Professional Documents

Culture Documents

C0NSOLIDATION

C0NSOLIDATION

Uploaded by

d.pagkatoytoyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C0NSOLIDATION

C0NSOLIDATION

Uploaded by

d.pagkatoytoyCopyright:

Available Formats

DE LA SALLE LIPA

College of Business, Economics, Accountancy and Management

Accountancy Department

2nd Semester A.Y. 2012-2013

Accounting Review

CONSOLIDATION

I. Consolidated Financial Statements at the Date of Acquisition (Acquisition of Net Assets)

Problem 1. The following data refers to the Statement of Financial Position as of January 1,2012 of GLOBE Inc. whose

net assets is acquired by PLDT Inc. on the said date:

GLOBE Inc.

Statement of Financial Position

January 1,2012

Cash P 2,000,000 Accounts payable P 1,000,000

Financial assets 1,000,000 Notes payable 2,000,000

Accounts receivable (net) 500,000 Bonds payable 3,000,000

Inventory 2,500,000 Ordinary share (P10 par) 1,000,000

PPE, net 2,000,000 Share premium 2,000,000

Intangible asset, net 2,000,000 Retained earnings 1,000,000

Total assets P10,000,000 Total liabilities and equity P10,000,000

The following additional data are provided on January 1,2012 regarding the financial position of GLOBE Inc.:

1) The following are the fair values of the assets on January 1,2012:

Assets Fair values

Cash P2,000,000

Financial assets P1,500,000

Accounts receivable(net) 500,000

Inventory 2,300,000

PPE, net 2,200,000

Intangible asset, net 1,900,000

2) As of January 1,2012, the balance of unamortized premium on bonds payable is P200,000 and the balance of

unamortized bond issue cost is P100,000. The following items are not recorded.

3) Provision for lawsuit in the amount of P100,000 is omitted in the statement of financial position.

The Statement of Financial Position of PLDT Inc. as of January 1,2012 is presented below:

PLDT Inc.

Statement of Financial Position

January 1,2012

Cash P10,000,000 Accounts Payable P 2,000,000

Financial Assets 4,000,000 Accrued Expenses 3,000,000

Accounts Receivable (net) 5,000,000 Notes Payable 4,000,000

Inventory 3,000,000 Preference Shares (P70 par) 7,000,000

Prepaid Assets 2,000,000 Ordinary Share (P30 par) 6,000,000

PPE, net 20,000,000 Share Premium 8,000,000

Intangible asset, net 1,000,000 Retained Earnings 15,000,000

Total Assets P45,000,000 Total Liability and SHE P45,000,000

The following additional data are provided concerning the difference in fair values and book values of the assets of PLDT:

1) The fair value of Inventory is P5,000,000 while the fair value of PPE is P23,000,000.

Required: Determine the total assets and total shareholder’s equity to be presented in the Consolidated Statement of

Financial Position of PLDT Inc. as of January 1,2012 under the following considerations:

_________&________1. PLDT issued 100,000 of its ordinary shares with par value of P30/share. On January 1,2012, the

ordinary share of PLDT is traded at P50 per share. PLDT incurred P200,000 as stock issuance costs. PLDT also incurred

direct costs of business combination consisting of accounting, legal, and other professional fees totaling P100,000. In

addition to that, PLDT also incurred indirect costs consisting of general and administrative costs in the amount of P50,000.

_________&________2. PLDT issued 50,000 of its preference shares with par value of P50/share. On January 1,2012,

the preference share of PLDT is traded at P70 per share. PLDT incurred P150,000 as stock issuance costs. PLDT also

incurred direct costs of business combination consisting of accounting, legal, and other professional fees totaling

P200,000. In addition to that, PLDT also incurred indirect costs consisting of general and administrative costs in the

amount of P150,000.

