Professional Documents

Culture Documents

10 Pertanyaan Dari Artikel

10 Pertanyaan Dari Artikel

Uploaded by

Oppo A57Copyright:

Available Formats

You might also like

- Equity Analysis of SBI Bank-1Document69 pagesEquity Analysis of SBI Bank-1mustafe ABDULLAHINo ratings yet

- A Study On Investors Behaviour in Stock MarketDocument5 pagesA Study On Investors Behaviour in Stock Marketaparna_sajeev0% (1)

- Performance Analysis of Mutual Funds A Comparative StudyDocument88 pagesPerformance Analysis of Mutual Funds A Comparative StudybhagathnagarNo ratings yet

- Fundamental Analysis of ICICI BankDocument70 pagesFundamental Analysis of ICICI BankAnonymous TduRDX9JMh0% (1)

- Chapter 2 - Theoretical Basis and Literature Review 2.1 Theoretical Basis 1. Agency TheoryDocument6 pagesChapter 2 - Theoretical Basis and Literature Review 2.1 Theoretical Basis 1. Agency TheoryConnie ChristinaNo ratings yet

- Dok Mi J Ku GTRDocument2 pagesDok Mi J Ku GTRSena WehlNo ratings yet

- Fundamental Analysis of FMCG Companies. (New)Document67 pagesFundamental Analysis of FMCG Companies. (New)AKKI REDDYNo ratings yet

- The Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per ShareDocument11 pagesThe Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per Sharegrizzly hereNo ratings yet

- The Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesDocument5 pagesThe Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesInternational Journal of Business Marketing and ManagementNo ratings yet

- Factors Influencing Investment Decision of Individual Investors in Stocks (With Reference To Indore City)Document10 pagesFactors Influencing Investment Decision of Individual Investors in Stocks (With Reference To Indore City)Ankitha KavyaNo ratings yet

- Comparative Analysis of Share Price in Various SectorsDocument7 pagesComparative Analysis of Share Price in Various SectorsMallikarjun RaoNo ratings yet

- Victory Portfolio Limited by Rahul GargDocument16 pagesVictory Portfolio Limited by Rahul GargRitika GargNo ratings yet

- A Study On Investor's Perception About Mutual FundsDocument6 pagesA Study On Investor's Perception About Mutual FundsRavi SharmaNo ratings yet

- Fundamental Analysis and Stock Returns: An Indian Evidence: Full Length Research PaperDocument7 pagesFundamental Analysis and Stock Returns: An Indian Evidence: Full Length Research PaperMohana SundaramNo ratings yet

- Sondakh 2019 The Effect of Dividend Policy, Liquidity, Profitability and Firm Size On Firm Value in Financial Service Sector Industries Listed in Indonesia Stock ExchangeDocument11 pagesSondakh 2019 The Effect of Dividend Policy, Liquidity, Profitability and Firm Size On Firm Value in Financial Service Sector Industries Listed in Indonesia Stock ExchangeGufranNo ratings yet

- A STUDY ON Fundamental & Technical AnalysisDocument86 pagesA STUDY ON Fundamental & Technical AnalysisKeleti Santhosh100% (1)

- A Study On Investors Behaviour in Stock MarketDocument5 pagesA Study On Investors Behaviour in Stock MarketMaddy09061986No ratings yet

- The Role of Profitability and Leverage in Determining Indonesia's Companies Stock PricesDocument10 pagesThe Role of Profitability and Leverage in Determining Indonesia's Companies Stock Pricesindex PubNo ratings yet

- A Study On Equity Analysis With Respect To Banking Sector at INDIABULLSDocument20 pagesA Study On Equity Analysis With Respect To Banking Sector at INDIABULLSNationalinstituteDsnr0% (1)

- Customers Perception On Online TradingDocument48 pagesCustomers Perception On Online TradingVarsha chhipaNo ratings yet

- Questionnaire For Financial Investors : 1. How Often Do You Invest in Stocks?Document14 pagesQuestionnaire For Financial Investors : 1. How Often Do You Invest in Stocks?Rohit BichkarNo ratings yet

- Chapter - Ii: Review of LiteratureDocument35 pagesChapter - Ii: Review of LiteratureSai VarunNo ratings yet

- 11 - Chapter 03 Review of LiteratureDocument66 pages11 - Chapter 03 Review of LiteratureAman GuptaNo ratings yet

- Financial Statement Black BookDocument35 pagesFinancial Statement Black BookomkarNo ratings yet

