Professional Documents

Culture Documents

80072cajournal May2024 23

80072cajournal May2024 23

Uploaded by

Puneet MittalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

80072cajournal May2024 23

80072cajournal May2024 23

Uploaded by

Puneet MittalCopyright:

Available Formats

1394

Public Finance

THE CHARTERED ACCOUNTANT

Assessment of selected Urban Local Bodies preparedness

for Timely Preparation of Annual Financial Statements

in line with 15th Finance Commission

Finance commissions in the past have focused on the

Financial Sustainability of Urban Local Bodies (ULBs)

and grants have been linked to parameters that require

Urban Local Bodies (ULBs) to have robust revenue like

the 14th Finance Commission kept a provision of 20% as

Performance Grant, 15th Finance Commission used carrot

and stick approach for releasing grants; carrot in terms of

released grants if the State has migrated to the Capital Value

method of Property Tax and its growth is commensurated with

Anuradha Goel State Gross State Domestic Product (GSDP)1.

Academician

Government of India (GoI) Flagship Programs whether

Smart City or Atal Mission for Rejuvenation and Urban

Transformation (AMRUT), 14th Finance Commission (FC),

and 15th Finance Commission (FC) advocate publishing of

unaudited and audited Annual Financial Statement (AFS)

of Urban Local Bodies (ULBs) within specified timelines.

The Ministry of Housing and Urban Affairs (MoHUA)2 has

recently released guidelines for ranking cities financially.

These guidelines, which are based on 15 parameters, utilize

the Budget and Annual financial statements of Urban Local

CA. Pankaj Goel Bodies (ULBs) as the primary documents for assessing the

Member of the Institute financial ranking of cities. This underlies the importance of

timely financial reporting in coming years.

This article aims to highlight the essential requirements

that States and Urban Local Bodies (ULBs) must fulfill to

adhere to the timelines set by the 15th FC. Establishing a

robust Financial Ecosystem by the State/ULB is crucial

for maintaining financial discipline. This ensures not only

eligibility for grants but also the availability of documented

Annual Financial Statements (AFS) for future city financial

rankings and assessing the creditworthiness of ULBs for

issuing Municipal Bonds.

1

15th Finance Commission and Para 8 of AMRUT 2.0

2

Final Guidelines & Ranking Framework March, 2023, MoHUA

MAY 2024 74 www.icai.org

1395

Public Finance

THE CHARTERED ACCOUNTANT

Introduction iv. Receipts and Payments Account (detailed as per the

account heads);

India is one of the fastest-growing economies in the

v. Notes to Accounts; and

world, and its growth is propelled by its cities. Cities

contribute 66% to the national GDP, and the number vi. Financial Performance Indicators.

is expected to rise to 80% by 2050. The growth and

sustainability of these cities would be dependent on what More than 30 years have passed since autonomy

extent they can meet their expenses with their financial was provided to Urban Local Bodies (ULBs) through

position. Their Financial Position is determined by their the 74th Constitutional Amendment Act (CAA), still

financial statements which are prepared by Urban Local financial reporting is at a nascent stage restricting to

Bodies as per the State Municipal Accounts Manual the preparation and uploading of Annual Financial

(SMAM) & National Municipal Accounts Manual (NMAM). Statements (AFS). None of the Guidelines whether City

Financing ranking or 15th FC specifies what financial

In line with the State Municipal Accounts Manual (SMAM) statements shall cover to comply with condition of

& National Municipal Accounts Manual (NMAM), Urban uploading of Annual Financial Statements. Most of the

Local Bodies (ULBs) prepare their Annual Financial Urban Local Bodies (ULBs) fail to adhere to timelines

Statements (AFS) on an annual basis to depict their required for preparing and publishing Annual Financial

financial performance in the financial year. Para 31.4 Statements (AFS) despite their dependence on third-

of Chapter 31 of NMAM “Financial Statements states party professionals for its preparation.

that the Annual Report/ financial statements” of the

ULB shall include the following: 14th and 15th FC and other Guidelines issued by MoHUA

requires Urban Local Bodies (ULBs) to prepare and

i. Balance Sheet; publish Annual Financial Statements (AFS). (Table 1)

ii. Income and Expenditure Statement;

It is evident that the 15th Finance Commission has

iii. Statement of Cash flows (a summary of an enterprise’s mandated timeline of 15th May of the year for publishing

cash flow over a given period); unaudited accounts of the previous year with the vision

