Professional Documents

Culture Documents

Chapter 7

Chapter 7

Uploaded by

ricamelaocampo21Copyright:

Available Formats

You might also like

- BSBFIM601 - Assessment 2 ProjectDocument12 pagesBSBFIM601 - Assessment 2 ProjectPhenday SangayNo ratings yet

- Fabm-2 Las Quarter 3Document97 pagesFabm-2 Las Quarter 3Karl Vincent Uy96% (26)

- Standard Costing and Variance Analysis NotesDocument8 pagesStandard Costing and Variance Analysis NotesPratyush Pratim SahariaNo ratings yet

- Standard Costing Variance AnalysisDocument27 pagesStandard Costing Variance AnalysisSnappYNo ratings yet

- Account 203Document1 pageAccount 203RAVI KISHANNo ratings yet

- f2 MGMT Acc Standard CostingDocument4 pagesf2 MGMT Acc Standard CostingKEITH JEROME VIERNESNo ratings yet

- Standard Costing: A Functional-Based Control Approach: Questions For Writing and DiscussionDocument40 pagesStandard Costing: A Functional-Based Control Approach: Questions For Writing and DiscussionKeith Alison Arellano100% (1)

- Standard CostingDocument17 pagesStandard CostingTony KumarNo ratings yet

- Fundamental Managerial Accounting Concepts 8Th Edition Edmonds Solutions Manual Full Chapter PDFDocument67 pagesFundamental Managerial Accounting Concepts 8Th Edition Edmonds Solutions Manual Full Chapter PDFhorsecarbolic1on100% (14)

- Fundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions ManualDocument38 pagesFundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions Manualjeanbarnettxv9v100% (15)

- Fundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions ManualDocument38 pagesFundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions Manualrivelkeelvaty1f8100% (19)

- AFAR H01 Cost Accounting PDFDocument7 pagesAFAR H01 Cost Accounting PDFhellokittysaranghaeNo ratings yet

- AFAR H01 Cost Accounting PDFDocument7 pagesAFAR H01 Cost Accounting PDFhellokittysaranghaeNo ratings yet

- Chapter 8 - Standard CostingDocument8 pagesChapter 8 - Standard CostingJoey LazarteNo ratings yet

- Essay Los 2015 Section D. Cost Management 20 %Document18 pagesEssay Los 2015 Section D. Cost Management 20 %lassaadNo ratings yet

- Standard Costing Cost and Management Accounting Cap Ii IcanDocument11 pagesStandard Costing Cost and Management Accounting Cap Ii IcanArjan AdhikariNo ratings yet

- Cost Accounting Raiborn and Kinney Solman Chapter 07 CompressDocument35 pagesCost Accounting Raiborn and Kinney Solman Chapter 07 CompressMa. Paula JabunganNo ratings yet

- Cost Ii CH 4Document31 pagesCost Ii CH 4TESFAY GEBRECHERKOSNo ratings yet

- Standard CostingDocument21 pagesStandard Costingkalpesh1956No ratings yet

- Cost Chap 1Document24 pagesCost Chap 1Peter Paul DeiparineNo ratings yet

- W1 Cost 1 LessonDocument11 pagesW1 Cost 1 LessonMoniette JimenezNo ratings yet

- Actg 132 Standard CostingDocument2 pagesActg 132 Standard Costingaly joyNo ratings yet

- Standard CostingDocument13 pagesStandard CostingRia ChoithaniNo ratings yet

- Standard Costing UNIT VDocument17 pagesStandard Costing UNIT VTonie NascentNo ratings yet

- TB Addatu - Standard Costs and Variable AnalysisDocument15 pagesTB Addatu - Standard Costs and Variable AnalysisJean Fajardo Badillo0% (3)

- 7 - Standard CostingDocument16 pages7 - Standard CostingRakeysh RakyeshNo ratings yet

- Process Operation CostingDocument71 pagesProcess Operation CostingMansi IndurkarNo ratings yet

- Cost and Management Accounting 2 CHAPTER 3Document34 pagesCost and Management Accounting 2 CHAPTER 3Abebe GosuNo ratings yet

