles - A2Quang MinhNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Chapter 11 Financial Accounting With Adjustment: Question 1 FuguangDocument15 pagesChapter 11 Financial Accounting With Adjustment: Question 1 FuguangClaudia WongNo ratings yet

- Chapter 4 - Statement of Financial PositionDocument15 pagesChapter 4 - Statement of Financial PositionHan Yee YeoNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- W-2013 Cor PDFDocument21 pagesW-2013 Cor PDFKashif NiaziNo ratings yet

- Homework 2Document2 pagesHomework 2Sudeep0% (1)

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- PBL Group Assignment Far160Document9 pagesPBL Group Assignment Far160Nur Izzah AtiraNo ratings yet

- Basic Accounting - With AnswersDocument12 pagesBasic Accounting - With AnswersMarie MeridaNo ratings yet

- Tutorial 7 - IntangibleDocument2 pagesTutorial 7 - IntangibleABABNo ratings yet

- Pilot Test Solution Official (NLKT)Document36 pagesPilot Test Solution Official (NLKT)an27504No ratings yet

- Final Accounts: Problem SheetDocument2 pagesFinal Accounts: Problem SheetSaransh MaheshwariNo ratings yet

- Aud Prob RecDocument21 pagesAud Prob RecRNo ratings yet

- Tutorial AdjustmentDocument13 pagesTutorial AdjustmentnoorhanaNo ratings yet

- Company AccountsDocument10 pagesCompany AccountsLawrence101No ratings yet

- Amaliya Quiz Tutor Finacc 1 Week 2Document8 pagesAmaliya Quiz Tutor Finacc 1 Week 2Amaliya MalikovaNo ratings yet

- Profit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaDocument8 pagesProfit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaUmesh SharmaNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- AFM Case Study MbaDocument2 pagesAFM Case Study MbaN . pavanNo ratings yet

- Accounting Model Paper - Final ExamDocument6 pagesAccounting Model Paper - Final ExamShenali NupehewaNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- BAABDocument8 pagesBAABaqilahNo ratings yet

- Preparation & Analysis of Cash Flow StatementsDocument27 pagesPreparation & Analysis of Cash Flow StatementsAniket PanchalNo ratings yet

- Accruals and Prepayments: AlreadyDocument4 pagesAccruals and Prepayments: AlreadyLOW YAN QINNo ratings yet

- Single Entry Ques.Document6 pagesSingle Entry Ques.Garima GarimaNo ratings yet

- Extra Exercises ErrorsDocument6 pagesExtra Exercises ErrorsMohd Rafi Jasman100% (1)

- Accounting Cycle WorksheetDocument11 pagesAccounting Cycle Worksheettarikuabdisa0No ratings yet

- Tutorial Chapter 4 (TRIAL BALANCE)Document2 pagesTutorial Chapter 4 (TRIAL BALANCE)azra balqisNo ratings yet

- Tutorial Accounting Equation and ClassificationDocument2 pagesTutorial Accounting Equation and ClassificationNara SakuraNo ratings yet

- Co Operative HSG Soc. 2Document48 pagesCo Operative HSG Soc. 2ishan.patel.310No ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Tutorial Chapter 5Document8 pagesTutorial Chapter 5Aisyah SafiNo ratings yet

- Practice Question and Answer On Preparing JournalDocument3 pagesPractice Question and Answer On Preparing JournalNaz JrNo ratings yet

- Accounting For Finance: Eric Cauvin Exercises 2Document6 pagesAccounting For Finance: Eric Cauvin Exercises 2ddd huangNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Strategic Value of Regression Analysis in MarketingDocument9 pagesThe Strategic Value of Regression Analysis in MarketingsnwareresearchNo ratings yet

- Obe Ecmf 013Document5 pagesObe Ecmf 013AmalMdIsaNo ratings yet

- Investment ThesisDocument5 pagesInvestment Thesisu jNo ratings yet

- Microfridge Case AnalysisDocument2 pagesMicrofridge Case AnalysisMeme MBA100% (1)

- Power of Digital Marketing in Building Brands: A Review of Social Media AdvertisementDocument11 pagesPower of Digital Marketing in Building Brands: A Review of Social Media AdvertisementIAEME PublicationNo ratings yet

- Entry Test Questions For M. Phil Bzu PDFDocument2 pagesEntry Test Questions For M. Phil Bzu PDFapex gamingNo ratings yet

- Consolidated FsDocument7 pagesConsolidated FsfreyawonderlandNo ratings yet

- Financial Ratio Analysis Case StudyDocument10 pagesFinancial Ratio Analysis Case StudyGracel Joy VicenteNo ratings yet

- BBI2O Test ENTR COLDocument6 pagesBBI2O Test ENTR COLMani MNo ratings yet

- InventoryDocument36 pagesInventorydhruvbhartiya2420No ratings yet

- 3.4 Final Accounts Balance Sheet (Statement of Financial Position)Document45 pages3.4 Final Accounts Balance Sheet (Statement of Financial Position)Magdalena NeuschitzerNo ratings yet

- Job Order CostingDocument25 pagesJob Order CostingNors PataytayNo ratings yet

- YakultDocument17 pagesYakultErichSantosValdeviesoNo ratings yet

- Money Demand, The Equilibrium Interest Rate, and Monetary PolicyDocument29 pagesMoney Demand, The Equilibrium Interest Rate, and Monetary PolicyAbood AlissaNo ratings yet

- IFRS 5 - Non-Current Assets Held For Sale - AFE3782 NOTESDocument13 pagesIFRS 5 - Non-Current Assets Held For Sale - AFE3782 NOTESSelma IilongaNo ratings yet

- (Test Sample) - SUMMER MIDTERM EXAM (2021)Document2 pages(Test Sample) - SUMMER MIDTERM EXAM (2021)tranthithanhhuong25110211No ratings yet

- Running Head: Veestro LLC.: Global Marketing and Managers (Name of Institution) (Name of Student)Document17 pagesRunning Head: Veestro LLC.: Global Marketing and Managers (Name of Institution) (Name of Student)Faraz Ahmed KhanNo ratings yet

- The Sales ProcessDocument19 pagesThe Sales ProcessHarold Dela FuenteNo ratings yet

- GZU Past Exam Papers Purchasing and SupplyDocument1 pageGZU Past Exam Papers Purchasing and Supplyashley100% (2)

- Cfas 11 15Document3 pagesCfas 11 15Jeck GulbinNo ratings yet

- Entrep Learning Content 7Document8 pagesEntrep Learning Content 7ChristyNo ratings yet

- Accounting EquationDocument28 pagesAccounting EquationNurin ZarifahNo ratings yet

- DocxDocument7 pagesDocxJennifer AdvientoNo ratings yet

- Hsslive XII BS Chapter 11 Marketing SignedDocument27 pagesHsslive XII BS Chapter 11 Marketing SignedksNo ratings yet

- Securities Fraud, Stock Price Valuation, and Loss Causation: Toward A Corporate Finance-Based Theory of Loss CausationDocument5 pagesSecurities Fraud, Stock Price Valuation, and Loss Causation: Toward A Corporate Finance-Based Theory of Loss CausationMoin Max ReevesNo ratings yet

- PDF Copy of Lecture 2 Preparing For A Sales MeetingDocument25 pagesPDF Copy of Lecture 2 Preparing For A Sales Meetingnasir.zooeiNo ratings yet

- Unit 1 EDSDocument20 pagesUnit 1 EDSYUVRAJ SINGH TAKNo ratings yet

- ACC 3501-Fair Value AdjDocument7 pagesACC 3501-Fair Value AdjatikahNo ratings yet