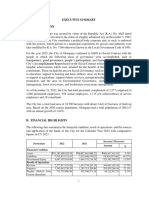

Table 1: Conditions for Preparation and Publishing Annual Financial Statements by Finance Commissions and

Centrally sponsored schemes guidelines

Finance Commission/

# Centrally sponsored Conditions Timelines

schemes guidelines

Audited Financial Statements need to be in place due to:

1 Smart City Mission Credit Rating of Cities

Issuance of Municipal Bonds

Augmenting Accrual Based Double Entry Accounting System

(ABDEAS)

AMRUT and AMRUT Migration to ABDEAS & audit certificate from FY 2012-13

2

2.0

Publication of annual financial statement on website

Appointment of internal auditor (IA)

City financial ranking guidelines issued by MoHUA, Fiscal

Governance Parameter - Point 10 requires a Timely Audit Closure

City Financial Ranking & Publication of Audited Annual Accounts in the public domain

3

guidelines, 2022 for 3 years. The audit shall not be done beyond a period of

12 months since the end of FY else no marks will be awarded.

As per 14th FC, each ULB is required to submit audited accounts

that relate to a year not earlier than two years preceding the

year in which a ULB seeks to claim the performance grant. In

4 14th FC addition to this mandatory condition, the following activities are 30th Sept of FY

to be undertaken by individual ULBs for accessing the grant for

the remaining three years, i.e., 2017-18, 2018- 19, and 2019-20.

MAY 2024 75 www.icai.org

1396

Public Finance

THE CHARTERED ACCOUNTANT

Finance Commission/

# Centrally sponsored Conditions Timelines

schemes guidelines

For the Performance Grant of 2017-18, 2018-19, and 2019-

20, audited accounts must be published on the ULB website

for the years 2015-16, 2016-17, and 2017-18 respectively

To claim a Grant for FY 2024-25; State to ensure online

availability of:

Unaudited accounts i.e. Annual Financial Statements (AFS)

5 15th FC for the previous year i.e. FY 2023-24, and 15th May 2024

Audited accounts i.e. Annual Financial Statements (AFS) of

the year before the previous year i.e. FY 2022-23

that accounts of local-self government are prepared well be followed by ULBs and other provisions related to it

on time like that of listed companies. This will further put realizing the importance of financial Statements.

financial discipline in place making it easier for ULBs to

explore the bond market in the coming years. To Illustrate: The Jharkhand Municipal (Accounts

& Finance) Rules, 2012 have been prepared in

In today’s era of Aatma Nirbhar visioned cities, congruence with the Jharkhand Municipal Act, 2011.

punctuality in financial reporting needs to be addressed.

Part A – Jharkhand Municipal (Accounts & Finance)

Rules, 2012: The Jharkhand Municipal (Accounts &

Scope of the Assessment Finance) Rules, 2012 have been presented with the

10 Cities of Two States i.e. Jharkhand and Assam, have rules containing Accounting and Financial matters

been selected based on random sampling. Annual and forms and registers related to the rules.

Financial Statements for the past three years i.e. FY

2019-20, 2020-21, & 2021-22 have been examined Part B – Jharkhand Municipal Accounts Preparation

from the city financial portal3. Guidelines: Jharkhand Municipal Accounts

Preparation Guidelines have been prepared in

Methodology pursuance to Rule no. 13 of Jharkhand Municipal

Accounts & Finance Rules, 2012. The Guidelines in

A realistic study based on secondary sources was steered

separate volumes consist of

to find the measures adopted by the Government of

India and State Governments for financial reporting Accounting Principles under the double-entry

through the preparation of annual financial statements. accrual system of accounting;

The data was collected from government reports,

research articles, reports of research agencies, and Chart of Accounts;

other online resources. The assessment of 10 cities is Guidelines for the preparation of the Opening

based on author’s experience in the Municipal Finance Balance Sheet;

field.

Formats and procedures to record the

Regulatory Framework for Accounting accounting entries.

Urban Local Bodies (ULBs) are governed by their However, there are no Assam Municipal (Account

respective State Municipal Act like Urban Local Bodies & Finance) Rules, unlike The Jharkhand Municipal

(ULBs) of Jharkhand are currently governed by the (Accounts & Finance) Rules, 2012 which are based on

Jharkhand Municipal Act (JMA), 2011. Urban Local the National Municipal Accounts Manual (NMAM).