- 6.2 Standard Costing & Variance Anlysis: Cost Accounting 341Document25 pages6.2 Standard Costing & Variance Anlysis: Cost Accounting 341sadhaya rajanNo ratings yet

- Mas 9403 Standard Costs and Variance AnalysisDocument21 pagesMas 9403 Standard Costs and Variance AnalysisBanna SplitNo ratings yet

- Standard CostingDocument1 pageStandard CostingKarthik AnandNo ratings yet

- Cost Accounting BookDocument148 pagesCost Accounting BookSharma Vishnu100% (2)

- Standard Costing and Variance AnalysisDocument19 pagesStandard Costing and Variance AnalysisHardeep KaurNo ratings yet

- Present MsuzanDocument11 pagesPresent Msuzan4alimuhamad4No ratings yet

- 1 - p5 - Detailed NotesDocument115 pages1 - p5 - Detailed NotesJames KalangilaNo ratings yet

- A Revision of Management Accounting (MA) Topics: OutcomeDocument24 pagesA Revision of Management Accounting (MA) Topics: OutcomeCoc GamingNo ratings yet

- Chapter 12 Standard CostingDocument95 pagesChapter 12 Standard CostingErika Villanueva MagallanesNo ratings yet

- Kinney 8e - CH 05Document16 pagesKinney 8e - CH 05Ashik Uz ZamanNo ratings yet

- Standard CostDocument9 pagesStandard CostJohnNo ratings yet

- Ktqt2 - Standard Cost VariancesDocument40 pagesKtqt2 - Standard Cost VariancesNguyễn Thanh MaiNo ratings yet

- Introduction To Process CostingDocument29 pagesIntroduction To Process Costingshersudsher67% (3)

- Cost Accounting and Control (Cost 1) Module: Clariza C. GamboaDocument32 pagesCost Accounting and Control (Cost 1) Module: Clariza C. GamboaCatherine OrdoNo ratings yet

- Cost Accounting and Control (Cost 1) Module: Clariza C. GamboaDocument32 pagesCost Accounting and Control (Cost 1) Module: Clariza C. GamboaCatherine OrdoNo ratings yet

- Modul Akuntansi Manajemen (TM7)Document7 pagesModul Akuntansi Manajemen (TM7)Aurelique NatalieNo ratings yet

- Block 4 MCO 5 Unit 3Document19 pagesBlock 4 MCO 5 Unit 3Tushar SharmaNo ratings yet

- BLACKBOOK (Standard Costing and Variance Analysis)Document15 pagesBLACKBOOK (Standard Costing and Variance Analysis)Rashi Desai100% (1)

- Lanen - Fundamentals of Cost Accounting - 6e - Chapter 10 - NotesDocument3 pagesLanen - Fundamentals of Cost Accounting - 6e - Chapter 10 - NotesRorNo ratings yet

- CH 09Document46 pagesCH 09STU DOCNo ratings yet

- Process Costing and Management Accounting: in Today's Business EnvironmentDocument8 pagesProcess Costing and Management Accounting: in Today's Business Environmentمحمد زرواطيNo ratings yet

- Lesson 16 Job Order CostingDocument3 pagesLesson 16 Job Order CostingMark TaysonNo ratings yet

- Introduction To Cost Accounting: Chapter OneDocument12 pagesIntroduction To Cost Accounting: Chapter OneAiziel OrenseNo ratings yet

- Methods of CostingDocument9 pagesMethods of Costingmehtahimani80No ratings yet

- Chapter 8 Standard Cost Accounting CompressDocument13 pagesChapter 8 Standard Cost Accounting CompressJohn Kenneth Jarce CaminoNo ratings yet

- CA 01 - Introduction To Cost AccountingDocument3 pagesCA 01 - Introduction To Cost AccountingJoshua UmaliNo ratings yet

- MODULE 8 Standard CostingDocument11 pagesMODULE 8 Standard CostingAlexandra AbasNo ratings yet

- Learning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGDocument6 pagesLearning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGRegina PhalangeNo ratings yet