- The Effect of Current Ratio, Debt To Equity Ratio, Return On Assets On Earning Per Share (Study in Company Group of LQ45 Index Listed in Indonesia Stock Exchange 2011-2015)Document8 pagesThe Effect of Current Ratio, Debt To Equity Ratio, Return On Assets On Earning Per Share (Study in Company Group of LQ45 Index Listed in Indonesia Stock Exchange 2011-2015)ajmrdNo ratings yet

- 1106-Article Text-3172-4-10-20210519Document24 pages1106-Article Text-3172-4-10-20210519hoaintt0122No ratings yet

- Accounting Numbers As A Predictor of Stock Returns: A Case Study of NSE NiftyDocument12 pagesAccounting Numbers As A Predictor of Stock Returns: A Case Study of NSE NiftyAnuj PapnejaNo ratings yet

- Analysis of Conventional Mutual FundDocument7 pagesAnalysis of Conventional Mutual Fundrecruitment.andrejayagroupNo ratings yet

- Analysis of The Factors Affecting Devident PolicyDocument12 pagesAnalysis of The Factors Affecting Devident PolicyJung AuLiaNo ratings yet

- Comparative Analysis of Icici and BirlaDocument91 pagesComparative Analysis of Icici and BirlaVeeravalli AparnaNo ratings yet

- Comparative Analysis of HDFC and Icici Mutual FundsDocument8 pagesComparative Analysis of HDFC and Icici Mutual FundsVeeravalli AparnaNo ratings yet

- Equity Analysis in Banking sector-ICICI Direct New WordDocument56 pagesEquity Analysis in Banking sector-ICICI Direct New WordJoshua heavenNo ratings yet

- PS2008 InstitutionalDocument22 pagesPS2008 InstitutionalSaurang PatelNo ratings yet

- Equity Research On Paint and FMCG SectorDocument43 pagesEquity Research On Paint and FMCG SectornehagadgeNo ratings yet

- Literature Review Mutual Funds IndiaDocument5 pagesLiterature Review Mutual Funds Indiaea3j015d100% (1)

- Pengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaDocument14 pagesPengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaYuniar ArridhaNo ratings yet

- Pengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaDocument14 pagesPengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaYuniar ArridhaNo ratings yet

- Dividend Policies of Indian CompaniesDocument28 pagesDividend Policies of Indian CompaniesPriyanka RaipancholiaNo ratings yet

- Part 2Document63 pagesPart 2Sivaraman ManoharanNo ratings yet

- Analysis of Specific Equity Shares in Stock NseDocument71 pagesAnalysis of Specific Equity Shares in Stock NseRajesh BathulaNo ratings yet

- Incn15 Fin 059 PDFDocument15 pagesIncn15 Fin 059 PDFchirag_nrmba15No ratings yet

- Project Work BajajDocument49 pagesProject Work BajajSurendra Kumar MullangiNo ratings yet

- Investment DECISIONS ANALYSIS - INDIA BULLSDocument78 pagesInvestment DECISIONS ANALYSIS - INDIA BULLSL. V B Reddy100% (1)

- 128-Article Text-227-1-10-20190703Document5 pages128-Article Text-227-1-10-20190703sojeli4261No ratings yet

- Equity Analysis Pharma and It SectorDocument88 pagesEquity Analysis Pharma and It SectorcityNo ratings yet

- Chapter IDocument83 pagesChapter IAruna TalapatiNo ratings yet

- Financial Analysis of Information and Technology Industry of India (A Case Study of Wipro LTD and Infosys LTD)Document13 pagesFinancial Analysis of Information and Technology Industry of India (A Case Study of Wipro LTD and Infosys LTD)A vyasNo ratings yet

- Journal Int 4Document6 pagesJournal Int 4Jeremia Duta PerdanakasihNo ratings yet

- Introduction of RSD Sem IIDocument4 pagesIntroduction of RSD Sem IIop bolte broNo ratings yet

- 51-Article Text-107-1-10-20220403Document18 pages51-Article Text-107-1-10-20220403Bintang Adi PNo ratings yet

- A Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIADocument45 pagesA Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIAKiran AryaNo ratings yet

- Thesis On Stock Market in IndiaDocument8 pagesThesis On Stock Market in Indiapamelawatkinsjackson100% (2)