Bodies (ULBs) of Assam are currently governed by the Thus, there is inconsistency among states regarding

Assam Municipal Act,1956 (amended in 2022). Some the adoption of State Municipal Accounting manuals to

States have made necessary amendments to their empower ULBs through the power of Governance with

Municipal Acts regarding the method of accounting to the weapon of Municipal (Account & Finance) Rules.

3

https://cityfinance.in/home

MAY 2024 76 www.icai.org

1397

Public Finance

THE CHARTERED ACCOUNTANT

A brief comparison of 2 States among 10 Urban also established a national portal of ULB finances, i.e.,

Local Bodies (ULBs) showing the inconsistency of http://www.cityfinance.in that is a repository of municipal

robust governance has been presented in Table 2: financial information where all urban Local Bodies need

to publish annual accounts audited and unaudited for

15TH Finance Commission Timelines: verification by Project Management Unit(PMU), MoHUA.

Assessment Each state has its system of preparing annual financial

Timely financial reporting ensures meeting of statutory statements (AFS) and getting its audit done. Some

deadlines and availability of information to decision- illustrative examples of State of Assam, Jharkhand,

makers promptly. The relevance of financial information Chhattisgarh, and Tamil Nadu have been given below:

tends to be lost if it is delayed so it is important to provide

up-to-date and current data for decision-making. Like in Jharkhand, each ULB has an accountant

as an employee who prepares Annual Financial

Seeing the importance of timelines of financial Statements (AFS) reviewed by the State Project

reporting, Section 137 of the Companies Act, Management Unit (PMU).

2013 has given a statutory timeline of filing Annual

Financial Statements within 30 days of the Annual In Assam, most ULBs except in Guwahati, day-to-

General Meeting of the Company. day accounting is done on a cash basis by a ULB

accountant on a manual basis. For the preparation

The Ministry of Housing and Urban Affairs (MoHUA) of Annual Financial Statements, external parties are

in its city financial ranking, 2023 has also given a

hired by ULB themselves. In Guwahati Municipal

timeline of Timely Audit Closure & Publication of

Corporation, a professional CA has been hired for

Audited Annual Accounts in the public domain -i.e.

the maintenance of day-to-day accounting and

within 12 months of ending the financial year, else

zero marks will be awarded out of 25 marks. preparation of the Annual Financial Statements.

15th Finance Commission has given a timeline of In Chhattisgarh, tenders have been floated by the

15th May of 2024 for ULBs to become eligible for State Urban Development Agency (SUDA) for the

2022-23 grants. preparation of annual financial statements (AFS) on an

accrual-based double-entry system by external parties.

However, once these Urban Local Bodies (ULBs) are

listed for municiple bonds, they need to get annual In Tamil Nadu, the ULB accounting Department

accounts prepared and audited within the timeline of prepares annual financial statements (AFS) through

SEBI for listed companies. The Ministry of Housing and their Centralized Software Urban Tree (UTIS) and

Urban Affairs (MoHUA) (earlier known as MoUD) has accounts are audited by a Local Fund auditor.

Table 2: Table showing the status of the State Municipal Accounting Manual (SMAM) and amendment in the

Municipal Act for selected ULBs

SMAM SMAM Municipal Act

# Cities State prepared approved amendment

Yes/No Yes/No Done Yes/No

1 Dhanbad Municipal Corporation Jharkhand Y Y Y

2 Giridih Nagar Nigam Y Y Y

3 Godda Nagar Panchayat Y Y Y

4 Latehar Nagar Panchayat Y Y Y

5 Ranchi Municipal Corporation Y Y Y

6 Guwahati Municipal Corporation Assam Y Y No

7 Tejpur Municipal Board Y No No

8 Nagaon Municipal Board Y No No

9 Nalbari Municipal Board Y No No

10 Digboi Municipal Board Y No No

Source: Annual Financial Statements and State Municipal Acts

MAY 2024 77 www.icai.org

1398

Public Finance

THE CHARTERED ACCOUNTANT

Brief assessment of 2 States among 10 Urban Local difficulty in meeting the deadline of 15th May from FY

Bodies (ULBs). regarding the timelines followed for past 2024-25 onwards.

financial years have been presented in Table 3.