- Chapter 04Document28 pagesChapter 04Lê Chấn PhongNo ratings yet

- MAS 3 - Standard Costing For UploadDocument9 pagesMAS 3 - Standard Costing For UploadJD SolañaNo ratings yet

- Unit - 5: Objectives of Standard CostingDocument16 pagesUnit - 5: Objectives of Standard CostingThigilpandi07 YTNo ratings yet

- UNIT 4 Standard Costing and Variance AnalysisDocument39 pagesUNIT 4 Standard Costing and Variance Analysisannabelle albaoNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Process Costing Practice QuestionsDocument67 pagesProcess Costing Practice QuestionsCool Mom100% (1)

- ABC - Process.Cost Allocation.Document21 pagesABC - Process.Cost Allocation.Keyt VintageNo ratings yet

- Chap 006Document52 pagesChap 006hania sheikhNo ratings yet

- Practice FRA BSAFDocument52 pagesPractice FRA BSAFHafiz Abdullah MushtaqNo ratings yet

- Financial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusDocument29 pagesFinancial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusHanabusa Kawaii IdouNo ratings yet

- Quiz Bowl 10Document9 pagesQuiz Bowl 10mark_somNo ratings yet

- Definition of CostingDocument22 pagesDefinition of CostingmichuttyNo ratings yet

- SCM Pe LMR QuestionsDocument87 pagesSCM Pe LMR QuestionsFayaz ShaikNo ratings yet

- Cost Accounting OMDocument26 pagesCost Accounting OMJohn CenaNo ratings yet

- Cost & Management Accounting - MGT402 Quiz 1Document63 pagesCost & Management Accounting - MGT402 Quiz 1Ayesha NaureenNo ratings yet

- Handouts Acctg 1 - MerchandisingDocument13 pagesHandouts Acctg 1 - MerchandisingJoannah Marie OliverosNo ratings yet

- Assessment of Cost Accounting SystemDocument41 pagesAssessment of Cost Accounting Systempadm100% (6)

- FS FINAL Copy 2Document27 pagesFS FINAL Copy 2lois martinNo ratings yet

- 31 Top Finance Cheat Sheets 1693854197Document33 pages31 Top Finance Cheat Sheets 1693854197AyaNo ratings yet

- p2 Guerrero ch15Document30 pagesp2 Guerrero ch15Clarissa Teodoro100% (1)

- Coordinated Assignment 2 Spring 2021Document4 pagesCoordinated Assignment 2 Spring 2021Affan AhmedNo ratings yet

- Chapter 15 - AnswerDocument18 pagesChapter 15 - AnswerCrisalie BocoboNo ratings yet

- Af101 Inventory Quiz BankDocument7 pagesAf101 Inventory Quiz BankKarismaNo ratings yet

- Daftar Akun Cv. Maju HomewareDocument2 pagesDaftar Akun Cv. Maju HomewareKamilatu Sa'diyahNo ratings yet

- Latihan Soal Week 8Document6 pagesLatihan Soal Week 8Natasya Prashta WidyadhariNo ratings yet

- Insurance Claims - FTDocument6 pagesInsurance Claims - FTblack jackNo ratings yet

- Module For ACC 206 Standard Costing and Variance AnalysisDocument35 pagesModule For ACC 206 Standard Costing and Variance AnalysisChryshelle LontokNo ratings yet

- No. 4 Supply - Chain - Management - Lecture PDFDocument67 pagesNo. 4 Supply - Chain - Management - Lecture PDFPrashant GunahNo ratings yet

- Intx311 Final CH.7 9Document28 pagesIntx311 Final CH.7 9ZARANo ratings yet

- Mark MinerviniDocument89 pagesMark Minervinibangkit nugrohoNo ratings yet

- Exam 3 Coc Level 3Document4 pagesExam 3 Coc Level 3tamene wolde100% (1)

- Financial RatiosDocument21 pagesFinancial RatiosAamir Hussian100% (1)

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

Chapter 7

Chapter 7

Uploaded by

ricamelaocampo21Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 7

Chapter 7

Uploaded by

ricamelaocampo21Copyright:

Available Formats

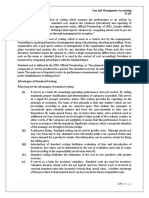

CHAPTER 7

END OF CHAPTER QUESTIONS

By: Ocampo Ricamela Von R.

