Professional Documents

Culture Documents

P4-3ATutorial Question Chapter 4

P4-3ATutorial Question Chapter 4

Uploaded by

Silke HerbertCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P4-3ATutorial Question Chapter 4

P4-3ATutorial Question Chapter 4

Uploaded by

Silke HerbertCopyright:

Available Formats

21 0 chapter 4 Accrual Accounting Concepts

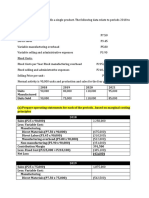

P4-3A The Vang Hotel opened for business on May 1, 2012. Here is its trial balance be-

Prepare adjusting entries,

fore adjustment on May 31.

adjusted trial balance, and

VANGHOTEL

financial statements.

Trial Balance

(SO 4. 5. 6. 7). AP

May 31, 2012

~ Debit Credit

$ 2,500

Cash 1,800

Prepaid Insurance

2,600

Supplies 15,000

Land 70,000

Buildings 16,800

Equipment $ 4,700

Accounts Payable 3,300

Unearned Rent Revenue 36,000

Mortgage Payable 60,000

Common Stock 9,000

Rent Revenue

Salaries and Wages Expense 3,000

800

Utilities Expense

500

Advertising Expense

$113,000 $113,000

Other data:

1. Insurance expires at the rate of $450 per month.

2. A count of supplies shows $1,050 of unused supplies on May 31.

3. Annual depreciation is $3,600 on the building and $3,000 on equipment.

4. The mortgage interest rate is 6%. (The mortgage was taken out on May 1.)

5. Unearned rent of $2,500 has been earned.

6. Salaries of $900 are accrued and unpaid at May 31.

Instructions

(a) Journalize the adjusting entries on May 31.

(b) Prepare a ledger using T accounts. Enter the trial balance amounts and post the ad-

justing entries.

(c) Prepare an adjusted trial balance on May 31.

(c) Rent revenue $11,500 (d) Prepare an income statement and a retained earnings statement for the month of

Tot. adj. trial ~'A') c-~<i ~ d..assified balance sheet at May 31.

balance (e) Identity wb.icb. accounts sb.ou\d be dosed on 'l:\7la~ :,\.

(d) Net income P4-4A Rolling Hills Golf Inc. was organized on July 1, 2012. Quarterly financial statements

Prepare adjusting entries and are prepared. The trial balance and adjusted trial balance on September 30 are shown here.

financial statements; identify ROLLING HILLS GOLF INC.

accounts to be closed. Trial Balance

(SO 4, 5, 6. 7), AP September 30, 2012

Adjusted

~

Unadjusted

Dr. Cr.

Dr. Cr.

$ 6,700

$ 6,700'

1,000

Cash 400

Accounts Receivable 900

1,800

Prepaid Rent 180

1,200

15,000

Supplies 15,000 350

$

Equipment 5,000

Accumulated Depreciation-Equipment $ 5,000 1,070

Notes Payable 1,070

600

Accounts Payable 50

Salaries and Wages Payable

800

Interest Payable 1,000

14,000

Unearned Rent Revenue 14,000

0

Common Stock 0

Retained Earnings 600

600

Dividends

You might also like

- Auditing and Assurance: Concepts and Applications 1Document22 pagesAuditing and Assurance: Concepts and Applications 1Ken Mateyow100% (1)

- Sarbanes Oxley Vs PH LegislationsDocument5 pagesSarbanes Oxley Vs PH LegislationsJNo ratings yet

- Raymond S. Schmidgall, David K. Hayes, Jack D. Ninemeier - Restaurant Financial Basics-Wiley (2002)Document338 pagesRaymond S. Schmidgall, David K. Hayes, Jack D. Ninemeier - Restaurant Financial Basics-Wiley (2002)leonardo soteldo100% (2)

- Auditing in A Computerized EnvironmentDocument15 pagesAuditing in A Computerized EnvironmentLawrenceValdezNo ratings yet

- Go-Figure WorksheetDocument2 pagesGo-Figure WorksheetChris Marasigan0% (1)

- Assignment 1Document25 pagesAssignment 1Judy ZhangNo ratings yet

- Soal Latihan DDADocument1 pageSoal Latihan DDAMutia AzzahraNo ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- PR 4 Completing The Cycle 2022 1Document1 pagePR 4 Completing The Cycle 2022 1smthlikeyouNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- E3-5 (LO 3) Adjusting Entries: InstructionsDocument6 pagesE3-5 (LO 3) Adjusting Entries: InstructionsAntonios Fahed0% (1)

- 11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentDocument4 pages11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentSandeep NehraNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- 11 Accountancy t2 Sp01Document19 pages11 Accountancy t2 Sp01Lakshy BishtNo ratings yet

- CH 02Document4 pagesCH 02flrnciairnNo ratings yet

- Chapter 4 Exercises & SolutionsDocument13 pagesChapter 4 Exercises & SolutionsMariamNo ratings yet

- Acc HWDocument5 pagesAcc HWHasan NajiNo ratings yet

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- BT C1 - kttcqt1Document13 pagesBT C1 - kttcqt1Thảo NguyễnNo ratings yet

- Test Soal AdjustingDocument2 pagesTest Soal AdjustingNicolas ErnestoNo ratings yet

- Accounting Activity 6Document2 pagesAccounting Activity 6Kae Abegail GarciaNo ratings yet

- Accountancy Auditing 2016Document7 pagesAccountancy Auditing 2016Abdul basitNo ratings yet

- Comm 457Document4 pagesComm 457reetNo ratings yet

- BUSN7008 Week 3 Adjustments - Updated 2023Document33 pagesBUSN7008 Week 3 Adjustments - Updated 2023berfamenNo ratings yet

- Chapter (3) Adjusting The Accounts Practice Exercises and SolutionsDocument5 pagesChapter (3) Adjusting The Accounts Practice Exercises and Solutionsclara2300181No ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- Accountancy I 2016 PDFDocument4 pagesAccountancy I 2016 PDFShahid RazwanNo ratings yet

- Accountancy and Auditing-2016 PDFDocument6 pagesAccountancy and Auditing-2016 PDFMian Abdullah YaseenNo ratings yet

- UAS Akuntansi Lanjutan 2022Document2 pagesUAS Akuntansi Lanjutan 2022Teo RinNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- ch4 2Document3 pagesch4 2hohrmpm2No ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- PR 4 Completing The Cycle 2015Document1 pagePR 4 Completing The Cycle 2015Permana bobbyNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- 10531lecture 6Document14 pages10531lecture 6Najia Salman100% (1)

- Acc100 SW WSDocument3 pagesAcc100 SW WSKathleen MarcialNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- Accounting Exercises PDFDocument7 pagesAccounting Exercises PDFMoni TafechNo ratings yet

- Final Marryland AccountingDocument15 pagesFinal Marryland AccountingNatnael AsnakeNo ratings yet

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- Poa HWDocument3 pagesPoa HW赵宇哲No ratings yet

- FAR Adjusting Entries ExcerciseDocument3 pagesFAR Adjusting Entries ExcerciseSheena LeysonNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- AFR Session 4 ExercisesDocument10 pagesAFR Session 4 ExercisesSherif KhalifaNo ratings yet

- Exercise 2BDocument2 pagesExercise 2Bmytu261105No ratings yet

- Adjusting EntryDocument8 pagesAdjusting EntryRaeha Tul Jannat BuzdarNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Problems: Set C: InstructionsDocument4 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- Forever Green Landscaping Unadjusted Trial Balance August 31, 2008Document60 pagesForever Green Landscaping Unadjusted Trial Balance August 31, 2008yoantanNo ratings yet

- ACCT 2211 Assignment 2Document17 pagesACCT 2211 Assignment 2Tannaz SNo ratings yet

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- MODULE 6 - Chapter 8 - ANSWERSDocument3 pagesMODULE 6 - Chapter 8 - ANSWERSArmer MacalintalNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Literature Review DemoDocument9 pagesLiterature Review DemoSilke HerbertNo ratings yet

- New Lecture On Product and BrandingDocument32 pagesNew Lecture On Product and BrandingSilke HerbertNo ratings yet

- Short NEW DIRECT MARKETING AND E-COMMERCE LECTUREDocument16 pagesShort NEW DIRECT MARKETING AND E-COMMERCE LECTURESilke HerbertNo ratings yet

- Short Distribution Lecture-Mktg 2001Document21 pagesShort Distribution Lecture-Mktg 2001Silke HerbertNo ratings yet

- CH 05Document65 pagesCH 05Silke HerbertNo ratings yet

- MKTG 2001 LECTURE 8-PricingDocument23 pagesMKTG 2001 LECTURE 8-PricingSilke HerbertNo ratings yet

- GOVERNMENT TERMS & ConceptDocument1 pageGOVERNMENT TERMS & ConceptSilke HerbertNo ratings yet

- Auditing and Corporate GovernanceDocument10 pagesAuditing and Corporate GovernancealexandraNo ratings yet

- Peregrine+-Externnal Audit CaseDocument9 pagesPeregrine+-Externnal Audit CaseGisselle CollinsNo ratings yet

- The Sherwin-Williams Company Excel Spread Sheet 2010Document6 pagesThe Sherwin-Williams Company Excel Spread Sheet 2010Bitsy627No ratings yet

- Financial Accounting Tools For Business Decision Making Canadian 5th Edition Kimmel Test BankDocument43 pagesFinancial Accounting Tools For Business Decision Making Canadian 5th Edition Kimmel Test Bankcuonghuong8eb100% (31)

- IFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Document36 pagesIFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Дарья ГоршковаNo ratings yet

- 2009 Undergraduate ScheduleDocument15 pages2009 Undergraduate Schedulemattyou2007No ratings yet

- Conceptual Framework Module 5Document3 pagesConceptual Framework Module 5Jaime LaronaNo ratings yet

- Buffalo Accounting Go-Live ChecklistDocument16 pagesBuffalo Accounting Go-Live ChecklistThach Doan100% (1)

- Auditing IiiDocument2 pagesAuditing IiiRose Medina BarondaNo ratings yet

- CSR RoadmapDocument1 pageCSR RoadmapSamNo ratings yet

- SAP Asset AccountingDocument8 pagesSAP Asset AccountingMohamed HabebNo ratings yet

- Etam Representation Letter For Annual Audit 2014Document5 pagesEtam Representation Letter For Annual Audit 2014nirjhor006No ratings yet

- Balance SheetDocument24 pagesBalance SheetGnanasekar ThirugnanamNo ratings yet

- International Terms - Sep 07Document2 pagesInternational Terms - Sep 07Caterina De LucaNo ratings yet

- BRFABM1Document59 pagesBRFABM1tenderjuicyiyyyNo ratings yet

- Accountancy Set (A) Class - Xi - FinalDocument98 pagesAccountancy Set (A) Class - Xi - Finalsamarthj.9390No ratings yet

- Standard Costing Ang Variance AnalysisDocument3 pagesStandard Costing Ang Variance AnalysisLhorene Hope DueñasNo ratings yet

- Scroll Down To Complete All Parts of This Task.: Situation ResponseDocument15 pagesScroll Down To Complete All Parts of This Task.: Situation ResponseDaljeet SinghNo ratings yet

- What Is The Consolidated Net Income Before Allocation To The Controlling and Noncontrolling Interests?Document81 pagesWhat Is The Consolidated Net Income Before Allocation To The Controlling and Noncontrolling Interests?Lê Thiên Giang 2KT-19No ratings yet

- Investment in Associate and Joint VentureDocument5 pagesInvestment in Associate and Joint VenturedumpyforhimNo ratings yet

- Cost Accounting Importance and Advantages of Cost Accounting PapaDocument14 pagesCost Accounting Importance and Advantages of Cost Accounting PapaCruz MataNo ratings yet

- Last Na NiDocument5 pagesLast Na NiNatalie SerranoNo ratings yet

- Accounting For Special Transactions Problems 2Document219 pagesAccounting For Special Transactions Problems 2Ella MyrrNo ratings yet

- In God We Trust - Multiple ChoiceDocument13 pagesIn God We Trust - Multiple ChoiceNevan NovaNo ratings yet

- Emlak Konut REIC: Price Target RevisionDocument6 pagesEmlak Konut REIC: Price Target RevisionCbpNo ratings yet