- Ijrpr2741 Study On Investor Perception Towards Stock Market InvestmentDocument19 pagesIjrpr2741 Study On Investor Perception Towards Stock Market InvestmentAbhay RanaNo ratings yet

- Literature Review OriginalDocument7 pagesLiterature Review OriginalJagjeet Singh82% (11)

- 07 Chapter 1Document34 pages07 Chapter 1Janavi chhetaNo ratings yet

- Table of Contents: CCC CDocument27 pagesTable of Contents: CCC CNina JayanNo ratings yet

- Chapter - 1 Introduction: 1.1 Background of The StudyDocument78 pagesChapter - 1 Introduction: 1.1 Background of The StudyPRIYA RANANo ratings yet

- Research Paper On Financial Market in IndiaDocument7 pagesResearch Paper On Financial Market in Indiauyqzyprhf100% (1)

- How To Begin Investing In The Stock Market: Obtaining Financial FreedomFrom EverandHow To Begin Investing In The Stock Market: Obtaining Financial FreedomNo ratings yet

- Extensive Reading Log 1Document2 pagesExtensive Reading Log 1Oppo A57No ratings yet

- Essay Lamaran KerjaDocument4 pagesEssay Lamaran KerjaOppo A57No ratings yet

- Jurnal Teori Bahasa InggrisDocument1 pageJurnal Teori Bahasa InggrisOppo A57No ratings yet

- Esaay 1Document2 pagesEsaay 1Oppo A57No ratings yet

- Essay Lamaran KerjaDocument4 pagesEssay Lamaran KerjaOppo A57No ratings yet

- Middle East ContractorsDocument8 pagesMiddle East ContractorsDeepak Nair100% (1)

- ABCR 2103 AssignmentDocument13 pagesABCR 2103 AssignmentZen FooNo ratings yet

- Fooddepo-Zimbabwe's Only App in Trying To Reduce Food WastageDocument14 pagesFooddepo-Zimbabwe's Only App in Trying To Reduce Food WastageRowan RootNo ratings yet

- STR Rishabh Bambha 089 Final PDFDocument59 pagesSTR Rishabh Bambha 089 Final PDFRishabh bambhaNo ratings yet

- Post-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyDocument55 pagesPost-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyjlskdfjNo ratings yet

- Total Unit To Be Accounted For 90Document6 pagesTotal Unit To Be Accounted For 90Harsh KSNo ratings yet

- Tax Invoice - 2555703 - 1686188896465Document1 pageTax Invoice - 2555703 - 1686188896465Ivy GaudicosNo ratings yet

- Random Rubble Masonry in Cement Mortar 1:5 in SuperstructureDocument6 pagesRandom Rubble Masonry in Cement Mortar 1:5 in Superstructuredimuthu lasinthaNo ratings yet

- 2022-12-15 StrategiesDocument1 page2022-12-15 StrategiesquemilangaNo ratings yet

- Reference RRL RRSDocument4 pagesReference RRL RRSMarvin AgullanaNo ratings yet

- Bill October 1Document2 pagesBill October 1Muhammad RashidNo ratings yet

- Latihan Soal Coc Dan WMCCDocument9 pagesLatihan Soal Coc Dan WMCCyolandaNo ratings yet

- ICAEW - Chapter 6 - Control Accounts Errors and Suspense AccountsDocument21 pagesICAEW - Chapter 6 - Control Accounts Errors and Suspense Accountsvothituongnhi7703No ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Electrolux Market Overview 2022Document6 pagesElectrolux Market Overview 2022Gere TassewNo ratings yet

- Ar Darma Henwa 31121138Document388 pagesAr Darma Henwa 31121138SintyaNo ratings yet

- Quote: Bill ToDocument2 pagesQuote: Bill ToaceroadmarkingNo ratings yet

- Yashika Colgate PalmoliveDocument2 pagesYashika Colgate Palmoliveyashika vohraNo ratings yet

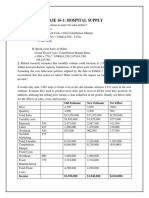

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- Hortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorDocument2 pagesHortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorAndres UrrutiaNo ratings yet

- Humbor Endterm NotesDocument2 pagesHumbor Endterm NotesVaness Alvarez PrudenteNo ratings yet

- ERP PresentationDocument39 pagesERP PresentationArren GohNo ratings yet

- COVID 19 S Impact On Globalization and InnovationDocument7 pagesCOVID 19 S Impact On Globalization and InnovationRabiya TungNo ratings yet