1. On what basis The process costing system separates costs into categories

based on their nature and how they are incurred during

does process

production. This typically includes direct materials, direct

costing system labor, and manufacturing overhead. Direct materials are the

separate costs into raw materials directly used in production, direct labor is the

categories? wages of workers directly involved, and manufacturing

overhead covers other production costs like rent and

utilities. These categories help in accurately tracking

production expenses and determining product costs for

decision-making.

2. Under what The weighted average and FIFO methods of process costing

conditions will will yield different levels of operating income when there are

weighted average and fluctuations in costs and inventory levels. FIFO tends to

result in higher reported operating income compared to

FIFO method of

weighted average when costs are increasing over time, as it

process costing yield

assigns higher costs to ending inventory and lower costs to

different levels of

units completed.

operating income?

3. How are the Work done on partially completed units in beginning work-in-

weighted average and process inventory represents prior-period work. Two

FIFO method of approaches used for dealing with prior period output and

prior period costs found in beginning work in process are:

process costing applied

to transfer-in costs? a. weighted average method: combines beginning

inventory cost (prior period work) with cost from

current period

b. First-in, First-out (FIFO) method: separates beginning

inventory costs (prior period work) from cost of

current period work.

4. When do you A hybrid costing system is useful when a production facility

handles groups of products in batches and charges the cost

consider operating- of materials to those batches (as is the case in a job costing

environment), while also accumulating labor and overhead

costing or hybrid

costs at the departmental or work center level and allocating

costing system a these costs at the individual unit level.

better approach in

product costing

5. What are the · Cost Control: It provides a benchmark against which actual

costs can be compared, enabling managers to identify and

benefits of using

rectify any significant deviations.

standard costing

· Performance Evaluation: By comparing actual costs with

method of process standard costs, managers can evaluate the performance of

costing? different departments, processes, or products.

· Cost Prediction: Standard costing allows for the prediction

of future costs based on established standards

· Inventory Valuation: Standard costing provides a consistent

basis for valuing inventory, which is crucial for financial

reporting and determining the cost of goods sold

· Motivation and Incentives: Establishing standards can

motivate employees to meet or exceed them, as they provide

clear targets to strive for.

· Simplified Record-Keeping: Standard costing simplifies

record-keeping by providing predetermined costs for

materials, labor, and overhead.

6.Identify the main The main difference between journal entries in process

costing and job costing is that in process costing, costs are

difference between

accumulated per production process stage and journal

journal entries in entries transfer costs between these stages, while in job

job costing and costing, costs are accumulated for individual jobs or projects

process costing and journal entries allocate costs directly to specific jobs

rather than production stages

7.What is the Normal spoilage is the expected and inherent loss that

occurs under normal operating conditions and is included in

distinction between

the cost of production, while abnormal spoilage is the

normal and unexpected loss due to non-routine factors and is treated as

abnormal spoilage? a period cost.

8. How does Regular inspections at different stages of production enable

inspection at early detection of defects or issues in the manufacturing

process. Early detection of abnormal conditions allows for

various stages of

immediate corrective actions to be taken to prevent further

completion affect spoilage and minimize the impact on production and for

the amount of continuous improvement efforts driven by inspection

normal and findings help optimize production processes, enhance

product quality, and minimize waste.

abnormal spoilage.

9. How do managers Managers use information about scrap to analyze costs,

identify root causes, drive process improvements, enhance

use information

quality control, optimize inventory management, evaluate

about scrap?

performance, and allocate costs accurately. This enables

them to make informed decisions to reduce waste, improve

efficiency, and enhance overall operational performance.