DLSL CPA Board Operation – Practical Accounting 2

Page 1 of 2

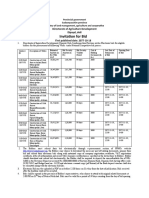

_________&________3. The following are the consideration for the purchase of net assets of GLOBE Inc. by PLDT Inc.

Consideration Book value/Par value Fair value

Cash P1,000,000 P1,000,000

10,000 Ordinary shares P100/share P120/share

5,000 Preference shares P50/share P80/share

Land P500,000 P1,000,000

Inventory P100,000 P 200,000

Machinery P2,000,000 P3,000,000

PLDT incurred P100,000 as stock issuance costs for ordinary shares and P50,000 for preference shares. PLDT also

incurred direct costs of business combination consisting of accounting, legal, and other professional fees totaling P70,000.

In addition to that, PLDT also incurred indirect costs consisting of general and administrative costs in the amount of

P30,000.

_________&________4. The following are the consideration for the purchase of net assets of GLOBE Inc. by PLDT Inc.

Consideration Book value/Par value Fair value

Cash P 500,000 P 500,000

5,000 Ordinary shares P100/share P150/share

10,000 Preference shares P10/share P25/share

Land P 100,000 P 300,000

Inventory P 100,000 P 200,000

Machinery P 800,000 P1,000,000

PLDT incurred P50,000 as stock issuance costs for ordinary shares and P30,000 for preference shares. PLDT also

incurred direct costs of business combination consisting of accounting, legal, and other professional fees totaling P30,000.

In addition to that, PLDT also incurred indirect costs consisting of general and administrative costs in the amount of

P20,000.

II. Consolidated Financial Statements at the Date of Acquisition (Acquisition of Stocks)

Problem 1. Use the data provided for PLDT Inc. and Globe Inc. as of January 1,2012.

Assumption 1: Determine the following assuming PLDT acquired 100% of all of the outstanding ordinary shares of Globe Co. by paying P6,000,000 cash. PLDT also

incurred direct costs of business combination consisting of accounting, legal, and other professional fees totaling P100,000. In addition to that, PLDT also incurred

indirect costs consisting of general and administrative costs in the amount of P50,000:

__________1. Total Assets of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________2. Total Liabilities of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________3. Total Shareholder’s PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________4. Goodwill to be recognized on January 1,2012

Assumption 2: Determine the following assuming PLDT acquired 100% of all of the outstanding ordinary shares of Globe Co. by paying P4,000,000 cash. PLDT also

incurred direct costs of business combination consisting of accounting, legal, and other professional fees totaling P100,000. In addition to that, PLDT also incurred

indirect costs consisting of general and administrative costs in the amount of P50,000:

__________1. Total Assets of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________2. Total Liabilities of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________3. Total Shareholder’s PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________4. Gain on bargain purchased to be recognized on January 1,2012

Assumption 3. Determine the following assuming PLDT acquired 60% of all of the outstanding ordinary shares of Globe Co. by paying P4,000,000 cash. PLDT also

incurred direct costs of business combination consisting of accounting, legal, and other professional fees totaling P100,000. In addition to that, PLDT also incurred

indirect costs consisting of general and administrative costs in the amount of P50,000:

__________1. Total Assets of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________2. Total Liabilities of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________3. Total Shareholder’s PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________4. Total Controlling Equity of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________5. Non-controlling Interest of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012

__________6. Goodwill to be recognized on January 1,2012

Assumption 4. Determine the following assuming PLDT acquired 80% of all of the outstanding ordinary shares of Globe Co. by paying P3,000,000 cash. PLDT also

incurred direct costs of business combination consisting of accounting, legal, and other professional fees totaling P100,000. In addition to that, PLDT also incurred

indirect costs consisting of general and administrative costs in the amount of P50,000:

__________1. Total Assets of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________2. Total Liabilities of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________3. Total Shareholder’s PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________4. Total Controlling Equity of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012.

__________5. Non-controlling Interest of PLDT Inc. to be presented in the Consolidated Financial Statements as of January 1,2012

__________6. Gain on bargain purchased to be recognized on January 1,2012

Note: PFRS 3(2008) provides two options of measuring non-controlling interest in an acquiree:

1) At fair value which should not be less than number 2.

DLSL CPA Board Operation – Practical Accounting 2

Page 2 of 2

2) At the non-controlling interest’s proportionate share of the acquiree’s identifiable net assets

Note: Gain on bargain purchased shall be recognized only by controlling interest but noncontrolling interest may share on goodwill recognized.

