Professional Documents

Culture Documents

Econs 1

Econs 1

Uploaded by

khai.phamtien2002Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Econs 1

Econs 1

Uploaded by

khai.phamtien2002Copyright:

Available Formats

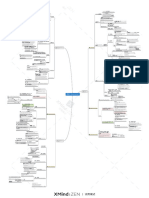

Law of demand

Demand function Demand concepts

Demand curve (graph of

inverse demand function)

Elastic, Unit-elastic, and Inelastic

Elasticity

Perfectly elastic and inelastic

Elasticity and total expenditure on a good

Price elasticity of demand

Own-price

Larger for goods with close substitutes, occupy a large

portion of the budget, are seen as discretionary, or

have longer time to adjust to changes in its price.

Cross-price

Income

Substitution and income effects

Law of diminishing marginal returns

Total cost: TC = wL + rK Supply analysis : cost, marginal returns, and productivity

w = hourly wage; L = labor hours; r =

rental rate of capital; K = capital hours

Total, average, and marginal product of labor

Economic profit = Total revenue (TR) - Economic cost (total cost (TC))

Accounting profit = TR - Accounting cost

Economic vs Accounting

Economic depreciation: What am I giving up if I use

my resources to produce output in the coming period?

Accounting depreciation: How should I distribute the

historical cost—that I have already paid—across units

of output that I intend to produce this period?

Marginal revenue (MR) and marginal cost (MC) Demand & Supply

Cooperative vs Non-cooperative countries

Landlocked countries rely on neighbors for access to vital resources => cooperation

Total, Variable, Fixed, and Marginal Costs more important.

National security or military

S, the lowest point on the AVC curve, is where MC = AVC. Beyond quantity QAVC, MC > AVC;

thus, the AVC curve begins to rise. Countries highly connected to trade routes or acting as a conduit for trade use their

T, the lowest point on the ATC curve, is where MC = ATC. Beyond quantity QATC, MC > ATC; geographic location as a lever of power in broader international dynamics.

thus, the ATC curve is rising.

A, the difference between ATC and AVC at output quantity Q1, is exactly the AFC.

R is the lowest point on the MC curve. Beyond this point of production, fixed input Domestically, growing national wealth and limiting income inequality contribute to

constraints reduce labor productivity. Economy social stability, an important component of national security.

X is the difference between ATC and AVC at Q2. X < A because AFC (Y) falls with output.

Internationally, countries that cooperates in support of their economic interest are focused

Motivations for cooperation on 1 of 2 factors:

(1) securing essential resources through trade, or

(2) leveling the global playing field for their companies/industries through standardization.

Livable geography and climate, access to food and water, etc.

Perfect and imperfect competition Highly unequal among countries.

Geophysical Resource Endowment

More endowed with a resource => more political leverage

when dealing with another in need of that resource.

Resource-rich => use or sale of the resource benefits certain

Resource Endowment, Standardization, and Soft Power

groups more than others => internal political instability.

State actors (national governments) & Political cooperation Regulatory cooperation:

Basel Committee on Banking Supervision (BCBS): more effective supervision of the

global banking sector and international capital flows.

Standardization

Perfectly competitive firm

Process standardization:

Profit-Maximization, Breakeven, and

Society for Worldwide Interbank Financial Telecommunication (SWIFT): global payment

Shutdown Points of Production

infrastructure.

Monopolist firm

Operational synchronization:

Containerization: reduces time and cost of shipping.

Historical or modern

Cultural Considerations and “Soft Power”

Cultural programs, advertisement, travel grants, and university exchanges, etc.

Generally, strong institutions => more stable internal and external political forces =>

more opportunity to develop cooperative relationships.

The Role of Institutions

Countries with strong institutions => more authority and independence in the international space.

Increasing returns to scale. Stronger institutions => more durable cooperative relationships.

Specialization in one task rather than perform many duties.

More efficient equipment, and adaptation the latest in technology. Economies of scale Every country has different resources, goals, and leadership => different priorities.

Marketable byproducts, less energy consumption, and enhanced quality control.

Better use of market information for more effective decision making.

Economies and Diseconomies of scale

Obtaining discounted prices on resources when buying in bulk. Priorities may shift as political leadership turns over or as global events change.

Hierarchy of Interests and Costs of Cooperation

Breakeven: P = MR = SMC = ATC

Shutdown: SMC = AVC Decreasing returns to scale. Some elements on the hierarchy of national interests may be universally clear-cut. However, as

Being so large that it cannot be properly managed. Power of the Decision Maker basic societal needs are met, the hierarchy of national interests can become more subjective.