- INTL-728-Workbook Assignments For Final ReportDocument8 pagesINTL-728-Workbook Assignments For Final ReportDani GhansahNo ratings yet

- Lecture 2 AcceptanceDocument12 pagesLecture 2 AcceptanceMason TangNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument23 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsFery AnnNo ratings yet

- Welco M eDocument28 pagesWelco M eLLYOD FRANCIS LAYLAYNo ratings yet

- Let's Check Activity 1: Practice Set 7 Mathematics in Our WorldDocument6 pagesLet's Check Activity 1: Practice Set 7 Mathematics in Our WorldMarybelle Torres VotacionNo ratings yet

- Fco Oficial Company Brahm Inc...Document9 pagesFco Oficial Company Brahm Inc...Phill BonatoNo ratings yet

- BUS407 Chapter 13 CSR and Community RelationsDocument44 pagesBUS407 Chapter 13 CSR and Community RelationssaidahNo ratings yet

10 Pertanyaan Dari Artikel

10 Pertanyaan Dari Artikel

Uploaded by

Oppo A57Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Pertanyaan Dari Artikel

10 Pertanyaan Dari Artikel

Uploaded by

Oppo A57Copyright:

Available Formats

The Indonesia Stock Exchange (IDX) is one of the capital markets in

Indonesia which is managed by the government with the legal status of a State-

Owned Enterprise (BUMN). IDX is a company that provides a means to bring

together offers and buys and sells of shares and other securities. Stock is one of

the products that can be marketed through the IDX. One of the conditions is the

deposit of financial statements by companies listed on the IDX. The financial

report aims to provide information to shareholders and the public. Shares

according to paper proof of ownership of capital or funds in a company clearly

stated nominal value, company name and followed by clear rights and obligations

to each holder (Fahmi and Hadi, 2012). Companies, both private and government

or state-owned companies, usually sell and buy shares to get capital. Shares are

traded on the capital market as a long-term financial instrument. The higher the

value of a company's stock price, in general, will represent the higher the value of

the company.

1. What is the main role of the Indonesia Stock Exchange (IDX) in the

Indonesian capital market system?

2. Why do companies listed on the IDX have to submit financial statements,

and who are the primary audiences for these reports?

3. How is stock defined in the context of the Indonesian capital market, and

what is the purpose of trading stocks?

4. What is the impact of an increase in a company's stock price on the overall

value of the company?

5. What are the differences between private and government-owned

companies when it comes to buying and selling shares in the Indonesian

capital market?

Financial statement analysis is one way that can be used by users of

financial statements to be able to improve the information. The information has

been written in the financial statements so that it can be used as information that is

more useful in decision making. One of the financial analyzes is ratio analysis,

which is to compare the numbers contained in the financial statements by dividing

one number by another (Kasmir, 2013). The results of the comparison of these

figures can be used to assess the company's management performance. Investors

can use these ratios as a basis for making a decision whether the investor will buy

shares or invest in the company or not. The decision is based on what kind of ratio

is used and what the investor actually wants because each of the ratios relates

information to one another. This ratio can be calculated using the information

contained in the financial statements such as the statement of financial position

and income statement.

1. How does financial statement analysis contribute to improving the

usefulness of information for decision-making by users of financial

statements?

2. What is ratio analysis, and how does it help in assessing a company's

management performance?

3. How do investors use the results of ratio analysis to make decisions

regarding buying shares or investing in a company?

4. What financial statements are typically used as a source of information for

calculating these ratios, and how are they used in the analysis?

5. Can you provide an example of a specific ratio that investors commonly

use in their decision-making process, and how does it relate to the

information presented in the financial statements?

You might also like

- Equity Analysis of SBI Bank-1Document69 pagesEquity Analysis of SBI Bank-1mustafe ABDULLAHINo ratings yet

- A Study On Investors Behaviour in Stock MarketDocument5 pagesA Study On Investors Behaviour in Stock Marketaparna_sajeev0% (1)

- Performance Analysis of Mutual Funds A Comparative StudyDocument88 pagesPerformance Analysis of Mutual Funds A Comparative StudybhagathnagarNo ratings yet

- Fundamental Analysis of ICICI BankDocument70 pagesFundamental Analysis of ICICI BankAnonymous TduRDX9JMh0% (1)

- Chapter 2 - Theoretical Basis and Literature Review 2.1 Theoretical Basis 1. Agency TheoryDocument6 pagesChapter 2 - Theoretical Basis and Literature Review 2.1 Theoretical Basis 1. Agency TheoryConnie ChristinaNo ratings yet