DLSL CPA Board Operation – Practical Accounting 2

Page 3 of 2

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Business CombinationDocument10 pagesBusiness CombinationLora Mae JuanitoNo ratings yet

- Advac Guerero Chapter 14 CompressDocument29 pagesAdvac Guerero Chapter 14 Compressnon existingNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Bfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Document10 pagesBfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Arah OpalecNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Cash To Accrual Basis, Single Entry and Error CorrectionDocument7 pagesCash To Accrual Basis, Single Entry and Error CorrectionHasmin Saripada AmpatuaNo ratings yet

- 1001 SpecDocument2 pages1001 SpecconejoNo ratings yet

- Key ANS. Book4.4 Valuation and Appraisal RDL 55q 10p 2014Document11 pagesKey ANS. Book4.4 Valuation and Appraisal RDL 55q 10p 2014Noel RemolacioNo ratings yet

- Prac 2Document10 pagesPrac 2Fery AnnNo ratings yet

- Exercise 2 Statement of Financial PositionDocument8 pagesExercise 2 Statement of Financial Positionjumawaymichaeljeffrey65No ratings yet

- Exam - Finance Officer With AnsDocument2 pagesExam - Finance Officer With Ansconequip philippines100% (1)

- MOD2 Statement of Cash FlowsDocument2 pagesMOD2 Statement of Cash FlowsGemma DenolanNo ratings yet

- Activity Consolidated Financial StatementDocument2 pagesActivity Consolidated Financial StatementCynthia CanlasNo ratings yet

- Handouts ConsolidationSubsequent To Date of AcquisitionDocument5 pagesHandouts ConsolidationSubsequent To Date of AcquisitionCPANo ratings yet

- BFJPIA Cup Level 4 P2Document9 pagesBFJPIA Cup Level 4 P2Blessy Zedlav LacbainNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Corporate Liquidation Practical Accounting IIDocument4 pagesCorporate Liquidation Practical Accounting IIJalieha Mahmod100% (2)

- INVESTMENTS With AnswersDocument3 pagesINVESTMENTS With AnswersShaira BugayongNo ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Partnership Accounting With AnsDocument22 pagesPartnership Accounting With Ansjessica amorosoNo ratings yet

- Department of Accountancy: Investment in AssociateDocument2 pagesDepartment of Accountancy: Investment in AssociateAiza S. Maca-umbosNo ratings yet

- Statement of Financial PositionDocument7 pagesStatement of Financial PositionKAYLA SHANE GONZALESNo ratings yet

- 2 PFRS For SMEs Business CombinationDocument1 page2 PFRS For SMEs Business CombinationRay Allen UyNo ratings yet

- Practical Accounti ng2: Business CombinationsDocument9 pagesPractical Accounti ng2: Business CombinationsKath SapitanNo ratings yet

- 1 Partneship Formation PDFDocument7 pages1 Partneship Formation PDFSienna PrcsNo ratings yet

- Audit of Financial Statement PresentationDocument7 pagesAudit of Financial Statement PresentationHasmin Saripada Ampatua100% (1)

- Quiz 1 - Midterm ReviewerDocument4 pagesQuiz 1 - Midterm ReviewerJack HererNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationCloudKielGuiang0% (1)

- P2 06Document9 pagesP2 06Darrel100% (1)

- Questions 15 Through 18 Are Based On The FollowingDocument1 pageQuestions 15 Through 18 Are Based On The FollowingSherlock HolmesNo ratings yet

- Advac 2Document3 pagesAdvac 2acadsbreakNo ratings yet

- Sevilla - Unit 1 - IA3Document14 pagesSevilla - Unit 1 - IA3Hensel SevillaNo ratings yet

- Advact PrelimDocument10 pagesAdvact PrelimSano ManjiroNo ratings yet

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- Pamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Document5 pagesPamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Trixie HicaldeNo ratings yet

- HW On Quasi-Reorganization BDocument2 pagesHW On Quasi-Reorganization BCharles Tuazon100% (1)