10. Why is there a need Accounting for spoilage and rework costs is crucial for

to account for spoilage understanding the true cost of production, managing

and rework cost? expenses effectively, and maintaining product quality. It

enables businesses to identify areas for improvement,

control wastage, and make informed decisions regarding

pricing and resource allocation. By tracking these costs,

companies can enhance operational efficiency, reduce waste,

and stay competitive in the market.

end.

You might also like

- BSBFIM601 - Assessment 2 ProjectDocument12 pagesBSBFIM601 - Assessment 2 ProjectPhenday SangayNo ratings yet

- Fabm-2 Las Quarter 3Document97 pagesFabm-2 Las Quarter 3Karl Vincent Uy96% (26)

- Standard Costing and Variance Analysis NotesDocument8 pagesStandard Costing and Variance Analysis NotesPratyush Pratim SahariaNo ratings yet

- Standard Costing Variance AnalysisDocument27 pagesStandard Costing Variance AnalysisSnappYNo ratings yet

- Account 203Document1 pageAccount 203RAVI KISHANNo ratings yet

- f2 MGMT Acc Standard CostingDocument4 pagesf2 MGMT Acc Standard CostingKEITH JEROME VIERNESNo ratings yet

- Standard Costing: A Functional-Based Control Approach: Questions For Writing and DiscussionDocument40 pagesStandard Costing: A Functional-Based Control Approach: Questions For Writing and DiscussionKeith Alison Arellano100% (1)

- Standard CostingDocument17 pagesStandard CostingTony KumarNo ratings yet

- Fundamental Managerial Accounting Concepts 8Th Edition Edmonds Solutions Manual Full Chapter PDFDocument67 pagesFundamental Managerial Accounting Concepts 8Th Edition Edmonds Solutions Manual Full Chapter PDFhorsecarbolic1on100% (14)

- Fundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions ManualDocument38 pagesFundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions Manualjeanbarnettxv9v100% (15)

- Fundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions ManualDocument38 pagesFundamental Managerial Accounting Concepts 8th Edition Edmonds Solutions Manualrivelkeelvaty1f8100% (19)

- AFAR H01 Cost Accounting PDFDocument7 pagesAFAR H01 Cost Accounting PDFhellokittysaranghaeNo ratings yet

- AFAR H01 Cost Accounting PDFDocument7 pagesAFAR H01 Cost Accounting PDFhellokittysaranghaeNo ratings yet

- Chapter 8 - Standard CostingDocument8 pagesChapter 8 - Standard CostingJoey LazarteNo ratings yet

- Essay Los 2015 Section D. Cost Management 20 %Document18 pagesEssay Los 2015 Section D. Cost Management 20 %lassaadNo ratings yet

- Standard Costing Cost and Management Accounting Cap Ii IcanDocument11 pagesStandard Costing Cost and Management Accounting Cap Ii IcanArjan AdhikariNo ratings yet

- Cost Accounting Raiborn and Kinney Solman Chapter 07 CompressDocument35 pagesCost Accounting Raiborn and Kinney Solman Chapter 07 CompressMa. Paula JabunganNo ratings yet

- Cost Ii CH 4Document31 pagesCost Ii CH 4TESFAY GEBRECHERKOSNo ratings yet

- Standard CostingDocument21 pagesStandard Costingkalpesh1956No ratings yet

- Cost Chap 1Document24 pagesCost Chap 1Peter Paul DeiparineNo ratings yet

- W1 Cost 1 LessonDocument11 pagesW1 Cost 1 LessonMoniette JimenezNo ratings yet

- Actg 132 Standard CostingDocument2 pagesActg 132 Standard Costingaly joyNo ratings yet

- Standard CostingDocument13 pagesStandard CostingRia ChoithaniNo ratings yet

- Standard Costing UNIT VDocument17 pagesStandard Costing UNIT VTonie NascentNo ratings yet

- TB Addatu - Standard Costs and Variable AnalysisDocument15 pagesTB Addatu - Standard Costs and Variable AnalysisJean Fajardo Badillo0% (3)

- 7 - Standard CostingDocument16 pages7 - Standard CostingRakeysh RakyeshNo ratings yet

- Process Operation CostingDocument71 pagesProcess Operation CostingMansi IndurkarNo ratings yet