- Dok Mi J Ku GTRDocument2 pagesDok Mi J Ku GTRSena WehlNo ratings yet

- Fundamental Analysis of FMCG Companies. (New)Document67 pagesFundamental Analysis of FMCG Companies. (New)AKKI REDDYNo ratings yet

- The Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per ShareDocument11 pagesThe Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per Sharegrizzly hereNo ratings yet

- The Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesDocument5 pagesThe Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesInternational Journal of Business Marketing and ManagementNo ratings yet

- Factors Influencing Investment Decision of Individual Investors in Stocks (With Reference To Indore City)Document10 pagesFactors Influencing Investment Decision of Individual Investors in Stocks (With Reference To Indore City)Ankitha KavyaNo ratings yet

- Comparative Analysis of Share Price in Various SectorsDocument7 pagesComparative Analysis of Share Price in Various SectorsMallikarjun RaoNo ratings yet

- Victory Portfolio Limited by Rahul GargDocument16 pagesVictory Portfolio Limited by Rahul GargRitika GargNo ratings yet

- A Study On Investor's Perception About Mutual FundsDocument6 pagesA Study On Investor's Perception About Mutual FundsRavi SharmaNo ratings yet

- Fundamental Analysis and Stock Returns: An Indian Evidence: Full Length Research PaperDocument7 pagesFundamental Analysis and Stock Returns: An Indian Evidence: Full Length Research PaperMohana SundaramNo ratings yet

- Sondakh 2019 The Effect of Dividend Policy, Liquidity, Profitability and Firm Size On Firm Value in Financial Service Sector Industries Listed in Indonesia Stock ExchangeDocument11 pagesSondakh 2019 The Effect of Dividend Policy, Liquidity, Profitability and Firm Size On Firm Value in Financial Service Sector Industries Listed in Indonesia Stock ExchangeGufranNo ratings yet

- A STUDY ON Fundamental & Technical AnalysisDocument86 pagesA STUDY ON Fundamental & Technical AnalysisKeleti Santhosh100% (1)

- A Study On Investors Behaviour in Stock MarketDocument5 pagesA Study On Investors Behaviour in Stock MarketMaddy09061986No ratings yet

- The Role of Profitability and Leverage in Determining Indonesia's Companies Stock PricesDocument10 pagesThe Role of Profitability and Leverage in Determining Indonesia's Companies Stock Pricesindex PubNo ratings yet

- A Study On Equity Analysis With Respect To Banking Sector at INDIABULLSDocument20 pagesA Study On Equity Analysis With Respect To Banking Sector at INDIABULLSNationalinstituteDsnr0% (1)

- Customers Perception On Online TradingDocument48 pagesCustomers Perception On Online TradingVarsha chhipaNo ratings yet

- Questionnaire For Financial Investors : 1. How Often Do You Invest in Stocks?Document14 pagesQuestionnaire For Financial Investors : 1. How Often Do You Invest in Stocks?Rohit BichkarNo ratings yet

- Chapter - Ii: Review of LiteratureDocument35 pagesChapter - Ii: Review of LiteratureSai VarunNo ratings yet

- 11 - Chapter 03 Review of LiteratureDocument66 pages11 - Chapter 03 Review of LiteratureAman GuptaNo ratings yet

- Financial Statement Black BookDocument35 pagesFinancial Statement Black BookomkarNo ratings yet

- The Effect of Current Ratio, Debt To Equity Ratio, Return On Assets On Earning Per Share (Study in Company Group of LQ45 Index Listed in Indonesia Stock Exchange 2011-2015)Document8 pagesThe Effect of Current Ratio, Debt To Equity Ratio, Return On Assets On Earning Per Share (Study in Company Group of LQ45 Index Listed in Indonesia Stock Exchange 2011-2015)ajmrdNo ratings yet

- 1106-Article Text-3172-4-10-20210519Document24 pages1106-Article Text-3172-4-10-20210519hoaintt0122No ratings yet

- Accounting Numbers As A Predictor of Stock Returns: A Case Study of NSE NiftyDocument12 pagesAccounting Numbers As A Predictor of Stock Returns: A Case Study of NSE NiftyAnuj PapnejaNo ratings yet

- Analysis of Conventional Mutual FundDocument7 pagesAnalysis of Conventional Mutual Fundrecruitment.andrejayagroupNo ratings yet

