Professional Documents

Culture Documents

Inprinciple Letter

Inprinciple Letter

Uploaded by

ffytgod940Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inprinciple Letter

Inprinciple Letter

Uploaded by

ffytgod940Copyright:

Available Formats

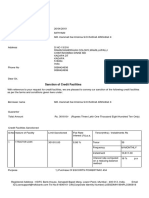

Congratulations

Swadsangam

Sanction for your application : ANS-PMMY-4163892-2813169

Date : 08 May 2024

Pradhan Mantri MUDRA Yojna for Business Activity

You have received a Sanction from Punjab National Bank

We are pleased to inform you that limit of Rs 1,30,000 has been sanctioned to you under Pradhan Mantri MUDRA Yojna for Business Activity -. This will be subject to

satisfactory submission and verification of various documents and other details as may be required by Punjab National Bank and upon successful clearance of Due Diligence

and Other procedures as may be undertaken at Punjab National Banks discretion and internal risk/credit process requirements. Following are tentative terms

Loan Details Bank Branch Details

Product Mudra Kishore up to 2.00 Lakh - Branch Name SHALIMAR GARDEN,GHAZIABAD

Working Capital

Bank Code 995600

Loan Amount ₹ 1,30,000

IFSC Code PUNB0995600

Interest Rate (Floating) 10.65 %

Branch Address S-1, A BLOCK, SHALIMAR GARDEN

Loan Tenure 5 Years EXT.II DISTT. GHAZIABAD

Processing Fees 0.0 % Contact Details

$message

The Lenders representative will contact you soon for further requirements. Now, all you need to do is to keep your documents ready in original along with a copy of this letter

for swift actions and processing.

Note

1. The Banker will have the option to request shifting of existing facilities / limits to their Bank

2. Applicant will also be liable to bear the actual expenses pertaining to Stamp duty, Registration Charges, Government & Other charges and taxes as and when applicable. In

addition to this, Legal fee, Valuation fee, Guarantee Trusts premium and other costs, as may be finalized by lender from time to time, pertaining to the processing of loan will

be solely borne by the applicant

Bank reserves the right to call upon additional documents at its discretion based on credit, risk, compliance, loan and other applicable policies/ guidelines of the Bank

Disclaimer

This Sanction letter is subject to the accuracy and correctness of information and data provided by you, its successful verification and satisfactory completion of

comprehensive due diligence as per Banks standards and regulations. This letter shall stand unilaterally revoked and cancelled by issuing authority/ies and shall be absolutely

null and void, if any discrepancies are found in the information and data you have provided based on which the said loan Sanction by the Bank. Please note that availability /

issuance / final sanction of Loan/ Finance shall be at the sole discretion of the Bank. The Bank reserves the right to approve /reject any loan application without assigning any

reason whatsoever.

JanSamarth merely acts as an online facilitator for availing Loan and further benefits, if any, from the Lender / Concerned Authorities & does not make any offer or does not

guarantee any loan and/or any other benefits on its own behalf as well as on the behalf of the Bank/ Concerned Authorities. There will be no liability of the platform with

respect to the Products rolled out by any Bank on the Platform

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to the respective intellectual property owners. Display of such IP along

with the related products information does not imply the Platform's partnership with the owner of the Intellectual Property or issuer of such products

Regards

Team JanSamarth

In case of any query you can call us at 07969076111 or mail at Customer.support@jansamarth.in

You might also like

- Penman - Financial Statement Analysis and SecurDocument371 pagesPenman - Financial Statement Analysis and SecurAndreyZinchenko100% (4)

- Vamsi Krishna Loan Sanction Letter 456Document7 pagesVamsi Krishna Loan Sanction Letter 456Venkatesh DoodamNo ratings yet

- FD Acknowledgement SlipDocument1 pageFD Acknowledgement SlipSwapnil kadamNo ratings yet

- Legal NoticeDocument2 pagesLegal NoticeAjay rawatNo ratings yet

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- UAE Corporate Tax PDFDocument59 pagesUAE Corporate Tax PDFzahidfrqNo ratings yet

- KB220502AIMCU - Sanction Letter PDFDocument3 pagesKB220502AIMCU - Sanction Letter PDFRatnesh ShuklaNo ratings yet

- Sanction 4Document4 pagesSanction 4ParinithNo ratings yet

- NN IP Guidebook To Alternative CreditDocument140 pagesNN IP Guidebook To Alternative CreditBernardNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterSIYARAM JHANo ratings yet

- DigitalApproval LetterDocument2 pagesDigitalApproval LetterPUNALE MICHEL REDDYNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval LetteraashishkulpaharNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LettershivaNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval Lettershubhamkumarrajput92No ratings yet

- DigitalApproval Letter PDFDocument1 pageDigitalApproval Letter PDFreddynagiNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple Letterbiberabhishek384No ratings yet

- Inprinciple LetterDocument1 pageInprinciple Lettergautambarbhuiya29905gNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval LetterSM GamingNo ratings yet

- Congratulations!: Your In-Principle Approval LetterDocument2 pagesCongratulations!: Your In-Principle Approval Lettervedant bodkheNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterDeep PratyakshNo ratings yet

- Congratulations!: Your In-Principle Approval LetterDocument2 pagesCongratulations!: Your In-Principle Approval LetterLokanath ChoudhuryNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple Lettersachinkumarmalra792000No ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterAyush PatilNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterChiranjeet PANDITNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval LetterBIKRAM KUMAR BEHERANo ratings yet

- Inprinciple LetterDocument2 pagesInprinciple Letterloanconsultant285No ratings yet

- Inprinciple LetterDocument1 pageInprinciple Letterrushikeshchintkuntwar123456No ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval LetterThe Cool Telly UpdateNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterMoin RashidNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval LetterKANNADIGA ANIL KERURKARNo ratings yet

- DigitalApproval LetterDocument1 pageDigitalApproval Letteromkarchikkodi26No ratings yet

- C0042559 - Pankaj Kumar - 63810Document3 pagesC0042559 - Pankaj Kumar - 63810pankaj kumarNo ratings yet

- Sanction of Credit Facilities: 1/tractor Agri LoanDocument3 pagesSanction of Credit Facilities: 1/tractor Agri LoanShaik Chand BashaNo ratings yet

- Sanction Letter - 94950693 - 165227119Document2 pagesSanction Letter - 94950693 - 165227119km8817371No ratings yet

- Agreement 4Document16 pagesAgreement 4karthik keyanNo ratings yet

- WelcomeKit - T02972221022093313 - 2 Feb 2023Document3 pagesWelcomeKit - T02972221022093313 - 2 Feb 2023rajkumar sainiNo ratings yet

- IfoDocument2 pagesIfosdfsdsdfsdf sdfsfdsdffNo ratings yet

- Nagoor SANCTION - LETTER - PSI - AVFSDocument16 pagesNagoor SANCTION - LETTER - PSI - AVFSgudavalli0088No ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - NoRajesh KumarNo ratings yet

- Sanction of Credit Facilities: 1/tractor LoanDocument3 pagesSanction of Credit Facilities: 1/tractor LoanShaik Chand BashaNo ratings yet

- Foreclosure LetterDocument3 pagesForeclosure LetterSyed ShahbazNo ratings yet

- Nur FarhanaDocument2 pagesNur FarhanaFarhana FuzlaNo ratings yet

- Sanction of Credit Facilities: 1/tractor LoanDocument3 pagesSanction of Credit Facilities: 1/tractor LoanShaik Chand BashaNo ratings yet

- Sanction Letter V4Document2 pagesSanction Letter V4DaMoN0% (1)

- Legal Notice 2006397 XXXXXXXXXX6392 PDFDocument2 pagesLegal Notice 2006397 XXXXXXXXXX6392 PDFAyush KumarNo ratings yet

- ForeclosureLetter 4080CDJU248908Document3 pagesForeclosureLetter 4080CDJU248908sankar007kNo ratings yet

- BHAWNA BABBAR Appointment Letter 04022023Document15 pagesBHAWNA BABBAR Appointment Letter 04022023Bhawna BabbarNo ratings yet

- Pothuluru Subba Reddy-DODocument3 pagesPothuluru Subba Reddy-DOShaik Chand BashaNo ratings yet

- Kammati Sai Krishna D.O.Document3 pagesKammati Sai Krishna D.O.Shaik Chand BashaNo ratings yet

- Dunning Notice 31 60-1Document2 pagesDunning Notice 31 60-1advocate572No ratings yet

- Adobe Scan Feb 14, 2024Document3 pagesAdobe Scan Feb 14, 2024pradeep kumar gudalaNo ratings yet

- Welcomeletter Ka3024cd0401313Document9 pagesWelcomeletter Ka3024cd0401313davalmobile25No ratings yet

- 4080CDJL956903 Foreclosure LetterDocument3 pages4080CDJL956903 Foreclosure LetterJanakiram TammineniNo ratings yet

- Manappuram Finance Limited: SR - NoDocument2 pagesManappuram Finance Limited: SR - NoPrayag UpadhyayNo ratings yet

- ForeclosureDocument3 pagesForeclosuremohammadafreed223No ratings yet

- Ogl 347901676355685668 PDFDocument5 pagesOgl 347901676355685668 PDFBHUSHAN DahaleNo ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - NoRajesh KumarNo ratings yet

- 0129450730004260Document3 pages0129450730004260Deependra Singh100% (1)

- SL AllDocument10 pagesSL AllyogeshsannapuriNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- Preview AgreementDocument11 pagesPreview Agreementasoukot84No ratings yet

- Legal Notice 5107808 XXXXXXXXXX7111 20122023172809Document2 pagesLegal Notice 5107808 XXXXXXXXXX7111 20122023172809RoopikaNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Golden Shipping and Trading Company Inc 2MDocument8 pagesGolden Shipping and Trading Company Inc 2MSkyline Music GroupNo ratings yet

- History of Banking in IndiaDocument24 pagesHistory of Banking in Indiaamitindelhi20027179No ratings yet

- Sample Computation (A & B Lots of 750 SQM.)Document2 pagesSample Computation (A & B Lots of 750 SQM.)iquotientsolutionsNo ratings yet

- Resume-Murad 2021Document2 pagesResume-Murad 2021aliz kNo ratings yet

- 06.money Market and Bond MarketDocument20 pages06.money Market and Bond MarketYogun BayonaNo ratings yet

- Unit 4 Derivatives Part 1Document19 pagesUnit 4 Derivatives Part 1UnathiNo ratings yet

- Foundations of Risk ManagementDocument173 pagesFoundations of Risk ManagementTrà Mi NguyễnNo ratings yet

- Mobil Bill July, 20Document73 pagesMobil Bill July, 20biddut782No ratings yet

- Product Disclosure Statement: Asb Kiwisaver SchemeDocument28 pagesProduct Disclosure Statement: Asb Kiwisaver SchemeMeNo ratings yet

- CV Adnan MAnsoor KhanDocument3 pagesCV Adnan MAnsoor KhanFaizan MansoorNo ratings yet

- CL-9 SAP AuthorizationDocument13 pagesCL-9 SAP AuthorizationEVANo ratings yet

- Crypto CurrencyDocument3 pagesCrypto CurrencyAarika BudyeNo ratings yet

- JPIA Review S2 - Notes ReceivablesDocument5 pagesJPIA Review S2 - Notes ReceivablesrylNo ratings yet

- AmericanExpressCompany 10K 20120224Document306 pagesAmericanExpressCompany 10K 20120224technoxplorer100% (1)

- ACCTG 221 Final Exam Part 1Document6 pagesACCTG 221 Final Exam Part 1Get BurnNo ratings yet

- PMAC5112w MODocument36 pagesPMAC5112w MOAmmarah RamnarainNo ratings yet

- Me443 CH5Document55 pagesMe443 CH5abhi9119No ratings yet

- Accounting For Investments in Debt SecuritiesDocument119 pagesAccounting For Investments in Debt SecuritiesJay-L TanNo ratings yet

- Case 40 Primus Automation Division 2002 Leasing Opsi 4Document39 pagesCase 40 Primus Automation Division 2002 Leasing Opsi 4rizkal rizaldiNo ratings yet

- Rinson Trust NewDocument19 pagesRinson Trust Newjeremy lacanduaNo ratings yet

- Investing in Stock Markets Important QuestionsDocument3 pagesInvesting in Stock Markets Important Questionsbharathik.v.No ratings yet

- The Monetary SystemDocument6 pagesThe Monetary SystemLâm Trần Phan HoàngNo ratings yet

- 32-Banking Practice and Procedure - WorksheetDocument4 pages32-Banking Practice and Procedure - WorksheetBereket DesalegnNo ratings yet

- Kumari and Nabil Chapter 4Document22 pagesKumari and Nabil Chapter 4kiranNo ratings yet

- Fin 501 Payout PolicyDocument14 pagesFin 501 Payout Policyovi_hassan74No ratings yet

- A Comparative Study On Security Features of Banknotes of Various CountriesDocument9 pagesA Comparative Study On Security Features of Banknotes of Various CountriesRachit ParmarNo ratings yet

- Chapter 6 Receivables Additional ConceptsDocument14 pagesChapter 6 Receivables Additional ConceptsElaiza RegaladoNo ratings yet