This article attempts throw light on areas where States and

Table 2 indicates that due to the requirement of 15th ULBs need to gear up well on time by getting their all tools

FC and City Financial ranking, pending audit of various in place like getting all accounting entries updated, all

past years was done lately like some ULBs of Assam, reconciliations done, and appointing a Statutory auditor

audit for 2019-20 annual accounts has been done in well on time else the timeline of 15th May of Financial Year

FY 2023-24. The prime reason for the delay in auditing may become the dream for certain ULBs leading to their

Annual Financial Statements (AFS) is the delay in the failure to claim Grants for FY 2024-25.

preparation of annual accounts due to a lack of real-time

updating of Tally accounting software by Urban Local Some of the key tools/suggestions that the State and

Bodies (ULBs). This is a clear indication that the time ULB can place in their baggage of complying with 15th

has come to link reform to Grants so that timeliness in FC conditions well before the close of 31st March of FY

financial reporting can be adhered. have been presented below:

a. Appointment of Firm of Chartered Accountants: State/

Annual Financial Statements Assessment ULB needs to appoint a Firm of Chartered Accountants

Annual accounts prepared by ULB either themselves through a valid tendering process for the preparation

or with external support have to be in line with the of Annual Financial Statements and/or for carrying out

SMAM & NMAM. Furthermore, it shall also meet the Statutory Audit to meet 15th FC conditions.

qualitative characteristics of financial statements for

effective financial reporting. Assessment against these b. Resolving Accounting Staff shortage issues: Staff

parameters has been done in Table 4 and Table 5: shortage in municipalities can pose significant

challenges in the timely preparation of financial

Conclusion statements. Adequate staffing is crucial for ensuring

compliance with legal and regulatory requirements.

Preliminary assessments of Annual Financial

States shall create a Municipal Cadre of accounting

Statements (AFS) of sample cities indicate that lately

Staff and it shall be ensured that staff appointed

due to the 15th FC condition for claiming Grants

shall be of commerce background to give justice

and City Financial Ranking requirements, cities

to day-to-day bookkeeping and they shall be given

have started preparation and auditing of financial

regular training, both off the job and on the job. A

statements seriously Sample assessment of 10 cities

Municipal Accounts Service cadre was proposed in

indicates that delay significantly reduced in 2021-22

one of report of MoHUA4.

as compared to 2019-20 as even earlier years’ financial

statements have been audited in the years 2021-22 c. Creation of State Mission Monitoring Team (SMMT):

and 2022-23. The challenge is that all cities of India The State Mission Monitoring Team (SMMT) needs

where accounts are not updated in real-time will face to be set up under the leadership of any senior

Table 3: Status of Audited Annual Financial Statements in Sample ULBs

FY

Sl.No. Name of ULB

2019-20 2020-21 2021-22

1 Dhanbad Municipal Corporation 23.07.2021 10.11.2021 14.12.2022

2 Giridih Nagar Nigam 01.07.2021 10.11.2021 14.12.2022

3 Godda Nagar Panchayat 09.08.2021 30.01.2022 12.11.2022

4 Latehar Nagar Panchayat 24.07.2021 31.12.2021 30.11.2022

5 Ranchi Municipal Corporation 09.12.2020 16.12.2021 27.01.2023

6 Guwahati Municipal Corporation 08.02.2022 15.02.2022 30.06.2023

7 Tejpur Municipal Board 19.05.2023 20.01.2023 30.06.2022

8 Nagaon Municipal Board 26.06.2023 26.06.2023 09.05.2023

9 Nalbari Municipal Board 12.05.2022 12.05.2022 03.04.2023

10 Digboi Municipal Board 05.05.2022 20.05.2022 03.04.2023

Source: City Financial Ranking (https://cityfinance.in/login)

4

Approach towards Establishing Municipal Cadres in India, 2014, MoHUA

MAY 2024 78 www.icai.org

1399

Public Finance

THE CHARTERED ACCOUNTANT

Table 4: Assessment of Audited Annual Financial Statements of FY 2021-22 in selected ULBs against

Chapter 31 of NMAM/JMAM

Chapter 31

Receipts

Sl.No. Name of ULB Balance

Income and

Statement of and Notes to

Financial

Expenditure Performance

Sheet Cash Flows Payments Accounts

Statement Indicators

Account

Dhanbad Municipal

1 Yes Yes Yes Yes Yes Yes

Corporation

2 Giridih Nagar Nigam Yes Yes Yes Yes Yes Yes

3 Godda Nagar Panchayat Yes Yes Yes Yes Yes Yes

Latehar Nagar

4 Yes Yes Yes Yes Yes Yes

Panchayat

Ranchi Municipal

5 Yes Yes Yes Yes Yes Yes

Corporation

Guwahati Municipal

6 Yes Yes No Yes No No

Corporation

7 Tejpur Municipal Board Yes Yes No Yes No No

8 Nagaon Municipal Board Yes Yes No Yes No No

9 Nalbari Municipal Board Yes Yes No Yes No No

10 Digboi Municipal Board Yes Yes No Yes No No

Source: City Financial Ranking (https://cityfinance.in/login)

