Professional Documents

Culture Documents

Problem Set. Chapter 5. Lecture 12. Tax

Problem Set. Chapter 5. Lecture 12. Tax

Uploaded by

Thùy Trang0 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

Problem-set.-Chapter-5.-Lecture-12.-Tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageProblem Set. Chapter 5. Lecture 12. Tax

Problem Set. Chapter 5. Lecture 12. Tax

Uploaded by

Thùy TrangCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

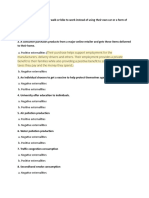

Problem Chapter 6: Impact of Taxation

1. The demand curve for a cigarette is QD = 72 - 2P while the supply curve is QS

= 12 + 4P, where P is measured by VND thousand per box, and Q by a hundred

thousand boxes. The government decided to levy a consumption tax of VND 6,000

per box.

a. What is pre- and after-tax gross revenue?

b. What is the tax burden paid by consumers and producers?

c. What is tax-induced deadweight loss from consumers’ and producers’

sides?

d. What is the total tax revenue and total deadweight loss of the society?

2. The demand curve for school bags in a small locality is QD = 600 – 2P while

the supply curve is QS = 300 + 4P, where P is measured by VND thousand per

school bag, and Q by thousands of pieces. The government decided to levy a

consumption tax of VND 6,000 per school bag. Please indicate:

a. What is market equilibrium, producer surplus, and consumer surplus before

taxes?

b. What is total tax revenue, tax burden paid by producers and consumers, and

change in producer surplus and consumer surplus after taxes?

c. What is the total deadweight loss of the society by consumption tax?

deadweight loss from consumers’ and producers’ sides?

3. With the market for school bags as stated in Exercise 2 instead of levying a

consumption tax, the government wants to encourage the learning production

firms, so it decides to subsidize a production subsidy of VND 3,000 per school

bag. Please indicate:

a. What is market equilibrium, producer surplus, and consumer surplus before

subsidies?

b. The total amount of subsidy that the government budget has to spend, the

benefits of the subsidy by producers and consumers, and the change in

producer surplus and consumer surplus after the subsidy.

c. What is the total deadweight loss of the society by production subsidy?

deadweight loss from consumers’ and producers’ sides?

1|Page Note: Open Book

You might also like

- 2010 'A' Level H1 Essay Q3 (Updated 25 June) (LT5)Document4 pages2010 'A' Level H1 Essay Q3 (Updated 25 June) (LT5)JohnNo ratings yet

- Prob Set KTCCDocument1 pageProb Set KTCClinhnhimuondichoiNo ratings yet

- Lecture SlidesDocument6 pagesLecture Slidesm-1511204No ratings yet

- Supply, Demand, Government Policies: Numerical QuestionsDocument6 pagesSupply, Demand, Government Policies: Numerical QuestionsArnica TradersNo ratings yet

- ECN 104 Sample Problems CH 1-2Document11 pagesECN 104 Sample Problems CH 1-2y2k100No ratings yet

- Application Economics of Public PolicyDocument13 pagesApplication Economics of Public Policyfilipa barbosaNo ratings yet

- A Level Paper 3: 2016 2012 Only Basic Economic Ideas and Resource AllocationDocument36 pagesA Level Paper 3: 2016 2012 Only Basic Economic Ideas and Resource AllocationShehrozSTNo ratings yet

- C1 Basic Economic QuizDocument5 pagesC1 Basic Economic QuizStevanus Jovan SaputraNo ratings yet

- ANS Hw8Document4 pagesANS Hw8abhiramreddy3No ratings yet

- PcEx 2Document2 pagesPcEx 2Asad ZamanNo ratings yet

- G9 - MQP - SA1 - MS TipsDocument21 pagesG9 - MQP - SA1 - MS TipsjyotsnatrathodNo ratings yet

- ECA5325 Assignment 1 S22324Document1 pageECA5325 Assignment 1 S22324keirazheng2001No ratings yet

- Econ Assignment AnswersDocument4 pagesEcon Assignment AnswersKazımNo ratings yet