- Analysis of The Factors Affecting Devident PolicyDocument12 pagesAnalysis of The Factors Affecting Devident PolicyJung AuLiaNo ratings yet

- Comparative Analysis of Icici and BirlaDocument91 pagesComparative Analysis of Icici and BirlaVeeravalli AparnaNo ratings yet

- Comparative Analysis of HDFC and Icici Mutual FundsDocument8 pagesComparative Analysis of HDFC and Icici Mutual FundsVeeravalli AparnaNo ratings yet

- Equity Analysis in Banking sector-ICICI Direct New WordDocument56 pagesEquity Analysis in Banking sector-ICICI Direct New WordJoshua heavenNo ratings yet

- PS2008 InstitutionalDocument22 pagesPS2008 InstitutionalSaurang PatelNo ratings yet

- Equity Research On Paint and FMCG SectorDocument43 pagesEquity Research On Paint and FMCG SectornehagadgeNo ratings yet

- Literature Review Mutual Funds IndiaDocument5 pagesLiterature Review Mutual Funds Indiaea3j015d100% (1)

- Pengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaDocument14 pagesPengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaYuniar ArridhaNo ratings yet

- Pengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaDocument14 pagesPengaruh Faktor Fundamental Perusahaan Terhadap Harga Saham Di Bursa Efek IndonesiaYuniar ArridhaNo ratings yet

- Dividend Policies of Indian CompaniesDocument28 pagesDividend Policies of Indian CompaniesPriyanka RaipancholiaNo ratings yet

- Part 2Document63 pagesPart 2Sivaraman ManoharanNo ratings yet

- Analysis of Specific Equity Shares in Stock NseDocument71 pagesAnalysis of Specific Equity Shares in Stock NseRajesh BathulaNo ratings yet

- Incn15 Fin 059 PDFDocument15 pagesIncn15 Fin 059 PDFchirag_nrmba15No ratings yet

- Project Work BajajDocument49 pagesProject Work BajajSurendra Kumar MullangiNo ratings yet

- Investment DECISIONS ANALYSIS - INDIA BULLSDocument78 pagesInvestment DECISIONS ANALYSIS - INDIA BULLSL. V B Reddy100% (1)

- 128-Article Text-227-1-10-20190703Document5 pages128-Article Text-227-1-10-20190703sojeli4261No ratings yet

- Equity Analysis Pharma and It SectorDocument88 pagesEquity Analysis Pharma and It SectorcityNo ratings yet

- Chapter IDocument83 pagesChapter IAruna TalapatiNo ratings yet

- Financial Analysis of Information and Technology Industry of India (A Case Study of Wipro LTD and Infosys LTD)Document13 pagesFinancial Analysis of Information and Technology Industry of India (A Case Study of Wipro LTD and Infosys LTD)A vyasNo ratings yet

- Journal Int 4Document6 pagesJournal Int 4Jeremia Duta PerdanakasihNo ratings yet

- Introduction of RSD Sem IIDocument4 pagesIntroduction of RSD Sem IIop bolte broNo ratings yet

- 51-Article Text-107-1-10-20220403Document18 pages51-Article Text-107-1-10-20220403Bintang Adi PNo ratings yet

- A Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIADocument45 pagesA Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIAKiran AryaNo ratings yet

- Thesis On Stock Market in IndiaDocument8 pagesThesis On Stock Market in Indiapamelawatkinsjackson100% (2)

- Ijrpr2741 Study On Investor Perception Towards Stock Market InvestmentDocument19 pagesIjrpr2741 Study On Investor Perception Towards Stock Market InvestmentAbhay RanaNo ratings yet

- Literature Review OriginalDocument7 pagesLiterature Review OriginalJagjeet Singh82% (11)

- 07 Chapter 1Document34 pages07 Chapter 1Janavi chhetaNo ratings yet

- Table of Contents: CCC CDocument27 pagesTable of Contents: CCC CNina JayanNo ratings yet

- Chapter - 1 Introduction: 1.1 Background of The StudyDocument78 pagesChapter - 1 Introduction: 1.1 Background of The StudyPRIYA RANANo ratings yet

- Research Paper On Financial Market in IndiaDocument7 pagesResearch Paper On Financial Market in Indiauyqzyprhf100% (1)

- How To Begin Investing In The Stock Market: Obtaining Financial FreedomFrom EverandHow To Begin Investing In The Stock Market: Obtaining Financial FreedomNo ratings yet

