Professional Documents

Culture Documents

Tata Super Select Equity Fund

Tata Super Select Equity Fund

Uploaded by

sanoobkarimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Super Select Equity Fund

Tata Super Select Equity Fund

Uploaded by

sanoobkarimCopyright:

Available Formats

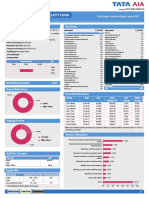

SUPER SELECT EQUITY FUND Fund Assure, Investment Report, March 2024

ULIF 035 16/10/09 TSS 110

Fund Details Portfolio

Investment Objective: The primary investment objective of the fund is to provide Instrument % Of NAV Instrument % Of NAV

income distribution over a period of medium to long term while at all times Equity 97.91 Coforge Ltd 2.28

Titan Company Ltd. 4.58 PI Industries Ltd. 2.27

emphasizing the importance of capital appreciation. The fund will invest significant Ultratech Cement Ltd. 3.88 Dixon Technologies India Ltd. 2.19

Infosys Ltd. 3.67 Alembic Pharmaceuticals Ltd. 2.12

amount in equity and equity linked instruments specifically excluding companies

Hindustan Unilever Ltd. 3.60 Thermax Ltd. 2.06

predominantly dealing in Gambling, Lotteries/Contests, Animal Produce, Liquor, Bikaji Foods International Ltd 3.21 Amara Raja Energy & Mobility Ltd. 2.02

Astral Poly Technik Ltd 2.96 Concord Biotech Ltd 2.02

Tobacco, Entertainment (Films, TV etc) Hotels, Banks and Financial Institutions. Trent Ltd. 1.97

AIA Engineering Ltd. 2.72

NAV as on 31 March, 24: `69.0724 Britannia Industries Ltd. 2.64 Apollo Hospitals Enterprise Ltd. 1.94

Tube Investments Of India Ltd 2.56 ZF Commercial Vehicle Control Systems India Ltd 1.90

Benchmark: Nifty500 Shariah - 100%

Tech Mahindra Ltd. 2.50 Krishna Institute of Medical Sciences Ltd 1.85

Corpus as on 31 March, 24: `1,244.73 Crs. Ceat Ltd 2.50 APL Apollo Tubes Ltd. 1.84

Fund Manager: Mr.Nimesh Mistry & Mr. Rajeev Tewari Oil and Natural Gas Corpn Ltd. 2.49 Other Equity 26.67

Shyam Metalics and Energy Ltd 2.46 MMI & Others (Non Interest Bearing) 2.09

Co-Fund Manager: - Total 100.00

Jindal Stainless Ltd. 2.35

Investment Style KEC International Ltd. 2.33

KPIT Technologies Ltd 2.31

Investment Style Size

Value Blend Growth

Large

Fund Performance

Mid Period Date NAV Nifty500 NAV INDEX

Small Shariah Change Change

Last 1 Month 29-Feb-24 69.9219 6697.74 -1.21% -1.89%

Last 3 Months 31-Dec-23 68.0331 6410.93 1.53% 2.50%

Last 6 Months 30-Sep-23 62.4940 5727.84 10.53% 14.72%

Asset Allocation Last 1 Year 31-Mar-23 52.0620 4890.50 32.67% 34.37%

Last 2 Years 31-Mar-22 52.0022 5283.83 15.25% 11.52%

Last 3 Years 31-Mar-21 45.1826 4333.91 15.20% 14.88%

97.91% Last 4 Years 31-Mar-20 26.1832 2461.79 27.44% 27.82%

2.09% Last 5 Years 31-Mar-19 32.2781 2996.44 16.43% 17.01%

Last 10 Years 31-Mar-14 14.9103 1623.70 16.57% 15.00%

Equity Since Inception 21-Oct-09 10.0000 1208.56 14.31% 12.43%

MMI & Others Note: The investment income and prices may go down as well as up.“Since Inception” and returns above “1 Year” are

(Non Interest Bearing) calculated as per CAGR.

Asset Mix

Instrument Asset Mix as per F&U Actual Asset Mix

AUM (in Crores) Equity 60% - 100% 98%

Instrument AUM Money Market & Others * 0% - 40% 2%

Hybrid Fund

Equity 1,218.76 * Money Market & Others includes current assets

Debt -

MMI & Others 25.97 Sector Allocation

Computer programming, consultancy and related

13.08%

activities

Manufacture of chemicals and chemical products 9.85%

Retail trade, except of motor vehicles and motorcycles 8.19%

Manufacture of Basic Metals 6.96%

Manufacture of rubber and plastics products 6.44%

Manufacture of other non-metallic mineral products 6.09%

Manufacture of food products 5.85%

Human health activities 5.80%

Manufacture of pharmaceuticals,medicinal chemical and

5.46%

botanical products

Manufacture of fabricated metal products, except

4.78%

machinery and equipment

Others 27.49%

0% 5% 10% 15% 20% 25% 30%

Equity Fund Debt Fund Hybrid Fund 15

You might also like

- Full Download Principles of Corporate Finance 10th Edition Brealey Solutions ManualDocument14 pagesFull Download Principles of Corporate Finance 10th Edition Brealey Solutions Manualdrockadeobaq96% (24)