Overlapping and duplication of business functions

and product lines.

Diseconomies of scale The length of a country’s political cycle has an important impact on priority designation.

Higher resource prices because of supply

constraints when buying inputs in bulk.

Political Non-Cooperation

Features of globalization

Raising sales

Raising profits

Reducing costs (lower tax-operating environments, reduce labor costs, or seek other supply

Motivations for globalization chain efficiency gains)

Portfolio investment flows

Non-state actors & Forces of globalization Access to resources and markets

Marginal revenue (MR) and marginal cost (MC)

FDI

Intrinsic gain (personal growth and education, improved productivity, higher standards)

Unequal Accrual of Economic and Financial Gains

Lower Environmental, Social, and Governance Standards

Political Consequences (income/wealth inequality, differences in opportunity

Costs of globalization Interdependence (if there is a disruption to the supply chain,

firms may not be able to produce the good themselves)

Reshoring essentials

How firms fortify their supply chains Re-globalizing production

Perfect competition

Doubling down on key markets

Monopolistic competition

4 market structures Autarky

Oligopoly Self-sufficiency, sometimes swifter economic and political development, but gradual

loss of economic and political development within the country

Monopoly Assessing geopolitical actors and risks

Hegemony

Geopolitics Regional or global leaders, influence on global affairs, but may become more

Number and relative size of firms competitive and increase geopolitical risk when gaining or losing influence

Degree of product differentiation Multilateralism

Both capable of and highly dependent on international cooperation for economic growth.

Regionalism

Pricing power Determinants of market structure

In between the two extremes of bilateralism and multilateralism.

Analysis of market structures Bilateralism

In regionalism, a group of countries cooperate with one another.

One-at-a-time agreements without multiple partners.

Barrier to entry and exit Both bilateralism and regionalism can be conducted at the exclusion of other groups.

National security tools

Degree of non-price competition

Economics 1 Cooperative: trade agreements, WTO, common markets/currency

Threat of entry

Economic tools

Non-cooperative: nationalization, voluntary export restraints, domestic content requirements

Power of suppliers

Cooperative: currency exchange

Power of buyers Porter's 5 forces

Financial tools Reduce geopolitical risk if they encourage cooperation in security, economic, or

Tools of geopolitics financial arenas.

Threat of substitutes May cause vulnerabilities (e.g., global use of the USD)

Rivalry among existing competitors Non-cooperative: limiting access to local currency markets, restricting foreign investments,

sanctions

Q = a - bP

Perfect competition Multi-tool approaches Cabotage: the right to transport passengers or goods within a country by a foreign firm

MR = ΔTR/ΔQ

Geopolitical Risk and Comparative Advantage

A consistent threat of conflict may drive more regular volatility in asset prices.

Own-price

Countries/regions with limited geopolitical risk may attract more labor and capital.

Not every country will be endowed with the same factors and capabilities => benefit

Substitutes => (+) from trade => more variety of products, higher competition between firms, and more

efficient resource allocation.

Cross-price

Complements => (-)

Event risk: evolves around set dates, such as elections, new legislation, or

other date-driven milestones, such as holidays or political anniversaries,

Income known in advance.

Elasticity of demand

Horizontal demand schedule (perfectly elastic)

Exogeneous risk: sudden or unanticipated risk that impacts either a country’s

Extremes Types of geopolitical risk

cooperative stance, the ability of non-state actors to globalize, or both.

Vertical demand schedule (perfectly inelastic)

Thematic risk: known risks that evolve and expand over a period of time (climate

Price elasticity will be higher if there are many close substitutes for the product. change, pattern migration, the rise of populist forces, threat of terrorism, and cyver

threats)

The greater the share of the consumer’s budget spent on the item, the higher the price elasticity of demand. Determinants

Black swan risk: An event that is rare and difficult to predict but has an important impact.

The length of time within which the demand schedule is being considered.

Likelihood (how likely the risk is to happen)

Long term:

TR, MR and price elasticity

Impact investors' asset allocation.

May have important environmental, social, governance, and other impacts.

Immediate impact on portfolios is likely to be more limited.

Incorporating geopolitical risk into investment

Velocity (how quickly the risk impacts investment portfolios) Time horizon

Assessing Geopolitical Threats Medium term:

The difference between the value that a consumer places on units purchased and the Consumer surplus Impair companies’ processes, costs, and investment opportunities, resulting in lower valuations.

amount of money that was required to pay for them. Impact some more than others.