- Cost and Management Accounting 2 CHAPTER 3Document34 pagesCost and Management Accounting 2 CHAPTER 3Abebe GosuNo ratings yet

- 6.2 Standard Costing & Variance Anlysis: Cost Accounting 341Document25 pages6.2 Standard Costing & Variance Anlysis: Cost Accounting 341sadhaya rajanNo ratings yet

- Mas 9403 Standard Costs and Variance AnalysisDocument21 pagesMas 9403 Standard Costs and Variance AnalysisBanna SplitNo ratings yet

- Standard CostingDocument1 pageStandard CostingKarthik AnandNo ratings yet

- Cost Accounting BookDocument148 pagesCost Accounting BookSharma Vishnu100% (2)

- Standard Costing and Variance AnalysisDocument19 pagesStandard Costing and Variance AnalysisHardeep KaurNo ratings yet

- Present MsuzanDocument11 pagesPresent Msuzan4alimuhamad4No ratings yet

- 1 - p5 - Detailed NotesDocument115 pages1 - p5 - Detailed NotesJames KalangilaNo ratings yet

- A Revision of Management Accounting (MA) Topics: OutcomeDocument24 pagesA Revision of Management Accounting (MA) Topics: OutcomeCoc GamingNo ratings yet

- Chapter 12 Standard CostingDocument95 pagesChapter 12 Standard CostingErika Villanueva MagallanesNo ratings yet

- Kinney 8e - CH 05Document16 pagesKinney 8e - CH 05Ashik Uz ZamanNo ratings yet

- Standard CostDocument9 pagesStandard CostJohnNo ratings yet

- Ktqt2 - Standard Cost VariancesDocument40 pagesKtqt2 - Standard Cost VariancesNguyễn Thanh MaiNo ratings yet

- Introduction To Process CostingDocument29 pagesIntroduction To Process Costingshersudsher67% (3)

- Cost Accounting and Control (Cost 1) Module: Clariza C. GamboaDocument32 pagesCost Accounting and Control (Cost 1) Module: Clariza C. GamboaCatherine OrdoNo ratings yet

- Cost Accounting and Control (Cost 1) Module: Clariza C. GamboaDocument32 pagesCost Accounting and Control (Cost 1) Module: Clariza C. GamboaCatherine OrdoNo ratings yet

- Modul Akuntansi Manajemen (TM7)Document7 pagesModul Akuntansi Manajemen (TM7)Aurelique NatalieNo ratings yet

- Block 4 MCO 5 Unit 3Document19 pagesBlock 4 MCO 5 Unit 3Tushar SharmaNo ratings yet

- BLACKBOOK (Standard Costing and Variance Analysis)Document15 pagesBLACKBOOK (Standard Costing and Variance Analysis)Rashi Desai100% (1)

- Lanen - Fundamentals of Cost Accounting - 6e - Chapter 10 - NotesDocument3 pagesLanen - Fundamentals of Cost Accounting - 6e - Chapter 10 - NotesRorNo ratings yet

- CH 09Document46 pagesCH 09STU DOCNo ratings yet

- Process Costing and Management Accounting: in Today's Business EnvironmentDocument8 pagesProcess Costing and Management Accounting: in Today's Business Environmentمحمد زرواطيNo ratings yet

- Lesson 16 Job Order CostingDocument3 pagesLesson 16 Job Order CostingMark TaysonNo ratings yet

- Introduction To Cost Accounting: Chapter OneDocument12 pagesIntroduction To Cost Accounting: Chapter OneAiziel OrenseNo ratings yet

- Methods of CostingDocument9 pagesMethods of Costingmehtahimani80No ratings yet

- Chapter 8 Standard Cost Accounting CompressDocument13 pagesChapter 8 Standard Cost Accounting CompressJohn Kenneth Jarce CaminoNo ratings yet

- CA 01 - Introduction To Cost AccountingDocument3 pagesCA 01 - Introduction To Cost AccountingJoshua UmaliNo ratings yet

- MODULE 8 Standard CostingDocument11 pagesMODULE 8 Standard CostingAlexandra AbasNo ratings yet