- G.R. No. L-12582Document8 pagesG.R. No. L-12582Inter_vivosNo ratings yet

- Olympia CaseDocument5 pagesOlympia Caseaa1122No ratings yet

- Candlestick DescriptionsDocument14 pagesCandlestick Descriptionsflakeman100% (3)

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundAbdulazeezNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundHarsh SrivastavaNo ratings yet

- Tata India Consumption FundDocument1 pageTata India Consumption FundJeremiah SolomonNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- Tata Whole Life Mid Cap Equity FundDocument1 pageTata Whole Life Mid Cap Equity FundK Dviya VennelaNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundJeremiah SolomonNo ratings yet

- Multi Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110Document1 pageMulti Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110editor's cornerNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110editor's cornerNo ratings yet

- Equity Elite OpportunitiesDocument1 pageEquity Elite OpportunitiesdibuayroorNo ratings yet

- Tata Emerging Opportunities FundDocument1 pageTata Emerging Opportunities FundJeremiah SolomonNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Prafful TriPathiNo ratings yet

- Utivalueopportunitiesfund 193Document2 pagesUtivalueopportunitiesfund 193201 TVNo ratings yet

- Uti Children'S Career Fund - Investment Plan: JANUARY 2023Document3 pagesUti Children'S Career Fund - Investment Plan: JANUARY 2023rout.sonali20No ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- Utimidcapfund 16020220823 053119Document2 pagesUtimidcapfund 16020220823 053119meghaNo ratings yet

- Whole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Document1 pageWhole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Abhishek BadalNo ratings yet

- SBI Multi Asset Allocation Fund FactsheetDocument1 pageSBI Multi Asset Allocation Fund FactsheetamanNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- 8ccff Pms Communique August 22Document13 pages8ccff Pms Communique August 22pradeep kumarNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Axis Smallcap FundDocument1 pageAxis Smallcap FundManoj JainNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- 2020756102monthly Communique June, 2022Document13 pages2020756102monthly Communique June, 2022Dhairya BuchNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- 578380618monthly Communique May, 2022Document12 pages578380618monthly Communique May, 2022Dhairya BuchNo ratings yet

- Round 2 Moolyankan2021Document2 pagesRound 2 Moolyankan2021Mahek MallNo ratings yet

- BOP One Pager Jan 2019Document1 pageBOP One Pager Jan 2019Ashwin HasyagarNo ratings yet

- HDFC MF Factsheet April 2023-1Document1 pageHDFC MF Factsheet April 2023-1Jayashree PawarNo ratings yet

- JM Midcap Oct 30Document1 pageJM Midcap Oct 30yugendhar janjiralaNo ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- Solutions Oriented Scheme-Children'S Fund: Investment ObjectiveDocument1 pageSolutions Oriented Scheme-Children'S Fund: Investment Objectiveparvinder.singh02No ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- 590784414monthly Communique March, 2022Document12 pages590784414monthly Communique March, 2022Dhairya BuchNo ratings yet

- Utiniftyindexfund 12820200210 213216Document2 pagesUtiniftyindexfund 12820200210 213216VarathavasuNo ratings yet

- Midcap FundDocument1 pageMidcap FundAman KumarNo ratings yet

- Sbi Life Bond Optimiser Fund PerformanceDocument1 pageSbi Life Bond Optimiser Fund PerformanceVishal Vijay SoniNo ratings yet

- LST ProtfolioDocument14 pagesLST ProtfolioPranjay ChauhanNo ratings yet

- Tata Mid Cap Growth Fund December 2019Document2 pagesTata Mid Cap Growth Fund December 2019ChromoNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- DSP Dec 2021Document97 pagesDSP Dec 2021RUDRAKSH KARNIKNo ratings yet

- Equity FundDocument1 pageEquity Fundnitin choudharyNo ratings yet

- Report On Demerger - Tube Investment India LimitedDocument8 pagesReport On Demerger - Tube Investment India LimitedMithil DoshiNo ratings yet

- ABSL Equity Hybrid '95 Fund Factsheet PDFDocument1 pageABSL Equity Hybrid '95 Fund Factsheet PDFKiranmayi UppalaNo ratings yet

- Equity Portfolio Oct10Document62 pagesEquity Portfolio Oct10akchatNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- UTI Multi Asset Allocation Fund Fact Sheet Feb 2024Document3 pagesUTI Multi Asset Allocation Fund Fact Sheet Feb 2024Lancelot DCunhaNo ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- Ishares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021Document3 pagesIshares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021hkm_gmat4849No ratings yet

- Sbi Life Pure Fund PerformanceDocument1 pageSbi Life Pure Fund PerformanceVishal Vijay SoniNo ratings yet

- Ethical Fun9Document1 pageEthical Fun9Nitish KumarNo ratings yet

- Mirae Asset India Opportunities Fund - Regular Plan: As On % Net AssetsDocument31 pagesMirae Asset India Opportunities Fund - Regular Plan: As On % Net AssetsNamrata ShettiNo ratings yet