Short term:

Volatility in the markets may affect entire industries or even the entire market.

Economic costs = Total accounting costs - Implicit opportunity costs Long-term changes are unnecessary.

P = AR = MR

Optimal price and output in perfect competition Supply analysis, optimal price, and output in perfectly competitive markets Low => adjust asset allocation

Law of diminishing returns => Profit maximization at output level where MR = MC

Quickness Medium => adjust investments in specific sectors

Only perfect competition has a defined supply function.

High => flight to quality (the herd-like behavior of investors to shift out of risky assets during

financial downturns or bear markets)

Profit maximization at output level where MR = MC Firm and market structures

Impact

The long-run marginal cost schedule is the perfectly competitive firm’s supply curve.

Long-run equilibrium in perfect competition

The firm’s demand curve is dictated by the aggregate market’s equilibrium price. Groupthink: thinking or making decisions as a group in a way that discourages creativity or

individual responsibility. For scenario analysis to be useful in portfolio management, teams

Scenario analysis: evaluating portfolio outcomes across potential circumstances or states of the world.

must build creative processes, identify scenarios, track these scenarios, and assess the need

The long-run competitive equilibrium occurs where MC = AC = P for action on a regular cadence.

Tracking risks according to signposts

Short-run profit maximization at output level where MR = MC

Acting on Geopolitical Risk Consider objectives, risk tolerance, and time horizon.

There is no well-defined supply function. The information used to determine the

appropriate level of output is based on the intersection of MC and MR. However, Monopolistic competition

the price that will be charged is based on the market demand schedule.

Long-run equilibrium in monopolistic competition: MR = MC High levels of geopolitical risk reduce investment, employment, and price level of the stock market.

Observations from the Geopolitical Risk Index (GPR) Firms reduce investment in the wake of idiosyncratic events, which would be unlikely to repeat.

The threat of an event was shown to have a larger impact over time than that of the actual events themselves.

In a market where collusion is present, the aggregate market demand curve is divided up by

the individual production participants.

Under non-colluding market conditions, each firm faces an individual demand curve

depending on the pricing strategies adopted by the participating firms.

1. If price increases, the competitor ignores it so demand is more responsive (more elastic).

2. If the price falls, the competitor matches it so demand is less responsive (more inelastic).

The kink point => current price offered by the market.

Assumption in which each firm determines its profit-maximizing

production level assuming that the other firms’ output will not change.

Cournot assumption

The Cournot strategy’s solution can be found by setting Q = q1 + q2,

where q1 and q2 represent the output levels of the two firms. Oligopoly and pricing strategies

When two or more participants in a non-cooperative game have no incentive to deviate

from their respective equilibrium strategies given their opponent’s strategies.

The number and size distribution of sellers: number of firms is small or if one firm is dominant.

The similarity of the products: products are homogeneous.

Nash equilibrium

Cost structure: similar the cost structures. Determinants of successful cartel

Order size and frequency: orders are frequent, received on a regular basis, and relatively small.

The strength and severity of retaliation: low threat.

The degree of external competition.

Stackelberg model: a prominent model of strategic decision making in which firms are

assumed to make their decisions sequentially.

Top-dog strategy: the leader aggressively overproduce to force the follower to scale

back its production or even punish or eliminate the weaker opponent.

The price leader identifies its profit-maximizing output where MRL = MCL, at output QL.

No single optimum price and output analysis that fits all

oligopoly market situations because of the interdependence. Optimal price, output, and long-run equilibrium in Oligopoly

Optimal price is determined at the output level where MR = MC (at kinked point)

Long-run economic profits are possible for firms operating in oligopoly markets but over

time, the market share of the dominant firm declines.

The profit-maximizing level of output occurs where MR = MC. Demand/Supply and Optimal Price/Output

First-degree: charge each customer the highest price the customer is willing to pay.

Monopoly

Second-degree: charge different per-unit prices using the quantity purchased. Price discrimination and consumer surplus

Third-degree: segregates customers into groups based on characteristics and offers different pricing to each group.

Economic profit is possible.

To maintain a monopoly market position in the long run, the firm must be protected by Long-run equilibrium in monopoly

substantial and ongoing barriers to entry, or national ownership of the monopoly.

The regulator sets price equal to LRAC.

Observed price and quantity are the equilibrium values of price and quantity and do not

represent the value of either supply or demand.