Table 5:

Proposed Municipal Functional Groups Municipal Services under the Municipal Cadre

Municipal Executive Service

Municipal Administrative Service [MAS] Municipal Social Development Service

Municipal Staff Services

Municipal Engineering Service

Municipal Sanitation Service

Municipal Technical Service [MTS] Urban Planning & Transportation Service

Municipal Fire Service

Municipal E-Governance Service

Municipal Accounts Service

Municipal Finance Service [MFS]

Municipal Revenue & Financial Service

official of the Urban Department, primarily from a for completion of work of preparation of Annual

finance background. State Mission Monitoring Team Financial Statements and its auditing.

at the State Level consisting of Senior Chartered d. Completion of Preliminary work of bookkeeping:

Accountants with experience in Municipal Finance The prime reason that audit work is delayed in ULBs

and implementation of accrual-based double is due to the delay in preparation of Annual

entry in ULBs and IT staff shall be formed to act Financial Statements which is due to a lack of real-

as surveillance unit to monitor and guide ULB time accounting and reconciliations. State/ULB

MAY 2024 79 www.icai.org

1400

Public Finance

THE CHARTERED ACCOUNTANT

Table 6: Indicative Checklist for Readiness of System

# Checkpoints Yes/No

Whether previous year’s opening balance from the approved Balance sheet have

1 been entered?

Whether journal has been prepared for all receivable income such as tax, charges

2 and lease income?

3 Whether journal has been prepared for all pending/outstanding payments?

Whether periodic reconciliation of various sub registers including Bank reconciliation

4 is done?

Whether capital work in progress completed during the year have been capitalized

5 and depreciated during the year?

shall ensure with strict instruction to the accounts Final Guidelines & Ranking Framework March 2023,

department to update all accounting entries in real- Government of India, Ministry of Housing & Urban

time so that financial statements can be prepared Affairs, 2022

without any significant delay once the financial year Fourteenth Finance Commission Performance Grant

FY 2023-24 is closed. Scheme 2017-2020 Tool Kit, Government of India

Indicative checklist in Table 6 may be used by the Municipal Bonds for Financing Urban Infrastructure

State/ULB to assess the readiness of the system in India: An Overview, (Revised 2020), ICAI

and completeness of AFS: Reform Toolkit for Atal Mission for Rejuvenation

e. Accounting preceedes Auditing: Auditing is known and Urban Transformation (AMRUT), Government of

as post mortem of books of accounts and thus India, Ministry of Housing & Urban Affairs, 2022

timeliness of the audit is dependent on the timely Research Study on Accounting Reforms in Urban

preparation of accounts. Thus, ULB accounts staff Local Bodies in India, Committee on Public Finance

shall ensure that day to day accounting is done on & Government Accounting The Institute of Chartered

real time with periodic reconciliation. This would Accountants of India, February 2019

ensure to prepare of annual financial statements on Smart City Guidelines, India, Government of India,

time to be available for audit. Ministry of Urban Development (2015), June 2015

f. Capacity Building Initiatives: Nothing can be The Report of the Fifteenth Finance Commission

achieved without effective Training in terms of (2022-2026), Government of India, (2021)

troubleshooting guide. Thus State/ULB shall

Transition to Accrual Accounting: Models and

ensure regular training, especially on-the-job

Learnings for Urban Local Bodies, An ICAI-ICAI ARF

training is provided so that queries can be

Study for NITI Aayog, 2022

resolved without any delay. State/ may may get a

small video solution to queries of ULB developed

that ULB accountants may face while entering

transactions and generating reports as part of

training material.