- 04Document9 pages04Thuỳ DươngNo ratings yet

- ICSE - Economics Sample Paper-1 - SOLUTION-Class 10 Question PaperDocument12 pagesICSE - Economics Sample Paper-1 - SOLUTION-Class 10 Question PaperFirdosh KhanNo ratings yet

- IB Economics SL Paper 1 Question Bank - TYCHRDocument25 pagesIB Economics SL Paper 1 Question Bank - TYCHRansirwayneNo ratings yet

- Microeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDocument62 pagesMicroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test Bankelfledalayla5900x100% (36)

- Microeconomics Australia in The Global Environment Australian 1St Edition Parkin Test Bank Full Chapter PDFDocument68 pagesMicroeconomics Australia in The Global Environment Australian 1St Edition Parkin Test Bank Full Chapter PDFSherryElliottpgys100% (12)

- DE THI 2 VJCCk58 2 1Document5 pagesDE THI 2 VJCCk58 2 1k60.2112520041No ratings yet

- TJC Paper 2 AnswerDocument30 pagesTJC Paper 2 AnswerdavidbohNo ratings yet

- Market Failure SampleDocument5 pagesMarket Failure SampleHarshil ChordiaNo ratings yet

- (4b.) Negative Consumption Externalities (Types of Market Failure) - NotesDocument10 pages(4b.) Negative Consumption Externalities (Types of Market Failure) - NotesDBXGAMINGNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallDocument55 pagesThis Paper Is Not To Be Removed From The Examination HallSithmi HimashaNo ratings yet

- Full Essentials of Economics 7Th Edition Gregory Mankiw Solutions Manual Online PDF All ChapterDocument40 pagesFull Essentials of Economics 7Th Edition Gregory Mankiw Solutions Manual Online PDF All Chapterdreaaybahrain267100% (4)

- Microeconomics Theory and Applications 12th Edition Browning Test Bank 1Document43 pagesMicroeconomics Theory and Applications 12th Edition Browning Test Bank 1michael100% (65)

- Microeconomics Theory and Applications 12Th Edition Browning Test Bank Full Chapter PDFDocument36 pagesMicroeconomics Theory and Applications 12Th Edition Browning Test Bank Full Chapter PDFneil.anderson266100% (11)

- GR 10 Eco 1st TermDocument9 pagesGR 10 Eco 1st TermmaaheerjainNo ratings yet

- The Tax Reform For Acceleration and InclusionDocument3 pagesThe Tax Reform For Acceleration and InclusionbeckNo ratings yet

- Synoptic Topics: Fiscal Policy and Labour Markets: The Sugar TaxDocument5 pagesSynoptic Topics: Fiscal Policy and Labour Markets: The Sugar TaxMijwad AhmedNo ratings yet

- Sdvgeger ECONDocument2 pagesSdvgeger ECONtahmeemNo ratings yet

- 6.2 - Externalities Worksheet (All) - 1Document4 pages6.2 - Externalities Worksheet (All) - 1marianamzia06No ratings yet

- Essentials of Economics 7th Edition Gregory Mankiw Solutions Manual Full Chapter PDFDocument38 pagesEssentials of Economics 7th Edition Gregory Mankiw Solutions Manual Full Chapter PDFalbertkaylinocwn100% (16)

- 1.4. Government InterventionDocument11 pages1.4. Government InterventionJoel KennedyNo ratings yet

- Ampi, Mary Jescho v. Midterm AnswersDocument5 pagesAmpi, Mary Jescho v. Midterm AnswersMary Jescho Vidal AmpilNo ratings yet

- Principles of Economics 5Th Edition Mankiw Solutions Manual Full Chapter PDFDocument40 pagesPrinciples of Economics 5Th Edition Mankiw Solutions Manual Full Chapter PDFmohurrum.ginkgo.iabwuz100% (11)

- Kolej MARA Banting: SEPTEMBER 4, 2020Document6 pagesKolej MARA Banting: SEPTEMBER 4, 2020Syazwan KhirudinNo ratings yet