Econometric approaches

Must use a model with 2 equations, an equation of demanded quantity and an equation of Identification of market structure

supplied quantity.

Concentration ratio Simpler approaches

Herfindahl–Hirschman index Unaffected by mergers among the top market incumbents.

Does not directly quantify market power and threat of entrance.

You might also like

- 1911 - LVSP Delhi NCR Market Study PDFDocument130 pages1911 - LVSP Delhi NCR Market Study PDFDarshan SubashNo ratings yet

- "The Mammogram Myth" by Rolf HeftiDocument3 pages"The Mammogram Myth" by Rolf HeftiRolf HeftiNo ratings yet

- AAS Application Form SampleDocument22 pagesAAS Application Form SamplePopy InthavongNo ratings yet

- Econ201 ReviewDocument4 pagesEcon201 ReviewChristopher Demmerle-McGregorNo ratings yet

- Tariff and Associated ConditionsDocument1 pageTariff and Associated Conditionsak mitraNo ratings yet

- Price ElasticityDocument1 pagePrice ElasticityRene PalanyNo ratings yet

- Individual and Market DemandDocument3 pagesIndividual and Market DemandAhmad ShukriNo ratings yet

- Examples of Applicable Steels For Typical Products: Cproperties of Die MaterialsDocument1 pageExamples of Applicable Steels For Typical Products: Cproperties of Die MaterialsErnestoFloresNo ratings yet

- Vol-I Part-II Section 5.B.3 1 Technical Investigation Report 487Document1 pageVol-I Part-II Section 5.B.3 1 Technical Investigation Report 487mayank dixitNo ratings yet

- Summary of Formula - Geotech MidtermDocument1 pageSummary of Formula - Geotech MidtermJohn Paull CuaNo ratings yet

- List of Numeric Codes For Railway Companies (RICS Code)Document8 pagesList of Numeric Codes For Railway Companies (RICS Code)Md. Shiraz JinnathNo ratings yet

- V2 V4 V20 V55 V100: SignalforceDocument3 pagesV2 V4 V20 V55 V100: SignalforceGIRIPRASAD T GNo ratings yet

- All DiagramsDocument6 pagesAll Diagramsgr306688No ratings yet

- Chapter 8: Utility and Demand: Equalize The Marginal Utility Per Dollar For All GoodsDocument1 pageChapter 8: Utility and Demand: Equalize The Marginal Utility Per Dollar For All GoodsYtibNo ratings yet

- Reading 28 - Long-Lived AssetsDocument1 pageReading 28 - Long-Lived Assetsmaimaitaan120201No ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- Elasticity and Its ApplicationDocument1 pageElasticity and Its Applicationduyennthds170525No ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- Header Ends DData (ID 749918)Document6 pagesHeader Ends DData (ID 749918)Vaniya GoelNo ratings yet

- Ec 19800728 The Consumer Price Index Concepts Construction and Controversy PDFDocument2 pagesEc 19800728 The Consumer Price Index Concepts Construction and Controversy PDFVõ Ngọc Ý NhiNo ratings yet

- Effects of Microsparger Surface Area and Pore Size On Mass Transfer in A Development Bioreactor PDFDocument1 pageEffects of Microsparger Surface Area and Pore Size On Mass Transfer in A Development Bioreactor PDFFISHNo ratings yet

- Hot Water CalculationDocument2 pagesHot Water CalculationNghiaNo ratings yet

- Examples of Applicable Steels For Typical ProductsDocument1 pageExamples of Applicable Steels For Typical Productsapi-3848892No ratings yet

- Shaping The Future: Army Robotics and Autonomous Systems: March 2016Document14 pagesShaping The Future: Army Robotics and Autonomous Systems: March 2016Grigore JelerNo ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- Chapters - 2,3,6Document10 pagesChapters - 2,3,6alex smithNo ratings yet

- Unit 7: Elasticities of DemandDocument7 pagesUnit 7: Elasticities of DemandNISHA BANSALNo ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- 3m Heat Shrink Tubing Product Selection Guide Low Res PDFDocument3 pages3m Heat Shrink Tubing Product Selection Guide Low Res PDFBayu PutraNo ratings yet

- Theorems of Exam Linear AlgebraDocument4 pagesTheorems of Exam Linear AlgebraDavide ThrowawayNo ratings yet

- QuantDocument1 pageQuantkhaipham7302No ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- MacroDocument19 pagesMacroMusyafiin SajaNo ratings yet