References

Annual Financial Statements of Selected

municipalities

Common Mistakes in Annual Financial Statements Authors may be reached at

of Urban Local Bodies, April 2023, Chartered eboard@icai.in

Accountant

MAY 2024 80 www.icai.org

You might also like

- © The Institute of Chartered Accountants of IndiaDocument48 pages© The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- Intermediate Advance Accounting RTP May 20Document48 pagesIntermediate Advance Accounting RTP May 20barnwalayush7531No ratings yet

- Intermediate Advance Accounting RTP May 20Document48 pagesIntermediate Advance Accounting RTP May 20BAZINGANo ratings yet

- Downloadfile 1Document43 pagesDownloadfile 1muhilanNo ratings yet

- Wapato Financial ReportDocument41 pagesWapato Financial ReportJanine LoutzenhiserNo ratings yet

- Finances of MunicipalitiesDocument5 pagesFinances of MunicipalitiesVinodk2010No ratings yet

- Rbi Report On Finances of PanchayatsDocument8 pagesRbi Report On Finances of PanchayatsSKNo ratings yet

- Adv RTP 20Document38 pagesAdv RTP 20Pawan AgrawalNo ratings yet

- States' Projection of Revenue and ExpenditureDocument8 pagesStates' Projection of Revenue and ExpenditureAakriti PantNo ratings yet

- Annual Report Circular 63 - 26 September 2012Document20 pagesAnnual Report Circular 63 - 26 September 2012khaya khanyezaNo ratings yet

- Balochistan Financial Statments 2018-19Document22 pagesBalochistan Financial Statments 2018-19Subhan WaheedNo ratings yet

- Dasmariñas2020 Audit ReportDocument228 pagesDasmariñas2020 Audit ReportJuswa DanyelNo ratings yet

- Crux of Indian Economy For IAS Prelims 2021 Book (January 2021 Edition)Document9 pagesCrux of Indian Economy For IAS Prelims 2021 Book (January 2021 Edition)Hari PrasadNo ratings yet

- Meycauayan City Executive Summary 2019Document8 pagesMeycauayan City Executive Summary 2019Secret secretNo ratings yet

- Ethiopia Public Debt Portfolio Analysis No 21 - 2019-20Document82 pagesEthiopia Public Debt Portfolio Analysis No 21 - 2019-20Mk FisihaNo ratings yet

- Surallah Executive Summary 2020Document5 pagesSurallah Executive Summary 2020Kynard PatrickNo ratings yet

- Adv RTP 19Document34 pagesAdv RTP 19Pawan AgrawalNo ratings yet

- Accounting ManualDocument273 pagesAccounting Manualkailasasundaram100% (3)

- Chapter 1Document3 pagesChapter 1Shan amirNo ratings yet

- Malolos City Executive Summary 2018Document8 pagesMalolos City Executive Summary 20182022105431No ratings yet

- FINAL Performance Audit City of Oaklands Financial Condition For FYs 2012 13 Through 2019 20Document63 pagesFINAL Performance Audit City of Oaklands Financial Condition For FYs 2012 13 Through 2019 20Zennie AbrahamNo ratings yet

- Financial State of The Cities 2021Document184 pagesFinancial State of The Cities 2021Ryan FinnertyNo ratings yet

- 11-CebuCity2017 Part3-Status of PYs RecommDocument64 pages11-CebuCity2017 Part3-Status of PYs RecommKen AbabaNo ratings yet

- Financial Reporting in Public Sector: Topic 9Document29 pagesFinancial Reporting in Public Sector: Topic 9Nur ImanNo ratings yet

- Executive SummaryDocument8 pagesExecutive SummaryNathan Roy OngcarrancejaNo ratings yet

- FY2011Audit Finalized062512Document86 pagesFY2011Audit Finalized062512My-Acts Of-SeditionNo ratings yet

- Leyte Executive Summary 2021Document4 pagesLeyte Executive Summary 2021Jade MaratasNo ratings yet

- Branch Auditor's Report: Raman Manoj& CoDocument25 pagesBranch Auditor's Report: Raman Manoj& CoDon bhaiNo ratings yet

- AFP Vol-1Document340 pagesAFP Vol-1Nitesh SharmaNo ratings yet

- Budget Manual Complete)Document342 pagesBudget Manual Complete)Humayoun Ahmad Farooqi71% (7)

- Manual PDFDocument299 pagesManual PDFNitish AggarwalNo ratings yet

- XJVFTQ: Rajiv GaubaDocument9 pagesXJVFTQ: Rajiv GaubachiaNo ratings yet

- Budget Manual (Complete)Document318 pagesBudget Manual (Complete)Kashif NiaziNo ratings yet

- Motiong Executive Summary 2017Document7 pagesMotiong Executive Summary 2017Ronel CadelinoNo ratings yet

- Introduction 310809Document18 pagesIntroduction 310809Arsh sharmaNo ratings yet

- Funancial StudiesDocument39 pagesFunancial Studiesarhamenterprises5401No ratings yet

- Latest September 2023Document32 pagesLatest September 2023Sreenivasan KorappathNo ratings yet

- 2010AFR GOCCs Vol2Document340 pages2010AFR GOCCs Vol2Glen LubricoNo ratings yet

- CM&TSA Rules - 2020Document14 pagesCM&TSA Rules - 2020Shahid HussainNo ratings yet

- E39042b6 PDFDocument199 pagesE39042b6 PDFGilbert PariyoNo ratings yet

- Chap - 17 AccountDocument31 pagesChap - 17 AccountAmit PatilNo ratings yet

- Bislig City Executive Summary 2017Document8 pagesBislig City Executive Summary 2017liezeloragaNo ratings yet

- Magsaysay Executive Summary 2020Document9 pagesMagsaysay Executive Summary 2020Johanna Mae AutidaNo ratings yet

- Volume XIV Issue 2 August: Monetary Policy Third Bi-Monthly Monetary Policy Statement, 2018-19Document4 pagesVolume XIV Issue 2 August: Monetary Policy Third Bi-Monthly Monetary Policy Statement, 2018-19gv25chalamNo ratings yet

- Newark Cy2014 MouDocument39 pagesNewark Cy2014 Mounsnix100% (1)

- Olongapo City Executive Summary 2022Document9 pagesOlongapo City Executive Summary 2022Mary Patricia Irma MoralesNo ratings yet

- Executive Summary: in Thousands of PesosDocument6 pagesExecutive Summary: in Thousands of PesosDAS MAGNo ratings yet

- Butuan City Executive Summary 2018Document6 pagesButuan City Executive Summary 2018ebustillobxuNo ratings yet

- Accounting For Budgetary AccountsDocument51 pagesAccounting For Budgetary Accountsacctg2012No ratings yet

- Volume XV - Issue 2 - AUGUST 2019: I. RBI Central Board Approves Surplus Transfer To The GovernmentDocument4 pagesVolume XV - Issue 2 - AUGUST 2019: I. RBI Central Board Approves Surplus Transfer To The GovernmentAnonymous Ax5bwAHvNo ratings yet

- La Paz Executive Summary 2021Document5 pagesLa Paz Executive Summary 2021kmarkcramosNo ratings yet

- 01-Angadanan2020 Transmittal LettersDocument14 pages01-Angadanan2020 Transmittal LettersAlicia NhsNo ratings yet

- Barangay Budget ExecutionDocument6 pagesBarangay Budget Executionlinden_07100% (1)

- The Punjab Budget ManualDocument171 pagesThe Punjab Budget ManualMushahid123456No ratings yet

- Budgetting DSD - LatestDocument72 pagesBudgetting DSD - LatestMuhammad Moeen BhattiNo ratings yet

- Ac 16 - 601P - Gabuat-Habac-Visca-Section-ReviewerDocument15 pagesAc 16 - 601P - Gabuat-Habac-Visca-Section-ReviewerRenelle HabacNo ratings yet

- San Jorge Executive Summary 2020Document130 pagesSan Jorge Executive Summary 2020Maria CharessaNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- 80074cajournal May2024 25Document7 pages80074cajournal May2024 25Puneet MittalNo ratings yet

- 80075cajournal May2024 26Document5 pages80075cajournal May2024 26Puneet MittalNo ratings yet

- 80076cajournal May2024 27Document2 pages80076cajournal May2024 27Puneet MittalNo ratings yet

- Dvat 51Document1 pageDvat 51Puneet MittalNo ratings yet

- UCO BANK - Empanelment of Concurrent Auditors 2015-16-3d52232154Document15 pagesUCO BANK - Empanelment of Concurrent Auditors 2015-16-3d52232154Puneet MittalNo ratings yet

- Eprocurement System Government of Uttar PradeshDocument1 pageEprocurement System Government of Uttar PradeshsanjaykmrNo ratings yet

- National Urban Innovation Stack Web Version PDFDocument86 pagesNational Urban Innovation Stack Web Version PDFsrikanth mukkeraNo ratings yet

- TD PDFDocument575 pagesTD PDFAbinashNo ratings yet

- The Gist DECEMBER 2019 - IAS EXAM PORTALDocument129 pagesThe Gist DECEMBER 2019 - IAS EXAM PORTALHemant BhardwajNo ratings yet

