Professional Documents

Culture Documents

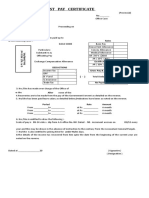

Annexure - B

Annexure - B

Uploaded by

arunt1991Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure - B

Annexure - B

Uploaded by

arunt1991Copyright:

Available Formats

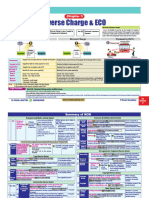

RG Payroll Solutions

Annexure – B

TO WHOM IT MAY CONCERN

I, ……………….. (Emp ID……) had availed a loan of Rs……………… from ........................ (bank)

alongwith .......................................... (co-borrowers)

That I am owner of the house property and my share in the repayment of the principal and interest

thereon is …… (specify % of repayment).

That no other co-borrower is availing the tax benefits for the repayment of principal (u/s 80C) and

interest (u/s 24) / That other co-borrowers are availing tax benefit to the extent of ............. (specify %)

only.

As such, I can avail tax benefits to the extent of .............(specify %) of the principal repayment and interest

amount.

That I shall indemnify the company for any future loss /liability arising on account of allowing above

deduction/exemption.

(……………………)

E ID ……….

13

You might also like

- HDFC Third Party 2Document3 pagesHDFC Third Party 2Pankaj babu0% (1)

- Ap-37-Y-2859 DasuDocument2 pagesAp-37-Y-2859 Dasusarath potnuriNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2320101184002700000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2320101184002700000sarath potnuriNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2380101884002700000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2380101884002700000sarath potnuriNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2320101185173300000Document2 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2320101185173300000sarath potnuriNo ratings yet

- Ap 37 TC 6856Document2 pagesAp 37 TC 6856sarath potnuriNo ratings yet

- Ap-37-Tc-7016 AzDocument2 pagesAp-37-Tc-7016 Azsarath potnuriNo ratings yet

- Policy Schedule Cum Cer Ficate of Insurance: Premium Computation TableDocument2 pagesPolicy Schedule Cum Cer Ficate of Insurance: Premium Computation Tableriyaz ahmadNo ratings yet

- Chapter 3 - RCMDocument14 pagesChapter 3 - RCMMohit Jain100% (1)

- Systems PVT LTD, Hyderabad. You Will Be Working With The Leadership Team, Who Will Assign Your Specific Responsibilities FromDocument3 pagesSystems PVT LTD, Hyderabad. You Will Be Working With The Leadership Team, Who Will Assign Your Specific Responsibilities FromBabu RaoNo ratings yet

- AP-37-TE-3834 AzDocument2 pagesAP-37-TE-3834 Azsarath potnuriNo ratings yet

- Ap-37-Tk-2044 MohDocument2 pagesAp-37-Tk-2044 Mohsarath potnuriNo ratings yet

- Ap37-Y-4542 RajDocument2 pagesAp37-Y-4542 Rajsarath potnuriNo ratings yet

- Ap-37-Tb-3870 DasuDocument2 pagesAp-37-Tb-3870 Dasusarath potnuriNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2320101184001300000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2320101184001300000sarath potnuriNo ratings yet

- 50 BooksDocument2 pages50 BooksFARMAN SHAIKH SAHABNo ratings yet

- Renewal Premium ReceiptDocument1 pageRenewal Premium ReceiptArush JamwalNo ratings yet

- AP 39 Te 1681 RameshDocument2 pagesAP 39 Te 1681 Rameshsarath potnuriNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2320 1001 7259 2300 000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2320 1001 7259 2300 000Jason RogersNo ratings yet

- Ap 39 TS 3030Document2 pagesAp 39 TS 3030sarath potnuriNo ratings yet

- Ap-26-Td-1418 NaguDocument2 pagesAp-26-Td-1418 Nagusarath potnuriNo ratings yet

- HDFC Teja AutoDocument2 pagesHDFC Teja Autosarath potnuriNo ratings yet

- 16 Summer 2018 BT SADocument8 pages16 Summer 2018 BT SApabloescobar11yNo ratings yet

- New Tax Calculator - AY 17-18Document11 pagesNew Tax Calculator - AY 17-18Rohankumar KshirsagarNo ratings yet

- Ap 37 TC 3646Document2 pagesAp 37 TC 3646sarath potnuriNo ratings yet

- Form 16 Generator (Blank) With 3 in 1 Calculator FY 2018 19Document27 pagesForm 16 Generator (Blank) With 3 in 1 Calculator FY 2018 19roneysfa644No ratings yet