- Sbi Life Top 300 Fund PerformanceDocument1 pageSbi Life Top 300 Fund PerformanceVishal Vijay SoniNo ratings yet

- Midcap FundDocument1 pageMidcap Fundnitin choudharyNo ratings yet

- Sbi Life Midcap Fund Latest Fund Performance (Jan 2024)Document1 pageSbi Life Midcap Fund Latest Fund Performance (Jan 2024)Vishal Vijay SoniNo ratings yet

- SBI Magnum Income Fund FactsheetDocument1 pageSBI Magnum Income Fund FactsheetKripa Shankar TiwariNo ratings yet

- Sbi Life Midcap Fund PerformanceDocument1 pageSbi Life Midcap Fund PerformanceVishal Vijay SoniNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Account Statement: Account Details Customer DetailsDocument4 pagesAccount Statement: Account Details Customer DetailsIJeoma KellyNo ratings yet

- Marketing ResearchDocument22 pagesMarketing ResearchUday KumarNo ratings yet

- Fund Factsheets IndividualDocument79 pagesFund Factsheets Individualmantoo kumarNo ratings yet

- Standard Chartered BankDocument41 pagesStandard Chartered BankGovind Tyagi100% (1)

- Analisis Penerapan Sistem Manajemen Mutu ISO 9001:2015 Terhadap Kinerja Biaya Mutu Pada Proyek UIN Sulthan Thaha Saifudin JambiDocument11 pagesAnalisis Penerapan Sistem Manajemen Mutu ISO 9001:2015 Terhadap Kinerja Biaya Mutu Pada Proyek UIN Sulthan Thaha Saifudin JambiMustafaNo ratings yet

- Unit 5 Market SegmentationDocument23 pagesUnit 5 Market SegmentationUyen ThuNo ratings yet

- Account Receivable ManagemntDocument12 pagesAccount Receivable ManagemntmehmuddaNo ratings yet

- Classification of Contracts: Contracts May Be Classified According To Their (1) Validity (2) Formation or (3) PerformanceDocument34 pagesClassification of Contracts: Contracts May Be Classified According To Their (1) Validity (2) Formation or (3) PerformanceJagdish YadavNo ratings yet

- Project Vision DocumentDocument9 pagesProject Vision DocumentSujal JaviaNo ratings yet

- HSE Risk Assessment Form: Risk/significance Evaluation Risk/significance EvaluationDocument1 pageHSE Risk Assessment Form: Risk/significance Evaluation Risk/significance EvaluationSachi AnandNo ratings yet

- Engstrom Auto Mirror Plant: Alex Barbosa Kelly Downes Justin Domingo Andy Fazzone Dave CassDocument16 pagesEngstrom Auto Mirror Plant: Alex Barbosa Kelly Downes Justin Domingo Andy Fazzone Dave CassDave CassNo ratings yet

- Oracle Cloud Enterprise Performance ManagementDocument27 pagesOracle Cloud Enterprise Performance Managementmohd.badrNo ratings yet

- E-Commerce CH-2Document30 pagesE-Commerce CH-2Madhan SNo ratings yet

- Group 5Document14 pagesGroup 5Kearn CercadoNo ratings yet

- Brand ManagementDocument31 pagesBrand ManagementBilal AhmadNo ratings yet

- Trust - Not A Separate Legal EntityDocument2 pagesTrust - Not A Separate Legal EntityNeha ShahNo ratings yet

- Lesson 10 Intercompany Transactions Exercise 2 - Suggested AnswersDocument18 pagesLesson 10 Intercompany Transactions Exercise 2 - Suggested AnswersjvNo ratings yet

- All About Investment BankingDocument3 pagesAll About Investment BankingMrugen ShahNo ratings yet

- End-Of-Chapter ProblemsDocument7 pagesEnd-Of-Chapter ProblemsSheila CortezNo ratings yet

- Practice Sheet - With Answers 2Document23 pagesPractice Sheet - With Answers 2Farah TarekNo ratings yet

- x1 English Conservation Dialog Logic Test 1 With AnswersDocument3 pagesx1 English Conservation Dialog Logic Test 1 With AnswersAleksandrNo ratings yet

- 18PM0044 - 1.0 ML Clear White Ring Snap Off & Yellow Ring On Neck Glass AmpouleDocument2 pages18PM0044 - 1.0 ML Clear White Ring Snap Off & Yellow Ring On Neck Glass Ampoulesystacare remediesNo ratings yet

- Political Economy - A Beginner's CourseDocument232 pagesPolitical Economy - A Beginner's CourseFelipe RodriguesNo ratings yet

- KEY-QMS-03 Training and CompetencyDocument5 pagesKEY-QMS-03 Training and CompetencyMenuka SiwaNo ratings yet

- Gurpej Singh - SAP ERP PGM RCDocument5 pagesGurpej Singh - SAP ERP PGM RCaamirbiNo ratings yet

- Accelerated DepreciationDocument4 pagesAccelerated DepreciationaaaaNo ratings yet