- Notes Economy - Current - Affairs Lecture 2 - 03 Sept 22Document9 pagesNotes Economy - Current - Affairs Lecture 2 - 03 Sept 22Tanay BansalNo ratings yet

- PP 3Document8 pagesPP 3Rashid okeyoNo ratings yet

- Principles of Macroeconomics 7Th Edition Gregory Mankiw Solutions Manual Full Chapter PDFDocument38 pagesPrinciples of Macroeconomics 7Th Edition Gregory Mankiw Solutions Manual Full Chapter PDFJamesWilliamsonjqyz100% (14)

- Chapter 23Document11 pagesChapter 23khanhlttss181012No ratings yet

- This Paper Is Not To Be Removed From The Examination Halls: Thursday, 13 May 2010: 2.30pm To 5.30pmDocument5 pagesThis Paper Is Not To Be Removed From The Examination Halls: Thursday, 13 May 2010: 2.30pm To 5.30pmSimbarashe MurozviNo ratings yet

- Chapter 1, DemandDocument16 pagesChapter 1, DemandRadhika JainNo ratings yet

- Tutorial Solutions 8Document5 pagesTutorial Solutions 8da3rXNo ratings yet

- Real World Econ Examples From MehdiDocument10 pagesReal World Econ Examples From MehdiToviel KiokoNo ratings yet

- Final Exam-Business Economics GM3Document2 pagesFinal Exam-Business Economics GM3FiqriNo ratings yet

- ECO EXAM 100 MARKS XI Term 1Document9 pagesECO EXAM 100 MARKS XI Term 1Sutapa DeNo ratings yet

- Managerial EconomicsDocument27 pagesManagerial EconomicsJanna TubalinalNo ratings yet

- Principles of Economics - Problem Set 5 Conceptual QuestionsDocument3 pagesPrinciples of Economics - Problem Set 5 Conceptual QuestionsantialonsoNo ratings yet

- Yunela Tugas 6Document4 pagesYunela Tugas 6yunela puputagustinaNo ratings yet

- Principles of Macroeconomics 7th Edition Gregory Mankiw Solutions Manual instant download all chapterDocument40 pagesPrinciples of Macroeconomics 7th Edition Gregory Mankiw Solutions Manual instant download all chapternitooxamary100% (2)

- Notes 1-Budget ConstraintDocument5 pagesNotes 1-Budget ConstraintTaposhi DasNo ratings yet

- Macro Multiple ChoiceDocument41 pagesMacro Multiple ChoiceNghi Lê Nguyễn PhươngNo ratings yet

- Eco GR 10Document19 pagesEco GR 10Abhinav MuraliNo ratings yet

- Principles - ProblemSet6 20-21Document3 pagesPrinciples - ProblemSet6 20-21София МашьяноваNo ratings yet

- Instant Download PDF Principles of Macroeconomics 7th Edition Gregory Mankiw Solutions Manual Full ChapterDocument40 pagesInstant Download PDF Principles of Macroeconomics 7th Edition Gregory Mankiw Solutions Manual Full Chapteryenewveron100% (5)

- Essentials of Economics 6th Edition Mankiw Solutions Manual instant download all chapterDocument40 pagesEssentials of Economics 6th Edition Mankiw Solutions Manual instant download all chapterelbanasaena70No ratings yet

- HOME WORK #5 Due 17 October 2019Document4 pagesHOME WORK #5 Due 17 October 2019Nevis SapphireNo ratings yet

- Macro 2, Quiz 1 AnswersDocument3 pagesMacro 2, Quiz 1 AnswersAlibekAkhmejanNo ratings yet

- Carbon Pricing and Fossil Fuel Subsidy Rationalization Tool KitFrom EverandCarbon Pricing and Fossil Fuel Subsidy Rationalization Tool KitNo ratings yet

- Surviving the Aftermath of Covid-19:How Business Can Survive in the New EraFrom EverandSurviving the Aftermath of Covid-19:How Business Can Survive in the New EraNo ratings yet