- Learning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGDocument6 pagesLearning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGRegina PhalangeNo ratings yet

- Chapter 04Document28 pagesChapter 04Lê Chấn PhongNo ratings yet

- MAS 3 - Standard Costing For UploadDocument9 pagesMAS 3 - Standard Costing For UploadJD SolañaNo ratings yet

- Unit - 5: Objectives of Standard CostingDocument16 pagesUnit - 5: Objectives of Standard CostingThigilpandi07 YTNo ratings yet

- UNIT 4 Standard Costing and Variance AnalysisDocument39 pagesUNIT 4 Standard Costing and Variance Analysisannabelle albaoNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Process Costing Practice QuestionsDocument67 pagesProcess Costing Practice QuestionsCool Mom100% (1)

- ABC - Process.Cost Allocation.Document21 pagesABC - Process.Cost Allocation.Keyt VintageNo ratings yet

- Chap 006Document52 pagesChap 006hania sheikhNo ratings yet

- Practice FRA BSAFDocument52 pagesPractice FRA BSAFHafiz Abdullah MushtaqNo ratings yet

- Financial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusDocument29 pagesFinancial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusHanabusa Kawaii IdouNo ratings yet

- Quiz Bowl 10Document9 pagesQuiz Bowl 10mark_somNo ratings yet

- Definition of CostingDocument22 pagesDefinition of CostingmichuttyNo ratings yet

- SCM Pe LMR QuestionsDocument87 pagesSCM Pe LMR QuestionsFayaz ShaikNo ratings yet

- Cost Accounting OMDocument26 pagesCost Accounting OMJohn CenaNo ratings yet

- Cost & Management Accounting - MGT402 Quiz 1Document63 pagesCost & Management Accounting - MGT402 Quiz 1Ayesha NaureenNo ratings yet

- Handouts Acctg 1 - MerchandisingDocument13 pagesHandouts Acctg 1 - MerchandisingJoannah Marie OliverosNo ratings yet

- Assessment of Cost Accounting SystemDocument41 pagesAssessment of Cost Accounting Systempadm100% (6)

- FS FINAL Copy 2Document27 pagesFS FINAL Copy 2lois martinNo ratings yet

- 31 Top Finance Cheat Sheets 1693854197Document33 pages31 Top Finance Cheat Sheets 1693854197AyaNo ratings yet

- p2 Guerrero ch15Document30 pagesp2 Guerrero ch15Clarissa Teodoro100% (1)

- Coordinated Assignment 2 Spring 2021Document4 pagesCoordinated Assignment 2 Spring 2021Affan AhmedNo ratings yet

- Chapter 15 - AnswerDocument18 pagesChapter 15 - AnswerCrisalie BocoboNo ratings yet

- Af101 Inventory Quiz BankDocument7 pagesAf101 Inventory Quiz BankKarismaNo ratings yet

- Daftar Akun Cv. Maju HomewareDocument2 pagesDaftar Akun Cv. Maju HomewareKamilatu Sa'diyahNo ratings yet

- Latihan Soal Week 8Document6 pagesLatihan Soal Week 8Natasya Prashta WidyadhariNo ratings yet

- Insurance Claims - FTDocument6 pagesInsurance Claims - FTblack jackNo ratings yet

- Module For ACC 206 Standard Costing and Variance AnalysisDocument35 pagesModule For ACC 206 Standard Costing and Variance AnalysisChryshelle LontokNo ratings yet

- No. 4 Supply - Chain - Management - Lecture PDFDocument67 pagesNo. 4 Supply - Chain - Management - Lecture PDFPrashant GunahNo ratings yet

- Intx311 Final CH.7 9Document28 pagesIntx311 Final CH.7 9ZARANo ratings yet

- Mark MinerviniDocument89 pagesMark Minervinibangkit nugrohoNo ratings yet

- Exam 3 Coc Level 3Document4 pagesExam 3 Coc Level 3tamene wolde100% (1)

- Financial RatiosDocument21 pagesFinancial RatiosAamir Hussian100% (1)

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet