Professional Documents

Culture Documents

FM Assignment 1

FM Assignment 1

Uploaded by

varmaria004Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Assignment 1

FM Assignment 1

Uploaded by

varmaria004Copyright:

Available Formats

Component name: ASSIGNMENT1

Question 1:- The commonly accepted goal of financial management is to:

a) avoid financial distress.

b)) maximize current dividends per share of the existing stock.

c)O maximize the current value per share of the existing stock.

d) maintain steady growth in both sales and net earnings.

Question 2:- The treasurer and the controller of a compay generally report to the:

a) board of directors.

b) chief financial officer.

c)O chief executive officer.

d) chairman of the board.

Question 3:- Annuities where the payments occur at the end of each time period are called

a) ordinary annuities

b)O early annuities

c)O annultles due

d)O late annuities

Question 4:- The time value of money concept can be defined as:

a)) the relationship between the supply and demand of money.

b)) the relationship between money spent versus money received.

c)O the relationship between a rupee to be recelved in the future and a rupee today.

d) ) the relationship between interest rate stated and amount paid.

Question 5:- The present value of Rs 6000 to be received at the end of third year, when the required rate of return is 8% is:

a)) Rs 6480

b)O Rs 6998

c)O Rs 5763

d) Rs 4763

Question 6: refers to the cash flow that results from the firm 's ongoing, normal business activities.

a) Cash flow from operating activities

b)O Net working capital

c)O Cash flow from financing actlvities

d) Cash flow from investment activities

Question 7:- Earnings per share is equal to

a) net income divided by the total number of shares outstanding.

b) net income divided by the par value of the equity shares.

c)O operating Income divided by the par value of the equity shares.

d)O net income divided by total shareholders' equity.

Question 8:- Dividends per share is equal to dividends paid:

a) ) dlvided by the par value of equity shares.

b) divided by the total number of shares outstanding.

c)) divided by total shareholders' equity.

d) muitiplied by the par value of the equity shares.

Question 9:- Accounting profits as obtained In income statement and cash flows are:

a) generally the same since they reflect current laws and accounting standards.

b) O generally the same since accounting profits reflect when the cash flows are received.

c) generally not the same since GAAP allows for revenue recognition separate from the receipt of cash flows.

d) O generally not the same because cash inflows occur before revenue recognition.

Question 10:- Which one of the following is a capital budgeting decision?

a) Determining how much debt should be borrowed from a particular lender

b) Declding whether or not to open a new store

c)O Deciding how much dividend is to be paid in current year

d) Determining how much inventory to keep on hand

Question 11:- Which one of the following is a correct statement concerning risk premium for an investor?

a) The greater the volatility of returns, the greater the risk premium.

b)O The lower the volatility of returns, the greater the risk prermium.

c) The lower the average rate of return, the greater the risk premium.

d) The risk premiun is not affected by the volatility of returns.

Question 12:- The market price of a bond is equal to the present value of the:

a) ) face value minus the present value of the annuity payments.

b) O annuity payments plus the future value of the face amount.

c) face value plus the present value of the annuity payments.

d) O face value plus the future value of the annuity payments.

Question 13:- The underlying assumption of the dividend growth model, which is used to value equity shares, is that stock is worth:

a) the same amount to every investor regardless of theirdesired rate of return.

b)O the present value of the future Income which the stock qenerates.

c) an amount computed as the next annual dividend divided by the market rate of return.

d) an amount computed as the next annual dividend divided by the requlred rate of return.

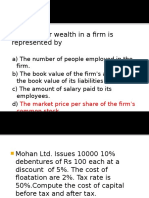

Question 14:- The book value of the shareholders' ownership is represented by

a) the sum of the par value of common stock, the capital surplus and the accumulated retained earnings.

b) the total assets minus the net worth.

c)O the sum of the preferred stock, debt and the capital surplus.

d) the sum of the total assets minus the current liabilities.

refers to the cash flow that results from the firm's ongoing, normal business activities.

Question 6:

a) Cash flow from operating activities

b)O Net working capltal

c)O Cash flow from financing activities

d) O Cash flow from investment activities

Question 7:- Earnings per share is equal to:

a) net income divided by the total number of shares outstanding.

b)) net income divided by the par value of the equlty shares.

c) O operating income divided by the par value of the equity shares.

d) O net income divided by total shareholders' equity.

Question 8:- Dividends per share is equal to dividends pald:

a) divided by the par value of equity shares.

b) divided by the total number of shares outstanding.

c)O divided by total shareholders equity.

d) O multiplied by the par value of the equity shares.

Question 9:- Accounting profits as obtained in income statement and cash flows are

a) generally the same since they reflect current laws and accounting standards.

b)O generally the same since accounting profits reflect when the cash flows are received.

c) generally not the same since GAAP allows for revenue recognition separate from the receipt of cash flows

recognition.

d) O generally not the same because cash inflows occur before revenue

Question 10:- Which one of the following is a capital budgeting decision?

a)) Determining how much debt should be borrowed from a particular lender

b) Deciding whether or not to open a new store

c)O Deciding how much dividend is to be paid in current year

d)O Determining how much Inventory to keep on hand

Question 11:- Which one of the following is a correct staternent concerning risk premium for an investor?

a) O The greater the volatility of returns, the greater the risk premiurn,

b) ) The lower the volatility of returns, the greater the risk premium.

c) The lower the average rate of return, the greater the risk premium.

d) The risk premlum is not affected by the volatility of returns

Question 12:- The market price of a bond is equal to the present value of the:

a)) face value minus the present value of the annuity payments.

b)O annuity payments plus the future value of the face amount.

c) face value plus the present value of the annuity payments.

d)O face value plus the future value of the annuity payments.

Question 13:- The underlying assurmption of the dividend growth model, which is used to value equity shares, is that stock is worth:

a) the same amount to every investor regardless of their desired rate of return.

b) the present value of the future income which the stock generates.

c)O an amount computed as the next annual dividend divided by the market rate of return.

an amount computed as the next annual dividend divided by the required

rate of return.

d)

Question 14:- The book value of the shareholders' ownership is represented by:

retained earnings.

a) the sum of the par value of common stock, the capital surplus and the accumulated

b)O the total assets minus the net worth.

c)O the sum of the preferred stock, debt and the capital surplus.

d) Othe sum of the total assets minus the current liabilities.

Question 15:- The market value or T-cap of the ownership of the firm equals:

a) the market price of the shares times the number of shares outstanding.

b) the sum of the market price of the bonds and the stock

c) the par value of the share times the number of shares outstanding.

d)O the market price of the share minus the retained earnings.

Question 16:- A fund/account that is created as provision for long term debt

a) retirement fund.

b) sinking fund.

c) Irrevocable trustee fund.

d)O escrow account.

Question 17:- The unlevered cost of capital is:

a) the cost of capital for a firm with no equity in its capital structure.

b) the cost of capital for a firm with no debt in its capital structure

c)O the interest tax shield times pretax net income.

d)O the cost of preferred stock for a firm with equal parts debt and common stock in its capital structure.

Question 18:- The firm's capital structure refers to:

a) the way a firm invests its assets

b) the amount of capital in the firm,

c) the amount of dividends a firm pays.

d) the mix of debt and equity used to finance the frn's assets

Question 19:- The value of common stock today depends on:

a) the expected future holding period and the discount rate.

b)) the expected future dividends and the capital gains.

c) the expected future dividends, capital gains and the discount rate.

d) the expected future holding period and capital gains

Question 20:- The earnings per share will:

a) increase as net income increases.

b) increase as the number of shares outstanding increase.

c)O decrease as the total revenue of the firm increases.

d) Odecrease as the costs decrease.

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Dwnload Full Options Futures and Other Derivatives 10th Edition Hull Solutions Manual PDFDocument36 pagesDwnload Full Options Futures and Other Derivatives 10th Edition Hull Solutions Manual PDFwhalemanfrauleinshlwvz100% (14)

- 96198880Document34 pages96198880Joel Christian MascariñaNo ratings yet

- Capital Budgeting FM2 AnswersDocument17 pagesCapital Budgeting FM2 AnswersMaria Anne Genette Bañez89% (28)

- Financial Statement Analysis Test Bank Part 1Document14 pagesFinancial Statement Analysis Test Bank Part 1Judith67% (9)

- FRM Part 2 TopicsDocument4 pagesFRM Part 2 Topicschan6No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 6 Practice Exam For Available Courses PageDocument7 pagesSeries 6 Practice Exam For Available Courses PageRudy Gonzalez100% (1)

- FM MCQsDocument58 pagesFM MCQsPervaiz ShahidNo ratings yet

- MCQ of Corporate Finance PDFDocument11 pagesMCQ of Corporate Finance PDFsinghsanjNo ratings yet

- The Fall of Barings Bank: Rakesh Kumar YadavDocument11 pagesThe Fall of Barings Bank: Rakesh Kumar YadavRakesh YadavNo ratings yet

- FM Assignment 2Document2 pagesFM Assignment 2varmaria004No ratings yet

- q4 1Document7 pagesq4 1JimmyChaoNo ratings yet

- Sample of The Fin320 Department Final Exam With SolutionDocument10 pagesSample of The Fin320 Department Final Exam With Solutionnorbi113100% (1)

- Multiple Choice at The End of LectureDocument6 pagesMultiple Choice at The End of LectureOriana LiNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers TheDocument6 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers TheKwaku Frimpong GyauNo ratings yet

- Finance Mid TermDocument4 pagesFinance Mid TermbloodinawineglasNo ratings yet

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Document27 pagesQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurNo ratings yet

- DocxDocument26 pagesDocxMary DenizeNo ratings yet

- Important Notice:: D. I, III and IV OnlyDocument12 pagesImportant Notice:: D. I, III and IV Onlyjohn183790No ratings yet

- Exam II Version BDocument12 pagesExam II Version B조서현No ratings yet

- 804 MCQDocument15 pages804 MCQOlamilekan JuliusNo ratings yet

- Activity 6B CapStructure FinmaDocument4 pagesActivity 6B CapStructure FinmaDiomela BionganNo ratings yet

- Business Fin PascoDocument12 pagesBusiness Fin PascoAbaane MosesNo ratings yet

- Questions Based On F Inancial Managem EntDocument21 pagesQuestions Based On F Inancial Managem EntHemant kumarNo ratings yet

- Mba Ii Sem - FM - QBDocument29 pagesMba Ii Sem - FM - QBMona GhunageNo ratings yet

- Review Extra CreditDocument8 pagesReview Extra CreditMichelle de GuzmanNo ratings yet

- Capital Budget IDocument9 pagesCapital Budget Ia100% (1)

- MCQ 501Document90 pagesMCQ 501haqmalNo ratings yet

- CF2 1Document11 pagesCF2 1COPY PAPAGAJKANo ratings yet

- Trustee. B. States The Bond's Current Rating. C. States The Yield To Maturity of The Bond DDocument5 pagesTrustee. B. States The Bond's Current Rating. C. States The Yield To Maturity of The Bond DAshish BhallaNo ratings yet

- Chapter NineDocument10 pagesChapter NineAsif HossainNo ratings yet

- 97fi MasterDocument12 pages97fi MasterHamid UllahNo ratings yet

- MCQ-on-FM WITH SOLDocument28 pagesMCQ-on-FM WITH SOLarmansafi761100% (1)

- Exam AnswersDocument5 pagesExam AnswersKelly Smith100% (2)

- MCQ On FMDocument28 pagesMCQ On FMSachin Tikale100% (1)

- MCQ of Corporate Valuation Mergers AcquisitionsDocument19 pagesMCQ of Corporate Valuation Mergers AcquisitionsNuman AliNo ratings yet

- FIN370 Final ExamDocument9 pagesFIN370 Final ExamWellThisIsDifferentNo ratings yet

- CF Self Assess QuestionsDocument6 pagesCF Self Assess QuestionsLeo Danes100% (1)

- Practice Final ExamDocument8 pagesPractice Final ExamrahulgattooNo ratings yet

- Fin622 McqsDocument25 pagesFin622 McqsIshtiaq JatoiNo ratings yet

- B&a - MCQDocument11 pagesB&a - MCQAniket PuriNo ratings yet

- Mca - 204 - FM & CFDocument28 pagesMca - 204 - FM & CFjaitripathi26No ratings yet

- Financial Statement Analysis MBA 6thDocument4 pagesFinancial Statement Analysis MBA 6thShahzad MalikNo ratings yet

- Corp Fin Test PDFDocument6 pagesCorp Fin Test PDFRaghav JainNo ratings yet

- Practicequestions Mt3a 625Document25 pagesPracticequestions Mt3a 625sonkhiemNo ratings yet

- Corporate Finance MCQDocument35 pagesCorporate Finance MCQRohan RoyNo ratings yet

- MCQDocument9 pagesMCQsk_lovNo ratings yet

- Ashford Bus401 Week 1 4 Quiz and Practice QuestionsDocument15 pagesAshford Bus401 Week 1 4 Quiz and Practice QuestionsDoreenNo ratings yet

- FM Recollected QuestionsDocument8 pagesFM Recollected Questionsmevrick_guyNo ratings yet

- FIN 320 - Sample Final Exam 2011Document7 pagesFIN 320 - Sample Final Exam 2011rawrissexyNo ratings yet

- MCQ On FMDocument32 pagesMCQ On FMShubhada AmaneNo ratings yet

- Winter 2007 Final ExamDocument15 pagesWinter 2007 Final Examupload55No ratings yet

- FRM 3 EsatDocument0 pagesFRM 3 EsatChuck YintNo ratings yet

- MCQ On Corporate FinanceDocument5 pagesMCQ On Corporate FinanceManika SharmaNo ratings yet

- MCQ On Financial ManagementDocument28 pagesMCQ On Financial ManagementibrahimNo ratings yet

- Winter 2010 Midterm With SolutionsDocument11 pagesWinter 2010 Midterm With Solutionsupload55No ratings yet

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350No ratings yet

- Corporate Finance QBDocument27 pagesCorporate Finance QBVelu SamyNo ratings yet

- ACFrOgBx84rfZPyeSLrX1uGbBiJOuh8CxfoOW Sa27wIJ0pJhFscjg97S8GuIUyYNTIKVw0IjgvGpgKvW1ox2he6OUTioCpoBD7L57 uZfMVpsBFYkr9VyEvkrselfIT0UE5vh7U8NtBRqMp7XhODocument5 pagesACFrOgBx84rfZPyeSLrX1uGbBiJOuh8CxfoOW Sa27wIJ0pJhFscjg97S8GuIUyYNTIKVw0IjgvGpgKvW1ox2he6OUTioCpoBD7L57 uZfMVpsBFYkr9VyEvkrselfIT0UE5vh7U8NtBRqMp7XhOPRIYANSHU GOELNo ratings yet

- Dividend QuestionsDocument6 pagesDividend QuestionsperiNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Doctor DetailsDocument3 pagesDoctor Detailsvarmaria004No ratings yet

- PRO DetailsDocument2 pagesPRO Detailsvarmaria004No ratings yet

- FMA Assignment 3Document6 pagesFMA Assignment 3varmaria004No ratings yet

- Apptiude Assignment 2024Document25 pagesApptiude Assignment 2024varmaria004No ratings yet

- HRM - 1 PGDMDocument119 pagesHRM - 1 PGDMvarmaria004No ratings yet

- RIYA EDS AprilDocument4 pagesRIYA EDS Aprilvarmaria004No ratings yet

- Test Paper Life-Science-1Document19 pagesTest Paper Life-Science-1varmaria004No ratings yet

- Financial Literacy and Banking Ppt-1Document15 pagesFinancial Literacy and Banking Ppt-1278Mariyam RahmanNo ratings yet

- Stone Container Case DiscussionDocument6 pagesStone Container Case DiscussionAvon Jade RamosNo ratings yet

- Types of DebtDocument5 pagesTypes of Debtayesha1985100% (2)

- 1 - Cau Truc Thi Truong MS - Ivan Kum enDocument26 pages1 - Cau Truc Thi Truong MS - Ivan Kum enkhánh nguyễnNo ratings yet

- MFRS 121 - Foreign Currency Lecture Notes 2022 - UploadDocument38 pagesMFRS 121 - Foreign Currency Lecture Notes 2022 - UploadZhaoYing TanNo ratings yet

- Huyen Bui Asm1Document10 pagesHuyen Bui Asm1Helen Joan BuiNo ratings yet

- Statement 71081325 GBP 2023-10-08 2023-11-07-1 231107 165616Document3 pagesStatement 71081325 GBP 2023-10-08 2023-11-07-1 231107 165616ashu7009831990No ratings yet

- BV CIA3 Comp1Document5 pagesBV CIA3 Comp1Saloni Jain 1820343No ratings yet

- NP EX 4 SunriseDocument13 pagesNP EX 4 SunriseakbarNo ratings yet

- Lesson 11 - Consumer BehaviourDocument7 pagesLesson 11 - Consumer BehaviourSaid Sabri KibwanaNo ratings yet

- Information On IPO in SingaporeDocument37 pagesInformation On IPO in SingaporeHemant SinghNo ratings yet

- RATIOS MEANING A Ratio Shows The Relationship Between Two Numbers.Document15 pagesRATIOS MEANING A Ratio Shows The Relationship Between Two Numbers.shru44No ratings yet

- CH-1 Advanced FADocument54 pagesCH-1 Advanced FAamogneNo ratings yet

- CfatDocument12 pagesCfatSahil MakkarNo ratings yet

- AIMCO CLO 11 Reset - Second Preliminary Offering Circular (BL vs. POC)Document99 pagesAIMCO CLO 11 Reset - Second Preliminary Offering Circular (BL vs. POC)aws devopsNo ratings yet

- Week 1 - Asset Classes and Financial MarketsDocument37 pagesWeek 1 - Asset Classes and Financial MarketsshanikaNo ratings yet

- Baudewyn 79191400 & Draou 32771500 2020Document104 pagesBaudewyn 79191400 & Draou 32771500 2020lam alferoNo ratings yet

- IKEA's Marketing Strategy in JapanDocument2 pagesIKEA's Marketing Strategy in JapanAaks TurabNo ratings yet

- Foreign Currency Translation - Modified.aDocument71 pagesForeign Currency Translation - Modified.asamuel debebeNo ratings yet

- Financial System Scope and FunctionDocument2 pagesFinancial System Scope and FunctionvivekNo ratings yet

- Ch11 - Latest VersionDocument54 pagesCh11 - Latest VersionMhmood Al-saadNo ratings yet

- Forex Summary Ca Final SFMDocument13 pagesForex Summary Ca Final SFMNksNo ratings yet

- Acct Statement XX2856 18052023Document12 pagesAcct Statement XX2856 18052023debsudipto93No ratings yet

- Financial Markets and Institutions: EthiopianDocument26 pagesFinancial Markets and Institutions: Ethiopiansemeredin wabeNo ratings yet

- Artko Capital 2019 Q3 LetterDocument10 pagesArtko Capital 2019 Q3 LetterSmitty WNo ratings yet

- Bfi200 - Tutorial 8 An 9 Risk Management - QDocument7 pagesBfi200 - Tutorial 8 An 9 Risk Management - QJoanna JacksonNo ratings yet