- Translation ActivityDocument1 pageTranslation ActivityJon Dumagil Inocentes, CPANo ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- Quizzer 6Document2 pagesQuizzer 6Midas PhiNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- CMPC 131 1-Partneship-FormationDocument7 pagesCMPC 131 1-Partneship-FormationGab IgnacioNo ratings yet

- BusCom SubsequentDocument7 pagesBusCom SubsequentDianeL.ChuaNo ratings yet

- Consolidated FS at Date of AcquisitionDocument1 pageConsolidated FS at Date of Acquisitionassoc.uls2324No ratings yet

- Mysanflower HVA Prob (QUIZ 8 - 26)Document2 pagesMysanflower HVA Prob (QUIZ 8 - 26)NicoleNo ratings yet

- Chapter 1 The Context of Systems Analysis and Design MethodsDocument5 pagesChapter 1 The Context of Systems Analysis and Design MethodsAlta SophiaNo ratings yet

- AUDITING (35 Items) : Problem No. 1Document8 pagesAUDITING (35 Items) : Problem No. 1Angelica EstolatanNo ratings yet

- Final Exam Advance IIDocument4 pagesFinal Exam Advance IIRobin RossNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationMa Teresa B. CerezoNo ratings yet

- Unit Number/ Heading Learning Outcomes: Intermediate Accounting Iii (Ae 17) Learning Material: Single EntryDocument5 pagesUnit Number/ Heading Learning Outcomes: Intermediate Accounting Iii (Ae 17) Learning Material: Single EntrySandia EspejoNo ratings yet

- Assignment Bus. CombiDocument49 pagesAssignment Bus. CombiAe AsisNo ratings yet

- Act131-Prelim Examination: Book Value Fair ValueDocument2 pagesAct131-Prelim Examination: Book Value Fair ValueSittie Ainna Acmed UnteNo ratings yet

- Business Combination and Consolidation On Acquisition Date (Summary)Document6 pagesBusiness Combination and Consolidation On Acquisition Date (Summary)Ma Hadassa O. Foliente33% (3)

- 5rd Batch - P2 Final Pre-Boards - Wid ANSWERDocument11 pages5rd Batch - P2 Final Pre-Boards - Wid ANSWERKim Cristian MaañoNo ratings yet

- Simple Company-WPS OfficeDocument3 pagesSimple Company-WPS OfficeAngeline BautistaNo ratings yet

- Act 6J03 - Comp1 - 1stsem05-06Document13 pagesAct 6J03 - Comp1 - 1stsem05-06d.pagkatoytoyNo ratings yet

- Final Preboar1Document35 pagesFinal Preboar1d.pagkatoytoyNo ratings yet

- Act 6J03 - Comp2 - 1stsem05-06Document11 pagesAct 6J03 - Comp2 - 1stsem05-06d.pagkatoytoyNo ratings yet

- CH 7 Answers 09Document5 pagesCH 7 Answers 09d.pagkatoytoyNo ratings yet

- Pfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4Document8 pagesPfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4d.pagkatoytoyNo ratings yet

- CH 3 Answers 09Document9 pagesCH 3 Answers 09d.pagkatoytoyNo ratings yet

- CH 6 Answers 09Document6 pagesCH 6 Answers 09d.pagkatoytoyNo ratings yet

- Pfrs 11, Pfrs 12, Pfrs 13Document6 pagesPfrs 11, Pfrs 12, Pfrs 13d.pagkatoytoyNo ratings yet

- Pfrs 9, Pfrs 10 and Pfrs 11Document1 pagePfrs 9, Pfrs 10 and Pfrs 11d.pagkatoytoyNo ratings yet

- Audit of CoE, CB, AB, SES and PPE - SW10Document8 pagesAudit of CoE, CB, AB, SES and PPE - SW10d.pagkatoytoyNo ratings yet

- PAS 28 - Investment in Associate,, Equity Method, Cost Method, DividendsDocument3 pagesPAS 28 - Investment in Associate,, Equity Method, Cost Method, Dividendsd.pagkatoytoyNo ratings yet

- Audit of Financial Statements - SW9Document12 pagesAudit of Financial Statements - SW9d.pagkatoytoyNo ratings yet