- Ap-39-W-9404 RameshDocument3 pagesAp-39-W-9404 Rameshsarath potnuri100% (1)

- US Internal Revenue Service: f5500sr - 1999Document2 pagesUS Internal Revenue Service: f5500sr - 1999IRSNo ratings yet

- Medgulf Nextcare Rn2 QuoteDocument1 pageMedgulf Nextcare Rn2 Quotekcatolico00No ratings yet

- Instructions To Use Tax CalculatorDocument5 pagesInstructions To Use Tax Calculatormadhuri priyankaNo ratings yet

- Motor Insurance Passenger Carrying LiabiDocument4 pagesMotor Insurance Passenger Carrying LiabiMohammed ShafiNo ratings yet

- Adobe Scan Aug 01, 2022Document1 pageAdobe Scan Aug 01, 2022biswajit prustyNo ratings yet

- US Internal Revenue Service: f5500sr - 2001Document2 pagesUS Internal Revenue Service: f5500sr - 2001IRSNo ratings yet

- ASHADocument4 pagesASHAamarjitkumarmattu94617No ratings yet

- US Internal Revenue Service: f5500sr - 2000Document2 pagesUS Internal Revenue Service: f5500sr - 2000IRSNo ratings yet

- 2320100020213100000Document4 pages2320100020213100000vineet chaudharyNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1005 0512 8700 000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 1005 0512 8700 000rajkumargiritekarNo ratings yet

- 3in1tax Calculator With Form 16 V 14.2 FY 2019-20Document18 pages3in1tax Calculator With Form 16 V 14.2 FY 2019-20Nihit SandNo ratings yet

- Orange FinDocument1 pageOrange Finisha selvamNo ratings yet

- Ajay Randey PolicyDocument1 pageAjay Randey PolicyHarsh PatelNo ratings yet

- Mployment Enefits AW Eport: E & B L RDocument6 pagesMployment Enefits AW Eport: E & B L RflastergreenbergNo ratings yet

- Motor Insurance - Two Wheeler Multiyear Liability Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesMotor Insurance - Two Wheeler Multiyear Liability Only: Certificate of Insurance Cum Policy Scheduleanon_103901460No ratings yet

- 2320100231958600000Document2 pages2320100231958600000vikas100% (2)

- 2320100231958600000Document2 pages2320100231958600000vikasNo ratings yet

- S Lachamma InsDocument1 pageS Lachamma Insyukta tvsNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2320 1001 7259 2300 000Document2 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2320 1001 7259 2300 000Jason RogersNo ratings yet

- Car InsuranceDocument5 pagesCar InsuranceAditya kumarNo ratings yet

- Renewal Premium Receipt 15022023Document3 pagesRenewal Premium Receipt 15022023sumanta KMrfgtyhNo ratings yet

- LAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsDocument2 pagesLAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsSyed Jalil abbas100% (1)

- Advertisement For The Post of GM Finance GM Civil DGM Civil DGM Architect AM Civil AM Town Planner JE Civil Legal Assistant 1Document7 pagesAdvertisement For The Post of GM Finance GM Civil DGM Civil DGM Architect AM Civil AM Town Planner JE Civil Legal Assistant 1RiyazulSamadBinMohammadNo ratings yet

- A62da2466a154a 1658463334poovarasan Murugasamy UJJ39393 Elevation Letter Updated 20220722 094412 67460965062da24144cf94435614311Document2 pagesA62da2466a154a 1658463334poovarasan Murugasamy UJJ39393 Elevation Letter Updated 20220722 094412 67460965062da24144cf94435614311Poovarasan MNo ratings yet

- UP14DT3850Document3 pagesUP14DT3850Aakash ShishodiaNo ratings yet

- CT Engineering Polymers PVT LTD PDFDocument2 pagesCT Engineering Polymers PVT LTD PDFSangeetaNo ratings yet

- Final Return For TARA PDFDocument8 pagesFinal Return For TARA PDFAnonymous NaYWx2vJN100% (1)

- 2019 Mitsubishi Outlander Sport LEDocument1 page2019 Mitsubishi Outlander Sport LECraig HodgesNo ratings yet

- Description Previous This Period CumulativeDocument3 pagesDescription Previous This Period CumulativeChathuranga PriyasamanNo ratings yet

- Motor Insurance Two Wheeler ComprehensivDocument4 pagesMotor Insurance Two Wheeler Comprehensivravi dhimanNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- PolicyDocument2 pagesPolicySibananda PanigrahiNo ratings yet