- CSB Ias Academy: PIB February-15Document7 pagesCSB Ias Academy: PIB February-15Surendra KumarNo ratings yet

- Rapid Revision Book 2024 (Imp. Govt. Schemes) Prelims 2024Document134 pagesRapid Revision Book 2024 (Imp. Govt. Schemes) Prelims 2024ranjeetgkp05No ratings yet

- Indore-Smart-City-Case-Study RemnameDocument63 pagesIndore-Smart-City-Case-Study RemnameGokul NathanNo ratings yet

- 01 Vol III A Extent of WorksDocument26 pages01 Vol III A Extent of WorksDhaval ParmarNo ratings yet

- Atal Mission For Rejuvenation and Urban TransformationDocument3 pagesAtal Mission For Rejuvenation and Urban TransformationAshutosh MasgondeNo ratings yet

- Gujarat Schemes ListDocument15 pagesGujarat Schemes ListIshaNo ratings yet

- Cuet PG GK Questions PDFDocument50 pagesCuet PG GK Questions PDFSwati SharmaNo ratings yet

- 17284final Report VCF Rajnandgaon With SummaryDocument141 pages17284final Report VCF Rajnandgaon With SummaryNeeraj JhaNo ratings yet

- Important Govt Schemes by PMO of India Study Notes For UGC NETDocument11 pagesImportant Govt Schemes by PMO of India Study Notes For UGC NETDHIVYA VENKATARAMANNo ratings yet

- Urban Sustainability With Government Missions - JnNURM, AMRUT, SCM, SBM, HRIDAY and Comparative Analysis.Document12 pagesUrban Sustainability With Government Missions - JnNURM, AMRUT, SCM, SBM, HRIDAY and Comparative Analysis.mayankNo ratings yet

- 26 Important Schemes Launched by Narendra Modi Government A.O.AUGUST 2019Document14 pages26 Important Schemes Launched by Narendra Modi Government A.O.AUGUST 2019KARTHIKEYAN MNo ratings yet

- Agartala Adb PDMC - TorDocument9 pagesAgartala Adb PDMC - TorSaurabh SrivastavaNo ratings yet

- Summary Sheet: ESI-UrbanizationDocument26 pagesSummary Sheet: ESI-UrbanizationAbhey RattanNo ratings yet

- Slum Case Study: - Vidyadhar Nagar Sector 4Document10 pagesSlum Case Study: - Vidyadhar Nagar Sector 4Mallika SinghNo ratings yet

- Handout 13 Mrunal SirDocument58 pagesHandout 13 Mrunal SirTHE COMMERCE COACH STUDYNo ratings yet

- Amrut 2.0Document5 pagesAmrut 2.0Tejaswini ShindeNo ratings yet

- Reqest For Proposal (RFP) DocumentDocument20 pagesReqest For Proposal (RFP) DocumentAbhishek Kumar SinhaNo ratings yet

- Gujarat Surat PDFDocument5 pagesGujarat Surat PDFastral projectNo ratings yet

- Part A Manual Engineering Planning Design and ImplementationDocument1,267 pagesPart A Manual Engineering Planning Design and Implementationlinesh3No ratings yet

- Foundation Book FinalDocument408 pagesFoundation Book Finalsparsh guptaNo ratings yet

- JagranJosh CA Dec 2021Document537 pagesJagranJosh CA Dec 2021Deepak YadavNo ratings yet

- 5.2. Jal Jeevan Mission Urban: Department of Drinking Water and Sanitation Under The Jal Shakti MantralayaDocument1 page5.2. Jal Jeevan Mission Urban: Department of Drinking Water and Sanitation Under The Jal Shakti MantralayaRaghav SharmaNo ratings yet

- Supw ProjectDocument17 pagesSupw Projectatharv shindeNo ratings yet

- 2020 Government Schemes by AffairsCloudDocument19 pages2020 Government Schemes by AffairsCloudanitha925No ratings yet

- Team 15: - Niharika - Meghna - Neeraj - Varalika - Aarti - Lalit - Prashanth - UnnikrishnanDocument13 pagesTeam 15: - Niharika - Meghna - Neeraj - Varalika - Aarti - Lalit - Prashanth - UnnikrishnanLalit SapkaleNo ratings yet

- Investing in Future Cities Building Inclusive Resilient and Sustainable UrbanscapesDocument9 pagesInvesting in Future Cities Building Inclusive Resilient and Sustainable UrbanscapesRaj DwivediNo ratings yet