- Audit of Cash - SW8Document7 pagesAudit of Cash - SW8d.pagkatoytoyNo ratings yet

- Audit of Intangible AssetDocument3 pagesAudit of Intangible Assetd.pagkatoytoyNo ratings yet

- Pope Lawsuit 2011 /the Pope Has Been Indicted in The International Criminal CourtDocument48 pagesPope Lawsuit 2011 /the Pope Has Been Indicted in The International Criminal Courtzeitgeist-explorateurNo ratings yet

- 6 - TRO-PI (Motion)Document47 pages6 - TRO-PI (Motion)tgillmanNo ratings yet

- Star Trek/Planet of The Apes #5 (Of 5) PreviewDocument7 pagesStar Trek/Planet of The Apes #5 (Of 5) PreviewGraphic Policy100% (1)

- QIS Brochure USL DigitalDocument24 pagesQIS Brochure USL DigitalSaeedArshadiNo ratings yet

- Result PRCJune 2023Document56 pagesResult PRCJune 2023Iqramunir IqramunirNo ratings yet

- 6th 7th Amendment101Document30 pages6th 7th Amendment101Donald KingNo ratings yet

- S.R. Bommai v. Union of India: CritiqueDocument4 pagesS.R. Bommai v. Union of India: Critiqueanon_913299743No ratings yet

- KTC CARL Sections 41 To 78 ReviewerDocument17 pagesKTC CARL Sections 41 To 78 ReviewerUser 010897020197No ratings yet

- Iso 4021-1992Document13 pagesIso 4021-1992Oscar CampoNo ratings yet

- BCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS AccountDocument6 pagesBCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS Accountmugger123456No ratings yet

- Bi Form Cgaf-001-Rev 2Document2 pagesBi Form Cgaf-001-Rev 2Nerissa de jesus60% (5)

- AM No. 10-3-7-SC Rules On E-FilingDocument4 pagesAM No. 10-3-7-SC Rules On E-FilingNarciso Reyes Jr.No ratings yet

- Lesson 6Document7 pagesLesson 6Ira Charisse BurlaosNo ratings yet

- FINEXUS Prepaid Card Application Form 20220309Document2 pagesFINEXUS Prepaid Card Application Form 20220309mohamad muazimNo ratings yet

- Romance V R 1987 MR 57Document4 pagesRomance V R 1987 MR 57ganesen RenghenNo ratings yet

- HomeworkkDocument7 pagesHomeworkkkigismichikoNo ratings yet

- Lea 3 Week 1Document2 pagesLea 3 Week 1John Florenz RamosNo ratings yet

- A Lawyer Is Not Expected To Know All The LawDocument9 pagesA Lawyer Is Not Expected To Know All The LawAilein Grace100% (1)

- Forensic Analisys of Web Browser With Dual Layout Engine (Slides - Linda - ICDFI2012)Document20 pagesForensic Analisys of Web Browser With Dual Layout Engine (Slides - Linda - ICDFI2012)whiskmanNo ratings yet

- Necessity of Agent Banking To AgentsDocument3 pagesNecessity of Agent Banking To AgentsjannatulNo ratings yet

- Cabanatuan City: Coach ChaperonDocument38 pagesCabanatuan City: Coach ChaperonJayjay RonielNo ratings yet

- Employment Application FormDocument8 pagesEmployment Application FormYashpal SinghNo ratings yet

- Invitation For Bid: Directorate of Agriculture Development Dipayal, Doti First Published Date: 2077-10-18Document2 pagesInvitation For Bid: Directorate of Agriculture Development Dipayal, Doti First Published Date: 2077-10-18Suresh KunwarNo ratings yet

- HM2011 GridDocument24 pagesHM2011 GridumarsizNo ratings yet

- Acc 102Document3 pagesAcc 102Ike UzuNo ratings yet

- LCR 600 Manual SetupDocument68 pagesLCR 600 Manual SetupAgista FifthoriNo ratings yet

- Enrollment Form: Name of StudentDocument2 pagesEnrollment Form: Name of StudentThat's EntertainmentNo ratings yet