- Hot Water CalculationsDocument2 pagesHot Water Calculationsminn pyae son eNo ratings yet

- 312-Chapter 4 PDFDocument55 pages312-Chapter 4 PDFDileep GNo ratings yet

- Supply Chain Mapping - Reporte2 - Grupo8Document2 pagesSupply Chain Mapping - Reporte2 - Grupo8Josue LoaizaNo ratings yet

- 3600 2 TX All Rounder Rotary Brochure India enDocument2 pages3600 2 TX All Rounder Rotary Brochure India ensaravananknpcNo ratings yet

- Defective ContractsDocument1 pageDefective Contractsdinm6230No ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- MAHLER Process - Descr - Flow - N2 - PSADocument1 pageMAHLER Process - Descr - Flow - N2 - PSAPatrick MalmbergNo ratings yet

- Energy Comparison November-2023Document1 pageEnergy Comparison November-2023Deepak KumarNo ratings yet

- Geh 6225Document1 pageGeh 6225AztvNo ratings yet

- King Power Synchronous BEltDocument7 pagesKing Power Synchronous BEltvietkhamNo ratings yet

- King Power Synchronous Belt (KPS II) : 1. Product Introduction StructureDocument7 pagesKing Power Synchronous Belt (KPS II) : 1. Product Introduction StructureArif HidayatNo ratings yet

- Mcr3U Unit #7: Trigonometric Functions Section Numbers HomeworkDocument18 pagesMcr3U Unit #7: Trigonometric Functions Section Numbers HomeworkpersonNo ratings yet

- Acme Thread General Purpose - Class 2G: Reference PWM Drawing PC50563, Rev. 5Document1 pageAcme Thread General Purpose - Class 2G: Reference PWM Drawing PC50563, Rev. 5metroroadNo ratings yet

- Resumen de Especificaciones MotoresDocument1 pageResumen de Especificaciones MotoresJavier ArdilesNo ratings yet

- Physics Reviewer Jusq TabangDocument1 pagePhysics Reviewer Jusq TabangIan DibNo ratings yet

- Miniature Linear Guides: Standard Blocks, Light Preload / Slight ClearanceDocument1 pageMiniature Linear Guides: Standard Blocks, Light Preload / Slight ClearanceTrần Việt DũngNo ratings yet

- Star Super Surplus Floater BrochureDocument14 pagesStar Super Surplus Floater BrochureBeenu BhallaNo ratings yet

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Document1 pageSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxNo ratings yet

- WMW LuzVis 20231218 20231224Document4 pagesWMW LuzVis 20231218 20231224Jose Bienvenido BionaNo ratings yet

- Infographic Vietnam National Power Development Plan PDP8 Created by Royal HaskoningDHVDocument1 pageInfographic Vietnam National Power Development Plan PDP8 Created by Royal HaskoningDHVdbigfatNo ratings yet

- Diversification MindmapDocument1 pageDiversification Mindmapmccallk2003No ratings yet

- (T) Topic - 03 - ManEcon 2Document10 pages(T) Topic - 03 - ManEcon 2Mariane JuinioNo ratings yet

- Recommended Laboratory TestsDocument2 pagesRecommended Laboratory TestsVishalya Nipuni LankeshiNo ratings yet

- Topic 6 Market AccessDocument1 pageTopic 6 Market Access3213349886No ratings yet

- Asst. Nodal Officer Nagar Panchayat Koora (Kunra) Architect C.M.O / Nodal Officer Nagar Panchayat Koora (Kunra)Document1 pageAsst. Nodal Officer Nagar Panchayat Koora (Kunra) Architect C.M.O / Nodal Officer Nagar Panchayat Koora (Kunra)SHOAIB MEMONNo ratings yet

- Set 04 Mechanical Behaviours of MetalsDocument18 pagesSet 04 Mechanical Behaviours of MetalsHayford KyeremahNo ratings yet

- CV AssignmentDocument3 pagesCV AssignmentShivneel SwamyNo ratings yet

- Motion Media and InformationDocument2 pagesMotion Media and InformationLovely PateteNo ratings yet

- Care of Dying and DeadDocument10 pagesCare of Dying and Deadd1choosenNo ratings yet

- Caution:: For MZ790U Model Only Duplicator Model: MZ790U RFID System Model: 444-59003 Contains FCC ID: RPARFMHL00Document266 pagesCaution:: For MZ790U Model Only Duplicator Model: MZ790U RFID System Model: 444-59003 Contains FCC ID: RPARFMHL00Haii NguyenNo ratings yet