- Extensive Reading Log 1Document2 pagesExtensive Reading Log 1Oppo A57No ratings yet

- Essay Lamaran KerjaDocument4 pagesEssay Lamaran KerjaOppo A57No ratings yet

- Jurnal Teori Bahasa InggrisDocument1 pageJurnal Teori Bahasa InggrisOppo A57No ratings yet

- Esaay 1Document2 pagesEsaay 1Oppo A57No ratings yet

- Essay Lamaran KerjaDocument4 pagesEssay Lamaran KerjaOppo A57No ratings yet

- Middle East ContractorsDocument8 pagesMiddle East ContractorsDeepak Nair100% (1)

- ABCR 2103 AssignmentDocument13 pagesABCR 2103 AssignmentZen FooNo ratings yet

- Fooddepo-Zimbabwe's Only App in Trying To Reduce Food WastageDocument14 pagesFooddepo-Zimbabwe's Only App in Trying To Reduce Food WastageRowan RootNo ratings yet

- STR Rishabh Bambha 089 Final PDFDocument59 pagesSTR Rishabh Bambha 089 Final PDFRishabh bambhaNo ratings yet

- Post-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyDocument55 pagesPost-Commencement Analysis of The Dutch Mission-Oriented Topsector and Innovation Policy' StrategyjlskdfjNo ratings yet

- Total Unit To Be Accounted For 90Document6 pagesTotal Unit To Be Accounted For 90Harsh KSNo ratings yet

- Tax Invoice - 2555703 - 1686188896465Document1 pageTax Invoice - 2555703 - 1686188896465Ivy GaudicosNo ratings yet

- Random Rubble Masonry in Cement Mortar 1:5 in SuperstructureDocument6 pagesRandom Rubble Masonry in Cement Mortar 1:5 in Superstructuredimuthu lasinthaNo ratings yet

- 2022-12-15 StrategiesDocument1 page2022-12-15 StrategiesquemilangaNo ratings yet

- Reference RRL RRSDocument4 pagesReference RRL RRSMarvin AgullanaNo ratings yet

- Bill October 1Document2 pagesBill October 1Muhammad RashidNo ratings yet

- Latihan Soal Coc Dan WMCCDocument9 pagesLatihan Soal Coc Dan WMCCyolandaNo ratings yet

- ICAEW - Chapter 6 - Control Accounts Errors and Suspense AccountsDocument21 pagesICAEW - Chapter 6 - Control Accounts Errors and Suspense Accountsvothituongnhi7703No ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Electrolux Market Overview 2022Document6 pagesElectrolux Market Overview 2022Gere TassewNo ratings yet

- Ar Darma Henwa 31121138Document388 pagesAr Darma Henwa 31121138SintyaNo ratings yet

- Quote: Bill ToDocument2 pagesQuote: Bill ToaceroadmarkingNo ratings yet

- Yashika Colgate PalmoliveDocument2 pagesYashika Colgate Palmoliveyashika vohraNo ratings yet

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- Hortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorDocument2 pagesHortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorAndres UrrutiaNo ratings yet

- Humbor Endterm NotesDocument2 pagesHumbor Endterm NotesVaness Alvarez PrudenteNo ratings yet

- ERP PresentationDocument39 pagesERP PresentationArren GohNo ratings yet

- COVID 19 S Impact On Globalization and InnovationDocument7 pagesCOVID 19 S Impact On Globalization and InnovationRabiya TungNo ratings yet

- INTL-728-Workbook Assignments For Final ReportDocument8 pagesINTL-728-Workbook Assignments For Final ReportDani GhansahNo ratings yet

- Lecture 2 AcceptanceDocument12 pagesLecture 2 AcceptanceMason TangNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument23 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsFery AnnNo ratings yet

- Welco M eDocument28 pagesWelco M eLLYOD FRANCIS LAYLAYNo ratings yet

- Let's Check Activity 1: Practice Set 7 Mathematics in Our WorldDocument6 pagesLet's Check Activity 1: Practice Set 7 Mathematics in Our WorldMarybelle Torres VotacionNo ratings yet

- Fco Oficial Company Brahm Inc...Document9 pagesFco Oficial Company Brahm Inc...Phill BonatoNo ratings yet

- BUS407 Chapter 13 CSR and Community RelationsDocument44 pagesBUS407 Chapter 13 CSR and Community RelationssaidahNo ratings yet