- British HeritageDocument15 pagesBritish HeritageOksana BulhakovaNo ratings yet

- POYDocument6 pagesPOYChristine KatalbasNo ratings yet

- Orthodontic Treatment of Mandibular Anterior Crowding: Key Words: Crowding, Malocclusion, Labial FlaringDocument4 pagesOrthodontic Treatment of Mandibular Anterior Crowding: Key Words: Crowding, Malocclusion, Labial FlaringDunia Medisku OnlineShopNo ratings yet

- MODULEDocument8 pagesMODULEFrances Nicole SegundoNo ratings yet

- International Primary Curriculum SAM Science Booklet 2012Document44 pagesInternational Primary Curriculum SAM Science Booklet 2012Rere Jasdijf100% (1)

- Kakhisong Church A2-ModelDocument1 pageKakhisong Church A2-ModelanzaniNo ratings yet

- Dungeoncraft Wild Beyond The Witchlight v1.1Document9 pagesDungeoncraft Wild Beyond The Witchlight v1.1RalphNo ratings yet

- Annotated BibliographyDocument7 pagesAnnotated Bibliographyapi-340711045No ratings yet

- Asuhan Keperawatan Pada Klien Dengan Pasca Operasi Hernia Inguinalis Di Lt.6 Darmawan Rs Kepresidenan Rspad Gatot Soebroto Jakarta Tahun 2019Document7 pagesAsuhan Keperawatan Pada Klien Dengan Pasca Operasi Hernia Inguinalis Di Lt.6 Darmawan Rs Kepresidenan Rspad Gatot Soebroto Jakarta Tahun 2019Ggp Kristus Raja SuliNo ratings yet

- Priority Payment: The Status For Payment 78735WQ007TU Is: Pending AuthorisationDocument3 pagesPriority Payment: The Status For Payment 78735WQ007TU Is: Pending AuthorisationShohag RaihanNo ratings yet

- Tve 8 Shielded Metal Arc WeldingDocument11 pagesTve 8 Shielded Metal Arc WeldingJOHN ALFRED MANANGGITNo ratings yet

- Tle Ap-Swine Q3 - WK3 - V4Document7 pagesTle Ap-Swine Q3 - WK3 - V4Maria Rose Tariga Aquino100% (1)

- Ahnan-Winarno Et Al. (2020) Tempeh - A Semicentennial ReviewDocument52 pagesAhnan-Winarno Et Al. (2020) Tempeh - A Semicentennial ReviewTahir AliNo ratings yet

- Collection of Windows 10 Hidden Secret Registry TweaksDocument9 pagesCollection of Windows 10 Hidden Secret Registry TweaksLiyoNo ratings yet

- The Dark Eye - Adv - One Death in GrangorDocument68 pagesThe Dark Eye - Adv - One Death in GrangorBo Poston100% (2)

- Paraphrase Practice WorksheetDocument2 pagesParaphrase Practice WorksheetSaber NouiraNo ratings yet

- Final Management Project On Geo TVDocument35 pagesFinal Management Project On Geo TVAli Malik100% (1)

- Untitled DocumentDocument4 pagesUntitled DocumentLove Jirah JamandreNo ratings yet

- Equinix Inc. 2022 Sustainability Report HighlightsDocument25 pagesEquinix Inc. 2022 Sustainability Report HighlightsDaniel ChuaNo ratings yet

- Jersey Documentation 1.0.3 User GuideDocument35 pagesJersey Documentation 1.0.3 User Guidenaresh921No ratings yet

- Woolworths Group Limited, Share Purchase Plan (SPP) Cancellation of Salary Sacrifice Arrangements Form F20-21Document1 pageWoolworths Group Limited, Share Purchase Plan (SPP) Cancellation of Salary Sacrifice Arrangements Form F20-21HaadS.AbbasiNo ratings yet

- G.R. No. 52179 - Municipality of San Fernando, La Union v. FirmeDocument6 pagesG.R. No. 52179 - Municipality of San Fernando, La Union v. FirmeBluebells33No ratings yet

- John Champagne - The Ethics of Marginality - A New Approach To Gay Studies (1995)Document267 pagesJohn Champagne - The Ethics of Marginality - A New Approach To Gay Studies (1995)Ildikó HomaNo ratings yet

- Nit 2187 3Document62 pagesNit 2187 3Imran MulaniNo ratings yet